Helicopter Wheel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443354 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Helicopter Wheel Market Size

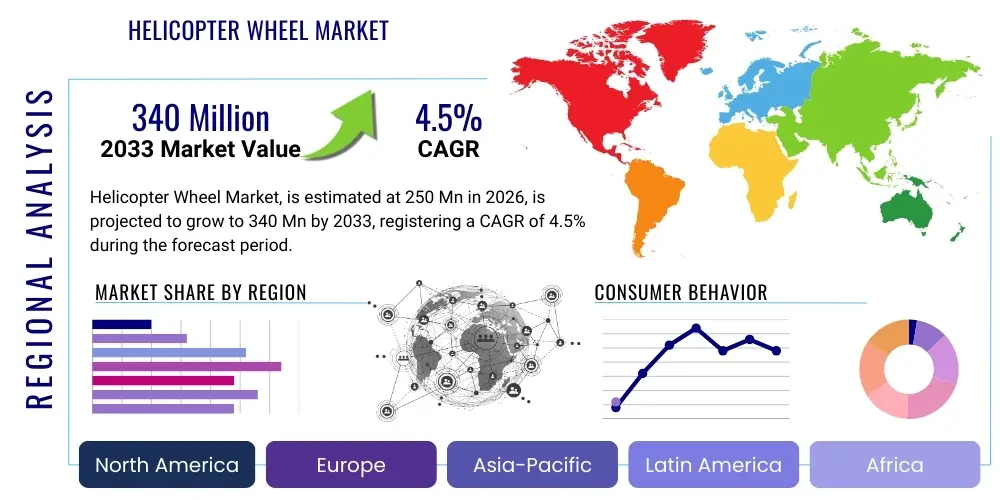

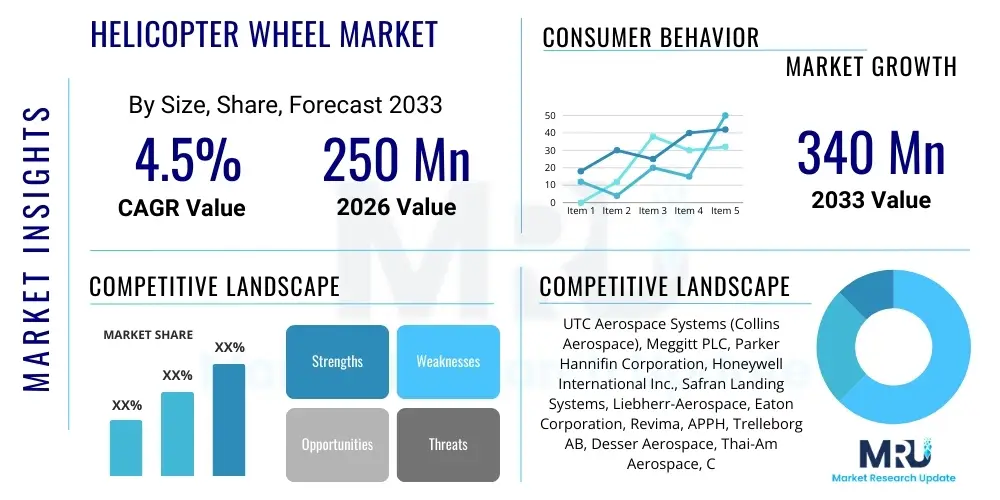

The Helicopter Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $250 Million USD in 2026 and is projected to reach $340 Million USD by the end of the forecast period in 2033.

Helicopter Wheel Market introduction

The Helicopter Wheel Market encompasses the design, manufacture, and servicing of landing gear wheel assemblies critical for rotary-wing aircraft operation. These components are essential for ground movement, taxiing, takeoff, and especially landing, bearing the full dynamic load of the aircraft. Given the high stress, varied landing surfaces, and stringent safety requirements associated with helicopter operations, these wheels must adhere to extremely rigorous airworthiness standards set by bodies like the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). The technological landscape is dominated by the use of lightweight, high-strength materials, primarily specialized aluminum and magnesium alloys, though composites are emerging for certain applications to improve fuel efficiency and durability. The market is closely tied to both new helicopter deliveries (Original Equipment Manufacturer or OEM sales) and ongoing maintenance, repair, and overhaul (MRO) activities.

Helicopter wheels are complex assemblies comprising the wheel rim, brake system interface, bearings, and associated hardware, designed for reliable operation across diverse environmental conditions, including high temperatures generated during braking and operations in abrasive environments like sand or snow. Major applications span across critical sectors, including military defense and surveillance, civil transport (e.g., offshore oil and gas transport), emergency medical services (EMS), search and rescue (SAR), and corporate and private aviation. The functional requirement for robust performance under heavy load and repeated stress cycles dictates the high value placed on certified and traceable components within this industry.

Key benefits driving market demand include enhanced operational safety resulting from continuous material innovation, reduced lifecycle costs attributed to optimized maintenance schedules facilitated by condition monitoring systems, and improved performance metrics such as decreased landing roll distance due to advanced braking systems. The primary driving factors fueling market expansion are the global increase in military rotorcraft procurement programs, the expansion of commercial fleets servicing offshore energy and tourism, and the necessity of mandatory replacement cycles and modernization upgrades under strict aviation regulations, ensuring sustained aftermarket demand.

Helicopter Wheel Market Executive Summary

The Helicopter Wheel Market is characterized by steady, moderate growth, primarily driven by the robust demand from the aftermarket segment, which accounts for the majority of revenue due to scheduled overhauls and mandatory component replacement necessitated by airworthiness directives. Business trends emphasize strategic partnerships between component manufacturers and major MRO providers to secure long-term service contracts, thus ensuring a stable revenue stream beyond initial OEM deliveries. Technological investments are centering on developing lighter, more corrosion-resistant materials and integrating smart sensors into wheel assemblies for real-time monitoring of temperature, pressure, and wear, moving towards predictive maintenance models that minimize operational downtime for operators. Consolidation among suppliers is a prevailing trend, aiming to achieve economies of scale and better manage the demanding certification processes.

Regional dynamics highlight the significant dominance of North America, underpinned by the world’s largest fleet of military and civil helicopters and a highly developed MRO infrastructure. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, propelled by increasing defense modernization expenditures, particularly in emerging economies like India and China, and the expansion of civil aviation infrastructure supporting utility and commercial applications. Europe maintains a strong presence, driven by strict regulatory adherence (EASA) and a mature market focusing heavily on safety enhancements and fuel efficiency upgrades through advanced component technologies. Geopolitical stability and defense budget fluctuations remain critical influences on regional market performance, especially within the military application segment.

Segment trends indicate that the Aftermarket segment will continue to hold the largest market share, though the OEM segment is witnessing episodic spikes corresponding to major new platform launches or large-scale military procurement contracts. Segmentation by material is shifting, with a growing interest in high-performance composites, though traditional aluminum and magnesium alloys remain the workhorses due to their proven reliability, established supply chains, and lower initial cost. The military application segment is consistently the largest revenue contributor, demanding customized, highly durable wheels capable of operating in extreme conditions, while the civil segment focuses more on weight optimization and cost-effectiveness for transport and utility roles. This dual demand profile requires manufacturers to maintain diverse product portfolios tailored to specific mission requirements and regulatory environments.

AI Impact Analysis on Helicopter Wheel Market

User queries regarding the impact of Artificial Intelligence (AI) on the Helicopter Wheel Market predominantly revolve around three critical areas: enhanced safety through predictive maintenance, optimization of complex supply chains, and acceleration of the design and testing lifecycle for new wheel components. Users are keen to understand how AI algorithms can analyze vast datasets—including historical flight data, sensor readings (vibration, heat), and non-destructive testing (NDT) results—to accurately predict component failure long before it occurs, thereby shifting maintenance from scheduled intervals to condition-based interventions. Concerns often center on data security, the required infrastructure investment for sensor integration, and the certification hurdles associated with deploying AI-validated maintenance protocols in highly regulated aerospace environments. Expectations are high for AI to drastically reduce unscheduled grounding events and lower the Total Cost of Ownership (TCO) for helicopter operators.

In manufacturing, AI is expected to revolutionize quality control and material processing. Specifically, advanced machine vision systems coupled with deep learning are enabling automated, ultra-precise inspection of forgings and machined parts, identifying minute flaws undetectable by human inspectors, ensuring optimal structural integrity of the wheel assembly. Furthermore, generative design algorithms powered by AI are being used to explore novel geometries and optimize the strength-to-weight ratio of wheel hubs and rims, potentially leading to significant weight reductions without compromising safety. This iterative design process, managed by AI, shortens development cycles and reduces the dependency on costly, time-consuming physical prototyping and certification testing phases.

The supply chain integration of AI is equally transformative, focusing on demand forecasting accuracy for aftermarket parts and managing the complex logistics of global aerospace distribution. AI models utilize external factors, such as fleet utilization rates, global conflict zones, and regulatory changes, to predict regional component demand with higher precision. This capability minimizes inventory holding costs for manufacturers and distributors while ensuring critical components, like specialized wheel bearings and brake pads, are available exactly when needed by MRO facilities worldwide, thereby enhancing operational readiness for civil and military fleets alike. The successful integration of these AI applications hinges on standardization of data formats and robust communication infrastructure across the value chain.

- Predictive Maintenance Optimization: AI algorithms analyze sensor data (vibration, temperature, pressure) and flight history to predict wheel component failure (e.g., bearing wear, rim fatigue), enabling condition-based maintenance.

- Quality Control and Inspection: Machine learning-based vision systems perform automated, high-precision non-destructive testing (NDT) and defect detection during manufacturing, improving component reliability.

- Generative Design and Material Optimization: AI tools accelerate the development of lightweight, structurally optimized wheel geometries, reducing material waste and prototyping time.

- Supply Chain Efficiency: AI models forecast aftermarket demand more accurately based on fleet utilization and operational profiles, reducing inventory costs and improving parts availability.

- Autonomous Landing Systems Interface: Integration of AI in flight control systems relies on robust wheel performance data for optimizing automatic taxiing and runway management, especially in emerging urban air mobility (UAM) platforms.

DRO & Impact Forces Of Helicopter Wheel Market

The Helicopter Wheel Market is primarily driven by rigorous safety mandates and the continuous growth of both military and commercial helicopter fleets globally. Drivers include the rising global focus on rotorcraft modernization programs, particularly in APAC and the Middle East, demanding certified, high-performance wheel and braking systems. The mandatory replacement schedule for highly stressed components like wheels and associated brake units under strict airworthiness directives ensures a consistent, high-volume aftermarket demand, insulating the market somewhat from fluctuations in new aircraft delivery cycles. Furthermore, technological advancements leading to superior lifespan and reduced weight are viewed as strong incentives for operators to adopt newer wheel technologies during fleet upgrades. These core drivers create a fundamentally stable demand environment for certified manufacturers.

Restraints, however, pose structural challenges. The primary restraint is the exceptionally long product lifecycle and high initial cost associated with aerospace component certification. The time and investment required to gain airworthiness approval (often spanning several years) limit the rapid introduction of disruptive technologies and favor established incumbents. Furthermore, the specialized nature of the components and the relatively small batch production compared to fixed-wing aircraft parts result in higher unit manufacturing costs. Economic volatility, particularly affecting defense budgets in certain regions or impacting the profitability of offshore oil and gas operations (a major user of heavy transport helicopters), can cause immediate restraint by delaying MRO activity or new platform purchases. The dependence on specialized raw materials (e.g., specific aluminum or magnesium alloys) also presents supply chain risks.

Opportunities for growth are concentrated in the development and adoption of lightweight composite materials for wheel construction, addressing the industry's pervasive focus on fuel efficiency and payload capacity. The burgeoning sector of electric vertical takeoff and landing (eVTOL) aircraft presents a significant long-term market opportunity, requiring fundamentally new, optimized wheel designs suitable for distributed propulsion architectures and frequent, short-cycle operations, potentially integrating braking into electric motors rather than traditional systems. Furthermore, integrating smart sensor technology into wheel assemblies for sophisticated health monitoring and predictive maintenance represents a lucrative area for product differentiation and service revenue expansion. The market exhibits moderate competition, with established players controlling technology and certification, leading to complex impact forces dynamics.

The impact forces analysis, utilizing a framework similar to Porter’s Five Forces, indicates specific market pressures. The threat of new entrants is low due to the extremely high capital investment, complex technology requirements, and regulatory barriers associated with obtaining critical airworthiness certification (Barrier to Entry is High). The bargaining power of suppliers is moderate-to-high, especially for specialized raw materials (high-grade alloys) and critical subsystems like specialized bearings or braking materials, as the component quality is non-negotiable for flight safety. The bargaining power of buyers (large OEMs and major MRO operators/military agencies) is high due to consolidation among customers and the ability to negotiate long-term supply agreements based on volume and proven performance history. The threat of substitutes is low, as certified wheels are indispensable for conventional landing gear; however, emerging technologies like air cushion landing systems or radical eVTOL concepts represent long-term, minor substitutional threats. Competitive rivalry is medium-to-high, primarily centered on intellectual property, MRO service quality, and pricing in the aftermarket segment rather than radical component innovation.

Segmentation Analysis

The Helicopter Wheel Market is systematically segmented based on various technical and commercial parameters to provide granular insights into demand patterns and growth drivers. These segments allow market participants to tailor their product offerings, pricing strategies, and distribution channels to specific end-user requirements, whether they prioritize maximum durability (military), lowest lifecycle cost (commercial transport), or extreme lightweighting (new-generation platforms). Understanding these segment dynamics is crucial for strategic planning, especially given the dual nature of demand originating from both new aircraft production and ongoing maintenance activities.

The key segmentation framework involves analyzing the market across End-Use (OEM vs. Aftermarket), Platform Type (Light, Medium, Heavy), Application (Military vs. Civil/Commercial), and Material Type (Alloys vs. Composites). The dominance of the aftermarket segment underscores the need for robust logistics and service networks that can quickly supply replacement components globally. Conversely, the OEM segment requires intensive collaboration with airframe manufacturers during the initial design phase to ensure seamless integration and certification of the landing gear assembly, where wheels form a critical sub-system. Growth forecasts vary significantly across these segments, with civil demand often being more sensitive to economic cycles, while military demand is tied to long-term government defense planning and procurement budgets.

- By End-Use

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO and Replacement)

- By Platform Type

- Light Helicopters (e.g., utility, training, reconnaissance)

- Medium Helicopters (e.g., transport, SAR, EMS)

- Heavy Helicopters (e.g., heavy lift, tactical transport)

- By Application

- Military Rotorcraft

- Civil and Commercial Rotorcraft

- Offshore Energy Transport

- Emergency Medical Services (EMS)

- Corporate and Private Use

- Utility and Construction

- By Material Type

- Aluminum Alloys (Most common)

- Magnesium Alloys (Used for lightweighting)

- Composites (Emerging high-performance materials)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Helicopter Wheel Market

The value chain for the Helicopter Wheel Market is highly structured and focuses intensely on precision, material integrity, and regulatory compliance, starting with the procurement of specialized raw materials. The upstream segment involves the sourcing of high-grade aerospace metals (aluminum-lithium, specific magnesium alloys) and advanced composites. These materials must undergo rigorous verification and testing to meet mechanical strength and stress tolerance requirements. Key upstream processes include specialized forging or casting of the wheel blank, which sets the foundational structural properties. The scarcity of specialized suppliers capable of delivering certified aerospace-grade raw materials often grants high bargaining power to this upstream segment, necessitating long-term supplier qualification and management by wheel manufacturers.

The midstream segment is where the core manufacturing and integration processes occur. This stage includes complex CNC machining of the forged blanks, heat treatment processes, surface finishing (such as anodizing or specialized coatings for corrosion resistance), assembly of the wheel halves, and integration of critical components like bearings, seals, and the brake system interface. Crucially, this stage involves extensive quality assurance, including Non-Destructive Testing (NDT) methodologies (e.g., ultrasonic inspection, dye penetrant inspection) to detect internal defects. Certification by aviation authorities is paramount, making compliance and documented quality management systems non-negotiable entry barriers. Manufacturers often vertically integrate specialized processes like coating application to maintain quality control.

The downstream segment focuses on distribution and service delivery. Distribution channels are bifurcated: direct channels supply Original Equipment Manufacturers (OEMs) for new aircraft integration through long-term contracts, while indirect channels utilize authorized distributors, MRO providers, and dedicated service centers for aftermarket replacement and repair parts. MRO service centers play a vital role, handling wheel overhaul, refurbishment, and replacement under strict regulatory guidelines. Due to the critical safety function of wheels, traceability and authorized repair are mandatory, driving demand toward certified and approved distributors rather than general aviation parts suppliers. Effective downstream support, including technical bulletins and rapid parts supply, is a crucial competitive differentiator for securing lucrative, long-term aftermarket contracts.

Helicopter Wheel Market Potential Customers

Potential customers for the Helicopter Wheel Market are highly specialized entities operating rotary-wing aircraft under controlled regulatory frameworks, driven by the need for certified components and minimal downtime. The largest consumer base is comprised of military and government defense agencies globally. These entities operate large, diverse fleets ranging from attack helicopters to heavy transport rotorcraft, demanding wheels optimized for extreme operational loads, diverse terrain (sand, ice), and extended service life. Military procurement often involves large volume, long-term contracts, making them highly desirable customers, although their buying cycles are influenced by geopolitical tensions and national budget allocations.

The second major customer group consists of Original Equipment Manufacturers (OEMs) such as Airbus Helicopters, Bell, Leonardo, and Sikorsky. OEMs represent the direct channel for new product integration, requiring close collaboration during the platform development phase. These customers prioritize components that contribute to overall aircraft performance specifications, focusing intensely on weight optimization, integration ease, and reliability guarantees, which form part of the aircraft’s type certification. Winning an OEM contract secures significant long-term revenue as the chosen wheel supplier typically becomes the exclusive provider of the component and its spares for the platform's entire operational lifecycle.

Finally, Maintenance, Repair, and Overhaul (MRO) service providers and large commercial fleet operators constitute the primary demand source for the profitable aftermarket segment. Commercial operators, including those supporting offshore oil and gas platforms, aerial work, and corporate travel, emphasize total lifecycle cost, predictable maintenance schedules, and rapid availability of replacement parts to minimize aircraft grounding time. MRO facilities, whether independent or airline-affiliated, are key purchasers as they manage the scheduled overhaul and refurbishment of wheels based on strict flight hour or cycle limits dictated by airworthiness directives. Catering to this customer base requires a robust global distribution network and certified repair capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million USD |

| Market Forecast in 2033 | $340 Million USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UTC Aerospace Systems (Collins Aerospace), Meggitt PLC, Parker Hannifin Corporation, Honeywell International Inc., Safran Landing Systems, Liebherr-Aerospace, Eaton Corporation, Revima, APPH, Trelleborg AB, Desser Aerospace, Thai-Am Aerospace, CPI Aerostructures, NORDAM, LISI AEROSPACE, Messier-Bugatti-Dowty (Safran), Crane Aerospace & Electronics, CIRCOR Aerospace & Defense, Hella Aerospace, Satair. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helicopter Wheel Market Key Technology Landscape

The technology landscape within the Helicopter Wheel Market is primarily defined by advancements in materials science, sophisticated braking systems, and the implementation of embedded monitoring solutions. A major focus is the transition towards advanced, lightweight materials. While traditional high-strength aluminum and magnesium alloys continue to dominate due to their proven performance and cost-effectiveness, there is an increasing adoption of aerospace-grade composite materials, particularly carbon-fiber reinforced polymers, for non-load bearing sections or even for the entire wheel structure in next-generation platforms. These composites offer superior fatigue resistance and corrosion protection while significantly reducing unsprung weight, thereby improving overall helicopter performance and fuel efficiency. Manufacturers are also applying highly specialized thermal barrier and corrosion-resistant coatings to traditional alloy wheels to extend service life in harsh operating environments, such as marine or tropical climates.

Technological innovation is heavily concentrated in the integrated braking system, which operates in conjunction with the wheel assembly. The shift towards carbon-based friction materials (carbon brakes) is a key trend, offering substantial weight savings over steel brakes, superior heat absorption capacity, and longer lifespan, which are critical features for high-performance military and heavy commercial rotorcraft that demand rapid braking and short-field operations. Furthermore, the incorporation of advanced anti-skid and brake-by-wire technologies is becoming standard. These systems utilize electronic controllers and actuators to optimize braking force application, preventing tire skidding and minimizing component wear, thereby maximizing safety during critical ground maneuvers and high-speed landings.

The implementation of smart technology, aligning with the broader trends of Industry 4.0 and predictive maintenance, represents another significant technological driver. Modern helicopter wheels are increasingly equipped with embedded sensors—including temperature gauges, vibration monitors, and tire pressure monitoring systems (TPMS)—that continuously track the wheel’s health and operational parameters in real-time. This sensor data is often integrated with the aircraft’s Health and Usage Monitoring Systems (HUMS) and analyzed using AI/ML algorithms to predict maintenance needs for bearings, brakes, and the wheel structure itself. This capability shifts operators towards condition-based monitoring, reducing unexpected failures, lowering MRO costs, and enhancing aircraft availability, marking a pivotal shift in component lifecycle management for the helicopter wheel market.

Regional Highlights

Geographically, the Helicopter Wheel Market exhibits distinct consumption patterns and growth dynamics influenced by regional defense spending, commercial fleet size, and regulatory stringency. North America currently dominates the global market, largely attributed to the immense size and technical maturity of its civil and military helicopter fleets, including the extensive operations of the U.S. Department of Defense. This region features a highly established MRO infrastructure and is home to several leading OEMs and wheel component manufacturers, creating a robust demand ecosystem driven by stringent FAA oversight and continuous fleet modernization programs. The focus here is often on high-tech integration, including advanced sensors and lighter components, to meet modern military mission requirements and commercial operational efficiency demands.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This rapid expansion is fueled by significant increases in military spending across countries like China, India, and South Korea, aimed at upgrading aging fleets and expanding rotary-wing capabilities for surveillance, anti-submarine warfare, and troop transport. Simultaneously, the burgeoning commercial sector, particularly supporting infrastructure development, disaster relief, and rapidly expanding regional tourism, drives strong OEM and aftermarket demand for medium and heavy-lift helicopter wheels. The increasing complexity of regional air traffic management necessitates strict adherence to international safety standards, further boosting demand for certified replacement parts and modern component upgrades.

Europe represents a mature market characterized by stringent safety regulations imposed by EASA and a high concentration of sophisticated MRO expertise. Demand in Europe is less driven by rapid fleet expansion and more by mandated upgrades, component lifespan extensions, and the adoption of technologies that enhance fuel efficiency and reduce environmental impact, aligning with European green initiatives. Western European countries maintain high spending on EMS and SAR operations, requiring consistently available, reliable helicopter platforms and components. The Middle East and Africa (MEA) region, while smaller, presents targeted growth opportunities tied to ongoing security requirements (military and internal security operations) and expansion in the oil and gas sector, particularly for wheels and brakes capable of withstanding extreme heat and abrasive desert conditions.

- North America: Market leader due to the largest installed fleet base (military and civil); strong emphasis on technological integration and advanced material adoption; mature MRO network.

- Asia Pacific (APAC): Highest projected CAGR, driven by military modernization programs (India, China) and growth in commercial utility and transport sectors; increasing emphasis on localized MRO services.

- Europe: Stable demand governed by strict EASA safety mandates and environmental regulations; focus on component lifespan optimization and MRO efficiency; significant presence of leading aerospace manufacturers.

- Latin America (LATAM): Growth tied primarily to resource extraction activities (mining, oil & gas) and increasing governmental investment in internal security and anti-narcotics operations; often reliant on imported parts and foreign MRO support.

- Middle East and Africa (MEA): Demand sensitive to oil price fluctuations; strong military spending in the GCC countries demanding high-durability, specialized wheels for desert operations; reliance on international OEM support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helicopter Wheel Market, analyzing their product portfolios, strategic initiatives, and market positioning.- Collins Aerospace (A segment of Raytheon Technologies)

- Meggitt PLC

- Parker Hannifin Corporation

- Honeywell International Inc.

- Safran Landing Systems

- Liebherr-Aerospace

- Eaton Corporation

- APPH (Héroux-Devtek)

- Trelleborg AB

- Desser Aerospace

- Revima

- Thai-Am Aerospace

- CPI Aerostructures

- NORDAM

- LISI AEROSPACE

- Crane Aerospace & Electronics

- CIRCOR Aerospace & Defense

- Hella Aerospace

- Satair (Airbus Services Company)

- Michelin Group (Tire and associated components)

Frequently Asked Questions

Analyze common user questions about the Helicopter Wheel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Helicopter Wheel Aftermarket?

The primary driver is mandatory compliance with strict airworthiness directives that dictate fixed replacement or overhaul cycles (based on flight hours or landing cycles) for critical landing gear components like wheels and brakes, ensuring continuous, non-negotiable demand for certified spares.

How are emerging eVTOL aircraft influencing the traditional Helicopter Wheel Market?

While current eVTOL platforms utilize simplified or novel landing systems, they are driving innovation in lightweight material usage and integrated electronic monitoring systems, pressuring traditional helicopter wheel manufacturers to accelerate R&D in composites and smart component integration for future rotary-wing applications.

Which material segment currently holds the largest market share in helicopter wheel manufacturing?

Aluminum alloys, specifically high-strength aerospace grades, currently hold the largest market share due to their proven reliability, superior fatigue life, ease of certification, and balanced cost-to-performance ratio across most light and medium helicopter platforms.

What role does Artificial Intelligence play in the maintenance of helicopter wheel assemblies?

AI is crucial for predictive maintenance, analyzing real-time sensor data from wheels and brakes (temperature, vibration) to forecast component degradation with high accuracy, enabling operators to move from scheduled maintenance to condition-based interventions, thus reducing unscheduled downtime.

What are the highest barriers to entry for new companies in the Helicopter Wheel Market?

The highest barriers are the extremely lengthy and capital-intensive process of obtaining mandatory airworthiness certification (e.g., FAA/EASA approval) for safety-critical components and the difficulty of establishing certified supply chains for high-grade aerospace materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager