High Heels Footwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442133 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

High Heels Footwear Market Size

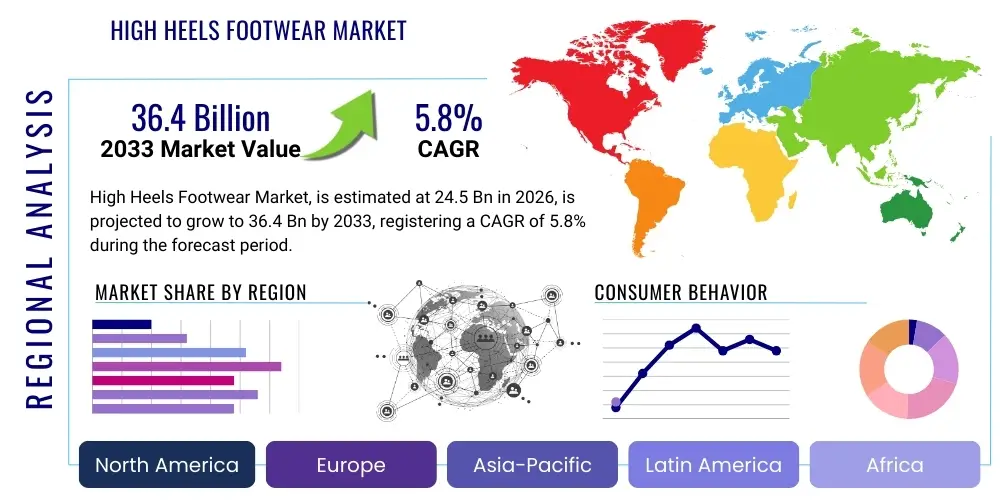

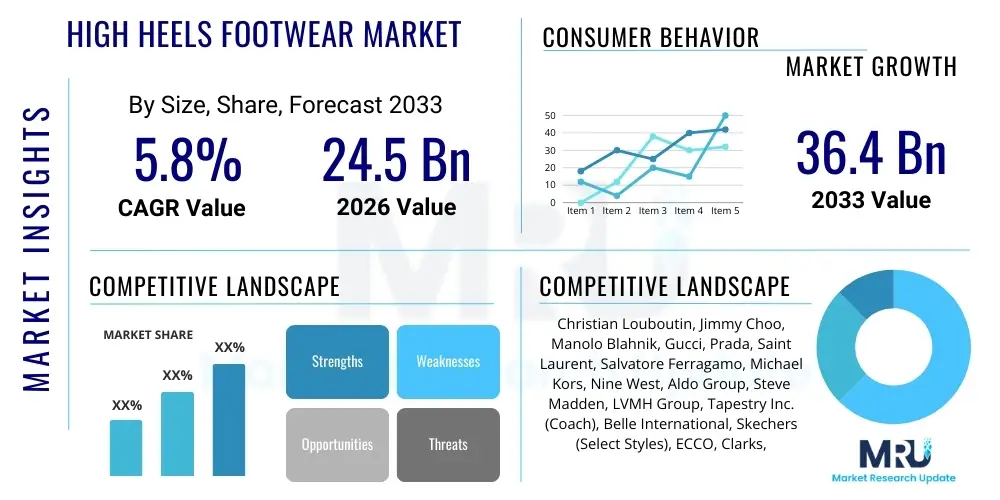

The High Heels Footwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $36.4 Billion by the end of the forecast period in 2033.

High Heels Footwear Market introduction

The High Heels Footwear Market encompasses the production, distribution, and sale of shoes designed to elevate the heel significantly higher than the toe. This segment of the global footwear industry is driven primarily by evolving fashion trends, increasing consumer expenditure on luxury and branded apparel, and the widespread adoption of Western dress codes in emerging economies. High heels, which include product types such as stilettos, pumps, wedge heels, and block heels, serve diverse applications ranging from formal business wear and wedding events to casual social gatherings and high-fashion runway shows. The market’s resilience is rooted in its continuous innovation regarding material science, focusing increasingly on enhanced comfort technologies and ergonomic designs that mitigate traditional health concerns associated with high-heel use.

A major catalyst for market expansion is the growing influence of social media and celebrity endorsements, which rapidly disseminate new styles and drive fast fashion cycles. E-commerce platforms have also revolutionized distribution, offering consumers unparalleled access to a vast array of styles, colors, and sizes from global brands, thereby overcoming geographical barriers. Furthermore, the rising participation of women in the professional workforce across developing regions contributes significantly to the demand for formal and semi-formal high-heeled footwear, establishing it as a staple accessory for professional presentation and corporate environments. Brands are heavily investing in marketing strategies that link high heels to confidence, empowerment, and style quotient, appealing directly to the psychological benefits sought by consumers.

The primary benefit derived from high heels is aesthetic enhancement, including creating an illusion of longer legs and contributing to a more formal or fashionable silhouette. Major driving factors include global fashion weeks dictating seasonal trends, the increasing disposable income of middle-class populations, and technological advancements allowing for lighter, more durable, and sustainably sourced materials. However, manufacturers must constantly navigate the complex trade-off between style and ergonomic requirements, leading to significant R&D efforts focused on incorporating specialized padding, arch supports, and adjustable mechanisms within the footwear structure to improve overall wearability and reduce potential musculoskeletal issues associated with prolonged use.

High Heels Footwear Market Executive Summary

The global High Heels Footwear Market is characterized by robust business trends emphasizing personalization, speed-to-market, and sustainability. Key business trends include the vertical integration of supply chains by major brands to ensure traceability of materials and rapid response to shifting consumer demands, particularly in luxury and high-fashion segments where counterfeiting remains a significant challenge. Furthermore, the proliferation of direct-to-consumer (DTC) models, often leveraging robust digital platforms and virtual fitting technology, is streamlining sales processes, reducing inventory risks, and allowing brands to gather crucial customer data for hyper-targeted product development and marketing campaigns. Collaborative partnerships between footwear designers and orthopedic specialists are also becoming increasingly common, reflecting a strategic pivot toward 'comfort luxury' that marries sophisticated aesthetics with ergonomic function.

Regionally, the market dynamics exhibit distinct variations. North America and Europe currently represent mature markets, dominating in terms of established brands, high average selling prices, and advanced technology adoption, particularly in material research and retail personalization. These regions are also spearheading the trend toward ethical sourcing and sustainable production, influenced by stringent consumer expectations and regulatory frameworks. Conversely, the Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by substantial urbanization, the burgeoning aspirational middle class, and the rapid expansion of organized retail and e-commerce infrastructure, especially in countries like China and India, where Western fashion influence is rapidly escalating. Latin America and the Middle East and Africa (MEA) present niche opportunities, particularly for luxury brands targeting high-net-worth individuals and culturally relevant designs.

In terms of segment trends, the market is witnessing significant shifts driven by end-user preferences. While stilettos and traditional pumps maintain their status in the formal wear category, the medium-heel height segment (2 to 3.5 inches) is experiencing accelerated growth, driven by consumers seeking versatile footwear suitable for both office and casual settings. Material segmentation highlights a sustained preference for genuine leather in premium categories due to its durability and aesthetic appeal, though the rapid advancement and increasing quality of vegan leather and innovative synthetic materials are significantly challenging this dominance, especially amongst environmentally conscious younger generations. The online distribution channel continues to outperform brick-and-mortar sales growth, largely attributed to enhanced digital marketing capabilities, streamlined returns policies, and the convenience offered by personalized sizing recommendations facilitated by AI tools.

AI Impact Analysis on High Heels Footwear Market

User inquiries concerning AI's influence in the High Heels Footwear Market frequently revolve around personalization, efficiency, and predictive styling. Key themes emerging from common questions include how AI algorithms can predict future fashion trends, thus optimizing inventory and reducing waste; the feasibility and accuracy of virtual try-on technology to mitigate high return rates associated with online purchases; and the capacity of AI-driven design tools to create customized, comfortable high-heel geometries tailored precisely to individual foot biomechanics. Users also express strong expectations regarding AI's role in ethical sourcing and supply chain transparency, wanting to know if technology can reliably track materials from origin to retail and verify sustainable labor practices. Concerns often center on data privacy regarding detailed biometric scans necessary for custom fitting and the potential homogenization of design if algorithms become overly prescriptive, stifling creative diversity.

AI's primary impact across the design and manufacturing spectrum is efficiency enhancement. Generative AI tools are being deployed to rapidly iterate on design possibilities, allowing brands to test hundreds of design variations based on real-time market data and social media sentiment analysis, significantly cutting down the traditional product development lifecycle. This capability ensures that new collections are highly relevant and responsive to micro-trends, enabling true fast-fashion response times without compromising quality control. Furthermore, sophisticated machine learning models are optimizing raw material cutting patterns and assembly line processes, leading to reduced material wastage, lower production costs, and greater overall throughput, which is crucial for maintaining competitive pricing in a highly saturated market.

Crucially, AI is transforming the consumer experience both in physical retail and e-commerce environments. Virtual try-on applications, often integrated with augmented reality (AR), allow consumers to visualize how different high heel styles appear on their feet before purchasing, addressing one of the major pain points of online footwear shopping—sizing and fit uncertainty. Beyond visualization, predictive analytics are leveraged to offer highly personalized style recommendations based on purchase history, browsing behavior, and even local weather and event calendars. This level of granular customization not only enhances customer satisfaction and loyalty but also increases the average transaction value by promoting complementary accessories or premium product lines that align precisely with individual aesthetic profiles.

- AI-driven trend forecasting minimizes inventory risk and optimizes style relevance.

- Generative design algorithms facilitate rapid prototyping and mass customization based on biometric data.

- Augmented Reality (AR) and Virtual Try-On (VTO) tools reduce return rates by improving fit accuracy online.

- Machine learning optimizes supply chain logistics, improving transparency and verifying sustainability claims.

- Personalized marketing and recommendation engines enhance customer engagement and drive conversion rates.

DRO & Impact Forces Of High Heels Footwear Market

The High Heels Footwear Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core impact forces shaping its trajectory. The dominant drivers stem from global socio-cultural shifts, particularly the rising societal emphasis on aesthetic presentation and the continued growth of celebratory events and formal occasions worldwide, which necessitate specific types of footwear. Restraints predominantly center on physiological and ethical concerns, including mounting consumer awareness of the potential health issues—such as musculoskeletal strain and chronic foot pain—associated with high heels, alongside growing pressure for ethical sourcing and sustainable production practices, which can increase manufacturing costs and complexity. Opportunities reside significantly in technological innovation, specifically the development of comfort-focused materials, smart footwear features for health monitoring, and personalized manufacturing processes like 3D printing that promise bespoke comfort solutions and unique designs.

A primary market driver is the sustained growth in female workforce participation globally, particularly in professional environments where formal attire often includes high-heeled shoes, creating a steady demand for elegant and durable designs. Simultaneously, the relentless cycle of global fashion trends, amplified by fast digital consumption and influencer culture, constantly encourages replacement purchases and experimental styling, maintaining market vibrancy. However, these drivers are counterbalanced by powerful restraints. The increasing adoption of athletic and casual footwear (athleisure) for everyday use represents a significant substitution threat, as consumers prioritize all-day comfort over traditional aesthetics. Furthermore, stringent regulatory standards in mature markets concerning material toxicity (e.g., REACH regulations in Europe) and fair labor practices necessitate higher compliance costs, posing a barrier to entry for smaller manufacturers and constraining operational flexibility for established firms.

The forward-looking opportunities for the high heels segment are profoundly linked to material science breakthroughs and digital integration. Developing advanced cushioning systems using aerospace or biomedical material technology allows brands to directly address the primary restraint of discomfort, transforming the perceived utility of high heels. Moreover, integrating NFC chips or sensor technology into high heels could open lucrative opportunities in the burgeoning smart wearables market, offering features like step counting, posture analysis, or temperature regulation. Strategic investments in localized, on-demand manufacturing using 3D printing technologies further minimize production lead times and inventory holding costs, providing an agile response mechanism that capitalizes on volatile fashion cycles and caters specifically to the growing demand for customization, mitigating environmental concerns associated with overproduction.

Segmentation Analysis

The High Heels Footwear Market is highly diversified and segmented across multiple dimensions to cater to the varied needs and purchasing power of a global consumer base. Key segmentation is primarily based on Product Type, distinguishing between formal styles like stilettos and pumps, versatile designs like wedges and block heels, and specialized segments such as platform heels and kitten heels. Further critical segmentation is derived from Material, where traditional preferences for leather and suede are increasingly challenged by innovative synthetic, textile, and vegan leather alternatives, driven by cost-efficiency and sustainability mandates. Analyzing the market by End-User reveals distinct purchasing patterns between women (the primary market) and specialized demographic groups requiring tailored products. Lastly, the Distribution Channel segmentation, spanning across offline retail (department stores, specialty stores) and online platforms (e-commerce portals, brand websites), dictates pricing strategies and logistical requirements across different regions.

- Product Type: Stilettos, Pumps, Wedges, Block Heels, Platforms, Kitten Heels, Others.

- Material: Leather, Synthetic, Textile, Suede, Patent Leather, Vegan/Sustainable Materials.

- End-User: Women (Major Segment), Specialized Groups (e.g., transgender consumers, performers).

- Distribution Channel: Online Retail (E-commerce Platforms, Brand Websites), Offline Retail (Specialty Stores, Department Stores, Discount Stores).

- Heel Height: Low (Below 2 inches), Medium (2 to 3.5 inches), High (Above 3.5 inches).

Value Chain Analysis For High Heels Footwear Market

The value chain for the High Heels Footwear Market begins with the highly complex upstream analysis involving the sourcing and processing of diverse raw materials. This stage is critical as the quality of materials—ranging from premium leathers and high-grade synthetic polymers to specialized cushioning foams and durable sole compounds—directly impacts the final product's comfort, longevity, and price point. Key upstream suppliers include tanneries, chemical companies providing specialized adhesives and finishes, and textile manufacturers. Increasing ethical and environmental scrutiny mandates rigorous verification of material provenance, leading many high-end brands to vertically integrate or establish long-term, audited supplier relationships to ensure compliance with sustainability standards and anti-slavery laws. The cost efficiency and quality control achieved in the upstream phase are foundational to maintaining competitive margins downstream.

The midstream segment involves manufacturing, which is rapidly evolving through technology adoption. Traditional labor-intensive craftsmanship is being supplemented by computer-aided design (CAD), precision cutting machines, and automated assembly processes, particularly for high-volume, standardized models. However, specialized or luxury designs still heavily rely on skilled artisans for intricate detailing and complex assembly, maintaining a blend of technology and handwork. Downstream analysis focuses on effective market penetration, primarily driven by distribution and retail. The distribution channels are bifurcated between direct sales via owned boutiques and e-commerce platforms, offering higher control over brand experience and margins, and indirect sales through multi-brand retailers, department stores, and independent distributors, which offer wider market access and geographic reach.

Crucially, the rise of e-commerce has significantly shortened the value chain for many manufacturers, allowing for a more direct relationship with the end consumer. This direct approach enables brands to gather immediate feedback, optimize inventory management in real-time, and significantly reduce reliance on intermediary markups, thereby enhancing profitability. Effective distribution relies heavily on sophisticated logistics networks capable of handling global shipping and managing high return rates common in footwear e-commerce. Furthermore, the value chain extends into after-sales services, including repair, customization, and increasingly, circularity programs (resale and recycling initiatives), which enhance brand loyalty and address consumer demand for sustainable product lifecycle management, positioning high heels not just as a commodity, but as a long-term investment.

High Heels Footwear Market Potential Customers

The core customer base for High Heels Footwear remains women aged 18 to 45, encompassing significant segments within Millennials and Generation Z, who purchase these products for a wide variety of occasions. Potential customers are broadly segmented by usage intent: the professional segment requires comfortable yet formal pumps or medium-height block heels for office environments, prioritizing durability and subtle styling. In contrast, the social and celebratory segment seeks high-fashion, high-impact styles such as stilettos and designer platforms for weddings, parties, and evening events, where aesthetic appeal and trend alignment outweigh day-to-day comfort concerns. These distinct segments necessitate a differentiated product portfolio focusing on either ergonomic innovation or purely fashion-forward design elements.

A rapidly expanding segment of potential customers includes aspirational buyers in emerging markets, whose purchasing decisions are highly influenced by brand visibility, perceived status, and the democratization of luxury through social media. For these consumers, high heels serve as a status symbol and an accessible entry point into luxury fashion, driving strong demand for mid-range and premium brands. Furthermore, specialized niches, such as individuals within the entertainment industry, dancers, models, and individuals seeking custom footwear solutions due to unique physical requirements or specialized styling needs, represent high-value potential customers who often prioritize bespoke craftsmanship and specialized features, tolerating higher price points for personalized comfort and unique aesthetics.

Customer acquisition strategies must also address the growing cohort of consumers driven by ethical consumption. These buyers seek high heels made from certified sustainable materials (e.g., recycled rubber, organic cotton, chrome-free leather alternatives) and manufactured under fair labor conditions. Brands that provide transparent supply chain narratives and measurable commitments to reducing their environmental footprint are increasingly successful in capturing this high-intent, value-driven customer segment. Understanding the shift in purchasing drivers—from purely aesthetic appeal to a balance of style, comfort, and ethical provenance—is crucial for mapping the future trajectory of marketing and product development targeted at discerning end-users and buyers of high-heel products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $36.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Christian Louboutin, Jimmy Choo, Manolo Blahnik, Gucci, Prada, Saint Laurent, Salvatore Ferragamo, Michael Kors, Nine West, Aldo Group, Steve Madden, LVMH Group, Tapestry Inc. (Coach), Belle International, Skechers (Select Styles), ECCO, Clarks, ZARA (Inditex), ASOS Design, H&M. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Heels Footwear Market Key Technology Landscape

The technological landscape in the High Heels Footwear Market is rapidly being redefined by advancements aimed primarily at improving comfort, fit accuracy, and manufacturing efficiency. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems are foundational, allowing designers to create complex shoe geometries and ensure precision in material cutting and assembly, minimizing errors that can impact fit. More recent developments focus heavily on three-dimensional (3D) scanning and printing technologies. 3D scanning allows for precise capture of individual foot morphology, providing the necessary data for creating truly custom-fitted insoles and shoe lasts, thereby directly addressing the chronic discomfort issues associated with mass-produced high heels. This technology is particularly transformative for bespoke luxury brands and medical footwear providers.

Material science innovation constitutes another critical technological area. Research and development efforts are concentrated on creating advanced shock-absorption systems and pressure-distributing gels and foams. Utilizing viscoelastic materials originally developed for athletic footwear or aerospace applications, manufacturers are now integrating these technologies into high heel insoles and midsoles, providing enhanced cushioning without compromising the shoe's structural integrity or silhouette. Furthermore, the shift toward sustainable and smart materials includes the development of self-cleaning or water-resistant coatings, and bio-based polymers that replicate the feel and durability of traditional leather while satisfying eco-conscious consumer demand and complying with increasingly strict chemical regulations.

Finally, the operational efficiency of the market is being bolstered by digital supply chain technologies. Implementation of RFID tags and Internet of Things (IoT) sensors throughout the manufacturing and inventory process allows for real-time tracking of components and finished goods, drastically improving logistics and reducing losses due to counterfeiting or misplacement. Retail technology, including AI-powered sizing applications and augmented reality mirrors, leverages sophisticated algorithms to predict the optimal size and style for a customer based on minimal input, digitizing the fitting experience and making online purchasing significantly more reliable. These technologies collectively drive the market towards greater customization, reduced waste, and a superior, data-informed customer journey.

Regional Highlights

The regional analysis reveals differential growth rates and market maturity levels influenced by economic stability, cultural consumption patterns, and local fashion industry strength. North America, specifically the United States, represents a highly competitive and mature market characterized by high consumer spending power and a rapid adoption of digital retail technologies, driving growth particularly in the premium and comfort-focused segments. European markets, led by Italy, France, and the UK, maintain global leadership in luxury high heels due to the concentration of heritage luxury brands and excellence in artisanal craftsmanship, with current growth being driven by sustainable luxury and bespoke services. Asia Pacific (APAC) is the engine of future expansion, benefiting from surging disposable incomes, rapid urbanization, and a growing adoption of Western fashion, particularly in populous countries such as China and India, where localized e-commerce strategies are key to unlocking mass market potential.

Latin America presents a market with significant potential but higher economic volatility. Brazil and Mexico are the primary markets, demonstrating strong internal manufacturing capabilities and consumer preference for vibrant, trend-driven designs. The market structure often favors local brands and designs that are adapted to regional climate and cultural requirements, although international brands are increasingly penetrating through flagship stores in major metropolitan areas. This region’s growth trajectory is dependent on stabilizing macroeconomic conditions and improved retail infrastructure.

The Middle East and Africa (MEA) region, while disparate, shows strong demand for high-end luxury high heels, driven largely by high-net-worth individuals in the Gulf Cooperation Council (GCC) countries. Consumption here is less sensitive to economic downturns and is characterized by a high demand for exclusive, heavily embellished, and culturally appropriate designs suitable for significant social events and religious observances. Africa's market remains highly fragmented, with emerging opportunities in fashion hubs like South Africa and Nigeria, where local designers are starting to compete with international imports, emphasizing customized and culturally unique high-heel creations.

- North America: Market maturity, strong e-commerce penetration, focus on comfort technology and athleleisure influence, major growth in medium heel segments.

- Europe: Dominance in luxury and heritage brands, strong emphasis on sustainability and ethical sourcing, stringent material regulations, robust bespoke services in high-end segments.

- Asia Pacific (APAC): Highest projected growth rate driven by urbanization and rising middle class; massive potential in e-commerce and fast-fashion high heels; manufacturing hub concentration.

- Latin America: Potential growth constrained by economic volatility; regional preference for colorful, bold designs; strong local manufacturing bases in countries like Brazil.

- Middle East and Africa (MEA): High demand for ultra-luxury and exclusive designer footwear in the GCC region; emerging modern retail infrastructure driving branded sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Heels Footwear Market.- Christian Louboutin

- Jimmy Choo (Capri Holdings)

- Manolo Blahnik

- Gucci (Kering Group)

- Prada S.p.A.

- Saint Laurent (Kering Group)

- Salvatore Ferragamo

- Michael Kors (Capri Holdings)

- Aldo Group

- Steve Madden

- LVMH Moët Hennessy Louis Vuitton SE

- Tapestry Inc. (Coach, Kate Spade)

- Belle International Holdings Ltd.

- Skechers U.S.A., Inc. (Select Styles)

- ECCO Sko A/S

- Clarks International

- Nine West (Sycamore Partners)

- Zara (Inditex S.A.)

- ASOS Design

- Bata Corporation

Frequently Asked Questions

Analyze common user questions about the High Heels Footwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the sustainable high heels segment?

The growth of sustainable high heels is primarily driven by increasing consumer awareness regarding environmental and ethical sourcing issues, particularly among Gen Z and Millennials. Brands are responding by utilizing recycled materials, bio-based polymers, and certified vegan leathers, offering products with verified supply chain transparency to meet this demand.

How is technology addressing the comfort issues associated with high heels?

Technology addresses comfort through two main avenues: material innovation (using advanced cushioning, shock-absorbing materials developed in sports science) and personalization (utilizing 3D scanning and printing to create custom insoles and footwear geometries that perfectly match the individual wearer's foot biomechanics, distributing pressure more evenly).

Which distribution channel is expected to dominate the high heels market in the forecast period?

Online retail, particularly through specialized brand websites and major e-commerce platforms, is projected to dominate the growth trajectory. The convenience of browsing extensive inventory, coupled with advancements in virtual try-on technology and improved logistics for returns, is accelerating the shift away from traditional brick-and-mortar sales for standardized products.

What are the primary restraints impacting market expansion for high heels?

The main restraints include pervasive consumer concerns about the long-term health implications (foot and back injuries) associated with frequent high heel wear, coupled with the rising popularity and functional substitution offered by comfortable athletic and athleisure footwear for daily activities.

Where do luxury brands focus their marketing efforts in the high heels market?

Luxury high heel brands primarily focus their marketing efforts on exclusivity, craftsmanship, and status affirmation. Strategies heavily involve high-fashion collaborations, limited-edition releases, personalized shopping experiences in flagship stores, and targeted digital campaigns leveraging influential celebrities and high-net-worth customer data to maintain premium positioning and brand desirability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager