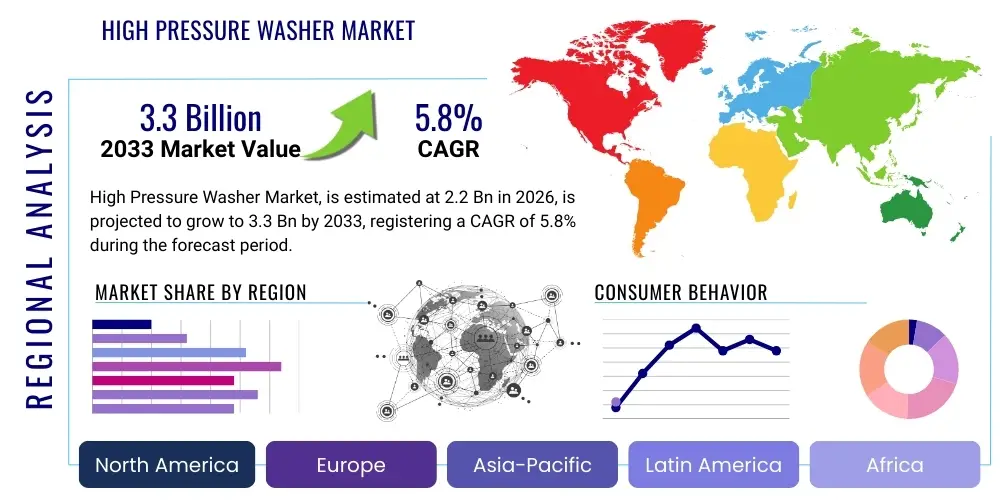

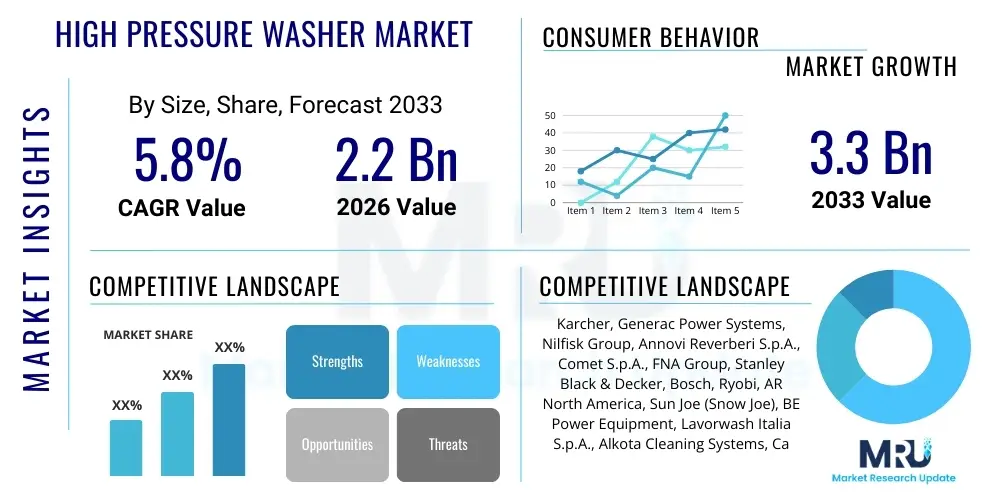

High Pressure Washer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443470 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High Pressure Washer Market Size

The High Pressure Washer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.2 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

High Pressure Washer Market introduction

The High Pressure Washer Market encompasses devices designed to spray water at high velocity, primarily used for cleaning various surfaces, equipment, and structures efficiently. These powerful tools leverage pressurized water flow to remove dirt, grime, mold, dust, mud, and other contaminants from surfaces rapidly and effectively. High pressure washers, often referred to as pressure washers or power washers, are essential cleaning instruments utilized across residential, commercial, and industrial sectors due to their superior performance compared to traditional cleaning methods.

The product description involves systems categorized mainly by operational mechanism (electric, gasoline, diesel), pressure range (PSI), and water temperature (cold or hot water units). Major applications span vehicle cleaning (cars, trucks, construction equipment), infrastructure maintenance (roads, bridges, public spaces), agricultural cleaning (barns, machinery), and industrial upkeep (factory floors, tanks, and pipelines). Key benefits include significant time savings, reduced manual effort, lower water consumption compared to hose cleaning, and achieving a high standard of cleanliness critical for sanitation and asset maintenance.

Market growth is predominantly driven by increasing urbanization leading to greater demand for property and vehicle maintenance, stringent governmental regulations concerning hygiene and cleanliness in food processing and healthcare facilities, and technological advancements focusing on developing portable, energy-efficient, and IoT-enabled smart cleaning systems. Furthermore, the rising adoption of DIY culture in developed economies, coupled with growing construction and manufacturing activities globally, acts as a significant catalyst for market expansion.

High Pressure Washer Market Executive Summary

The High Pressure Washer Market is characterized by robust growth, propelled primarily by escalating demand from the automotive, construction, and municipal cleaning sectors globally. Business trends indicate a strong shift towards battery-powered and compact electric models, catering to residential and light commercial segments prioritizing portability and reduced noise pollution. Manufacturers are focusing intensely on developing durable components, integrating smart features for optimized performance tracking, and offering versatile nozzle systems to address diverse cleaning challenges.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, attributed to rapid infrastructure development, expanding industrial base, and improving disposable incomes in countries like China and India, fueling both industrial and residential uptake. North America and Europe maintain dominance in terms of market value, driven by high consumer awareness, replacement cycles of sophisticated equipment, and stringent environmental regulations favoring water-efficient cleaning technologies. Competition remains intense, pushing key players to enhance distribution networks, particularly through e-commerce platforms.

Segment trends reveal that the electric-powered segment commands the largest market share due to ease of use and lower maintenance requirements, while the hot water segment is gaining traction in specialized industrial applications requiring superior degreasing and sanitation capabilities. The professional segment (above 2000 PSI) dominates revenue generation, reflecting substantial investment in high-performance equipment by commercial cleaning contractors and heavy industries. The overall market trajectory indicates sustained innovation focused on sustainability and automation.

AI Impact Analysis on High Pressure Washer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the High Pressure Washer Market revolve around automation capabilities, predictive maintenance schedules, and the optimization of resource usage, specifically water and energy. Users frequently inquire if AI can enable autonomous cleaning systems suitable for large industrial environments, how machine learning algorithms can detect surface sensitivity to prevent damage during high-pressure cleaning, and whether AI integration will significantly reduce operational downtime through proactive fault detection. There is also considerable interest in how AI can inform optimal pressure settings based on real-time contamination levels, ensuring maximum cleaning efficiency with minimum resource expenditure.

The core themes emerging from these user queries highlight expectations for enhanced precision, substantial operational cost reduction, and the transformation of pressure washing from a manual task to a semi-autonomous, data-driven service. Concerns center on the initial integration costs, the complexity of sensor deployment, and the necessity for specialized training to operate and maintain AI-enabled equipment. Users anticipate that AI will facilitate highly customized cleaning cycles, moving beyond simple timer-based operations to environment-aware processes that adapt dynamically to varying surfaces and soil types, thereby setting a new benchmark for efficiency and environmental responsibility in the cleaning industry.

Consequently, the influence of AI is projected to revolutionize high pressure washing by embedding intelligence into the equipment, transforming maintenance protocols, and offering superior operational control. AI algorithms, when coupled with sensors, can monitor motor performance, pump pressure stability, and water flow rates in real-time. This predictive capacity minimizes unexpected failures, extends the equipment's lifespan, and allows for scheduled, targeted maintenance, thereby drastically improving the total cost of ownership (TCO) for commercial and industrial users. Furthermore, machine learning models can process visual data (e.g., via integrated cameras) to identify specific areas requiring intensive cleaning, guiding autonomous systems or providing actionable feedback to human operators, leading to maximized cleaning quality and consistency.

- Implementation of Predictive Maintenance: AI monitors pump vibration, temperature, and current draw to predict component failure, reducing unplanned downtime.

- Resource Optimization: Machine learning determines the minimum effective pressure and flow rate required for specific cleaning tasks, conserving water and energy.

- Autonomous Operation: Integration with robotics and computer vision enables AI-guided pressure washers for large-scale, consistent industrial cleaning without human intervention.

- Dynamic Pressure Control: AI adjusts PSI levels in real-time based on sensor inputs detecting surface material and contamination density, preventing surface damage.

- Enhanced Safety Protocols: AI systems detect human presence or obstacles, automatically adjusting operation or shutting down to ensure operator and bystander safety.

DRO & Impact Forces Of High Pressure Washer Market

The High Pressure Washer Market is primarily driven by rigorous regulatory requirements mandating high standards of cleanliness and hygiene across industrial, food processing, and healthcare environments. This is coupled with the expansion of the global automotive detailing and cleaning services sector, which relies heavily on efficient pressure washing technology. A major driver is the increasing focus on water conservation, where high-pressure systems offer a significant advantage over conventional cleaning methods by reducing water consumption while maintaining superior cleaning efficacy. Furthermore, continuous product innovation, particularly the introduction of ergonomic, lightweight, and battery-powered models, is stimulating consumer uptake in the residential and light commercial segments, overcoming previous limitations related to cumbersome power cords and weight.

Restraints impeding market growth include the relatively high initial capital expenditure associated with professional-grade hot water and ultra-high-pressure systems, which can deter small businesses or residential buyers. Concerns regarding the noise pollution generated by gasoline and diesel-powered units, particularly in densely populated urban areas, also pose a significant challenge. Moreover, the risk of surface damage if the equipment is improperly used or if pressure settings are incorrectly calibrated necessitates specialized training, which can be perceived as an operational hurdle in some industries, leading to hesitation in widespread adoption of the highest pressure categories.

Opportunities for market expansion are abundant, centered around the untapped potential in developing economies where modernization of infrastructure and sanitation practices is accelerating. The increasing demand for specialized cleaning solutions in emerging niche sectors, such as solar panel cleaning and graffiti removal, presents lucrative avenues for manufacturers to diversify product lines. The development and commercialization of sophisticated, integrated systems combining high-pressure washing with chemical injection or abrasive blasting offer substantial market potential for tackling complex industrial cleaning tasks. The competitive landscape is further defined by the impact forces of substitution (traditional manual cleaning or low-pressure alternatives), buyer bargaining power (driven by standardization in the consumer segment), supplier bargaining power (limited due to numerous component suppliers), and threat of new entrants (moderate due to required R&D and established distribution networks).

Segmentation Analysis

The High Pressure Washer Market is comprehensively segmented based on various operational, technical, and application parameters, providing a detailed view of current market dynamics and future growth trajectories. Key segmentation vectors include the type of operation (electric, engine-driven), the pressure range (low, medium, high, ultra-high), the temperature of the water used (cold water vs. hot water), and the specific end-use application (residential, commercial, industrial). Understanding these segments is crucial for strategic market entry and product development, as demands vary significantly based on user needs, from basic home maintenance to heavy industrial degreasing and preparation work.

The power source segmentation reveals distinct preferences: electric washers dominate the residential and light commercial sectors due to low noise and zero emissions, while engine-driven (gasoline/diesel) washers are indispensable in remote outdoor or heavy-duty industrial settings where portability and high power output are prioritized. The pressure segmentation is particularly critical; medium-pressure (1,200–1,999 PSI) units are the workhorses of the consumer segment, whereas high-pressure (2,000–3,999 PSI) and ultra-high-pressure (>4,000 PSI) machines form the backbone of industrial cleaning and surface preparation markets, necessitating different material and component resilience standards.

Furthermore, the segmentation by end-use application highlights the strong revenue contribution from the industrial segment, driven by sectors such as manufacturing, oil and gas, and construction, where rigorous cleaning is non-negotiable for operational safety and equipment longevity. Conversely, the residential segment provides high volume sales, particularly for compact and easy-to-store cold water electric models. The hot water segment, though smaller in volume, holds significant value due to its indispensable role in sanitation-critical environments like food processing and healthcare, commanding a premium price point due to specialized heating components and greater energy requirements.

- By Type:

- Electric Pressure Washers

- Gasoline/Engine Driven Pressure Washers

- Diesel Pressure Washers

- By Pressure Range:

- Low Pressure (Up to 1,200 PSI)

- Medium Pressure (1,200 to 1,999 PSI)

- High Pressure (2,000 to 3,999 PSI)

- Ultra-High Pressure (>4,000 PSI)

- By Output Temperature:

- Cold Water Pressure Washers

- Hot Water Pressure Washers

- By Application:

- Cleaning Vehicles and Equipment

- Infrastructure and Surface Cleaning

- Sanitation and Hygiene Maintenance

- Agricultural Cleaning

- By End-Use Industry:

- Residential

- Commercial (Hotels, Retail, Facility Management)

- Industrial (Manufacturing, Oil & Gas, Construction, Mining)

- Agricultural

Value Chain Analysis For High Pressure Washer Market

The value chain for the High Pressure Washer Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized plastics for housing, high-grade metals for pumps and internal mechanisms (brass, ceramic, or stainless steel), and electronic components (motors, switches, sensors). Key upstream suppliers include manufacturers of induction motors, high-precision piston pumps (triplex pumps are standard for professional use), and specialized hoses capable of withstanding extreme pressures. Quality control and material science innovation at this stage are crucial, as component failure under high stress directly impacts the reputation and durability of the final product, creating moderate bargaining power for specialized component suppliers.

Midstream activities encompass the manufacturing, assembly, and testing of the final pressure washer unit. This phase involves sophisticated assembly lines, robust quality assurance testing for pressure stability and leakage, and integration of control systems and safety features. Efficient manufacturing processes, leveraging automation and lean techniques, are vital for maintaining competitive pricing, particularly in the mass-market electric segment. The distribution channel is bifurcated: direct channels often involve manufacturers supplying large industrial clients or specialized cleaning contractors, allowing for customization and direct after-sales service. Indirect channels dominate the residential and light commercial markets, relying heavily on retail stores, hardware chains, and increasingly, e-commerce platforms.

Downstream activities involve marketing, sales, and post-sales service, targeting the diverse end-user base. Marketing strategies must clearly differentiate between consumer-grade portability/ease-of-use and professional-grade power/durability. E-commerce platforms have emerged as powerful indirect distribution channels, offering comprehensive product comparisons and simplifying the purchasing process for consumers and small commercial entities. The after-sales service, including the provision of spare parts (nozzles, hoses, pumps seals), maintenance contracts, and technical support, is a critical competitive differentiator, especially for complex hot water and ultra-high-pressure systems where downtime is costly for the end-user. Effective logistics and inventory management across both direct and indirect networks ensure timely product delivery and responsiveness to regional demand fluctuations.

High Pressure Washer Market Potential Customers

Potential customers for high pressure washers span a wide spectrum, ranging from individual residential homeowners requiring occasional maintenance tools to large multinational corporations demanding specialized, heavy-duty cleaning systems for continuous operation. In the residential segment, the primary buyer is the homeowner or DIY enthusiast who prioritizes ease of use, compact storage, and affordability, typically opting for cold water electric models ranging from 1,500 to 2,000 PSI for cleaning patios, siding, and personal vehicles. This segment is highly responsive to promotional activities and seasonal demands, particularly during spring and summer cleaning seasons, constituting a high volume, lower average transaction value market.

The commercial segment represents facility managers, professional cleaning contractors, and automotive detailing businesses. These customers require reliable, durable equipment capable of several hours of continuous operation weekly. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), efficiency metrics (GPM and PSI), and robust servicing options. Hot water pressure washers are frequently mandated in commercial settings like kitchens, hotels, and fleet management depots where grease and bacterial sanitation are critical concerns, driving demand for specialized and premium-priced equipment with superior heat exchange capabilities.

The most demanding potential customers reside within the industrial sector, including heavy manufacturing plants, oil and gas refineries, construction sites, and marine operations. These end-users typically invest in ultra-high-pressure (UHP) equipment (often exceeding 4,000 PSI) for tasks such as abrasive blasting, paint stripping, concrete surface preparation, and heat exchanger tube cleaning. Decision-making in this sector is driven by regulatory compliance, safety features, customization capabilities (e.g., specialized nozzles and lance lengths), and integration with existing industrial automation systems. These customers often form long-term relationships with manufacturers offering tailored maintenance programs and quick access to specialized components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Karcher, Generac Power Systems, Nilfisk Group, Annovi Reverberi S.p.A., Comet S.p.A., FNA Group, Stanley Black & Decker, Bosch, Ryobi, AR North America, Sun Joe (Snow Joe), BE Power Equipment, Lavorwash Italia S.p.A., Alkota Cleaning Systems, Campbell Hausfeld, SIMPSON Cleaning, Kranzle, Daimer Industries, CAT PUMPS, Honda Power Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Washer Market Key Technology Landscape

The technological landscape of the High Pressure Washer Market is rapidly evolving, moving beyond simple mechanical efficiency towards sophisticated control systems, enhanced durability, and improved user interfaces. A fundamental technology is the pump system, where triplex plunger pumps remain the standard for high-performance units due to their reliability and efficiency in handling high pressure and flow rates. Materials science innovation focuses on ceramic pistons and specialized seals to increase pump longevity and reduce maintenance needs, particularly in hot water and chemical injection applications. Furthermore, variable frequency drives (VFDs) are increasingly integrated into electric models, allowing for precise control over motor speed and pressure output, optimizing energy consumption and adapting the washing intensity dynamically to the surface being cleaned.

A significant trend involves the integration of smart technologies, aligning with the broader Internet of Things (IoT) movement. New generations of commercial and industrial washers feature embedded sensors and connectivity modules that monitor key operational parameters, such as pump temperature, pressure deviations, and fuel/battery levels. This data is transmitted to cloud-based platforms, enabling remote diagnostics, predictive maintenance scheduling, and detailed utilization reporting. These smart features are particularly critical for fleet management companies and large industrial operations that require centralized oversight of numerous deployed units, optimizing uptime and inventory management for consumables.

In terms of user experience and safety, key technological advancements include the development of anti-kink high-pressure hoses, ergonomic spray guns designed to minimize operator fatigue, and advanced Total Stop Systems (TSS) which automatically shut off the pump when the trigger is released, conserving energy and prolonging pump life. Noise reduction technology, particularly in electric models through superior insulation and motor design, is also a critical competitive differentiator, addressing environmental concerns in urban settings. The ongoing evolution of battery technology (lithium-ion) is enabling powerful, cordless models that offer significant operational flexibility for mobile commercial users, eroding the dominance of gasoline engines in certain medium-duty applications.

Regional Highlights

Geographic analysis reveals distinct market maturity, growth drivers, and preferred product types across key global regions, reflecting variations in industrialization levels, consumer purchasing power, and environmental regulations.

- North America: This region holds a substantial market share, driven by a high rate of residential home ownership, a robust construction and infrastructure maintenance sector, and significant demand from the mature automotive cleaning and detailing industry. The market is characterized by strong consumer awareness and acceptance of technologically advanced, often gasoline-powered, high PSI equipment, particularly in the US. Stringent maintenance standards for commercial fleets and industrial facilities ensure sustained demand for professional-grade, durable pressure washing systems.

- Europe: Europe is a key market, distinguished by strict environmental regulations and a strong emphasis on energy efficiency and low noise operation. This drives demand primarily for premium, high-quality electric pressure washers and advanced hot water systems used extensively in sanitation-focused industries (e.g., food & beverage processing). Germany, the UK, and France are dominant contributors, with a noticeable trend towards compact, environmentally friendly, and ergonomic designs suitable for dense urban environments.

- Asia Pacific (APAC): APAC is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapid urbanization, massive infrastructure development projects, and the expanding manufacturing base, especially in China, India, and Southeast Asian countries. The high volume of agricultural activities and the burgeoning middle class demanding better vehicle maintenance services contribute significantly. The market here is price-sensitive but rapidly adopting mid-range electric and gasoline models as industrial modernization progresses.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by increasing investments in the mining and construction sectors, requiring rugged, high-performance cleaning equipment. Economic volatility poses some restraints, but demand remains stable for essential industrial maintenance. Brazil and Mexico are the primary revenue generators, characterized by demand for durable engine-driven units due to infrastructure constraints in some remote industrial areas.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states (UAE, Saudi Arabia) due to large-scale construction projects, development of tourist infrastructure (hotels, resorts), and substantial oil and gas operations. These sectors require heavy-duty, high-pressure washers capable of handling extreme temperatures and cleaning tasks related to sand and oil removal. The market emphasizes performance and reliability under harsh operating conditions, favoring robust industrial-grade systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Washer Market.- Karcher

- Generac Power Systems

- Nilfisk Group

- Annovi Reverberi S.p.A.

- Comet S.p.A.

- FNA Group

- Stanley Black & Decker

- Bosch

- Ryobi

- AR North America

- Sun Joe (Snow Joe)

- BE Power Equipment

- Lavorwash Italia S.p.A.

- Alkota Cleaning Systems

- Campbell Hausfeld

- SIMPSON Cleaning

- Kranzle

- Daimer Industries

- CAT PUMPS

- Honda Power Equipment

Frequently Asked Questions

Analyze common user questions about the High Pressure Washer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the High Pressure Washer Market?

The primary driver is the increasing global demand for efficient and environmentally compliant cleaning solutions across the automotive, construction, and municipal sectors, coupled with stringent hygiene regulations in industrial environments.

How are electric pressure washers different from engine-driven (gasoline) models?

Electric pressure washers are quieter, require less maintenance, and produce zero emissions, making them ideal for residential and indoor commercial use. Engine-driven models offer superior power (higher PSI and GPM) and complete portability for remote industrial and heavy-duty outdoor applications.

Which pressure range dominates the professional cleaning segment?

The professional segment is dominated by high-pressure (2,000–3,999 PSI) and ultra-high-pressure (>4,000 PSI) units, necessary for specialized tasks such as industrial degreasing, construction site cleanup, and surface preparation.

What role does AI technology play in modern high pressure washers?

AI is increasingly integrated for predictive maintenance, remote diagnostics, and optimizing resource usage (water and energy) by dynamically adjusting pressure based on real-time contamination and surface conditions, improving operational efficiency.

Which region currently offers the fastest growth potential for the market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid industrialization, expanding infrastructure projects, and increasing consumer spending on vehicle and property maintenance across key countries like China and India.

The detailed analysis of the High Pressure Washer Market underscores the continuous evolution of cleaning technology, where durability, efficiency, and smart connectivity are becoming critical competitive advantages. The shift towards sustainable and automated solutions is reshaping the industry, offering substantial opportunities for manufacturers focusing on innovative pump design and integrated IoT features. Market stability is ensured by non-negotiable regulatory demands for cleanliness across diverse industrial sectors globally.

In conclusion, the market's trajectory is positive, supported by robust end-user demand across both consumer and heavy-duty applications. Strategic efforts by market leaders focus on optimizing distribution channels, particularly expanding e-commerce presence, and investing in R&D to deliver lighter, more powerful, and smarter cleaning equipment. The long-term outlook remains strong, cemented by the essential nature of high-pressure cleaning technology in modern infrastructure and maintenance protocols.

The segmentation by operational temperature (cold vs. hot water) also highlights a vital distinction. While cold water units are standard for general dirt removal, hot water pressure washers are indispensable for specialized cleaning tasks that involve grease, oil, and sterilization. Hot water units, often powered by diesel burners or natural gas, carry a higher operational complexity but provide significantly superior cleaning power, making them mandatory equipment in food processing, chemical manufacturing, and heavy equipment repair workshops. This duality ensures that innovation in both temperature segments remains a key focus area for specialized manufacturers.

Further analysis of the competitive landscape shows that manufacturers are increasingly adopting modular designs, allowing customers to easily upgrade components such as pumps, motors, and heating elements, thereby extending the lifecycle of the equipment and improving customer retention. This focus on long-term serviceability is particularly valued by large commercial and industrial fleet operators who seek to minimize capital expenditure through prolonged equipment use. Furthermore, the integration of advanced safety features, including thermal relief valves, low-water cut-offs, and sophisticated pressure regulators, is a non-negotiable requirement, driven both by consumer expectations and occupational safety standards, ensuring that high performance does not compromise operator protection.

The impact of rising labor costs, especially in developed economies, further amplifies the attractiveness of high pressure washers. By significantly reducing the time required for deep cleaning compared to traditional scrubbing or low-pressure washing, these machines offer a compelling Return on Investment (ROI) for professional cleaning services. This economic justification directly translates into increased procurement of higher-flow-rate and higher-pressure models, as businesses seek to maximize labor efficiency. This macroeconomic factor solidifies the industrial segment as the primary revenue generator within the forecasted period, despite the high volume sales observed in the residential sector.

The market for specialized attachments and accessories is also experiencing rapid growth, driven by the desire for greater versatility. Products such as specialized surface cleaners for driveways, gutter cleaners, telescopic lances, and foam cannons expand the utility of the core pressure washer unit. Manufacturers who successfully bundle these high-value accessories, or design systems that are inherently compatible with a wide array of specialized tools, gain a significant competitive edge by offering comprehensive cleaning solutions rather than just basic equipment. This accessory market provides an additional revenue stream and fosters brand loyalty among both DIY consumers and professional users who demand application-specific performance enhancements.

Geopolitical factors and global supply chain stability also indirectly affect the market. Since high-quality pumps and specialized electric motors often rely on complex international supply chains, manufacturers must proactively manage risks associated with material sourcing and logistics. Companies that have established diversified or vertically integrated supply networks are better positioned to maintain consistent production schedules and mitigate pricing volatility, especially concerning brass and aluminum components essential for durable pump heads. This strategic resilience is increasingly important in maintaining market share and meeting the accelerated demand from emerging markets.

The push for sustainable solutions involves not only water conservation but also minimizing the environmental impact of detergents and chemicals used in conjunction with pressure washing. Manufacturers are responding by developing integrated detergent injection systems that allow for precise dilution control and promote the use of biodegradable, eco-friendly cleaning agents. This focus on green cleaning not only appeals to environmentally conscious consumers and corporations but also helps facilities comply with increasingly stringent wastewater discharge regulations, particularly in European and North American markets. This intersection of technology and sustainability is a pivotal determinant of long-term market success.

Furthermore, the industrial mining and construction sectors present a unique demand profile for ultra-high-pressure water jetting equipment. These applications often require pressures exceeding 10,000 PSI for hydro-demolition, surface preparation, and removing hardened material deposits. This niche segment demands specialized training and highly robust, often trailer-mounted or skid-mounted, equipment that falls under strict safety classifications. While representing a smaller volume, the UHP segment contributes disproportionately high revenue due to the complexity, customization, and extended service contracts associated with these powerful machines, reflecting a high-value industrial sub-market.

Finally, distribution strategy is being revolutionized by digital channels. While traditional brick-and-mortar retailers remain crucial for consumer visibility and immediate purchase, the B2B segment is increasingly leveraging digital platforms for complex procurement processes. Manufacturers are providing detailed technical specifications, 3D models, and comparative performance data online, enabling industrial buyers to make informed decisions remotely. The ability to manage warranties, order spare parts, and access technical support seamlessly through digital interfaces is becoming a critical expectation, driving investment in robust e-commerce and customer relationship management (CRM) infrastructure across the industry.

The residential segment is seeing an increasing penetration of battery-powered pressure washers. While historically limited in pressure and run-time, advancements in lithium-ion battery technology are enabling compact units that deliver sufficient power (up to 1,500 PSI) for typical home maintenance tasks without the constraint of electrical outlets. This freedom from cords significantly enhances user convenience and portability, especially for tasks like cleaning balconies, recreational vehicles, and boats, thereby broadening the market appeal beyond traditional corded electric models and fueling competitive innovation in the consumer space.

The competitive intensity within the High Pressure Washer Market is defined by global players like Karcher and Nilfisk, who leverage extensive global distribution networks and brand recognition, constantly pushing innovation boundaries. Mid-tier regional players often specialize in specific segments, such as ultra-high-pressure systems (e.g., CAT PUMPS) or customized industrial solutions (e.g., Alkota). Price competition is fiercest in the low-to-mid-range consumer electric segment, where Chinese and Asian manufacturers compete aggressively on affordability, driving the need for established brands to continuously justify their premium positioning through superior quality, warranty, and customer support services.

The trend towards modular and repairable design is also a reaction to evolving environmental policies in regions like the European Union, which are pushing for ‘Right to Repair’ legislation. This regulatory environment mandates that manufacturers ensure their products are easily repairable and that spare parts are available for an extended period. For pressure washer manufacturers, this means designing pumps and motors that can be individually replaced or serviced, moving away from sealed, disposable units, ultimately benefitting the consumer through reduced long-term maintenance costs and less electronic waste.

Furthermore, the adoption of pressure washers in municipal services is growing rapidly. Local governments and public works departments are utilizing high-pressure cleaning for maintaining public spaces, removing graffiti, sanitizing waste bins, and cleaning street furniture. The investment is driven by public health initiatives and the need to maintain civic cleanliness standards, often requiring trailer-mounted units with large water tanks for mobile operations in areas lacking convenient water access. This municipal segment provides a stable, long-term revenue stream for manufacturers capable of supplying durable, commercial-grade equipment meeting government procurement standards.

In conclusion of the segmentation breakdown, the evolution of component technology is paramount. The shift from standard aluminum pumps to more durable triplex pumps with ceramic plungers—even in some prosumer-grade machines—reflects a market-wide premium placed on longevity and continuous performance. This focus on internal component quality ensures that high pressure washers can withstand the demanding cycles required in automotive and fleet washing operations, where continuous running time is often critical to business profitability. The performance differential resulting from superior pump technology significantly influences purchasing decisions in the mid to high-end market tiers.

The Value Chain perspective highlights that effective supply chain management is not just about cost reduction but also about quality assurance. A defect in a small but critical component, such as a check valve or a pressure relief mechanism, can render an expensive high-pressure unit non-operational. Therefore, leading manufacturers maintain stringent audit processes for their tier-one suppliers, often engaging in strategic long-term contracts to ensure the consistent quality and availability of high-precision components like specialized bearings and high-pressure seals, mitigating the risks associated with global sourcing in a highly engineered product category.

The detailed review of potential customers reveals a critical difference in purchasing criteria between residential and industrial buyers. Residential purchases are often driven by seasonal promotions, brand accessibility at local retail outlets, and compact size. Conversely, industrial procurement decisions are highly technical, involve multiple stakeholders (maintenance managers, safety officers, procurement teams), and focus heavily on compliance certifications, Gross Pump Output (GPO/GPM), and verifiable mean time between failures (MTBF) statistics, emphasizing reliability over initial unit cost.

Technology advancement in noise reduction remains a high-priority area, particularly for engine-driven units used in urban environments or during restricted hours. Acoustic baffling, advanced exhaust systems, and strategic engine placement are technologies being continuously refined to meet noise abatement regulations without sacrificing the necessary power output. This balance between raw power and reduced acoustic footprint is a major differentiating factor, particularly in Europe and parts of North America where urban noise restrictions are rigorously enforced.

Finally, the overall market narrative confirms that the High Pressure Washer Market is transitioning from a commodity cleaning tool sector into a highly technical, solution-oriented industry. The convergence of hardware innovation (durable pumps, high-efficiency motors) with software integration (IoT, AI diagnostics) is creating intelligent cleaning systems that offer predictive capabilities and optimized performance, positioning the high pressure washer not just as equipment, but as a critical, data-generating asset in modern facility management and industrial operations. This continuous evolution promises sustained market expansion throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Pressure Washer Market Statistics 2025 Analysis By Application (Residential, Commercial, Industrial), By Type (Electric Motor, Petrol Engine, Diesel Engine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Petrol Engine High Pressure Washer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Light-duty washers, Heavy-duty washers, Medium-duty washers), By Application (Residential, Commercial, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager