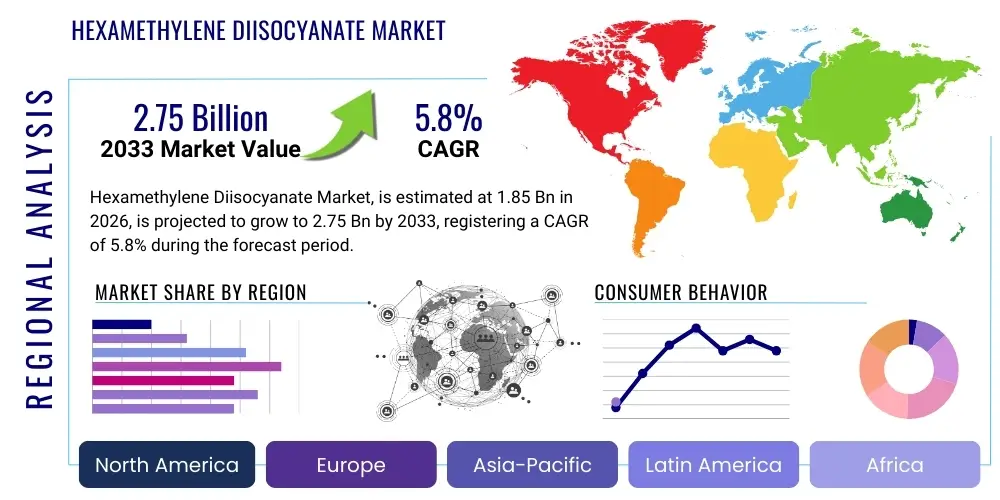

Hexamethylene Diisocyanate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441471 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hexamethylene Diisocyanate Market Size

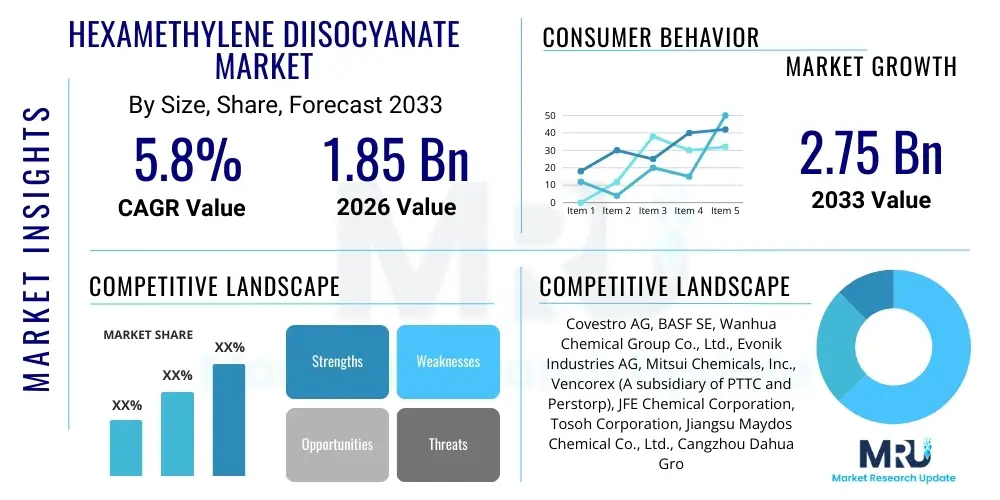

The Hexamethylene Diisocyanate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Hexamethylene Diisocyanate Market introduction

Hexamethylene Diisocyanate (HDI) is a crucial aliphatic diisocyanate monomer renowned for its exceptional light stability, weather resistance, and non-yellowing characteristics. Unlike aromatic isocyanates, HDI forms polyurethanes that maintain color integrity even when exposed to UV radiation, making it indispensable in high-performance coating applications. The primary production process involves phosgenation of hexamethylene diamine, yielding a versatile intermediate that is further processed into biurets and isocyanurates—the commercial forms primarily used in the market.

The product is predominantly utilized in the manufacturing of polyurethane coatings, elastomers, and adhesives, serving industries such as automotive, aerospace, construction, and wood finishing. Its key benefits include superior hardness, abrasion resistance, chemical resistance, and excellent gloss retention, features highly sought after in protective and decorative finishes. The growing global focus on sustainable and durable infrastructure, coupled with the expansion of the high-end automotive sector, significantly propels the demand for HDI-based derivatives, particularly those used in two-component (2K) polyurethane systems.

Major driving factors include the stringent regulatory environment promoting lower Volatile Organic Compound (VOC) content in coatings, where high-solids and waterborne HDI formulations offer compliant solutions. Furthermore, increasing urbanization in emerging economies fuels the construction sector, demanding robust protective coatings for architectural and structural elements. The ongoing material science advancements aimed at improving reaction efficiency and reducing environmental impact within the HDI synthesis process continue to secure its strategic position in the advanced materials market.

Hexamethylene Diisocyanate Market Executive Summary

The Hexamethylene Diisocyanate market is characterized by robust growth, primarily driven by expanding applications in high-performance protective coatings, especially within the automotive and aerospace maintenance sectors where durability and aesthetic retention are paramount. Key business trends indicate a concentrated effort by major producers to enhance capacity utilization and invest heavily in sustainable manufacturing processes, including the development of non-phosgene routes for HDI synthesis to address increasing environmental scrutiny. Strategic alliances and joint ventures aimed at securing raw material supply chains and expanding geographical reach, particularly into high-growth Asian markets, are defining the competitive landscape.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by rapid industrialization, burgeoning automotive production in China and India, and large-scale infrastructure projects requiring advanced coatings for corrosion protection. Europe and North America maintain significant market shares, characterized by a mature regulatory framework that favors high-solids and low-VOC compliant HDI derivatives, leading to continuous innovation in formulation chemistry. The regional dynamics are heavily influenced by local automotive production cycles and the housing and construction recovery rates, positioning APAC as the primary hub for both production expansion and consumption growth.

In terms of segment trends, the biuret derivative segment holds the largest share due to its established use in general industrial coatings, offering excellent handling properties and cost-effectiveness. However, the isocyanurate trimer segment is exhibiting the fastest growth rate, fueled by demand for high-performance, weather-resistant clear coats and finishes in high-end exterior applications, requiring superior cross-linking density and longevity. Furthermore, the application shift toward waterborne and powder coatings, away from traditional solvent-borne systems, is forcing manufacturers to innovate HDI derivatives suitable for these eco-friendlier formulations, driving segmentation evolution towards specialized prepolymers and polyisocyanates.

AI Impact Analysis on Hexamethylene Diisocyanate Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Hexamethylene Diisocyanate (HDI) market frequently center on three main themes: optimizing production processes, enhancing supply chain resilience, and accelerating materials discovery for next-generation polyurethanes. Users are keen to understand how AI-driven predictive maintenance can reduce operational downtime in phosgenation plants, a critical concern given the hazardous nature of raw material handling. Furthermore, there is significant interest in using machine learning (ML) models to forecast demand fluctuations across diverse end-user industries (automotive, construction), thereby minimizing inventory costs and improving the notoriously complex global logistics of diisocyanates. Expectations also highlight AI’s role in computational chemistry, speeding up the screening of novel polyols and curative agents that react optimally with HDI to create coatings with enhanced functionality.

- AI optimizes phosgenation reactor efficiency by monitoring real-time pressure, temperature, and flow dynamics, minimizing yield variability.

- Machine learning algorithms enhance predictive maintenance schedules for critical production equipment, reducing unplanned downtime and associated costs.

- AI-driven supply chain platforms improve inventory management and demand forecasting for HDI precursors (hexamethylene diamine), stabilizing procurement strategies.

- Computational chemistry accelerates the discovery of novel HDI-based prepolymers, optimizing formulations for low-VOC and waterborne coating systems.

- AI tools assist in quality control by analyzing spectroscopic data and ensuring the purity standards of HDI monomer and its polyisocyanate derivatives.

DRO & Impact Forces Of Hexamethylene Diisocyanate Market

The Hexamethylene Diisocyanate market is governed by a dynamic interplay of growth drivers, regulatory constraints, and emerging opportunities, collectively shaping its impact forces. The primary driver is the escalating global demand for durable and aesthetically superior surface finishes, especially in the premium automotive aftermarket and robust industrial flooring applications where HDI's non-yellowing property is non-negotiable. Conversely, the market faces significant restraints, chiefly the toxicity concerns associated with isocyanate handling and the volatility of key raw material prices, particularly phosgene and hexamethylene diamine, which introduce operational and financial risk into the production cycle. Opportunities are heavily concentrated around sustainability, including the commercialization of bio-based HDI alternatives and the development of waterborne HDI systems that meet increasingly stringent environmental regulations.

Key impact forces include the increasing global shift toward sustainable chemistry and green building initiatives, which directly favor low-VOC, high-solids, and powder coating formulations utilizing HDI derivatives. Regulatory actions, such as stricter occupational exposure limits and substance restrictions in regions like the EU (REACH), exert considerable pressure, mandating continuous innovation towards safer handling and application methods. Furthermore, the cyclical nature of the construction and automotive industries significantly impacts demand, as HDI is a key input for both new production and maintenance coatings. The rapid capacity expansion by Chinese manufacturers introduces intense pricing competition, acting as a crucial balancing force on market revenues.

Technological advancement represents a critical opportunity, specifically the development of non-phosgene manufacturing routes for HDI, which would fundamentally alter the cost structure, environmental risk profile, and competitive dynamics of the market. The persistent need for high-performance protective layers in energy infrastructure (wind turbines, pipelines) and specialized aerospace applications further ensures sustained demand. Addressing the long-term environmental liability associated with traditional HDI production while capitalizing on new functional coating requirements (e.g., anti-graffiti, self-healing) are pivotal strategies for maximizing market potential over the forecast period.

Segmentation Analysis

The Hexamethylene Diisocyanate market is comprehensively segmented based on its derivative type, application method, and end-use industry, reflecting the specialized requirements of the polyurethanes sector. Derivative types—primarily biurets, isocyanurates, and prepolymers—determine the specific properties (viscosity, cross-link density, drying time) of the final polyurethane product, directly influencing their suitability for different coating systems. Application methods segment the market based on formulation types, such as solvent-borne, waterborne, and powder coatings, illustrating the industry’s trajectory toward high-solids and environmentally compliant systems. This detailed segmentation allows producers to tailor their HDI offerings to meet the precise technical specifications required by distinct industrial users, ensuring optimized performance across diverse operational environments.

- By Derivative Type:

- HDI Biurets

- HDI Isocyanurates (Trimers)

- HDI Prepolymers

- Others (e.g., Uretdiones)

- By Application Method:

- Solvent-Borne Coatings

- Waterborne Coatings

- Powder Coatings

- Radiation-Curable Coatings

- By End-Use Industry:

- Automotive & Transportation (OEM and Refinish)

- Construction & Architecture (Industrial Flooring, Roof Coatings)

- Wood & Furniture Coatings

- Aerospace

- Industrial Maintenance & Protective Coatings (IMPC)

- Others (e.g., Adhesives, Sealants, Elastomers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hexamethylene Diisocyanate Market

The value chain for the Hexamethylene Diisocyanate market is complex, beginning with the highly integrated upstream segment involving the production of key precursors. Upstream activities primarily focus on the manufacturing of Hexamethylene Diamine (HDA) from adiponitrile, alongside the highly specialized production of phosgene gas, a hazardous but essential reagent. Control over these upstream inputs is crucial as the cost and purity of HDA and the safe handling of phosgene significantly influence the final cost of the HDI monomer. Major global chemical players often maintain captive production of these precursors to ensure supply stability and cost control.

Midstream activities involve the phosgenation reaction to produce crude HDI, followed by extensive purification, distillation, and subsequent conversion into high-performance polyisocyanate derivatives such as biurets and isocyanurates. This stage is characterized by high capital expenditure and stringent safety requirements. The distribution channel is bifurcated into direct sales to large, specialized coatings manufacturers (Bayer/Covestro, BASF) and indirect sales through specialized chemical distributors who manage smaller volumes and regional deliveries. Given the nature of HDI (moisture sensitivity, toxicity), specialized logistics and cold-chain management are often required.

The downstream market comprises various end-use applications, with coatings manufacturers utilizing the polyisocyanates to formulate two-component (2K) polyurethane systems. Direct distribution dominates for large-volume purchases by major automotive OEM coaters and industrial maintenance firms, facilitating technical support and bulk delivery. Indirect channels leverage regional distributors to reach smaller paint manufacturers, specialized applicators, and contractors in the construction and wood finishing sectors. Effective technical collaboration throughout the chain, from monomer synthesis to final coating application, is vital for product success and market penetration, particularly in highly regulated industries like aerospace.

Hexamethylene Diisocyanate Market Potential Customers

The primary customers for Hexamethylene Diisocyanate and its derivatives are manufacturers of high-performance coatings, adhesives, sealants, and elastomers, who utilize HDI for its superior aliphatic properties. Specifically, the automotive original equipment manufacturers (OEMs) and the vast automotive refinish sector represent critical buyer groups, demanding HDI-based clear coats and topcoats that offer exceptional gloss retention, resistance to chemicals (fuel, road salt), and non-yellowing performance under harsh UV exposure. These buyers focus heavily on product consistency, supply security, and compliance with global environmental standards regarding VOC emissions.

Another significant segment of buyers includes large industrial maintenance and protective coating (IMPC) companies serving infrastructure, oil and gas, and energy sectors. These buyers require polyurethanes formulated with HDI for extreme durability, corrosion protection, and abrasion resistance in harsh environments, such as marine vessels, offshore platforms, and industrial flooring. Furthermore, manufacturers in the wood and furniture industry purchase HDI derivatives for high-end lacquers and finishes that must withstand wear, cleaning agents, and provide a lasting aesthetic appeal, increasingly favoring waterborne HDI dispersions to comply with indoor air quality regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Evonik Industries AG, Mitsui Chemicals, Inc., Vencorex (A subsidiary of PTTC and Perstorp), JFE Chemical Corporation, Tosoh Corporation, Jiangsu Maydos Chemical Co., Ltd., Cangzhou Dahua Group Co., Ltd. (CDH), Chem-Station Co., Ltd., Hangzhou Dayang Chemical Co., Ltd., Fuxin Chemical Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Gochem Co., Ltd., Dalian Richon Chemical Co., Ltd., Hubei Jusheng Technology Co., Ltd., Zhejiang Sanhe Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hexamethylene Diisocyanate Market Key Technology Landscape

The technology landscape for the Hexamethylene Diisocyanate market is defined by continuous process optimization and innovation focused on safety, efficiency, and environmental sustainability. The conventional manufacturing method, based on the phosgenation of hexamethylene diamine, remains dominant. However, recent technological advancements emphasize process intensification, specifically in reaction kinetics and product purification, utilizing advanced distillation columns and proprietary catalyst systems to enhance yield and reduce energy consumption. Significant R&D efforts are channeled into achieving ultra-low residual monomer content in polyisocyanate derivatives, crucial for meeting stricter health and safety standards in coating applications.

A burgeoning technological shift involves the exploration and scaling up of non-phosgene (NP) routes for HDI synthesis. The NP route, often utilizing Urethane (or carbamate) intermediates, seeks to eliminate the highly hazardous phosgene step, thereby lowering operational risk and reducing the capital intensity associated with stringent safety infrastructure. While the traditional phosgene route currently offers superior cost-effectiveness and scale, advancements in NP technology, driven by sustainability goals and regulatory pressure, are expected to improve the feasibility and competitiveness of these alternative processes over the forecast period, potentially reshaping the competitive structure.

Furthermore, technology development is also concentrated downstream in application chemistry. This includes creating specialized HDI derivatives suitable for high-solids, 100% solids, and waterborne polyurethane dispersions (PUDs). Innovations focus on developing prepolymers with lower viscosity and higher functionality to facilitate easier application and faster curing times, essential for efficiency gains in the automotive refinish and industrial maintenance markets. Advances in particle morphology and stabilization techniques are critical for producing stable, high-performance HDI-based waterborne coatings that rival the performance of traditional solvent-borne systems, addressing both durability and environmental compliance requirements simultaneously.

Regional Highlights

The regional dynamics of the HDI market are highly diversified, reflecting varying industrial growth rates, regulatory frameworks, and automotive production trends. Asia Pacific (APAC) commands the largest market share and is projected to exhibit the fastest growth, primarily fueled by massive infrastructure development in China and India, coupled with expanding automotive manufacturing and subsequent demand for protective and decorative coatings. Rapid urbanization across Southeast Asia drives significant consumption of HDI derivatives in construction and architectural protective coatings, necessitating local manufacturing capacity expansion.

Europe represents a mature yet highly valuable market, distinguished by its stringent environmental regulations, particularly concerning VOC emissions and REACH compliance. This forces continuous market innovation toward waterborne HDI dispersions and high-solids formulations. The European automotive sector, especially premium manufacturers, drives steady demand for high-quality, non-yellowing finishes. North America follows a similar trajectory, with strong demand from the aerospace and high-end industrial maintenance sectors, prioritizing performance and regulatory compliance, leading to high adoption rates of advanced HDI isocyanurates.

- Asia Pacific (APAC): Dominates consumption and growth, driven by China and India's automotive and construction sectors. Focus on capacity expansion and infrastructure coating demand.

- Europe: Characterized by high regulatory standards (REACH), driving demand for sustainable, low-VOC HDI solutions (waterborne and powder coatings). Steady growth linked to high-end automotive refinish and industrial applications.

- North America: Stable market supported by aerospace coatings, robust industrial maintenance spending, and strict adherence to environmental protection agency (EPA) standards. Focus on specialized, high-performance prepolymers.

- Latin America (LATAM): Emerging market showing potential, tied to recovery in regional automotive production (Brazil, Mexico) and increasing foreign investment in infrastructure projects.

- Middle East and Africa (MEA): Growth driven by oil & gas infrastructure protection (anti-corrosion coatings) and large construction projects (Saudi Arabia, UAE), demanding weather-resistant, durable finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hexamethylene Diisocyanate Market.- Covestro AG

- BASF SE

- Wanhua Chemical Group Co., Ltd.

- Evonik Industries AG

- Mitsui Chemicals, Inc.

- Vencorex (A subsidiary of PTTC and Perstorp)

- JFE Chemical Corporation

- Tosoh Corporation

- Jiangsu Maydos Chemical Co., Ltd.

- Cangzhou Dahua Group Co., Ltd. (CDH)

- Chem-Station Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Fuxin Chemical Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Gochem Co., Ltd.

- Dalian Richon Chemical Co., Ltd.

- Hubei Jusheng Technology Co., Ltd.

- Zhejiang Sanhe Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hexamethylene Diisocyanate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Hexamethylene Diisocyanate (HDI) over other common isocyanates?

HDI is an aliphatic diisocyanate known for superior UV stability and non-yellowing characteristics, making it essential for high-quality exterior coatings (clear coats and topcoats) where color retention and weather resistance are critical, unlike aromatic alternatives like TDI or MDI.

Which application method segments show the highest growth potential for HDI consumption?

The highest growth potential lies within waterborne and powder coating formulations. These high-performance systems utilize HDI derivatives (such as PUDs and crosslinkers) to comply with increasingly strict global regulations aimed at reducing Volatile Organic Compound (VOC) emissions.

What regulatory challenges significantly impact the HDI market?

The primary challenges involve stringent occupational safety regulations (e.g., EU REACH) concerning the handling and exposure limits of diisocyanates, necessitating advanced ventilation, personal protective equipment, and continuous innovation toward derivatives with lower vapor pressure.

How is sustainability affecting the production technology of Hexamethylene Diisocyanate?

Sustainability drives significant investment in non-phosgene (NP) manufacturing routes, aiming to eliminate the use of hazardous phosgene gas in the synthesis process. Additionally, there is growing research into developing bio-based or renewable feedstocks to replace petrochemical-derived hexamethylene diamine.

Which end-use industry is the largest consumer of HDI derivatives globally?

The Automotive & Transportation industry, particularly the automotive refinish (aftermarket) and OEM clear coat segments, constitutes the largest consumer base due to the non-negotiable requirement for high-durability, scratch-resistant, and aesthetically stable protective finishes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager