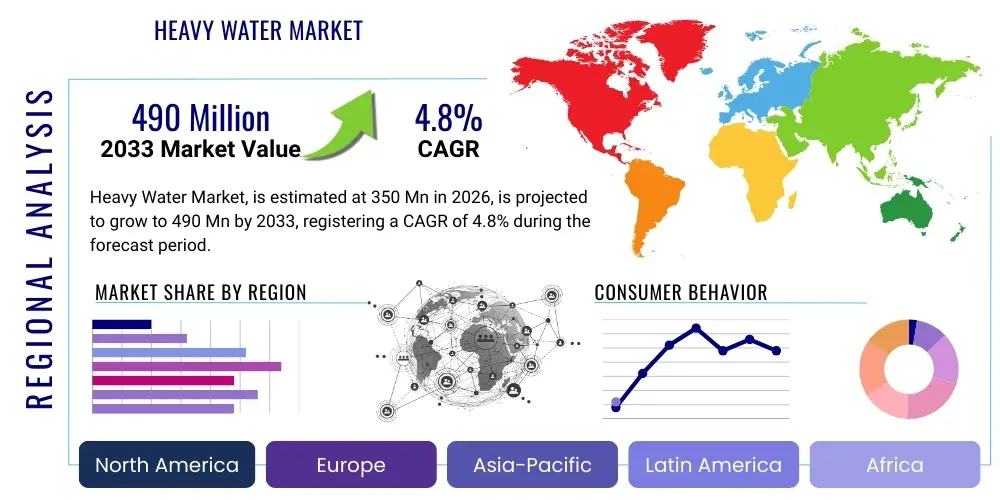

Heavy Water Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441939 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Heavy Water Market Size

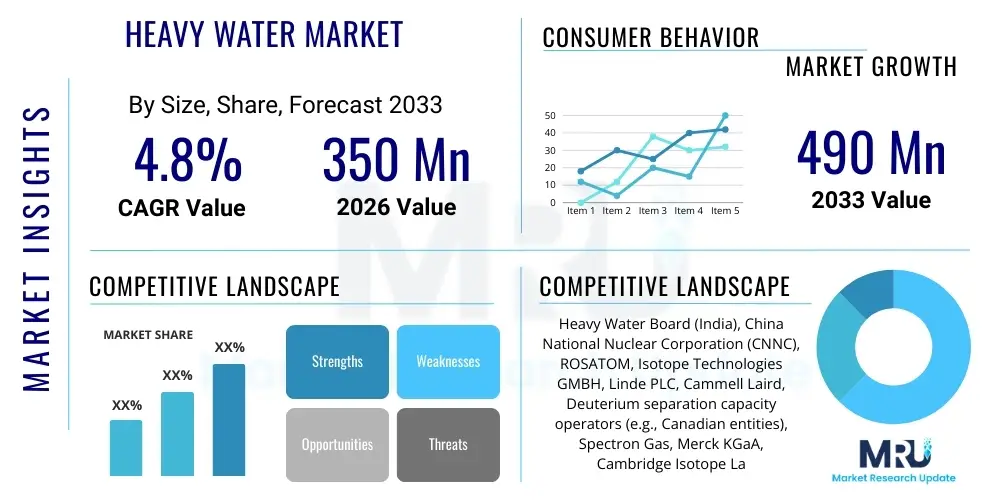

The Heavy Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 490 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the sustained global demand for nuclear power generation, particularly the expansion and refurbishment of existing CANDU (Canada Deuterium Uranium) reactors, which rely exclusively on heavy water (D₂O) as both a moderator and coolant. The market’s valuation reflects increased investment in advanced nuclear technologies and the critical role heavy water plays in various high-purity scientific applications.

Market expansion is further bolstered by the rising utilization of deuterium and deuterium-labeled compounds in pharmaceutical research, advanced material sciences, and specialized medical diagnostics. Heavy water serves as a crucial raw material for producing these high-value isotopes, which are essential for enhancing drug stability and efficacy through metabolic stabilization. While the nuclear sector remains the dominant consumer, the diversification of applications in high-tech industries provides a stable, high-margin revenue stream, mitigating risks associated with long lead times in nuclear infrastructure projects. Regulatory shifts favoring low-carbon energy sources also position heavy water as an indispensable component of sustainable energy infrastructure.

Heavy Water Market introduction

Heavy water, chemically known as deuterium oxide (D₂O), is a non-radioactive form of water where the hydrogen atoms are replaced by deuterium, a stable isotope of hydrogen containing one neutron. This unique isotopic composition makes it invaluable across several high-tech domains. The primary and most significant application is its role as a neutron moderator and coolant in specific types of nuclear reactors, notably the CANDU design, where its superior moderation properties allow for the use of natural uranium fuel. Beyond the nuclear industry, heavy water is vital for the production of deuterium-labeled compounds used extensively in pharmaceutical development to improve drug half-life, enhancing therapeutic value. Benefits of heavy water include its efficiency in nuclear fission control, its non-toxic nature, and its critical utility in advanced research, driving market growth despite the high energy cost associated with its production via complex separation processes like the Girdler Sulfide process or various catalytic exchange methods.

Heavy Water Market Executive Summary

The Heavy Water Market is characterized by a high degree of technological sophistication, stringent regulatory oversight, and concentrated supply chain dynamics. Current business trends indicate a critical link between market stability and global nuclear energy policy, with major investments originating from countries committed to expanding their nuclear power capabilities (e.g., China, India, Russia). Regionally, the Asia Pacific (APAC) holds the leading position due to massive ongoing and planned nuclear reactor projects, particularly in emerging economies seeking energy security. Segment trends show that the Nuclear Grade Heavy Water segment dominates by volume consumption, while the High Purity Grade segment, dedicated to pharmaceutical and research applications, exhibits the highest revenue growth rate (CAGR), reflecting the increasing sophistication of medicinal chemistry and biotechnology research globally. The market is highly influenced by geopolitical stability and international agreements concerning nuclear materials.

AI Impact Analysis on Heavy Water Market

Common user questions regarding AI's impact on the Heavy Water Market typically center around optimizing production efficiency, enhancing safety protocols in nuclear applications, and accelerating pharmaceutical R&D utilizing deuterium-labeled compounds. Key user concerns revolve around whether AI can significantly reduce the energy-intensive costs associated with heavy water separation processes, predict equipment failure in production facilities, and streamline the complex supply chain logistics for high-purity grades. Users expect AI to primarily contribute through advanced predictive maintenance in nuclear facilities and computational chemistry tools that accelerate the design and synthesis of new deuterated drugs, thereby indirectly boosting demand for heavy water as a raw material. The primary themes are efficiency improvement, safety assurance, and application expansion via computation.

- AI-driven optimization of Girdler Sulfide and catalytic exchange processes to maximize D₂O yield and minimize energy consumption.

- Implementation of predictive maintenance algorithms in nuclear facilities utilizing heavy water moderators, enhancing operational safety and extending reactor lifespan.

- Accelerated computational drug discovery (in silico modeling) utilizing AI to design and test new deuterium-labeled pharmaceuticals, increasing demand for research-grade heavy water.

- AI-enhanced anomaly detection and real-time monitoring of heavy water inventory purity and storage conditions, crucial for maintaining reactor efficiency.

- Optimization of complex international logistics and regulatory compliance tracking for controlled heavy water shipments using machine learning frameworks.

The direct application of AI in heavy water *production* focuses on process control and optimization. Heavy water plants are capital-intensive and operate continuously; minor improvements in separation efficiency, driven by machine learning models analyzing vast streams of operational data (temperature, pressure, flow rates), can translate into substantial cost savings. Furthermore, integrating AI into the maintenance scheduling for critical infrastructure, such as distillation columns and exchange towers, reduces unscheduled downtime, ensuring stable output vital for the nuclear sector.

In the application domain, especially pharmaceuticals, AI's influence is profound. Generative AI models are instrumental in designing novel molecules where strategic deuterium substitution improves metabolic stability. This capability shortens the drug discovery pipeline, making deuterated compounds more attractive to pharmaceutical giants. This computational shift indirectly dictates future demand patterns for pharmaceutical-grade heavy water, shifting the market focus toward ultra-high purity materials suitable for clinical use.

DRO & Impact Forces Of Heavy Water Market

The Heavy Water Market is fundamentally driven by the resurgence in global nuclear power development and technological advancements utilizing stable isotopes. However, expansion is constrained by extremely high capital investment required for dedicated production facilities and the sensitive international regulatory framework surrounding nuclear materials. Opportunities arise from increasing demand in specialized sectors like deuterated pharmaceuticals and fusion energy research, providing diversification away from traditional nuclear fission applications. These market forces collectively shape the competitive landscape: sustained investment in nuclear infrastructure acts as the primary driver, while the high barriers to entry and regulatory scrutiny represent significant restraints, ultimately impacting strategic decisions regarding capacity expansion and technological innovation.

Market Drivers

The foremost driver for the Heavy Water Market is the global shift toward cleaner, baseload energy sources, positioning nuclear power as a viable alternative to fossil fuels. Many nations are updating energy policies to meet stringent carbon reduction goals, leading to the extension of operational licenses for existing heavy water moderated reactors (like CANDU) and the planning of new units, particularly in regions like Asia Pacific and Eastern Europe. The operational advantage of heavy water reactors, allowing them to use natural, unenriched uranium, simplifies fuel cycle management and reduces costs compared to Light Water Reactors (LWRs), thus ensuring persistent demand for D₂O as the core functional fluid.

A secondary yet highly impactful driver is the rapid growth in pharmaceutical R&D focused on deuterated drugs. Substituting hydrogen with deuterium at metabolically sensitive positions in drug molecules significantly slows down oxidative metabolism, leading to a prolonged half-life and improved pharmacokinetics. This structural modification enhances drug efficacy and reduces dosing frequency, making it a critical tool in modern medicinal chemistry. As pharmaceutical companies increasingly pursue stable isotope labeling strategies for novel and generic drug variants, the demand for high-purity (99.9%+) heavy water as a precursor escalates dramatically.

Furthermore, advancements in fusion energy research, though nascent, present a long-term demand stimulant. Deuterium, extracted from heavy water, and tritium are the primary fuel sources for magnetic confinement and inertial confinement fusion reactors. Significant government and private investment in projects such as ITER (International Thermonuclear Experimental Reactor) creates a future pipeline for heavy water consumption, necessary for fueling experimental and eventual commercial fusion power facilities. This strategic investment underscores the long-term utility of heavy water beyond current fission reactor requirements.

- Renewed global investment in nuclear energy infrastructure and extension of existing reactor lifecycles.

- Increasing prevalence and commercial success of deuterium-labeled pharmaceuticals (deuterated drugs).

- Critical requirement in advanced scientific research, including neutron scattering and high-resolution NMR spectroscopy.

- Long-term strategic demand generated by international fusion energy research projects (e.g., ITER).

Market Restraints

The single most significant restraint is the exceptionally high energy and capital intensity associated with heavy water production. Separation processes, such as the Girdler Sulfide process, require massive industrial complexes and consume considerable amounts of energy over extended periods, leading to high production costs per unit volume. This complexity and cost result in high barriers to entry, maintaining the market as an oligopoly dominated by state-owned enterprises or facilities with deep historical ties to national nuclear programs. The initial investment hurdle limits the responsiveness of the supply chain to sudden spikes in demand.

Another crucial constraint is the stringent regulatory oversight and proliferation concerns surrounding heavy water. Due to its potential role in producing weapons-grade plutonium in certain reactor types, heavy water is classified as a dual-use material subject to strict national and international export controls (e.g., IAEA safeguards). These regulations impose burdensome licensing, tracking, and inspection requirements on producers and end-users, complicating international trade and supply chain flexibility. Geopolitical tensions can further exacerbate these restrictions, making long-term supply agreements precarious.

Finally, the operational lifespan and maintenance cycles of existing heavy water reactors present inherent demand cyclicality. If major consumers decommission reactors without equivalent replacements or choose different reactor technologies (like advanced Light Water Reactors or Small Modular Reactors which do not require heavy water moderation), the market could face significant demand contraction. Although the demand from pharmaceuticals offers diversification, the nuclear sector still dictates the bulk volume, making the market vulnerable to adverse changes in national nuclear policies or reactor fleet composition.

- Extremely high capital expenditure and energy consumption required for heavy water production technologies.

- Stringent international regulatory frameworks and export controls due to non-proliferation concerns.

- Limited number of global producers leading to supply chain rigidity and dependence on state actors.

- Long decommissioning cycles of heavy water reactors potentially leading to cyclical demand fluctuations.

Market Opportunities

The key opportunity lies in leveraging technological advancements to reduce the cost profile of heavy water production. Innovations in laser separation and optimized catalytic exchange processes promise to offer a less energy-intensive and smaller footprint alternative to traditional industrial methods. Companies investing in research to commercialize these next-generation separation technologies stand to gain a significant competitive advantage by reducing operational expenses and potentially democratizing supply access, thereby meeting global research and pharmaceutical demand more efficiently.

A major commercial opportunity is the expansion into high-purity, specialized applications beyond nuclear moderation. The demand for stable isotopes and labeled compounds extends into advanced analytical chemistry (e.g., NMR solvents), semiconductor manufacturing, and specialized fiber optics. Developing ultra-high purity grades tailored for these niche, high-value markets allows producers to achieve superior profit margins compared to bulk nuclear-grade sales. Furthermore, the emerging market for fusion energy technology provides a long-term strategic opportunity to secure future high-volume contracts for deuterium fuel.

The refurbishment and life extension programs for existing CANDU reactors represent a stable, near-term revenue opportunity. These projects often require significant quantities of replacement or top-up heavy water inventory due to leakage or degradation over decades of operation. Suppliers strategically positioned to offer comprehensive heavy water management services—including purification, inventory management, and technical consultancy—can secure long-term contracts associated with these multi-billion dollar refurbishment efforts across key markets like Canada, India, and South Korea.

- Development and commercialization of next-generation, energy-efficient heavy water separation technologies (e.g., laser isotope separation).

- Expansion into high-value, niche markets such as specialized analytical reagents, electronics, and deuterated optical materials.

- Strategic positioning to supply deuterium fuel for advanced fusion energy research and prototype reactors.

- Providing integrated heavy water inventory management, purification, and technical support services for reactor refurbishment programs.

Impact Forces Analysis

The impact of drivers and restraints is significantly weighted toward technological and governmental forces. The dominant impact force stems from governmental policies on nuclear energy (Driver D1), which dictates the vast majority of volume consumption. Conversely, the high capital cost (Restraint R1) acts as a persistent dampener on supply responsiveness. The pharmaceutical driver (D2) offers a high-value stabilizing force, reducing the market's complete reliance on nuclear cycles. If technological opportunities (O1) regarding production efficiency are successfully realized, the negative impact of high cost (R1) will diminish, potentially leading to faster market growth than currently projected. However, due to the critical nature of the material, stringent regulation (R2) will always maintain a strong, limiting impact, ensuring that the market remains highly controlled regardless of technological advancements or application diversification.

- High Impact Drivers: Global Nuclear Policy Shifts, Deuterated Drug Success.

- High Impact Restraints: Production Cost Intensity, Regulatory Controls (IAEA/Export).

- Mitigating Factor: Advances in separation technology offsetting R1.

- Overall Market Impact: Controlled growth driven by strategic national interests and high-value niche applications.

Segmentation Analysis

The Heavy Water Market is fundamentally segmented based on the purity level (Grade), which directly dictates the end-use application and market value, and by Application, reflecting the major consuming industries. Purity segmentation is crucial as nuclear reactors require a minimum threshold of 99.75% D₂O, while advanced research and pharmaceutical synthesis often demand Ultra-High Purity Grade (99.9% to 99.999%). Analyzing the market through these lenses provides essential insights into volume versus value trends, highlighting the dominance of the nuclear sector in consumption volume and the pharmaceutical sector in premium value generation.

- By Grade:

- Nuclear Grade (99.75% and above)

- Reactor Grade (99.5% - 99.75%)

- High Purity Grade (99.9% to 99.999%)

- Industrial Grade (Below 99.5%)

- By Application:

- Nuclear Power Reactors (Moderator & Coolant)

- Pharmaceutical & Biotechnology (Deuterated Drugs, Solvents)

- Research & Development (Neutron Scattering, NMR Spectroscopy)

- Industrial Processes (Semiconductors, Optical Fibers)

- By End-User:

- Nuclear Power Utilities

- Pharmaceutical Companies

- Research Institutes and Universities

- Specialty Chemical Manufacturers

- Electronics/Semiconductor Industry

Value Chain Analysis For Heavy Water Market

The Heavy Water Value Chain is complex, heavily regulated, and vertically integrated, starting with the Upstream analysis involving natural water sourcing and concentration. Upstream activities primarily encompass the energy-intensive isotope separation processes (Girdler Sulfide, ammonia-hydrogen exchange, or distillation), transforming natural water with a deuterium concentration of about 150 parts per million into high-concentration D₂O. This initial production step is the highest value-add activity and demands specialized, large-scale industrial infrastructure, often state-owned.

Midstream involves purification, quality testing (ensuring isotopic purity for nuclear or pharmaceutical specifications), storage under strict security and environmental controls, and packaging. Distribution channels are highly controlled: Direct sales are dominant for Nuclear Grade heavy water, where producers sell directly to national nuclear utilities or government agencies under specific safeguards agreements. Indirect sales, though less common for bulk materials, utilize specialized chemical distributors for smaller quantities of High Purity Grade D₂O destined for pharmaceutical R&D labs and university research centers, where strict security and specialized handling remain paramount.

Downstream analysis focuses on the end-use application, primarily nuclear reactor loading and inventory management, or integration into pharmaceutical synthesis processes. The value chain is characterized by a high degree of integration between production and the primary end-users (nuclear utilities), ensuring security of supply. The stringent requirements for purity and regulatory compliance throughout every step of the chain significantly increase operational costs and restrict market participants, emphasizing long-term contractual relationships over spot market transactions.

Heavy Water Market Potential Customers

The primary customers for Heavy Water are large-scale governmental or quasi-governmental entities involved in the nuclear power cycle. Nuclear Power Utilities operating CANDU or related heavy water moderated reactor designs constitute the largest volume consumers, requiring tons of Nuclear Grade D₂O for initial reactor loading and ongoing replenishment throughout the reactor's operational life. These utilities are long-term, stable buyers whose procurement decisions are guided by national energy policy and regulatory compliance.

The second major category encompasses global Pharmaceutical and Biotechnology Companies. These customers specifically demand ultra-high purity, small-volume quantities for use as solvents in Nuclear Magnetic Resonance (NMR) spectroscopy and, more significantly, as a foundational raw material for synthesizing patented deuterated drug candidates. This segment is characterized by high-margin transactions and an increasing demand correlation with global R&D spending and the FDA approval rate of deuterated therapies.

Additionally, National Research Institutes, Universities, and Specialized Analytical Labs serve as critical, albeit smaller, customers. They utilize heavy water for advanced scientific applications such as neutron moderation in particle physics, environmental tracer studies, and the calibration of specialized analytical instruments. Specialty Chemical Manufacturers also consume Industrial Grade heavy water for select chemical reactions where the isotopic effect is necessary, although this constitutes a smaller portion of the overall market volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 490 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heavy Water Board (India), China National Nuclear Corporation (CNNC), ROSATOM, Isotope Technologies GMBH, Linde PLC, Cammell Laird, Deuterium separation capacity operators (e.g., Canadian entities), Spectron Gas, Merck KGaA, Cambridge Isotope Laboratories, Center of Applied Isotope Studies, Marshall Isotopes, Scientific Isotopes, Q-Innovation, Thermo Fisher Scientific, SI Science, 3M, Nikkiso Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Water Market Key Technology Landscape

The primary technological landscape for heavy water production is dominated by established, large-scale industrial separation processes, primarily the Girdler Sulfide (GS) process and the Ammonia-Hydrogen Exchange process. The GS process, utilizing hydrogen sulfide and water, remains the most prevalent method due to its high throughput capability, although it is characterized by massive capital requirements, high energy consumption, and environmental concerns related to hydrogen sulfide handling. Innovations within this landscape focus on improving process efficiency through advanced catalysts and optimization software to reduce the energy footprint and operational complexity of these legacy facilities.

An increasingly important technological area involves catalytic exchange methods, such as the hydrogen-water exchange processes. These methods offer potential advantages in safety and flexibility, as they operate at lower temperatures and pressures and avoid the use of toxic or corrosive materials characteristic of the GS process. Continuous R&D is aimed at developing highly efficient, long-lasting catalysts that can significantly enhance the isotopic exchange rate, thereby reducing the size and cost of the required separation towers. This technological evolution is particularly critical for smaller-scale, high-purity production tailored for the pharmaceutical and research markets.

Looking forward, advanced separation technologies like laser isotope separation (LIS) represent the frontier of technological development. LIS methods, which exploit subtle differences in the absorption spectra of light water and heavy water molecules, promise significantly lower energy consumption and potentially lower capital costs than traditional methods. While LIS has yet to reach commercial viability for bulk nuclear-grade production, its eventual maturation could fundamentally disrupt the market structure by lowering the barrier to entry and enabling decentralized, more efficient production tailored to specialized, ultra-pure market needs. Investment in these cutting-edge technologies remains a key strategic differentiator for future market leadership.

Regional Highlights

The Heavy Water Market exhibits pronounced regional disparities primarily driven by the concentration of heavy water moderated nuclear reactors and specialized R&D centers. Asia Pacific (APAC) stands as the undisputed leader in volume consumption and expected growth over the forecast period, owing largely to India's extensive fleet of pressurized heavy water reactors (PHWRs) and China's ambitious nuclear expansion goals, which include exploration of heavy water technology. High energy demands and government initiatives focused on achieving energy self-sufficiency fuel substantial investment in APAC's nuclear infrastructure, creating consistent, high-volume demand for Nuclear Grade D₂O.

North America, led by Canada, represents a historically significant market due to the origin and deployment of CANDU technology. Although new reactor construction has been moderate, the region maintains substantial demand through ongoing maintenance, refurbishment, and life extension programs for existing CANDU units. Furthermore, the U.S. market contributes significantly through its sophisticated pharmaceutical and research sectors, driving premium demand for High Purity Grade heavy water used in deuterated drugs and advanced scientific instrumentation like NMR facilities and neutron scattering sources.

Europe maintains a stable, albeit smaller, market share, focusing predominantly on high-value research applications and niche pharmaceutical needs. European facilities are major consumers of deuterium and deuterated solvents for advanced chemical analysis and drug development. While the region is less dependent on heavy water moderated reactors, its world-class research infrastructure and highly regulated pharmaceutical industry ensure sustained demand for ultra-pure D₂O. The Middle East and Africa (MEA) and Latin America currently represent emerging markets, with demand closely tied to potential future nuclear energy programs and limited local research activities, positioning them for gradual, policy-dependent growth.

- Asia Pacific (APAC): Dominates the market share due to large-scale nuclear programs in India (PHWR fleet) and China. Projected to exhibit the highest growth rate driven by national energy security goals and reactor expansion.

- North America: Significant established market, heavily reliant on CANDU reactor maintenance (Canada) and high-value consumption from sophisticated pharmaceutical and biotechnology sectors (U.S.).

- Europe: Focuses primarily on Research & Development applications, particularly high-purity deuterated solvents for NMR and scientific instrumentation, maintaining a stable, high-value segment.

- Middle East and Africa (MEA): Emerging market potential linked to nascent nuclear energy exploration programs in countries like the UAE and Saudi Arabia; currently characterized by low volume consumption.

- Latin America: Market presence is limited, tied mainly to existing or planned heavy water reactor operations in countries such as Argentina.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Water Market.- Heavy Water Board (HWB) – India

- China National Nuclear Corporation (CNNC)

- ROSATOM (Russia)

- Isotope Technologies GMBH

- Linde PLC

- Cammell Laird

- Koei Industry Co., Ltd.

- Deuterium separation capacity operators (e.g., Canadian entities)

- Spectron Gas

- Merck KGaA (Isotopes Division)

- Cambridge Isotope Laboratories (CIL)

- Center of Applied Isotope Studies (CAIS)

- Marshall Isotopes

- Scientific Isotopes, Inc.

- Q-Innovation

- Thermo Fisher Scientific Inc.

- SI Science

- 3M (Select divisions involved in materials science)

- Nikkiso Co., Ltd. (Pumps and equipment for separation)

- Suzhou Zhonghe Sciences and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Heavy Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Heavy Water and why is it essential for certain nuclear reactors?

Heavy water (D₂O) is water containing deuterium instead of common hydrogen. It is essential in CANDU-type reactors because deuterium's extra neutron makes D₂O an excellent moderator, slowing neutrons efficiently without significant absorption. This allows these reactors to operate successfully using cost-effective natural (unenriched) uranium fuel.

How is the growth in deuterated pharmaceuticals impacting the Heavy Water Market?

The pharmaceutical industry is driving high-purity heavy water demand by using deuterium to synthesize "deuterated drugs." Substituting deuterium enhances the drug's metabolic stability and half-life, improving efficacy. This application provides a high-value, high-margin revenue stream, diversifying the market beyond bulk nuclear consumption.

What are the primary methods used globally for commercial heavy water production?

The main commercial production methods are the Girdler Sulfide (GS) process and various catalytic exchange processes (e.g., ammonia-hydrogen exchange). The GS process is currently the most widely deployed for bulk quantities, though it is highly capital and energy-intensive. Newer catalytic methods are being researched to improve efficiency and reduce environmental impact.

Which geographical region dominates the consumption of heavy water, and why?

The Asia Pacific (APAC) region dominates heavy water consumption, primarily due to India's established fleet of Pressurized Heavy Water Reactors (PHWRs) and substantial ongoing nuclear energy expansion projects in countries like China. These national nuclear programs create consistent, large-volume requirements for Nuclear Grade D₂O inventory.

Are there significant safety or regulatory hurdles affecting the heavy water supply chain?

Yes, heavy water is classified as a dual-use material under international safeguards (IAEA) due to its proliferation risk potential. This classification imposes stringent regulatory controls on its production, storage, transfer, and export, leading to complex supply chain logistics and high security costs for producers and end-users worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Heavy Water (D20) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nuclear Decommissioning Services Market Size Report By Type (Pressurized Water Reactor (PWR), Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), Others), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Nuclear Reactor Market Statistics 2025 Analysis By Application (Generating electricity, Moving aircraft carriers and submarines), By Type (Pressurized water reactor (PWR), Boiling water reactor (BWR), Pressurized heavy water reactor (PHWR), Gas-cooled reactor (AGR & Magnox), Fast neutron reactor (FBR), Light water graphite reactor (RBMK & EGP)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Nuclear Safety Related Parts Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (OEM, Safety Related Replacement Parts), By Application (Pressurised water reactor (PWR), Boiling water reactor (BWR), Pressurised heavy water reactor (PHWR), Gas-cooled reactor (AGR), Light water graphite reactor (LWGR), Fast neutron reactor (FBR)), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ionic Exchange Based Liquid Nuclear Waste Treatment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Low Level Waste, Intermediate Level Waste, High Level Waste), By Application (Inorganic Natural Ion Exchangers Water Reactor (BWR), Organic Natural Ion Exchangers Cooled Reactors (GCR), Pressurized Water Reactors (PWR), Pressurized Heavy Water Reactors (PHWR), Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager