High Pressure Commercial Toilet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441208 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

High Pressure Commercial Toilet Market Size

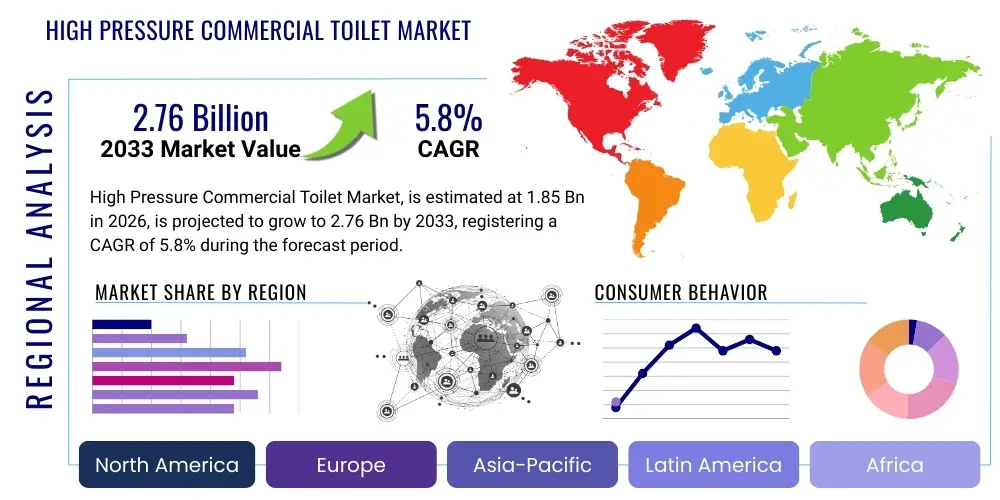

The High Pressure Commercial Toilet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.76 billion by the end of the forecast period in 2033. This steady growth trajectory is primarily driven by increasing urbanization, stringent regulatory mandates emphasizing water conservation in commercial establishments, and the continuous need to upgrade aging public and institutional infrastructure globally. High pressure systems are favored in high-traffic commercial environments due to their superior flushing performance, enhanced durability, and reduced risk of clogging compared to traditional gravity-fed systems, ensuring reliable operation under heavy usage conditions.

High Pressure Commercial Toilet Market introduction

The High Pressure Commercial Toilet Market encompasses specialized sanitary fixtures designed for demanding, high-traffic commercial, institutional, and industrial environments. These systems utilize pressurized water supply lines or integral pressure vessels to achieve powerful and highly efficient flushing cycles, ensuring maximum waste removal and hygiene standards with minimal water consumption per flush (often meeting or exceeding 1.28 gallons per flush (gpf) or 4.8 liters per flush (lpf) requirements mandated by modern building codes). The products primarily include tankless flushometer valve toilets, pressure-assisted toilets, and sophisticated sensor-operated units, engineered for superior reliability and vandal resistance.

Major applications of high pressure commercial toilets span across sectors such as healthcare facilities (hospitals, clinics), educational institutions (universities, schools), corporate office buildings, airports, transportation hubs, hospitality venues (hotels, large resorts), and retail complexes (shopping malls). The product description emphasizes rugged construction, often utilizing vitreous china or stainless steel, integrated trapways designed to handle larger volumes, and flush mechanisms built for millions of cycles without failure. These attributes are critical for reducing maintenance frequency and associated costs in public spaces.

Key driving factors accelerating market adoption include strict governmental mandates promoting water efficiency, particularly in regions prone to water scarcity; the global boom in commercial real estate development and infrastructure projects; and heightened public awareness regarding sanitation and hygiene, catalyzed partly by recent global health events. Furthermore, the inherent benefits—such as powerful flushing action, reduced water staining, reliable performance in multi-story buildings where water pressure fluctuations are common, and robust construction—make them the preferred choice over standard residential fixtures for facility managers focused on long-term operational efficiency and minimizing downtime.

High Pressure Commercial Toilet Market Executive Summary

The High Pressure Commercial Toilet Market is defined by technological innovation centered on water efficiency, sensor integration, and durability. Current business trends indicate a strong shift towards smart restroom solutions, where high pressure units are integrated with IoT sensors for predictive maintenance, usage monitoring, and automated cleaning protocols. Manufacturers are increasingly focusing on developing sophisticated flushometer valves that offer customizable flow rates and reduced noise levels, catering specifically to the hospitality and premium commercial office segments. Regional trends show North America maintaining dominance due to stringent water conservation laws (like those enforced by the EPA WaterSense program) and a mature market for institutional infrastructure upgrades, while the Asia Pacific region exhibits the fastest growth driven by rapid urbanization and massive investment in new commercial and transportation infrastructure, particularly in countries like China and India.

Segmentation trends highlight the increasing preference for flushometer-based systems over pressure-assisted tank models in large public facilities due to their rapid recovery time and higher cycle capability. Within end-user segments, the healthcare and transportation sectors are proving to be major demand drivers, requiring the highest standards of hygiene and reliability. Additionally, the shift towards sustainable procurement practices is pushing the adoption of ultra-low flow (ULF) models, which utilize advanced flushing dynamics to maintain performance while significantly reducing water usage (e.g., 1.1 gpf). The competitive landscape is characterized by established plumbing giants leveraging global distribution networks and focusing strategic investments on digital integration and advanced material science to enhance product longevity and hygiene features.

AI Impact Analysis on High Pressure Commercial Toilet Market

Common user questions regarding AI's impact on commercial toilets frequently revolve around how data analytics can reduce maintenance costs, optimize water consumption, and enhance user experience. Users are keen to understand the Return on Investment (ROI) associated with smart restroom retrofits, asking specifically how AI interprets sensor data (such as flush count, water flow rates, and ambient restroom conditions) to predict potential failures like valve leaks or blockages before they escalate. Another key concern involves the cybersecurity implications of integrating toilet systems into Building Management Systems (BMS) networks and the long-term viability of AI-driven maintenance contracts. The overarching theme is the transition from reactive maintenance (fixing a clog) to predictive facility management, using algorithms to ensure 99.9% uptime and compliance with water usage goals without human intervention.

The impact analysis reveals that AI fundamentally transforms the operational paradigm of commercial restrooms. AI-powered systems are crucial for analyzing vast datasets generated by connected high pressure flushometers and environmental sensors. For instance, anomaly detection algorithms can pinpoint minor fluctuations in flush volume or cycle time, indicating impending mechanical wear or sediment buildup in the pressurized mechanism, allowing facility managers to schedule non-urgent, targeted maintenance. This predictive capability minimizes disruption, extends the lifespan of expensive high pressure components (like diaphragm valves), and ensures consistent, optimal water performance, directly contributing to sustainability goals and lowering overall utility expenditure for large organizations.

Furthermore, AI algorithms are now being utilized in the design phase (Generative AI) to simulate flushing dynamics and optimize the ceramic geometry for maximal performance at minimal water usage, exceeding standard engineering constraints. In terms of inventory and supply chain, AI helps predict demand for specific spare parts (e.g., flushometer repair kits) based on observed usage patterns across a facility portfolio, leading to Just-In-Time inventory management, reducing storage costs, and ensuring rapid response capability. This integration elevates high pressure toilets from simple fixtures to integrated data points within a larger smart building ecosystem, maximizing resource efficiency and hygiene monitoring.

- Predictive Maintenance Scheduling: AI analyzes real-time sensor data (flush count, water flow, pressure) to forecast component failure (e.g., worn seals, valve degradation) before performance issues occur.

- Water Consumption Optimization: Machine learning algorithms dynamically adjust flush volume parameters based on usage patterns and time of day, ensuring compliance with ultra-low flow mandates.

- Usage Pattern Analysis: AI identifies high-traffic periods and underutilized units, optimizing cleaning schedules and resource allocation across large facilities (e.g., airports, stadiums).

- Automated Hygiene Monitoring: Integration with air quality and presence sensors triggers automated cleaning alerts and provides compliance reporting, particularly critical for healthcare settings.

- Generative Design Optimization: AI assists engineers in designing more efficient trapways and bowls, maximizing waste removal efficiency at reduced water pressures.

- Supply Chain and Inventory Forecasting: Algorithms accurately predict demand for proprietary high pressure components, streamlining maintenance parts procurement.

DRO & Impact Forces Of High Pressure Commercial Toilet Market

The High Pressure Commercial Toilet Market is strongly influenced by a combination of stringent regulatory drivers, operational cost constraints, and technological innovation. Key drivers include widespread governmental regulations, such as those in North America and Europe, mandating low-flow plumbing fixtures in all new commercial constructions and major renovations, forcing facility owners away from older, less efficient 3.5 gpf systems towards modern 1.28 gpf or lower pressure-assisted and flushometer units. Additionally, the growing focus on green building certifications (like LEED) elevates the demand for fixtures that demonstrably reduce water footprint. These regulatory and environmental pressures create a foundational demand for the high efficiency characteristic of high pressure toilets.

Restraints primarily center on the higher initial procurement cost of high pressure and flushometer systems compared to conventional gravity units, alongside the complexity involved in retrofitting existing buildings which often lack the necessary high-pressure plumbing infrastructure or sufficient pipe diameter required for optimal performance. Facility owners, especially in budget-constrained public sectors, may face resistance to this capital expenditure, even when recognizing the long-term savings in water bills. Furthermore, maintaining specialized high-pressure valve systems requires technicians with specific training, posing a hurdle for smaller maintenance crews.

Opportunities are significant, particularly in the smart plumbing segment, leveraging IoT integration for data collection and optimization. The opportunity for manufacturers lies in developing modular, easy-to-install flushometer systems that simplify retrofitting and minimize downtime during installation. Furthermore, addressing the noise concern associated with older high pressure flushes through advanced dampening technology opens pathways into the premium hotel and corporate segments. Impact forces include the fluctuating prices of raw materials (ceramics, brass, stainless steel) and the accelerated pace of water-saving innovation, where the effective gpf benchmark is constantly pushed lower, forcing continuous R&D investment to maintain market competitiveness and regulatory compliance.

- Drivers (D):

- Stringent Water Conservation Regulations: Global adoption of mandates requiring ultra-low flow fixtures (1.28 gpf or less) in commercial buildings.

- Rapid Urbanization and Infrastructure Development: Construction boom in commercial, public, and transportation sectors globally, particularly in APAC.

- Demand for Superior Hygiene and Performance: Need for non-clogging, high-reliability fixtures in high-traffic areas like airports and healthcare facilities.

- Green Building Initiatives: Certification programs like LEED favoring high-efficiency, durable plumbing solutions.

- Restraints (R):

- High Initial Installation and Procurement Cost: High cost of specialized flushometer valves and associated piping infrastructure compared to conventional systems.

- Complexity of Retrofitting: Challenges in adapting older buildings to meet the pressure and volume requirements for optimal performance of high pressure systems.

- Perceived Noise Levels: Older pressure-assisted units were notoriously loud, creating a persistent market perception challenge that manufacturers must overcome.

- Opportunities (O):

- Smart Restroom and IoT Integration: Developing systems with integrated sensors for predictive maintenance, usage monitoring, and automated sanitization.

- Market Penetration of Ultra-Low Flow (ULF) Technologies: Focus on advanced hydrodynamic designs to meet performance standards at 1.0 gpf or less.

- Expansion in Emerging Markets: Leveraging infrastructure investment in developing economies requiring durable commercial fixtures.

- Impact Forces:

- Technological Obsolescence Rate: Rapid advancements in flushing technology and smart features necessitate frequent product updates.

- Raw Material Price Volatility: Fluctuations in the cost of metals (brass, stainless steel for valves) and ceramic materials.

Segmentation Analysis

The High Pressure Commercial Toilet Market is strategically segmented based on product type, technology, flushing mechanism, and crucial end-user application, allowing manufacturers to tailor offerings to specific facility requirements such as durability in schools or extreme hygiene in hospitals. Segmentation by product type typically divides the market into floor-mounted and wall-hung models, with wall-hung units gaining preference in new construction due to simplified floor cleaning and better hygiene access. Technology segmentation is critical, distinguishing between pressure-assisted, siphon jet, and washdown systems, with the pressure-assisted category often dominating high-performance institutional settings requiring maximum efficiency and speed.

The flushing mechanism segment separates manual (lever-operated) flush systems from automated sensor-operated systems, where the latter is rapidly growing due to infection control mandates and enhanced user convenience, particularly post-2020. End-user applications form the most diverse segmentation layer, recognizing the unique demands of sectors like healthcare (which prioritizes hygiene and robust materials like stainless steel), education (which demands maximum vandal resistance and durability), and hospitality (which emphasizes low noise and sleek design aesthetics). Understanding these segments allows companies to optimize distribution channels, focusing specific durable product lines towards facility management procurement officers and designer-focused lines toward architectural specification firms.

- By Product Type:

- Floor-Mounted Commercial Toilets

- Wall-Hung Commercial Toilets

- By Flushing Technology:

- Flushometer Valve Systems (Diaphragm and Piston types)

- Pressure-Assisted Tank Systems

- Siphon Jet Systems

- By Operation Mechanism:

- Manual Flush (Lever/Button)

- Sensor/Automatic Flush (Hands-Free)

- By End-User Application:

- Office and Corporate Spaces

- Healthcare Facilities (Hospitals, Clinics)

- Educational Institutions (Schools, Universities)

- Hospitality (Hotels, Restaurants)

- Retail and Commercial Complexes (Malls, Stores)

- Transportation and Public Infrastructure (Airports, Stations)

- By Flow Rate:

- Standard Low Flow (1.6 gpf) - Mostly for older stock/regions

- High Efficiency/Ultra-Low Flow (1.28 gpf and 1.1 gpf)

Value Chain Analysis For High Pressure Commercial Toilet Market

The value chain for the High Pressure Commercial Toilet Market begins with the upstream activities involving the sourcing of primary raw materials: high-grade vitreous china clay for the ceramic body, brass and stainless steel for the complex flushometer valves and internal mechanisms, and advanced polymers for seals and sensor casings. The manufacturing process is highly specialized, requiring precision casting, kiln firing, glazing, and sophisticated assembly lines for the mechanical and electronic components. Key upstream challenges include managing the volatile pricing of metals and maintaining consistent quality in ceramic production, which is crucial for achieving specific flushing geometries required for high-efficiency performance. Collaboration with specialized component manufacturers for flushometers (piston vs. diaphragm technology) is a critical upstream activity.

Midstream activities primarily focus on the distribution channel, which is complex and highly specialized. High pressure commercial toilets are rarely sold directly to end consumers; instead, they move through a structured network. This includes direct sales to large institutional buyers (e.g., government contracts, hospital networks), sales via large wholesale plumbing supply houses, and distribution through mechanical, engineering, and plumbing (MEP) contractors who specify and install the products. Indirect channels, involving architects and designers, play a crucial role in product specification early in the construction cycle, influencing the brand and model selection heavily based on compliance and performance data.

Downstream activities involve post-installation support, maintenance, and the secondary market for replacement parts. Given the robustness and complexity of high pressure systems, facility managers often rely on manufacturer-certified service providers for regular maintenance and complex repairs of the flushometer valves. The effectiveness of the supply chain in delivering specialized repair kits and ensuring the longevity of the installation is paramount to customer satisfaction and repeat business. Direct engagement with facility management personnel provides valuable feedback for continuous product improvement regarding ease of maintenance and long-term durability metrics.

High Pressure Commercial Toilet Market Potential Customers

The primary customers and end-users of high pressure commercial toilets are entities that manage high-volume, continuously operating public or institutional facilities where hygiene, durability, and water efficiency are critical operational metrics. These include major property developers constructing Class A commercial office towers, seeking LEED certification and minimizing long-term utility costs. Large governmental and municipal agencies, such as departments managing public schools, state universities, and federal buildings, constitute a massive and consistent customer base, often procuring units through structured tender processes that prioritize compliance and lifespan over initial cost.

Another major segment includes facility managers and procurement officers for high-traffic environments like international airports, railway stations, and convention centers, where fixtures must withstand constant, often abusive usage while maintaining low water consumption standards. The healthcare sector—hospitals, nursing homes, and medical research facilities—represents a premium customer segment, demanding hands-free, high-pressure sanitation solutions for stringent infection control protocols. Finally, the hospitality industry, encompassing major hotel chains and large resorts, seeks systems that combine reliable high-performance flushing with aesthetically pleasing designs and, critically, low noise profiles to ensure guest comfort.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sloan Valve Company, TOTO Ltd., Kohler Co., American Standard Brands, Zurn Industries LLC, Geberit AG, Roca Sanitario, S.A., Bradley Corporation, Mansfield Plumbing, Eljer Plumbingware, Villeroy & Boch, Duravit AG, Grohe AG, Chicago Faucets, Saniflo, Cera Sanitaryware Ltd., Jaquar Group, Hindware Homes, Caroma Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Commercial Toilet Market Key Technology Landscape

The core technology defining the High Pressure Commercial Toilet Market revolves around efficient fluid dynamics and sophisticated mechanical or electronic control systems, primarily centered in the flushometer valve. Flushometer technology utilizes the existing high pressure building water supply (typically 25 psi to 80 psi) to execute a rapid, measured flush. The innovation lies in the valve design—either piston or diaphragm—which precisely controls the volume and duration of the water released, ensuring a powerful clean while meeting strict low-flow standards. Recent advancements focus on enhancing the sealing materials for greater resistance to harsh water chemistry (high chlorine or mineral content) and utilizing anti-siphon protection technologies to prevent backflow contamination, which is paramount in commercial settings. The evolution of sensor technology, moving from simple infrared proximity sensors to more robust and accurate capacitive sensors, minimizes accidental flushes and improves reliability in varied lighting conditions.

A major technological trend is the integration of electronic control systems (smart flushometers) with Building Management Systems (BMS) via wireless protocols (e.g., Bluetooth, Wi-Fi). These systems collect detailed telemetry data, including flush cycles, water consumption rates, and battery life (for sensor-operated units), which are essential inputs for AI-driven predictive maintenance platforms. Manufacturers are developing proprietary 'self-cleaning' or 'self-regulating' valve technology that automatically adjusts the internal components to maintain consistent flow performance despite fluctuations in source pressure. This technical sophistication is crucial for large commercial buildings where water pressure can vary significantly between floors and usage periods, thereby ensuring consistent, powerful flushing on every cycle, regardless of external hydraulic conditions.

Furthermore, material science plays a significant role, particularly in the ceramic body and glaze. Manufacturers are investing in specialized anti-microbial glazes (often incorporating silver ions) that inhibit bacterial growth on the toilet surface, a critical hygiene factor for healthcare and food service applications. The shift towards concealed flushometer systems, where the valve mechanism is hidden behind the wall, improves aesthetics, minimizes vandalism, and simplifies the sterilization process, aligning with contemporary architectural specifications for modern commercial restrooms. The continuous drive to reduce the noise signature of high-pressure flushing, often achieved through specialized flow restrictors and sound-dampening materials within the piping system, remains a key technological battleground for products targeting high-end corporate and hospitality environments where user comfort is prioritized alongside efficiency.

Regional Highlights

Regional dynamics significantly influence the High Pressure Commercial Toilet Market, driven primarily by local building codes, water availability, and the pace of commercial infrastructure development. North America, encompassing the United States and Canada, remains the largest and most mature market segment. This dominance is attributed to early and widespread adoption of stringent federal and state-level water conservation standards, such as the EPA's WaterSense program, which heavily favors high-efficiency, high-pressure flushometer systems. The market here is characterized by highly sophisticated distribution networks, a strong presence of established plumbing fixture brands, and substantial demand fueled by continuous retrofitting projects aimed at meeting evolving water-efficiency benchmarks. Furthermore, the US healthcare and education sectors represent significant institutional buyers requiring the most durable and reliable fixtures.

Europe exhibits steady growth, primarily focused on product innovation emphasizing sustainability, elegant design, and low noise levels. Countries in Western Europe, particularly Germany and the UK, prioritize systems that integrate seamlessly with advanced modular and pre-wall installation systems (like those championed by Geberit AG), often demanding concealed cisterns and robust frame systems that support wall-hung, high-pressure units. European regulations heavily influence product design through ecological labeling schemes and energy efficiency directives, making ultra-low flow, quiet-operation systems essential for competitiveness. Meanwhile, Eastern Europe presents an emerging opportunity fueled by modernization of public infrastructure and commercial buildings post-EU accession funds.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily propelled by explosive rates of urbanization, massive government and private sector investment in new commercial real estate (office towers, integrated townships, retail malls), and the construction of state-of-the-art airports and high-speed rail networks, particularly in China, India, and Southeast Asian nations. Although regulatory adoption of strict water efficiency standards varies across the region, market demand is increasingly influenced by Western standards and the proliferation of international hotel chains and multinational corporate headquarters, which mandate the installation of globally compliant, high-performance fixtures. Local manufacturing also plays a vital role, adapting high-pressure technology to meet regional price sensitivities while navigating diverse local plumbing standards and water quality challenges.

- North America: Market leader driven by strict regulatory mandates (WaterSense, California AB 1953) enforcing ultra-low flow rates; high adoption rate of sophisticated flushometer valve systems in institutional settings; strong retrofitting market.

- Europe: Focus on high aesthetic standards, sustainability (low water usage, circular economy principles), and pre-wall installation systems; key growth areas in smart restroom technology integration across commercial and hospitality sectors.

- Asia Pacific (APAC): Fastest growing market fueled by rapid construction of commercial and transportation infrastructure; significant opportunities in developing economies (India, Southeast Asia) adapting Western-standard plumbing technology; varying regulatory landscapes driving localized product solutions.

- Latin America (LATAM): Growth tied to major metropolitan expansions and tourism infrastructure investment; challenges include varying water pressure across municipalities and fragmented distribution networks; demand for robust, easily maintained fixtures.

- Middle East and Africa (MEA): Growth driven by massive commercial construction projects (e.g., Saudi Arabia’s Vision 2030, UAE development); high demand for water-efficient technologies due to extreme water scarcity; focus on high-durability products for public spaces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Commercial Toilet Market.- Sloan Valve Company

- TOTO Ltd.

- Kohler Co.

- American Standard Brands

- Zurn Industries LLC

- Geberit AG

- Roca Sanitario, S.A.

- Bradley Corporation

- Mansfield Plumbing

- Eljer Plumbingware

- Villeroy & Boch

- Duravit AG

- Grohe AG

- Chicago Faucets

- Saniflo

- Cera Sanitaryware Ltd.

- Jaquar Group

- Hindware Homes

- Caroma Industries Ltd.

- Crane Plumbing LLC

Frequently Asked Questions

Analyze common user questions about the High Pressure Commercial Toilet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between high pressure commercial toilets and standard gravity-fed toilets?

High pressure commercial toilets, typically using flushometer valves or pressure-assisted tanks, rely on incoming municipal water line pressure (high PSI) or compressed air to rapidly discharge a precise volume of water, creating a powerful jet action for superior waste removal. Standard gravity-fed toilets rely solely on the weight of water dropping from a tank (low PSI). The high pressure system provides faster recovery time, ensures consistent performance across multi-story buildings, and is inherently designed for the extreme durability and efficiency required in high-traffic commercial environments, enabling low water consumption rates (1.28 gpf or less) without sacrificing performance, a critical requirement for modern building codes and water conservation initiatives globally. The robust construction and specialized valve mechanisms in high pressure units ensure millions of flush cycles are achieved, minimizing the need for frequent maintenance in demanding public spaces like airports and stadiums.

How do high pressure commercial toilets comply with stringent water conservation regulations like EPA WaterSense?

High pressure systems achieve WaterSense compliance, which requires fixtures to use 1.28 gallons per flush (gpf) or less, through highly engineered flushometer valves that precisely meter the water volume released from the high-pressure supply line, or via pressure-assisted tanks that use trapped air to push water out forcefully, maximizing the momentum created by the limited water volume. Modern high pressure fixtures utilize advanced ceramic trapway geometry optimized via computational fluid dynamics (CFD) to maximize siphon action at ultra-low flow rates (often 1.1 gpf or less). Compliance is ensured through independent testing and registration, providing facility managers and developers with certified proof that the installation contributes significantly to building sustainability goals and ensures adherence to increasingly demanding regional water mandates, crucial for obtaining certifications such as LEED and lowering overall operational water costs.

What are the key benefits of installing sensor-operated (hands-free) high pressure flushometers in commercial settings?

The installation of sensor-operated, hands-free high pressure flushometers provides substantial benefits across hygiene, water efficiency, and maintenance. From a hygiene perspective, eliminating physical contact with the flushing mechanism drastically reduces the transmission of pathogens, a critical requirement in healthcare and food service settings. In terms of efficiency, sensor-operated units often incorporate advanced water management features, ensuring the toilet flushes only when necessary and automatically initiating a reduced courtesy flush if usage is detected but a full flush is missed, thereby preventing odor issues and ensuring consistent low-flow compliance. Operationally, these systems reduce component wear associated with physical levers and are essential for meeting accessibility standards (ADA compliance), while integrated diagnostics often simplify troubleshooting and predictive maintenance through connectivity to Building Management Systems (BMS), leading to reduced long-term maintenance labor and ensuring maximum uptime, highly valued by facility management professionals.

What are the primary maintenance considerations and common failure points for high pressure flushing systems?

Maintenance for high pressure systems primarily focuses on the flushometer valve components, which are subject to high velocity water flow and mineral deposits, particularly in areas with hard water. Common failure points include degradation of the rubber diaphragm or piston seals, mineral buildup restricting the critical bypass hole, or failure of the solenoid valve in electronic sensor systems. Regular maintenance involves cleaning the filter screens, inspecting and replacing worn rubber components, and ensuring the correct setting of the stop valve to maintain optimal flow and pressure. Compared to gravity systems, high pressure units require specialized repair kits and technical expertise for repair, although their overall lifespan between major repairs is generally longer due to robust component materials (brass, stainless steel). The shift towards smart flushometers is simplifying maintenance by providing remote diagnostic alerts that pinpoint the exact component needing service before total failure occurs.

How is the market addressing the historical issue of noise associated with high pressure commercial toilets?

Manufacturers are actively addressing the historical perception of high-pressure flushing systems being excessively loud, a particular drawback for corporate and hospitality environments. This is being mitigated through several technological advancements. Firstly, engineered flushometer valves now incorporate acoustic dampening features and flow-regulating mechanisms that control the rate of pressure release, minimizing the sharp "blast" of water into the bowl and reducing pipe noise transfer. Secondly, the design of the ceramic bowl itself has been refined using hydro-acoustic modeling to optimize water trajectory and mitigate noise generation during the siphon process. For wall-hung systems popular in modern architecture, manufacturers integrate sound-isolating mounting frames and pre-wall systems that physically decouple the fixture from the building structure. These collective improvements ensure that modern high pressure commercial toilets can deliver high performance and reliability while meeting the low noise level expectations of premium commercial and residential facilities, substantially expanding their adoption potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager