Hexafluorozirconic Acid Solution Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442268 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Hexafluorozirconic Acid Solution Market Size

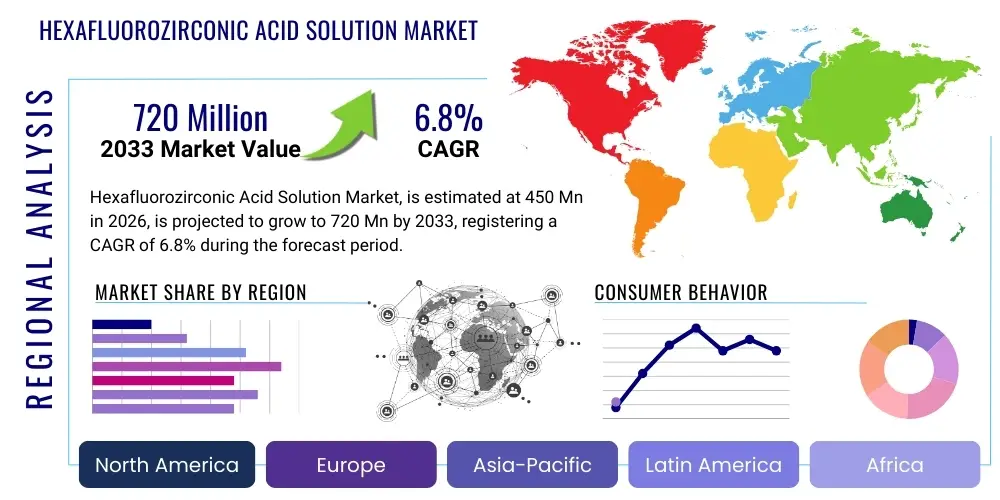

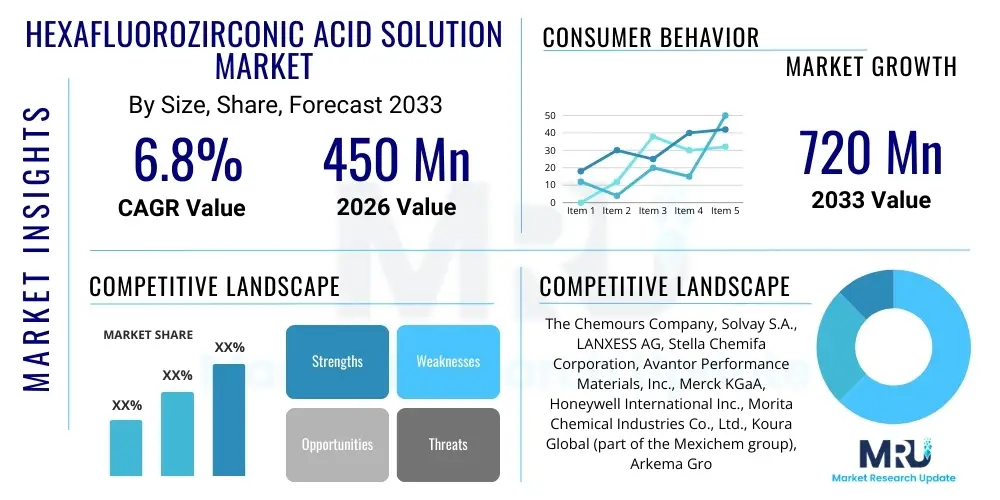

The Hexafluorozirconic Acid Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the expanding applications in surface treatment processes for aluminum and its alloys, where the solution offers superior corrosion resistance and adhesion properties compared to traditional chromate-based treatments. The global emphasis on environmental regulation, particularly the phasing out of hazardous substances like chromates, positions Hexafluorozirconic Acid as a critical green chemistry alternative, spurring adoption across major industrial sectors including aerospace, automotive, and construction materials manufacturing.

Hexafluorozirconic Acid Solution Market introduction

Hexafluorozirconic Acid Solution (H2ZrF6) is a highly specialized chemical compound, typically supplied in aqueous solution form, crucial for advanced material science and industrial finishing. The product description emphasizes its role as a precursor chemical utilized primarily in the preparation of zirconium-based conversion coatings. These coatings are indispensable for enhancing the surface integrity of metals, providing exceptional resistance against corrosion, and acting as an optimal primer layer for subsequent painting or adhesion processes. The formulation exhibits stability and efficiency, making it preferred over legacy surface preparation methods.

Major applications for Hexafluorozirconic Acid Solution span several high-value industries. In the automotive sector, it is used for pre-treating body parts, ensuring the durability of paint finishes. The aerospace industry relies on its performance for critical airframe components requiring stringent corrosion control. Furthermore, it plays a vital role in the production of high-performance ceramics, specialized catalysts, and in certain electronic manufacturing processes for semiconductor production and plating operations. The benefits include reduced environmental footprint due to its non-chromate nature, enhanced operational safety, and markedly superior performance characteristics in terms of coating uniformity and adhesion strength.

Driving factors for market expansion are multifaceted, anchored by stringent global environmental policies pushing for non-toxic surface treatments. Increased production and consumption of light metals, such as aluminum and magnesium, particularly in emerging economies and the electric vehicle (EV) market, necessitate advanced pre-treatment solutions that Hexafluorozirconic Acid provides. The relentless demand for durable, high-quality finishes in infrastructure and consumer goods further solidifies its market position, making it a cornerstone component in modern manufacturing supply chains seeking both efficacy and sustainability compliance.

Hexafluorozirconic Acid Solution Market Executive Summary

The Hexafluorozirconic Acid Solution market exhibits robust business trends characterized by intense focus on capacity expansion and strategic vertical integration among key suppliers to secure raw material access, primarily zirconium chemicals and hydrofluoric acid. Market growth is being fueled by innovation in application methods, specifically the development of lower concentration baths and specialized proprietary formulations that optimize coating performance and reduce material consumption, thereby improving overall cost-efficiency for end-users. Consolidation activities, including mergers and acquisitions, are observed as companies seek to expand their geographical reach, especially into high-growth manufacturing hubs in Asia Pacific, and diversify their application portfolio beyond traditional metal finishing into specialized catalytic roles and high-purity electronics applications.

Regionally, the market dynamics are shifting, with Asia Pacific (APAC) emerging as the primary growth engine, surpassing traditional markets in North America and Europe. This surge is attributed to the rapid industrialization, burgeoning automotive manufacturing base (especially EV battery component production), and massive infrastructure projects across countries like China, India, and South Korea. While North America and Europe maintain a significant market share, driven by strict regulatory mandates favoring environmentally compliant chemical substitutes, their growth rate is slightly lower but stable, focusing on high-specification aerospace and specialty coating demands. Latin America and MEA are seeing nascent demand, primarily linked to localized construction and resource processing sectors requiring metal protection.

Segment trends highlight the dominance of the 45% concentration solution segment, preferred for its versatility and widespread use in conversion coating baths. However, the high-purity (electronic grade) segment is demonstrating the highest CAGR, propelled by the semiconductor and advanced electronics manufacturing boom, requiring ultra-low impurity levels for sensitive fabrication processes. Application-wise, the metal surface treatment segment remains the largest consumer, but demand from the ceramics manufacturing sector, especially for refractory materials and specialized industrial coatings requiring zirconium components, is witnessing accelerated growth. These segment shifts reflect the dual reliance of the market on high-volume industrial uses and high-value niche technical applications.

AI Impact Analysis on Hexafluorozirconic Acid Solution Market

User inquiries regarding AI's influence on the Hexafluorozirconic Acid Solution market predominantly revolve around questions concerning process optimization, supply chain predictability, and the development of novel formulations. Common themes include how AI can enhance the efficiency of conversion coating bath management, predict necessary chemical adjustments in real-time, and optimize raw material procurement strategies to mitigate price volatility. Furthermore, users frequently ask about AI's role in accelerating the research and development cycle for new, specialized zirconium chemistries and ensuring regulatory compliance through automated data analysis and reporting, leading to expectations of significant operational cost reductions and enhanced product quality control within complex manufacturing environments.

The integration of Artificial Intelligence and Machine Learning (ML) is beginning to transform the operational landscape of chemical production and downstream application of Hexafluorozirconic Acid. In manufacturing, AI algorithms are deployed to manage complex chemical reactors, optimizing temperature, concentration, and reaction times, which directly impacts the yield and purity of the acid solution. Predictive maintenance fueled by AI minimizes equipment downtime, ensuring consistent supply chain reliability, a critical factor for industrial clients. Furthermore, AI-driven demand forecasting allows producers to align production schedules with volatile market needs, thereby minimizing inventory holding costs and reducing the risk associated with handling hazardous materials.

In application science, particularly within metal finishing, AI systems are crucial for maintaining the optimal performance of conversion coating lines. Sensors collect real-time data on bath parameters—such as pH, concentration, and temperature—which ML models analyze to recommend precise chemical replenishment or adjustment sequences. This level of real-time optimization leads to significant material savings, extends the lifespan of the chemical bath, and guarantees consistent coating quality across high-volume throughput, far surpassing the capabilities of traditional manual monitoring and control systems. AI is also being used in material informatics to screen potential new additives that could improve the acid’s performance in specialized alloys or high-temperature applications, potentially unlocking new market segments.

- AI optimizes chemical synthesis processes, boosting yield and product purity.

- Machine Learning enhances real-time control of conversion coating baths, ensuring quality consistency.

- Predictive analytics minimizes supply chain disruptions and forecasts raw material demand (Zirconium and HF).

- AI-driven material informatics accelerates R&D for next-generation zirconium-based coatings.

- Automation of quality control processes reduces human error and enhances safety compliance.

- Intelligent monitoring of industrial wastewater treatment linked to Hexafluorozirconic Acid usage ensures stricter environmental adherence.

DRO & Impact Forces Of Hexafluorozirconic Acid Solution Market

The market for Hexafluorozirconic Acid Solution is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), creating significant Impact Forces. Key drivers center on the global legislative movement away from toxic chromate conversion coatings (RoHS, REACH compliance), compelling industries to adopt safer, more effective zirconium-based alternatives. This regulatory pressure is amplified by the accelerating industrial adoption of light metals (aluminum, magnesium) in transportation sectors, which necessitates high-performance pre-treatment chemicals for corrosion mitigation. Conversely, major restraints include the high costs and logistical complexities associated with the safe handling, storage, and disposal of hydrofluoric acid, a key raw material, alongside inherent fluctuations in the price and supply of zirconium chemicals, which directly impacts the profitability and stability of the supply chain. Opportunities are primarily found in developing customized, high-purity solutions for niche electronics and catalyst markets, and expanding its use in next-generation aerospace composite structures requiring tailored surface treatments.

The impact forces resulting from this balance are significant. The primary force is the compelling push towards sustainability: as chromate phase-out deadlines approach globally, demand for Hexafluorozirconic Acid surges, giving producers substantial pricing power and market stability, provided they can manage raw material volatility. The secondary impact force stems from technological refinement; continuous investment in application research aims to reduce the required concentration of the solution and improve application efficiency, addressing the cost restraint and broadening the appeal of the product across small and medium enterprises (SMEs). If raw material supply chains are successfully stabilized through long-term contracts or vertical integration, the market can realize its full growth potential driven purely by regulatory tailwinds and sustained industrial demand.

Furthermore, the competitive landscape is intensely shaped by the capability of manufacturers to offer ultra-pure grades, especially necessary for the lucrative semiconductor sector. Producers who can consistently meet stringent purity specifications and demonstrate robust compliance standards gain a significant competitive edge. The restraint posed by disposal concerns is also driving innovation towards closed-loop recycling and regeneration technologies for spent coating baths, presenting an opportunity for specialized chemical service providers. Ultimately, the market trajectory is highly correlated with global automotive and aerospace production volumes and the evolving stringency of global chemical safety regulations, creating a powerful, sustained market pull for this advanced surface treatment agent.

Segmentation Analysis

The Hexafluorozirconic Acid Solution market is systematically segmented based on concentration, application, and end-use industry, reflecting the diverse requirements of its customer base. Concentration-based segmentation distinguishes between the high-volume, standard industrial grades (typically 45% or 50%) used for bulk surface treatment and specialized, lower concentration solutions tailored for specific material handling or purity requirements. Application segmentation focuses on the functional purpose, ranging from general metal pre-treatment (conversion coatings) to specialized uses like catalyst preparation and ceramic manufacturing. The end-use industry analysis highlights the dominant influence of the automotive and aerospace sectors, while recognizing the high growth potential in electronics and specialized chemicals, providing a granular view of demand drivers and growth pockets.

A deeper look into the segmentation reveals crucial market dynamics. The segment utilizing Hexafluorozirconic Acid for aluminum pre-treatment is paramount due to the extensive use of aluminum in lightweighting strategies across transport sectors. However, the market is increasingly appreciating the complexity of magnesium and other exotic alloy treatments, where specialized formulations of the acid are required, creating lucrative, high-margin opportunities. Geographically, segmentation underscores the importance of local manufacturing ecosystems; for instance, the dominance of automotive production in Germany and China translates directly into high localized demand for metal surface preparation chemicals, guiding regional production and distribution strategies among major vendors.

The high-purity segment (often termed electronic or semiconductor grade) commands a substantial price premium and represents a strategic priority for innovation. Manufacturing this grade requires exceptionally rigorous purification processes to minimize trace elements that could compromise sensitive electronic components. Successful penetration into this high-growth sector requires significant capital investment in cleanroom facilities and advanced quality control systems, positioning market players capable of meeting these specifications favorably against competitors focusing solely on commodity industrial grades. This dual segmentation strategy—serving both volume industrial needs and high-spec niche applications—is critical for maximizing overall market revenue.

- By Concentration:

- 45% Hexafluorozirconic Acid Solution (Standard Industrial Grade)

- 50% Hexafluorozirconic Acid Solution (High Concentration Grade)

- Low Concentration Solutions (Customized Baths)

- Ultra-High Purity Solutions (Electronic/Semiconductor Grade)

- By Application:

- Metal Surface Pre-treatment (Conversion Coatings)

- Aluminum and Alloys

- Magnesium Alloys

- Galvanized Steel

- Ceramic Manufacturing and Refractory Materials

- Catalyst Preparation (Zirconium-based Catalysts)

- Chemical Intermediates and Synthesis

- Electronics and Semiconductor Processing

- Metal Surface Pre-treatment (Conversion Coatings)

- By End-Use Industry:

- Automotive and Transportation (including Electric Vehicles)

- Aerospace and Defense

- Construction and Architecture (Aluminum Extrusions)

- Electronics and Electrical Goods

- Chemicals and Petrochemicals

- Industrial Machinery and Equipment

Value Chain Analysis For Hexafluorozirconic Acid Solution Market

The value chain for Hexafluorozirconic Acid Solution is initiated by the upstream analysis, which is characterized by the procurement and processing of two primary raw materials: zirconium ore derivatives (such as Zirconium Silicate or Zirconium Oxide) and high-purity Hydrofluoric Acid (HF). The extraction and refining of zirconium chemicals are capital-intensive and concentrated among a limited number of global suppliers, subjecting this stage to commodity price volatility and supply concentration risk. The availability and stable pricing of HF, which is highly regulated due to its hazardous nature, also significantly influence production costs and capacity utilization among Hexafluorozirconic Acid manufacturers. Successfully managing these complex upstream dependencies, often through long-term supply agreements or backward integration, is crucial for maintaining competitive production costs and ensuring supply security in the downstream market.

The midstream stage involves the chemical synthesis and formulation of the aqueous acid solution. Manufacturers focus heavily on process optimization to achieve required purity levels, especially for electronic-grade applications. This manufacturing stage includes rigorous quality control and specialized handling procedures mandated by the corrosive nature of the product. Following production, the distribution channel is critical; due to the hazardous classification of the acid, specialized logistics providers are required for transportation, utilizing dedicated, corrosion-resistant packaging and conforming to strict international hazardous goods regulations (e.g., DOT, ADR, IMDG). The choice between direct and indirect distribution channels largely depends on the customer size and geographical location.

Downstream analysis focuses on the end-use applications, primarily in metal finishing facilities (job coaters and large original equipment manufacturers - OEMs) and specialty chemical users. The indirect channel involves distributors and specialized chemical service providers who not only supply the acid but also offer technical support, consulting on bath management, and often assist with regulatory compliance and waste disposal services. The direct channel is typically reserved for large, high-volume OEMs (like major automotive or aerospace firms) that purchase directly from the manufacturer for integration into their sophisticated internal production lines. The effectiveness of the overall value chain is highly dependent on technical service and application expertise provided at the downstream level, ensuring customers maximize the performance benefits of the conversion coatings.

Hexafluorozirconic Acid Solution Market Potential Customers

The potential customer base for Hexafluorozirconic Acid Solution is highly industrialized and structurally diverse, primarily composed of end-user sectors reliant on advanced corrosion protection and high-performance material surfaces. The primary buyers are large Original Equipment Manufacturers (OEMs) within the automotive, aerospace, and construction material sectors who utilize the acid for in-house metal pre-treatment processes. Specifically, automotive manufacturers transitioning to lighter, aluminum-intensive vehicle structures for improved fuel economy and EV battery enclosures are major consumers. These customers prioritize solutions that offer superior paint adhesion and meet stringent environmental and safety standards imposed by regulatory bodies.

A second major category of potential customers includes independent job coaters and contract metal finishers. These businesses provide specialized surface treatment services to various smaller manufacturers who lack the internal capacity or expertise to manage complex chemical processes. For these buyers, consistency of supply, technical support, and competitive pricing are critical factors. Additionally, high-tech sectors such as semiconductor fabricators and advanced ceramics producers represent lucrative, albeit smaller-volume, customer segments, demanding the ultra-high purity grades of the acid for precision manufacturing and specialty product development, where even trace impurities can lead to product failure.

In summary, the end-users are defined by their need for superior, chromate-free metal surface preparation. They include major aluminum extrusion companies serving the architectural and infrastructure markets, defense contractors requiring mil-spec corrosion resistance, and chemical companies using the acid as a precursor for synthesizing specialized zirconium compounds, catalysts, or flame retardants. The common denominator among these buyers is the non-negotiable requirement for high-quality, reliable chemical performance to ensure the durability and longevity of their final products in demanding operating environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chemours Company, Solvay S.A., LANXESS AG, Stella Chemifa Corporation, Avantor Performance Materials, Inc., Merck KGaA, Honeywell International Inc., Morita Chemical Industries Co., Ltd., Koura Global (part of the Mexichem group), Arkema Group, PCC Group, Alfa Aesar (part of Thermo Fisher Scientific), Noah Chemicals, Inc., Gelest Inc., Central Glass Co., Ltd., Fuji Film Wako Pure Chemical Corporation, ICL Group Ltd., Triveni Interchem Pvt. Ltd., Shaanxi Top Metal Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hexafluorozirconic Acid Solution Market Key Technology Landscape

The technological landscape surrounding the Hexafluorozirconic Acid Solution market encompasses not only the primary manufacturing processes but also the crucial application and environmental management technologies that define its efficacy and acceptance. Manufacturing technologies primarily involve the controlled reaction of Zirconium Dioxide (or related precursors) with Hydrofluoric Acid. Innovations in this area focus on maximizing conversion efficiency, reducing energy consumption during synthesis, and, most importantly, implementing advanced filtration and purification techniques (such as ion-exchange chromatography and solvent extraction) to achieve the stringent ultra-low impurity levels required for electronic-grade materials. The ability to minimize residual trace elements, particularly heavy metals and chlorides, is a core technological differentiator for leading suppliers targeting high-value markets.

Application technology represents a critical area of innovation, particularly concerning the deployment of conversion coatings. This includes the development of highly efficient, low-temperature application baths that reduce overall energy consumption at the user level. Modern coating lines utilize sophisticated spray, immersion, or wipe-on techniques, often integrating automated dosing systems controlled by sensors and feedback loops to maintain optimal bath chemistry. Furthermore, research is intensely focused on proprietary blends that incorporate additives (e.g., surfactants, stabilizers, and reactive polymers) alongside the Hexafluorozirconic Acid to improve film formation kinetics, coating thickness uniformity, and multi-metal compatibility, allowing the treatment of complex mixed-metal assemblies commonly found in modern vehicles.

Environmental management technology is the third pillar supporting market growth. Given the hazardous nature of fluoride waste streams generated by spent Hexafluorozirconic Acid baths, advanced wastewater treatment and resource recovery systems are essential. Technologies such as electrochemical methods, precipitation (using calcium compounds), and membrane filtration are employed to safely neutralize and dispose of fluoride waste or, increasingly, to regenerate the active components, enabling a circular economy approach. This investment in sustainable technology not only ensures regulatory compliance but also offers operational cost savings to end-users and manufacturers, thereby strengthening the long-term viability and competitive advantage of Hexafluorozirconic Acid as a green surface treatment chemical.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, driven by monumental investments in automotive manufacturing (especially EVs), electronics production, and infrastructure development, particularly in China, India, Japan, and South Korea. Regulatory bodies in these nations are increasingly aligning with global environmental standards, creating strong demand for chromate alternatives. The region benefits from lower production costs and a dense network of original equipment manufacturers (OEMs) and associated supply chains, leading to high consumption rates of industrial-grade solutions for construction and consumer electronics coatings.

- North America: North America is a mature market characterized by stringent regulatory oversight (e.g., EPA regulations) and a dominant presence of high-specification industries, notably aerospace, defense, and high-end automotive manufacturing. Demand here is stable, emphasizing ultra-high quality and traceability, with significant consumption driven by the need for Mil-Spec compliant protective coatings on military and commercial aircraft. Investment is heavily focused on R&D for customized formulations suitable for advanced alloys and composite materials.

- Europe: Europe holds a crucial market position, largely propelled by the ambitious directives of REACH and the EU’s commitment to phasing out hazardous substances, which accelerated the adoption of Hexafluorozirconic Acid. Germany, France, and Italy are key consumer countries, supported by robust automotive and industrial machinery sectors. The European market leads in the adoption of sustainable application technologies and closed-loop chemical recycling systems, valuing environmental performance alongside coating efficiency.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in Brazil and Mexico, correlating directly with localized automotive assembly and industrial construction projects. Market penetration is gradually increasing as industrial standards improve, moving away from older, chromate-based technologies. Supply is often managed through specialized distributors linked to major US or European producers.

- Middle East and Africa (MEA): MEA presents specialized demand pockets, primarily in the petrochemical, construction, and nascent defense sectors. High demand for corrosion-resistant coatings is essential due to the severe environmental conditions (high temperatures and salinity) prevalent in the region. Growth is sporadic, depending heavily on large-scale infrastructure and industrial projects, and is largely focused on standard industrial-grade solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hexafluorozirconic Acid Solution Market.- The Chemours Company

- Solvay S.A.

- LANXESS AG

- Stella Chemifa Corporation

- Avantor Performance Materials, Inc.

- Merck KGaA

- Honeywell International Inc.

- Morita Chemical Industries Co., Ltd.

- Koura Global (part of the Mexichem group)

- Arkema Group

- PCC Group

- Alfa Aesar (part of Thermo Fisher Scientific)

- Noah Chemicals, Inc.

- Gelest Inc.

- Central Glass Co., Ltd.

- Fuji Film Wako Pure Chemical Corporation

- ICL Group Ltd.

- Triveni Interchem Pvt. Ltd.

- Shaanxi Top Metal Co., Ltd.

- Jiangsu Changjiu Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hexafluorozirconic Acid Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Hexafluorozirconic Acid Solution primarily used for?

It is predominantly used as a non-chromate alternative for metal surface pre-treatment, specifically creating corrosion-resistant conversion coatings on aluminum, magnesium, and other light metal alloys in the automotive and aerospace industries.

Which application segment is driving the highest growth in the market?

The high-purity (electronic grade) Hexafluorozirconic Acid segment is experiencing the highest growth rate, driven by the expanding global semiconductor and advanced electronics manufacturing sectors requiring ultra-low impurity chemical precursors.

What are the key substitutes for Hexafluorozirconic Acid in metal finishing?

Historically, the primary substitutes were chromate conversion coatings, which are being phased out. Current substitutes include certain titanium-based and silicate-based pre-treatment technologies, though they often exhibit different performance characteristics.

How do regulatory changes influence the market demand?

Strict global regulations, notably REACH in Europe and similar compliance measures worldwide, mandate the phase-out of toxic substances like chromates, forcing industrial users to adopt environmentally safer alternatives like Hexafluorozirconic Acid, which acts as a major market driver.

What are the primary logistical challenges for suppliers?

The main logistical challenges involve the safe and compliant handling, storage, and specialized transportation of the solution, which is classified as a hazardous material, and managing the cost volatility of key raw materials like Hydrofluoric Acid and Zirconium derivatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager