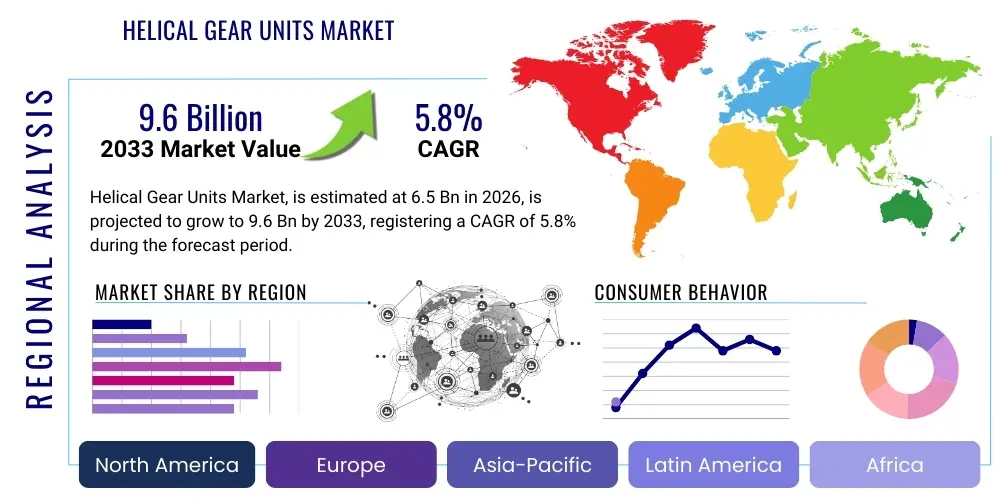

Helical Gear Units Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442204 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Helical Gear Units Market Size

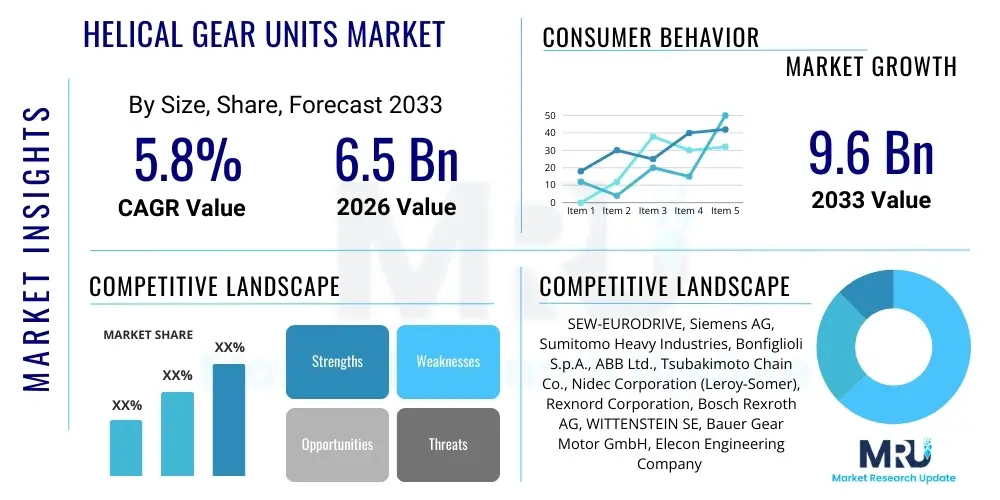

The Helical Gear Units Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Helical Gear Units Market introduction

The Helical Gear Units Market encompasses the global trade and utilization of gearboxes utilizing helical gears, which are cylindrical gears with teeth cut at an angle to the axis of rotation. These units are critical components in mechanical power transmission systems, offering advantages such as smooth operation, high efficiency, and superior load-carrying capacity compared to spur gears. Helical gears typically operate with less noise and vibration due to the gradual engagement of the slanted teeth, making them essential in applications requiring precision and sustained performance under demanding conditions. The market includes standard helical gearboxes, parallel shaft helical gearboxes, and bevel-helical gearboxes, categorized by their configuration and application specific requirements.

Helical gear units serve as vital links in machinery across almost every industrial sector, translating input speed and torque into the desired output characteristics efficiently. Major applications span across heavy industrial machinery, including material handling equipment such as conveyors and cranes, power generation systems, notably in wind turbines and hydro power plants, and within the rigorous environments of mining and construction equipment. They are also indispensable in the automotive sector for transmission systems and in the food and beverage industry where reliable, precise motion control is paramount. The inherent design benefits—including higher contact ratio and increased tooth strength—contribute significantly to machinery longevity and reduced maintenance costs, fueling their widespread adoption globally.

Market expansion is primarily driven by escalating global industrialization, particularly in emerging economies, which necessitates robust and reliable mechanical drive solutions. Furthermore, the increasing adoption of automation and robotics across manufacturing processes mandates high-efficiency power transmission components capable of continuous duty cycles. Key driving factors also include stringent energy efficiency regulations compelling industries to upgrade to more efficient gear technologies, and ongoing technological advancements in materials science and manufacturing precision that enhance the performance and durability of helical gear units, thus sustaining their demand across traditional and emerging high-tech sectors.

Helical Gear Units Market Executive Summary

The Helical Gear Units Market is characterized by steady expansion, propelled by robust global industrial output and significant investments in infrastructure and automation technologies. Current business trends indicate a strong move toward customization and modular designs, allowing manufacturers to rapidly adapt gear units to diverse industrial specifications, thereby reducing lead times and optimizing operational integration. Key players are increasingly focusing on incorporating digital technologies, such as IoT sensors and condition monitoring systems, into their gearboxes, transitioning from purely mechanical components to smart, interconnected drive systems. This integration supports predictive maintenance strategies, significantly improving uptime and overall equipment effectiveness (OEE) for end-users. Competitive strategy is centered on geographical expansion into high-growth regions like Asia Pacific and enhancing product portfolios to meet specialized demands in sectors such as renewable energy and high-speed rail.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption and manufacturing capacity, driven by rapid urbanization and massive infrastructure projects in China, India, and Southeast Asia. North America and Europe, while mature, exhibit high demand for high-specification, technologically advanced helical gear units due to stringent quality control standards and a focus on premium, energy-efficient machinery upgrades. Segment trends reveal that multi-stage helical gear units are experiencing higher growth rates compared to single-stage units, primarily due to the increasing requirement for higher reduction ratios and torque outputs in heavy-duty applications like mining and power transmission. Furthermore, the capacity segment above 500 kW is projected for accelerated growth, reflecting the global trend toward larger, more powerful industrial machinery, especially in offshore wind power and large-scale industrial complexes. The construction and material handling sectors remain primary revenue contributors, but the chemical and petrochemical industries are showing enhanced adoption driven by capacity expansion and modernization initiatives.

The market faces challenges related to raw material price volatility and intense competition from domestic manufacturers offering cost-effective alternatives, particularly in emerging markets. However, opportunities abound in the proliferation of Industry 4.0 standards, which demand integrated, reliable, and data-capable power transmission components. Strategic market participants are leveraging advanced manufacturing techniques, such including precision machining and specialized heat treatments, to enhance gear unit performance parameters, focusing on efficiency rating improvements and noise reduction. The market structure remains moderately consolidated, with large multinational corporations holding significant market share through established distribution networks and technological superiority, while niche players focus on specialized applications or geographical strongholds, fostering a dynamic competitive environment centered on innovation and lifecycle cost efficiency.

AI Impact Analysis on Helical Gear Units Market

Common user inquiries regarding AI's influence on the Helical Gear Units Market frequently revolve around predictive maintenance capabilities, optimization of manufacturing processes, and the development of 'smart' gearboxes. Users are concerned with how AI-driven analytics can extend the operational lifespan of existing gear units, reduce unexpected failures, and lower overall total cost of ownership (TCO). Key themes emerging from these questions include the feasibility of integrating affordable sensors and AI algorithms for continuous condition monitoring, the effectiveness of machine learning in detecting subtle anomalies indicative of gear wear or impending breakdown, and the long-term implications of AI-optimized production lines on component quality and production cost efficiency. The consensus expectation is that AI will fundamentally shift the service paradigm from reactive repair to proactive, data-driven management, leading to significant efficiency gains across major industrial sectors utilizing helical gear units.

The direct impact of Artificial Intelligence is bifurcated between manufacturing optimization and end-use operational enhancement. In manufacturing, AI algorithms optimize CNC machining parameters, improving cutting tool life, reducing scrap rates, and ensuring micron-level precision in gear tooth geometry, crucial for maximizing efficiency and minimizing noise output of the final helical unit. This optimization accelerates new product development cycles and allows for complex, customized gear designs that were previously too challenging or costly to mass-produce. Furthermore, AI is utilized in quality control by analyzing imaging data and vibration signatures to detect microscopic defects in gear sets before assembly, ensuring only flawless components enter the final product stage.

Operationally, AI integrated through Industrial IoT (IIoT) platforms allows helical gear unit manufacturers to offer Gearbox-as-a-Service (GaaS) models, focusing on maximizing runtime rather than just selling hardware. Machine learning models continuously process vibration, temperature, oil analysis, and acoustic data captured by embedded sensors, identifying patterns associated with specific failure modes, such as pitting, micro-cracking, or misalignment. This capability enables highly accurate predictions of remaining useful life (RUL), allowing maintenance teams to schedule interventions precisely when needed, thereby avoiding catastrophic failures and minimizing production downtime, significantly enhancing the value proposition of modern helical gear units across industries.

- AI optimizes CNC machining parameters for increased precision and reduced scrap rates in gear manufacturing.

- Predictive maintenance driven by Machine Learning (ML) analyzes sensor data (vibration, temperature) to forecast gear unit failure and estimate Remaining Useful Life (RUL).

- AI enhances quality control by automating defect detection using image processing and vibration signature analysis.

- Implementation of AI supports the development of 'smart' gear units and enables GaaS business models focused on operational uptime.

- Deep Learning models improve efficiency modeling, allowing manufacturers to design helical units with minimal power losses under varying load conditions.

DRO & Impact Forces Of Helical Gear Units Market

The Helical Gear Units Market is shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), all subject to significant external impact forces. A primary driver is the global emphasis on energy efficiency, compelling industries, particularly in high-consumption sectors like mining, cement, and power generation, to replace older, inefficient drive systems with modern, high-efficiency helical units. Concurrent expansion of renewable energy infrastructure, such as utility-scale wind farms and specialized hydro plants, necessitates large, high-torque helical gearboxes capable of reliable performance in fluctuating environments. This demand is further amplified by continuous technological upgrades within key end-user industries, specifically the move towards enhanced automation and robotics which require precise, smooth, and low-noise power transmission components. Restraints largely center around the intense price sensitivity prevalent in emerging markets, where local manufacturers offer cheaper alternatives, sometimes compromising on quality or efficiency. Furthermore, the complexity and high cost associated with manufacturing high-precision, large-scale helical gear components require significant capital investment and specialized expertise, forming a barrier to entry for smaller firms.

Opportunities for growth are prominently situated within the burgeoning smart manufacturing and Industry 4.0 paradigm. The demand for helical gear units integrated with IIoT capabilities, enabling remote diagnostics and condition monitoring, opens up new revenue streams based on service and data analytics. Furthermore, specialized application areas, such as high-speed, high-precision applications in aerospace and sophisticated robotics, offer premium market potential for manufacturers capable of meeting stringent performance standards. The continuous development of advanced gear materials, including specialized alloys and surface treatments, presents opportunities to enhance the power density and operational lifespan of gear units, addressing the need for lighter, yet more robust, components in mobile machinery and confined industrial spaces. The global push for electric vehicles (EVs) also offers ancillary opportunities in the manufacturing equipment necessary for battery production and EV component assembly lines, which rely heavily on specialized helical drive systems.

Impact forces significantly influencing the market include global supply chain volatility, particularly affecting the cost and availability of specialized metals like nickel and molybdenum used in high-grade gear steel. Regulatory impact forces, specifically environmental mandates promoting reduced energy consumption and lower noise pollution (acoustic impact), necessitate continuous product redesign and optimization, benefiting companies investing heavily in R&D. Economic cyclicality directly influences capital expenditure decisions in core industrial sectors (mining, construction), resulting in fluctuating demand for new equipment purchases. However, the secular trend towards modernization and replacement of legacy machinery provides a stabilizing counter-force. Finally, geopolitical stability affects regional investment flows in infrastructure and industrial capacity, dictating the pace and location of new manufacturing installations requiring helical gear units.

Segmentation Analysis

The Helical Gear Units Market segmentation provides a granular view of demand dynamics across various product types, operational capacities, and critical end-use applications. Analysis by Type focuses on the configuration of the gear mechanism—distinguishing between single-stage units, which provide modest reduction ratios, and multi-stage units (including two-stage and three-stage), engineered for high-torque, slow-speed output essential for heavy industrial applications. The Capacity segmentation is critical as it delineates market needs based on power transmission requirements, ranging from low-power applications (below 100 kW) commonly found in light machinery and conveyors, up to very high-capacity units (above 500 kW) indispensable in areas like large mills, crushers, and utility-scale power generation turbines. Understanding these segments is vital for manufacturers to align product portfolios with specific industry needs and operational demands.

Segmentation by End-Use Industry is the most significant determinant of market demand, reflecting diverse operational environments and duty cycles. The material handling segment, encompassing logistics, port operations, and warehousing, requires reliable, medium-duty helical units for continuous operation of cranes, hoists, and conveyors. Conversely, the mining and metals sector demands robust, high-torque, and specialized units built to withstand abrasive environments and extreme shock loads prevalent in crushers and grinding mills. Similarly, the construction industry drives demand for mobile and compact helical units for excavators, mixers, and drilling equipment. The automotive and food & beverage sectors focus more on precision, cleanliness (stainless steel options), and low-noise operation, illustrating the necessity of highly specialized product offerings within each vertical.

Further analysis within the market includes segmentation by Mounting Type, primarily distinguishing between Foot Mounted units, which offer stable, robust installation in fixed industrial settings, and Flange Mounted units, which are often utilized for more compact integration or direct coupling with motors or machinery frames, providing installation flexibility. The sustained growth across all segments underscores the fundamental role of helical gear units in modern mechanical power transmission. The future trajectory indicates a growing penetration of high-capacity and technologically integrated (smart) helical units, driven primarily by industrial expansion in APAC and efficiency-driven upgrades in mature North American and European markets.

- By Type: Single-Stage, Multi-Stage (Two-Stage, Three-Stage)

- By Capacity: Up to 100 kW, 100 kW to 500 kW, Above 500 kW

- By Mounting: Foot Mounted, Flange Mounted

- By End-Use Industry: Material Handling, Construction, Power Generation (Wind, Hydro, Thermal), Mining & Metals, Food & Beverage, Automotive, Chemical & Petrochemical, Others (Aerospace, Marine)

Value Chain Analysis For Helical Gear Units Market

The value chain for the Helical Gear Units Market initiates with the upstream supply of raw materials, primarily high-grade steel alloys (e.g., chrome-molybdenum steel) necessary for producing durable gears and casings, along with precision bearings and specialized lubricants. This upstream phase is highly sensitive to global commodity prices and metallurgical advancements, as the quality of these input materials directly dictates the gear unit's final performance characteristics, including load capacity, efficiency, and lifespan. Key activities at this stage include sourcing, heat treatment, and specialized forging/casting processes. Manufacturers engage in rigorous supplier qualification to ensure consistent material quality, as failures in material integrity can lead to catastrophic gear unit breakdowns in heavy-duty applications. The procurement logistics and inventory management of these specialized raw materials represent a crucial area for cost control and operational efficiency within the value chain.

The core manufacturing stage involves intricate processes such as hobbing, shaping, grinding, and super-finishing of the gear teeth, followed by precise assembly of the gear train, shafts, bearings, and casing. Investment in advanced CNC machinery and quality control systems is paramount here, particularly for achieving the precise geometry required for low-noise, high-efficiency helical units. Following manufacturing, the distribution channel plays a critical role. Direct sales channels are often utilized for large, custom-engineered gear units sold to OEMs (Original Equipment Manufacturers) in the construction, mining, and power generation sectors, enabling close collaboration on specifications and post-sale service. Indirect distribution, leveraging a network of authorized distributors, agents, and system integrators, is commonly used for standard, smaller gear units and replacement parts, ensuring broader market reach and quicker delivery times for Maintenance, Repair, and Operations (MRO) demand.

Downstream activities involve integration, installation, and comprehensive aftermarket services. System integrators frequently customize standard helical units for specific plant requirements, acting as crucial technical intermediaries. Post-sale services, including maintenance, repair, overhaul (MRO), and condition monitoring, contribute significantly to the total lifetime value derived from the gear unit. The shift towards IIoT-enabled gearboxes integrates the downstream phase more tightly with data analytics, allowing manufacturers to offer service contracts based on predictive failure analysis. The profitability within the value chain is increasingly shifting towards these high-value aftermarket services, compelling manufacturers to focus on product reliability and digital integration to secure long-term service revenue.

Helical Gear Units Market Potential Customers

The potential customer base for the Helical Gear Units Market is exceptionally broad, spanning nearly all heavy and continuous process industries globally, reflecting the fundamental necessity of mechanical power transmission components. The primary buyers are large-scale industrial companies, classified mainly as Original Equipment Manufacturers (OEMs) and End-Users (EUs) involved in capital-intensive projects. OEMs, such as manufacturers of conveyors, cranes, wind turbines, rolling mills, and construction machinery, purchase helical gear units in bulk for integration into their final products, prioritizing units that offer high power density, reliability, and ease of integration. The selection criteria for OEMs are highly technical, focusing on specific torque ratings, service factors, and compatibility with proprietary motor systems. Strategic partnerships with OEMs are critical for sustained revenue generation and market penetration.

End-users represent a significant segment, purchasing helical gear units both for new facility installations and for replacement/modernization of existing machinery (MRO demand). Within the mining industry, customers are typically large mining corporations requiring extremely rugged, high-capacity helical units for crushers, ball mills, and stackers. Similarly, power generation companies, specifically those operating large wind farms or thermal plants, require highly reliable, specialized gearboxes designed for continuous, severe-duty cycles, where the cost of failure is immensely high. These customers prioritize long Mean Time Between Failures (MTBF) and comprehensive service contracts, making lifecycle cost a more important factor than initial purchase price.

Furthermore, niche markets such as the food and beverage sector and specialized robotics manufacturers represent crucial, albeit smaller, potential customer groups demanding tailored products. Food processing companies require hygienic, stainless steel helical units with food-grade lubricants and high protection ratings (IP66/IP67) to withstand aggressive washdown procedures. Robotics and high-precision automation customers require compact, zero-backlash helical units capable of highly dynamic and precise motion control. The increasing focus on automation in sectors ranging from agriculture to pharmaceuticals guarantees continued demand for customized, high-specification helical gear units across diverse operational needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEW-EURODRIVE, Siemens AG, Sumitomo Heavy Industries, Bonfiglioli S.p.A., ABB Ltd., Tsubakimoto Chain Co., Nidec Corporation (Leroy-Somer), Rexnord Corporation, Bosch Rexroth AG, WITTENSTEIN SE, Bauer Gear Motor GmbH, Elecon Engineering Company Limited, Dana Incorporated, Philadelphia Gear, Inc., Emerson Electric Co., Hansen Industrial Transmissions NV, Zhejiang Xingda Gear Co., Ltd., Kumera Corporation, Varvel SpA, Nord Drivesystems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helical Gear Units Market Key Technology Landscape

The technology landscape of the Helical Gear Units Market is undergoing continuous refinement, moving beyond fundamental mechanical design towards smart, digitally integrated systems and advanced materials. A key technological focus is on precision machining, particularly the use of high-speed five-axis CNC grinding and superfinishing techniques. These processes are essential for achieving the required geometric accuracy (often AGMA 12 or higher) of the helical tooth flanks, which directly minimizes friction, reduces operational noise (a critical factor in urban and HVAC applications), and maximizes power transmission efficiency. Furthermore, specialized gear profile modifications, such as tip and root relief, are being engineered using Finite Element Analysis (FEA) to ensure uniform load distribution across the entire tooth width, enhancing reliability under high stress and preventing premature failure.

Material science advancements represent another critical area of innovation. Manufacturers are increasingly utilizing specialized low-alloy and case-hardened steels combined with advanced heat treatment processes, such as vacuum carburizing and nitriding. These treatments create a highly durable, wear-resistant surface layer while maintaining a tough, shock-absorbent core, significantly improving the gear unit's resistance to pitting and scuffing, particularly in high-torque density applications. Furthermore, the development of synthetic, high-performance lubricants designed specifically for helical gearboxes, capable of maintaining stable viscosity across wide temperature ranges and reducing drag losses, contributes substantially to the overall energy efficiency of the units, aligning with stricter environmental regulations.

The integration of digital technology, central to Industry 4.0, is transforming helical gear units into intelligent assets. Modern gearboxes are frequently equipped with embedded sensors for monitoring critical parameters like vibration, temperature, oil particle count, and acoustic signatures. These sensors transmit real-time data to cloud-based diagnostic platforms, often utilizing proprietary algorithms and Machine Learning (ML) models to identify impending mechanical issues long before catastrophic failure occurs. This capability shifts maintenance strategies from time-based or reactive repairs to highly efficient, predictive maintenance, thereby maximizing operational uptime and significantly reducing the lifecycle costs associated with industrial power transmission systems.

Regional Highlights

The global helical gear units market exhibits distinct regional dynamics driven by differing levels of industrialization, infrastructure spending, and technological maturity. Asia Pacific (APAC) currently holds the dominant market share and is projected to experience the fastest growth throughout the forecast period. This rapid expansion is primarily fueled by extensive governmental investments in infrastructure (including high-speed rail and utility-scale power projects) and booming manufacturing sectors in countries like China, India, and Southeast Asian nations. The region’s low-cost manufacturing base also makes it a major global hub for gear unit production, attracting significant foreign investment and fostering strong domestic competition. High demand for construction machinery and continued urbanization drives substantial sales volumes across all capacity segments.

Europe represents a mature market characterized by stringent quality requirements and a strong emphasis on energy efficiency and low environmental impact. Demand here is largely driven by modernization and replacement cycles, particularly in Germany and Italy, which are leading centers for advanced machinery manufacturing and automotive production. European end-users prioritize high-precision, low-noise helical units integrated with advanced digital monitoring capabilities. The region is also a key center for specialized high-capacity gearboxes used in the robust offshore wind energy sector, necessitating gear units built for extreme reliability and minimal maintenance intervention over multi-year service periods. Regulatory frameworks promoting energy-efficient machinery further incentivize the adoption of premium helical gear units over older transmission technologies.

North America maintains a significant market presence, driven by substantial capital expenditures in the mining, oil & gas, and manufacturing sectors. The focus in this region is on high-power density and high-durability gear units capable of meeting the demands of heavy-duty industrial applications, such as large conveyors in mining operations and process machinery in petrochemical plants. Recent shifts toward re-shoring and expansion of domestic manufacturing capacity, coupled with significant investments in logistics and warehousing automation, are sustaining consistent demand for mid-to-high capacity helical gear units. While growth rates are more moderate compared to APAC, the market value remains high due to the preference for technologically advanced, often customized, gear drive solutions featuring integrated smart diagnostics and long warranty periods provided by established market leaders.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by infrastructure development (China, India) and rapid industrialization; key consumer in material handling and construction.

- Europe: Mature market focusing on high efficiency, precision, and smart technology integration; strong demand from specialized sectors like wind energy and advanced machinery (Germany, Italy).

- North America: Stable market driven by capital expenditure in mining, oil & gas, and general manufacturing; high preference for robust, high-power density units and advanced digital diagnostic features.

- Latin America (LATAM): Growth tied closely to commodity prices and mining sector investment (Brazil, Chile); demand focused on robust, cost-effective gear units for resource extraction.

- Middle East and Africa (MEA): Emerging market growth stimulated by oil & gas infrastructure projects and diversification into logistics and construction; demand is highly sensitive to geopolitical stability and crude oil prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helical Gear Units Market.- SEW-EURODRIVE

- Siemens AG

- Sumitomo Heavy Industries

- Bonfiglioli S.p.A.

- ABB Ltd.

- Tsubakimoto Chain Co.

- Nidec Corporation (Leroy-Somer)

- Rexnord Corporation

- Bosch Rexroth AG

- WITTENSTEIN SE

- Bauer Gear Motor GmbH

- Elecon Engineering Company Limited

- Dana Incorporated

- Philadelphia Gear, Inc.

- Emerson Electric Co.

- Hansen Industrial Transmissions NV

- Zhejiang Xingda Gear Co., Ltd.

- Kumera Corporation

- Varvel SpA

- Nord Drivesystems

Frequently Asked Questions

Analyze common user questions about the Helical Gear Units market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of helical gear units over spur gear units in industrial applications?

Helical gear units offer superior operational characteristics due to the angled tooth design, which allows for gradual tooth engagement. This results in significantly smoother, quieter operation and higher load-carrying capacity compared to spur gears. The increased contact ratio enhances durability and allows for higher speed applications with reduced vibration, making them ideal for heavy industrial machinery requiring continuous, reliable power transmission.

How is Industry 4.0 influencing the design and maintenance strategies for helical gearboxes?

Industry 4.0 is transforming helical gearboxes into 'smart' components by integrating IIoT sensors and connectivity. This enables advanced condition monitoring, real-time diagnostics, and predictive maintenance (PdM). Machine learning algorithms analyze operational data (vibration, temperature) to forecast potential failures, shifting maintenance from reactive to proactive, thereby maximizing uptime and substantially reducing the total cost of ownership (TCO) for end-users.

Which end-use industry drives the largest demand for high-capacity helical gear units (above 500 kW)?

The largest demand for high-capacity helical gear units is primarily driven by the Power Generation sector, particularly large-scale wind turbine applications and utility-scale hydro and thermal power plants, and the Mining & Metals industry. These sectors require extremely robust, high-torque gearboxes capable of handling massive loads and continuous severe-duty cycles, essential for crushers, grinding mills, and heavy-duty speed multiplication/reduction tasks.

What technological advancements are enhancing the lifespan and efficiency of modern helical gear units?

Key technological advancements include enhanced precision machining techniques, such as high-accuracy CNC grinding, and specialized material treatments (e.g., vacuum carburizing and nitriding) for increased surface hardness and wear resistance. Furthermore, sophisticated finite element analysis (FEA) is used during design to optimize gear profiles for uniform load distribution, alongside the development of advanced synthetic lubricants that minimize frictional losses and maintain stable performance across varying operational temperatures.

What is the current growth trajectory for the Helical Gear Units Market in the Asia Pacific region?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate globally, driven by substantial government infrastructure investments, rapid urbanization, and accelerated industrialization across key economies like China, India, and Vietnam. The extensive demand stems from new manufacturing facility installations, massive construction projects, and expansion in the region's automotive and material handling sectors, positioning APAC as the largest and most dynamic market segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager