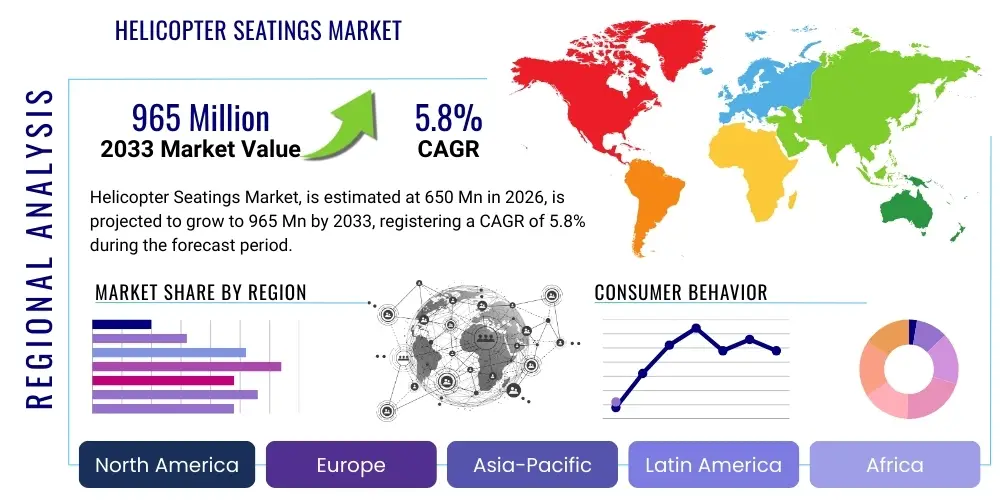

Helicopter Seatings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441432 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Helicopter Seatings Market Size

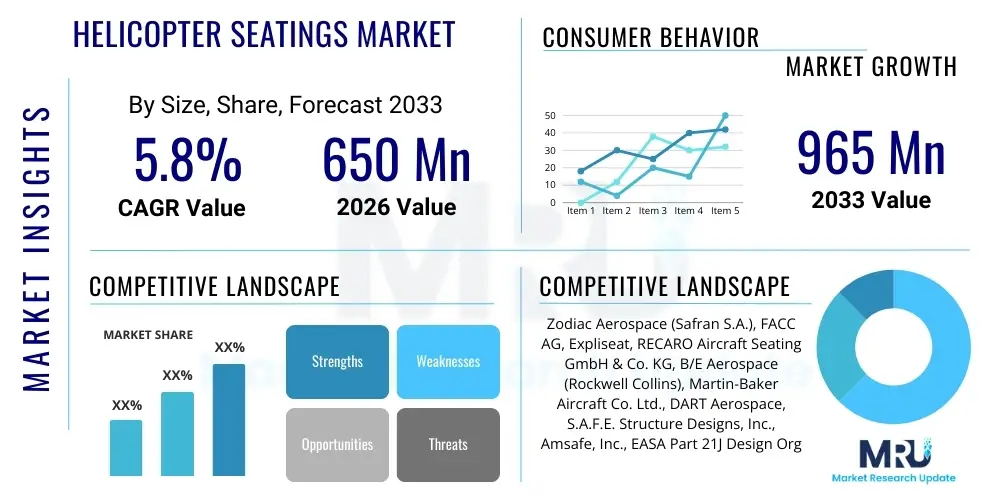

The Helicopter Seatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 965 Million by the end of the forecast period in 2033.

Helicopter Seatings Market introduction

The Helicopter Seatings Market encompasses the design, manufacturing, and maintenance of specialized seating systems tailored for various rotary-wing aircraft applications, including commercial transport, military operations, search and rescue (SAR), and emergency medical services (EMS). These seating solutions are highly engineered to meet stringent aerospace safety regulations, focusing particularly on crashworthiness, occupant protection, and weight reduction. Crashworthiness, achieved through advanced energy-attenuating (EA) seat designs, is a primary technical requirement, ensuring that the kinetic energy from a hard landing or crash sequence is absorbed effectively, minimizing injury severity to pilots and passengers. The complexity of these systems necessitates collaboration between airframe original equipment manufacturers (OEMs), specialized seating suppliers, and regulatory bodies like the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency).

Product sophistication ranges from lightweight, ergonomic standard passenger seats found in corporate or utility helicopters to highly complex military or specialized tactical seats integrated with survival equipment and ballistic protection. Major applications driving demand include the continuous modernization of aging military fleets, the expansion of global EMS networks requiring rapid and safe patient transport capabilities, and the robust growth in offshore oil and gas operations, which mandates extremely reliable, crash-tested seating for routine crew transfers. The benefit profile of high-quality helicopter seating extends beyond mere comfort, fundamentally enhancing operational safety, crew readiness, and adherence to evolving international airworthiness standards. Manufacturers are increasingly focusing on modular designs that allow for quick configuration changes, vital for multi-mission platforms used by paramilitary or government agencies.

Driving factors in this specialized market include strict global safety mandates, particularly those concerning the installation of EA seats in new rotary-wing platforms; the necessity for weight optimization to improve fuel efficiency and payload capacity, leading to increased adoption of composite materials in seat structures; and the steady increase in global helicopter fleet utilization across commercial and governmental sectors. Furthermore, technological advancements in materials science, coupled with sophisticated simulation tools for dynamic crash testing, are accelerating the development of lighter, safer, and more durable seating solutions. The replacement cycle within the mature military and aging civilian fleet segment also contributes significantly to aftermarket demand, driven by necessary overhauls and upgrades to comply with modern safety standards.

Helicopter Seatings Market Executive Summary

The Helicopter Seatings Market exhibits robust growth propelled primarily by stringent global aviation safety regulations mandating crash-attenuating seats and the rising utilization of rotary-wing aircraft in high-growth application areas such as EMS and offshore energy. Business trends indicate a strong focus on lightweight composite materials (like carbon fiber) to meet payload and efficiency demands, coupled with a shift towards modular seating systems that facilitate multi-mission flexibility for operators. Key manufacturers are investing heavily in advanced dynamic testing capabilities and simulation software to optimize energy absorption profiles and certify products quickly under rigorous standards. Mergers and acquisitions are common strategies among suppliers seeking to consolidate market share, acquire niche technologies (e.g., advanced restraint systems), or secure long-term contracts with major OEMs like Airbus Helicopters and Bell Textron.

Regional trends reveal that North America remains the largest market due to significant defense spending, particularly on helicopter fleet modernization and the presence of major aerospace OEMs and high regulatory compliance rates. Asia Pacific, however, is emerging as the fastest-growing region, driven by expanding civil aviation sectors, increased demand for Search and Rescue (SAR) capabilities in developing economies, and growing defense procurement, particularly in countries like India, China, and South Korea. Europe maintains a strong presence, underpinned by a mature aftermarket, stringent EASA requirements, and a significant base of MRO (Maintenance, Repair, and Overhaul) service providers specializing in rotary-wing platforms. These regions dictate localized demand for specific seat types, such such as high-density utility seats in APAC and high-spec executive seats in North America and Europe.

Segmentation trends highlight that Energy Attenuating (EA) seats dominate the market value due to their mandatory nature in newer aircraft and high unit cost, reflecting complex hydraulic or mechanical damping mechanisms. The Military segment retains the largest market share by application, driven by demand for pilot seats integrated with armor and specialized flight controls, while the EMS sector is demonstrating the highest growth trajectory, reflecting global investment in air ambulance services requiring dedicated, crashworthy patient and attendant seating. The aftermarket segment, focusing on refurbishment, upgrades, and scheduled maintenance, is critical for revenue stability, offering sustained opportunities for component suppliers and service providers who specialize in ensuring continued regulatory compliance for in-service fleets.

AI Impact Analysis on Helicopter Seatings Market

User queries regarding AI’s influence on the Helicopter Seatings Market primarily center on how artificial intelligence and machine learning (ML) could optimize design for crashworthiness, personalize seating ergonomics in real-time, and enhance predictive maintenance for seat components. Users are concerned about the regulatory approval process for AI-driven safety enhancements and expect AI to streamline the labor-intensive dynamic testing required for certification. Key themes emerging from these inquiries include the application of Generative Design techniques (using AI to create optimal structural geometries for maximum strength and minimum weight), the use of ML to analyze vast crash test datasets for improved energy attenuation modeling, and the integration of smart sensors within seats to provide real-time occupant health monitoring and fatigue detection, crucial for long-duration missions.

- AI-driven Generative Design: Optimizes seat structure geometry, reducing material usage and weight while maintaining superior crash resistance, leading to faster design cycles.

- Predictive Maintenance Algorithms: Utilizes ML to analyze sensor data from seat components (actuators, harnesses, energy absorbers) to predict fatigue or failure, reducing unscheduled maintenance.

- Enhanced Simulation & Testing: AI accelerates the processing of complex Finite Element Analysis (FEA) and dynamic test data, refining Energy Attenuation (EA) parameters far faster than traditional methods.

- Real-Time Ergonomic Adaptation: Sensor-equipped seats use AI to adjust lumbar support, cushion pressure, and vibration damping based on crew fatigue and G-force exposure, particularly critical in tactical operations.

- Supply Chain Optimization: ML algorithms improve forecasting for material procurement and component scheduling, essential for managing complex aerospace supply chains involving specialized composite manufacturing.

DRO & Impact Forces Of Helicopter Seatings Market

The market dynamics are defined by powerful driving forces such as strict safety legislation, which mandates the adoption of advanced, high-cost energy-attenuating systems, directly inflating market value and unit price. The increasing global demand for new helicopter platforms, especially in military reconnaissance, counter-terrorism, and specialized humanitarian aid missions, fuels OEM demand for certified seating solutions. Simultaneously, restraints challenge market growth, most notably the extremely high costs associated with rigorous regulatory compliance and dynamic crash testing (Tso-C127a/b/c standards), which creates significant barriers to entry for smaller manufacturers and prolongs product development cycles. Furthermore, the specialized nature of materials and low-volume production characteristic of the aerospace sector contribute to high manufacturing overheads.

However, significant opportunities exist, particularly in the aftermarket segment, focusing on the refurbishment and retrofitting of existing non-EA equipped fleets, especially older utility helicopters, to meet contemporary safety standards—a continuous revenue stream for specialized MRO providers. Technological advancements in lightweight composite materials, such as advanced thermoset and thermoplastic resins reinforced with carbon fiber, present an opportunity for manufacturers to meet the dual objectives of maximizing safety and minimizing weight, thereby increasing performance and fuel efficiency. The rise of Unmanned Aerial Systems (UAS) and specialized eVTOL aircraft, while not directly competing with traditional helicopter seating now, presents long-term technological cross-over opportunities for restraint and energy management systems.

The impact forces within this market are predominantly high-intensity regulatory pressure and competitive pricing strategies among established players. The switch to performance-based regulations encourages innovation but requires substantial capital investment in R&D and testing infrastructure, creating a high impact force on product viability. Buyer power is moderate to high, as major OEMs dictate specifications and demand competitive, customized supply contracts, forcing suppliers to invest heavily in platform-specific certification. The threat of substitutes is low, as highly specialized safety seating cannot be easily replaced by off-the-shelf commercial aviation products, solidifying the niche market position. These interconnected forces ensure that safety compliance and technological differentiation remain the paramount competitive factors.

Segmentation Analysis

The Helicopter Seatings Market is intricately segmented based on seating type, primary application, key components, and end-user, reflecting the diverse operational requirements inherent in rotary-wing aviation. The Type segmentation distinguishes between highly specialized crashworthy seats, which incorporate complex mechanical or hydraulic systems for kinetic energy absorption, and standard utility or VIP seating, which prioritizes comfort and modularity. This delineation is crucial as crashworthy seats command significantly higher price points and stricter regulatory scrutiny. Segmentation by application highlights the dominant demand from the Military sector, which requires features like ballistic protection and quick-release mechanisms, contrasting with the high-growth EMS sector, which emphasizes accessible design and patient comfort interfaces.

The Component segmentation provides insight into the supply chain, differentiating between the core Seat Structure (often composite or lightweight alloy), critical energy-absorbing Actuators or dampers, and visible elements such as Upholstery and safety Harnesses and Belts. Ongoing technological advancements are particularly focused on the actuator segment, driving innovation in passive and semi-active energy absorption. Finally, the End-User segmentation separates demand generated by Original Equipment Manufacturers (OEMs), who integrate seats into new airframes, from the Aftermarket, which covers maintenance, repair, overhaul, and critical fleet upgrade programs, ensuring sustained demand throughout the operational lifecycle of a helicopter.

- By Type:

- Standard Seats

- Energy Attenuating Seats (EA)

- Executive/VIP Seats

- Crashworthy Seats (Specialized Military/Tactical)

- By Application:

- Commercial Helicopters (Corporate, Utility)

- Military Helicopters (Transport, Attack, Reconnaissance)

- Emergency Medical Services (EMS) / Air Ambulance

- Offshore Transportation (Oil & Gas Rig Transfers)

- Search and Rescue (SAR)

- By Component:

- Seat Structure (Frame & Shell)

- Actuators and Energy Absorption Systems

- Upholstery and Cushions

- Harnesses and Belts (Restraint Systems)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (MRO and Retrofit)

Value Chain Analysis For Helicopter Seatings Market

The value chain for the Helicopter Seatings Market is characterized by highly specialized stages, beginning with the upstream supply of advanced, certified raw materials. This upstream analysis focuses heavily on suppliers of aerospace-grade composite materials (carbon fiber, aramid fibers), specialized lightweight alloys (aluminum and titanium), and high-performance textiles and foams required for upholstery that meets fire retardancy standards (FAR 25.853). The criticality of these suppliers lies in their ability to provide materials that are simultaneously light, structurally robust, and compliant with strict aerospace material specifications. Certification and traceability throughout this stage are non-negotiable, requiring long-term agreements between seat manufacturers and approved material providers. Innovation in this segment is driven by the demand for stronger, lighter components capable of managing extreme impact loads.

The midstream component involves the highly integrated process of seat manufacturing, including precision engineering, complex assembly of energy attenuation mechanisms (hydraulic dampers or crushable materials), and dynamic testing simulation. Direct involvement of specialized design organizations (EASA Part 21J or FAA DERs) is crucial during this stage, validating compliance with standards like TSO-C127. Distribution channels are predominantly direct, particularly for the OEM segment, where manufacturers negotiate multi-year supply contracts directly with major helicopter builders (e.g., Airbus, Leonardo, Bell). The aftermarket segment, however, often utilizes indirect channels, relying on approved Maintenance, Repair, and Overhaul (MRO) facilities and certified distributors who handle repairs, retrofits, and spare parts procurement for in-service fleets globally.

The downstream analysis focuses on the end-users: the helicopter operators, including military and governmental bodies, large commercial fleet operators (offshore transport), and dedicated EMS providers. These end-users prioritize product reliability, operational uptime, and rapid MRO support. Key aspects of the downstream value are after-sales support, technical documentation, and ongoing maintenance contracts, ensuring the continued airworthiness of the installed seating systems over the helicopter's operational life. The relationship between manufacturers and MRO providers is symbiotic, as the complexity of energy-attenuating technology necessitates factory-trained technicians for periodic inspection and recertification, thus closing the loop in the highly regulated aerospace value chain.

Helicopter Seatings Market Potential Customers

The primary customers in the Helicopter Seatings Market are highly specialized entities demanding certified, reliable, and application-specific seating solutions, dictated primarily by mission profiles and regulatory environment. Original Equipment Manufacturers (OEMs) represent a crucial customer segment, incorporating thousands of seats annually into new helicopter airframes ranging from light utility to heavy-lift transport. These major airframe manufacturers demand long-term, high-volume contracts and seek partners capable of managing the full certification process specific to their new platforms. The quality and safety requirements of these OEMs are the highest in the industry, influencing the entire market standard.

Another dominant customer group is military and governmental procurement agencies globally. These entities, often working through competitive tenders, require highly customized tactical seating, crashworthy troop seats, and specialized pilot/co-pilot seats integrated with survival gear, armor plating, and mission control interfaces. The procurement cycle is often long but results in lucrative, multi-year support contracts. Key considerations for this segment include survivability ratings, ballistic protection capabilities, and adherence to specific military standards (MIL-SPECS), differentiating their needs significantly from civilian operators.

Commercial helicopter operators, especially those in high-risk environments such as offshore oil and gas transportation and Emergency Medical Services (EMS), form the third major customer base. Offshore operators require robust, easily cleanable, crashworthy seating designed for high utilization rates and often operate under specific regional mandates (e.g., UK CAA requirements). EMS buyers require lightweight patient litters and attendant seats that allow for rapid ingress/egress and seamless integration with medical equipment. These customers prioritize reliability, weight savings, and quick turnaround times for maintenance and replacement parts within the aftermarket segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 965 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zodiac Aerospace (Safran S.A.), FACC AG, Expliseat, RECARO Aircraft Seating GmbH & Co. KG, B/E Aerospace (Rockwell Collins), Martin-Baker Aircraft Co. Ltd., DART Aerospace, S.A.F.E. Structure Designs, Inc., Amsafe, Inc., EASA Part 21J Design Organization, United Technologies Corporation (Raytheon Technologies), Oregon Aero, Inc., Pacific Scientific Aerospace, RCO Aerospace, Saint-Gobain Sully, Contour Aerospace, Inc., Ipeco Holdings Ltd., Sogerma (Stelia Aerospace). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helicopter Seatings Market Key Technology Landscape

The technology landscape of the Helicopter Seatings Market is dominated by the pursuit of enhanced crash protection and significant weight reduction, critical parameters dictated by both safety regulations and operational efficiency requirements. The core technology centers around Energy Attenuating (EA) systems, which primarily utilize hydraulic dampers, mechanical crush tubes, or frangible components designed to progressively absorb kinetic energy during a vertical hard landing, thereby limiting the forces transmitted to the occupant's spine and head. Continuous innovation is focused on developing multi-axis attenuation capabilities to handle complex, oblique crash vectors, moving beyond simple vertical impact absorption. This necessitates the use of advanced simulation tools, such as high-fidelity Finite Element Analysis (FEA), to model material deformation and failure under dynamic loading conditions, minimizing the need for expensive physical testing iterations.

Material science is another crucial technological pillar. The substitution of traditional metallic structures (aluminum alloys) with advanced composites, particularly carbon fiber reinforced plastics (CFRP), is a major trend. These composite structures offer superior strength-to-weight ratios, achieving weight savings of up to 30% compared to legacy metal seats, directly translating to increased payload capacity and reduced fuel consumption for the operator. Furthermore, specialized foam technologies and fire-resistant upholstery materials compliant with aerospace fire standards (e.g., FAR 25.853) are essential. Manufacturers are exploring smart materials and non-flammable thermoplastics that are easier to mold, reduce production time, and simplify the maintenance process without compromising safety ratings.

Integration of smart technology is an emerging trend. This includes the implementation of integrated health monitoring sensors (IHM) within seat structures and harnesses. These sensors collect data on structural integrity, excessive loading, or component wear, feeding into predictive maintenance systems and ensuring continuous airworthiness. For specialized military and VIP seating, active vibration control systems are being developed using sophisticated actuators and algorithms to counter rotor-induced vibrations, significantly reducing crew fatigue and improving mission effectiveness. The regulatory environment drives the technological pace, ensuring that all innovations, from material choices to attenuation mechanisms, undergo rigorous, dynamic, 16G certification testing before commercial deployment.

Regional Highlights

Regional dynamics heavily influence the demand and technological adoption rates within the Helicopter Seatings Market, primarily driven by differences in defense spending, civil aviation maturity, and local safety mandates. North America, dominated by the United States, represents the largest and most mature market. This region benefits from the presence of major military and commercial helicopter OEMs (Bell, Boeing, Sikorsky) and extensive defense modernization programs. The strict adherence to FAA safety standards and substantial investments in EMS and offshore transport fleets ensure high demand for premium, TSO-certified Energy Attenuating seats. The strong aftermarket support structure further bolsters the region's market share, focusing on retrofits and component upgrades for aging fleets.

Europe constitutes a significant market, characterized by stringent EASA regulations and a strong emphasis on passenger safety and ergonomic design, particularly within the VIP and corporate transport segments. Countries like Germany, France, and the UK are major hubs for MRO activities and high-value manufacturing, driving demand for technologically advanced seating solutions. The expansion of cross-border EMS services in Europe also contributes to steady growth. Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid expansion of civil aviation, increasing defense procurement in response to geopolitical tensions, and necessary improvements in Search and Rescue (SAR) capabilities across vast territories. Countries such as China and India are ramping up domestic manufacturing capabilities and fleet modernization, creating substantial long-term OEM and aftermarket opportunities.

Latin America and the Middle East & Africa (MEA) present niche but growing opportunities. Latin America's market is primarily driven by utility operations, including law enforcement and resource extraction (mining, oil & gas), demanding durable, low-maintenance seating. The MEA region, particularly the Gulf Cooperation Council (GCC) states, shows significant investment in specialized military rotorcraft and high-end VIP transport, driving demand for bespoke executive seating with advanced features. These regions are more reliant on imports and are highly sensitive to global commodity prices, which can influence fleet expansion and upgrade schedules, requiring suppliers to maintain flexible distribution strategies.

- North America: Dominant market share due to major defense budgets, established OEM presence, and rigorous FAA TSO-C127 mandates; focus on high-specification EA seats and extensive aftermarket support.

- Europe: High adoption of advanced technologies driven by EASA standards; strong demand for executive/VIP seating and specialized EMS configurations; mature MRO network.

- Asia Pacific (APAC): Fastest growth trajectory driven by military modernization, commercial fleet expansion, and increased investment in regional SAR and utility operations across emerging economies.

- Middle East & Africa (MEA): Growing demand for tactical military seating and high-end VIP transport solutions, sensitive to defense spending and oil price stability.

- Latin America: Market driven by governmental utility operations and resource sector transport; primary focus on durability and cost-effective maintenance in utility seating applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helicopter Seatings Market.- Zodiac Aerospace (Safran S.A.)

- FACC AG

- Expliseat

- RECARO Aircraft Seating GmbH & Co. KG

- B/E Aerospace (Rockwell Collins)

- Martin-Baker Aircraft Co. Ltd.

- DART Aerospace

- S.A.F.E. Structure Designs, Inc.

- Amsafe, Inc.

- EASA Part 21J Design Organization

- United Technologies Corporation (Raytheon Technologies)

- Oregon Aero, Inc.

- Pacific Scientific Aerospace

- RCO Aerospace

- Saint-Gobain Sully

- Contour Aerospace, Inc.

- Ipeco Holdings Ltd.

- Sogerma (Stelia Aerospace)

- Jankel Group

- C.E. Parmelee Co.

Frequently Asked Questions

Analyze common user questions about the Helicopter Seatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Energy Attenuating (EA) seats and why are they mandatory in new helicopters?

Energy Attenuating seats are specialized crashworthy systems designed to absorb the kinetic energy from hard landings (vertical impacts) by controlled deformation or dampening mechanisms. They are mandatory in modern helicopters under regulations like FAA TSO-C127 and EASA specifications to significantly reduce the impact forces transmitted to occupants, minimizing spinal and head injuries, thereby enhancing overall survivability.

How do composite materials impact the design and performance of helicopter seating?

Composite materials, such as carbon fiber reinforced polymers (CFRP), are crucial as they offer a superior strength-to-weight ratio compared to traditional metals. This lightweighting is critical for maximizing payload and fuel efficiency, while also offering inherent structural properties that can be optimized through generative design for enhanced crash performance and durability.

Which segment holds the highest growth potential in the Helicopter Seatings Market?

The Emergency Medical Services (EMS) application segment, along with the Aftermarket segment focused on retrofitting older fleets with crashworthy seating, exhibit the highest growth potential. This growth is fueled by increasing global investment in rapid air ambulance services and stringent government mandates requiring compliance upgrades.

What is the typical certification process for new helicopter seating systems?

New seating systems must undergo rigorous dynamic testing, often simulating 16G vertical and horizontal impacts, to prove compliance with TSO-C127 standards (or equivalent EASA requirements). This process involves extensive Finite Element Analysis (FEA) modeling, physical sled testing, and subsequent approval by regulatory bodies like the FAA or EASA.

How is AI being utilized to improve helicopter seat safety?

AI and machine learning are employed in Generative Design to optimize the structural shape and material distribution for crashworthiness, reducing weight while maximizing strength. Furthermore, AI analyzes dynamic crash test data to rapidly refine energy attenuation mechanisms and predict component failure for proactive maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager