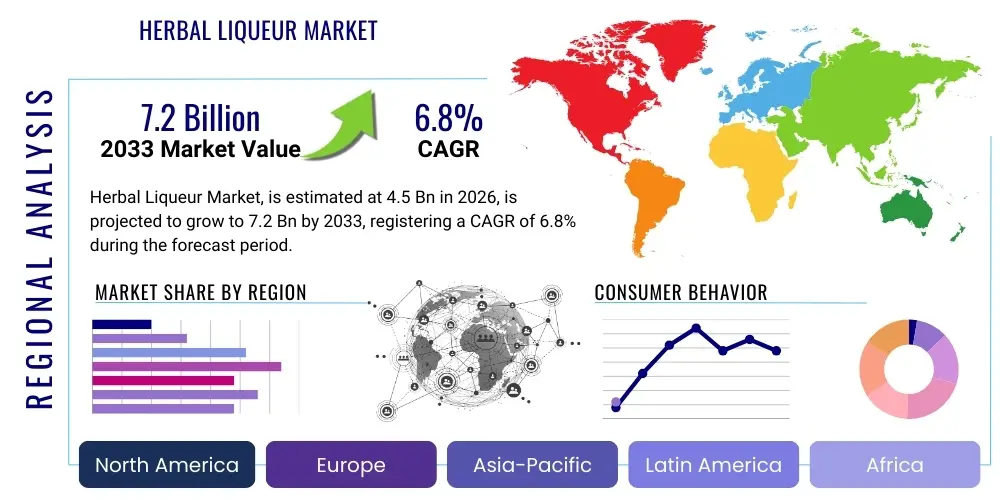

Herbal Liqueur Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442981 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Herbal Liqueur Market Size

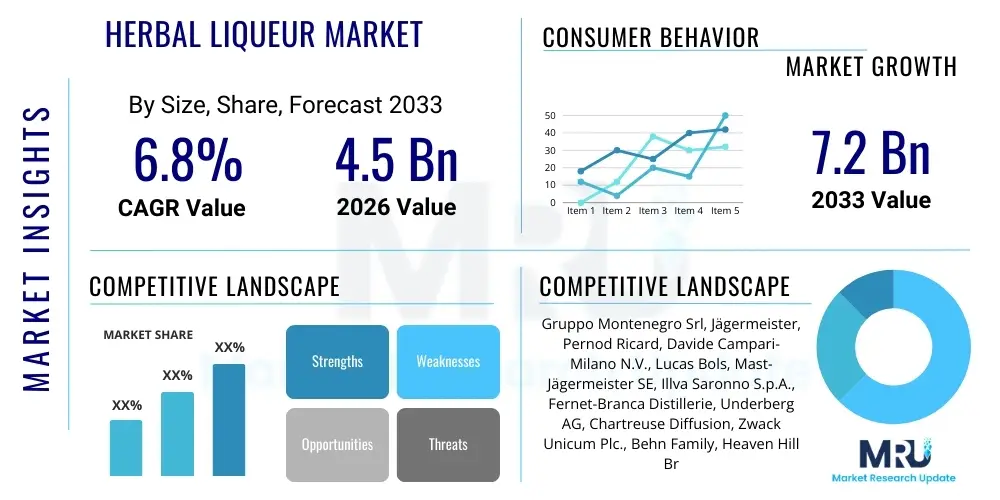

The Herbal Liqueur Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is strongly influenced by evolving consumer preferences leaning towards natural ingredients, artisanal production methods, and historically rooted alcoholic beverages, particularly in developed economies across North America and Europe. The perception of herbal liqueurs as sophisticated digestifs or versatile cocktail ingredients has significantly bolstered their appeal among younger demographics seeking authentic and experience-driven consumption.

The valuation reflects a robust post-pandemic recovery within the hospitality sector, where premium herbal liqueurs are seeing increased adoption in high-end bars and restaurants. Furthermore, the expansion of e-commerce channels has dramatically improved product availability, enabling niche and smaller craft producers to reach a wider international audience, thereby contributing substantially to market capitalization. Manufacturers are also focusing on innovation in low-sugar or zero-proof herbal extracts to capture the burgeoning health-conscious consumer base, ensuring sustained market expansion throughout the forecast period.

Herbal Liqueur Market introduction

The Herbal Liqueur Market encompasses a diverse range of alcoholic beverages derived from the maceration, distillation, or infusion of various botanicals, including herbs, roots, spices, and fruits. These products often boast complex flavor profiles and are traditionally consumed as digestifs (after meals) or aperitifs (before meals), though modern mixology has repurposed them into essential cocktail components. Major applications span the retail sector, hospitality industry (bars, hotels, restaurants), and specialized gifting segments, reflecting their versatility and cultural significance in various global cuisines and drinking traditions. The core product identity revolves around natural sourcing and often proprietary, centuries-old recipes that utilize specific blends of up to 50 or more different botanicals to achieve distinctive tastes and perceived wellness benefits.

The primary benefits driving consumer adoption include the perceived digestive aid properties, the intrinsic flavor complexity suitable for premium cocktails, and the demand for products with a strong heritage and narrative. The driving factors behind the market’s vigorous growth are multi-faceted, encompassing the global trend toward premiumization in alcoholic beverages, where consumers are willing to pay more for quality, natural ingredients, and unique production stories. Simultaneously, the revival of classic cocktails, which frequently utilize bitter and herbaceous liqueurs, has broadened the consumer base beyond traditional, older demographics. Increased disposable income in emerging markets and aggressive marketing strategies emphasizing the botanical origins and artisanal craftsmanship further propel the market forward, making herbal liqueurs a staple in modern beverage portfolios.

Herbal Liqueur Market Executive Summary

The Herbal Liqueur Market is experiencing significant dynamic shifts driven by a confluence of business trends centered on sustainability, ingredient transparency, and premium product innovation. Regional trends indicate robust demand in established European markets (Germany, Italy, France) where herbal liqueurs are deeply embedded in culture, alongside accelerating growth in North America and Asia Pacific, fueled by expanding cocktail culture and rising awareness of diverse international spirits. Business strategies are focused on acquiring niche, craft producers to diversify portfolios and leverage localized traditional recipes. Key players are also investing heavily in sustainable sourcing of botanicals and eco-friendly packaging, aligning with increasing consumer demands for ethical consumption. The competitive landscape is characterized by intense activity from both large multinational corporations and specialized artisanal distilleries, all vying for dominance in the high-margin premium segment.

Segment trends reveal that the Digestif category maintains market leadership, though the Aperitif segment is growing faster due to its utility in pre-meal social settings and light mixed drinks. Flavor profiles are shifting, with traditional bitter and intensely herbaceous varieties coexisting with lighter, citrus-infused, and subtly sweet offerings tailored for broader appeal. Distribution channel expansion highlights the pivotal role of E-commerce, which offers unparalleled access to specialized imports and limited-edition products, bypassing traditional retail barriers. Regionally, the Asia Pacific market presents the highest long-term growth opportunity, contingent upon adapting product offerings to local taste preferences and navigating complex regulatory environments, particularly concerning imported spirits and alcohol content labeling.

AI Impact Analysis on Herbal Liqueur Market

User queries regarding AI in the Herbal Liqueur market primarily center on optimizing complex botanical formulations, enhancing supply chain transparency for rare herbs, and utilizing predictive analytics for consumer flavor preference modeling. Users are particularly concerned with how AI can maintain the integrity and secrecy of traditional, often proprietary, herbal recipes while improving production efficiency and quality control. Key themes emerging include the application of machine learning for personalized marketing campaigns based on regional flavor biases, leveraging computer vision for quality inspection of raw botanicals, and using AI-driven demand forecasting to minimize inventory spoilage, given the specialized and sometimes sensitive nature of natural ingredients. There is a general expectation that AI will standardize quality across batches and uncover new, optimal flavor combinations without compromising the artisanal narrative.

- AI-driven optimization of botanical extraction and blending processes, ensuring consistency.

- Predictive modeling for consumer flavor trends and personalized product recommendations.

- Enhanced supply chain traceability of rare and protected herbal ingredients using blockchain integrated with AI.

- Automated quality control of raw materials (roots, spices) via computer vision systems.

- Demand forecasting and inventory management optimization specific to seasonal ingredient availability.

- Development of proprietary digital flavor profiles to accelerate R&D for new product lines.

DRO & Impact Forces Of Herbal Liqueur Market

The Herbal Liqueur Market is propelled by significant drivers, notably the global premiumization trend in alcoholic beverages and the increasing consumer interest in natural, functional ingredients that often characterize these spirits. Restraints include the high initial investment required for sourcing high-quality, often organic, botanicals and navigating stringent regulatory frameworks regarding alcohol taxation and labeling, which vary drastically across major markets. Opportunities abound in expanding into emerging Asian economies where Western drinking culture is evolving rapidly, and in developing innovative, low-ABV (Alcohol by Volume) or non-alcoholic herbal variants that cater to the mindful drinking movement. Impact forces, such as the rising costs of agricultural commodities and fluctuating consumer tastes influenced by social media, necessitate agility in both sourcing and marketing strategies. The market’s sustainability hinges on balancing traditional, small-batch production methods with the need for large-scale, consistent global supply, making supply chain resilience a crucial competitive differentiator.

Segmentation Analysis

The Herbal Liqueur market is highly diverse and segmented based on flavor profile, end-use application, alcohol content, and distribution channel, reflecting the wide array of products available globally. Segmentation helps manufacturers tailor their products and marketing efforts to specific consumer groups, ranging from traditionalists seeking intense bitter digestifs to modern consumers looking for lighter, herbaceous mixers. The fastest-growing segment is currently E-commerce, leveraging digital platforms to educate consumers about product heritage and provide direct access to unique, imported brands that might not be available through conventional retail outlets. The functional segmentation, particularly between aperitifs and digestifs, dictates usage occasions, profoundly influencing packaging and promotional strategies deployed by market leaders aiming to maximize shelf presence and usage frequency.

- By Flavor Profile: Bitter, Sweet, Herbaceous, Citrus/Fruity.

- By Type: Digestif Liqueurs, Aperitif Liqueurs, Traditional Medicinal Liqueurs.

- By Distribution Channel: On-Trade (Bars, Restaurants, Hotels), Off-Trade (Retail Stores, Supermarkets, Liquor Stores), E-commerce.

- By Alcohol Content: High ABV (Above 35%), Mid ABV (20% to 35%), Low ABV (Below 20%).

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Value Chain Analysis For Herbal Liqueur Market

The value chain for herbal liqueurs begins with extensive upstream analysis focused on the sourcing and procurement of botanicals, which often involves cultivating or ethically foraging rare herbs and roots. This initial stage is critical, as the quality and provenance of these ingredients directly determine the final product's flavor and market price. Major activities at this stage include identifying certified organic suppliers, negotiating long-term contracts for seasonal crops, and rigorous quality testing of incoming raw materials to ensure compliance with purity and safety standards. Given the artisanal nature of many herbal liqueurs, relationships with specialized, often small-scale agricultural producers are vital, necessitating robust supplier management systems to guarantee sustainable and ethical sourcing practices.

Midstream activities encompass the proprietary production processes, including maceration, distillation, infusion, and aging. Unlike standard spirits, herbal liqueur production often involves complex, multi-stage processes governed by closely guarded secrets concerning temperature, time, and specific equipment used for extraction. Significant value addition occurs during blending and maturation, where the master distiller or blender meticulously balances the intense flavors of various extracts with neutral spirits and sweeteners. Investment in cutting-edge, yet traditional, processing technology is crucial here, ensuring both high quality and scalability while preserving the authentic character of the historical recipes.

Downstream analysis centers on distribution channel efficiency, which is bifurcated into direct and indirect routes. Direct distribution channels, primarily through company-owned websites and specialty distillery tasting rooms, allow for maximum margin capture and direct consumer engagement, enhancing brand storytelling. Indirect channels, involving wholesalers, retailers (Off-Trade), and the hospitality sector (On-Trade), require intricate logistics management due to the weight and fragility of packaged goods and varying international regulations. The rise of sophisticated third-party e-commerce fulfillment services has optimized indirect global reach, although maintaining cold-chain integrity for certain products and managing complex import duties remain significant operational hurdles for achieving seamless market penetration across diverse geographical areas.

Herbal Liqueur Market Potential Customers

The primary potential customers for the Herbal Liqueur Market span several distinct demographic and behavioral groups, reflecting the versatile nature of the product. The traditional consumer segment includes older adults in European countries who consume these beverages as cultural staples, primarily as digestifs for perceived wellness benefits or cultural rituals. This segment values heritage, consistency, and intense, traditional flavor profiles, making them loyal purchasers of established legacy brands. Secondly, the rapidly growing premium cocktail enthusiast demographic, typically millennials and Generation Z in urban centers globally, represents a high-value customer base. These consumers seek complexity, unique ingredients, and provenance, utilizing herbal liqueurs as essential mixing components for classic and innovative cocktails, preferring products with strong branding and sustainable credentials.

Furthermore, specialized segments such as high-end restaurants and hotel bars (the On-Trade sector) represent significant bulk buyers, utilizing herbal liqueurs to differentiate their beverage programs and offer sophisticated culinary pairings. Bartenders and mixologists act as key influencers, often driving demand for specific niche or highly specialized botanicals. Another critical segment includes health-conscious consumers interested in natural remedies or functional beverages, who are drawn to the low-sugar, organic, or historically medicinal qualities often associated with herbal liqueurs. This group seeks transparency regarding ingredients and is increasingly receptive to low-ABV and non-alcoholic alternatives offered by innovative brands.

The third substantial segment involves gift buyers and tourists seeking unique, regionally specific alcoholic souvenirs. Products with strong local narratives, distinctive packaging, and limited-edition releases often target this segment, capitalizing on the demand for authentic, experience-driven purchases. Marketing strategies aimed at potential customers must therefore be highly segmented, employing digital storytelling for the cocktail demographic, emphasizing heritage and quality for the traditional consumer, and utilizing trade education and professional outreach to engage the influential On-Trade sector effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gruppo Montenegro Srl, Jägermeister, Pernod Ricard, Davide Campari-Milano N.V., Lucas Bols, Mast-Jägermeister SE, Illva Saronno S.p.A., Fernet-Branca Distillerie, Underberg AG, Chartreuse Diffusion, Zwack Unicum Plc., Behn Family, Heaven Hill Brands, Drambuie Liqueur Company, St. Germain (Bacardi), Tattersall Distilling, Giffard, Luxardo S.p.A., Patron Spirits International AG (Bacardi), Diagio Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Herbal Liqueur Market Key Technology Landscape

The technology landscape within the Herbal Liqueur Market is characterized by a blend of traditional, time-honored techniques and modern analytical tools designed to ensure consistency, purity, and authenticity. Traditional technologies, such as copper pot stills and extensive wood aging processes, remain critical as they impart the specific flavor profiles and textures consumers associate with premium herbal products. However, modern analytical chemistry plays an increasingly vital role. Advanced gas chromatography and mass spectrometry (GC-MS) are employed to meticulously analyze the chemical composition of botanical extracts, ensuring batch-to-batch flavor consistency, confirming the absence of contaminants, and validating the origin of raw materials, which is essential for combating counterfeiting and maintaining brand integrity in global supply chains.

Furthermore, technology is revolutionizing the upstream supply chain. Sophisticated climate-controlled storage facilities utilize sensor technology and IoT monitoring to precisely manage the humidity and temperature of delicate dried herbs and roots, maximizing their potency and shelf life before processing. Digital manufacturing platforms are also being adopted by larger producers for process optimization, integrating real-time data from maceration tanks and distillation columns to minimize yield loss and energy consumption. This integration allows producers to scale operations while retaining the flavor fidelity traditionally associated only with smaller, artisanal batches, thereby addressing the challenge of meeting rising global demand without sacrificing quality standards.

In the consumer-facing sphere, packaging technology, particularly in bottling and labeling, incorporates advanced features for sustainability and brand security. Lightweight, recycled glass and innovative closures reduce the environmental footprint, aligning with consumer values. Furthermore, digital technologies such as QR codes and Near Field Communication (NFC) chips embedded in bottles are increasingly used for direct consumer engagement, providing instant access to detailed information regarding the product’s heritage, ingredients, sourcing location, and suggested cocktail recipes. This transparency, facilitated by technology, enhances consumer trust and supports the premium price point commanded by high-quality herbal liqueurs in competitive international retail environments.

Regional Highlights

- Europe: As the spiritual home of herbal liqueurs, Europe dominates the market, driven by high per capita consumption in countries like Italy, Germany, and the Czech Republic. The segment is deeply cultural, with local artisanal producers maintaining strong influence. Growth is stable, focusing primarily on premiumization and maintaining traditional product authenticity, though Eastern European markets show faster expansion rates driven by increasing disposable income and exposure to diverse imported brands. Regulatory harmonization remains a key factor influencing cross-border trade within the EU.

- North America (NA): Characterized by dynamic growth fueled by cocktail culture and mixology innovation, North America is the fastest-growing major region for imported and locally crafted herbal liqueurs. Consumer interest is focused on products with unique, complex flavor profiles and strong brand narratives. The US market, in particular, showcases high demand for both traditional bitter digestifs and contemporary, low-sugar apertivos, pushing manufacturers to constantly innovate and expand their portfolio relevance through strategic partnerships with influential bar programs.

- Asia Pacific (APAC): APAC represents a high-potential future market, driven by rapidly urbanizing populations, Westernization of dining and drinking habits, and increasing affluence in China, Japan, and Australia. While traditionally low consumers of strong herbal spirits, the rise of sophisticated nightlife and imported Western alcohol creates significant opportunities. Market entry strategies often require adapting sweetness levels or introducing smaller bottle formats to align with local consumption patterns and gift-giving traditions.

- Latin America (LATAM): Growth in LATAM is concentrated in urban centers, where international brands are gaining traction among upper-middle-class consumers. Local production of regionally specific herbal extracts is also strong, often utilizing native botanicals. Economic volatility remains a key challenge, but long-term potential is high due to a large, young population increasingly embracing global spirit trends and seeking aspirational, high-quality beverage options for social occasions.

- Middle East and Africa (MEA): This region is highly fragmented, with limited consumption of high-ABV herbal liqueurs due to regulatory restrictions in many Islamic countries. However, pockets of growth exist in affluent, liberalized markets (e.g., UAE, South Africa) where tourism and expatriate communities drive demand for imported premium spirits, primarily through duty-free and high-end hospitality channels. Non-alcoholic herbal extracts and mixers are a potential growth avenue here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Herbal Liqueur Market.- Gruppo Montenegro Srl (Producer of Amaro Montenegro and Vecchia Romagna)

- Mast-Jägermeister SE (Global leader, focusing on distribution efficiency)

- Davide Campari-Milano N.V. (Owner of Aperol and Campari, dominant in Aperitifs)

- Pernod Ricard (Diverse portfolio including various bitters and liqueurs)

- Diageo Plc. (Global giant with focus on premium imports and distribution scale)

- Lucas Bols (Specialist in high-quality liqueurs and historic recipes)

- Illva Saronno S.p.A. (Known for Disaronno and various traditional Italian liqueurs)

- Fernet-Branca Distillerie (Leading producer of highly bitter digestifs)

- Underberg AG (Focuses on traditional German herbal digestifs)

- Chartreuse Diffusion (Monastically produced, high-status brand with extremely complex formulations)

- Zwack Unicum Plc. (Hungarian producer with strong traditional roots)

- Heaven Hill Brands (American distiller with growing liqueur portfolio)

- Drambuie Liqueur Company (Scottish herbal liqueur with whisky base)

- St. Germain (Bacardi Limited subsidiary, known for elderflower liqueur innovation)

- Giffard (French family-owned producer focusing on high-quality syrups and liqueurs)

- Luxardo S.p.A. (Italian heritage brand specializing in fruit and herbal extracts)

- Tattersall Distilling (Craft distiller emphasizing locally sourced botanicals)

- Patron Spirits International AG (Bacardi Limited subsidiary)

- Behn Family (German distiller with specialized herbal products)

- Vana Tallinn (Estonian traditional herbal liqueur)

Frequently Asked Questions

Analyze common user questions about the Herbal Liqueur market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Herbal Liqueur Market?

Market growth is primarily driven by the premiumization trend in the alcoholic beverage sector, increasing global interest in sophisticated cocktail culture requiring complex flavor components, and the consumer shift towards products featuring natural, authentic, and functional botanical ingredients with strong historical narratives and high perceived quality.

Which geographical region holds the largest market share for herbal liqueurs?

Europe currently holds the largest market share for herbal liqueurs due to the deeply embedded cultural tradition of consuming these spirits, particularly as aperitifs and digestifs, in countries such as Italy, France, and Germany. This dominance is supported by high consumer loyalty and the presence of numerous legacy brands.

How is the market addressing the growing demand for healthier alcoholic beverages?

The market is addressing health trends by introducing innovative product variations, including low-ABV (Alcohol by Volume) herbal aperitifs, non-alcoholic herbal extracts, and premium options formulated with significantly reduced sugar content, ensuring the complex flavor profile is maintained while appealing to the mindful drinking segment.

What role does E-commerce play in the distribution of herbal liqueurs?

E-commerce is a pivotal and rapidly growing distribution channel, offering essential direct-to-consumer access, particularly for specialized, high-end, and imported artisanal brands that may have limited physical retail presence. This channel also facilitates crucial consumer education regarding product heritage and complex usage instructions.

What are the primary challenges facing producers in the Herbal Liqueur Market?

Key challenges include maintaining the consistency of flavor profiles across large batches due to variations in natural botanical harvests, navigating complex and diverse international regulatory requirements for alcohol content and ingredient labeling, and managing the increasing volatility and sourcing costs associated with rare or specialized natural herbal commodities.

What is the difference between an herbal aperitif and an herbal digestif?

An herbal aperitif is typically consumed before a meal to stimulate the appetite, often characterized by lighter, sometimes slightly bitter, or citrus notes, and may have a lower alcohol content. Conversely, an herbal digestif is consumed after a meal to aid digestion, frequently featuring richer, more intense, and distinctly bitter or highly herbaceous flavors, often with a higher ABV.

How does sustainability affect the sourcing of raw materials in this industry?

Sustainability is a major factor, forcing producers to adopt ethical sourcing and organic farming practices for botanicals. Consumers increasingly demand transparency regarding the origin and harvesting methods of ingredients, driving manufacturers to invest in certified sustainable supply chains and fair trade partnerships to ensure long-term resource availability and ethical product positioning.

What technological advancements are impacting the production process?

Technological advancements include the use of sophisticated analytical chemistry techniques, such as GC-MS, to ensure precise flavor profiling and consistency. Additionally, IoT sensors and advanced climate control systems are employed in storage and aging to optimize conditions for raw botanicals and finished products, blending tradition with modern quality assurance protocols.

Which flavor profile segment is exhibiting the fastest growth?

While traditional bitter flavors remain culturally significant, the herbaceous and citrus/fruity segments are exhibiting accelerated growth, largely driven by their versatility in contemporary mixology and their appeal to newer consumers who prefer lighter, less challenging flavor bases for mixed drinks and cocktails.

How do market players utilize packaging to enhance market appeal?

Market players heavily invest in premium packaging design, utilizing heavy glass, unique bottle shapes, and elaborate labeling that often references the product’s historical narrative or botanical contents. Packaging serves as a crucial differentiator, communicating quality, heritage, and luxury, justifying the higher price points in the premium segment and attracting gift buyers.

What impact does the "craft spirits" movement have on herbal liqueurs?

The craft spirits movement strongly benefits herbal liqueurs by emphasizing small-batch production, local sourcing of botanicals, and artisanal manufacturing techniques. This trend drives consumer interest in unique, non-mass-produced brands and allows smaller distillers to compete effectively by focusing on niche ingredients and authenticity narratives, further fragmenting the market.

Are there notable regional differences in consumption habits?

Yes, significant differences exist. In Southern Europe, consumption is often centered around traditional family meals (digestifs), while in North America and Western Europe, consumption is increasingly social, driven by bar culture and cocktail experimentation (aperitifs and mixers). Asia Pacific is adopting consumption through high-end dining and entertainment venues.

What measures are companies taking to protect proprietary herbal recipes?

Companies utilize a combination of legal protection, such as trade secrets and specialized intellectual property registration, alongside physical security measures to protect key production facilities. In some cases, specific parts of the process, particularly the blending of key extracts, are known only to a few trusted individuals or managed via highly automated systems to prevent formula leakage.

How does the volatile pricing of agricultural commodities affect the market?

The volatile pricing of specialized agricultural commodities, such as rare spices and medicinal roots, directly impacts the production cost of herbal liqueurs. Companies often mitigate this risk by engaging in long-term supply contracts, diversifying sourcing locations, and hedging commodity prices, though unexpected cost increases can sometimes necessitate price adjustments for the end product.

What is the current trend regarding the alcohol content (ABV) in new herbal liqueur launches?

The predominant trend in new launches leans towards lower ABV options, specifically in the aperitif category (typically 15% to 25% ABV), appealing to consumers practicing moderate drinking or those looking for lighter beverage options that can be easily mixed with soda or sparkling wine for casual consumption.

Do herbal liqueurs face competition from non-alcoholic spirits?

Yes, the rise of sophisticated non-alcoholic spirits and functional beverages poses indirect competition, especially among health-conscious consumers. Herbal liqueur manufacturers are responding by launching their own zero-proof herbal extracts that mimic the complex flavor profile of traditional liqueurs without the alcohol, capturing market share in this parallel segment.

What are the key considerations for expansion into the Asia Pacific market?

Key considerations for APAC expansion include adapting product sweetness levels to local palates, navigating stringent and diverse import regulations and tariffs, establishing robust cold chain logistics in warmer climates, and tailoring marketing strategies to emphasize the product's premium Western heritage and luxury positioning.

How do large multinational corporations participate in this niche market?

Large multinational corporations typically participate through acquisition of established, high-heritage artisanal brands (e.g., Bacardi acquiring St. Germain), allowing them to instantly gain market expertise and authentic product lines, which they then scale globally using their expansive distribution networks and marketing budgets, consolidating a fragmented market.

What is the significance of the Digestif segment within the overall market?

The Digestif segment is the foundational and historically dominant segment of the market, representing significant volume and value, particularly in Europe. Its continued relevance is tied to cultural tradition and the perception of herbal liqueurs as sophisticated, post-meal aids, providing stable demand even as the aperitif segment experiences faster growth.

How is consumer education affecting purchase decisions?

Consumer education, largely driven by digital content, bar professionals, and specialized media, is profoundly affecting purchasing decisions by highlighting the intricate production processes, the sourcing of rare botanicals, and the ideal serving methods. This knowledge empowers consumers to seek out higher-priced, more complex products based on informed appreciation rather than simple brand recognition.

What are the current trends regarding product innovation in flavors?

Current flavor innovation trends include experimenting with hyper-local or forgotten ancient botanicals, integrating savory notes (e.g., truffle, unusual peppers), and focusing on functional ingredients (e.g., adaptogens, nootropics) that offer perceived stress-relief or cognitive benefits alongside the traditional flavor complexity of the liqueur base.

How do regulatory bodies classify herbal liqueurs compared to other spirits?

Regulatory bodies typically classify herbal liqueurs based on their alcohol content, defined production methods (maceration, infusion, distillation), minimum sugar content, and the specific use of botanicals. These classifications often place them under specific liqueur or specialty spirit categories, subjecting them to distinct labeling requirements, excise duties, and import restrictions compared to base spirits like whiskey or gin.

What is the projected long-term impact of AI on the creation of new herbal liqueur recipes?

The long-term impact of AI will involve using algorithms to analyze successful flavor combinations, predict consumer acceptance of novel botanical blends, and optimize extraction parameters to develop new recipes faster. This will significantly reduce the R&D cycle and lead to a new generation of data-driven, yet artisanal, products that precisely meet emerging market demands.

How important are certifications (e.g., organic, fair trade) to market success?

Certifications, such as Organic, Fair Trade, and B Corp status, are highly important, particularly in premium markets in North America and Western Europe. They signal ingredient quality, ethical sourcing, and environmental responsibility, acting as crucial trust indicators that influence the purchase decisions of modern, socially conscious consumers and commanding a price premium.

What role do professional bartenders play in shaping market demand?

Professional bartenders and mixologists are critical market influencers; they are early adopters of niche products and drive consumer trial through innovative cocktail development. Their endorsement and integration of specific herbal liqueurs into popular drink menus generate visibility and significantly impact both on-trade and off-trade demand for those select brands.

What are the typical shelf life considerations for herbal liqueurs?

Most high-ABV herbal liqueurs have a long, stable shelf life due to their alcohol content. However, products with lower ABV, higher sugar content, or specific natural colorings/flavorings may require specific storage conditions (e.g., refrigeration after opening) to maintain color stability and flavor integrity, necessitating clear labeling instructions for consumers.

Is there a noticeable trend towards ready-to-drink (RTD) herbal liqueur cocktails?

Yes, the convenience and popularity of the RTD category are influencing the herbal liqueur market. Manufacturers are increasingly launching canned or bottled cocktails featuring their signature herbal liqueurs (e.g., Aperol Spritz RTD), capitalizing on the desire for quality, sophisticated pre-mixed drinks suitable for home consumption or outdoor events.

How does counterfeiting affect the premium segment of the market?

Counterfeiting is a serious threat to the premium segment, particularly for high-value, exclusive brands like Chartreuse. It erodes brand trust and results in lost revenue. Companies combat this using advanced anti-counterfeiting measures, including secure packaging, tamper-evident seals, blockchain traceability, and aggressive legal enforcement in key international markets.

What types of marketing strategies are most effective for herbal liqueurs?

Effective marketing strategies focus heavily on experiential marketing, engaging consumers through masterclasses and tasting events; digital storytelling, highlighting the brand’s heritage and unique botanical sourcing; and influencer marketing, collaborating with respected mixologists to showcase versatility and premium positioning across social media platforms.

How does the seasonal availability of botanicals affect production scheduling?

Seasonal availability dictates strict production scheduling and necessitates forward contracting and substantial long-term storage of dried or preserved botanicals. Producers must accurately forecast annual requirements to ensure sufficient inventory of key ingredients year-round, as relying solely on fresh, seasonal harvests can compromise batch consistency and restrict scaling capabilities.

What is the long-term outlook for the Latin American Herbal Liqueur Market?

The long-term outlook for the Latin American market is positive, driven by urbanization and the growing middle class, leading to increased exposure and acceptance of international premium spirits. Future growth will rely on establishing efficient distribution networks and overcoming macroeconomic instability, focusing initially on major metropolitan areas like São Paulo and Mexico City.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager