Hem Flange Bonding Adhesives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441059 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hem Flange Bonding Adhesives Market Size

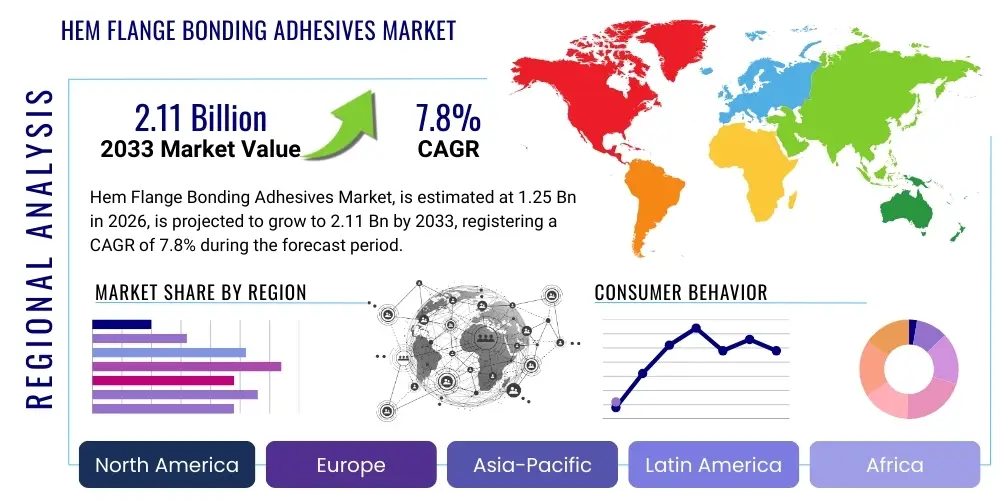

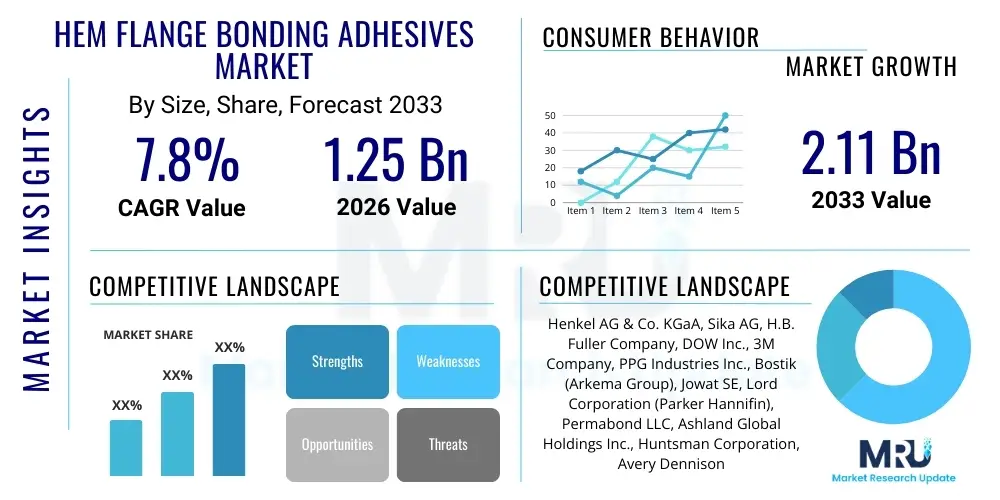

The Hem Flange Bonding Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.11 Billion by the end of the forecast period in 2033.

Hem Flange Bonding Adhesives Market introduction

Hem Flange Bonding Adhesives are specialized structural adhesives primarily used in the automotive industry for joining inner and outer body panels, particularly for closure panels such as hoods, doors, trunk lids, and tailgates. These high-performance chemical formulations are crucial for replacing or supplementing traditional mechanical fastening methods like spot welding, offering enhanced structural rigidity, superior aesthetics by eliminating weld marks, and improved crashworthiness by distributing stress loads more uniformly across the bonded area. The primary function of these adhesives is to provide a durable, fatigue-resistant connection that can withstand dynamic stresses, temperature fluctuations, and environmental exposure while facilitating the overall lightweighting goals of modern vehicle manufacturing.

The product portfolio within this market includes various chemical bases, such as epoxy, polyurethane, and modified acrylics, each optimized for specific substrate materials, curing requirements, and performance criteria. A significant application benefit is their ability to bond dissimilar materials, such as aluminum to steel or various composite materials, a capability essential for multi-material vehicle architectures designed to reduce curb weight and improve fuel efficiency or battery range in electric vehicles (EVs). Furthermore, the application processes for these adhesives are increasingly integrated into automated body shops, demanding formulations that offer excellent sag resistance, rapid application rates, and precise rheological properties to ensure consistent bond line thickness and coverage.

Major driving factors fueling the expansion of the Hem Flange Bonding Adhesives market include stringent global vehicle safety standards requiring enhanced collision performance, the relentless industry push towards vehicle lightweighting to meet stringent emission regulations (e.g., CAFE standards, EU carbon targets), and the accelerating adoption of electric vehicles, which necessitates innovative material joining solutions to manage high battery weights and maximize structural battery housing integrity. The adhesives also contribute significantly to reducing Noise, Vibration, and Harshness (NVH) levels within the vehicle cabin, adding a critical layer of quality and comfort that consumers demand in premium and mass-market vehicles alike.

Hem Flange Bonding Adhesives Market Executive Summary

The global Hem Flange Bonding Adhesives market is characterized by robust growth, driven primarily by transformative shifts in automotive manufacturing, particularly the transition toward multi-material designs and the electrification of the vehicle fleet. Business trends indicate a strong focus on developing highly specialized two-component systems and single-component heat-curing epoxies that offer superior environmental resistance and crash performance tailored for next-generation vehicle platforms. Competitive intensity is high, focusing on proprietary formulation technologies that enable faster cycle times in OEM assembly lines and improved adhesion to challenging, pre-treated substrates. Strategic alliances between adhesive manufacturers and Tier 1 automotive suppliers are becoming commonplace to co-develop application equipment and process protocols, ensuring seamless integration into modern, highly automated production environments globally.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by massive vehicle production volumes in China, India, and Japan, coupled with rapid technological adoption in domestic manufacturing plants focusing on electric and hybrid vehicles. Europe is witnessing significant growth, largely influenced by stringent regulatory mandates concerning vehicle safety and CO2 emissions, pushing European OEMs to rapidly adopt advanced lightweight bonding solutions. North America demonstrates stable demand, underpinned by recovery in vehicle production and a decisive pivot towards heavier electric trucks and SUVs, which require robust structural bonding solutions to maintain integrity and battery protection. Investment in localized production facilities across these regions is a key strategy for market players to mitigate supply chain volatility and reduce lead times for specialized chemical products.

Segment trends reveal that the Epoxy resin type maintains the largest market share due to its excellent strength, stiffness, and heat resistance, making it ideal for critical structural applications; however, Polyurethane adhesives are exhibiting the fastest growth due to their superior flexibility and ability to handle substrates with different coefficients of thermal expansion (CTEs), which is vital in bonding mixed materials. Segmentation by application confirms that Passenger Vehicles remain the primary end-user segment, although Commercial Vehicles, particularly electric buses and delivery vans, are emerging as significant growth contributors as fleet operators prioritize longevity and lower maintenance costs facilitated by superior bonding systems. The evolution of curing mechanisms is also noteworthy, with UV-curing technologies gaining traction in specific, non-critical flange applications where speed is paramount, complementing the foundational heat-curing processes.

AI Impact Analysis on Hem Flange Bonding Adhesives Market

User inquiries regarding AI's influence in the Hem Flange Bonding Adhesives market frequently center on three core themes: accelerated material discovery, enhanced manufacturing quality control, and predictive maintenance capabilities. Common questions revolve around whether AI can design novel adhesive formulations faster than traditional R&D, how machine learning algorithms can ensure flawless application in high-speed assembly lines, and the potential for AI-driven sensors to predict bond failure before it occurs. This synthesis indicates that industry users and potential buyers are highly optimistic about AI's role in mitigating formulation complexity, optimizing process parameters (like curing temperature and dispensing volume), and significantly reducing material waste and defect rates associated with manual inspection or rudimentary quality checks, thereby increasing the overall efficiency and reliability of bonded automotive structures.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is transforming the research and development phase of hem flange adhesives. By leveraging massive datasets encompassing material properties, environmental stress testing results, and molecular structure data, AI models can rapidly screen and predict the performance of novel chemical formulations, drastically cutting down the time required for product commercialization. This predictive modeling capability allows manufacturers to design adhesives specifically optimized for novel substrates, such as ultra-high-strength steel or advanced composites, ensuring compatibility and optimal mechanical performance under severe operating conditions before extensive physical testing is initiated. Furthermore, AI helps in fine-tuning rheological properties to match specific robot dispensing hardware and varying line speeds, a critical aspect of modern, flexible automotive manufacturing.

In the manufacturing and application segment, AI-powered vision systems and process monitoring tools are enabling a step-change in quality assurance (QA). High-resolution cameras and laser sensors integrated with ML models can continuously monitor the adhesive bead geometry, volume, and placement accuracy in real time, immediately flagging deviations that could lead to bond line weakness or failure. This proactive defect detection capability minimizes costly rework and ensures adherence to the stringent dimensional tolerance requirements set by automotive OEMs. Predictive algorithms are also being deployed to analyze sensor data from curing ovens and dispensing equipment to anticipate potential equipment malfunctions or inconsistencies in the curing process, ensuring consistent product quality across different batches and geographical production sites.

- AI accelerates the design and optimization of complex adhesive chemistries, predicting optimal performance under specific load conditions.

- Machine learning enhances real-time quality control (QC) in automated dispensing, utilizing vision systems for flaw detection and bead consistency verification.

- Predictive maintenance schedules for dispensing equipment are optimized using AI, minimizing line stoppages and ensuring application consistency.

- AI algorithms analyze manufacturing data to optimize curing cycles, reducing energy consumption and maximizing bond strength development time.

- Supply chain logistics for raw materials are optimized using AI, predicting demand fluctuations and ensuring stable procurement of specialty chemicals.

DRO & Impact Forces Of Hem Flange Bonding Adhesives Market

The market dynamics for Hem Flange Bonding Adhesives are governed by a robust confluence of mandatory performance requirements (Drivers), technological complexity and regulatory hurdles (Restraints), and burgeoning applications in next-generation mobility (Opportunities). Key drivers include the overwhelming industry requirement for vehicle lightweighting to achieve stricter environmental targets and the necessity of structural reinforcement to improve passenger safety during high-impact collisions. Restraints primarily involve the high initial investment cost associated with specialized application equipment and the complexity of ensuring effective bonding between highly dissimilar materials, often requiring intensive surface pre-treatment. Opportunities lie in the fast-paced growth of the electric vehicle market, which demands highly durable, thermally resistant adhesives for battery housing and structural components, alongside the potential for developing sustainable, bio-based adhesive alternatives.

The primary impact forces shaping the competitive landscape are technological innovation and regulatory pressure. Technological forces compel manufacturers to continuously improve adhesive characteristics—specifically focusing on higher crash resistance, faster cure rates, and superior environmental durability against moisture and extreme temperatures. Regulatory forces, particularly global standards for vehicle safety (e.g., Euro NCAP ratings) and fuel economy/emissions targets, act as constant accelerators, mandating the adoption of solutions that enable lighter and safer vehicles. Furthermore, the substitution threat posed by advanced mechanical fasteners (e.g., specialized riveting, flow drill screws) requires adhesive suppliers to continuously validate the cost-effectiveness and performance superiority of chemical bonding solutions, especially concerning weight reduction and fatigue life under cyclic loading.

Market sustainability is also influenced significantly by the material science impact force, centered on formulating adhesives with lower Volatile Organic Compound (VOC) emissions and reduced hazardous substances, aligning with evolving global environmental health and safety standards (EHS). The necessity for robust thermal management in EV battery packs has introduced a new dynamic, requiring hem flange adhesives to possess specific thermal conductivity properties alongside structural strength. Successfully navigating these forces—driving performance while managing complexity and cost—will determine the long-term competitive advantage of key market players, prioritizing those who invest heavily in application engineering support and advanced material compatibility testing.

Segmentation Analysis

The Hem Flange Bonding Adhesives market is meticulously segmented to reflect the diverse operational needs of the automotive and related industries, categorizing the offerings primarily based on the chemical composition of the adhesive, its final application area, and the type of vehicle platform utilizing the technology. This segmentation enables targeted product development and tailored market strategies, addressing specific performance requirements such as elasticity, shear strength, impact resistance, and curing speed, which vary significantly between different segments. Understanding these distinctions is critical for both manufacturers and end-users to optimize material selection for weight savings and structural integrity, crucial elements in the design and production cycles of modern vehicles across all segments, from standard passenger cars to heavy commercial transport solutions.

- By Resin Type:

- Epoxy-based Adhesives

- Polyurethane-based Adhesives

- Acrylic-based Adhesives

- Others (e.g., Modified Silicones, Hybrids)

- By Application:

- Doors and Hoods

- Trunk Lids and Tailgates

- Fender Assemblies

- Body-in-White (BIW) Structural Reinforcement

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By End-Use Industry:

- Automotive

- Aerospace

- Marine

- Rail

Value Chain Analysis For Hem Flange Bonding Adhesives Market

The value chain for Hem Flange Bonding Adhesives commences upstream with the procurement of specialized raw materials, including monomers, polymers (epoxy resins, polyols, isocyanates), curing agents, fillers, plasticizers, and proprietary performance additives. This stage is dominated by large chemical commodity and specialty chemical producers who supply the foundational components necessary for adhesive formulation. Critical dependency exists on the stability and purity of these raw materials, which significantly influences the final mechanical properties and application consistency of the finished adhesive product. Innovation at this stage focuses on developing sustainable, bio-based feedstocks and high-purity functional chemicals to meet stringent performance and environmental criteria imposed downstream by vehicle manufacturers.

The midstream of the value chain involves the synthesis and formulation of the adhesives by specialized chemical companies. This phase is characterized by intensive R&D, focusing on achieving specific rheological characteristics (viscosity, thixotropy, sag resistance) necessary for robotic application, alongside optimizing crash performance, fatigue life, and corrosion resistance. Distribution channels play a vital role, often categorized into direct sales and indirect channels. Direct distribution involves suppliers working intimately with major Automotive Original Equipment Manufacturers (OEMs) for large-volume, highly customized products, often requiring dedicated technical support and on-site application engineering. Indirect channels utilize specialized distributors or Tier 1 system integrators who supply smaller manufacturers or handle maintenance and repair operations (MRO).

The downstream segment is primarily dominated by the automotive manufacturing industry, including OEMs and their Tier 1 suppliers (e.g., body panel stampers and assembly specialists), who utilize the adhesives in high-volume, automated production lines. The final consumer of the vehicle benefits indirectly through enhanced safety, durability, and lighter vehicle weight. A key consideration in the downstream value chain is the application equipment—dispensing robots, mixing nozzles, and curing systems—which often requires close collaboration between the adhesive supplier, the equipment manufacturer, and the end-user to ensure optimal process integration and consistent quality control, thereby maximizing the performance gains promised by structural bonding over traditional methods.

Hem Flange Bonding Adhesives Market Potential Customers

The primary customer base for Hem Flange Bonding Adhesives resides overwhelmingly within the automotive sector, specifically the Original Equipment Manufacturers (OEMs) responsible for final vehicle assembly and their extensive network of Tier 1 and Tier 2 suppliers involved in stamping, body-in-white (BIW) construction, and closure panel production. OEMs, such as Volkswagen Group, General Motors, Toyota, Tesla, and Hyundai, are the ultimate decision-makers, setting the performance specifications and demanding high volumes of material that meet strict regulatory and internal durability requirements. Their procurement decisions are driven by the need for superior crash performance, reduction in vehicle mass, and improved manufacturing efficiency, necessitating adhesives that cure rapidly and integrate seamlessly into high-speed assembly lines, often involving complex mixed-material architectures.

Tier 1 suppliers, who manufacture sub-assemblies like complete door structures, hood assemblies, or specialized battery enclosures, represent an immediate and vital customer group. These companies require adhesives that not only meet OEM specifications but are also compatible with their specific manufacturing processes, often involving pre-treatment chemicals and proprietary stamping techniques. Their purchasing criteria focus heavily on material handling ease, consistency, and the reliability of supply, making long-term contractual agreements and technical support paramount in vendor selection. The increasing global distribution of these suppliers means adhesive companies must offer consistent products and support across multiple international production sites.

Beyond the core automotive sector, secondary customer segments include specialty vehicle manufacturers (e.g., luxury bus builders, high-performance sports car producers), and increasingly, the aerospace and rail industries, which also require strong, lightweight bonding solutions for paneling and structural components exposed to severe environmental conditions and cyclic fatigue. These customers prioritize ultra-high performance, fire resistance, and long-term durability, often utilizing specialized structural epoxies and hybrid adhesive systems. The growing maintenance, repair, and overhaul (MRO) sector also constitutes a recurring customer segment, requiring smaller quantities of specialized adhesives for accident repair and restoration of vehicle body integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.11 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, DOW Inc., 3M Company, PPG Industries Inc., Bostik (Arkema Group), Jowat SE, Lord Corporation (Parker Hannifin), Permabond LLC, Ashland Global Holdings Inc., Huntsman Corporation, Avery Dennison Corporation, Illinois Tool Works (ITW) Polymers, Cytec Solvay Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hem Flange Bonding Adhesives Market Key Technology Landscape

The technology landscape in the Hem Flange Bonding Adhesives market is rapidly evolving, driven by the persistent need for faster processing speeds and improved performance on complex, multi-material structures common in electric vehicles. A crucial technological advancement is the development of single-component heat-curing epoxies with significantly lower temperature activation requirements, reducing energy consumption in the automotive paint shop ovens while maintaining superior bond strength. Furthermore, advanced rheology control is paramount, allowing the adhesives to maintain precise bead profiles even when applied vertically or over complex contours, preventing sag and ensuring consistent bond line thickness crucial for crash performance predictability and reducing post-application material cleanup.

Another significant technological focus is on developing formulations optimized for bonding dissimilar materials, specifically addressing the challenge of galvanic corrosion that occurs when metals like aluminum and steel are joined. Adhesives now incorporate proprietary corrosion inhibitors and utilize specific polymer chemistries that act as insulating barriers, preventing the electrochemical reaction while maintaining robust structural integrity. The incorporation of microscopic spacers, or glass beads, within the adhesive matrix is also a mature technology used to guarantee a minimum bond line thickness (MBT), which is essential for managing thermal expansion differences and ensuring optimal crash performance across wide joints. This constant refinement in material science directly translates into lighter, safer, and more durable vehicle bodies.

Furthermore, the shift towards Industry 4.0 in automotive manufacturing is driving innovation in application technology. Automated dispensing systems now utilize highly precise gear pumps and volumetric metering units, coupled with sophisticated sensor feedback loops, to ensure zero variation in the amount of adhesive applied, regardless of line speed fluctuations. This application accuracy is enhanced by sophisticated software that controls robotic paths and material flow. Research into structural polyurethane and hybrid systems (e.g., Epoxy-Polyurethane hybrids) is accelerating, aiming to combine the high modulus and strength of epoxies with the superior flexibility and fatigue resistance of polyurethanes, offering next-generation solutions suitable for high-stress areas like battery housings and chassis elements that require simultaneous shock absorption and structural integrity, significantly pushing the boundaries of traditional hem flange application requirements.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, largely driven by the sheer scale of vehicle production, particularly in China and India. China's aggressive push toward electric vehicle manufacturing and strong domestic competition among OEMs necessitate rapid adoption of advanced bonding technologies for lightweighting and structural battery integration. Government initiatives supporting domestic EV production, coupled with expanding manufacturing capacities, solidify APAC's leading role in consuming hem flange bonding adhesives.

- Europe: Europe is characterized by high technical maturity and stringent regulatory environments, particularly concerning emissions (EU Green Deal) and pedestrian safety (Euro NCAP). European OEMs are leaders in multi-material vehicle architecture, creating high demand for premium, specialized adhesives that bond complex combinations of high-strength steel, carbon fiber, and aluminum. The market growth here is driven by quality-over-volume principles, focusing on high-performance, low-VOC formulations.

- North America: North America presents a highly resilient market, currently undergoing significant transformation due to major investments in electric truck and SUV manufacturing. The region demands adhesives that offer exceptional performance under extreme temperature variations and comply with USMCA trade standards. The focus is increasingly on structural adhesives capable of handling the heavy mass and unique impact forces associated with large EV battery packs and robust vehicle frames.

- Latin America (LATAM): The LATAM market, while smaller, exhibits stable growth, primarily concentrated in Brazil and Mexico, major automotive manufacturing hubs. Demand is largely driven by local manufacturing requirements and export mandates to North American and European markets. Cost-effectiveness and robust, reliable performance under diverse climate conditions are key purchasing criteria.

- Middle East and Africa (MEA): The MEA region is currently a nascent but emerging market. Growth is tied to local assembly operations and industrialization initiatives in countries like Turkey, South Africa, and the Gulf nations. Adoption is gradual, initially favoring standardized and cost-effective adhesive solutions, with future potential linked to regional expansion of EV manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hem Flange Bonding Adhesives Market.- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- DOW Inc.

- 3M Company

- PPG Industries Inc.

- Bostik (Arkema Group)

- Jowat SE

- Lord Corporation (Parker Hannifin)

- Permabond LLC

- Ashland Global Holdings Inc.

- Huntsman Corporation

- Avery Dennison Corporation

- Illinois Tool Works (ITW) Polymers

- Cytec Solvay Group

Frequently Asked Questions

Analyze common user questions about the Hem Flange Bonding Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of hem flange adhesives over traditional spot welding?

Hem flange adhesives offer superior advantages, including enhanced structural rigidity, improved fatigue resistance, and better crash energy absorption compared to spot welding. They also facilitate the joining of dissimilar materials, crucial for vehicle lightweighting strategies, and improve corrosion resistance by sealing the joint completely.

How does the shift to Electric Vehicles (EVs) specifically influence the demand for these adhesives?

The transition to EVs significantly boosts demand by increasing the need for lightweighting solutions to maximize battery range and demanding highly durable, thermally resistant structural adhesives for secure battery housing and robust body-in-white (BIW) integration, ensuring high safety standards under impact conditions.

Which resin type currently dominates the hem flange bonding market and why?

Epoxy-based adhesives dominate the market due to their excellent shear strength, high stiffness, and thermal resistance, making them ideal for critical structural components. However, polyurethane and hybrid systems are rapidly gaining share for applications requiring greater flexibility and handling of differential thermal expansion.

What role does automation play in the application of hem flange bonding adhesives?

Automation is crucial for ensuring application precision, consistency, and speed in high-volume automotive production. Robotic dispensing systems utilize advanced rheology-controlled adhesives to guarantee optimal bead placement, volume accuracy, and minimize material waste, directly impacting final product quality and manufacturing throughput.

What key material compatibility challenges exist when using hem flange adhesives?

Major challenges include ensuring effective adhesion to low-energy surfaces (like certain plastics), managing differences in the Coefficient of Thermal Expansion (CTE) between materials (e.g., steel and aluminum), and mitigating the risk of galvanic corrosion when bonding dissimilar metals through specialized formulation and insulating properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager