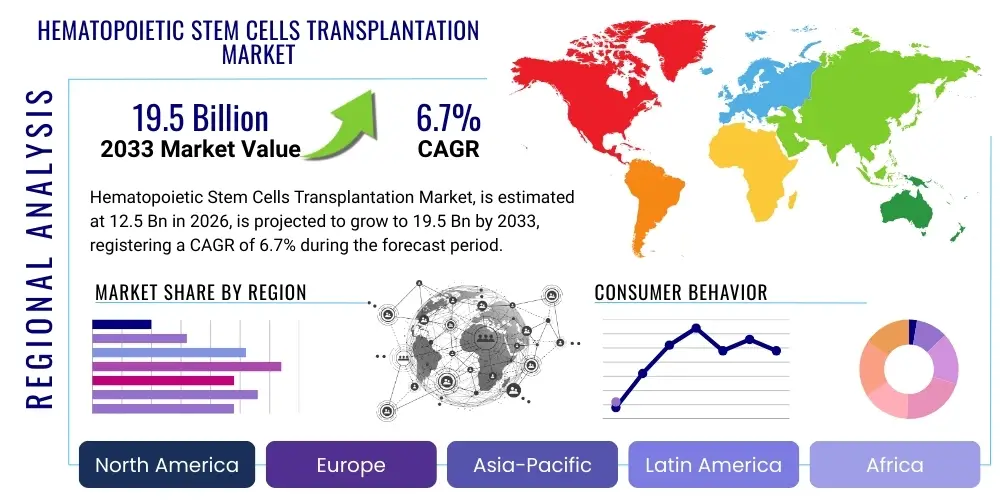

Hematopoietic Stem Cells Transplantation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441058 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Hematopoietic Stem Cells Transplantation Market Size

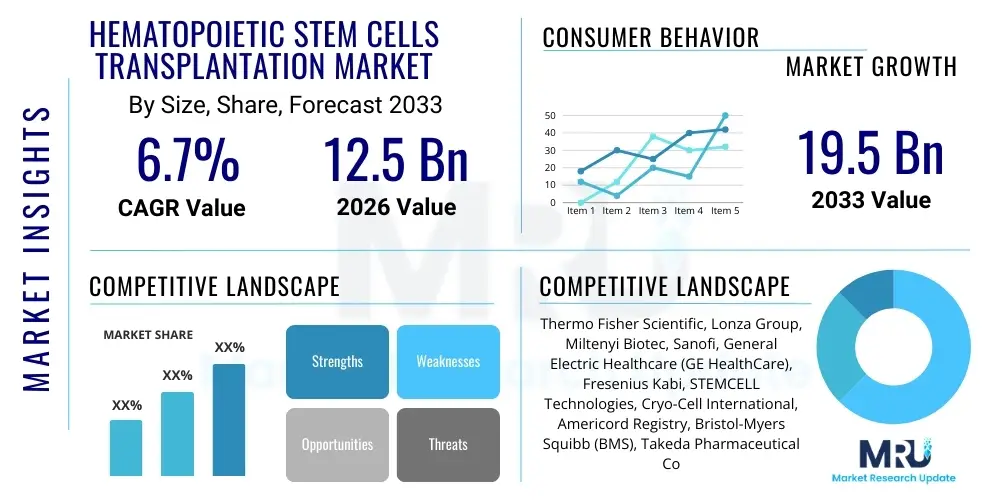

The Hematopoietic Stem Cells Transplantation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

Hematopoietic Stem Cells Transplantation Market introduction

The Hematopoietic Stem Cells Transplantation (HSCT) Market encompasses the sophisticated ecosystem of procedures, products, and services dedicated to the transplantation of hematopoietic stem cells, primarily employed as a curative strategy for a wide spectrum of severe hematological malignancies, inherited immune deficiencies, and specific genetic blood disorders. This highly intricate medical intervention fundamentally involves the destruction of diseased or damaged bone marrow using high-intensity chemo-radiotherapy (conditioning regimen), followed by the infusion of healthy stem cells derived either from the patient (autologous) or a meticulously matched donor (allogeneic). The success and applicability of HSCT have been dramatically enhanced by continuous refinements in supportive care, the development of reduced intensity conditioning (RIC) protocols, and significant strides in human leukocyte antigen (HLA) tissue typing techniques, solidifying its irreplaceable role within high-stakes oncology and immunology worldwide.

The market’s product portfolio is broad, spanning critical components necessary for the end-to-end procedure: specialized automated cell processing systems (such as cell separators and immunomagnetic devices), high-grade cryopreservation media and logistics solutions essential for cell viability, advanced molecular diagnostics for donor matching and chimerism monitoring, and dedicated sterile containment infrastructure (cleanrooms). Major clinical applications are centered on curative treatments for devastating diseases, including Acute Myeloid Leukemia (AML), Chronic Lymphocytic Leukemia (CLL), refractory Non-Hodgkin's Lymphoma, and Multiple Myeloma, alongside treating non-malignant conditions like severe aplastic anemia, thalassemia major, and congenital immunodeficiency disorders. The paramount benefit of HSCT remains its potential to offer long-term, disease-free survival where conventional treatments have failed, thereby justifying the substantial infrastructural investment required for its execution and driving consistent demand within high-resource healthcare systems globally.

Several fundamental drivers are propelling the sustained expansion of the global HSCT market. Key among these is the escalating global prevalence and incidence of age-related hematological cancers, which disproportionately affect the aging populations in developed economies. Further momentum is generated by relentless technological innovation, including the successful implementation of haploidentical transplantation—which significantly broadcasts the donor pool by allowing partially mismatched relatives to donate—and the commercialization of novel, less toxic conditioning agents that reduce overall transplant morbidity. Furthermore, the burgeoning field of cellular immunotherapy, particularly CAR T-cell therapy, indirectly drives the autologous HSCT segment, as many of these treatments rely on specialized cell collection and processing methodologies common to traditional HSCT. Increased government and non-profit funding for establishing and maintaining robust national and international donor registries also serves as a crucial infrastructural driver, mitigating one of the procedure’s historical bottlenecks—donor availability.

Hematopoietic Stem Cells Transplantation Market Executive Summary

The global Hematopoietic Stem Cells Transplantation (HSCT) market exhibits strong growth momentum, underpinned by a dynamic interplay of clinical need, technological breakthrough, and strategic consolidation within the life sciences sector. Current business trends illustrate a significant shift towards integration, where organizations specializing in cell processing equipment are forging deep partnerships with providers of molecular diagnostic services (HLA typing) to offer seamless, validated solutions to transplant centers. This holistic approach focuses on enhancing procedural standardization and optimizing critical metrics like time-to-infusion and minimizing cellular product loss. Furthermore, the market is witnessing increased capital allocation towards developing advanced logistical chains capable of handling ultra-sensitive cellular materials, addressing the stringent cold chain requirements necessary for cryopreserved products like cord blood units, which is crucial for market safety and compliance.

Geographically, market leadership is firmly held by North America, attributed to its early adoption of advanced clinical protocols, robust private and public reimbursement mechanisms that facilitate access to expensive therapies, and a high concentration of leading academic research institutions pioneering next-generation transplantation techniques, including gene-edited stem cell applications. European nations follow closely, benefiting from high procedural volumes across countries like Germany and the UK, supported by comprehensive national health services and collaborative pan-European donor networks. Conversely, the Asia Pacific (APAC) region is emerging as a critical future growth engine, characterized by steep increases in disposable income allocated to healthcare, rapid expansion of modern hospital infrastructure, and government initiatives aimed at establishing regional centers of excellence to meet the needs of large patient populations in countries such as China, Japan, and India.

Segmentation analysis highlights the continuous importance of the Autologous HSCT segment, which remains high in volume due to its established efficacy in treating prevalent conditions like Multiple Myeloma and certain lymphomas, minimizing the immunological risks associated with donor cells. However, the Allogeneic HSCT segment is projected to achieve a higher Compound Annual Growth Rate (CAGR), driven by innovations in haploidentical and mismatched unrelated donor transplants, which are solving the historic problem of donor scarcity crucial for treating severe leukemias and inherited disorders. Technological trends within sources show Peripheral Blood Stem Cells (PBSC) as the preferred collection method for efficiency, while the application segment is diversifying, with increasing procedural acceptance for non-malignant indications such as severe autoimmune diseases and inherited metabolic disorders, signaling a crucial broadening of therapeutic utility.

AI Impact Analysis on Hematopoietic Stem Cells Transplantation Market

Users frequently center on the transformative potential of Artificial Intelligence (AI) in refining precision medicine within the HSCT domain, specifically focusing on its ability to handle the enormous complexity of genomic and clinical data involved in predicting therapeutic success. Key thematic concerns often include the validation processes necessary for deploying machine learning models in high-risk clinical settings, ensuring data privacy across international donor registries, and the economic accessibility of these advanced computational tools for transplant centers in lower-resource settings. Users are keen to understand how AI can move beyond simple statistical correlation to provide actionable, real-time clinical recommendations regarding optimal timing for transplantation, personalized immunosuppressive regimens, and early identification of impending post-transplant complications, anticipating a significant reduction in procedure-related mortality and long-term morbidity associated with GVHD.

The deployment of AI algorithms is revolutionizing the critical process of donor selection. Traditional HLA matching is complex, but AI can analyze high-resolution NGS data, alongside non-HLA genetic factors and historical patient-donor interaction data, to calculate a more accurate immunological compatibility score, minimizing the risk of adverse immune reactions. Moreover, in the realm of cellular product quality control, machine vision and deep learning are being integrated into automated processing equipment to assess cell morphology, viability, and count with greater precision and consistency than human operators, standardizing the quality of the infused therapeutic product. This automation is vital for maintaining the rigorous standards required by regulatory bodies like the FDA and EMA for cell and gene therapy manufacturing.

AI also holds immense promise in predictive monitoring and personalized care. By analyzing continuous streaming data from electronic health records (EHRs), biomarker assays, and patient wearables, AI models can forecast patient trajectories. For example, machine learning algorithms can rapidly analyze thousands of gene expression profiles to predict which patients are most likely to develop severe GVHD, enabling proactive therapeutic intervention before symptoms become refractory. This capability to transition from reactive treatment to proactive, personalized risk management is expected to dramatically enhance the therapeutic index of HSCT, making the procedure safer and more broadly applicable to a larger population cohort globally, thus acting as a strong future growth catalyst.

- AI-driven optimization of Human Leukocyte Antigen (HLA) matching algorithms to improve donor selection, reducing immunologic mismatches and subsequent complications by incorporating non-traditional compatibility markers.

- Predictive analytics leveraging patient genomic profiles, disease status (e.g., minimal residual disease), and procedural parameters to forecast the likelihood of engraftment success, acute or chronic graft-versus-host disease (GVHD), and potential long-term relapse risk.

- Machine learning integration into automated cell processing instrumentation for standardized, objective quality control, high-throughput assessment of cell viability, and precise quantification of therapeutic stem cell doses prior to patient infusion.

- Development of AI tools to personalize conditioning regimens (e.g., chemotherapy and radiation dose selection) based on individual patient pharmacogenomics, metabolic pathways, and toxicity profiles, specifically to maximize tumor cell kill while minimizing organ damage.

- AI support for rapid diagnosis and continuous monitoring of post-transplant complications, such as early detection of GVHD, opportunistic infections, or signs of organ toxicity through pattern recognition in complex clinical data and biomarker trends, facilitating timely, life-saving adjustments.

- Optimization of complex logistical challenges in cord blood banking, stem cell transportation, and inventory management using AI models for demand forecasting, supply chain efficiency, and optimal utilization of banked, precious biological units across vast geographical distances.

DRO & Impact Forces Of Hematopoietic Stem Cells Transplantation Market

The HSCT market is fundamentally driven by the relentless increase in the global incidence of hematological cancers coupled with the proven curative potential of the procedure, especially in younger, fitter patients. Technological momentum stems from the successful clinical implementation of haploidentical protocols, dramatically expanding donor availability, and the parallel development of less myeloablative conditioning regimens (RIC), which lower toxicity and extend the treatment option to older patients with comorbidities. The primary market restraint remains the persistently high cost of the end-to-end procedure, which encompasses complex surgical infrastructure, expensive specialized reagents, long hospital stays, and intensive supportive care. Furthermore, the significant risk of severe, life-threatening complications such as severe GVHD and fatal infections inherently limits the procedure’s adoption rate and accessibility in non-specialized centers.

A deeper look at the driving forces reveals that regulatory support for advanced cellular therapies is crucial; for instance, expedited pathways for novel conditioning drugs and innovative cell manipulation devices encourage manufacturer investment, driving market sophistication. The global expansion of specialized cancer treatment networks, particularly in emerging economies, is increasing the geographical footprint of HSCT capability, thereby expanding the patient population eligible for treatment. The continuous integration of HSCT with cutting-edge immunotherapies, such as its use as a consolidative therapy following CAR T-cell infusion or in conjunction with novel checkpoint inhibitors, positions the market at the forefront of modern precision oncology, ensuring sustained growth trajectory as clinical best practices evolve.

However, the restraints are powerful and multi-faceted. The required infrastructure—including Class 100 cleanrooms and highly specialized, FACT-accredited personnel—imposes massive capital expenditure barriers for new entrants, centralizing market growth among established academic centers. Opportunities are strongly rooted in the success of gene therapy integration; if stem cells can be effectively edited ex vivo to be resistant to certain diseases or to improve engraftment, it will dramatically broaden HSCT’s application scope and elevate success rates, thereby mitigating procedural risk factors. The ultimate impact force on the market is the irreversible trend toward personalized medicine; as diagnostics improve and risk stratification becomes more precise, HSCT will increasingly become the preferred curative intervention, overriding cost concerns due to its life-saving potential, particularly in the refractory setting where few other options exist.

Segmentation Analysis

Comprehensive market segmentation allows for the precise evaluation of growth pockets and evolving clinical preferences within the HSCT landscape, delineated by Type, Source, Application, and End-User. The Autologous segment, where the patient serves as their own donor, currently holds the largest volume share, primarily driven by its widespread use in standard-of-care protocols for high-incidence cancers like Multiple Myeloma and certain lymphomas, minimizing the associated immunological risks. The Allogeneic segment, involving donor cells, while inherently riskier, is witnessing a higher growth rate due to continuous advancements in techniques like haploidentical transplantation and T-cell depletion strategies aimed at mitigating Graft-versus-Host Disease (GVHD), thereby expanding its critical role in curative treatment for leukemias and genetic disorders where self-cells are inadequate.

Segmentation by Source reveals a strong preference shift toward Peripheral Blood Stem Cells (PBSC) over Bone Marrow (BM), largely because PBSC collection via apheresis is less invasive for the donor and typically yields a higher quantity of stem cells, often leading to faster engraftment times. However, Bone Marrow remains critical, particularly in pediatric transplants and for specific immune disorders where a less activated cell product is preferred. Umbilical Cord Blood (UCB), despite being limited in cell dose, offers immediate availability and lower HLA matching stringency, making it an indispensable resource for urgent cases and patients from ethnic minorities where matched unrelated donors are scarce, thus supporting the need for continued investment in public cord blood banking infrastructure globally.

The Application spectrum demonstrates the market’s core strength in treating malignant hematological conditions, with Leukemia (AML and ALL) being the largest segment demanding allogeneic transplants, while Multiple Myeloma heavily drives autologous procedures. Non-malignant indications, including severe autoimmune disorders like systemic sclerosis, and genetic diseases like Sickle Cell Anemia and Severe Combined Immunodeficiency (SCID), represent high-potential growth segments. The End-User segmentation confirms that specialized Hospitals and Academic Centers are the dominant consumers, requiring vast capital expenditure for sophisticated infrastructure and highly trained multidisciplinary staff, while the specialized nature of the procedure restricts significant market penetration by smaller ambulatory surgical centers, which typically focus on less intensive interventions.

- By Type:

- Autologous Stem Cells Transplantation (Utilized primarily for solid tumors and high-dose chemotherapy support for Myeloma/Lymphoma)

- Allogeneic Stem Cells Transplantation (Essential for leukemias, myelodysplastic syndromes, and most genetic/immune disorders)

- By Source:

- Bone Marrow (Used for specific patient cohorts, especially pediatrics and aplastic anemia)

- Peripheral Blood Stem Cells (PBSC) (Preferred source due to higher yield and rapid engraftment kinetics)

- Umbilical Cord Blood (UCB) (Crucial for immediate need and minority populations due to lower HLA matching requirements)

- By Application:

- Leukemia (e.g., Acute Myeloid Leukemia (AML), Acute Lymphoblastic Leukemia (ALL), Chronic Myeloid Leukemia (CML))

- Lymphoma (e.g., Hodgkin's, Non-Hodgkin's Lymphoma)

- Multiple Myeloma (High-volume indication for autologous procedures)

- Myelodysplastic Syndromes (MDS)

- Other Malignant Disorders (e.g., Neuroblastoma, Germ Cell Tumors)

- Non-Malignant Disorders (e.g., Aplastic Anemia, Thalassemia, Primary Immunodeficiencies, Autoimmune Diseases)

- By End-User:

- Hospitals (Tertiary care centers and university hospitals possessing comprehensive infrastructure)

- Ambulatory Surgical Centers (Limited use, primarily for initial collection procedures or simpler, post-transplant follow-up)

- Specialty Clinics and Cancer Centers (Dedicated, specialized facilities focused on cellular therapy delivery and management)

Value Chain Analysis For Hematopoietic Stem Cells Transplantation Market

The HSCT value chain commences with critical upstream activities centered on donor management and cell acquisition, a process governed by stringent quality and regulatory standards. This phase involves extensive operations carried out by donor registries (both public like NMDP/Be The Match and private cord blood banks) which manage recruitment, screening, high-resolution HLA typing using NGS platforms, and logistical coordination for timely cell collection. Diagnostic service providers are paramount here, ensuring the immunological fitness and safety of the donor material. Collection itself utilizes specialized apheresis equipment or bone marrow harvest kits. Efficiency in this upstream segment dictates the viability and availability of the therapeutic material, making specialized transportation logistics—maintaining strict temperature and time constraints (cold chain)—a crucial element of the initial value proposition.

Midstream activities focus on the complex manufacturing and manipulation of the cellular product. This occurs in highly regulated GMP-compliant cell processing facilities, often integrated within or closely affiliated with the transplant center. Key activities include volume reduction, cryopreservation using controlled-rate freezers and DMSO, and specific cellular manipulation techniques such as T-cell depletion (required for haploidentical transplants) or CD34+ cell selection, often utilizing immunomagnetic beads and automated systems. Suppliers of these high-value reagents, consumables, and automated processing instrumentation (e.g., cell separators, cryopreservation bags) capture significant market revenue during this critical transformation step, ensuring the product meets the physician’s prescription and adheres to international guidelines (e.g., FACT-JACIE standards).

Downstream activities predominantly involve the end-user (the hospital) executing the conditioning regimen, administering the prepared cellular product (the infusion), and managing the critical post-transplant recovery phase. This stage relies heavily on the provision of supportive care products, including expensive, high-purity immunosuppressive drugs, anti-infectives, growth factors (G-CSF), and specialized nutritional support, often procured through direct institutional pharmacy channels. The final stage involves long-term follow-up and monitoring for relapse or late complications, supported by specialized diagnostic testing for chimerism and minimal residual disease (MRD). Direct distribution channels dominate the delivery of processed cells and specialized equipment, whereas ancillary pharmaceuticals may utilize traditional distribution networks, but always with specialized oversight due to the high-risk nature of the patient population and the critical timing requirements of the therapy.

Hematopoietic Stem Cells Transplantation Market Potential Customers

The primary customer base for the Hematopoietic Stem Cells Transplantation market consists of major healthcare entities possessing the requisite infrastructure and clinical specialization to perform these life-saving procedures. This includes large academic teaching hospitals, government-funded national health service centers (e.g., NHS centers in the UK), and private specialized cancer treatment institutes designated as Centers of Excellence for bone marrow transplantation. These institutions are substantial buyers, not only of the stem cell products themselves (from registries/banks) but also of the capital equipment required for apheresis and cell processing, the high-dose chemotherapy/radiation agents used for conditioning, and the extensive inventory of specialized supportive care pharmaceuticals and blood products essential for managing the peri-transplant period. Procurement decisions are highly centralized, driven by clinical efficacy data, total cost of ownership (TCO) of equipment, and adherence to stringent quality accreditation bodies like FACT (Foundation for the Accreditation of Cellular Therapy).

A secondary, yet rapidly expanding, customer segment includes standalone, specialized biobanks and cellular therapy contract manufacturing organizations (CMOs). Private cord blood banks, for example, are essential consumers of high-capacity cryo-storage solutions, validated processing kits, and robust inventory management software, servicing consumer demand for private familial storage. CMOs, increasingly utilized by smaller biotech firms and research institutions, purchase specialized reagents and sophisticated automated processing platforms to scale up novel cell manipulation techniques (e.g., gene-editing) for clinical trials, thereby serving as a crucial proxy customer driving the adoption of next-generation manufacturing technology within the sector. These customers prioritize scalability, regulatory compliance (cGMP), and technical expertise in handling sensitive biological materials, making them highly selective in their vendor partnerships.

Furthermore, global and national donor registries, such as the NMDP (Be The Match) or specific national registries, are significant end-users of advanced molecular diagnostics, specifically high-resolution HLA typing services utilizing Next-Generation Sequencing (NGS) technology. Their procurement is focused on achieving maximum accuracy and throughput for donor screening and inventory maintenance. Additionally, governmental public health agencies and non-profit organizations that fund or subsidize transplantation access, particularly in developing nations, represent influential buyers who shape the demand for cost-effective generic supportive drugs and standardized, essential equipment. These diverse customer profiles underscore the market’s complexity, driven by both clinical necessity and underlying regulatory and public health mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Lonza Group, Miltenyi Biotec, Sanofi, General Electric Healthcare (GE HealthCare), Fresenius Kabi, STEMCELL Technologies, Cryo-Cell International, Americord Registry, Bristol-Myers Squibb (BMS), Takeda Pharmaceutical Company, PerkinElmer, Bio-Rad Laboratories, Merck KGaA, ViaCord, Promega Corporation, Gilead Sciences, AbbVie, Novartis AG, Be The Match (NMDP). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hematopoietic Stem Cells Transplantation Market Key Technology Landscape

The technological core of the HSCT market resides in highly specialized platforms designed for precise cellular manipulation and quality assurance. Immunomagnetic cell separation systems, exemplified by devices utilizing magnetic beads coated with specific antibodies (e.g., CD34 selection or T-cell depletion), are indispensable. These technologies ensure the purity and composition of the final cellular product, which is vital for minimizing post-transplant risks such as relapse (if tumor cells remain) or GVHD (if T-cells are not adequately depleted). Automation of these processes, moving away from manual centrifugation and washing, not only reduces human error and contamination risk but also enhances throughput, meeting the growing procedural demand in high-volume transplant centers globally while rigorously adhering to strict GMP standards required for advanced therapeutics.

Molecular diagnostics represent another crucial technological area. The transition from low-resolution serological HLA typing to high-resolution Next-Generation Sequencing (NGS) has dramatically improved the precision of donor-recipient matching. NGS provides detailed allele-level information, minimizing the chances of immunological mismatch, which is directly correlated with reduced incidence of severe GVHD and better overall survival. Beyond initial screening, molecular technologies, including digital droplet PCR (ddPCR) and sophisticated flow cytometry, are employed post-transplant for monitoring Minimal Residual Disease (MRD) in malignancy patients and tracking donor chimerism—the proportion of donor cells present in the recipient. Early, sensitive detection of rising MRD or failing donor chimerism allows for prompt, pre-emptive therapeutic intervention, significantly impacting long-term patient outcomes and solidifying the reliance on high-fidelity diagnostic platforms.

The cryopreservation and biobanking infrastructure also drives technological advancement. Maintaining the viability and potency of collected stem cells over extended periods—essential for cord blood banking and autologous cryopreservation—demands sophisticated technology. This includes controlled-rate freezers that manage the cooling kinetics precisely to prevent ice crystal formation, validated cryoprotectants (like pharmaceutical-grade DMSO), and ultra-low temperature storage units (liquid nitrogen tanks). Innovation here focuses on reducing toxicity (e.g., new cryoprotectant formulations), improving storage efficiency, and integrating comprehensive, secure, cloud-based tracking systems to manage inventory and ensure the integrity of the cellular material throughout its storage and logistics lifespan. The reliability of this technology is central to supporting global donor exchange and the clinical feasibility of delayed infusions, reinforcing the need for continuous quality improvement in biobanking practices worldwide.

Regional Highlights

- North America: Leads the global HSCT market due to the highest number of accredited transplant centers, substantial research funding from both government bodies (e.g., NIH) and private ventures, and highly favorable and complex reimbursement structures (Medicare/private insurers) that cover the high costs of both allogeneic and autologous procedures. The region is a primary innovation hub for cellular therapy integration, including the development of advanced conditioning and supportive care drugs.

- Europe: Holds the second-largest market share, characterized by high procedural density in Western European nations (e.g., Germany, Italy, France) supported by robust public healthcare systems. The market benefits significantly from well-organized, national, and supra-national bone marrow and cord blood donor registries (e.g., WMDA members), emphasizing harmonization of clinical standards through organizations like JACIE (Joint Accreditation Committee ISCT-Europe and EBMT).

- Asia Pacific (APAC): Recognized as the fastest-growing market globally, fueled by significant population growth, a rising middle class demanding better healthcare outcomes, and increasing governmental investment in specialized oncology infrastructure. Key markets like China and Japan are focusing on establishing large national donor registries and adopting Western clinical protocols and advanced processing technology to address the region’s massive patient base afflicted by hematological diseases.

- Latin America: Exhibits moderate growth, often driven by large economies like Brazil and Mexico, where centralized public institutions manage significant transplant volumes. The market faces challenges related to inconsistent funding, limited access to international donor pools, and variable regulatory environments, often leading to a higher dependence on cost-effective autologous procedures and reliance on governmental subsidies for complex allogeneic cases.

- Middle East and Africa (MEA): A nascent, high-potential market segment with concentration of advanced centers in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), which are investing heavily in medical tourism and world-class hospital infrastructure. The rest of the African continent faces severe infrastructural and resource constraints, necessitating reliance on international partnerships for capacity building and donor material access, often limiting procedures to essential autologous transplants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hematopoietic Stem Cells Transplantation Market.- Thermo Fisher Scientific (Provides cell processing instrumentation and molecular diagnostics)

- Lonza Group (Leading provider of specialized media and cell therapy manufacturing services)

- Miltenyi Biotec (Dominant player in automated immunomagnetic cell separation technology)

- Sanofi (Involved in supportive care and hematology drug development)

- General Electric Healthcare (GE HealthCare) (Offers diagnostic imaging and cell processing tools)

- Fresenius Kabi (Supplies blood management and supportive care products)

- STEMCELL Technologies (Provider of specialized cell culture media and reagents)

- Cryo-Cell International (Leading private cord blood banking service)

- Americord Registry (Private cord blood and tissue banking services)

- Bristol-Myers Squibb (BMS) (Focus on oncology and immunotherapy, often linked to HSCT protocols)

- Takeda Pharmaceutical Company (Oncology portfolio includes drugs used in HSCT conditioning)

- PerkinElmer (Offers diagnostic platforms and genetic screening services)

- Bio-Rad Laboratories (Provides diagnostic and life science research tools)

- Merck KGaA (Supplies critical reagents and life science services)

- ViaCord (Major player in private cord blood banking)

- Promega Corporation (Supplies molecular biology reagents used in cell processing QC)

- Gilead Sciences (Has strong focus on cellular therapy and related oncology treatments)

- AbbVie (Pharmaceutical company with products relevant to post-transplant care)

- Novartis AG (Pioneers in cell and gene therapy, closely related to HSCT infrastructure)

- Be The Match (NMDP) (Critical non-profit global registry for donor recruitment and matching services)

Frequently Asked Questions

Analyze common user questions about the Hematopoietic Stem Cells Transplantation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the HSCT market between 2026 and 2033?

The Hematopoietic Stem Cells Transplantation market is projected to exhibit robust growth, achieving a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033, driven primarily by increasing disease incidence and clinical adoption of novel transplantation techniques like haploidentical HSCT.

Which type of hematopoietic stem cell transplantation holds the largest current market volume and why?

The Autologous Stem Cell Transplantation segment currently accounts for the largest procedural volume and market share. This dominance is due to its standard use in treating high-incidence hematological malignancies, particularly Multiple Myeloma and Lymphoma, as it bypasses the immunological risks associated with donor-derived allogeneic cells.

What is the most significant technological factor currently driving growth in the allogeneic HSCT segment?

The most significant technological driver is the successful implementation of haploidentical transplantation protocols. This technique allows partially matched family members to serve as donors, critically expanding the available donor pool and increasing access to life-saving allogeneic procedures for patients lacking a fully matched unrelated donor.

How is AI specifically being utilized to improve donor-recipient matching accuracy?

AI and machine learning algorithms are utilized to analyze complex high-resolution Next-Generation Sequencing (NGS) data for Human Leukocyte Antigen (HLA) typing. AI models integrate multiple genetic and non-genetic factors to predict immunological compatibility with greater accuracy, significantly reducing the likelihood of post-transplant complications like severe Graft-versus-Host Disease (GVHD).

Which geographical region is anticipated to demonstrate the highest growth potential (fastest CAGR) over the forecast period?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest Compound Annual Growth Rate over the forecast period. This accelerated growth is attributed to massive investments in healthcare infrastructure, rapidly expanding donor registries, and the increasing patient population requiring definitive treatments for hematological malignancies in large economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager