Hedgehog Pathway Inhibitors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443017 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Hedgehog Pathway Inhibitors Market Size

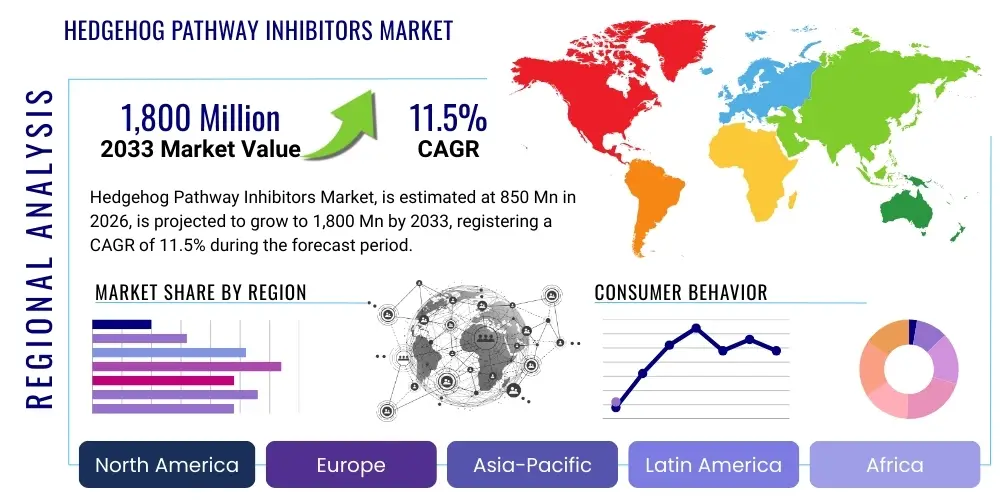

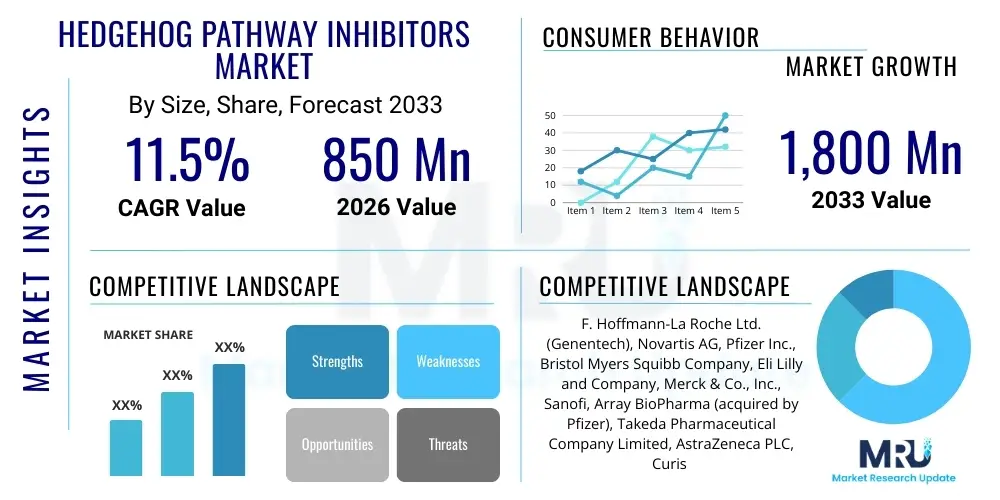

The Hedgehog Pathway Inhibitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,800 Million USD by the end of the forecast period in 2033.

Hedgehog Pathway Inhibitors Market introduction

The Hedgehog (Hh) signaling pathway is a critical developmental cascade that, when aberrantly reactivated or sustained in adult tissue, serves as a pivotal driver in the oncogenesis and maintenance of various human malignancies. This class of targeted therapeutics, known as Hedgehog Pathway Inhibitors (HhPIs), focuses on neutralizing this pathological signaling, most commonly by targeting the Smoothened (SMO) receptor protein, which is the key signal transducer within the pathway. Approved inhibitors like Vismodegib and Sonidegib have revolutionized the standard of care for specific, highly pathway-dependent tumors, notably locally advanced or metastatic basal cell carcinoma (BCC) and medulloblastoma, offering a precision therapeutic alternative where traditional treatments such as surgery or radiation are ineffective or infeasible. The clinical translation of HhPIs underscores a growing understanding of molecular drivers in cancer, positioning these agents as foundational elements in modern, targeted oncology practice and demanding continuous innovation to address issues such as primary resistance and acquired mutations.

The product landscape in the HhPI market encompasses a variety of pharmacological agents, predominantly small molecule inhibitors due to their favorable oral bioavailability and intracellular targeting capabilities, although pipeline research explores biologics targeting upstream ligands (Hedgehog proteins). Major therapeutic applications are centered exclusively within oncology, where their effectiveness is contingent upon identifying tumors exhibiting canonical Hh pathway activation, typically through loss-of-function mutations in the PTCH1 receptor or activating mutations in SMO. Beyond established indications, intense preclinical and clinical efforts are underway to expand the utility of HhPIs into higher-prevalence cancers, such as pancreatic, lung, and colorectal cancers, where the Hh pathway often contributes to the tumor microenvironment or facilitates stromal-epithelial interactions that support tumor growth and metastasis. This expansion requires sophisticated diagnostics and strategic combination therapy development, which are critical elements fueling ongoing market activity and pharmaceutical investment globally.

The market benefits significantly from high treatment efficacy in responder populations, leading to improved progression-free survival rates and reduced disease burden compared to non-targeted systemic treatments. Key driving factors propelling market growth include the escalating global incidence of basal cell carcinoma, which necessitates effective systemic options for advanced cases, coupled with demographic shifts toward an aging population, inherently more susceptible to malignancies. Furthermore, substantial R&D investments channeled by major pharmaceutical players into oncology, specifically focused on overcoming resistance mechanisms and developing combination regimens with immunotherapies, are anticipated to sustain a strong growth trajectory. The specialized nature of the target audience, predominantly oncologists and dermatologic surgeons, facilitates focused marketing and educational efforts, optimizing the penetration rate within the approved therapeutic areas and enhancing global adoption rates of these crucial targeted therapies.

Hedgehog Pathway Inhibitors Market Executive Summary

The Hedgehog Pathway Inhibitors market exhibits defined business trends characterized by strategic portfolio diversification, focusing on developing second and third-generation inhibitors designed to address acquired clinical resistance, particularly point mutations in the SMO receptor. Pharmaceutical companies are heavily investing in combination trials that pair HhPIs with immune checkpoint inhibitors (ICIs) and standard chemotherapies, aiming to leverage synergistic effects and broaden the therapeutic applicability beyond highly selective Hh-driven tumors. A critical business imperative is the establishment of robust global supply chains and strategic partnerships, particularly in emerging markets, to navigate regulatory complexities and ensure patient access to high-cost specialty drugs. Furthermore, the market demands precision diagnostics, prompting collaborations between drug developers and diagnostic companies to refine biomarker panels for optimal patient selection, thereby maximizing drug efficacy and commercial viability in a highly specialized oncology segment.

Regional dynamics clearly place North America at the forefront of the market, primarily due to advanced healthcare infrastructure, significant R&D expenditure on targeted oncology, and high per capita expenditure on specialized treatments. Europe maintains a strong growth trajectory, supported by centralized health technology assessments that often prioritize innovative targeted therapies for rare and specialized cancers like medulloblastoma, aided by European Medicines Agency (EMA) orphan drug designations. The Asia Pacific region, however, is projected to witness the most rapid expansion, driven by increasing public awareness, government initiatives to modernize cancer care, and a growing patient base seeking advanced treatments. Investment in localization strategies, including regional clinical trials and local manufacturing partnerships, is crucial for companies aiming to capitalize on the vast, underserved populations in countries such as China and India, where regulatory reforms are progressively streamlining drug approvals.

Segmentation analysis reveals that the Basal Cell Carcinoma application segment currently constitutes the largest revenue base, reflecting its high incidence rate and the established role of HhPIs as the standard of care for advanced cases. However, the segment related to investigative and orphan indications, notably Medulloblastoma, shows superior revenue acceleration potential, driven by premium pricing and high unmet medical need in pediatric oncology. Regarding drug type, Small Molecule Inhibitors dominate the current market landscape, but the future growth is increasingly tied to the success of pipeline assets designed to enhance specificity and reduce systemic toxicity. Strategic market focus is centered on navigating payer environments, demonstrating clear long-term overall survival benefits, and ensuring seamless integration of HhPIs into multi-modal treatment protocols, which is essential for sustained segment growth and favorable reimbursement decisions across diverse global healthcare systems.

AI Impact Analysis on Hedgehog Pathway Inhibitors Market

The integration of Artificial Intelligence (AI) and machine learning (ML) platforms is generating significant interest among stakeholders in the Hedgehog Pathway Inhibitors market, with user queries frequently targeting AI's capability to solve complex clinical challenges, particularly drug resistance. Users seek clarity on how AI can rapidly analyze massive datasets from genomics, transcriptomics, and real-world evidence (RWE) to pinpoint subtle, patient-specific predictors of response to Vismodegib or Sonidegib. The key concern is moving beyond the established SMO target, using AI to discover novel, non-canonical targets within the Hh pathway or identifying synergistic pathways that, when co-targeted, can prevent treatment failure. This sophisticated analysis is expected to accelerate the development of next-generation inhibitors and streamline the costly, multi-year process of validating novel combination therapies, ultimately leading to more personalized and effective treatment strategies for patients with refractory Hh-driven cancers.

- Accelerated Drug Discovery: AI analyzes structural protein data to model optimal binding affinities for novel small molecules against SMO or related proteins (e.g., PTCH1, GLI), significantly reducing the lead compound identification phase.

- Biomarker Identification and Prediction: Machine learning algorithms process multimodal patient data (imaging, genomics, clinical history) to generate predictive models that stratify patients based on their likelihood of responding to specific HhPIs, optimizing patient selection for clinical use.

- Clinical Trial Optimization: AI-driven predictive modeling helps in designing more efficient trials by determining optimal dosage levels, predicting adverse event profiles, and identifying ideal patient cohorts, thereby accelerating regulatory approval timelines.

- Resistance Mechanism Modeling: Deep learning platforms simulate the evolution of cancer cells under HhPI pressure, anticipating the emergence of acquired resistance mutations and guiding the development of cross-resistant or combination regimens before they manifest clinically.

- Personalized Treatment Regimens: AI assists oncologists in recommending dynamic dosing strategies and treatment schedules by integrating real-time patient monitoring data and genetic profiles, maximizing therapeutic benefit while minimizing the risk of severe side effects.

- Synthetic Biology Integration: AI facilitates the design of advanced biological therapies, potentially including engineered cells or viral vectors, that target Hh signaling components, offering alternatives to traditional small molecule inhibition.

DRO & Impact Forces Of Hedgehog Pathway Inhibitors Market

The Hedgehog Pathway Inhibitors market is shaped by powerful Drivers, inherent Restraints, and transformative Opportunities, collectively defining the key Impact Forces influencing its commercial trajectory. Primary drivers include the robust, proven efficacy in specific refractory cancers, especially locally advanced BCC, where HhPIs offer a non-surgical curative alternative, significantly improving patient outcomes and quality of life. Furthermore, substantial investment in oncology drug development, fueled by increasing global cancer incidence and favorable regulatory mechanisms like Orphan Drug status for rare diseases such as medulloblastoma, provides strong market momentum. These drivers underscore the medical necessity and commercial viability of targeted therapies focused on fundamental oncogenic pathways, ensuring continuous innovation and pipeline expansion within the sector. The targeted nature of these drugs compared to conventional chemotherapeutics further enhances their clinical appeal and drives market adoption among specialists.

Conversely, significant restraints pose formidable challenges to sustained market expansion and accessibility. The most prominent restraint is the rapid development of acquired resistance to first-generation SMO inhibitors, necessitating costly development cycles for second-generation agents. Additionally, the premium pricing structure of these specialty oncology drugs creates access barriers in healthcare systems with constrained budgets, leading to complex reimbursement negotiations and restricted utilization criteria by payers. Furthermore, the specialized nature of the target diseases—often low-incidence populations like advanced BCC or medulloblastoma—limits the overall market size, increasing the pressure on manufacturers to maximize revenue per prescription and justify the substantial R&D investments required to bring these precise medicines to market globally.

Opportunities for profound growth center on two strategic areas: expanding the therapeutic scope through combination strategies and the geographical penetration into high-growth emerging economies. The development of synergistic combination therapies, particularly with immune-oncology agents, holds the potential to unlock larger, non-Hh primary driver cancer markets, such as certain solid tumors that utilize Hh signaling for stromal support or immunosuppression. Furthermore, capitalizing on the high demand for advanced cancer treatments in APAC and LATAM, coupled with strategic pricing models adapted to local purchasing power, represents a significant opportunity for expanding global patient reach. The inherent Impact Forces, therefore, require companies to balance the commercial need for premium pricing with the ethical and regulatory pressure to ensure broad accessibility and to consistently innovate to stay ahead of resistance evolution, thereby determining competitive success in this high-stakes therapeutic arena.

Segmentation Analysis

The comprehensive market segmentation of the Hedgehog Pathway Inhibitors market is essential for understanding the diverse revenue streams and growth pockets across the oncology landscape. The segmentation criteria encompass Drug Type, which differentiates between chemically synthesized small molecules (currently dominating) and emerging biologic approaches; Application, highlighting the specific malignancies where HhPIs are utilized; and Distribution Channel, reflecting the specialized mechanisms required for dispensing high-cost, high-control oncology therapeutics. Analysis across these segments indicates that while small molecule inhibitors maintain a stronghold due to established clinical profiles, future market value creation will increasingly rely on pipeline success in expanding approved applications into investigative areas and optimizing the delivery mechanism through specialty pharmacy networks to support patient adherence and compliance with stringent monitoring protocols.

- By Drug Type:

- Small Molecule Inhibitors: Compounds like Vismodegib and Sonidegib, which target the intracellular domain or binding pocket of the SMO receptor, constituting the primary market revenue.

- Biologics: Investigational agents, such as monoclonal antibodies, that aim to neutralize upstream Hh ligands (e.g., Sonic Hh, Indian Hh), representing potential future growth segments, especially for combination therapies.

- By Application:

- Basal Cell Carcinoma (BCC): The leading application, covering advanced or metastatic cases unsuitable for local treatment.

- Medulloblastoma: A critical, high-value segment, predominantly pediatric, benefiting from Orphan Drug designation.

- Pancreatic Cancer: A major investigative area where HhPIs are being tested to disrupt tumor stroma and enhance chemotherapy efficacy.

- Other Solid Tumors (e.g., Sarcomas, Lung Cancer): Niche applications where Hh pathway dysregulation is observed, often explored within clinical trials for combination protocols.

- By Distribution Channel:

- Hospital Pharmacies: Primary channel for initial administration and inpatient treatment, especially for medulloblastoma and severe advanced cases requiring intensive monitoring.

- Retail Pharmacies and Drug Stores: Primarily specialty pharmacies designated to handle high-cost oral oncology medications for chronic outpatient use (e.g., maintenance therapy for BCC).

- Online Pharmacies: Emerging channel facilitating home delivery and specialized patient support programs in highly regulated markets.

- By Geography:

- North America: Market leader defined by high R&D and rapid adoption.

- Europe: Strong second position driven by focused oncology care and reimbursement for rare indications.

- Asia Pacific (APAC): Fastest growing, characterized by expanding oncology market access and increasing investment.

- Latin America (LATAM): Moderate growth, highly sensitive to economic and regulatory reforms.

- Middle East and Africa (MEA): Emerging markets focused on specialized treatment centers and high-net-worth patient segments.

Value Chain Analysis For Hedgehog Pathway Inhibitors Market

The upstream segment of the Hedgehog Pathway Inhibitors value chain is characterized by intensive intellectual property (IP) generation and complex chemical synthesis. Activities begin with rigorous preclinical research, often involving computational modeling and high-throughput screening to identify lead compounds with optimal selectivity for the SMO receptor. Specialized Contract Research Organizations (CROs) play a pivotal role in early-stage validation and toxicology studies. The manufacturing of the Active Pharmaceutical Ingredient (API) for small molecule inhibitors like Vismodegib demands sophisticated chemical processes, often requiring stringent Good Manufacturing Practice (GMP) compliance and specialized equipment to ensure high purity and stereochemical integrity. Successful management of upstream suppliers, particularly those providing scarce or highly specialized chemical intermediates, is critical for maintaining cost efficiency and preventing supply disruptions for these highly potent therapeutic agents.

Midstream processes encompass the large-scale industrial synthesis, formulation, and quality control of the final drug product. Given that most HhPIs are orally administered small molecules, formulation science focuses on optimizing bioavailability, dissolution profiles, and stability, typically resulting in capsule or tablet forms. Contract Manufacturing Organizations (CMOs) often handle scale-up and commercial production, leveraging their expertise to meet global regulatory standards. Distribution (downstream) is highly controlled due to the drugs' high cost, toxicity profile, and specific indication criteria. The drugs move primarily through closed-loop systems involving specialized wholesalers and dedicated specialty pharmacy networks, which are equipped to manage the logistical complexity, mandatory cold chain requirements, and stringent documentation necessary for targeted oncology treatments, ensuring security against counterfeiting and maintaining product integrity until delivery to the patient.

The downstream analysis highlights the crucial role of specialty distribution channels in market access and patient adherence. Direct channels involve manufacturers engaging directly with hospital group purchasing organizations (GPOs) and large oncology institutions, often negotiating volume-based contracts. Indirect distribution relies on specialty pharmacy providers who offer patient-centric services, including complex insurance verification, financial assistance programs, and ongoing adherence counseling, which are essential for maximizing the clinical benefit of long-term therapy. End-users, including oncologists, dermatologists, and pediatric specialists, serve as critical points of prescription and utilization. Successful market penetration relies on effective physician education and strong payer advocacy, demonstrating the superior health economic value of HhPIs compared to alternative or palliative care options, thereby securing favorable formulary placement and broad patient access in competitive healthcare markets.

Hedgehog Pathway Inhibitors Market Potential Customers

The core customer base for Hedgehog Pathway Inhibitors comprises healthcare organizations specializing in advanced cancer diagnosis and treatment, particularly comprehensive oncology centers and specialized university teaching hospitals. These institutions possess the multidisciplinary expertise and advanced molecular diagnostics necessary to confirm Hh pathway activation—a prerequisite for prescribing these targeted agents. Since HhPIs are utilized for chronic, often complex, malignancies like advanced BCC and medulloblastoma, these centers represent high-volume accounts due to their role as tertiary referral hubs. Their purchasing decisions are driven by clinical efficacy data, inclusion in national clinical guidelines, and the availability of robust patient support programs offered by manufacturers, ensuring compliance with intensive monitoring requirements associated with these potent inhibitors.

Secondary but rapidly growing customer segments include specialized outpatient dermatology and surgical oncology clinics focusing on high-risk, locally advanced basal cell carcinoma cases. As HhPIs are often administered orally in an outpatient setting, the critical customer interface shifts to the specialty pharmacy ecosystem, which acts as the crucial link between the manufacturer and the patient. Specialty pharmacies provide essential services such as prior authorization management, adherence monitoring, and patient counseling, thereby significantly influencing prescription fulfillment rates and overall patient outcomes. These pharmacies are therefore major customers of the manufacturers, contracting directly for the distribution and handling of these high-value, restricted access medications.

Furthermore, the reimbursement authorities and government health payers (e.g., Medicare, NHS, private insurance companies) constitute a powerful customer segment, as their coverage decisions fundamentally dictate market accessibility and volume. Manufacturers must invest heavily in Health Economics and Outcomes Research (HEOR) to convince these payers of the long-term cost-effectiveness of HhPIs, especially in comparison to the costly alternatives like extensive surgery or palliative care. Ultimately, the market demand is triangulated between the prescribing oncologist who determines clinical suitability, the patient who requires the therapy, and the payer organization that finances the treatment, making effective engagement with all three crucial for maximizing commercial uptake and successful deployment of Hedgehog Pathway Inhibitors across global markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,800 Million USD |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd. (Genentech), Novartis AG, Pfizer Inc., Bristol Myers Squibb Company, Eli Lilly and Company, Merck & Co., Inc., Sanofi, Array BioPharma (acquired by Pfizer), Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Curis Inc., PellePharm Inc., Sun Pharmaceutical Industries Ltd., Beigene, Ascentage Pharma, Jiangsu Hengrui Medicine Co., Ltd., Sumitomo Dainippon Pharma, CSPC Pharmaceutical Group Limited, Bayer AG, Boehringer Ingelheim International GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hedgehog Pathway Inhibitors Market Key Technology Landscape

The technological core of the Hedgehog Pathway Inhibitors market is firmly rooted in advanced pharmaceutical chemistry focused on G-protein coupled receptor (GPCR) modulation, specifically targeting the Smoothened (SMO) receptor. The technological advancements are driven by the need for enhanced specificity and potency, moving beyond first-generation agents to develop compounds that are resistant to common acquired mutations within the SMO binding pocket. Key research utilizes high-resolution structural biology, including cryo-electron microscopy and X-ray crystallography, to understand the conformational changes of SMO upon inhibition, allowing for rational drug design of allosteric inhibitors that bind at sites distinct from the active site. This technological approach minimizes cross-reactivity with non-target proteins and aims to reduce the systemic side effects associated with widespread Hh pathway suppression, thereby improving the therapeutic index and enabling safer, long-term use in chronic cancer management protocols.

A secondary, yet rapidly ascending, technological pillar involves the deployment of sophisticated companion diagnostics essential for maximizing the clinical and commercial success of HhPIs. Technologies such as Next-Generation Sequencing (NGS) and droplet digital PCR (ddPCR) are utilized to accurately detect specific activating mutations in PTCH1 or SMO, or to identify downstream GLI activation signatures, thereby ensuring accurate patient stratification. Liquid biopsy technology is gaining prominence, allowing for non-invasive, longitudinal monitoring of treatment response and early detection of resistance-conferring mutations circulating in the blood. This real-time molecular surveillance is critical for timely intervention, such as switching to a second-generation inhibitor or initiating a combination therapy, effectively extending the time to progression and contributing significant value to the overall patient treatment pathway by informing precision medicine decisions immediately.

Furthermore, the manufacturing and formulation technology for HhPIs involve specialized techniques to ensure optimal drug delivery. Given the poor solubility often associated with small molecule inhibitors, specialized technologies such as amorphous solid dispersions, micronization, and lipid-based formulations are employed to enhance oral bioavailability and ensure predictable absorption profiles. The increasing use of AI and computational chemistry models throughout the development cycle, from virtual screening to predicting clinical trial outcomes, accelerates the entire pipeline, reducing the cost and time required to bring a new HhPI to market. This comprehensive technological ecosystem—spanning molecular design, advanced diagnostics, and optimized manufacturing—is foundational to overcoming the current challenges of drug resistance and toxicity, securing the market's long-term growth and innovative edge within oncology therapeutics.

Regional Highlights

- North America: North America, encompassing the United States and Canada, leads the global Hedgehog Pathway Inhibitors market, primarily due to the region’s high cancer prevalence, particularly basal cell carcinoma, and the advanced regulatory environment that facilitates the rapid approval and adoption of specialized targeted oncology drugs. Significant factors contributing to dominance include high healthcare expenditure, established reimbursement mechanisms for high-cost targeted therapies (e.g., through Medicare and private payers), and the critical presence of major pharmaceutical innovators and leading clinical research institutions driving pipeline development.

- Europe: Europe represents a mature and substantial market, driven by robust public health systems (e.g., UK, Germany, France) that prioritize cancer care and specialized oncology treatment guidelines. The market is supported by generous Orphan Drug incentives from the EMA, encouraging the development of HhPIs for rare indications like medulloblastoma. While pricing pressures are often higher than in the US due to centralized health technology assessment (HTA) bodies, high patient awareness and increasing standardization of care across the EU sustain strong revenue generation.

- Asia Pacific (APAC): The APAC region, including powerhouses like China, Japan, and India, is forecast to be the fastest-growing market segment. This accelerated growth is attributed to improving healthcare access, increasing governmental focus on domestic pharmaceutical innovation, and a large, rapidly growing population susceptible to cancer. Strategic partnerships, localized clinical trials, and the gradual harmonization of regulatory standards are enabling major global players to penetrate these high-potential markets, particularly targeting the expanding middle class seeking access to advanced Western oncology treatments.

- Latin America (LATAM): Markets in Latin America show steady growth, primarily focused on key economies such as Brazil and Mexico. Growth is propelled by increasing investment in specialized cancer treatment centers and a rising demand for advanced therapies. However, market penetration is often hindered by economic volatility, complex import logistics, and fragmented reimbursement systems, necessitating focused strategies that address local pricing sensitivities and regulatory hurdles unique to the region.

- Middle East and Africa (MEA): MEA remains a nascent but strategically important market. Growth is localized in the Gulf Cooperation Council (GCC) states, characterized by rapidly developing private healthcare sectors and governmental initiatives to establish regional hubs for complex cancer care. Demand is driven by a segment of high-net-worth individuals and medical tourism, though broader adoption across Africa is limited by infrastructure constraints and affordability issues, requiring tailored market access programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hedgehog Pathway Inhibitors Market.- F. Hoffmann-La Roche Ltd. (Genentech)

- Novartis AG

- Pfizer Inc.

- Bristol Myers Squibb Company

- Eli Lilly and Company

- Merck & Co., Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- Curis Inc.

- PellePharm Inc.

- Sun Pharmaceutical Industries Ltd.

- Beigene

- Ascentage Pharma

- Jiangsu Hengrui Medicine Co., Ltd.

- Sumitomo Dainippon Pharma

- CSPC Pharmaceutical Group Limited

- Bayer AG

- Boehringer Ingelheim International GmbH

- Astellas Pharma Inc.

Frequently Asked Questions

Analyze common user questions about the Hedgehog Pathway Inhibitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Hedgehog Pathway Inhibitors?

The primary mechanism involves binding to and inhibiting the Smoothened (SMO) receptor protein, which is essential for transmitting the Hedgehog signal across the cell membrane. By blocking SMO activity, these drugs prevent the activation of downstream transcription factors (GLI proteins), thereby inhibiting aberrant cell proliferation characteristic of Hh pathway-driven cancers like basal cell carcinoma (BCC).

Which specific cancer types are treated using approved Hedgehog Pathway Inhibitors?

Currently approved HhPIs, such as Vismodegib (Erivedge) and Sonidegib (Odomzo), are primarily used for the treatment of locally advanced or metastatic basal cell carcinoma (BCC) in adult patients who are not candidates for surgery or radiation, and certain forms of medulloblastoma in specific patient populations.

What are the main factors restraining the growth of the HhPI market?

Key restraints include the emergence of acquired drug resistance mutations in the SMO receptor, the high cost of targeted oncology treatments impacting patient access and reimbursement decisions, and the relatively limited patient population for the FDA/EMA-approved indications.

How is Artificial Intelligence (AI) influencing the future of HhPI development?

AI is critically influencing HhPI development by accelerating the identification of novel drug targets, optimizing clinical trial design to improve efficiency, and generating predictive biomarkers that enable personalized patient stratification, aiming to overcome existing resistance mechanisms more effectively.

Which geographical region holds the largest market share for Hedgehog Pathway Inhibitors?

North America currently holds the largest market share due to its established infrastructure for specialized oncology care, high prevalence rates of BCC, substantial investment in targeted therapy research, and favorable reimbursement policies for premium-priced cancer drugs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager