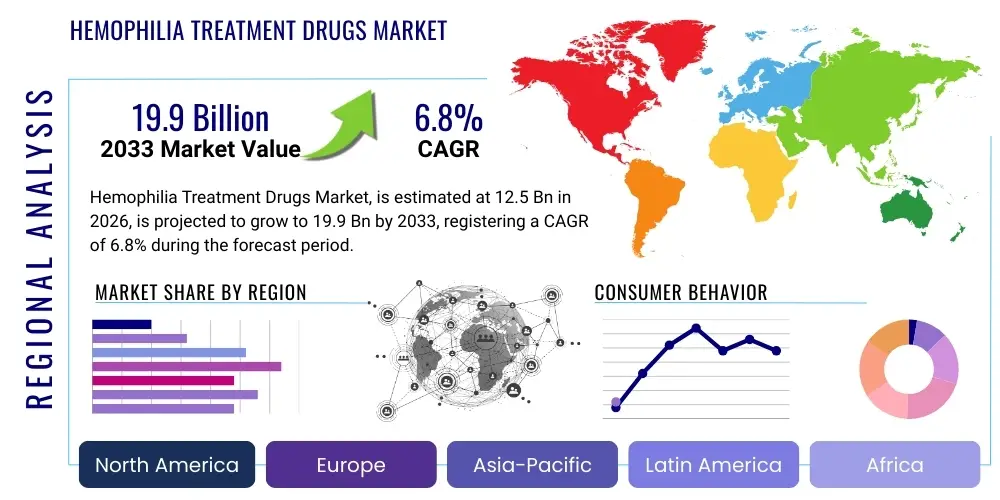

Hemophilia Treatment Drugs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442632 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hemophilia Treatment Drugs Market Size

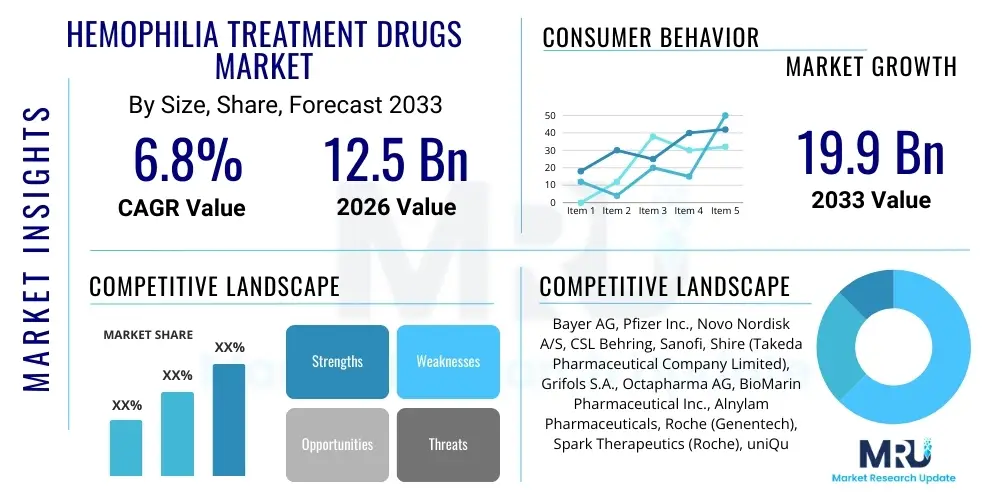

The Hemophilia Treatment Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 19.9 Billion by the end of the forecast period in 2033.

Hemophilia Treatment Drugs Market introduction

The Hemophilia Treatment Drugs Market encompasses a crucial pharmaceutical segment dedicated to managing and treating hemophilia, a genetic bleeding disorder caused by deficiencies in specific clotting factors, primarily Factor VIII (Hemophilia A) or Factor IX (Hemophilia B). The core products in this market are factor replacement therapies, which traditionally involve intravenously administered plasma-derived or recombinant factors designed to replace the missing clotting proteins and restore the body’s ability to clot blood effectively. These replacement therapies are essential for both prophylactic treatment—regular infusions to prevent bleeding episodes—and on-demand treatment following a bleeding event or surgical procedure. The continuous innovation in this sector focuses on improving patient quality of life, extending the half-life of replacement factors to reduce injection frequency, and developing alternative non-factor therapies that bypass the need for traditional factor replacement.

The product landscape is rapidly evolving beyond conventional replacement factors to include extended half-life (EHL) factors, which significantly reduce the burden of prophylaxis. Furthermore, breakthrough technologies, such as gene therapy and subcutaneous non-factor replacement therapies (like bispecific antibodies), are fundamentally reshaping the treatment paradigm. Major applications of these drugs span across pediatric and adult populations requiring lifelong management of the disorder, focusing on preventing joint damage, life-threatening hemorrhages, and improving overall mobility and functional capacity. The primary benefits derived from these treatments include substantial reduction in annual bleeding rates (ABR), prevention of chronic arthropathy, and significantly enhanced life expectancy for individuals afflicted with hemophilia. Effective management is paramount, particularly for patients developing inhibitors, which neutralize the replacement factors, necessitating the use of specialized bypassing agents.

The driving forces behind market expansion are multifaceted, anchored by the increasing global prevalence and diagnosis rates of hemophilia, especially in emerging economies where awareness campaigns and diagnostic capabilities are improving. Significant investments in research and development, aimed at novel therapeutics like gene editing and RNA interference, are propelling market growth. Favorable reimbursement scenarios in developed regions, coupled with strong advocacy from patient organizations, ensure sustained demand for high-cost, innovative treatments. The transition towards prophylactic treatment regimens as the standard of care globally is a foundational driver, recognizing that preventing bleeds is clinically and economically superior to treating acute episodes. This shift necessitates consistent access to safe, effective, and often expensive pharmaceutical agents, thereby stabilizing and expanding the market value considerably.

Hemophilia Treatment Drugs Market Executive Summary

The Hemophilia Treatment Drugs Market is characterized by intense technological innovation, driven by a paradigm shift from conventional factor replacement to advanced, curative, and less burdensome therapeutic modalities, such as extended half-life factors and gene therapy. Business trends indicate a robust competitive environment where large pharmaceutical companies are aggressively acquiring smaller biotech firms specializing in rare disease treatments and novel factor engineering techniques, ensuring portfolio diversification and control over critical intellectual property, particularly in the gene therapy space. The market is consolidating around advanced treatments that offer superior efficacy and convenience, leading to premium pricing strategies justified by improved patient outcomes and reduced long-term healthcare utilization costs associated with chronic bleeding complications. Furthermore, strategic alliances and licensing agreements focusing on global distribution and clinical trial expansion are commonplace, reflecting the global nature of rare disease treatment and the need for expansive patient recruitment for clinical validation.

Regionally, North America and Europe maintain dominance, primarily due to established healthcare infrastructure, high diagnosis rates, comprehensive insurance coverage, and early adoption of pioneering treatments. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, fueled by increasing healthcare expenditure, rising awareness of hemophilia management, and improving access to specialized care, particularly in major economies like China, India, and Japan. The challenge in emerging markets remains the affordability and accessibility of high-cost factor concentrates and innovative drugs, prompting governments and non-governmental organizations to implement targeted programs for subsidized treatment. The Middle East and Africa (MEA) present nascent but growing opportunities, contingent on enhanced diagnostics and regulatory streamlining, though economic instability in certain regions poses a constraint.

Segment trends highlight the rapid ascent of extended half-life (EHL) factors as the preferred prophylactic choice over standard half-life products, capitalizing on reduced infusion frequency and better adherence. The most profound shift is observed in the introduction and commercial maturation of non-factor replacement therapies, which are gaining significant market share, especially among hemophilia A patients with inhibitors, by offering subcutaneous administration and circumventing the need for factor concentrates entirely. Gene therapy, while still in its nascent commercial stage, represents the most disruptive segment, promising functional cures and attracting substantial R&D investment, positioning it as a dominant market force post-2030. Hemophilia A remains the largest disease type segment due to its higher prevalence, but innovative treatments for Hemophilia B are also experiencing significant growth momentum, often benefiting from improved vector technologies in gene transfer methodologies.

AI Impact Analysis on Hemophilia Treatment Drugs Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Hemophilia Treatment Drugs Market frequently revolve around personalized dosing, predictive modeling for bleeding episodes, optimization of clinical trial design, and accelerating the discovery of novel therapeutic targets, especially within gene therapy. Users are keen to understand how AI can mitigate the complexity of factor replacement therapy by providing precision prophylaxis tailored to individual pharmacokinetics, potentially reducing variability in treatment response and inhibitor development risk. Significant concerns focus on data privacy when utilizing large patient registries necessary for AI training and the regulatory pathway for AI-driven diagnostic tools and treatment algorithms. Expectations are high that AI will dramatically improve treatment adherence, refine patient stratification for gene therapy suitability, and ultimately lower the prohibitive cost barriers associated with managing this chronic condition through improved operational efficiency and targeted drug development. The consensus suggests AI integration is transformative, moving hemophilia care towards truly predictive and individualized medicine, far exceeding the capabilities of conventional clinical decision support systems.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to forecast individual patient clotting factor degradation rates, enabling personalized, optimized dosing schedules for prophylactic treatment, minimizing peaks and troughs in factor levels.

- Clinical Trial Acceleration: Employing AI for sophisticated patient recruitment (identifying ideal candidates based on genetic markers and disease severity), synthesizing vast real-world data (RWD) for comparative effectiveness studies, and optimizing dosage escalation in early-phase trials.

- Inhibitor Risk Prediction: Developing AI models that analyze genetic predispositions, treatment history, and demographic factors to accurately predict which patients are at high risk of developing inhibitors against factor replacement therapies, allowing for proactive intervention with bypassing agents or non-factor therapies.

- Drug Target Identification: Applying deep learning to vast omics datasets (genomics, proteomics) to identify novel therapeutic targets beyond Factor VIII and IX, particularly crucial for developing treatments that are less immunogenic or suitable for challenging inhibitor patients.

- Manufacturing Optimization: Using AI and automation in the bioprocessing and quality control of recombinant factors and viral vectors (for gene therapy), enhancing yields, ensuring batch consistency, and reducing manufacturing costs, thereby improving supply chain robustness.

- Diagnosis and Subtype Classification: Enhancing the speed and accuracy of diagnosing rare or complex hemophilia variants and stratifying patients based on severity using machine vision and pattern recognition applied to laboratory and clinical data.

DRO & Impact Forces Of Hemophilia Treatment Drugs Market

The Hemophilia Treatment Drugs Market dynamics are powerfully shaped by a balance between groundbreaking technological drivers and persistent financial and clinical restraints, with substantial opportunities arising from emerging markets and curative potential. Key drivers include the strong clinical momentum generated by the successful launch and adoption of extended half-life (EHL) factors and non-factor replacement therapies, offering improved convenience and efficacy profiles over traditional treatments. Furthermore, the tangible prospect of gene therapy achieving functional cures for both Hemophilia A and B is fueling R&D investment and profoundly shifting market expectations regarding long-term care management. Increased global awareness, coupled with improved diagnostic penetration, particularly in regions previously underserved, ensures a steadily expanding patient pool requiring sophisticated treatment options, contributing significantly to sustained market valuation and volume growth, particularly in prophylactic segments.

Conversely, significant restraints impede exponential growth, primarily the extremely high cost associated with innovative treatments, particularly gene therapies, which can run into millions of dollars per patient, placing immense pressure on healthcare systems and payers globally regarding coverage and access criteria. The inherent risk of inhibitor development remains a critical clinical challenge, requiring expensive and complex management strategies using bypassing agents, which adds considerable volatility to treatment costs and patient outcomes. Moreover, the stringent and lengthy regulatory approval processes for novel biologics and gene therapies, coupled with manufacturing complexities (especially scalability and quality control for viral vectors), slow down market entry and commercial scaling, limiting immediate global availability and hindering full market penetration of the most advanced modalities.

Opportunities for market stakeholders center on aggressive expansion into underserved geographical regions, where the current standard of care is often suboptimal or inaccessible, representing a massive untapped patient population. The ongoing development of novel small molecules and personalized prophylactic regimens, often supported by pharmacogenomic insights, offers avenues for differentiation and clinical advantage, catering to highly specific patient needs, including those with unique inhibitor profiles. The impact forces are generally high due to the life-saving nature of the treatments and the presence of disruptive technologies. The combined force of technological advancement and clinical necessity far outweighs the current restraints, projecting a trajectory toward market expansion and fundamental transformation of patient care. The opportunity to deliver a permanent solution via gene therapy is the single largest factor accelerating long-term market valuation and driving competitive intensity across the biopharmaceutical sector globally.

Segmentation Analysis

The Hemophilia Treatment Drugs Market is meticulously segmented based on several critical dimensions, including product type, disease type, and end-user, reflecting the complexity of treatment and patient care pathways. Analysis of these segments is crucial for understanding current market dynamics and future growth trajectories, as the adoption rate varies significantly across geographies and treatment modalities. The market is transitioning away from older generation, standard half-life products towards high-value, convenience-oriented therapeutics like EHL factors and non-factor replacement options, which are reshaping revenue distribution. This structural change is indicative of patient and physician preferences prioritizing convenience, reduced infusion burden, and effective management of severe phenotypes and inhibitor complications, ultimately leading to higher market contribution from the innovative product categories.

- Product Type:

- Recombinant Factor VIII

- Recombinant Factor IX

- Factor VIII Inhibitor Bypassing Agents (FIBAs)

- Extended Half-Life (EHL) Factors (FVIII and FIX)

- Non-Factor Replacement Therapies (e.g., Emicizumab, Fitusiran)

- Gene Therapy (e.g., Valoctocogene Roxaparvovec, Etranacogene Dezaparvovec)

- Disease Type:

- Hemophilia A

- Hemophilia B

- Other Hemophilia Types (e.g., Hemophilia C, rare factor deficiencies)

- Route of Administration:

- Intravenous

- Subcutaneous

- End-User:

- Hospitals

- Specialty Clinics

- Homecare Settings

Value Chain Analysis For Hemophilia Treatment Drugs Market

The value chain for Hemophilia Treatment Drugs is intensive, commencing with the upstream activities centered on complex R&D and manufacturing of biologics. Upstream analysis focuses heavily on biotechnology firms and large pharmaceutical companies involved in molecular engineering, cell line development, plasma fractionation (for plasma-derived factors), and, critically, the development and production of sophisticated viral vectors for gene therapy applications. Ensuring the safety, purity, and efficacy of these complex biological products requires significant capital investment, stringent quality control protocols (GMP), and specialized technical expertise. The cost structure at this stage is high, largely due to proprietary technology, patented processes, and regulatory compliance associated with producing sterile, injectable biological agents.

Midstream activities involve clinical trials management, regulatory submission, and the crucial step of obtaining market authorization, which often takes many years given the orphan drug status and high scrutiny applied to novel therapies. Once approved, the distribution channel becomes critical. Direct distribution involves manufacturers supplying large hospital systems or specialized hemophilia treatment centers (HTCs), particularly for highly specialized and temperature-sensitive products like gene therapies and some biologics. Indirect distribution involves working with specialty pharmacy networks, third-party logistics (3PL) providers, and wholesalers to reach smaller clinics and homecare settings, which are increasingly relevant for routine prophylactic administration. Specialty pharmacies play a crucial role in patient education, ensuring proper storage, and handling complex insurance verification, acting as an essential bridge between the manufacturer and the end-user.

Downstream analysis focuses on prescription, dispensing, and patient management, primarily handled by hematologists and specialized HTCs. The end-users—hospitals, specialty clinics, and homecare settings—determine the final consumption pattern. Homecare is rapidly expanding, driven by patient preference for convenience and improved training in self-infusion techniques, especially for prophylactic treatment. Reimbursement mechanisms, involving complex negotiations between manufacturers, payers, and government bodies, dictate the final price and accessibility. The highly controlled nature of the distribution—often restricted to specialty pharmacy networks to maintain cold chain logistics and manage high cost—differentiates this market from standard pharmaceuticals, emphasizing the need for robust tracking and risk mitigation throughout the entire supply process, from recombinant cell line to patient vein.

Hemophilia Treatment Drugs Market Potential Customers

The primary potential customers and buyers in the Hemophilia Treatment Drugs Market are individuals diagnosed with congenital hemophilia (A or B) and, by extension, the entities responsible for procuring and administering their treatment. The most significant direct institutional buyers are specialized Hemophilia Treatment Centers (HTCs) and major tertiary care hospitals that manage complex bleeding disorders, serving as critical points of care for diagnostics, initiation of therapy, and ongoing monitoring. These institutions possess the necessary infrastructure and specialist personnel (hematologists, specialized nurses) to handle factor replacement and the management of complications like inhibitor development. Furthermore, large national and regional health systems, particularly governmental purchasing bodies and centralized procurement agencies (like the NHS in the UK or national insurance providers), act as major consolidated buyers, negotiating volume discounts and determining national formularies for treatment access and availability.

Another rapidly growing customer segment comprises specialty pharmacies and homecare service providers. As prophylactic treatment becomes the standard of care, a substantial proportion of drug administration shifts from hospitals to the home setting, requiring reliable, specialized distribution channels that can handle cold-chain requirements, manage patient inventory, and ensure timely delivery. These specialty pharmacies often hold the contractual relationship with health insurers and act as the gatekeepers for dispensing high-cost treatments directly to the patient or their caregivers. The ultimate end-users are the patients themselves, necessitating market strategies that emphasize ease of use, compliance, and reduced treatment burden, driving the demand for subcutaneous non-factor therapies and extended half-life factors that enhance quality of life and adherence to lifelong prophylactic regimens.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Pfizer Inc., Novo Nordisk A/S, CSL Behring, Sanofi, Shire (Takeda Pharmaceutical Company Limited), Grifols S.A., Octapharma AG, BioMarin Pharmaceutical Inc., Alnylam Pharmaceuticals, Roche (Genentech), Spark Therapeutics (Roche), uniQure N.V., Sobi (Swedish Orphan Biovitrum AB), Kedrion Biopharma, Biomarin, Dimension Therapeutics, Bristol-Myers Squibb, Johnson & Johnson, E.Merck |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hemophilia Treatment Drugs Market Key Technology Landscape

The Hemophilia Treatment Drugs market is profoundly influenced by a complex and rapidly evolving technological landscape focused on overcoming the limitations of traditional factor replacement. The most impactful advancement is the development of Extended Half-Life (EHL) factors, achieved primarily through protein engineering techniques such as PEGylation, Fc fusion, and albumin fusion. These modifications extend the circulating half-life of Factor VIII and Factor IX, significantly reducing the required frequency of intravenous infusions from several times a week to once or twice a week (or less for FIX), dramatically improving patient compliance and quality of life while ensuring consistently higher trough levels necessary for effective prophylaxis and joint protection. This technological evolution represents a refinement of traditional replacement therapy, maximizing its therapeutic window and minimizing bleeding risk associated with low trough levels, providing a strong interim solution before potential curative options become widespread.

Beyond factor modification, the market's technological frontier is defined by non-factor replacement therapies and gene therapy. Non-factor replacement therapies, exemplified by bispecific antibodies like Emicizumab, offer a completely different mechanism of action: they mimic the function of missing Factor VIII by bridging activated Factor IX and Factor X, thus promoting effective hemostasis. These agents are game-changers due to their subcutaneous administration route, which is significantly easier and less invasive than intravenous infusion, and their clinical efficacy in patients who have developed inhibitors. Furthermore, RNA interference (RNAi) therapies, such as Fitusiran, represent another novel class, targeting antithrombin production to rebalance the coagulation cascade. These platform technologies demonstrate the industry's successful pivot towards non-replacement solutions, addressing historical clinical barriers like inhibitor complications and intravenous dependency.

The most disruptive technology, however, is AAV vector-based gene therapy. Technologies such as Valoctocogene Roxaparvovec (for Hemophilia A) and Etranacogene Dezaparvovec (for Hemophilia B) aim to deliver a functional copy of the deficient clotting factor gene directly to the liver cells. This single-infusion approach holds the promise of a functional cure, allowing the patient's own body to produce the necessary clotting factor long-term, thereby eliminating the need for periodic infusions. The technical challenges lie in optimizing the vector design for maximum transduction efficiency, managing immune responses against the vector, ensuring long-term factor expression stability, and minimizing hepatotoxicity. The success of gene therapy relies heavily on advancements in viral vector manufacturing (specifically high-titer AAV production) and rigorous patient screening using genetic analysis to maximize therapeutic success and manage the significant long-term clinical and economic risks associated with this groundbreaking, yet expensive, curative technology.

Regional Highlights

- North America: North America, specifically the United States, commands the largest share of the global Hemophilia Treatment Drugs Market. This dominance is attributed to high patient awareness, robust diagnostic capabilities, significant healthcare spending, and comprehensive reimbursement structures that readily cover high-cost specialty drugs, including gene therapies and EHL factors. The region is the primary site for the clinical development and early commercialization of groundbreaking treatments. Competition is fierce, driven by a strong presence of major pharmaceutical innovators and a culture of rapid adoption of superior, patient-centric therapeutic modalities. The US market dictates pricing trends and regulatory benchmarks globally, making it a critical focus area for pharmaceutical strategists.

- Europe: Europe represents the second-largest market, characterized by centralized procurement systems and stringent health technology assessment (HTA) evaluations, particularly in major economies like Germany, France, and the UK. While adoption of advanced therapies is high, pricing and market access negotiations are often protracted due to cost-containment measures inherent in national health services. The region benefits from strong patient registries and cooperative clinical networks that facilitate large-scale trials and real-world evidence generation. Eastern European countries are rapidly improving their treatment infrastructure, although access to the latest, highest-cost therapies remains challenging compared to Western counterparts.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market over the forecast period. This growth is underpinned by the massive, undiagnosed, and untreated patient population across populous nations like India and China, coupled with rapidly expanding healthcare infrastructure and increasing affordability. Governments in countries like Japan and Australia maintain highly developed hemophilia care protocols, driving demand for EHL and non-factor therapies. However, heterogeneous regulatory environments and vast socioeconomic disparities pose significant challenges in ensuring uniform access across the region, necessitating localized market strategies focused on increasing diagnostic penetration and subsidizing access to basic factor replacement concentrates.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by improved economic conditions in key countries such as Brazil and Mexico, leading to enhanced governmental funding for specialty care. Treatment penetration rates are improving, moving toward prophylaxis, but are often constrained by economic instability and reliance on international aid or tenders for obtaining necessary supplies of factor concentrates. The market represents a high-potential segment provided infrastructure development continues and access programs are maintained.

- Middle East and Africa (MEA): MEA holds the smallest current market share but offers considerable long-term potential, particularly within the Gulf Cooperation Council (GCC) nations, which boast sophisticated healthcare systems and high per capita spending. Market growth is heavily contingent on improving diagnostic infrastructure and political stability across the broader African continent, where hemophilia awareness and treatment accessibility are critically low. International collaborations and humanitarian efforts play a substantial role in providing basic care in resource-limited settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hemophilia Treatment Drugs Market.- Bayer AG

- Pfizer Inc.

- Novo Nordisk A/S

- CSL Behring

- Sanofi

- Shire (Takeda Pharmaceutical Company Limited)

- Grifols S.A.

- Octapharma AG

- BioMarin Pharmaceutical Inc.

- Alnylam Pharmaceuticals

- Roche (Genentech)

- Spark Therapeutics (Roche)

- uniQure N.V.

- Sobi (Swedish Orphan Biovitrum AB)

- Kedrion Biopharma

- Biomarin

- Dimension Therapeutics

- Bristol-Myers Squibb

- Johnson & Johnson

- E.Merck

Frequently Asked Questions

Analyze common user questions about the Hemophilia Treatment Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Hemophilia Treatment Drugs Market?

The key drivers include the shift towards prophylactic treatment as the standard of care, the introduction and adoption of Extended Half-Life (EHL) factors and non-factor replacement therapies offering improved patient convenience, and significant advancements in gene therapy promising functional cures for Hemophilia A and B.

How is gene therapy impacting the long-term outlook of hemophilia treatment?

Gene therapy, despite its high upfront cost, is the most disruptive innovation, offering the potential for a functional cure with a single infusion. It is expected to transition hemophilia management from chronic, periodic treatment to a one-time intervention, fundamentally reshaping market dynamics and reducing the long-term demand for traditional factor concentrates post-2030.

What is the main difference between factor replacement and non-factor replacement therapies?

Factor replacement therapies (e.g., Factor VIII/IX concentrates) directly replace the missing clotting protein via intravenous infusion. Non-factor replacement therapies (e.g., Emicizumab) use alternative mechanisms, such as mimicking Factor VIII function or regulating the coagulation cascade, often administered subcutaneously, providing an effective solution particularly for patients with inhibitors.

Why does the cost of hemophilia treatment remain significantly high?

The high cost is primarily driven by the complexity and expense of manufacturing biological agents (recombinant factors and viral vectors for gene therapy), the need for extensive research and development for rare diseases, and the premium pricing associated with innovative, life-saving therapies that offer superior clinical outcomes and reduced infusion burdens.

Which region currently dominates the global Hemophilia Treatment Drugs Market?

North America, particularly the United States, dominates the market share due to its advanced healthcare infrastructure, high patient diagnosis rates, widespread insurance coverage supporting premium-priced advanced therapies, and rapid adoption of innovative treatments like EHL factors and newly approved gene therapies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager