High-Power Infrared Fiber Laser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442281 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High-Power Infrared Fiber Laser Market Size

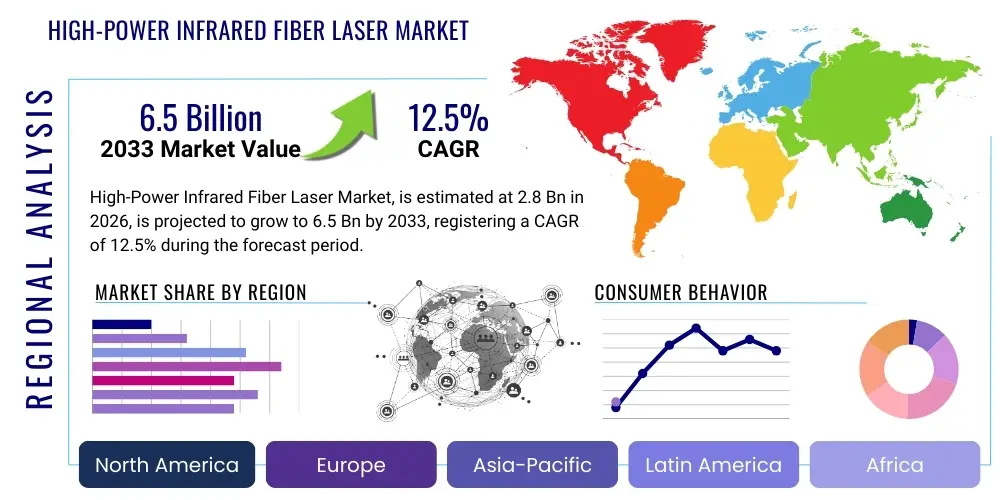

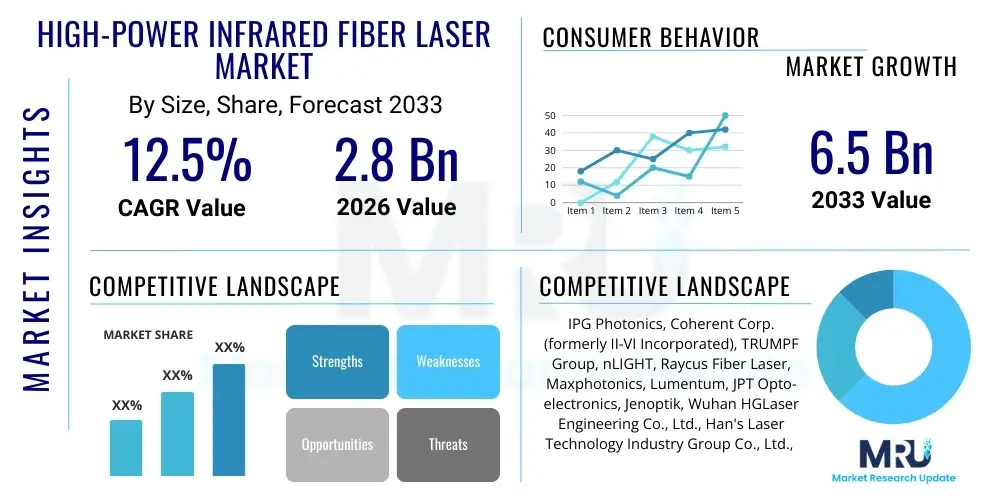

The High-Power Infrared Fiber Laser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for highly precise and energy-efficient laser sources across critical industrial sectors, notably in advanced manufacturing, automotive fabrication, and aerospace material processing. The inherent advantages of fiber lasers—such as superior beam quality, high wall-plug efficiency, compact size, and robust stability—position them as the preferred choice over traditional solid-state lasers, ensuring sustained growth throughout the projection period. The transition towards automation and the need for higher throughput in large-scale production facilities further cement the market's trajectory towards significant valuation milestones, catalyzed by continuous innovations in power scaling and spectral purity.

Market expansion is also heavily influenced by geographical shifts in manufacturing capabilities, particularly the rapid adoption of sophisticated laser processing techniques in emerging economies across Asia Pacific. These regions are investing heavily in infrastructure modernization, creating massive opportunities for the deployment of high-power fiber laser systems for tasks like deep penetration welding, precision cutting of thick metals, and surface treatment applications. Furthermore, the integration of these laser systems into robotic cells and specialized machine tools enhances their appeal, driving volume sales. The competitive landscape focuses intensely on achieving multi-kilowatt output levels while maintaining single-mode beam propagation, a technological sweet spot essential for high-speed, high-quality material interactions, which ultimately dictates the achievable market size.

The continuous push for higher power levels, extending into the tens of kilowatts, is crucial for processing materials used in electric vehicle battery manufacturing and specialized aerospace alloys. This technological advancement directly impacts the financial valuation of the market. Key manufacturers are differentiating themselves through proprietary core technologies, such as improved pumping schemes and effective thermal management, which reduce operational costs and increase system longevity. Regulatory standards promoting energy efficiency in manufacturing environments also subtly favor the adoption of fiber laser systems, underpinning the robust financial growth projections leading up to 2033, translating into the forecasted multi-billion dollar market size.

High-Power Infrared Fiber Laser Market introduction

The High-Power Infrared Fiber Laser Market encompasses advanced photonic devices that utilize optical fibers doped with rare-earth elements, such as Ytterbium, to generate and amplify continuous-wave or pulsed laser beams in the infrared spectrum (typically 1030 nm to 1100 nm). These lasers are distinguished by their exceptional power output, routinely exceeding 1 kW, coupled with near-diffraction-limited beam quality, which is paramount for precision material processing. The fundamental product structure involves a pump source (usually high-power diode lasers), a gain medium (the doped fiber), and specialized optical components for beam delivery and conditioning. The infrared wavelength makes these lasers ideally suited for interacting efficiently with common industrial materials, including steels, aluminum, copper, and various polymers, enabling tasks that require high energy density at the focal point.

Major applications of high-power infrared fiber lasers span several high-value sectors. In the industrial segment, they are predominantly used for material processing, encompassing high-speed cutting of thick sheet metal, precise seam welding in automotive body-in-white structures, additive manufacturing (3D printing of metal parts via selective laser melting), and intricate surface treatment like cladding and hardening. Beyond manufacturing, these lasers find crucial roles in defense applications, particularly directed energy systems, and in scientific research requiring ultra-high intensity beams for exotic material studies. The versatility and scalability of fiber laser technology allow manufacturers to tailor systems precisely to the required power and pulse characteristics of highly specialized industrial processes, yielding results unattainable with traditional mechanical or thermal methods.

The compelling benefits driving the market adoption include outstanding energy efficiency (wall-plug efficiency often exceeding 30%), significantly reduced maintenance requirements due to the absence of alignment-sensitive free-space optics within the resonator, and a compact, ruggedized form factor suitable for harsh industrial environments. These operational advantages translate directly into lower total cost of ownership (TCO) for end-users. The continuous scaling of power and improvements in beam stability are the primary driving factors for market growth. Furthermore, the integration with smart manufacturing ecosystems, facilitated by remote monitoring and diagnostics capabilities inherent in modern fiber laser systems, further accelerates their adoption, positioning high-power infrared fiber lasers as a cornerstone technology for Industry 4.0 initiatives globally.

High-Power Infrared Fiber Laser Market Executive Summary

The High-Power Infrared Fiber Laser Market is currently characterized by intense competitive pressure focused on power density maximization and system integration capabilities. Key business trends include aggressive mergers and acquisitions aimed at consolidating intellectual property related to high-power components and delivery optics, ensuring supply chain stability for critical rare-earth doped fibers, and vertically integrating manufacturing processes. There is a palpable shift towards modular system designs, allowing end-users flexibility in scaling power output based on evolving production needs, thereby increasing customer lifetime value. Furthermore, established players are increasingly investing in software platforms for laser process monitoring and quality control, transforming the product offering from a mere hardware component into an integrated manufacturing solution, often incorporating subscription-based service models for predictive maintenance and remote operational support.

Regionally, the market exhibits a dynamic concentration of demand. Asia Pacific (APAC) dominates the market share, driven primarily by robust growth in China's automotive and electronics manufacturing sectors, coupled with aggressive investment in advanced fabrication technologies across South Korea and Japan. North America and Europe remain key centers for technological innovation and high-value applications, particularly in aerospace, defense, and specialized medical device manufacturing, demanding ultra-high reliability and precision. These Western markets prioritize quality, service infrastructure, and adherence to stringent industry standards (e.g., ISO 9001, AS9100), often leading in the adoption of novel technologies such as ultrafast pulsed fiber lasers, which, while infrared, constitute a high-precision, high-margin niche within the overall market structure. The Middle East and Latin America show nascent but accelerating growth, fueled by diversification efforts away from resource extraction and towards manufacturing resilience.

Segment trends reveal a significant divergence based on power output and operational mode. The continuous wave (CW) segment, comprising lasers up to 10 kW, maintains the largest volume share, driven by mass-market cutting and welding applications. However, the ultra-high power segment (above 10 kW and moving towards 50 kW) is projected to experience the fastest growth rate, propelled by demand from specialized heavy industries and applications requiring extremely deep penetration welds, such as shipbuilding and large structure fabrication. By application, material processing remains the undisputed leader, though additive manufacturing is emerging as the fastest-growing sub-segment, necessitating fiber lasers with highly stable beam profiles and complex modulation capabilities. The shift towards higher single-mode power is a central technical trend, requiring innovations in large-mode-area (LMA) fiber designs to mitigate nonlinear optical effects and thermal degradation.

AI Impact Analysis on High-Power Infrared Fiber Laser Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the High-Power Infrared Fiber Laser Market primarily revolve around operational efficiency, predictive maintenance, and process optimization. Users frequently ask: "How can AI improve the quality consistency of high-speed laser welding?" or "Can AI models predict fiber degradation to minimize downtime?" and "What role does machine learning play in optimizing complex laser parameters for new materials?" These questions underscore a collective expectation that AI will move fiber lasers beyond simple hardware tools into intelligent, self-optimizing manufacturing systems. The core concerns focus on leveraging large datasets generated during laser operation (e.g., temperature, power stability, spectral data) to refine processing parameters in real-time, thereby reducing waste, maximizing throughput, and achieving highly repeatable quality in demanding applications like battery tab welding or aerospace component fabrication.

The integration of AI is expected to revolutionize the configuration and control systems associated with high-power fiber lasers. Currently, setting optimal parameters (power level, scanning speed, focus position, modulation frequency) often relies on empirical testing and expert knowledge, a time-consuming and often suboptimal approach. AI/Machine Learning (ML) algorithms are being deployed to ingest vast amounts of sensory data collected during the laser-material interaction, instantaneously correlating inputs with output quality metrics (e.g., weld penetration depth, cut edge roughness). This real-time feedback loop allows the system to autonomously adjust parameters mid-process to compensate for minor variations in material thickness, laser source drift, or ambient temperature fluctuations, leading to unprecedented levels of manufacturing resilience and quality assurance that were previously unattainable through traditional PID control systems.

Furthermore, AI-driven predictive maintenance represents a significant operational benefit. By analyzing historical performance data, including subtle anomalies in power readings or cooling system temperatures, ML models can accurately predict the remaining useful life of key components, such as pump diodes or fiber couplers. This capability allows manufacturers to schedule preventative maintenance precisely when needed, minimizing unplanned downtime—a critical factor in high-volume, capital-intensive manufacturing environments. The deployment of generative AI models is also starting to be explored for simulating laser-material interactions, reducing the necessity for physical prototypes and accelerating the development of new laser processing techniques for advanced or composite materials, thereby shortening the market entry time for novel applications.

- AI enables real-time parameter optimization based on visual and thermal feedback sensors, maximizing process stability and material utilization.

- Machine Learning algorithms predict component failure (e.g., pump diodes, fusion splices), facilitating predictive maintenance and increasing system uptime reliability.

- Generative AI models accelerate new process development by simulating complex laser-material interaction dynamics, reducing physical testing requirements.

- AI integration enhances quality control systems by classifying defects instantaneously and adjusting laser output to maintain strict quality thresholds.

- Data analytics platforms powered by AI provide deep insights into operational efficiency and energy consumption across multiple deployed laser systems.

- Autonomous robotic integration is optimized by AI path planning, ensuring efficient, non-stop laser deployment in complex manufacturing cell configurations.

DRO & Impact Forces Of High-Power Infrared Fiber Laser Market

The High-Power Infrared Fiber Laser Market is shaped by a confluence of strong drivers and critical restraints, alongside substantial opportunities that together define the overall impact forces. The primary driver is the accelerating global trend towards automation and the implementation of Industry 4.0 principles, demanding reliable, high-speed, and precise tools for material processing. This is complemented by the superior operational metrics of fiber lasers, including their high electrical-to-optical conversion efficiency and reduced maintenance profile compared to older laser technologies. Simultaneously, the market faces significant restraints, chiefly the extremely high initial capital expenditure (CAPEX) required for sophisticated multi-kilowatt systems, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the limited technical expertise required for the highly specialized repair and maintenance of doped fibers and beam delivery systems presents a bottleneck, particularly in developing regions, impacting widespread adoption and necessitating robust service networks.

Opportunities for market expansion are concentrated in several high-growth areas. The transition to electric vehicle (EV) manufacturing globally presents a massive opportunity, given the critical need for precise, high-speed laser welding for battery modules, packs, and structural components involving challenging materials like copper and aluminum. Another significant opportunity lies in the development of ultra-high power systems (20 kW and above) for specialized heavy industry applications such as thick plate cutting in shipbuilding and defense, which require continuous wave power previously confined to older CO2 or disk laser technologies. The continuous innovation in pulse shaping and ultrafast lasers (though often secondary to CW in power applications, they share the infrared spectrum and technological base) opens new avenues in micro-machining and surface engineering, commanding premium pricing and higher margins, thereby positively influencing the market valuation through technological diversification and differentiation.

The impact forces generated by these drivers and restraints create a complex market equilibrium. The economic benefits derived from high throughput and reduced TCO act as powerful magnetizing forces, overcoming the inertia caused by high initial costs, especially for large multinational corporations committed to long-term efficiency gains. The competitive pressure among laser manufacturers to continuously increase power output while minimizing physical footprint and cost per watt forces rapid technological cycles. This intense competition ensures that fiber lasers remain the dominant force in high-power laser material processing, driving down the unit cost of power over time. However, the presence of intellectual property disputes and the highly specialized nature of the supply chain for rare-earth doped fibers represent persistent latent constraints that must be managed to sustain continuous, uninterrupted market growth and mitigate potential supply chain shocks.

Segmentation Analysis

The High-Power Infrared Fiber Laser market is highly segmented based on crucial technological and application parameters, reflecting the diverse industrial requirements globally. Primary segmentation criteria include the Output Power (categorized typically into 1 kW–6 kW, 6 kW–12 kW, and above 12 kW), which dictates the complexity and material thickness capability of the laser system. A secondary, yet equally critical, segmentation is based on Operation Mode: Continuous Wave (CW), which is dominant for high-speed cutting and welding, and Pulsed/Q-Switched, vital for precision marking, annealing, and micro-machining tasks where energy delivery control is paramount. Further segmentation is derived from the application type and the end-use industry, reflecting where the greatest demand volume and specialized requirements reside, enabling manufacturers to tailor their marketing and product development strategies effectively to specific industrial verticals.

The segmentation by output power clearly delineates market maturity and growth potential. The 1 kW to 6 kW range represents the largest, most mature segment, acting as the entry point for many sheet metal fabrication shops and general manufacturing processes, providing excellent cost-performance ratio for general cutting and thin-section welding. Conversely, the segment above 12 kW, and increasingly moving towards 20 kW and higher, exhibits the highest growth potential (CAGR). This ultra-high power category addresses specialized needs in heavy industries—like thick plate marine fabrication or complex automotive aluminum casting welding—where exceptional power density and sustained operational performance are essential prerequisites, often involving complex beam shaping systems to manage the intense thermal load.

Application-based segmentation highlights the market's reliance on material processing, which consumes the majority of high-power fiber laser output. Sub-segments within material processing, such as cutting, welding, drilling, and cladding, exhibit unique demands regarding beam quality, power stability, and process control complexity. The rapidly expanding additive manufacturing segment requires highly consistent, multi-kilowatt fiber lasers optimized for powder bed fusion (PBF) processes, characterized by high repetition rates and precise energy distribution control. This detailed market segmentation is critical for accurate forecasting, allowing stakeholders to identify specific technological gaps, allocate R&D resources effectively, and formulate competitive pricing strategies that resonate with the distinct purchasing behaviors and technical requirements of different industrial consumers.

- By Output Power:

- 1 kW – 6 kW (Standard Industrial Cutting & Welding)

- 6 kW – 12 kW (High-Throughput General Fabrication)

- Above 12 kW (Heavy Industrial & Specialized Applications)

- By Operation Mode:

- Continuous Wave (CW)

- Pulsed (Q-Switched, Nanosecond, Picosecond, Femtosecond)

- By Doping Material:

- Ytterbium (Yb-doped) Fiber Lasers

- Erbium (Er-doped) Fiber Lasers (for specific mid-IR extensions)

- Thulium (Tm-doped) Fiber Lasers (for 2 µm applications)

- By Application:

- Material Processing (Cutting, Welding, Cladding, Drilling)

- Additive Manufacturing (Selective Laser Melting)

- Medical & Aesthetics

- Defense & Research (Directed Energy Systems, Scientific Spectroscopy)

- By End-Use Industry:

- Automotive & Transportation (EV battery manufacturing)

- Aerospace & Defense

- Heavy Machinery

- Electronics & Semiconductor

- Jewelry & Decorative

Value Chain Analysis For High-Power Infrared Fiber Laser Market

The value chain for the High-Power Infrared Fiber Laser Market is complex, beginning with highly specialized upstream suppliers and concluding with diverse downstream integration service providers. The upstream analysis focuses on the provision of core technical components, primarily high-power semiconductor pump diodes, which are essential for optical energy input, and the highly specialized rare-earth doped silica fibers (the gain medium), often produced by a limited number of specialized manufacturers worldwide. Manufacturing these components requires stringent quality control and proprietary processes, resulting in high barriers to entry and strong supplier bargaining power. Midstream activities involve the complex assembly and integration of these components by the core laser manufacturers, including the development of proprietary fiber architecture (e.g., LMA fibers) and advanced thermal management systems necessary to scale power efficiently while maintaining beam quality. This integration phase is where core intellectual property related to laser architecture and performance resides.

Downstream analysis involves the distribution, integration, and final deployment of the finished fiber laser system into the end-user’s manufacturing environment. Distribution channels are typically a mix of direct sales teams catering to large volume purchasers (e.g., major automotive OEMs) and indirect channels utilizing system integrators (SIs) and distributors. System integrators play a crucial role, as they often combine the fiber laser source with robotics, CNC machinery, specialized optics (galvanometers, focusing heads), and software to create a complete, ready-to-use manufacturing solution optimized for a specific application (e.g., robotic laser welding cells). This stage adds significant value through customization, software integration, and application support, ensuring that the laser performs optimally within the customer's production line.

The dual nature of distribution—direct for raw power units and indirect via SIs for complex systems—underscores the market structure. Direct sales ensure tight control over flagship products and large contracts, maximizing manufacturer margin. Indirect channels, however, are critical for penetrating diverse geographical markets and specialized niches where local expertise in machine integration and maintenance is required. Service and post-sales support form the final, crucial element of the value chain. Due to the high investment and mission-critical nature of these lasers, comprehensive service contracts, rapid spare parts supply (particularly replacement pump diodes), and localized technical expertise are essential, contributing significantly to the total lifetime value generated by each installed laser unit. Efficiency improvements in remote diagnostics and modular component replacement are continuously optimizing this service phase.

High-Power Infrared Fiber Laser Market Potential Customers

The potential customer base for the High-Power Infrared Fiber Laser Market is broad, but heavily concentrated within global industrial manufacturing sectors that rely on high-precision, high-speed, and high-throughput material processing. The primary end-users are large-scale fabrication facilities, particularly those involved in the automotive and transportation industry. These customers utilize multi-kilowatt CW lasers extensively for body-in-white welding, component cutting, and, increasingly, for battery enclosure welding in electric vehicles, demanding high reliability and speed to meet aggressive production quotas. Their purchasing decisions are driven by Total Cost of Ownership (TCO), speed of deployment, and the manufacturer's ability to provide global technical support, often leading them to prefer established, tier-one laser suppliers capable of guaranteeing long operational lifecycles.

A second major category of potential buyers includes aerospace and defense contractors. These customers require lasers for processing advanced, lightweight materials such as titanium alloys, Inconel, and various composite structures, where tolerances are exceptionally tight and material integrity is paramount. While volume may be lower than in the automotive sector, the specifications are often far more demanding, requiring specialized fiber lasers (often high-power pulsed or single-mode CW) optimized for deep penetration or complex surface modification techniques like cladding or ablation. Reliability and certification (meeting aerospace quality standards) are key purchasing criteria for this segment, and they often engage in long-term R&D partnerships with laser manufacturers to develop cutting-edge applications.

Finally, a significant emerging segment comprises contract manufacturers and specialized additive manufacturing bureaus. These customers use high-power infrared fiber lasers for Selective Laser Melting (SLM) and Direct Energy Deposition (DED) processes, fabricating intricate metal components layer by layer. Their purchasing needs revolve around the laser’s power stability, focus spot size, and modulation characteristics, which directly impact the metallurgical quality and density of the printed parts. As additive manufacturing shifts from prototyping to production-scale operation, the demand for highly reliable, multi-laser configurations within large 3D printing systems represents a high-growth customer segment, often valuing system flexibility and the ability to integrate into diverse manufacturing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Coherent Corp. (formerly II-VI Incorporated), TRUMPF Group, nLIGHT, Raycus Fiber Laser, Maxphotonics, Lumentum, JPT Opto-electronics, Jenoptik, Wuhan HGLaser Engineering Co., Ltd., Han's Laser Technology Industry Group Co., Ltd., Photonics Industries International, Fujikura Ltd., Novanta Inc., SPI Lasers (Amada), EKSPLA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High-Power Infrared Fiber Laser Market Key Technology Landscape

The technological landscape of the High-Power Infrared Fiber Laser Market is dominated by relentless innovation aimed at scaling output power while preserving near-perfect beam quality and mitigating detrimental thermal effects. A central technological focus is the development and commercialization of Large Mode Area (LMA) fibers, which increase the core diameter of the fiber to distribute the optical power over a wider area. This reduces the power density, effectively suppressing detrimental nonlinear optical effects like Stimulated Raman Scattering (SRS) and Stimulated Brillouin Scattering (SBS), which can severely limit the achievable power in standard fibers. Advanced LMA designs, including photonic crystal fibers and chirally coupled core (CCC) fibers, are crucial for achieving stable multi-kilowatt power levels with single-mode operation, a requirement for high-precision applications like remote welding and deep cutting, where focusability is paramount.

Another pivotal technological development involves sophisticated pumping architectures, moving increasingly toward tandem pumping schemes. Traditional high-power fiber lasers use 915 nm or 976 nm pump diodes to excite the Yb-doped fiber. Tandem pumping utilizes a secondary fiber laser (often operating at ~1018 nm) to pump the high-power gain fiber. This approach offers several advantages: the tandem pump source provides a higher quality beam than broad-area diode lasers, allowing for more efficient coupling and heat deposition, and the smaller quantum defect (difference between pump and signal photon energy) significantly reduces the waste heat generated within the core. Effective thermal management, incorporating sophisticated water-cooling jackets and specialized heat sinks, remains a critical component of the technological landscape, ensuring long-term operational stability and preventing thermal lensing, which otherwise degrades the crucial beam quality and limits power scaling potential.

Furthermore, significant research and commercial focus are being dedicated to developing highly reliable, power-handling components for the beam delivery system. This includes robust, low-loss combiners for merging multiple pump sources or signal beams, and advanced collimating and focusing optics that can withstand the intense power flux without damage or thermal distortion. For pulsed systems, innovations in master oscillator power amplifier (MOPA) configurations allow for precise control over pulse duration, repetition rate, and peak power, expanding the applications into high-precision micro-machining and surface treatment. The continuous evolution in these areas—LMA fiber design, pumping technology, and component reliability—is fundamental to maintaining the fiber laser's dominance in the high-power domain and enabling the progression towards higher industrial power limits that currently define the leading edge of the market.

Regional Highlights

Regional dynamics heavily influence the High-Power Infrared Fiber Laser Market, reflecting varying levels of industrialization, technological maturity, and governmental focus on manufacturing modernization. Asia Pacific (APAC) stands out as the undisputed leader in market size and growth trajectory. This dominance is primarily fueled by China, which boasts the largest manufacturing base globally, demanding high volumes of multi-kilowatt fiber lasers for automotive, general fabrication, and increasingly, its domestic aerospace sector. South Korea and Japan also contribute significantly, particularly in high-precision electronics manufacturing and high-end machinery, driving demand for technologically advanced, high-stability pulsed and CW fiber lasers. Government incentives supporting Industry 4.0 and smart factory development across the region act as powerful tailwinds, necessitating the replacement of older machine tools with high-efficiency laser systems.

North America represents a critical market characterized by demand for high reliability, application specialization, and the largest concentration of defense and aerospace investment. The United States market emphasizes the integration of fiber lasers into advanced systems for specialized applications like directed energy weapons, complex composite cutting, and intricate component welding that require ultra-high beam quality. Innovation often originates here, particularly regarding ultrafast fiber laser technologies and advanced sensor integration for intelligent manufacturing. The purchasing decisions in this region often involve long-term service agreements and stringent adherence to quality and safety standards, favoring established global suppliers with strong localized R&D capabilities and robust support infrastructure.

Europe maintains a strong position, driven by Germany’s robust engineering sector, the high concentration of advanced automotive manufacturing, and significant investment in industrial robotics. European demand is often centered around high-quality, customized laser systems for medium to high-power applications, emphasizing energy efficiency and environmental compliance. Eastern European countries are rapidly modernizing their manufacturing bases, creating a secondary growth pocket for standard industrial cutting and welding lasers. The European market is characterized by a high degree of integration between laser manufacturers and machine tool builders, facilitating the rapid adoption of new laser technologies into complete production lines, ensuring that the region remains a vital, albeit mature, component of the global market landscape.

- Asia Pacific (APAC): Dominates global volume and growth, driven by China's extensive manufacturing infrastructure and aggressive adoption of automation in the automotive and general fabrication sectors.

- North America: Characterized by high-value applications in aerospace and defense; strong focus on R&D for ultrafast and ultra-reliable high-power systems; demanding stringent performance and service standards.

- Europe: Stable, mature market led by Germany; strong demand from the automotive and heavy machinery industries; increasing focus on energy-efficient and highly integrated laser manufacturing solutions.

- Latin America: Emerging market with growing adoption in Brazil and Mexico, primarily for automotive component manufacturing and metal fabrication; growth trajectory is moderate but consistent.

- Middle East & Africa (MEA): Nascent market showing potential primarily in industrial diversification efforts in Saudi Arabia and the UAE, focusing on infrastructure development and specialized oil/gas related metal processing and cladding applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High-Power Infrared Fiber Laser Market.- IPG Photonics

- Coherent Corp. (formerly II-VI Incorporated)

- TRUMPF Group

- nLIGHT

- Raycus Fiber Laser

- Maxphotonics

- Lumentum

- JPT Opto-electronics

- Jenoptik

- Wuhan HGLaser Engineering Co., Ltd.

- Han's Laser Technology Industry Group Co., Ltd.

- Photonics Industries International

- Fujikura Ltd.

- Novanta Inc.

- SPI Lasers (Amada)

- EKSPLA

- Convergent Photonics

- Toptica Photonics

- Laserline GmbH

Frequently Asked Questions

Analyze common user questions about the High-Power Infrared Fiber Laser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of high-power fiber lasers over traditional CO2 or solid-state lasers?

The primary advantage is their superior wall-plug efficiency (often >30%), which significantly reduces operational costs, combined with exceptional beam quality and a maintenance-free solid-state architecture, leading to higher system uptime and reliability for demanding industrial applications.

How is the High-Power Infrared Fiber Laser Market segmented by power output, and which segment shows the highest growth?

Segmentation includes 1 kW–6 kW, 6 kW–12 kW, and above 12 kW. The segment above 12 kW is projected to exhibit the highest CAGR, driven by increasing industrial requirements for deep penetration welding, heavy plate cutting, and high-throughput processes in the aerospace and heavy machinery sectors.

What specific role do fiber lasers play in the rapidly growing electric vehicle (EV) manufacturing industry?

Fiber lasers are crucial for EV manufacturing, particularly in high-speed, precise welding tasks for battery components (e.g., battery tab welding, sealing battery enclosures) and lightweight structural components, utilizing their superior control over challenging materials like copper and aluminum.

What are the main technical challenges manufacturers face in scaling infrared fiber laser power above 20 kW?

Key challenges include mitigating detrimental nonlinear optical effects (like SRS), managing excessive thermal load generated within the fiber core, and designing highly robust, damage-resistant beam delivery optics capable of handling extreme power density without failure or degradation of the beam profile.

Which geographical region currently holds the largest market share and why is it dominant?

The Asia Pacific (APAC) region, primarily led by China, holds the largest market share due to its massive, rapidly expanding industrial base, continuous governmental investment in factory automation (Industry 4.0), and the resulting high-volume demand for multi-kilowatt laser systems across diverse manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager