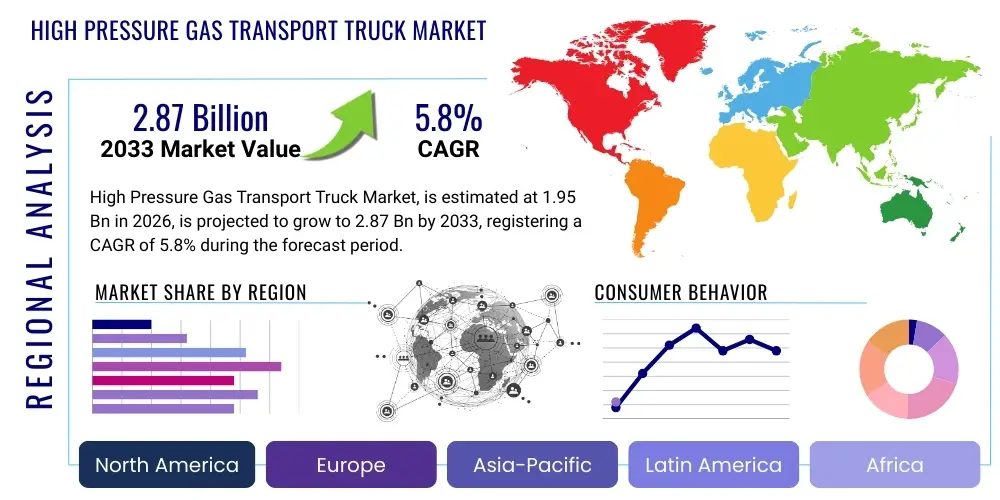

High Pressure Gas Transport Truck Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441158 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

High Pressure Gas Transport Truck Market Size

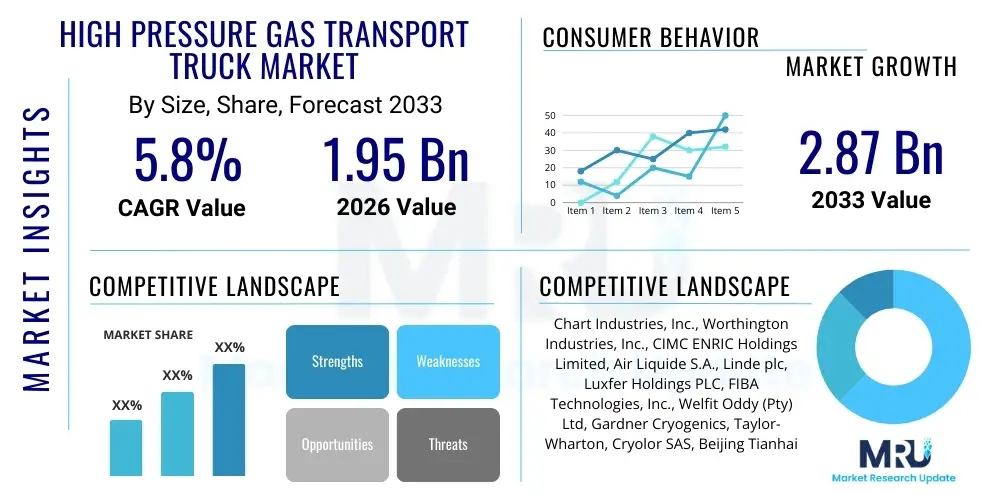

The High Pressure Gas Transport Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

High Pressure Gas Transport Truck Market introduction

The High Pressure Gas Transport Truck Market encompasses specialized heavy-duty vehicles designed explicitly for the secure and efficient bulk transportation of gases maintained at significantly elevated pressures, often ranging from 150 bar up to 700 bar depending on the specific gas and application. These specialized assets are indispensable components of the global industrial supply chain, facilitating the movement of critical materials such as bulk industrial oxygen, highly purified nitrogen, argon, and, increasingly, high-pressure gaseous fuels like Compressed Natural Gas (CNG) and hydrogen. The technology incorporated within these trucks is highly specialized, centering on tube trailers or modular skids featuring multiple interconnected, seamlessly integrated pressure vessels certified to withstand extreme internal stresses, maintaining absolute containment integrity, which is paramount given the inherent flammability or asphyxiation risks associated with these cargoes. The design and manufacturing processes must adhere strictly to international standards, including meticulous weld inspection, hydrostatic testing, and fatigue life assessment, ensuring reliability over a projected operational life often exceeding 20 years.

The core product offerings within this market segment revolve around advanced tube trailers, which are non-motorized high-capacity vessels permanently or semi-permanently mounted on a heavy-duty chassis towed by a tractor unit. These trailers vary significantly based on the intended payload; for instance, those transporting standard industrial gases might utilize high-strength steel alloy cylinders (Type I or II), while newer applications, particularly hydrogen transport, necessitate the utilization of advanced composite vessels (Type III or Type IV) made from carbon fiber reinforcement to minimize tare weight and maximize payload capacity. Major applications span critical sectors globally. In industrial manufacturing, these trucks ensure a continuous supply of atmospheric gases essential for processes like welding, cutting, and inert purging in electronics fabrication. The medical sector relies heavily on these transport systems for bulk oxygen delivery to hospitals and healthcare facilities. Crucially, the energy transition segment—specifically the rapidly developing hydrogen and natural gas fueling infrastructure—is becoming the largest catalyst for new procurement, demanding specialized high-pressure systems capable of moving vast quantities of gaseous energy carriers securely and economically across diverse geographies.

The principal benefits derived from utilizing specialized high-pressure gas transport trucks include superior logistical flexibility, as they can access points not reachable by rail pipelines, and optimized cost efficiency for medium-to-long distance regional transport compared to individualized cylinder delivery. Safety assurance is a non-negotiable benefit, achieved through mandated technological features such as robust anti-lock braking systems (ABS), electronic stability control (ESC), sophisticated manifold pressure monitoring, and integrated emergency shut-down mechanisms that meet or exceed dangerous goods transport regulations. Driving factors underpinning market growth are multifaceted: accelerating infrastructure spending in emerging economies demands more industrial gases; the global legislative and corporate commitment to establishing a hydrogen economy requires substantial fleet investment; and the continuous need for fleet replacement and modernization in mature markets due to the limited operational lifespan of high-stress pressure vessels. Furthermore, regulatory tightening, particularly concerning safety protocols and traceable transport logistics, compels operators to invest in cutting-edge, compliant equipment, further stimulating market demand across all regions.

High Pressure Gas Transport Truck Market Executive Summary

The trajectory of the High Pressure Gas Transport Truck Market is defined by technological convergence, regulatory rigor, and the dynamic restructuring of global energy sources. Current business trends are characterized by a pronounced shift towards digitalization in logistics, wherein asset utilization rates are being optimized through sophisticated fleet management software incorporating real-time performance analytics and route optimization algorithms. Leading manufacturers are investing heavily in material science R&D, focusing on reducing the weight of tube trailer assemblies without compromising structural integrity or pressure ratings, driving the rapid adoption of Type IV composite technology, particularly for high-value gases. Furthermore, there is a visible trend towards consolidation among specialized logistics providers who are expanding their service portfolios to offer integrated solutions, encompassing gas supply, transport, and on-site dispensing, creating fewer but larger, more specialized players in the transport domain, thereby increasing barriers to entry for new competitors.

Regional market dynamics showcase a clear divergence in drivers. In the Asia Pacific, the market growth is volumetric, dictated by rapid capacity expansion and sheer industrial scale, often favoring cost-effective, high-volume Type I steel vessels for traditional gases, while simultaneously building out cutting-edge composite fleets for hydrogen deployment subsidized by national policies. Conversely, mature regions like North America and Europe are driven primarily by qualitative factors: regulatory deadlines for emission reductions, necessitating the pairing of tube trailers with cleaner (electric or hydrogen-powered) tractor units, and safety enhancements, leading to higher average spending per unit. In Europe, the strict harmonization of transport regulations under the ADR framework standardizes technical specifications, favoring manufacturers who can offer globally certified, multi-jurisdictional compliant products, resulting in intense competitive pressure on product innovation, particularly around lightweighting and integrated safety telemetry systems.

Segmentation insights confirm that the technological evolution centered on hydrogen is reshaping the market composition. Although traditional Industrial Gases currently hold the largest volume share, the Energy Gases segment, dominated by CNG and Hydrogen, is showing exponential growth and is projected to capture a significantly larger market share by value due to the higher complexity and cost associated with Type IV composite vessels required for these high-pressure applications. Within the Application segment, the transition of gas companies into comprehensive energy solution providers means that the Energy & Power Generation application is transitioning from a steady consumer to the primary innovation driver, dictating future truck design and pressure requirements. This structural shift necessitates strategic alignment by equipment manufacturers towards developing products that meet the extreme pressures and cyclic fatigue resistance demanded by continuous high-speed refueling cycles typical of hydrogen mobility infrastructure.

AI Impact Analysis on High Pressure Gas Transport Truck Market

User inquiries surrounding the integration of Artificial Intelligence (AI) into the High Pressure Gas Transport Truck Market overwhelmingly focus on mitigating the critical risks associated with transporting hazardous materials under high pressure and achieving regulatory compliance through enhanced data fidelity. Key concerns explored involve how AI can move beyond simple historical data analysis to provide truly predictive models for component failure, particularly concerning the fatigue life of welds and stress points within pressure vessels exposed to constant road vibration and temperature fluctuations. There is significant user interest in leveraging AI for dynamic regulatory compliance checks, ensuring that routes automatically avoid restricted zones or adhere to time-of-day restrictions for dangerous goods transport in metropolitan areas. The overarching expectation is that AI systems must offer transparent, auditable decision-making processes, particularly when those decisions impact asset integrity and public safety, establishing a high threshold for reliability and validation compared to typical commercial logistics AI applications.

- Predictive Maintenance: AI algorithms continuously process massive datasets from embedded sensors (pressure, temperature, stress gauges) to accurately model and forecast the remaining useful life (RUL) of high-pressure components, such as valves, relief devices, and vessel structure, drastically reducing the risk of unexpected containment failure. This is critical for preventing catastrophic incidents in high-pressure gas transport.

- Dynamic Route Optimization: Machine learning systems ingest real-time logistical constraints, including traffic density, road surface conditions, severe weather warnings, and local regulatory mandates (e.g., hazmat route restrictions), optimizing routes for safety, compliance, and fuel efficiency simultaneously, ensuring minimal exposure risk during transit.

- Enhanced Safety Monitoring and Auditing: AI-powered computer vision and sensor fusion technologies monitor driver alertness and adherence to mandatory safety protocols during complex maneuvers like coupling, uncoupling, and loading/unloading operations, providing immediate alerts for non-compliance and generating immutable records for regulatory audits.

- Supply Chain Resilience: Advanced AI models optimize the deployment strategy of the specialized fleet across vast distribution networks, accurately matching complex supply schedules with fleet availability and maintenance cycles, ensuring continuous supply chain integrity for essential industrial and medical gases, even during periods of high geopolitical or industrial volatility.

- Cybersecurity and Data Integrity: AI-driven threat detection systems monitor the sophisticated telemetry networks embedded in modern tube trailers, protecting sensitive real-time pressure and location data from cyber threats, ensuring the integrity of the safety data used for operational decisions and regulatory reporting remains uncompromised.

DRO & Impact Forces Of High Pressure Gas Transport Truck Market

The High Pressure Gas Transport Truck Market’s momentum is fundamentally driven by the accelerated global energy transition, which necessitates reliable and robust high-pressure distribution logistics, particularly for hydrogen and CNG. A key driver is the overwhelming global policy push—exemplified by the European Green Deal and U.S. infrastructure acts—mandating massive investment in clean energy infrastructure, which cannot function without specialized high-pressure transport assets for gaseous fuels. Opportunities are significant in material innovation, specifically the widespread commercialization of Type IV vessels, which dramatically improve operational profitability by increasing payload per vehicle, thus lowering the cost of gas delivery per kilogram. These opportunities extend into the services sector, where maintenance and requalification services for high-pressure composite vessels are rapidly becoming high-value specialized offerings, capitalizing on the demanding inspection schedules required by regulators.

However, the market faces formidable restraints directly linked to its specialized nature. The acquisition cost for a high-pressure tube trailer, especially those utilizing advanced composite materials suitable for 700 bar hydrogen, is substantially higher than conventional heavy transport equipment, creating significant capital expenditure barriers for smaller operators. Furthermore, the mandatory, highly specialized, and periodic recertification (requalification) of every pressure vessel adds considerable operational expense and downtime, which must be carefully managed. Skilled labor shortage also poses a severe restraint; the maintenance, repair, and operation of high-pressure systems require technicians with highly specialized training and certification, a skill set that is not universally available, particularly in emerging markets, leading to higher labor costs and potential operational delays.

The principal impact force shaping this market is the perpetually stringent regulatory environment, stemming directly from the public safety risks associated with transporting large volumes of compressed, potentially volatile gases. Regulatory bodies globally consistently raise the bar for certification, testing, and operational monitoring (e.g., mandating advanced telemetry), forcing manufacturers to continuously innovate and invest in safety R&D, often resulting in complex compliance procedures that slow down product time-to-market. A secondary, but increasingly potent, impact force is the necessity for decarbonization within the transport fleet itself. End-users are increasingly demanding that their high-pressure tube trailers be paired with zero-emission tractor units (either battery-electric or hydrogen-powered), which requires fundamental redesign and integration challenges, placing pressure on OEMs to rapidly develop compatible, weight-optimized solutions to maintain total allowable payload capacity.

Segmentation Analysis

Understanding the High Pressure Gas Transport Truck Market requires detailed analysis across three primary axes: the specific gas commodity, the technology employed in containment, and the end-user industrial application. This structured segmentation enables market participants to effectively target investment in R&D and manufacturing capacity. The Gas Type segmentation (Industrial, Energy, Specialty) is crucial for identifying areas of future value capture, particularly observing the seismic shift towards Energy Gases driven by global climate mandates. Analyzing Vessel Type (Steel/Alloy vs. Composites) reveals the technological maturity and adoption rate across different geographical regions and pressure requirements. Finally, the Application segmentation provides visibility into the structural demand characteristics, distinguishing between cyclical demand from traditional manufacturing sectors and sustained, long-term infrastructure demand from the evolving energy sector, allowing for tailored marketing and product specification based on specific user needs like pressure ratings or required cyclic fatigue resistance.

- Gas Type:

- Industrial Gases: Includes high-volume gases like Oxygen, Nitrogen, and Argon, essential for metals, chemicals, and food industries. Transport typically uses traditional steel/alloy tube trailers at medium pressures (around 200 bar).

- Energy Gases: Encompasses Compressed Natural Gas (CNG), Biomethane, and Gaseous Hydrogen. This segment drives demand for ultra-high pressure (up to 700 bar) transport using Type IV composite technology to maximize volumetric energy density.

- Specialty & Medical Gases: Includes high-purity gases like Helium, Neon, and medical-grade Oxygen. These often require specialized, highly clean transport vessels and specialized manifold systems to prevent contamination, often transported in smaller, highly certified modules.

- Vessel Type:

- Steel/Alloy Tube Trailers: The historical backbone of the market, offering high durability and cost-effectiveness for medium-pressure, high-volume industrial gases, though limited by high tare weight.

- Type III Composite Vessels: Feature an aluminum liner wrapped with carbon fiber or fiberglass, offering a moderate weight reduction and suitability for pressures up to 300 bar.

- Type IV Composite Vessels: Utilize a fully non-metallic liner (polymer) encased in a full carbon fiber wrap. These represent the cutting edge, essential for achieving the necessary high pressures (350-700 bar) and low weight required for economical hydrogen transport.

- Application:

- Industrial Manufacturing: Dedicated transport for metallurgy, electronics fabrication (e.g., semiconductor production requiring ultra-high purity gases), and chemical synthesis.

- Energy & Power Generation: Supply of natural gas to power plants, distribution of CNG to fueling stations, and delivery of gaseous hydrogen to mobility hubs and industrial consumers initiating decarbonization efforts.

- Medical & Healthcare: Highly regulated transport of medical oxygen and other critical gases to hospitals, requiring stringent traceability and temperature control measures.

- Research & Development: Niche applications requiring specialty gases, often in smaller quantities but demanding the highest purity and most rigorous handling standards.

- Pressure Range:

- Low Pressure (Up to 150 Bar): Primarily used for older applications or certain low-density gases.

- Medium Pressure (150 Bar to 300 Bar): Standard range for conventional industrial oxygen and nitrogen transport, typically utilizing Type I or III vessels.

- High Pressure (Above 300 Bar): Critical range for new energy applications, particularly 350 bar and 700 bar hydrogen delivery, exclusively requiring Type IV composite materials for commercial viability and safety compliance.

Value Chain Analysis For High Pressure Gas Transport Truck Market

The upstream segment of the High Pressure Gas Transport Truck Value Chain begins with the highly specialized raw material suppliers and component manufacturers. This includes producers of advanced high-strength steels and aluminum alloys engineered to specific metallurgical specifications for high-pressure service, as well as the niche suppliers of high-performance carbon fiber and specialized polymer resins used in Type IV composite vessels. Critically, the upstream stage includes manufacturers of high-pressure components such as certified valves, complex manifold systems, and essential safety relief devices (PRDs). Quality control at this stage is absolutely crucial, as component failure can lead to catastrophic consequences; thus, suppliers must demonstrate impeccable traceability and compliance with global pressure vessel codes like ASME, PED, and specific national transport regulations, imposing a high barrier to entry and fostering an oligopoly structure among core component suppliers.

The midstream component is dominated by the primary equipment integrators and original equipment manufacturers (OEMs). These companies take the certified pressure vessels (cylinders or tubes) and assemble them into full tube trailer or skid systems, which involves highly complex engineering for structural mounting, piping, and telemetry integration. The integration process requires specialized welding techniques, rigorous non-destructive testing (NDT), and mandatory hydrostatic testing after final assembly, ensuring the trailer unit is compliant with all dynamic load and stress requirements encountered during road transport. Distribution channels for these finalized transport solutions are predominantly direct-to-customer for the largest global industrial gas companies (e.g., Air Liquide, Linde), as they possess the technical expertise and financial capacity to manage their own custom fleets. However, a significant portion of sales are handled indirectly through specialized heavy-duty commercial vehicle distributors who also provide necessary customization services, regional certification documentation, and post-sale technical support, acting as vital intermediaries between manufacturers and smaller fleet operators or 3PL providers.

The downstream market comprises the end-users and the essential maintenance and requalification ecosystem. Major industrial gas companies, petrochemical giants, and emerging hydrogen infrastructure developers constitute the primary customers. Their focus is on operational expenditure (OpEx), asset utilization, and lifecycle management. A critical downstream service is the mandatory periodic requalification of the pressure vessels, which must occur every 5 to 10 years, depending on the vessel type and jurisdiction. This specialized service, involving stress testing, internal inspection, and potentially relining or rewrapping composite vessels, is a high-value, highly regulated segment of the value chain. Continuous feedback from downstream operators regarding field performance, fatigue life, and the efficacy of safety systems drives upstream innovation and design changes, ensuring a closed-loop system that prioritizes enhanced safety and reliability over economic expediency in all operational phases.

High Pressure Gas Transport Truck Market Potential Customers

The primary cohort of potential customers for specialized High Pressure Gas Transport Trucks consists of the multinational industrial gas producers, including companies like Linde, Air Liquide, and Nippon Sanso, who require vast, highly reliable fleets to manage the massive scale of atmospheric gas (O2, N2, Ar) and specialty gas distribution required by global industrial clients. These buyers demand trucks with maximum volumetric capacity, excellent fleet reliability records, and advanced telemetry integration, as fleet uptime is directly linked to the operational continuity of their customer base in metallurgy, chemicals, and electronics. Procurement decisions here are heavily influenced by long-term strategic partnerships with OEMs capable of providing highly standardized global designs, ensuring consistency across disparate international operational mandates and simplified maintenance procedures across diverse fleet locations.

A rapidly expanding customer base is composed of energy distribution companies and infrastructure investors dedicated to developing the nascent hydrogen and natural gas fueling ecosystems. This includes utility providers, specialized renewable energy logistics firms, and state-owned enterprises focused on decarbonization targets. These customers require highly specialized, ultra-high-pressure transport solutions, exclusively seeking Type IV composite vessels designed for 350 bar and 700 bar gaseous hydrogen delivery. Their purchasing drivers are focused less on existing infrastructure compatibility and more on forward-looking technological preparedness, seeking solutions that offer the lowest cost-per-kilogram of gas delivered, necessitating lightweight designs, optimal safety features, and proof of cyclic fatigue resistance essential for frequent refueling cycles typical of hydrogen mobility applications.

Finally, a significant, though regionally varied, customer segment includes specialized Third-Party Logistics (3PL) providers and smaller regional gas distributors. These companies purchase high-pressure transport assets to service localized industrial clusters, often catering to small-to-medium enterprises (SMEs) that cannot justify owning specialized fleets. For this segment, cost-effectiveness, versatility (ability to carry multiple types of non-reactive gases), and ease of regional regulatory compliance are paramount. They often prefer robust, proven technologies like steel tube trailers due to lower initial capital outlay and less complex maintenance compared to advanced composites. Their sustained purchasing power contributes to the steady demand for traditional high-pressure transport units outside the primary growth areas driven by hydrogen.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chart Industries, Inc., Worthington Industries, Inc., CIMC ENRIC Holdings Limited, Air Liquide S.A., Linde plc, Luxfer Holdings PLC, FIBA Technologies, Inc., Welfit Oddy (Pty) Ltd, Gardner Cryogenics, Taylor-Wharton, Cryolor SAS, Beijing Tianhai Industry Co., Ltd. (BTIC), Nikkiso Co., Ltd., Inoxcva, Samuel Pressure Vessel Group, Hexagon Composites ASA, Sinomatech Composite Materials, Trinity Industries, Inc., Entegris, Inc., McConnell & Jones Tank Company, Universal Industrial Gases (UIG), and VRV Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Gas Transport Truck Market Key Technology Landscape

The technological evolution in the High Pressure Gas Transport Truck Market is critically dependent on breakthroughs in material science, which directly determine the payload capacity and safety factor of the transport units. The most transformative technology is the development and commercial deployment of Type IV pressure vessels. These utilize a sophisticated manufacturing process involving filament winding of high-tensile carbon fiber over a high-density polyethylene (HDPE) or other polymer liner, creating a structure that is exceptionally light yet capable of safely containing gases at pressures up to 700 bar (10,000 psi). This technology is mandatory for the economic viability of gaseous hydrogen transport, as the extremely low density of hydrogen requires maximizing pressure to achieve a useful volume per truck. Manufacturing these vessels requires highly automated, precision-controlled winding and curing processes, coupled with advanced non-destructive evaluation (NDE) techniques such as computed tomography and acoustic emission testing to ensure zero structural defects throughout the vessel walls, a level of scrutiny far exceeding conventional transport manufacturing.

In parallel, the market is defined by the integration of advanced digital monitoring and control systems, collectively known as smart trailer technology. These systems rely on sophisticated micro-sensors and embedded computing units that capture real-time operational data, including instantaneous pressure and temperature fluctuations, manifold valve status, global positioning (GPS), and dynamic stress exerted on the tube trailer chassis during movement. This telemetry is crucial not only for route optimization and theft prevention but, more importantly, for safety compliance. The data collected allows operators to conduct preventative maintenance based on the actual measured fatigue exposure rather than generalized schedules, thereby extending the operational lifespan and ensuring compliance with stringent regulatory requirements concerning asset monitoring. Furthermore, sophisticated software interfaces are now standard, enabling seamless integration of this operational data with enterprise resource planning (ERP) systems for efficient logistics planning and regulatory reporting.

A third area of vital technological advancement lies in the manifold and valve systems, which manage the complex process of loading, unloading, and isolating individual pressure vessels on the trailer. Modern high-pressure transport requires highly reliable, quick-closing emergency shut-off valves (ESV) that can be triggered remotely or automatically in the event of an abnormal pressure spike or accident. Furthermore, specialized thermal management systems are becoming critical, particularly for transport in extreme climates or for gases susceptible to temperature sensitivity. This includes robust passive insulation for cryogenic components and active cooling systems integrated into the truck chassis to prevent overheating of the vessel structure or associated components. The continuous drive towards zero emissions also means that the interface technology between the high-pressure gas trailer and the new generation of electric or hydrogen-fuel cell powered tractor units must be engineered for weight minimization and energy efficiency, impacting the design of fifth wheels and coupling mechanisms across the industry.

Regional Highlights

The High Pressure Gas Transport Truck Market demonstrates heterogeneous growth patterns shaped by local industrial consumption and national energy policies. The maturity of the industrial base, the presence of major gas producers, and government incentives for clean fuel adoption heavily dictate market investment and technological focus in each primary region, leading to different purchasing profiles for tube trailers and associated equipment.

- Asia Pacific (APAC): The APAC market dominates in terms of new unit procurement volume. Driven by aggressive industrial expansion, particularly in high-demand sectors like semiconductor manufacturing and renewable energy infrastructure in China and India, the need for bulk industrial gases and associated transport is massive. China's rapid build-out of CNG fueling stations and the Japanese/Korean commitment to the hydrogen fuel cell vehicle market are major specific catalysts. The region is characterized by significant governmental investment in localized supply chains, favoring domestic manufacturing capabilities, leading to intensive competition and rapid assimilation of new technologies like Type IV composites, often subsidized to accelerate clean energy adoption targets.

- North America: North America presents a highly regulated and high-value market, where replacement cycles are driven by safety mandates and operational efficiency targets. The vast distances necessitate high-capacity units, and the demand is bifurcated: steady, high-volume requirement for industrial gases supporting the petrochemical and metal fabrication sectors, and burgeoning demand for high-pressure hydrogen transport, concentrated along emerging hydrogen corridors in California and the Northeast. The US DOT regulations are highly prescriptive regarding periodic testing and vessel certification, ensuring only the highest quality, robustly documented equipment enters service, maintaining a preference for proven, heavy-duty truck chassis integrated with advanced safety controls.

- Europe: Europe is the epicenter for environmental regulatory compliance and the fastest adopter of advanced composite technologies, primarily due to the continent's stringent CO2 reduction targets and the pan-European commitment to the hydrogen strategy. ADR regulations unify the technical requirements across multiple countries, fostering a unified market focused on interoperability and safety. Fleet replacement is heavily influenced by the need to pair high-pressure trailers with increasingly mandated electric or hydrogen-powered tractor units, requiring engineering focus on weight reduction and trailer optimization to compensate for the heavier clean energy power trains. The demand is strong in Western Europe (Germany, France) due to established industrial bases and leading hydrogen infrastructure projects.

- Latin America (LATAM): This market is generally slower in adopting Type IV composite technology but shows strong, sustained demand for traditional steel and alloy tube trailers to support mining, oil and gas extraction, and basic industrial processing across Brazil, Mexico, and Chile. The procurement is highly sensitive to commodity market cycles and local macroeconomic stability. The focus is on ruggedness and resilience, as transport infrastructure can be challenging, demanding vehicles that are easy to maintain and durable under harsh conditions, prioritizing lower initial investment cost over the cutting-edge payload efficiency offered by composites.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-projects in petrochemical expansion and ambitious national visions for green and blue hydrogen production (e.g., NEOM in Saudi Arabia). These massive, state-backed projects are creating immediate demand for high-specification, robust high-pressure transport solutions designed to operate reliably in extremely high ambient temperatures. Fleet operators prioritize advanced thermal management and corrosion resistance, purchasing high-value units tailored for long-term deployment in resource-intensive, often remote environments, making this segment highly valuable on a per-unit basis.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Gas Transport Truck Market.- Chart Industries, Inc. (Specializes in cryogenic and liquid gas transport solutions, major supplier to the energy sector)

- Worthington Industries, Inc. (A leader in steel and composite pressure vessels, significant presence in industrial gas cylinders)

- CIMC ENRIC Holdings Limited (Global provider of integrated energy equipment, strong presence in Asia and Europe)

- Air Liquide S.A. (Major industrial gas producer, significant in-house fleet owner and technology developer)

- Linde plc (Largest global industrial gas company, influences fleet specification and procurement)

- Luxfer Holdings PLC (Focuses on high-performance composite cylinders, critical supplier for specialty gases)

- FIBA Technologies, Inc. (Specializes in manufacturing, repair, and requalification of high-pressure gas containment vessels and trailers)

- Welfit Oddy (Pty) Ltd (Tank container and bulk tanker manufacturer, serving regional industrial gas logistics)

- Gardner Cryogenics (Niche focus on highly specialized, ultra-cold gas transport and storage)

- Taylor-Wharton (Supplier of cryogenic storage equipment, related to specialized gas logistics)

- Cryolor SAS (European leader in cryogenic transport and storage equipment, strong in LNG and specialty gases)

- Beijing Tianhai Industry Co., Ltd. (BTIC) (Leading Chinese manufacturer of high-pressure gas cylinders and tube trailers)

- Nikkiso Co., Ltd. (Provides cryogenic pumps and systems, critical for liquefied gas interfaces)

- Inoxcva (Indian manufacturer specializing in cryogenic and industrial gas transport equipment)

- Samuel Pressure Vessel Group (North American manufacturer of custom pressure vessels for various industrial applications)

- Hexagon Composites ASA (Pioneer and leader in Type IV composite cylinder technology, particularly for hydrogen and CNG)

- Sinomatech Composite Materials (Major composite material producer, serving the growing Asian market demand)

- Trinity Industries, Inc. (Heavy transport equipment and rail car manufacturer, with involvement in specialized logistics)

- Entegris, Inc. (Focuses on specialized transport and handling of ultra-high purity materials for the semiconductor industry)

- McConnell & Jones Tank Company (Regional US supplier of specialized transport trailers)

Frequently Asked Questions

Analyze common user questions about the High Pressure Gas Transport Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards govern the transport of high-pressure gases globally?

The transport of high-pressure gases is governed primarily by regional and international regulatory frameworks to ensure public safety and operational consistency. Key standards include the ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) in Europe, the DOT (Department of Transportation) regulations in North America, and specific national codes like TC in Canada, all mandating rigorous specifications for vessel construction, periodic retesting, and operational handling protocols for dangerous goods.

How is the rise of the hydrogen economy impacting demand for high-pressure transport trucks?

The hydrogen economy is the definitive catalyst for market growth, significantly increasing demand for highly specialized, ultra-high-pressure transport trucks. These vehicles, predominantly utilizing lightweight Type IV composite tube trailers (350 bar to 700 bar), are essential for establishing the crucial logistics network needed to move gaseous hydrogen economically from centralized production facilities to decentralized refueling stations and industrial users globally.

What are the key differences between Type I, Type III, and Type IV pressure vessels used in transport?

Type I vessels are heavy, all-metal (steel/alloy) cylinders, robust for medium-pressure industrial use. Type III vessels use a metallic liner (aluminum) with a composite overwrap. Type IV vessels are the lightest and most advanced, featuring a non-metallic (polymer) liner fully encased in carbon fiber composite, ideal for the highest pressure applications like 700 bar hydrogen due to their superior strength-to-weight ratio and fatigue resistance.

What role does advanced telematics and IoT integration play in high-pressure gas logistics?

Advanced telematics provides continuous, real-time monitoring of critical operational parameters, including internal pressure, temperature, valve status, and dynamic vehicle stress. This data is leveraged by AI for predictive maintenance, route optimization based on safety protocols, immediate incident response, and ensuring auditable regulatory compliance throughout the supply chain, significantly minimizing operational risk and improving asset utilization.

What is the main advantage of Type IV composite vessels over traditional steel tube trailers?

The main advantage is the significantly reduced tare weight, which directly translates to a much higher payload capacity (more gas carried per trip) while maintaining ultra-high-pressure integrity. This weight efficiency is crucial for the economic transportation of low-density gases like hydrogen, lowering logistics costs per unit volume and extending the feasible transport range for high-pressure gaseous fuels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager