Hematologic Malignancies Treatment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442819 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hematologic Malignancies Treatment Market Size

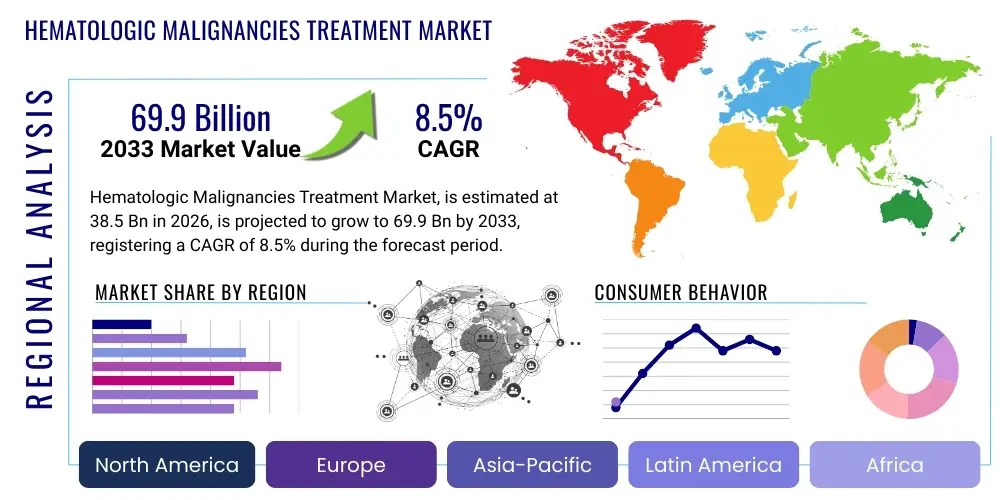

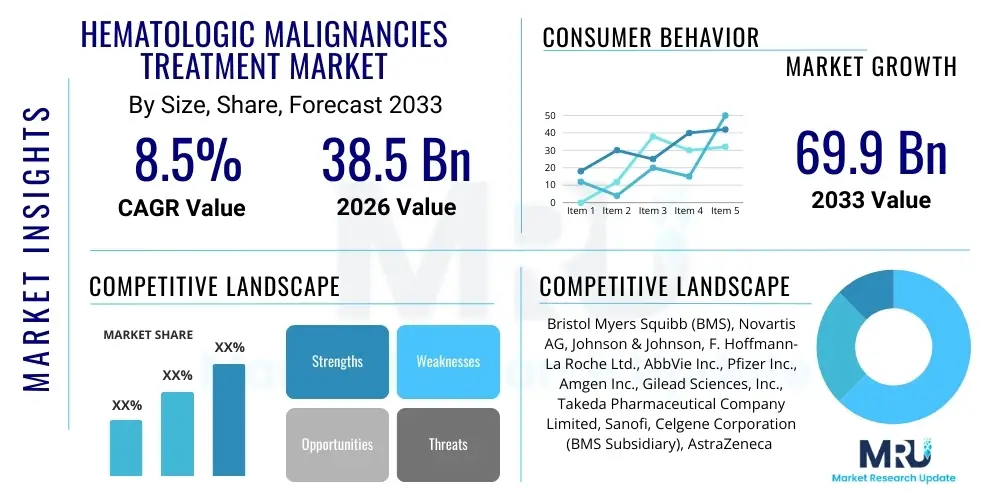

The Hematologic Malignancies Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 38.5 Billion in 2026 and is projected to reach USD 69.9 Billion by the end of the forecast period in 2033.

Hematologic Malignancies Treatment Market introduction

The Hematologic Malignancies Treatment Market encompasses pharmaceuticals, therapeutic procedures, and diagnostic tools used for managing cancers originating in blood-forming tissues, such as leukemia, lymphoma, and multiple myeloma. These cancers pose significant global health burdens, driving continuous innovation in therapeutic modalities. Treatments span traditional approaches like chemotherapy and radiation therapy to highly advanced interventions such as targeted therapy, immunotherapy, including revolutionary CAR T-cell therapy, and sophisticated allogeneic and autologous stem cell transplantation. The fundamental objective of this market is to significantly improve patient survival rates, substantially enhance quality of life, and offer highly personalized treatment options tailored precisely to the specific genetic and molecular profile of the malignancy. The complexity of these diseases, characterized by diverse subtypes and acquired drug resistance mechanisms, mandates a dynamic and rich therapeutic pipeline, which contributes significantly to the market’s high valuation and projected growth trajectory.

The product landscape within this highly specialized market is characterized by a rapid and decisive shift from generalized cytotoxic agents toward highly effective biologic and targeted therapies, reflecting a much deeper and more granular understanding of cancer pathophysiology at the molecular level. Key market products include small molecule inhibitors specifically targeting aberrant signaling pathways (e.g., BTK inhibitors for Chronic Lymphocytic Leukemia and Mantle Cell Lymphoma, and BCL-2 inhibitors), monoclonal antibodies engineered to block immune checkpoints or precisely target cancer cell surface markers (e.g., CD20, CD38), and highly personalized, curative-intent cellular therapies. The rise and rapid adoption of these innovative treatments is intrinsically linked to concurrent and sustained advancements in genomic sequencing and sophisticated molecular diagnostics, which collectively enable earlier, more sensitive, and significantly more precise identification of distinct disease subtypes and associated molecular drivers, thereby optimizing therapeutic selection, minimizing unnecessary toxicity, and dramatically improving overall clinical outcomes across diverse and challenging patient populations globally. Furthermore, the market is continually bolstered by robust and active pipelines focused intensely on developing synergistic combination therapies and novel drug delivery mechanisms designed specifically to overcome pervasive and complex mechanisms of drug resistance.

Driving factors for the substantial and sustained growth of the Hematologic Malignancies Treatment Market are multifaceted, primarily centered around the globally increasing incidence and prevalence of these cancers, particularly conspicuous in rapidly aging populations across both developed and developing economies. Enhanced diagnostic capabilities, coupled with increased public awareness, proactive physician education, and widespread screening programs, lead directly to earlier detection and diagnosis, significantly expanding the treatment-eligible patient pool across all disease types. Furthermore, substantial and necessary investment in oncology research and development (R&D), fueled by significant funding from both governmental bodies and proactive private sector initiatives, accelerates the regulatory approval and subsequent adoption of high-cost, high-efficacy novel therapeutics. Regulatory frameworks are increasingly prioritizing fast-track approval and breakthrough designation processes for oncology products, further stimulating rapid market entry for truly innovative treatments that address significant, persistent unmet clinical needs in refractory, relapsed, or high-risk hematological conditions. This conducive regulatory environment, coupled with the clear clinical benefit demonstrated by novel agents over standard-of-care, provides a powerful engine for market expansion and sustained commercial success.

Hematologic Malignancies Treatment Market Executive Summary

The global Hematologic Malignancies Treatment Market is currently navigating a period of profound and rapid transformation, largely characterized by seismic shifts in established therapeutic paradigms, driven primarily by the successful commercialization, regulatory acceptance, and accelerating uptake of advanced cellular and gene therapies. Business trends reflect an intensely competitive landscape where major pharmaceutical entities and highly focused biotechnology companies are engaging in aggressive mergers, strategic acquisitions, and critical strategic partnerships to efficiently acquire niche technologies, particularly focusing on the intellectual property and manufacturing capabilities in the sophisticated CAR T-cell, bispecific antibody, and gene editing domains. This strategic maneuvering is aimed at ensuring comprehensive portfolio diversification, securing robust manufacturing supply chains, and establishing market dominance in the highest-value, most innovative segments. While pricing pressure from major payers remains a critical constraint, particularly concerning high-cost biologics and personalized treatments, the demonstrable long-term efficacy, extended durability, and potential for curative intent offered by certain novel treatments frequently justify their premium pricing structure, especially within the oncology sector where maximizing clinical value and life extension is paramount.

Regional trends consistently indicate North America maintaining its global leadership position, primarily underpinned by its exceptionally high per capita healthcare expenditure, sophisticated and well-funded clinical research infrastructure, the physical concentration of major biopharma headquarters, and regulatory efficiencies (FDA) that facilitate the rapid adoption of newly approved innovations. However, the Asia Pacific (APAC) region is dynamically emerging as the undisputed fastest-growing market globally, propelled by rapidly expanding patient populations, significant improvements in healthcare access and quality, increasing governmental investment in specialized cancer care infrastructure, and the rising incidence of hematological cancers associated with demographic and environmental shifts in populous nations like China, Japan, and India. European growth remains steady and substantial, focusing strongly on regulatory harmonization (EMA) and the systematic, efficient integration of advanced cell therapies, often managed through complex national health technology assessment (HTA) and reimbursement systems that demand compelling evidence of cost-effectiveness and real-world clinical benefit.

Segmentation trends decisively highlight the exceptional and accelerating growth trajectory of both the Targeted Therapy and Immunotherapy segments, which are significantly outpacing the market's reliance on traditional cytotoxic chemotherapy. Specifically within Immunotherapy, the successful implementation and expansion of CAR T-cell therapies represent a critical market inflection point, transitioning progressively from late-line salvage treatments towards earlier therapeutic intervention in select, high-risk disease indications. Treatment modalities for Multiple Myeloma (MM) and Non-Hodgkin Lymphoma (NHL) collectively represent the largest and most valuable disease segments, benefiting from an exceptionally rich and productive pipeline of novel agents, including next-generation immunomodulatory drugs (IMiDs), novel proteasome inhibitors, sophisticated bispecific T-cell engagers (BiTEs), and advanced naked and conjugated monoclonal antibodies. This strategic and highly focused emphasis on highly specified molecular targets fundamentally underscores the market's ongoing evolution toward genuine precision oncology, enabling significantly better patient stratification, optimizing scarce healthcare resource allocation, and ultimately driving superior patient outcomes within increasingly strained global healthcare systems.

AI Impact Analysis on Hematologic Malignancies Treatment Market

Common user questions regarding AI’s influence in this domain predominantly coalesce around three distinct and critical themes: dramatically improving efficiency and reducing failure rates in drug discovery and translational development; optimizing highly personalized treatment planning, especially concerning the sequencing and integration of complex novel therapies; and significantly improving diagnostic accuracy, throughput, and speed, particularly in identifying rare or complex disease subtypes. Users frequently query how cutting-edge AI-driven predictive analytics can accurately forecast individual patient response to high-value, expensive therapies like CAR T-cells, thereby effectively minimizing the number of costly non-responders and achieving significant savings in overall healthcare expenditure. There is also extensive user interest in AI's foundational role in analyzing the enormous volume of complex genomic, transcriptomic, and clinical datasets routinely derived from advanced liquid biopsies, with the fundamental goal of identifying novel and highly sensitive biomarkers for Minimal Residual Disease (MRD) monitoring, which is a universally crucial prognostic factor in the long-term management of all types of hematologic malignancies. Primary concerns expressed often center on ensuring data privacy and security, the pressing need for rigorous regulatory validation and standardization of complex AI algorithms before clinical use, and crucially, ensuring equitable global access to these sophisticated and potentially centralized technologies across vastly different geographical healthcare settings.

AI is fundamentally reshaping both the preclinical pipeline and the clinical application landscape, embedding itself as a crucial tool at multiple stages of the therapeutic lifecycle. In the demanding preclinical phase, sophisticated machine learning algorithms are utilized extensively to accelerate the identification, validation, and prioritization of therapeutic targets and optimal drug candidates by meticulously analyzing vast, multi-dimensional biological and chemical property datasets, thereby substantially reducing the traditionally long timelines and immense costs associated with early-stage development and toxicity screening. Clinically, AI integration profoundly enhances diagnostic precision by providing critical assistance to pathologists and hematologists in rapidly classifying complex and morphologically ambiguous subtypes of leukemia and lymphoma from high-resolution microscopy and flow cytometry data, offering a level of quantitative consistency, objectivity, and processing speed that is simply unattainable by human observation alone. Furthermore, in the design and execution of pivotal clinical trials, AI algorithms can efficiently identify and recruit the most suitable patient cohorts, accurately predict probable trial outcomes based on previous data, and precisely optimize complex dosage regimens and scheduling, significantly streamlining the path from preclinical bench validation to patient bedside delivery, and thus making highly novel treatments available to the patient population faster.

The integration of robust AI systems into established patient care pathways extends strategically to post-treatment surveillance, robust toxicity management, and early relapse prediction. Advanced AI models are being intensively trained on deep, longitudinal patient data to accurately predict the likelihood and severity of highly specific adverse events associated with intense and novel treatments, such as the life-threatening cytokine release syndrome (CRS) or neurotoxicity following CAR T-cell administration, allowing specialized oncology teams to implement proactive intervention strategies and ensure substantially safer, more predictable patient management. Moreover, AI tools decisively facilitate the continuous, high-sensitivity monitoring of MRD status, enabling oncologists to make rapid, timely adjustments to maintenance therapy protocols or preemptively initiate salvage treatment upon the absolute earliest molecular signs of disease relapse. This superior predictive and proactive capability transforms traditional reactive patient care into a highly optimized proactive management strategy, ensuring higher long-term treatment success rates, mitigating late-stage complications, and dramatically improving the overall long-term prognosis for patients suffering from hematologic malignancies across a wide spectrum of complex and high-risk clinical scenarios.

- Accelerated, high-throughput target identification and lead compound optimization in drug discovery using predictive molecular modeling.

- Enhanced diagnostic accuracy and throughput speed for complex classification of leukemia and lymphoma subtypes via advanced image analysis.

- Highly personalized treatment selection by accurately predicting individual patient response to specific targeted or cellular therapies based on multi-omic data.

- Optimization of complex clinical trial design, efficient cohort selection, and real-time monitoring of efficacy and patient safety endpoints.

- Improved prediction, monitoring, and proactive management of severe treatment-related toxicities, such as CAR T-cell associated neurotoxicity and CRS.

- Advanced, high-sensitivity monitoring of Minimal Residual Disease (MRD) using machine learning analysis of liquid biopsy genomic data.

- Streamlining hospital administrative processes, optimizing complex logistics, and efficiently allocating specialized resources in cellular therapy centers.

DRO & Impact Forces Of Hematologic Malignancies Treatment Market

The market is primarily driven by technological advancements in precision medicine, restraints related to high treatment costs and complex reimbursement frameworks, and opportunities arising from the expansion into emerging markets and the development of oral targeted therapies. The primary impact forces include the increasing global incidence and prevalence of hematologic cancers, particularly in the geriatric population, which demands continuous innovation in therapeutic modalities. The significant unmet need for effective treatments in relapsed or refractory disease settings acts as a powerful catalyst for R&D investment, leading to the rapid introduction of novel, high-efficacy agents. Conversely, the complexity and specialized infrastructure required for cellular therapies (e.g., cell manufacturing, cryopreservation, administration centers) limit rapid global scalability, posing a structural constraint that requires substantial capital investment and regulatory harmonization to overcome. The complexity of manufacturing and logistics, particularly for autologous therapies, adds significant friction to widespread commercial uptake.

The rapid pace of innovation, particularly in the realm of cellular and gene therapies, acts as a profound driver, fundamentally altering therapeutic outcomes for previously incurable diseases. This success, however, brings forth substantial economic restraints; the cost of curative intent therapies, such as Kymriah or Yescarta, can exceed hundreds of thousands of dollars per patient, placing immense pressure on national healthcare budgets and private insurance systems, leading to stringent cost-effectiveness evaluations. Opportunities are significant in addressing cancers with poor prognosis, such as acute myeloid leukemia (AML), where current standard treatments offer limited long-term survival. Development of less invasive, potentially curative regimens, including oral inhibitors or off-the-shelf allogeneic cell therapies, represents a massive commercial opportunity for companies that can reduce the logistical burden and treatment cost associated with complex, autologous procedures. Furthermore, combining existing treatments with novel agents to overcome resistance mechanisms offers a viable pathway for market expansion.

The long-term impact forces are shaped by regulatory landscape shifts and the adoption of real-world evidence (RWE). Regulators are increasingly using RWE to support label expansions and post-market surveillance for novel oncology drugs, accelerating market access for proven treatments. Furthermore, the global push toward value-based healthcare models compels pharmaceutical companies to demonstrate superior clinical benefit relative to cost, forcing a strategic shift toward outcomes-based reimbursement agreements. This dynamic environment encourages innovation focused not only on maximizing clinical response rates but also on improving patient compliance, reducing hospital stays, and ultimately delivering quantifiable long-term value, ensuring sustained market relevance and mitigating payer resistance to premium pricing strategies in this highly specialized therapeutic area. Success relies heavily on the ability of manufacturers to validate both clinical and economic value across diverse healthcare settings.

Segmentation Analysis

The Hematologic Malignancies Treatment Market is segmented based on disease type, therapeutic class, and end-user, providing a granular view of market dynamics and opportunity landscapes. Analysis by disease type reveals that multiple myeloma and non-Hodgkin lymphoma dominate the market, driven by the increasing availability and adoption of novel targeted and immunotherapies for these prevalent conditions. The therapeutic class segmentation highlights the dominant shift toward targeted therapies and immunotherapies, which are replacing conventional chemotherapy as first-line or relapse treatment standards due to improved specificity and better toxicity profiles. Geographically, market performance is strongly correlated with healthcare infrastructure quality and accessibility to high-cost specialty pharmaceuticals, emphasizing regional disparities in growth and adoption rates across different treatment modalities and patient demographics, necessitating localized commercial strategies.

In-depth examination of the therapeutic class segment underscores the revolutionary impact of monoclonal antibodies and small molecule inhibitors. Monoclonal antibodies target surface antigens crucial for cancer cell survival or immune evasion, while kinase inhibitors disrupt intracellular signaling pathways driving malignant proliferation. The continued development of bi-specific and tri-specific antibodies is also rapidly gaining traction, offering enhanced mechanisms of action that can simultaneously engage immune effector cells and cancer targets. This focus on highly sophisticated biological agents necessitates specialized diagnostic capabilities to accurately select patients who will maximally benefit from these treatments, driving co-development of companion diagnostics alongside new drugs, which adds another layer of complexity to the development and commercialization process, but maximizes therapeutic utility and patient selection precision.

Segmentation by end-user, primarily hospitals and specialized oncology clinics, reflects the complexity of treatment administration. Hospitals, particularly large academic medical centers, are crucial for administering intensive treatments like bone marrow transplants and cellular therapies due to the required infrastructure for intensive care, specialized pharmacy services, and multidisciplinary teams. However, the trend toward outpatient administration of less toxic targeted oral therapies is growing, shifting some market volume toward outpatient clinics and reducing the overall burden on acute care facilities. Understanding these utilization patterns is vital for supply chain optimization and market access strategies, particularly in regions where outpatient oncology care is rapidly expanding its service portfolio, requiring manufacturers to adapt their distribution and educational efforts accordingly.

- By Disease Type:

- Leukemia (Acute Myeloid Leukemia, Acute Lymphocytic Leukemia, Chronic Lymphocytic Leukemia, Chronic Myeloid Leukemia)

- Non-Hodgkin Lymphoma (NHL)

- Multiple Myeloma (MM)

- Hodgkin Lymphoma (HL)

- Myelodysplastic Syndromes (MDS)

- By Therapeutic Class:

- Chemotherapy

- Targeted Therapy (Small Molecule Inhibitors, Monoclonal Antibodies)

- Immunotherapy (Checkpoint Inhibitors, CAR T-cell Therapy, Bispecific Antibodies)

- Radiation Therapy

- Stem Cell Transplantation

- By End User:

- Hospitals

- Specialized Oncology Clinics

- Ambulatory Surgical Centers

Value Chain Analysis For Hematologic Malignancies Treatment Market

The value chain for the Hematologic Malignancies Treatment Market is complex, beginning with extensive upstream R&D carried out by pharmaceutical and biotechnology firms, often in collaboration with academic institutions. The upstream segment involves drug discovery, target validation, and preclinical testing, requiring significant intellectual property management and capital investment. This is followed by clinical development and regulatory approval processes, which represent the highest risk and cost elements of the value chain. Key activities at this stage include manufacturing active pharmaceutical ingredients (APIs), especially the complex biological entities and personalized cell manufacturing for CAR T-cell therapies, where rigorous quality control and Good Manufacturing Practices (GMP) adherence are non-negotiable for product integrity and patient safety. Maintaining the chain of identity for personalized cell therapies adds unique logistical burdens at the upstream and midstream junctions, requiring specialized technologies and protocols.

The midstream phase focuses on manufacturing, bulk drug production, and formulation into final dosage forms. For conventional drugs, this involves scaling up chemical synthesis; however, for cellular therapies, this involves highly specialized logistics, including cryopreservation and ensuring the ‘vein-to-vein’ time is minimized while maintaining cell viability. Distribution channels (midstream/downstream) are highly specialized due to the temperature sensitivity and high value of the products. Distribution involves a controlled network of specialty pharmacies, wholesalers, and cold chain logistics providers capable of handling complex storage and transport requirements. Direct distribution models are increasingly utilized by manufacturers of ultra-high-cost biologics and cellular therapies to maintain strict control over product handling and traceability, ensuring product integrity until patient administration and circumventing potential risks associated with broad, less controlled distribution networks.

The downstream segment involves healthcare providers—hospitals, specialized clinics, and infusion centers—responsible for administering the treatment, followed by post-treatment monitoring. Direct sales forces and specialized medical science liaisons (MSLs) often facilitate the educational outreach to prescribing oncologists and hematologists. Indirect channels involve institutional procurement and centralized purchasing organizations, particularly in large public healthcare systems (like the NHS or regional health boards in Europe) where bulk procurement and negotiated pricing dictate market access. The ultimate value delivery is realized through clinical outcomes, which feedback into R&D strategies and future market access negotiations, emphasizing a continuous loop of innovation and efficacy validation across all stages of the complex value delivery system. Successful market players must manage this entire chain seamlessly, from intellectual property generation to final outcomes tracking.

Hematologic Malignancies Treatment Market Potential Customers

The primary potential customers and end-users of the Hematologic Malignancies Treatment Market are defined by institutions capable of diagnosing and managing complex hematological conditions, ranging from large academic medical centers to community oncology practices and government healthcare agencies responsible for procurement. Academic and tertiary hospitals serve as critical customers for novel, high-cost therapies like CAR T-cells and stem cell transplantation, as they possess the necessary infrastructure, multidisciplinary expertise, and accreditation required for administration and management of associated toxicities. These institutions are often early adopters, driven by clinical research mandates and the need to offer cutting-edge care for patients with refractory disease, thus representing a high-value customer segment for pharmaceutical innovation, and often serving as centers of excellence for referral networks and advanced medical education in oncology.

Community oncology clinics, while generally focusing on less intensive, standard-of-care treatments and oral therapies, are increasingly becoming key customers as targeted agents become easier to administer and regulatory pathways broaden their use in outpatient settings. These clinics represent a significant volume customer base, particularly for maintenance therapies and less acute presentations of hematologic malignancies. Furthermore, the payers—both government healthcare programs (e.g., Medicare, NHS) and private insurance companies—act as highly influential, indirect customers. Their formulary decisions, based on cost-effectiveness and clinical evidence, determine patient access and heavily influence purchasing patterns across all provider types, making successful market penetration dependent on favorable reimbursement outcomes and robust economic modeling tailored to the specific payer landscape.

Finally, blood banks and specialized cell processing laboratories are integral, specific customers, particularly for stem cell and cellular therapy products. These entities manage the collection, processing, and cryopreservation of biological materials required for transplantation or personalized cell therapy manufacturing. Procurement managers and hospital pharmacy directors within these facilities make purchasing decisions based on security of supply, adherence to quality standards (e.g., FACT accreditation), and logistical capability. The patient themselves, while not the direct transactional customer, ultimately drives demand, influenced heavily by physician recommendations and the availability of treatments through established healthcare networks, underscoring the crucial role of robust medical education and patient advocacy in facilitating treatment uptake and adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 38.5 Billion |

| Market Forecast in 2033 | USD 69.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol Myers Squibb (BMS), Novartis AG, Johnson & Johnson, F. Hoffmann-La Roche Ltd., AbbVie Inc., Pfizer Inc., Amgen Inc., Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Sanofi, Celgene Corporation (BMS Subsidiary), AstraZeneca PLC, Merck & Co., Inc., Regeneron Pharmaceuticals, Inc., Seagen Inc., Daiichi Sankyo Company, Limited, BeiGene, Ltd., Cellerix S.L., Legend Biotech, Adaptive Biotechnologies Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hematologic Malignancies Treatment Market Key Technology Landscape

The technological landscape of the Hematologic Malignancies Treatment Market is rapidly evolving, driven by innovations in cell engineering, genomics, and advanced biological manufacturing. The most impactful development is the maturation and expansion of Chimeric Antigen Receptor (CAR) T-cell therapy, which involves genetically modifying a patient’s own T-cells to target and destroy cancer cells. This technology requires highly sophisticated viral vector production, cell collection (apheresis), precise genetic modification, and stringent quality control protocols, establishing a new technological frontier in oncology. Furthermore, the move towards allogeneic (off-the-shelf) CAR T-cells, utilizing healthy donor cells or induced pluripotent stem cells (iPSCs), aims to reduce manufacturing complexity and waiting times, potentially democratizing access to this life-saving intervention across various global healthcare settings, thus overcoming the logistical bottlenecks currently limiting broad access to autologous treatments.

Beyond cellular therapies, the technology involves highly specific small molecule inhibitors and next-generation sequencing (NGS) platforms. NGS technology is crucial for identifying specific molecular mutations (e.g., FLT3, IDH1/2 in AML) that guide the selection of targeted inhibitors, enabling precision dosing and improving therapeutic efficacy while minimizing systemic toxicity. Advancements in bispecific and trispecific antibody technology are also prominent, designed to simultaneously bind to tumor cells and immune cells, effectively bridging them to enhance targeted cytotoxicity. These platforms represent a lower-cost, potentially more scalable alternative to cellular therapies, providing robust treatment options in conditions like multiple myeloma and non-Hodgkin lymphoma, driving competition and therapeutic diversification within the market and allowing for highly tailored combination treatment approaches.

Moreover, liquid biopsy technology is gaining prominence as a non-invasive tool for disease monitoring. By detecting circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) in the blood, liquid biopsies allow for real-time tracking of treatment response and early detection of molecular relapse, often long before clinical symptoms appear. This capability is paramount for monitoring Minimal Residual Disease (MRD), a critical prognostic indicator in hematologic malignancies, and facilitating timely intervention. The continued refinement of analytical sensitivity and standardization of these liquid biopsy assays are critical technological focus areas that promise to revolutionize post-treatment surveillance and contribute significantly to improved long-term patient outcomes, ensuring the high-value treatments are maximized in terms of sustained efficacy by enabling earlier detection of treatment failure.

Regional Highlights

- North America: Dominates the global market share due to exceptionally high healthcare expenditure, rapid uptake of advanced therapies (especially CAR T-cells), favorable reimbursement policies (particularly in the US), and the concentration of key biopharmaceutical innovation hubs. High disease incidence and well-established clinical trial infrastructure further cement its leadership position.

- Europe: Represents the second-largest market, characterized by mature healthcare systems and centralized regulatory bodies (EMA) facilitating consistent product approval. Market growth is driven by increasing adoption of targeted therapies and expanding access to cellular immunotherapy, though stringent health technology assessment (HTA) requirements in major markets like Germany, France, and the UK impose cost-effectiveness hurdles.

- Asia Pacific (APAC): Projected to exhibit the highest CAGR during the forecast period. Growth is fueled by massive patient populations, rising awareness of hematologic cancers, improving healthcare infrastructure, and increasing governmental investment in cancer research and treatment facilities in economies such as China, Japan, and India. Local manufacturing and increasing affordability initiatives are also contributing factors.

- Latin America (LATAM): Growth is steady but constrained by economic variability and fragmentation in healthcare access. The market relies heavily on imports of specialty drugs. Opportunities exist through increasing partnerships between international pharma companies and local distributors to navigate complex tendering processes and improve patient affordability and access in key markets like Brazil and Mexico.

- Middle East and Africa (MEA): This region is an emerging market, driven by rising chronic disease incidence and substantial infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries. Access to innovative treatments is limited outside of high-income urban centers, focusing primarily on high-end government or private health schemes capable of supporting complex oncology care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hematologic Malignancies Treatment Market.- Bristol Myers Squibb (BMS)

- Novartis AG

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- AbbVie Inc.

- Pfizer Inc.

- Amgen Inc.

- Gilead Sciences, Inc. (Kite Pharma)

- Takeda Pharmaceutical Company Limited

- Sanofi

- AstraZeneca PLC

- Merck & Co., Inc.

- Regeneron Pharmaceuticals, Inc.

- Seagen Inc.

- Daiichi Sankyo Company, Limited

- BeiGene, Ltd.

- Servier SA

- Jazz Pharmaceuticals plc

- Incyte Corporation

- Genmab A/S

- Sunesis Pharmaceuticals, Inc.

- Janssen Biotech (J&J Subsidiary)

- Seattle Genetics

- Syros Pharmaceuticals

- Celgene Corporation (Acquired by BMS)

Frequently Asked Questions

Analyze common user questions about the Hematologic Malignancies Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the significant revenue growth of the Hematologic Malignancies Treatment Market?

The primary driver is the rapid development, regulatory approval, and successful commercialization of high-efficacy therapeutic platforms, including cutting-edge targeted agents and personalized cellular immunotherapies (like CAR T-cells), complemented by the consistently increasing global incidence of hematologic cancers, particularly observed within the elderly demographic across industrialized nations.

Which therapeutic class is forecast to achieve the highest growth rate during the 2026–2033 period?

The Immunotherapy segment, specifically encompassing CAR T-cell therapies and novel bispecific antibodies, is forecast to achieve the highest growth rate. This acceleration is due to their unprecedented clinical success in achieving deep, durable remissions and their expanding utilization into earlier lines of therapy for prevalent conditions like Multiple Myeloma and aggressive Non-Hodgkin Lymphoma subtypes.

What is the key structural restraint significantly impacting the broad market adoption of the newest innovative treatments?

The most persistent structural restraint is the prohibitively high financial cost associated with advanced treatments, especially autologous cellular therapies, which places substantial budgetary strain on global healthcare payers and necessitates complex, often lengthy, negotiations for favorable reimbursement status and limits overall equitable patient access.

How is Artificial Intelligence (AI) fundamentally transforming the clinical diagnosis and treatment planning in this specialized market?

AI is transforming the field by enhancing the efficiency and accuracy of complex diagnostic processes, particularly in subtype classification from pathology and genomics data, and by implementing sophisticated predictive analytics tools to personalize treatment planning, forecasting patient response to specific high-value biologics and guiding optimal therapy sequencing.

Which geographical region is projected to experience the fastest market expansion and why?

The Asia Pacific (APAC) region is projected to experience the fastest market expansion, primarily driven by substantial improvements in healthcare infrastructure quality, burgeoning public and private investments in oncology centers, rapid regulatory streamlining, and the immense, growing patient pool within major economies like China and India seeking access to Western-approved therapeutic innovations.

What is the role of liquid biopsy technology in managing hematologic malignancies?

Liquid biopsy technology is crucial for non-invasive, high-sensitivity monitoring of Minimal Residual Disease (MRD) by detecting circulating tumor DNA (ctDNA). This enables oncologists to track treatment efficacy in real-time and detect molecular relapse much earlier than traditional methods, facilitating timely clinical intervention and optimization of long-term patient surveillance strategies.

What key challenges are manufacturers of autologous CAR T-cell therapies currently addressing?

Manufacturers are tackling challenges related to complex logistics, stringent quality control for personalized manufacturing (chain-of-identity), high production costs, and the critical need to shorten the 'vein-to-vein' time, which are all necessary steps to achieve wider commercial scalability and improved patient access beyond major academic medical centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager