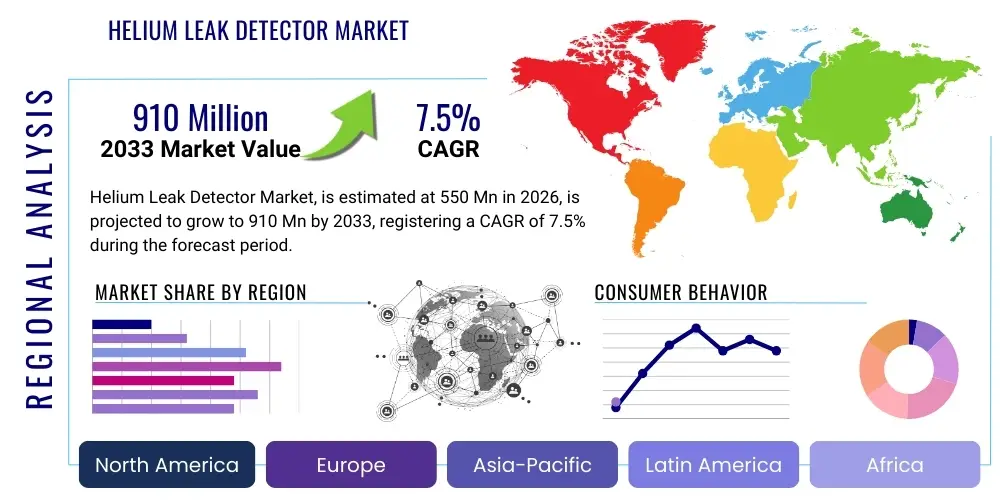

Helium Leak Detector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441193 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Helium Leak Detector Market Size

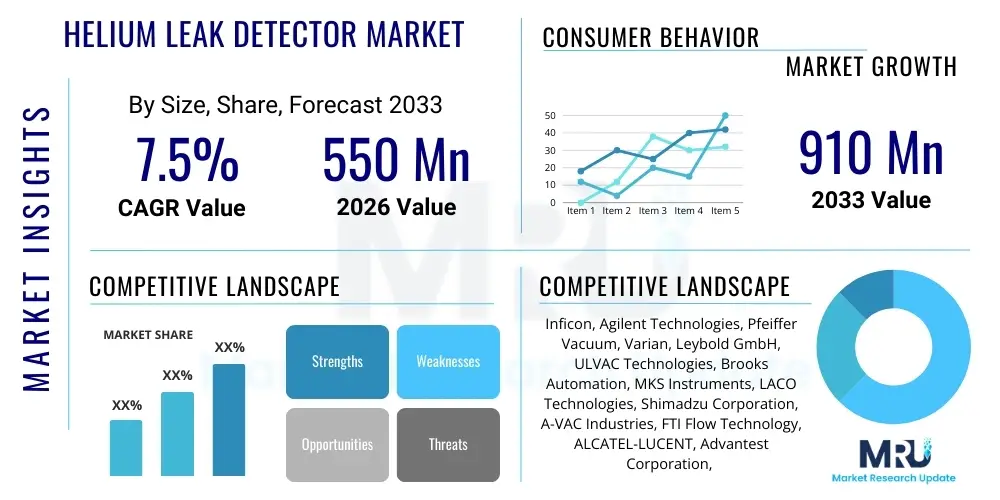

The Helium Leak Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033.

Helium Leak Detector Market introduction

The Helium Leak Detector Market encompasses specialized instrumentation designed to precisely locate and quantify leaks in sealed systems, primarily utilizing helium as the trace gas due to its small atomic size, inertness, and low natural background concentration. These high-precision devices, predominantly based on mass spectrometry, are critical in industries where absolute sealing integrity is paramount, such as high-vacuum systems, pressurized vessels, and sophisticated components. The core function involves drawing gas samples from the test part and analyzing the concentration of helium, translating this concentration into a quantified leak rate.

The product portfolio within this market ranges from stationary, high-sensitivity mass spectrometer leak detectors (MSLDs) used in manufacturing lines and research laboratories, to portable sniffing units designed for field service and large object testing. Major applications span the automotive sector, especially for EV battery cooling systems and air conditioning units; the aerospace industry for fuel systems and environmental control components; and the semiconductor industry for vacuum chambers and process gas lines. The detector's primary benefit is offering unmatched sensitivity and reliability, detecting leaks down to 10-12 mbar·l/s, ensuring product safety, performance longevity, and compliance with stringent industrial standards.

Market growth is predominantly driven by the increasing complexity of high-tech manufacturing processes globally, particularly in electronics and photonics, which necessitate ultra-high vacuum environments (UHV). Furthermore, stringent environmental and safety regulations, such as those governing refrigeration systems, natural gas pipelines, and nuclear installations, mandate high-fidelity leak testing protocols. The global push toward energy efficiency and reliability in critical infrastructure, coupled with continuous R&D investment in advanced materials and components, solidifies the indispensable role of helium leak detection technology in modern industrial quality control and assurance programs.

Helium Leak Detector Market Executive Summary

The Helium Leak Detector Market is currently witnessing robust expansion driven by pronounced macroeconomic and technological trends, most notably the exponential growth in semiconductor fabrication and the rapid transition toward electric vehicle (EV) manufacturing. Business trends indicate a strong move toward automated, in-line testing solutions that integrate seamlessly with Industry 4.0 frameworks, reducing manual intervention and increasing testing throughput and precision. Key manufacturers are focusing on developing hybrid technologies that combine vacuum testing with sniffer technology, offering greater flexibility and optimized testing procedures for varied component sizes and geometries, which is essential for maximizing manufacturing efficiency.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market expansion, primarily fueled by massive investments in semiconductor foundries in countries like China, Taiwan, and South Korea, coupled with the dominance of consumer electronics manufacturing. North America and Europe maintain leading positions in terms of technological adoption and demand for high-end research applications, propelled by stringent regulatory frameworks concerning environmental protection and industrial safety. The competitive landscape is characterized by moderate consolidation, with established players leveraging decades of expertise in mass spectrometry, while emerging companies introduce specialized, modular detectors optimized for specific niche applications like hydrogen fuel cell testing.

Segmentation trends highlight the dominance of the Mass Spectrometer Leak Detector segment due to its superior sensitivity required for UHV applications. However, the demand for portable sniffing detectors is rapidly accelerating, especially in maintenance, repair, and overhaul (MRO) operations within the oil & gas and power generation sectors. Application-wise, the automotive segment, driven by the quality control requirements of EV batteries (ensuring hermetic sealing against moisture ingress) and high-pressure components, is projected to record the highest CAGR, emphasizing leak detection's role in product reliability and safety critical systems.

AI Impact Analysis on Helium Leak Detector Market

Users frequently inquire about how Artificial Intelligence (AI) can move leak detection beyond simple threshold alarms toward predictive diagnostics and highly optimized process control. Common questions center on AI’s ability to handle the massive influx of data generated during high-speed, automated testing cycles, its role in improving detection limits under noisy conditions, and whether AI can reduce the reliance on highly skilled technicians for interpretation. The key themes revolve around achieving true predictive maintenance by correlating leak rates with operational conditions and component failure predictions, optimizing helium usage for cost efficiency, and automatically fine-tuning complex vacuum pump sequences and testing parameters for varied product specifications without manual input, thereby raising efficiency and lowering operational expenditures in quality assurance processes.

- AI enables predictive maintenance scheduling by correlating minute leak rate fluctuations with potential long-term component degradation.

- Integration of machine learning algorithms enhances signal-to-noise ratio interpretation, improving detection sensitivity, especially in challenging environments.

- AI optimizes automated testing cycles by dynamically adjusting pressure stabilization times and helium dosing, significantly reducing cycle time.

- Data analytics platforms utilize AI to identify patterns in production leaks, pinpointing root causes in the manufacturing process for proactive defect prevention.

- Generative AI assists in creating comprehensive, compliant testing reports and procedural documentation, automating a traditionally time-intensive task.

DRO & Impact Forces Of Helium Leak Detector Market

The market dynamics of Helium Leak Detectors are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces steering growth and innovation. Key drivers include the escalating global demand for ultra-reliable, hermetically sealed components across high-stakes industries such as aerospace, nuclear energy, and medical devices, where even minor leaks can result in catastrophic failures or severe performance degradation. Furthermore, governmental bodies worldwide are implementing increasingly stringent regulations regarding environmental emissions (e.g., refrigerants, greenhouse gases) and industrial safety, compelling manufacturers to adopt certified, high-sensitivity leak testing methodologies, making helium detection an industry standard.

Conversely, significant restraints challenge market expansion, primarily revolving around the high initial capital expenditure associated with purchasing sophisticated mass spectrometer-based leak detection equipment and the ongoing maintenance costs associated with ultra-high vacuum pumps and calibration standards. A more profound constraint lies in the supply chain volatility and increasing cost of helium itself, which is a non-renewable resource, prompting manufacturers to explore alternative trace gases or develop highly efficient recycling and recovery systems. The requirement for specialized technical expertise for operating, calibrating, and interpreting results from these complex instruments also acts as a barrier to entry for smaller enterprises or developing regional markets.

Opportunities for exponential growth are emerging from transformative technological shifts, most notably the global transition to the hydrogen economy and the rapid expansion of EV battery manufacturing. Hydrogen fuel cells and battery casings require absolute zero leakage assurance, presenting a massive untapped market for high-volume helium testing solutions. The ongoing trend of miniaturization in electronics and the rise of micro-electro-mechanical systems (MEMS) also necessitate specialized, high-resolution leak detection techniques. The cumulative impact forces push the market toward innovation in miniaturized, portable, and automated systems that can offer high sensitivity while optimizing helium consumption, ensuring long-term viability and expanded application horizons.

Segmentation Analysis

The Helium Leak Detector Market is highly segmented, allowing for granular analysis across various technological, application, and end-user dimensions. The segmentation primarily focuses on the underlying detection technology, the type of testing environment employed, and the industrial sector utilizing the equipment. This detailed breakdown aids market participants in tailoring their product offerings and strategic focus areas. The complexity of modern manufacturing necessitates a diverse range of detectors, from highly sensitive laboratory-grade instruments to rugged, portable units designed for field applications, reflecting the varied needs of sectors ranging from pharmaceutical manufacturing to high-energy physics research.

Technological segmentation is critical, dividing the market mainly into Mass Spectrometer Leak Detectors (MSLDs) and Residual Gas Analyzers (RGAs). MSLDs, which offer the highest sensitivity, dominate the value share, particularly in semiconductor and vacuum component manufacturing. Application segmentation provides insights into major demand centers, with the Automotive, Aerospace, and HVAC&R sectors consistently leading due to regulatory pressure and complexity of sealed components. Furthermore, the segmentation by operating method—vacuum (integral) testing versus sniffing (localized) testing—reveals operational preferences, with vacuum testing preferred for high-volume manufacturing lines requiring quantitative results and sniffing used for inspection and quality checks of large objects.

Understanding these segments allows market stakeholders to identify rapidly expanding niches, such as the demand for dedicated leak testing solutions for new energy components (batteries and fuel cells) and specialized detectors for ultra-clean environments in biological and pharmaceutical processing. The continuous requirement for higher precision, faster testing cycles, and reduced cost of ownership is driving cross-segment innovation, leading to the development of modular systems that can quickly switch between vacuum and sniffing modes, offering adaptability across various production stages and maintenance requirements.

- By Type:

- Mass Spectrometer Leak Detectors (MSLD)

- Residual Gas Analyzers (RGA)

- Portable and Handheld Detectors

- System Components (Pumps, Valves, Calibrators)

- By Operating Method:

- Vacuum Testing (Integral Testing)

- Sniffing Testing (Local Testing)

- By Application:

- Automotive (EV Batteries, Fuel Tanks, HVAC)

- Aerospace and Defense (Fuel Lines, Environmental Control Systems)

- Semiconductor and Electronics (Vacuum Chambers, Process Lines)

- HVAC and Refrigeration (AC Units, Heat Exchangers)

- Industrial and Manufacturing (Pharmaceutical, Nuclear, Oil & Gas)

- By End-User:

- Manufacturing Facilities

- Research & Development Laboratories

- Service and Maintenance Providers

- Government and Regulatory Agencies

Value Chain Analysis For Helium Leak Detector Market

The value chain for the Helium Leak Detector Market begins with the upstream suppliers of critical raw materials and components, which include specialized high-grade metals for detector components, sensitive electronic sensors, ultra-high vacuum (UHV) pumps, and specialized valves. Crucially, this upstream segment also involves the procurement and supply of high-purity helium gas itself, which often involves complex supply logistics due to its scarcity and global distribution constraints. The performance and quality of the final detector are heavily reliant on the precision and reliability of these specialized upstream components, making supplier qualification a vital stage in the value chain.

The midstream stage is dominated by detector manufacturers, who engage in sophisticated R&D, design, assembly, and rigorous calibration of the equipment. This process involves integrating mass spectrometry technology, vacuum engineering, and advanced software interfaces. Manufacturers often differentiate themselves through proprietary algorithms for improved sensitivity, enhanced automation features, and the development of application-specific tooling and fixtures necessary for integrating the detectors into high-volume production lines. Post-manufacturing, the value chain focuses on distribution and sales, utilizing both direct and indirect channels.

Distribution channels are multifaceted: direct sales are typically employed for large, complex, and customized systems sold to major semiconductor or aerospace clients, requiring extensive technical consultation and post-sales support directly from the OEM. Indirect channels involve authorized distributors, regional representatives, and specialized technical resellers who cater to smaller industrial end-users, R&D labs, and MRO service providers, often providing localized installation, training, and maintenance services. The downstream segment involves the end-users—ranging from automotive manufacturers utilizing in-line testing for quality control to research institutions requiring ultimate sensitivity—and associated service providers specializing in calibration, repair, and certification, completing the crucial feedback loop for product improvement and market understanding.

Helium Leak Detector Market Potential Customers

The core group of potential customers for Helium Leak Detectors are organizations operating systems or components where leakage minimization is a mission-critical requirement, falling predominantly within the high-technology and safety-critical industrial sectors. Semiconductor manufacturers represent one of the largest and most consistently growing customer bases. These companies rely heavily on detectors for maintaining the integrity of process gas lines, reaction chambers, and high-vacuum environments necessary for depositing ultra-thin films and fabricating microelectronic circuitry, where the presence of contaminants or atmospheric ingress can ruin entire production batches.

The second major cohort comprises the global automotive industry, particularly manufacturers involved in the Electric Vehicle (EV) supply chain. With the rapid proliferation of EVs, leak detection is essential for validating the hermetic sealing of battery enclosures to prevent moisture ingress that could compromise battery life and safety, and for ensuring the integrity of complex thermal management and cooling systems. Similarly, the aerospace and defense sectors are critical customers, requiring detectors for pre-flight testing of critical components like aircraft fuel tanks, hydraulic systems, and astronaut life support systems, where zero-defect manufacturing is non-negotiable for safety.

Beyond these high-volume sectors, other significant potential buyers include pharmaceutical and biotechnology companies utilizing freeze-drying (lyophilization) equipment and sterile packaging requiring package integrity verification; research institutions, including particle physics labs and fusion energy projects utilizing ultra-high vacuum systems; and utility providers in the oil & gas and nuclear power industries, who rely on these instruments for ensuring pipeline integrity and containing radioactive materials. The demand is driven not merely by production efficiency but increasingly by mandatory compliance with international quality standards (e.g., ISO 9001) and specialized industry regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inficon, Agilent Technologies, Pfeiffer Vacuum, Varian, Leybold GmbH, ULVAC Technologies, Brooks Automation, MKS Instruments, LACO Technologies, Shimadzu Corporation, A-VAC Industries, FTI Flow Technology, ALCATEL-LUCENT, Advantest Corporation, TASI Group, Cimbria, GHM GROUP, T-M Vacuum Products, Aixtron SE, and KLATencor Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helium Leak Detector Market Key Technology Landscape

The technological landscape of the Helium Leak Detector Market is dominated by the foundational principle of mass spectrometry, specifically utilizing sector-field or quadrupole mass analyzers optimized for detecting the specific atomic mass of helium (mass number 4). Modern technological advancements focus on improving the sensitivity, speed, and robustness of the detector systems. Key innovations include miniaturization of the spectrometer components, allowing for the creation of highly efficient, portable leak detectors that maintain laboratory-grade sensitivity while offering flexibility for field use. Furthermore, the incorporation of advanced vacuum technology, such as turbomolecular pumps and dry scroll pumps, has enhanced the detector's capability to handle higher test pressures and reduce contamination risks, thereby speeding up the time required for pump-down and testing cycles.

A crucial area of technological advancement involves the development of hybrid testing methodologies. While traditional testing is segmented into vacuum mode (for high sensitivity, measuring total leakage into a vacuum chamber) and sniffing mode (for localization and gross leak detection), modern systems are designed for rapid transition between these modes. This flexibility is supported by sophisticated integrated control software that manages complex test sequences and optimizes the process based on pre-defined component specifications. This integration ensures that manufacturers can achieve both high throughput and high precision on diverse product lines, addressing the dual industrial needs for speed and accuracy in quality control processes.

The market is also witnessing increasing investment in automated tooling and robotics for in-line leak detection. This includes the development of automated coupling systems that seal and evacuate test parts rapidly, minimizing operator error and maximizing production uptime. Furthermore, specialized technologies are emerging, such as helium accumulation testing (HAT), which provides a reliable alternative to vacuum testing for large components or systems where creating a deep vacuum is impractical. HAT involves enclosing the test object in a specialized chamber and detecting accumulated helium over time, offering a cost-effective and scalable solution for segments like large industrial heat exchangers and piping systems, thus diversifying the technological application base of helium leak detection.

Regional Highlights

Geographically, the Helium Leak Detector Market exhibits distinct growth patterns influenced by regional industrial concentration, regulatory frameworks, and technological maturity. North America, characterized by its mature aerospace, defense, and high-end R&D sectors, remains a key market focusing on high-precision, customized leak testing solutions. The presence of leading technology companies and a strong regulatory emphasis on industrial safety drives consistent demand for the latest, high-sensitivity mass spectrometer detectors, particularly in the semiconductor and medical device manufacturing hubs.

Europe represents a stable and high-value market, primarily driven by stringent environmental regulations, particularly those governing refrigeration and automotive industries (HVAC&R). The robust automotive sector, especially in Germany and Italy, is rapidly adopting advanced leak detection for EV components, while strong governmental support for nuclear and energy research ensures continuous investment in UHV technology. European firms are often leaders in detector innovation, focusing on energy efficiency and optimizing helium usage through advanced recovery systems.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This rapid expansion is directly attributable to massive governmental and private sector investments in establishing large-scale semiconductor fabrication plants (fabs) and expanding consumer electronics assembly lines, especially in countries like China, South Korea, and Taiwan. The rise of local manufacturing capabilities for electric vehicles and associated components further accelerates the adoption of helium leak detection technology, transforming APAC into the global manufacturing powerhouse for leak testing solutions and equipment.

- North America: High demand driven by strict military and aerospace standards, strong presence of semiconductor fabrication (e.g., in Arizona and Texas), and significant expenditure in scientific research.

- Europe: Growth fueled by strict F-Gas regulations in the HVAC&R sector and rigorous quality control requirements in the German and French automotive industries.

- Asia Pacific (APAC): Dominates market volume growth due to aggressive expansion of semiconductor manufacturing capacity and high-volume EV battery production lines.

- Latin America: Emerging market with demand concentrated in the oil and gas infrastructure and increasing foreign investment in automotive assembly plants.

- Middle East and Africa (MEA): Growth primarily linked to infrastructure projects, specifically LNG and petrochemical processing facilities requiring reliable pipeline and pressure vessel integrity testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helium Leak Detector Market.- Inficon

- Agilent Technologies

- Pfeiffer Vacuum

- Varian (now part of Agilent)

- Leybold GmbH

- ULVAC Technologies

- Brooks Automation

- MKS Instruments

- LACO Technologies

- Shimadzu Corporation

- A-VAC Industries

- FTI Flow Technology

- ALCATEL-LUCENT (now part of Nokia)

- Advantest Corporation

- TASI Group

- Cimbria

- GHM GROUP

- T-M Vacuum Products

- Aixtron SE

- KLATencor Corporation

Frequently Asked Questions

Analyze common user questions about the Helium Leak Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the increased adoption of Helium Leak Detectors?

The primary driver is the stringent quality control and safety requirements mandated by the rapid growth in high-precision manufacturing sectors, particularly semiconductor fabrication and the production of critical components for Electric Vehicles (EVs) and aerospace systems, where zero leakage is non-negotiable for product reliability and safety compliance.

How does the volatility of the helium supply impact the future of the leak detection market?

Helium scarcity drives innovation toward more efficient consumption methods, including the development of advanced helium recovery and recycling systems, and prompts research into alternative trace gases and hybrid testing technologies to mitigate reliance on fluctuating helium supply chains and costs.

Which end-user segment utilizes the highest volume of high-sensitivity mass spectrometer leak detectors?

The Semiconductor and Electronics manufacturing sector accounts for the largest utilization volume of high-sensitivity Mass Spectrometer Leak Detectors (MSLDs), as they require ultra-high vacuum conditions and precise integrity checks for vacuum chambers and process gas delivery systems essential for advanced chip fabrication.

What is the difference between vacuum testing and sniffing testing methodologies?

Vacuum testing (integral testing) involves placing the test object under vacuum to achieve maximum sensitivity and quantify the total leak rate. Sniffing testing (localized testing) uses a handheld probe to locate the precise source of a leak on pressurized components, offering lower sensitivity but greater localization capability.

Is the integration of AI and automation changing how leak detection processes are executed?

Yes, AI is transforming the field by enabling predictive maintenance, optimizing complex testing parameters to reduce cycle times, and improving data analysis capabilities to pinpoint manufacturing process deficiencies, leading to greater efficiency and accuracy in high-volume production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager