Hemodialysis Membrane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443378 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hemodialysis Membrane Market Size

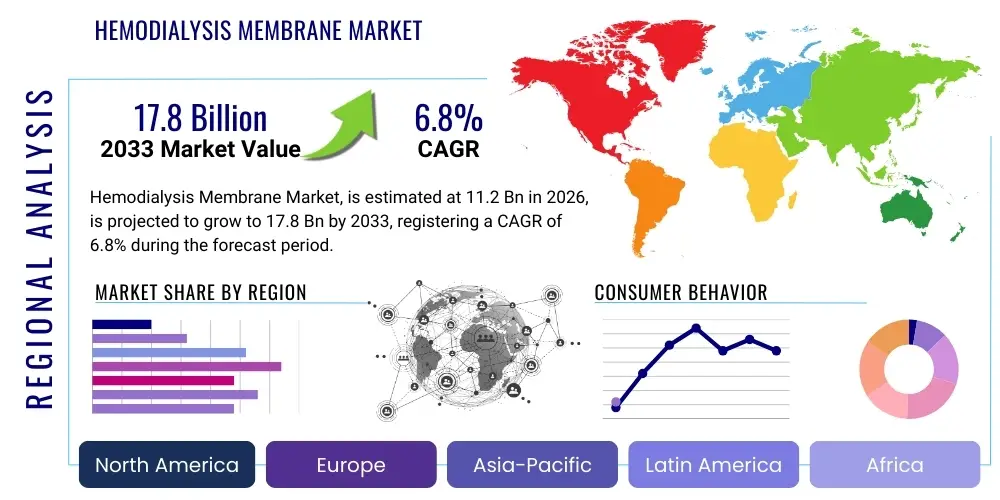

The Hemodialysis Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.2 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Hemodialysis Membrane Market introduction

The Hemodialysis Membrane Market encompasses the global trade and utilization of semi-permeable membranes integral to the hemodialysis process, essential for treating End-Stage Renal Disease (ESRD). These specialized membranes, often referred to as dialyzers, function as artificial kidneys, facilitating the removal of uremic toxins, waste products, and excess fluid from the patient's blood, while maintaining electrolyte balance. The primary materials utilized in these membranes include synthetic polymers like Polysulfone (PS), Polyethersulfone (PES), and Polymethylmethacrylate (PMMA), alongside modified cellulosic materials, each selected based on desired biocompatibility, permeability, and sieving coefficients. Technological evolution focuses intensely on enhancing flux rates—categorized generally into low-flux and high-flux membranes—and improving hemocompatibility to minimize adverse immune reactions during long-term treatment.

Product descriptions within this market center on hollow-fiber technology, where thousands of miniature capillaries, or fibers, are bundled inside a plastic casing. Blood flows through the lumen of these fibers, while dialysis fluid (dialysate) flows counter-currently around the outside. The membrane serves as the barrier across which ultrafiltration and diffusion occur. Major applications are predominantly directed towards chronic hemodialysis for patients suffering from permanent kidney failure, requiring treatment sessions multiple times per week, often spanning several hours. The benefits derived from utilizing high-quality membranes include better clearance of middle molecules (such as beta-2 microglobulin), reduced inflammatory response, and improved patient outcomes related to cardiovascular stability and long-term morbidity reduction.

Driving factors for sustained market growth are strongly linked to the escalating global prevalence of chronic kidney disease (CKD), driven by increasing rates of diabetes and hypertension, which are the leading causes of ESRD. Furthermore, continuous technological advancements focused on developing novel biocompatible materials with enhanced filtration efficiency, coupled with expanding governmental and private healthcare infrastructure investments globally, particularly in emerging economies, significantly propel market expansion. The growing geriatric population, which is inherently more susceptible to kidney impairment, further contributes substantially to the increasing demand for effective and reliable hemodialysis membranes.

Hemodialysis Membrane Market Executive Summary

The Hemodialysis Membrane Market demonstrates robust business trends characterized by intense competition among established global leaders focusing on portfolio diversification, especially toward high-flux membranes and innovative synthetic polymers offering superior performance. Strategic collaborations, mergers, and acquisitions are common methods for expanding geographical reach and integrating new membrane technologies, particularly those compatible with high-efficiency dialysis machines. Key business objectives across the industry involve scaling production to meet rising chronic patient demand while investing heavily in clinical trials to validate enhanced biocompatibility claims and long-term patient survival benefits associated with newer membrane types. Manufacturers are increasingly adopting sustainable manufacturing practices to reduce environmental impact while maintaining stringent quality standards mandated by global regulatory bodies such as the FDA and EMA.

Regional trends indicate that North America and Europe currently represent the most substantial revenue bases due to well-established healthcare systems, high treatment uptake rates, and widespread adoption of premium, high-flux membranes. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rates (CAGR) due to rapid infrastructure development, surging CKD prevalence stemming from lifestyle diseases, and increasing governmental support for renal care programs in populous nations like China and India. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, driven by increasing awareness and improving access to dialysis treatment, though challenges related to reimbursement policies and logistical complexities persist, particularly in rural areas.

Segment trends highlight the dominance of synthetic polymers, particularly Polysulfone/Polyethersulfone (PS/PES), over cellulosic membranes due to their superior filtration characteristics, hemocompatibility, and ability to handle middle molecule clearance effectively. The high-flux membrane segment is experiencing faster growth than the low-flux segment, reflecting clinical consensus favoring enhanced clearance efficiency to improve patient morbidity and mortality outcomes, addressing complications such as dialysis-related amyloidosis. End-user trends show significant sustained demand from specialized dialysis centers and hospitals, but there is an accelerating trend toward home dialysis settings, driven by portable machine technology, which necessitates smaller, high-performance membrane cartridges designed for user-friendliness and reliable operation outside clinical environments.

AI Impact Analysis on Hemodialysis Membrane Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hemodialysis Membrane Market predominantly focus on its potential to optimize membrane manufacturing processes, enhance personalized dialysis treatment protocols, and improve predictive maintenance for dialysis systems. Key themes revolve around leveraging machine learning algorithms to analyze patient physiological data in real-time to adjust ultrafiltration rates and dialysate composition dynamically, thus minimizing complications like hypotension and fluid imbalance. Users also express interest in how AI can accelerate the development of next-generation membrane materials by simulating molecular interactions and predicting biocompatibility and long-term performance characteristics before costly physical prototyping. A significant concern is the ethical implementation and data privacy implications associated with collecting and processing vast amounts of sensitive patient data generated during AI-driven dialysis sessions, alongside the integration challenges within legacy dialysis infrastructure globally.

- AI accelerates new membrane material R&D by simulating molecular structures and predicting filtration performance and biocompatibility.

- Machine Learning (ML) optimizes manufacturing yield and quality control by identifying microscopic defects in hollow fibers during high-speed production.

- Predictive algorithms analyze patient physiological responses to specific membrane types, aiding clinicians in personalized dialyzer selection for improved therapeutic efficacy.

- AI systems monitor dialysis session data (blood pressure, temperature, solute removal) in real-time, enabling automated, instantaneous adjustment of parameters to prevent adverse events.

- Integration of AI-driven diagnostics enhances early detection of clotting or fouling within the dialyzer, maximizing membrane life and treatment safety.

- Improved supply chain forecasting and inventory management of membrane cartridges using AI models based on regional ESRD prevalence and consumption patterns.

DRO & Impact Forces Of Hemodialysis Membrane Market

The dynamics of the Hemodialysis Membrane Market are shaped by a complex interplay of internal and external forces, which collectively define the growth trajectory and competitive intensity. The primary driving force is the global health crisis posed by End-Stage Renal Disease (ESRD), a condition demanding mandatory, life-sustaining treatment via dialysis, ensuring continuous, non-discretionary market demand. This demand is further amplified by technological innovation, where manufacturers continually introduce high-flux, biocompatible membranes designed to enhance patient outcomes by efficiently clearing uremic toxins. Restraints, however, include the substantial capital investment required for high-tech manufacturing and the inherent complexity of navigating diverse and rigorous regulatory landscapes across different geographical markets. Opportunities lie in penetrating high-growth emerging markets and developing specialized, portable dialyzers compatible with the burgeoning trend of home hemodialysis, which promises greater patient autonomy and reduced healthcare costs.

Key impact forces affecting market trajectory involve political regulatory shifts, specifically the stringent requirements for medical device approval, which dictate the speed and cost of new product introduction. Economically, healthcare reimbursement policies significantly influence the adoption rate of premium high-flux membranes, particularly in resource-constrained settings where cost-effectiveness dictates purchasing decisions. Socially, rising public awareness regarding CKD and the necessity of early intervention and quality dialysis positively influences market adoption. Technologically, advancements in polymer science and nanotechnology are paramount, allowing for the creation of membranes with tailored pore sizes and surface chemistries that minimize inflammatory response and maximize solute clearance efficiency, providing a constant cycle of incremental and disruptive improvements in product offerings.

The market faces inherent challenges related to the finite lifespan of current dialysis technologies and the ongoing need to address the inflammatory and oxidative stress associated with long-term blood-membrane interactions. While opportunities exist in developing highly customized membranes for specific patient subpopulations, the restraint imposed by manufacturing complexity and the high associated costs of personalized medical devices often slows broad commercialization. Successfully navigating these forces requires manufacturers to prioritize research into safer, more efficient materials while engaging in robust dialogue with regulatory bodies to streamline approval processes for products proven to offer significant clinical advantages to the growing global population dependent on chronic renal replacement therapy.

Segmentation Analysis

The Hemodialysis Membrane Market is structurally segmented based on crucial attributes including the material used for the membrane, the flux type determining filtration efficiency, the application environment, and the specific end-user settings where the dialysis procedures are performed. This comprehensive segmentation is critical for manufacturers to tailor their production, marketing strategies, and product development pipeline to specific clinical needs and regional demands. Synthetic membranes, particularly PS/PES, dominate the market due to their excellent biocompatibility and high-performance metrics compared to traditional cellulosic alternatives. Furthermore, the segmentation by flux type distinctly illustrates the shift toward high-flux membranes, reflecting clinical guidelines emphasizing superior clearance of medium-sized toxins, enhancing treatment efficacy and reducing patient morbidity risks associated with sub-optimal toxin clearance over extended periods of chronic treatment.

- By Material:

- Cellulose Triacetate (CTA)

- Polysulfone/Polyethersulfone (PS/PES)

- Polymethylmethacrylate (PMMA)

- Polypropylene

- Polyamide (PA)

- Others (e.g., Polyacrylonitrile (PAN), Ethylene Vinyl Alcohol (EVAL))

- By Flux Type:

- Low-Flux Membranes

- High-Flux Membranes

- High-Cutoff Membranes (Emerging)

- By Application:

- Acute Hemodialysis (requiring temporary, intensive treatment)

- Chronic Hemodialysis (long-term maintenance therapy for ESRD)

- By End-User:

- Hospitals (Tertiary Care and General Hospitals)

- Dialysis Centers and Clinics (Freestanding and Chain-Affiliated)

- Home Dialysis Settings (Increasing growth segment)

Value Chain Analysis For Hemodialysis Membrane Market

The value chain for the Hemodialysis Membrane Market begins with critical upstream activities centered on the procurement and synthesis of highly specialized polymer raw materials, primarily medical-grade Polysulfone, Polyethersulfone, or proprietary modified cellulosic polymers. Key upstream suppliers include major chemical and polymer manufacturers specializing in high-purity, biocompatible materials required for medical device manufacturing. Quality control and material science research at this stage are paramount, as the inherent characteristics of the base polymer directly determine the final membrane's porosity, filtration efficiency, and critical biocompatibility profile. Manufacturing involves highly technical, continuous fiber spinning and bundling processes under sterile conditions, requiring significant capital investment in precision machinery and cleanroom technology to ensure uniformity and minimize contamination risks, which constitutes the most specialized and value-adding step in the chain.

Downstream analysis focuses heavily on efficient distribution and the final consumption of the dialyzers. Once manufactured and sterilized, the dialyzers are packaged and distributed primarily through two distinct channels: direct sales and indirect distribution networks. Direct channels involve large manufacturers selling directly to major hospital chains or their own network of affiliated dialysis clinics, allowing for better price control and direct relationship management. Indirect channels rely on specialized medical device distributors and wholesalers who manage regional logistics, inventory, and sales to smaller independent dialysis centers, ensuring broad market reach, particularly in geographically diverse or complex regions. The efficiency of this downstream logistics is crucial, as dialyzers are consumable medical supplies required constantly.

The distribution channel landscape is dominated by indirect sales facilitated by regional medical supply companies, particularly for smaller purchasers, while leading integrated dialysis providers often leverage vertically integrated supply chains. The direct channel offers better margin control for manufacturers and deeper engagement with key accounts, facilitating training and after-sales support related to optimal dialyzer usage. Final customers (hospitals and dialysis centers) prioritize reliable supply, consistent product quality, and competitive pricing, often entering into long-term supply contracts. Effective management of the distribution logistics, ensuring sterility and timely delivery, is a key determinant of competitive success and efficiency within the latter half of the membrane value chain.

Hemodialysis Membrane Market Potential Customers

The core customer base for the Hemodialysis Membrane Market consists of institutional healthcare providers specializing in renal care, as hemodialysis treatment necessitates sophisticated equipment and medical supervision. The largest purchasers are dedicated Dialysis Centers and Clinics, both independent facilities and large national or international chains (e.g., Fresenius Kidney Care, DaVita). These centers represent the primary end-users due to the high volume of chronic ESRD patients they manage, requiring bulk purchases of dialyzers daily. These buyers prioritize product consistency, cost-effectiveness through high-volume contracts, and clinical evidence demonstrating the superior safety and efficacy of the membranes in minimizing long-term patient complications.

Hospitals, particularly those with critical care units (CCUs) and Intensive Care Units (ICUs), constitute another vital customer segment. Hospitals typically require membranes for acute kidney injury (AKI) patients, often necessitating specialized high-cut-off or continuous renal replacement therapy (CRRT) membranes, which differ slightly from standard chronic hemodialysis membranes. While the volume per hospital may be lower than a dedicated dialysis center, the demand for high-specification, specialized membranes for critically ill patients is constant. Purchasing decisions in hospitals are driven by clinical need, quality accreditation, compatibility with existing dialysis machines, and rapid availability from established suppliers.

An increasingly significant potential customer segment is patients or caregivers engaged in Home Dialysis Settings. This segment, although currently smaller in total volume compared to institutional settings, is experiencing rapid growth due to technological advances in portable dialysis machines and increased patient preference for flexible treatment schedules. These customers often purchase specialized, smaller, user-friendly dialyzer cartridges, either directly or through specialized home healthcare providers. The decision factors here include ease of use, safety features suitable for non-clinical environments, and integration with automated home dialysis equipment, signifying a shift toward convenience and autonomy alongside clinical performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.2 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fresenius Medical Care, Baxter International, B. Braun Melsungen, Nipro Corporation, Asahi Kasei Corporation, Toray Industries, Medica S.p.A, Marcor (part of Nikkiso), Kawasumi Laboratories, JMS Co. Ltd., Shandong Weigao Group Medical Polymer, Gambro (now part of Baxter), NxStage Medical (now part of Fresenius), Minntech (now part of Cantel Medical), Livanova PLC, DaVita Inc. (as a major consumer), GE Healthcare, Terumo Corporation, Dialife SA, Medtronic PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hemodialysis Membrane Market Key Technology Landscape

The technology landscape of the Hemodialysis Membrane Market is primarily defined by advanced polymer science and sophisticated membrane fabrication techniques, moving progressively away from traditional cellulosic materials toward high-performance synthetic polymers. The foundational technology remains the hollow-fiber dialyzer design, but innovations are focused on optimizing the pore structure and surface chemistry of these fibers. Key advancements include the development of membranes using Polysulfone (PS) and Polyethersulfone (PES), often blended or surface-modified, which offer superior hemocompatibility, reducing the activation of immune responses and inflammation often seen in long-term dialysis patients. This shift ensures more efficient removal of high molecular weight uremic toxins, such as beta-2 microglobulin, a crucial factor in preventing dialysis-related amyloidosis and improving long-term quality of life for ESRD patients.

Furthermore, an increasingly relevant technological trend is the development and commercialization of High-Cutoff (HCO) membranes and Medium Cut-off (MCO) membranes. These next-generation membranes are designed with pore sizes slightly larger than standard high-flux membranes, enabling enhanced clearance of larger molecules (middle molecules) while crucially retaining essential blood components like albumin. This balancing act, achieved through precise control over the polymer spinning process and subsequent post-treatment, represents a significant technical challenge and market differentiator. The development of MCO membranes, specifically, aims to bridge the performance gap between traditional high-flux dialysis and hemodiafiltration (HDF), offering near-HDF performance using standard hemodialysis equipment, thereby expanding access to enhanced clearance therapy globally without major infrastructure overhauls.

Another crucial technological area involves surface modification techniques and sterilization methods. Manufacturers are employing nanotechnological approaches to coat or graft anti-thrombogenic materials onto the membrane surface, minimizing blood clotting and reducing the required dosage of anticoagulants during treatment, thereby enhancing patient safety. Simultaneously, there is a technical shift away from older sterilization methods like Ethylene Oxide (EtO), which can leave residues, towards Gamma irradiation or Steam sterilization, particularly for synthetic membranes, to ensure maximum biocompatibility and minimize residual chemical contamination. Ongoing research also explores fully novel membrane materials and module geometries designed to enhance ultrafiltration rates under lower pressure differentials, optimizing performance for compact, portable hemodialysis systems designed for the rapidly expanding home dialysis market segment.

Regional Highlights

- North America: Dominates the market value share, driven by a high prevalence of ESRD, advanced healthcare infrastructure, high awareness, and rapid adoption of high-flux and novel membrane technologies. The U.S. market benefits significantly from robust reimbursement policies and the presence of major global dialysis providers, ensuring consistent demand for premium synthetic membranes and technologies supporting home dialysis initiatives.

- Europe: Represents a mature and substantial market characterized by high standards of renal care and stringent regulatory compliance (e.g., MDR). Western European countries exhibit high per capita utilization of dialysis treatments, focusing particularly on high-efficiency treatments like hemodiafiltration, which often requires high-performance membranes. Germany, France, and Italy are key contributors, driven by stable healthcare budgets and aging populations.

- Asia Pacific (APAC): Expected to register the highest growth rate during the forecast period. This accelerated expansion is attributed to the rapidly increasing incidence of diabetes and hypertension leading to ESRD in populous nations (China, India), coupled with significant governmental efforts to improve dialysis access and infrastructure development. Market penetration for advanced synthetic membranes is rising, though cost-sensitivity remains a primary factor influencing purchasing decisions.

- Latin America (LATAM): A growing market, though penetration rates vary significantly across countries. Brazil and Mexico are the primary revenue contributors, characterized by increasing private healthcare investment and rising middle-class access to advanced treatment options. Market growth is dependent on improving governmental procurement efficiency and managing economic volatility affecting medical device imports.

- Middle East and Africa (MEA): A nascent market segment with significant long-term potential, particularly in wealthy GCC nations where specialized healthcare services are rapidly expanding. Growth across the broader region is highly uneven, constrained by varying levels of healthcare spending and logistical challenges, yet the increasing prevalence of diabetes presents a substantial, untapped demand for basic and advanced hemodialysis membranes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hemodialysis Membrane Market.- Fresenius Medical Care

- Baxter International Inc.

- B. Braun Melsungen AG

- Nipro Corporation

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Medica S.p.A

- Marcor Biomedical Inc. (Nikkiso Group)

- Kawasumi Laboratories, Inc.

- JMS Co. Ltd.

- Shandong Weigao Group Medical Polymer Co., Ltd.

- Gambro AB (now part of Baxter)

- NxStage Medical, Inc. (now part of Fresenius)

- Minntech Corporation (now part of Cantel Medical)

- Livanova PLC

- Dialife SA

- Terumo Corporation

- Medtronic PLC

- GE Healthcare

- Haemotronic S.p.A.

Frequently Asked Questions

Analyze common user questions about the Hemodialysis Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is preferred for modern hemodialysis membranes and why?

Modern hemodialysis membranes predominantly utilize synthetic polymers, primarily Polysulfone (PS) and Polyethersulfone (PES). These materials offer superior biocompatibility, minimizing patient inflammation, and allow for precise pore size control necessary for high-flux efficiency, enabling better clearance of medium molecular weight uremic toxins compared to older cellulosic membranes.

How do high-flux membranes differ from low-flux membranes in clinical practice?

High-flux membranes are characterized by larger pore sizes and higher hydraulic permeability, facilitating increased removal of fluid and middle molecules (toxins >500 Daltons) primarily via convection (ultrafiltration). Low-flux membranes rely mostly on diffusion and are less efficient at clearing larger toxins, leading to high-flux being increasingly favored for improved patient outcomes.

What is driving the growing demand for the home dialysis segment?

The growth in the home dialysis segment is driven by advances in portable dialysis machine technology, patient preference for increased treatment flexibility and autonomy, and clinical evidence suggesting potential improvement in patient quality of life and reduced hospitalization rates. This segment necessitates specialized, reliable, high-performance membrane cartridges.

Which geographical region is expected to exhibit the fastest market growth?

The Asia Pacific (APAC) region is forecasted to experience the highest Compound Annual Growth Rate (CAGR). This acceleration is due to the rapidly rising prevalence of End-Stage Renal Disease (ESRD) caused by widespread chronic diseases (diabetes, hypertension) and extensive investments in healthcare infrastructure and improved access to dialysis services across countries like China and India.

What role does AI play in the future development of hemodialysis membranes?

AI is crucial in the future development cycle, mainly by employing machine learning algorithms to simulate and predict the performance and biocompatibility of novel polymer formulations. This accelerates the R&D process, allowing manufacturers to optimize membrane pore structure and surface chemistry for enhanced filtration efficiency and minimized inflammatory response before physical production.

The detailed analysis confirms that the Hemodialysis Membrane Market is structurally complex, dominated by synthetic polymer technology, and is undergoing a significant transition toward high-efficiency treatments and decentralized care models. The convergence of persistent global ESRD incidence and continuous technological refinement ensures stable, high-value growth, particularly within regions demonstrating aggressive healthcare infrastructure expansion and adaptation to advanced renal replacement therapies. Regulatory compliance and strategic management of manufacturing complexity remain core challenges, while leveraging AI and nanotechnologies represents the primary avenue for future competitive differentiation and clinical breakthroughs in membrane performance.

Manufacturers are heavily focused on developing membranes that offer optimized clearances for both small and middle molecules while enhancing long-term hemocompatibility, a critical factor for chronic patients. Strategic market positioning is increasingly reliant not just on the performance of the dialyzer itself, but also on seamless integration into comprehensive dialysis systems, including compatibility with advanced monitoring and fluid management solutions. The investment thesis in this sector remains strong, underpinned by mandatory demand and the inelastic nature of renal replacement therapy needs globally. The shift towards higher-performing high-flux and medium cut-off membranes is irreversible, driven by clinical studies linking superior clearance to improved morbidity and mortality rates for the ESRD population worldwide, compelling dialysis centers globally to upgrade their consumables portfolio and adopt the latest technological standards to meet elevated standards of patient care.

The financial viability of new membrane technologies is often linked to governmental and private insurance reimbursement decisions, especially in markets where treatment costs are under intense scrutiny. This economic force dictates that while technological advancement is necessary, cost-effectiveness remains a pivotal requirement for broad market adoption, particularly in developing economies. Furthermore, sustainability in manufacturing processes is becoming a material consideration for market leaders, reflecting broader global trends towards environmentally responsible medical device production. The intense competition among the top five global players drives continuous incremental improvements in efficiency and cost management, while smaller, specialized firms focus on niche areas, such as high-cut-off membranes for specific acute clinical needs or specialized dialyzers for pediatric applications, ensuring a dynamic and innovation-rich ecosystem. Ultimately, the market trajectory is determined by the ability of suppliers to consistently deliver safe, effective, and economically viable solutions to a patient population whose dependency on these devices is absolute and non-negotiable.

The long-term outlook for the Hemodialysis Membrane Market remains positive, bolstered by demographics that assure a growing patient pool and continuous innovation cycles mandated by clinical necessity. Key strategic imperatives for market participants include securing stable supply chains for raw polymers, optimizing automated manufacturing lines to scale production without compromising quality, and establishing strong clinical data to support the therapeutic advantages of novel membrane chemistries. The market is not merely reacting to existing demand but actively shaping future treatment paradigms through the integration of digital health and connectivity features into dialysis systems. This holistic approach, combining advanced membrane technology with smart, data-driven treatment delivery, promises to transform chronic renal care, driving global revenue expansion while elevating standards of care for millions of patients worldwide dependent on artificial kidney function.

Technological advancement is not solely confined to filtration efficiency; significant efforts are also dedicated to minimizing the overall size and footprint of the dialyzers, a crucial factor for their integration into portable and wearable artificial kidney concepts. This pursuit of miniaturization and enhanced energy efficiency is directly tied to the home dialysis revolution, where patient convenience and device simplicity are paramount. Success in this area requires breakthrough engineering in polymer fiber packing density and material strength. Moreover, regulatory harmonization, particularly concerning clinical data requirements for global market entry, is an ongoing challenge that large multinational firms actively seek to influence, aiming to reduce the lead time between product development and worldwide commercial availability. The market structure, defined by a few dominant players, maintains high barriers to entry due to intellectual property ownership, massive capital requirements for sterile manufacturing facilities, and the necessity of long-term clinical validation, reinforcing the competitive advantages held by established industry leaders.

The critical success factors in the evolving market environment include superior biocompatibility validated by minimal inflammatory markers, reliable long-term performance consistency across high-volume batches, and competitive cost structures enabling mass adoption across varying healthcare reimbursement tiers. The strategic expansion into emerging economies also necessitates product flexibility, offering a range of options from basic low-flux models to premium high-flux models, tailored to local economic realities and healthcare budgets. Ultimately, the performance of the hemodialysis membrane is the single most critical consumable component influencing the efficacy and safety of renal replacement therapy, ensuring that innovation in this sector will continue to attract significant research and development investment well beyond the current forecast horizon, maintaining its strategic importance within the broader medical device industry. The market continues to evolve in response to pressures from clinical specialists demanding better patient outcomes, economic payers demanding cost control, and patients demanding safer, more convenient treatment options, forcing a balance between cutting-edge technology and universal access to care.

The complexity of the manufacturing process involves stringent quality checks at every stage, from the initial polymer preparation to the final sterilization and packaging of the hollow fiber bundle. Defects at the micro-level, such as variations in pore size distribution or fiber breakage, can critically compromise the performance and safety of the dialyzer, necessitating sophisticated optical and sensor-based monitoring systems in modern production facilities. Furthermore, the material science research extends into developing membranes resistant to protein adsorption and fouling, which typically degrade filtration efficiency over the course of a single treatment session. By minimizing fouling, manufacturers aim to maximize the effective lifespan and consistent performance of the dialyzer, offering better value and consistent toxin clearance to the patient. This ongoing focus on surface chemistry and manufacturing precision is indicative of the highly technical nature of the competition within the Hemodialysis Membrane Market, ensuring continuous refinement of existing materials and the exploration of entirely new polymer composites designed specifically for optimized blood-membrane interaction.

The regulatory environment, particularly concerning classification and required testing protocols, varies significantly between major regulatory bodies (FDA, EMA, NMPA), adding layers of complexity to global market entry. Firms must conduct extensive pre-clinical and clinical trials to demonstrate not only safety but also equivalence or superiority in key performance indicators such as beta-2 microglobulin clearance compared to predicate devices. This regulatory burden acts as a natural restraint, slowing the introduction of truly novel technologies but ensuring a high standard of safety for essential life-support devices. The interaction between membrane manufacturers and dialysis service providers is synergistic; manufacturers rely on clinical feedback to refine product design, while service providers depend on high-quality, reliable membranes to deliver effective treatment, establishing a closely interconnected ecosystem where quality and innovation drive adoption.

Looking ahead, future growth is inextricably linked to successful clinical validation of high-performance membranes that can effectively emulate the natural kidney's function, particularly in managing fluid balance and middle molecule clearance without inducing systemic inflammatory responses. The integration of advanced diagnostics within the dialyzer circuit, allowing for real-time monitoring of clearance efficacy, represents a critical technological frontier. Ultimately, the market is poised for continued dominance by large, integrated renal care providers that control both the manufacturing of the membrane and the delivery of the dialysis service, leveraging vertical integration for cost efficiency and quality control across the entire patient care continuum, ensuring market stability and sustained investment in core product improvement.

The development of specialized membranes for Continuous Renal Replacement Therapy (CRRT), primarily used in acute care settings for critically ill patients with Acute Kidney Injury (AKI), also constitutes an important, high-value sub-segment. These CRRT membranes require materials optimized for prolonged, continuous operation and often feature tailored cutoff thresholds to manage inflammatory mediators and specific plasma components. Although lower in volume than chronic hemodialysis, the high per-unit cost and critical necessity of these products ensure high revenue streams and continuous technical innovation dedicated to managing complexity in the intensive care environment. The technical requirements for CRRT membranes focus heavily on sustained anti-coagulation and resistance to high-pressure gradients over 24-hour periods, demanding stringent material selection and engineering precision distinct from standard chronic hemodialysis dialyzers, diversifying the technological focus within the overall membrane market landscape.

Furthermore, the competitive strategy for manufacturers often involves bundling membrane products with dialysis machines and ancillary consumables (e.g., bloodlines, concentrates), leveraging volume discounts and integrated system performance guarantees to secure long-term contracts with major dialysis chains. This bundling strategy reinforces vendor loyalty and creates additional entry barriers for smaller competitors offering standalone membrane products. Successful navigation of this highly competitive landscape requires not only manufacturing excellence but also sophisticated commercial strategies, robust clinical support, and adept negotiation skills to secure dominance in bulk purchasing environments. The market is thus a battleground of technical superiority, operational efficiency, and commercial influence, all aimed at supplying the most critical component of millions of life-sustaining treatments globally, ensuring sustained growth commensurate with the rising global burden of renal disease.

The final element securing the market’s growth is the necessity of replacing dialyzers for every single treatment session, establishing a fundamentally repetitive consumption cycle that is insensitive to economic fluctuations once a patient is enrolled in chronic dialysis therapy. This reliable, non-discretionary demand underpins the stable revenue generation model for all major market players. As healthcare systems globally continue to mature and treatment access expands, particularly in large developing markets, the absolute volume of membrane consumption will inevitably rise, solidifying the market's long-term forecast. The strategic focus remains firmly fixed on innovation that delivers better patient outcomes, as improved quality of life and reduced hospital readmissions offer compelling clinical and economic arguments for the widespread adoption of next-generation, high-performance hemodialysis membranes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager