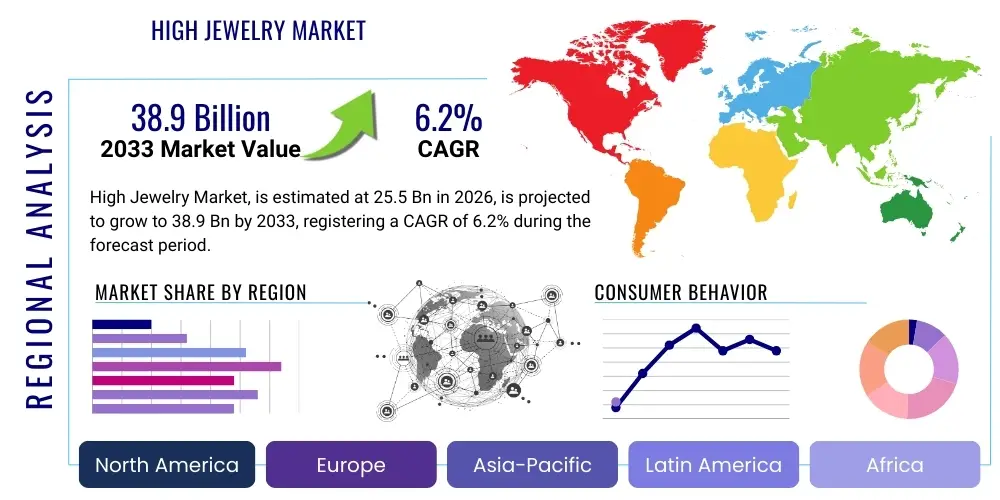

High Jewelry Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441433 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

High Jewelry Market Size

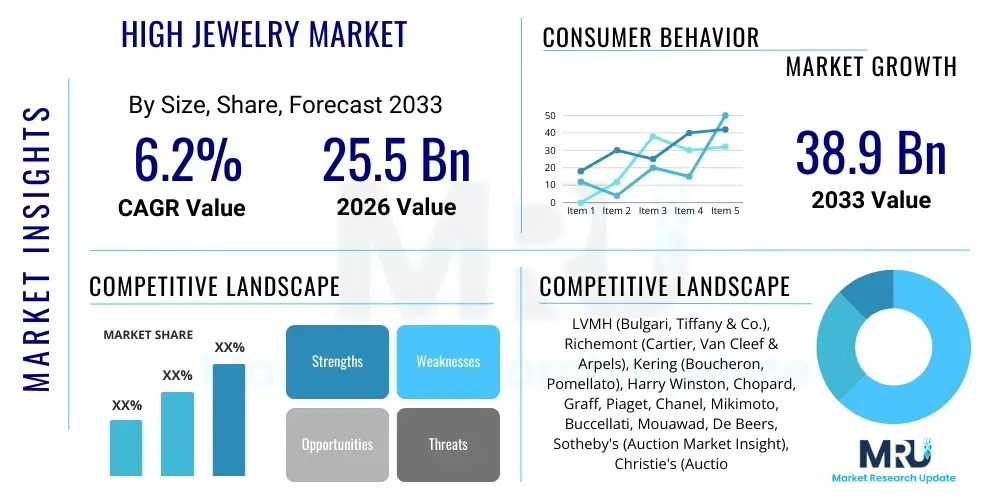

The High Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $38.9 Billion by the end of the forecast period in 2033.

High Jewelry Market introduction

The High Jewelry market encompasses the segment of luxury goods defined by exceptional craftsmanship, unique design, the use of rare and substantial precious materials—primarily large, investment-grade diamonds, colored gemstones, and high-purity gold or platinum. Unlike fine jewelry, which is often mass-produced or highly standardized, high jewelry pieces are typically bespoke, limited edition, or one-of-a-kind masterpieces that represent significant investment vehicles and symbols of extreme wealth and status. These pieces often carry substantial artistic and historical value, serving both as adornments for exclusive events and as tangible assets in high-net-worth individual (HNWI) portfolios. The production process involves master jewelers, advanced gemological science, and intense proprietary branding efforts.

Major applications of high jewelry extend beyond personal adornment to include wealth preservation and legacy building. Given the scarcity of the materials and the unparalleled artistry involved, these items generally retain or increase their value over time, positioning them as essential components of luxury auctions and private collections globally. The demand is critically influenced by global economic stability, the expansion of the ultra-high-net-worth population, and significant cultural events such as major awards ceremonies and royal engagements, which highlight the visibility and desirability of these unique creations. Brand heritage and provenance are paramount, with established houses commanding substantial premiums based on their history and signature styles.

Key benefits driving the market include the emotional connection associated with owning unique art, the tangible security of asset diversification during economic volatility, and the powerful statement of social standing that high jewelry confers. Driving factors fueling sustained growth involve the rapid accumulation of wealth in emerging economies, particularly in Asia Pacific, the increasing trend of luxury consumption experiences, and technological advancements such as blockchain that enhance transparency regarding the ethical sourcing and provenance of materials, thereby assuring discerning buyers of the integrity of their investments. Furthermore, successful integration of digital platforms, offering virtual try-ons and personalized consultations, is expanding the market reach without compromising the exclusivity required by the clientele.

High Jewelry Market Executive Summary

The High Jewelry market is currently characterized by resilience against broader economic fluctuations, primarily sustained by unwavering demand from Ultra-High-Net-Worth Individuals (UHNWIs) seeking tangible assets and highly personalized luxury experiences. Current business trends emphasize sustainability and ethical sourcing, compelling leading brands to invest heavily in supply chain transparency, particularly concerning diamonds and precious metals. Customization remains a critical differentiating factor, with clients increasingly demanding bespoke services and design collaborations that reflect unique personal narratives. Simultaneously, digital transformation is pushing luxury brands to integrate sophisticated e-commerce platforms and immersive digital showrooms, bridging the gap between traditional exclusivity and modern accessibility while maintaining controlled distribution channels.

Regionally, the Asia Pacific (APAC) market, spearheaded by mainland China, Hong Kong, and rapidly expanding economies like India, continues to exhibit the highest growth trajectory, driven by burgeoning HNWI populations and a strong cultural affinity for investment-grade jewelry. Europe maintains its historical dominance as the primary hub for design innovation, manufacturing expertise, and brand headquarters, ensuring stable, high-value transactions. North America remains a mature market focused heavily on established brands, classic styles, and significant transactional activity, often driven by celebrity endorsements and major social events. The Middle East, particularly the Gulf Cooperation Council (GCC) states, stands out due to its high propensity for high-carat, large-stone pieces, often serving as a key market for the most extravagant collections.

Segment trends confirm the continued preference for diamond-intensive jewelry, which dominates the material segment due to its historical status as an ultimate investment. Product-wise, unique necklaces and rings remain the most coveted categories, often forming the centerpiece of collections. The shift in distribution channels is notable; while exclusive physical boutiques remain paramount for high-touch customer service and secure transactions, the online segment is experiencing rapid growth, driven by secure transaction technologies, authenticated digital provenance, and younger affluent buyers who are comfortable making high-value purchases digitally. This segmentation evolution necessitates a hybrid strategy where digital presence complements and enhances the physical boutique experience.

AI Impact Analysis on High Jewelry Market

Common user inquiries concerning AI in the High Jewelry sector predominantly center on how technology can enhance personalization without eroding exclusivity, the reliability of AI in detecting synthetic or treated stones, and its role in ensuring ethical supply chains. Users seek clarity on whether AI-driven generative design threatens traditional craftsmanship, or if it acts as a tool for augmenting human creativity. There is significant interest in AI's capacity to analyze market trends and predict client preferences accurately, allowing brands to optimize inventory and create hyper-targeted marketing campaigns. Overall user sentiment is cautious yet optimistic, balancing the desire for enhanced transparency and bespoke experiences against the necessity of preserving the unique, human-centric artistry intrinsic to high jewelry creation.

The incorporation of Artificial Intelligence is revolutionizing multiple facets of the High Jewelry lifecycle, beginning with predictive analytics for demand forecasting. By analyzing vast datasets encompassing historical sales, demographic shifts, economic indicators, and even social media sentiment, AI algorithms can accurately predict which styles, materials, and price points will resonate with specific regional clienteles. This enables luxury houses to manage their notoriously complex and expensive inventory more efficiently, reducing overstocking of slow-moving items and ensuring the availability of bespoke materials for high-demand collections. Furthermore, AI assists in optimizing pricing strategies, dynamically adjusting valuations based on real-time market conditions for rare gemstones and precious metals, ensuring competitive yet profitable margins.

In the realm of customer experience and personalization, AI is proving transformative. Sophisticated recommendation engines analyze customer purchase histories, style preferences, and virtual interactions to suggest hyper-personalized designs or bespoke customization options, significantly elevating the luxury shopping journey. On the operational side, machine learning models are deployed to enhance quality control, assisting gemologists in identifying minute flaws, inclusions, or verifying the cut precision of large diamonds with unprecedented accuracy, surpassing human eye capabilities. This implementation ensures that the exceptional standards required in high jewelry production are consistently met, bolstering buyer confidence in authenticity and quality.

- AI-driven Predictive Analytics: Optimizing inventory management and forecasting demand for bespoke designs based on economic shifts and consumer behavior.

- Generative Design Tools: Assisting master jewelers in rapidly prototyping complex and novel designs, accelerating the creative process.

- Supply Chain Transparency (Blockchain Integration): Using AI to monitor and verify the provenance and ethical sourcing of materials from mine to market.

- Customer Relationship Management (CRM): Enabling hyper-personalization of marketing communications and virtual consultation recommendations.

- Quality Assurance: Machine learning algorithms used for precise gem grading, identification of synthetic stones, and ensuring dimensional accuracy in manufacturing.

- Counterfeit Detection: Employing image recognition and data analysis to identify and track unauthorized replicas, protecting brand integrity.

DRO & Impact Forces Of High Jewelry Market

The dynamics of the High Jewelry market are governed by a complex interplay of inherent luxury drivers and external economic vulnerabilities. Key drivers include the exponential growth in global High-Net-Worth and Ultra-High-Net-Worth populations, particularly in Asia, which translates directly into increased demand for investment-grade luxury assets. The inherent status symbol associated with owning bespoke, rare jewelry reinforces purchase motivation, especially in cultures where conspicuous consumption signals success and legacy. Furthermore, the perceived stability of high jewelry as a tangible investment hedge against inflation and currency devaluation significantly supports market resilience.

Restraints primarily revolve around the severe complexity and ethical scrutiny associated with the supply chain. The industry faces persistent challenges regarding the assurance of conflict-free sourcing, sustainable mining practices, and labor ethics, which, if mishandled, can lead to severe reputational damage. Additionally, the extreme volatility in the prices of key raw materials, such as rare colored diamonds and certain precious metals, introduces financial risk for manufacturers. Economic downturns, although impacting the luxury segment less severely than others, can still lead to delayed or canceled high-value purchases, coupled with increasing governmental scrutiny and taxation on luxury goods.

Opportunities for growth are abundant through targeted technological adoption and market expansion. The digital transformation offers unprecedented reach to geographically dispersed affluent clients through secured online platforms and advanced virtual reality experiences. Customization and personalization represent a major avenue for increased margin and customer loyalty, capitalizing on the desire for uniqueness. Furthermore, appealing to younger generations of affluent buyers, who prioritize transparency and sustainability, through clear ethical reporting and innovative materials offers significant long-term market potential. The critical impact forces are concentrated around the convergence of digital technology (enhancing trust and access) and stringent regulatory pressures (forcing transparency and ethical compliance).

Segmentation Analysis

The High Jewelry market is meticulously segmented based on the type of material, the final product category, the primary distribution channels utilized, and the end-user demographics. This detailed segmentation allows market players to craft highly targeted marketing strategies, optimize resource allocation, and tailor product offerings to the distinct needs and purchasing behaviors of various affluent consumer groups globally. Understanding these segments is crucial for predicting demand shifts and maintaining exclusivity in distribution.

- Material Type:

- Diamonds (White, Fancy Colored)

- Precious Metals (Platinum, High-Purity Gold)

- Colored Gemstones (Sapphires, Emeralds, Rubies)

- Others (Pearls, Unique Organic Materials)

- Product Type:

- Necklaces and Pendants

- Rings (Cocktail Rings, Engagement/Wedding Sets)

- Earrings and Ear Cuffs

- Bracelets and Bangles

- Brooches and Timepieces (High Complication Jewelry Watches)

- Distribution Channel:

- Brand-Owned Boutiques

- Multi-Brand Luxury Retailers

- Online Channels (Secure E-commerce, Digital Auction Houses)

- Private Viewings and Exclusive Events

- End-User:

- Women

- Men (Increasing demand for high-end cufflinks, rings, and timepieces)

Value Chain Analysis For High Jewelry Market

The value chain for High Jewelry is characterized by extreme vertical integration and stringent control exercised by major luxury houses to ensure authenticity, quality, and exclusivity across every stage. The upstream segment involves the sourcing of raw materials, primarily through direct procurement agreements with major mining houses (e.g., De Beers, Rio Tinto) or through specialized, regulated gemstone dealers. This stage is dominated by activities like rough diamond sorting, ethical compliance verification, and initial valuation, requiring high capital investment and specialized geological expertise. Transparency and traceability, increasingly facilitated by technologies like blockchain, are paramount at the upstream level to satisfy consumer and regulatory demands for conflict-free sourcing.

The middle segment focuses on manufacturing and design execution. This highly specialized phase involves cutting and polishing the rough stones—a critical process that can significantly impact the final value—followed by master bench work where design sketches are translated into physical settings using platinum or high-karat gold. This stage relies heavily on traditional artisan skills combined with modern technologies like advanced CAD/CAM modeling and micro-setting techniques. Given the rarity and fragility of the materials, minimizing loss and ensuring exceptional quality control are key operational challenges that distinguish high jewelry production from standard fine jewelry manufacturing.

The downstream segment concentrates on distribution, marketing, and final sale. Distribution channels are predominantly direct, utilizing exclusive brand-owned boutiques located in global luxury capitals, which allows for maximum control over the customer experience, brand narrative, and pricing integrity. Indirect channels, such as highly vetted authorized multi-brand retailers or high-end auction houses (e.g., Sotheby's, Christie's), are used strategically. Marketing is relationship-driven, relying on private viewings, exclusive events, and personal client advisors. The premium attached to high jewelry is sustained not just by the inherent value of the materials but by the unparalleled service, heritage, and trust conveyed during the final point of sale, emphasizing the importance of a curated, high-touch retail environment.

High Jewelry Market Potential Customers

The core customer base for the High Jewelry market consists primarily of Ultra-High-Net-Worth Individuals (UHNWIs) and High-Net-Worth Individuals (HNWIs) globally, defined by substantial liquid assets and a net worth often exceeding $30 million. These individuals purchase high jewelry not only for aesthetic pleasure and social signaling but crucially as part of a diversified portfolio of collectible assets. They seek exclusivity, verifiable provenance, and investment security. The buying decision is highly informed, often involving consultation with financial advisors and specialized gemologists, focusing on historical significance, rarity of the central stone, and the heritage of the crafting house.

A growing segment includes the affluent younger generations (Millennials and Gen Z) who, while possessing significant wealth, approach luxury consumption differently. This demographic values sustainability, ethical sourcing, and transparency, pushing brands to provide comprehensive digital documentation regarding a piece's journey. They are less focused on historical traditionalism and more open to contemporary designs, customization, and unique colored stones. Engaging this cohort requires sophisticated digital marketing that seamlessly integrates ethical narratives with cutting-edge design and modern aesthetic appeal, often prioritizing experiences over mere ownership.

Another significant, albeit niche, customer segment includes institutional buyers, luxury collectors, and museums who acquire pieces for historical preservation, collection enhancement, or investment speculation. These buyers drive the highest prices in auction markets for signature pieces with exceptional history or rarity. Geographically, potential customers are heavily concentrated in mature wealth centers like North America and Western Europe, but the fastest-growing customer base is emerging from major cities across Asia Pacific and the Middle East, necessitating regional adaptation in design and sales strategy to cater to local cultural preferences and investment priorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $38.9 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH (Bulgari, Tiffany & Co.), Richemont (Cartier, Van Cleef & Arpels), Kering (Boucheron, Pomellato), Harry Winston, Chopard, Graff, Piaget, Chanel, Mikimoto, Buccellati, Mouawad, De Beers, Sotheby's (Auction Market Insight), Christie's (Auction Market Insight), Asprey, Faberge, David Yurman, Moussaieff, Wallace Chan. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Jewelry Market Key Technology Landscape

The High Jewelry market, while rooted in tradition, is increasingly leveraging cutting-edge technology to enhance precision, ensure authenticity, and optimize client experience. Three-dimensional (3D) printing, specifically using high-resolution resin or wax materials, is now standard practice for prototyping complex settings and bespoke designs. This allows master jewelers to rapidly iterate on intricate forms and ensure perfect fit and stability for large, rare gemstones before the final precious metal casting begins. Furthermore, 3D scanning technology is utilized to digitally map unique stones, ensuring maximum yield during cutting and creating a permanent digital blueprint of the gem’s characteristics and inclusions, which aids in future identification and verification.

Blockchain technology represents one of the most critical technological integrations, addressing the industry's need for absolute transparency and immutable provenance. By assigning a digital ledger entry to each significant gemstone or piece of jewelry, brands can track its journey from the certified mine source, through cutting and polishing, to the final boutique sale. This irrefutable digital record reassures consumers about the ethical and conflict-free status of the materials, significantly mitigating risks associated with greenwashing or counterfeiting. The use of blockchain is paramount for maintaining the trust and integrity required for multi-million dollar transactions in high jewelry.

Beyond manufacturing and provenance, digital visualization technologies like Augmented Reality (AR) and Virtual Reality (VR) are transforming the consumer consultation process. AR applications allow prospective buyers to virtually try on high jewelry pieces in real-time, regardless of their location, offering a high-touch experience without the security risks associated with physical transportation of extremely valuable items. Simultaneously, sophisticated Customer Relationship Management (CRM) systems, powered by advanced data analytics, enable brands to understand the nuanced preferences of their elite clientele, facilitating highly personalized services, managing lifetime client histories, and scheduling private viewings and exclusive events tailored precisely to individual tastes.

Regional Highlights

The global distribution of high jewelry consumption is heavily skewed towards regions with concentrated wealth accumulation and cultural appreciation for investment-grade luxury. Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid wealth creation in mainland China, Hong Kong, and Southeast Asia. Consumers in this region often prioritize large, high-carat pieces, particularly diamonds and jadeite, viewing high jewelry as a crucial status symbol and a reliable form of investment hedge. The market penetration rate is accelerating, supported by strong retail presence expansion by Western luxury houses.

Europe, home to the majority of the established high jewelry houses (e.g., France, Switzerland, Italy), remains the undisputed hub for design, craftsmanship, and brand heritage. The market here is mature, driven by generational wealth and a deep cultural appreciation for artistry and historical provenance. Transactions are stable, often involving complex auction sales and bespoke commissions. North America, particularly the United States, represents a highly developed consumer market characterized by strong engagement with established international brands and a high consumption rate driven by high-profile social events and a robust secondary market for vintage high jewelry.

The Middle East (MEA), particularly the UAE, Saudi Arabia, and Qatar, shows exceptional demand for extremely extravagant and unique pieces, often commissioned specifically to feature rare colored stones and intricate gold work. These markets are known for their high average transaction value and rapid adoption of the most exclusive and limited-edition collections. Latin America, though facing occasional economic volatility, maintains a strong underlying demand from its affluent segments for portable, investment-grade jewelry, emphasizing discretion and asset security.

- Asia Pacific (APAC): Leading market for growth, driven by China and India's burgeoning UHNWI population; strong emphasis on investment-grade diamonds and status symbols.

- Europe: Center of craftsmanship, heritage, and design innovation; stable demand driven by established luxury houses and traditional clientele.

- North America: Mature, high-volume market focused on brand recognition and frequent purchasing for social visibility and major events.

- Middle East & Africa (MEA): High average purchase value, demand for rare, large stones, and bespoke, extravagant commissions.

- Latin America: Focus on investment security and tangible wealth preservation, characterized by discreet, high-value transactions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Jewelry Market.- LVMH Moët Hennessy Louis Vuitton SE (Bulgari, Tiffany & Co.)

- Compagnie Financière Richemont SA (Cartier, Van Cleef & Arpels)

- Kering SA (Boucheron, Pomellato)

- Harry Winston (Swatch Group)

- Chopard SA

- Graff Diamonds

- Piaget SA

- Chanel International B.V.

- Mikimoto Co., Ltd.

- Buccellati (Richemont)

- Mouawad Group

- De Beers Group

- Sotheby's

- Christie's International

- Asprey London

- Faberge

- David Yurman

- Moussaieff Jewellers Ltd.

- Wallace Chan

- Tasaki & Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes High Jewelry from Fine Jewelry?

High Jewelry is characterized by unique, often one-of-a-kind designs, exceptional craftsmanship, and the use of rare, large, investment-grade gemstones (e.g., 5-carat plus diamonds, rare colored stones). Fine Jewelry, while luxurious, tends to be more standardized and utilizes smaller, commercially available stones.

Is High Jewelry considered a good investment asset?

Yes, High Jewelry is often viewed as a reliable tangible asset. Pieces featuring certified rare gemstones, exceptional provenance, and heritage brand names typically appreciate over time, offering diversification against traditional financial investments and acting as a hedge against inflation.

How is ethical sourcing ensured in the High Jewelry supply chain?

Leading brands utilize stringent ethical standards, including Kimberley Process certification for diamonds, and increasingly deploy advanced technologies like blockchain tracking. This technology provides an immutable digital record of a stone’s journey from the mine to the final sale, ensuring transparency regarding conflict-free and sustainable origins.

What is the role of customization in the modern High Jewelry market?

Customization is paramount, reflecting consumer demand for uniqueness and personal expression. Brands offer bespoke services, allowing clients to collaborate on design, choose specific rare stones, and commission exclusive pieces, significantly elevating the perceived value and exclusivity of the final product.

Which geographic region demonstrates the strongest growth potential for High Jewelry?

The Asia Pacific (APAC) region, driven by countries like China and India, exhibits the highest growth potential. This is attributed to the rapid expansion of the UHNWI demographic and a strong cultural affinity for acquiring high jewelry as a primary indicator of status and long-term financial security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager