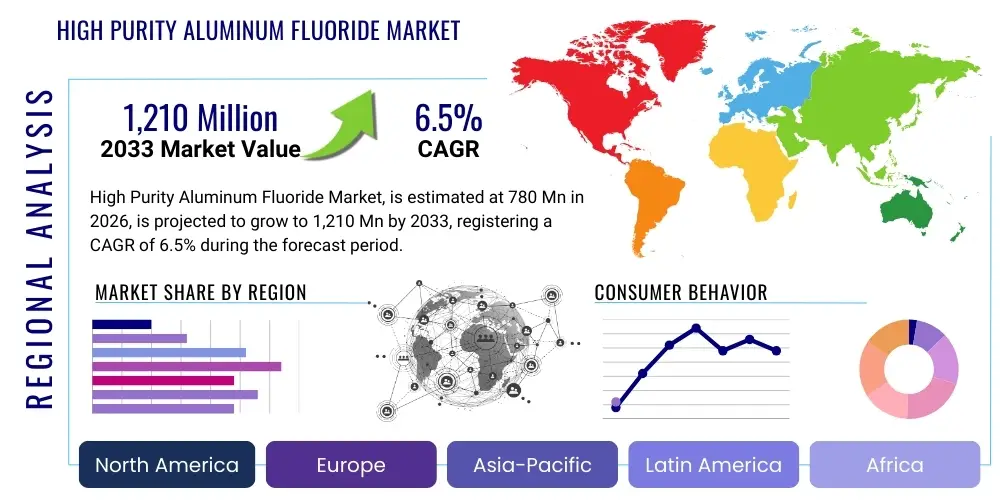

High Purity Aluminum Fluoride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441298 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High Purity Aluminum Fluoride Market Size

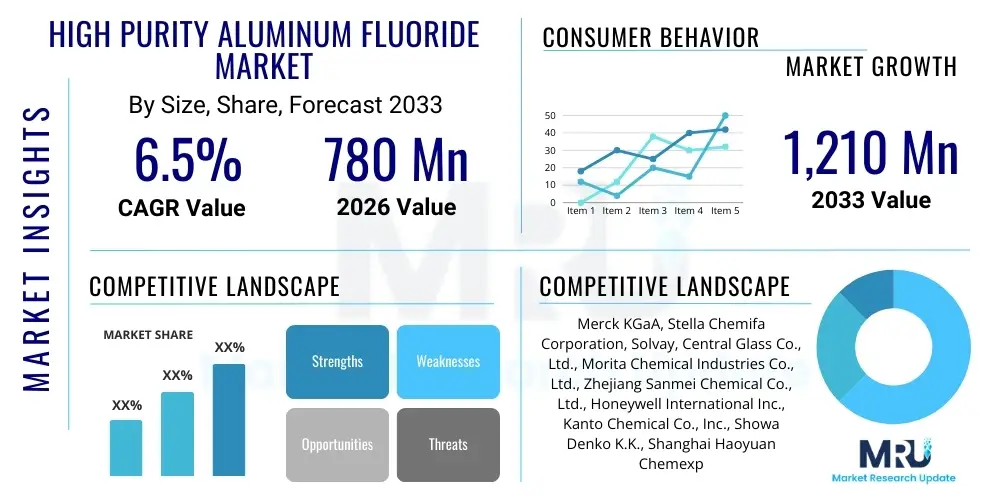

The High Purity Aluminum Fluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $780 Million in 2026 and is projected to reach $1,210 Million by the end of the forecast period in 2033.

High Purity Aluminum Fluoride Market introduction

High Purity Aluminum Fluoride (AlF₃) is a chemical compound characterized by exceptionally low levels of metallic and non-metallic impurities, typically ranging from 99.9% (3N) up to 99.999% (5N) purity levels. Unlike its industrial-grade counterpart primarily used in aluminum smelting, high purity AlF₃ is indispensable in sophisticated, technology-intensive applications where contamination can critically impair product performance and longevity. Its superior electrical, thermal, and chemical properties, including its high melting point and resistance to corrosion, make it uniquely suited for advanced material manufacturing.

The product's primary applications are concentrated within the burgeoning electronics and energy sectors. In lithium-ion battery production, high purity AlF₃ serves as a crucial component in electrolyte additives and cathode coatings, enhancing safety, stabilizing the crystal structure, and extending the cycle life of the battery cells—a critical requirement for electric vehicles (EVs) and high-density energy storage systems. Concurrently, the semiconductor industry utilizes it in etching processes and as a precursor for specific thin-film depositions necessary for producing advanced microelectronic devices, including memory chips and processors.

Market growth is predominantly driven by the global push towards electrification and digital transformation. Increasing demand for high-performance lithium-ion batteries, fueled by stringent environmental regulations and mass adoption of EVs, directly propels the need for high-purity battery components. Furthermore, the relentless miniaturization and increasing complexity of semiconductor devices necessitate materials with unparalleled purity to prevent defects and ensure operational reliability, thereby solidifying High Purity Aluminum Fluoride’s essential market position. Technological advancements focused on scalable purification techniques further support its commercial viability.

High Purity Aluminum Fluoride Market Executive Summary

The High Purity Aluminum Fluoride market is experiencing significant momentum driven by robust demand from the energy storage and semiconductor fabrication sectors, positioning it for accelerated expansion through the forecast period. Business trends indicate a strategic focus on vertical integration among key manufacturers, particularly those supplying to battery material producers, aimed at securing reliable, high-quality feedstock and mitigating supply chain volatilities. Furthermore, innovation in production methods, such as utilizing dry synthesis routes over traditional wet methods, is gaining traction to achieve higher purity grades (4N and 5N) efficiently, meeting the rigorous specifications of next-generation electronic components. Partnerships between chemical suppliers and major battery manufacturers (gigafactories) are becoming critical business differentiators.

Regionally, Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates the market, primarily due to the established and rapidly scaling infrastructure for EV battery production and advanced semiconductor foundries concentrated within these geographies. Government incentives promoting clean energy and domestic chip manufacturing further amplify APAC’s commanding market share. North America and Europe are emerging as high-growth regions, spurred by substantial investments under initiatives like the U.S. Inflation Reduction Act (IRA) and the European Green Deal, which are fostering localized production ecosystems for critical battery materials and semiconductors, thereby creating significant new demand pockets for High Purity Aluminum Fluoride.

Segment trends reveal that the 4N and 5N purity levels are the fastest-growing segments, reflecting the uncompromising quality requirements of advanced microelectronics and premium battery chemistries. Application-wise, the Lithium-ion Batteries segment accounts for the largest market share and is expected to maintain its lead due to the continuous scale-up of global EV production capacity. Electronic Grade AlF₃, while smaller in volume, commands a premium price and exhibits extremely rapid growth driven by the expansion of 5G technologies, AI hardware, and high-density computing requiring ultra-pure etchants and precursors.

AI Impact Analysis on High Purity Aluminum Fluoride Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can be leveraged to enhance the production efficiency and quality control of High Purity Aluminum Fluoride, a critical material in AI hardware supply chains (e.g., semiconductors and advanced batteries). Key concerns center on whether AI can accurately predict and control impurity levels during complex purification processes, optimize energy consumption in high-temperature reactions, and manage the complexity of global supply chains to ensure material availability and competitive pricing. Expectations are high regarding AI’s role in developing novel synthesis routes and material compositions that could potentially reduce cost while maintaining or exceeding current purity benchmarks, directly impacting the profitability of both suppliers and end-users in the highly competitive battery and chip manufacturing ecosystems.

- AI-driven process optimization minimizes energy consumption during calcination and fluorination, lowering production costs.

- Predictive maintenance models for reaction vessels and purification equipment reduce unexpected downtime, ensuring consistent supply.

- Machine Learning algorithms analyze spectral data in real-time for automated, ultra-precise quality control, guaranteeing 5N purity levels.

- AI enhances raw material sourcing strategies by predicting geopolitical risks and supply chain disruptions, ensuring procurement stability.

- Generative AI accelerates R&D efforts in developing new electrolyte additives or coating formulations incorporating high purity AlF₃.

- Automated defect detection in semiconductor etching processes utilizing AlF₃ precursors, increasing manufacturing yield.

DRO & Impact Forces Of High Purity Aluminum Fluoride Market

The market dynamics for High Purity Aluminum Fluoride are primarily shaped by robust demand drivers stemming from the electric mobility transition and concurrent technological advancements in microelectronics. However, the market faces significant restraints related to stringent purification complexity and environmental regulatory hurdles associated with fluorine chemistry. Opportunities exist in optimizing synthesis pathways and leveraging emerging end-use markets such as specialized optical components. These factors collectively exert powerful impact forces on market expansion, pricing, and strategic investment decisions across the value chain, mandating technological innovation and capital expenditure alignment with future demand trajectories, especially in battery-grade material production.

Segmentation Analysis

The High Purity Aluminum Fluoride market is comprehensively segmented based on purity level, application, and physical form, reflecting the diverse and highly specialized needs of various end-user industries. The segmentation by purity level is critical, as minute differences in impurity concentrations dictate suitability for high-end applications like 5N-grade demanded by semiconductor lithography versus 4N-grade often used in advanced battery electrolytes. Application segmentation highlights the dominance of the energy sector, while segmentation by physical form addresses logistical and processing requirements, with powder and granular forms being the most commercially relevant.

- By Purity Level:

- 99.9% (3N)

- 99.99% (4N)

- 99.999% (5N)

- By Application:

- Lithium-ion Batteries (Electrolyte Additives and Cathode Coating)

- Semiconductor Manufacturing (Etching and CVD Precursors)

- Optical Materials (UV Optics, Infrared Windows)

- Catalysis and Specialty Chemicals

- By Grade:

- Electronic Grade

- Battery Grade

- Research Grade

- By Physical Form:

- Powder

- Granular/Pellets

Value Chain Analysis For High Purity Aluminum Fluoride Market

The value chain for High Purity Aluminum Fluoride begins with the upstream sourcing of raw materials, principally high-grade aluminum hydroxide (Al(OH)₃) and hydrofluoric acid (HF) or fluorine derivatives. The purity of these precursors is paramount and dictates the complexity and cost of the subsequent purification stages. Upstream analysis highlights resource concentration risk, as securing reliable, low-impurity feedstock often requires long-term contracts and sophisticated supply management. Manufacturing involves complex chemical processes, such as thermal decomposition or dry-process fluorination, followed by proprietary purification steps (e.g., fractional sublimation or zone refining) to achieve electronic or battery grade specifications.

Midstream activities focus on the actual synthesis and rigorous quality assurance protocols, where significant capital investment in cleanroom facilities and advanced analytical testing (ICP-MS, GD-MS) is necessary to validate purity claims. The distribution channel is often highly specialized, relying heavily on direct sales and technical support due to the material’s sensitivity and high value. Indirect channels, involving specialized chemical distributors, handle smaller volumes or serve regional markets where direct logistics are uneconomical, but the primary sales path is direct to large end-users (e.g., Samsung SDI, SK Innovation, TSMC) to maintain tight control over material handling and specifications.

Downstream analysis focuses on the integration of High Purity Aluminum Fluoride into final applications. For lithium-ion batteries, it is often compounded into electrolyte formulations or used in protective cathode layer deposition. In semiconductors, it is typically used in gaseous or plasma form for precise etching. The success of the downstream user heavily depends on the consistency and purity supplied upstream. Thus, the value chain is characterized by strong vertical linkage and high barriers to entry, driven by the need for technical expertise, regulatory compliance, and significant investment in purification technologies that differentiate electronic-grade suppliers from commodity producers.

High Purity Aluminum Fluoride Market Potential Customers

The potential customer base for High Purity Aluminum Fluoride is concentrated among manufacturers operating within sectors demanding extremely tight material specifications and high performance. The primary buyers are large-scale lithium-ion battery manufacturers (often referred to as 'Gigafactories') and their associated component suppliers, particularly those focused on high-nickel cathode chemistries and solid-state battery development, where AlF₃ plays a vital stabilizing role. These customers purchase substantial volumes and prioritize long-term supply contracts guaranteeing purity and consistency. Secondary, yet equally critical, customers include leading semiconductor device fabricators (Fabs) globally, using AlF₃ for specialized processes in the production of advanced logic and memory chips, emphasizing 5N grade material.

Furthermore, research institutions and specialty chemical producers focused on advanced material science represent a significant niche customer segment, especially for ultra-high purity research-grade materials used in experimental applications, such as novel optical coatings or advanced catalyst development. The purchasing decision for these end-users is heavily influenced by technical specifications, vendor reliability, demonstrated analytical capabilities, and compliance with strict industrial certifications (e.g., ISO 9001, specific battery material standards). The purchasing cycles are lengthy, involving rigorous qualification processes to ensure the material integrates seamlessly into sensitive manufacturing environments without introducing defects or compromising yield rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $780 Million |

| Market Forecast in 2033 | $1,210 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Stella Chemifa Corporation, Solvay, Central Glass Co., Ltd., Morita Chemical Industries Co., Ltd., Zhejiang Sanmei Chemical Co., Ltd., Honeywell International Inc., Kanto Chemical Co., Inc., Showa Denko K.K., Shanghai Haoyuan Chemexpress Co., Ltd., Gelest, Inc., Fuji Titanium Industry Co., Ltd., AGC Inc., Fluorine China, Kishida Chemical Co., Ltd., Albemarle Corporation, Jiangsu Keli Chemical Co., Ltd., Luoyang Shuangrui Fluoride Chemical Co., Ltd., Avantor Inc., BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Aluminum Fluoride Market Key Technology Landscape

The technological landscape of the High Purity Aluminum Fluoride market is dominated by advancements in synthesis and purification methods aimed at achieving ultra-low impurity profiles, essential for electronic and battery grades. Traditional wet methods involve crystallization from aqueous solutions, but newer dry synthesis routes, particularly the reaction of high-purity alumina with hydrogen fluoride gas (HF) at elevated temperatures, are increasingly favored. Dry processes offer superior control over particle morphology and often result in lower residual moisture and metallic impurities, critical for battery performance and semiconductor material purity. Innovations in reactor design and temperature uniformity are continuous focuses for manufacturers.

A crucial technological differentiator is the post-synthesis purification technology. Techniques such as high-vacuum fractional sublimation are employed to separate aluminum fluoride from volatile and non-volatile metallic impurities, yielding purity levels up to 5N. Furthermore, manufacturers are investing heavily in advanced material characterization techniques. Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Glow Discharge Mass Spectrometry (GD-MS) are standard tools used to detect trace elements in parts per billion (ppb) or even parts per trillion (ppt) levels, providing the necessary assurance for high-stakes applications. The integration of advanced sensors and data analytics allows for real-time monitoring and adjustment of reaction parameters to maximize yield and quality consistency.

Furthermore, research into alternative, fluorine-free precursors and more environmentally benign synthesis pathways is slowly emerging due to regulatory pressures concerning HF handling and disposal. However, currently, the established dry fluorination followed by high-temperature sublimation remains the benchmark technology for achieving commercial volumes of ultra-high purity AlF₃. The key competitive edge lies in proprietary purification sequences and the ability to scale up these technologically intensive processes reliably while maintaining strict impurity control, particularly concerning elements like iron, sodium, and silicon, which negatively affect battery stability and semiconductor functionality.

Regional Highlights

- Asia Pacific (APAC): APAC is the global hub for both electric vehicle battery manufacturing and advanced semiconductor fabrication, positioning it as the largest consumer of High Purity Aluminum Fluoride. China, South Korea, and Japan lead demand, fueled by expansive gigafactory construction and heavy government subsidies supporting domestic electronics supply chains. The region is characterized by aggressive capacity expansions and the presence of numerous specialized suppliers catering directly to local electronics giants.

- North America: This region is experiencing exponential growth, largely driven by strategic initiatives (e.g., IRA) designed to localize the EV supply chain and bolster domestic semiconductor manufacturing (CHIPS Act). Significant new capital investments are flowing into battery material processing plants, creating substantial, immediate demand for High Purity Aluminum Fluoride, marking it as the fastest-growing market in terms of incremental volume.

- Europe: Driven by the European Green Deal and commitments to carbon neutrality, Europe is rapidly building its domestic battery production ecosystem (Battery Valley). While traditionally reliant on imports from APAC for ultra-pure materials, the focus on supply chain resilience is encouraging local procurement and investment in regional production facilities for battery-grade AlF₃, making it a critical strategic market for suppliers.

- Latin America, Middle East, and Africa (MEA): These regions represent nascent but growing markets. Demand is primarily focused on small-scale specialized chemical applications and mineral processing. Growth in MEA is linked to increasing investments in petrochemical and specialty chemical manufacturing, while Latin America’s potential hinges on the future development of its own lithium processing industries and related supply chain requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Aluminum Fluoride Market.- Merck KGaA

- Stella Chemifa Corporation

- Solvay

- Central Glass Co., Ltd.

- Morita Chemical Industries Co., Ltd.

- Zhejiang Sanmei Chemical Co., Ltd.

- Honeywell International Inc.

- Kanto Chemical Co., Inc.

- Showa Denko K.K.

- Shanghai Haoyuan Chemexpress Co., Ltd.

- Gelest, Inc.

- Fuji Titanium Industry Co., Ltd.

- AGC Inc.

- Fluorine China

- Kishida Chemical Co., Ltd.

- Albemarle Corporation

- Jiangsu Keli Chemical Co., Ltd.

- Luoyang Shuangrui Fluoride Chemical Co., Ltd.

- Avantor Inc.

- BASF SE

Frequently Asked Questions

Analyze common user questions about the High Purity Aluminum Fluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for High Purity Aluminum Fluoride?

The primary factor driving demand is the exponential growth of the global lithium-ion battery market, particularly for electric vehicles (EVs). High Purity AlF₃ is essential for stabilizing cathode materials and improving the safety and longevity of battery electrolytes.

How do the 4N and 5N purity grades differ in application?

4N (99.99%) grade is widely used in high-end battery electrolyte additives and certain optical applications. 5N (99.999%) grade, with its ultra-low impurity levels, is primarily reserved for highly sensitive semiconductor manufacturing processes, such as advanced etching and specialized thin-film deposition, where contamination must be minimized.

Which geographical region dominates the High Purity Aluminum Fluoride supply chain?

Asia Pacific (APAC) dominates both consumption and supply, driven by the concentration of leading EV battery manufacturers (gigafactories) and the vast semiconductor fabrication infrastructure located predominantly in China, South Korea, and Japan.

What are the main technical challenges in manufacturing ultra-high purity AlF₃?

The main technical challenge involves achieving and maintaining ultra-low impurity profiles, particularly trace metals (Fe, Na, Si), which requires highly sophisticated and capital-intensive purification techniques like high-vacuum fractional sublimation and stringent cleanroom manufacturing environments.

Is High Purity Aluminum Fluoride used in solid-state batteries?

Yes, High Purity Aluminum Fluoride is anticipated to play a critical role in next-generation solid-state battery technology, often as a component in novel solid electrolytes or as a protective interface layer between the solid electrolyte and the electrode to enhance stability and conductivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager