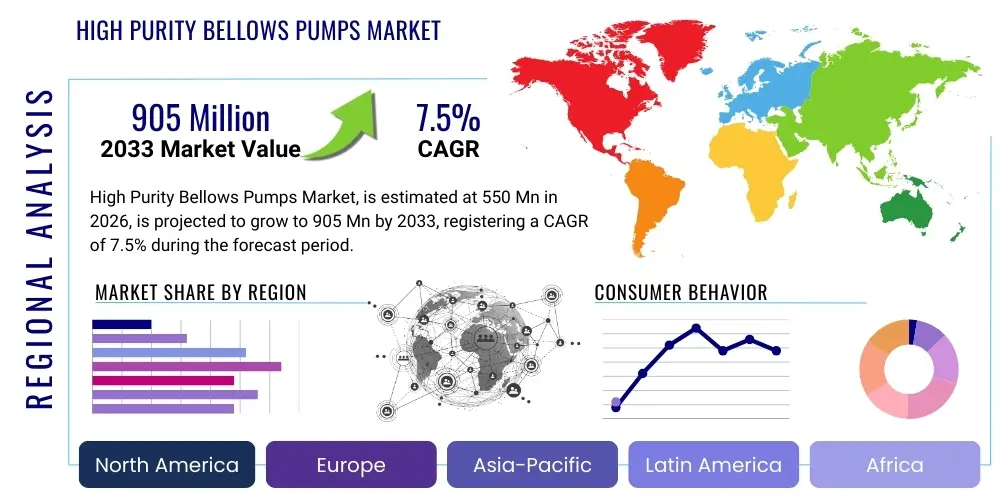

High Purity Bellows Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442613 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

High Purity Bellows Pumps Market Size

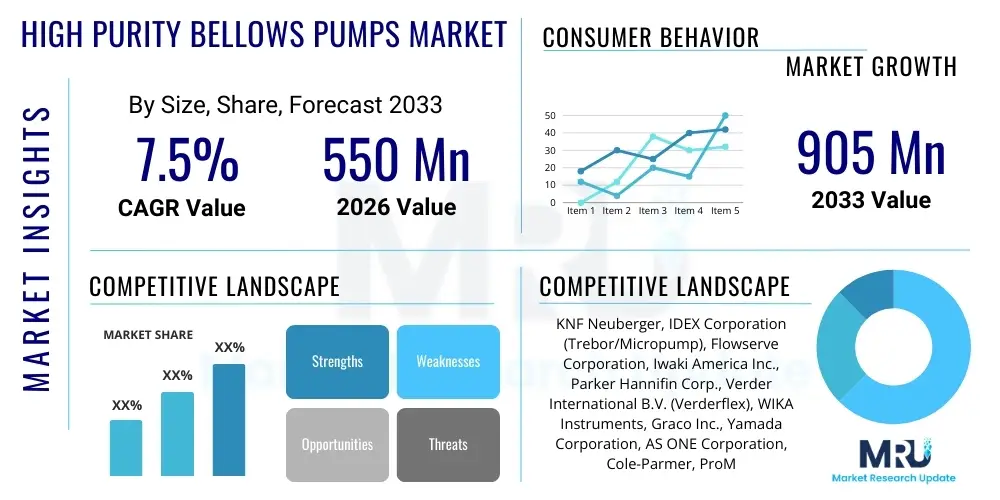

The High Purity Bellows Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 905 Million by the end of the forecast period in 2033.

High Purity Bellows Pumps Market introduction

The High Purity Bellows Pumps Market encompasses specialized fluid handling equipment designed to transfer highly corrosive, volatile, or ultra-pure liquids, primarily in sensitive industrial environments where metallic ion contamination must be strictly avoided. These pumps utilize a flexible bellows mechanism, typically constructed from chemically inert fluoropolymers like Polytetrafluoroethylene (PTFE) or Perfluoroalkoxy alkanes (PFA), to displace fluid. This design ensures that the pumped liquid only contacts the high-purity plastics, thereby eliminating the risk of internal wear particulate generation or chemical leaching that could compromise the fluid's integrity. The hermetically sealed nature of bellows pumps is critical, offering sealless operation which is vital for handling hazardous materials or maintaining sterility in pharmaceutical applications.

Major applications driving this market include the semiconductor manufacturing sector, particularly in the fabrication of integrated circuits (IC) and advanced memory chips, where ultra-pure chemicals (such as hydrofluoric acid, nitric acid, and specialized photoresists) are mandatory for etching, cleaning, and deposition processes. Additionally, the pumps find extensive use in the biotechnology and pharmaceutical industries for metering reagents, handling sterile media, and ensuring contamination-free transfer of expensive or sensitive APIs (Active Pharmaceutical Ingredients). The inherent benefits of these pumps—including exceptional chemical resistance, precision dosing capabilities, minimal pulsation, and robust operation in harsh chemical environments—position them as essential components within high-tech production lines globally. The strict regulatory landscape governing purity in these sectors ensures continuous demand for reliable, non-contaminating fluid transfer solutions, further propelling market expansion.

Driving factors for market growth are strongly linked to the global expansion of high-density semiconductor fabrication plants (fabs), the increasing complexity of microelectronic structures requiring ever-purer processing chemicals, and the ongoing investment in advanced drug manufacturing facilities. Furthermore, the trend toward miniaturization and higher integration in electronic devices necessitates more precise fluid delivery systems, which high-purity bellows pumps are specifically engineered to provide. The continuous technological advancements in fluoropolymer material science also contribute, offering improved mechanical strength and thermal stability, allowing these pumps to operate effectively under increasingly demanding pressure and temperature specifications required by next-generation manufacturing processes.

High Purity Bellows Pumps Market Executive Summary

The High Purity Bellows Pumps Market is witnessing robust growth, primarily fueled by unprecedented expansion in the global semiconductor industry and stringent regulatory requirements across life sciences. Business trends indicate a strong move toward customization and integration, where manufacturers are focusing on developing compact, highly durable pump modules optimized for integration into Chemical Mechanical Planarization (CMP) systems, wet bench processing equipment, and high-precision dosing systems. Key market players are strategically investing in enhancing material compatibility, focusing on materials such as modified PTFE (mPTFE) and highly stable PFA linings, to improve the lifespan and chemical resistivity against aggressive media used in sub-10nm chip fabrication. Mergers and acquisitions focusing on vertical integration—securing specialized fluoropolymer supply chains or acquiring niche precision engineering firms—are becoming prominent strategies to maintain competitive edge and ensure compliance with evolving purity standards, such as SEMI F57 guidelines.

Regionally, the Asia Pacific (APAC) region dominates the market share and is expected to exhibit the highest growth rate throughout the forecast period. This dominance is directly attributable to the concentration of major semiconductor manufacturing hubs in countries such as Taiwan, South Korea, China, and Japan, which are aggressively expanding their production capacities to meet global demand for advanced electronics. North America and Europe also remain vital markets, characterized by significant R&D investments in pharmaceutical manufacturing and specialty chemical processing. In these mature markets, the emphasis is often placed on energy efficiency, digitalization, and incorporating predictive maintenance features into pump designs, aligning with Industry 4.0 principles, though APAC’s massive volume requirements for semiconductor fabrication fluids solidify its leading position in market volume.

Segment trends highlight the dominance of the semiconductor application segment due to its high demand for ultra-pure chemical distribution systems. Within material segmentation, PTFE bellows pumps maintain a substantial share due to their widespread chemical compatibility and established manufacturing processes, although PFA and PVDF segments are growing rapidly, driven by requirements for higher thermal stability and mechanical robustness in specific high-temperature processes. Furthermore, there is a distinct trend favoring pumps with integrated diagnostics and remote monitoring capabilities (smart pumps), particularly in OEM applications, where uptime and precise process control are paramount. The market is also seeing polarization based on flow rate, with high-flow pumps serving bulk chemical delivery systems and micro-dosing pumps serving photolithography and precise additive manufacturing processes, each demanding distinct design specifications and validation rigor.

AI Impact Analysis on High Purity Bellows Pumps Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the reliability and efficiency of specialized fluid handling equipment, specifically high-purity bellows pumps. Key user concerns revolve around predictive maintenance capabilities: Can AI algorithms accurately forecast component failure (e.g., bellows rupture, valve wear) before catastrophic process disruption? Users also seek clarity on how AI can optimize dosing precision and flow control, particularly in complex, multi-stage chemical delivery systems used in advanced semiconductor fabrication. Furthermore, there is significant interest regarding AI's role in quality control, specifically automating the analysis of chemical purity and detecting minute traces of contamination in real-time by correlating sensor data (pressure, temperature, flow) with expected operational norms. The overarching themes are reducing downtime, minimizing chemical waste through enhanced precision, and accelerating fault diagnosis in cleanroom environments.

AI is set to revolutionize the operational management of high-purity bellows pumps by moving maintenance schedules from reactive or preventative to truly predictive. By leveraging vast amounts of operational data—including pump strokes, internal temperature gradients, pressure fluctuations, and motor current signatures—ML models can detect subtle anomalies indicative of impending material fatigue or valve obstruction. This capability allows facility managers to schedule maintenance during planned downtimes, drastically reducing the risk of unplanned, contamination-causing failures in mission-critical processes like advanced lithography. The integration of edge computing facilitates rapid data processing, ensuring real-time response capability essential for handling expensive and volatile process chemicals.

Moreover, AI algorithms are being deployed to optimize process parameters, particularly in systems requiring ultra-precise chemical blending or metering. By constantly analyzing output results and adjusting pump speeds, stroke lengths, and valve timing, AI ensures that chemical mixtures maintain optimal stoichiometry, directly improving yield rates in semiconductor and pharmaceutical manufacturing. This level of dynamic flow adjustment surpasses the capability of traditional Proportional-Integral-Derivative (PID) controllers. This integration minimizes chemical waste and ensures consistent product quality, further justifying the initial investment in smart pumping systems and contributing significantly to the reduction of operational variability in high-purity environments.

- Enhanced Predictive Maintenance: AI models forecast bellows fatigue and valve component degradation using sensor data, minimizing unplanned process stoppages.

- Optimized Chemical Dosing: Machine learning algorithms dynamically adjust pump parameters to ensure ultra-precise, real-time flow and mixing consistency, reducing material waste.

- Automated Anomaly Detection: AI monitors pressure, vibration, and temperature signatures to immediately flag potential contamination risks or operational deviations.

- Improved System Integration: AI facilitates seamless integration of pump diagnostics with centralized manufacturing execution systems (MES) and Supervisory Control and Data Acquisition (SCADA) platforms.

- Simulation and Digital Twin Creation: AI-driven modeling optimizes pump design and deployment scenarios before physical installation, predicting performance under extreme chemical loads.

DRO & Impact Forces Of High Purity Bellows Pumps Market

The High Purity Bellows Pumps Market is influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. The primary driver is the relentless technological scaling in the semiconductor industry, characterized by shrinking feature sizes (e.g., 5nm, 3nm nodes) that demand chemicals of exponentially higher purity and increasingly sophisticated fluid delivery systems. Restraints predominantly center around the high initial capital investment required for these specialized pumps and the inherent volatility in the global semiconductor market, which can lead to cyclical demand patterns. Opportunities arise from the burgeoning bioprocessing sector, especially in gene therapy and personalized medicine, where ultra-sterile, contamination-free fluid transfer is non-negotiable. These forces, when synthesized, create strong pressures on manufacturers to innovate materials science and engineering to maintain compatibility with emerging ultra-aggressive chemicals while simultaneously lowering the total cost of ownership (TCO) for end-users.

Key drivers include the global push for digitalization and data center expansion, necessitating increased production of advanced logic and memory chips, directly correlating to higher consumption of ultra-pure processing chemicals requiring bellows pump handling. Another significant driver is the tightening of regulatory standards (e.g., FDA, USP, SEMI guidelines) pertaining to material cleanliness and non-leaching components in both life science and microelectronics applications. The fundamental design of the bellows pump—sealless, non-metallic wetted parts—perfectly aligns with these stringent purity mandates. Furthermore, the growth in advanced packaging technologies (e.g., 3D integration, heterogeneous integration) demands more complex, precise chemical mixing and delivery at multiple stages of fabrication, reinforcing the demand for highly controllable metering pumps.

However, the market faces significant restraints. The complexity and niche nature of fluoropolymer molding and machining lead to high manufacturing costs, translating into elevated purchase prices compared to standard industrial pumps. This high cost of entry can slow adoption in emerging industrial applications. Moreover, bellows components, despite their chemical resistance, possess inherent mechanical limitations regarding pressure handling and temperature stability compared to metallic pump alternatives, restricting their use in extremely high-pressure environments. Replacement and maintenance of specialized bellows components are also expensive and require highly skilled technicians, contributing to the overall operational expenditure. Addressing these restraints through modular design and automated monitoring is critical for sustained market penetration. Opportunities, conversely, lie in expanding applications beyond traditional semiconductors into areas like advanced solar panel manufacturing, specialized chemical synthesis, and industrial cleanroom processes where high-purity requirements are becoming increasingly formalized.

- Drivers: Exponential growth in advanced semiconductor manufacturing (sub-10nm nodes); increasing demand for ultra-pure chemicals (UPC); stringent regulatory requirements for contamination control in pharmaceuticals and biotech; expansion of high-tech manufacturing capacity in Asia Pacific.

- Restraints: High initial capital expenditure and replacement costs for specialized fluoropolymer components; limitations in maximum operating pressure and flow rate compared to metallic pumps; susceptibility to sudden failure if exposed to incompatible chemicals or extreme mechanical stress.

- Opportunities: Expansion into niche applications like specialized ink jetting and micro-dispensing; integration of IoT and AI for predictive maintenance; growth in gene therapy manufacturing requiring absolute sterility; development of novel, highly durable fluoropolymer materials (e.g., next-generation PFA/PTFE).

- Impact Forces: The necessity for absolute purity, driven by semiconductor scaling, outweighs cost concerns in mission-critical applications, establishing high-purity performance as the primary competitive vector. The market is moderately consolidated, favoring established players capable of meeting rigorous quality control and certification requirements.

Segmentation Analysis

The High Purity Bellows Pumps Market is segmented primarily based on material composition, application, flow rate, and end-use, providing a structured view of the diverse requirements and technological preferences across various high-purity industries. The material segmentation is critical as it defines the pump's chemical compatibility and purity level, with PTFE, PFA, and PVDF being the dominant fluoropolymers utilized for the wetted components. PTFE offers excellent chemical inertness across a broad pH range and is cost-effective, while PFA provides superior mechanical strength and improved thermal resistance, making it suitable for high-temperature chemical delivery systems (e.g., hot phosphoric acid). PVDF is often preferred when a balance between cost, mechanical strength, and purity is sought, especially in less aggressive chemical environments.

Application segmentation reveals that the semiconductor industry is the undisputed leader, consuming bellows pumps for photolithography, wet processing, and bulk chemical distribution. This sector demands pumps capable of handling extremely low particle counts (parts per trillion level purity) and precise flow control for processes like Chemical Mechanical Planarization (CMP). The pharmaceutical and biotechnology segment, conversely, prioritizes sterility and cleanability (CIP/SIP capability), using bellows pumps for metering buffers, media, and final drug product transfer where cross-contamination is fatal. The chemical processing segment includes specialty chemical production and laboratory research, focusing on robust pumps that resist highly corrosive reagents outside of mainstream high-volume production.

Further segmentation by flow rate differentiates the market into micro-flow/metering pumps and high-flow/bulk transfer pumps. Micro-flow pumps are essential for precise dosing of expensive precursors, photoresists, or catalysts, typically requiring exceptional stroke accuracy and minimal pulsation. High-flow pumps are used in large chemical distribution loops and bulk delivery systems, focusing on throughput and robust operation over long periods. The increasing complexity and diversity of chemical processes across global manufacturing centers ensure that demand remains strong across all segments, necessitating continuous innovation in component design, material science, and electronic control systems to meet the increasingly narrow specifications of modern high-purity manufacturing.

- By Material:

- PTFE (Polytetrafluoroethylene)

- PFA (Perfluoroalkoxy Alkanes)

- PVDF (Polyvinylidene Fluoride)

- Other Fluoropolymers (e.g., PEEK, Modified PTFE)

- By Application:

- Semiconductor & Electronics Manufacturing (Wet Etching, CMP, Photoresist Delivery)

- Pharmaceutical & Biotechnology (Media Preparation, Fermentation, Sterile Transfer)

- Chemical Processing (Specialty Chemicals, Ultra-Pure Reagents)

- Others (Laboratory Research, Solar/Photovoltaic)

- By Flow Rate:

- Micro-Flow Bellows Pumps (Metering/Dosing)

- Medium-Flow Bellows Pumps

- High-Flow Bellows Pumps (Bulk Transfer)

- By End-Use:

- Original Equipment Manufacturers (OEMs)

- End-Users/Aftermarket

Value Chain Analysis For High Purity Bellows Pumps Market

The value chain for the High Purity Bellows Pumps Market begins with the highly specialized Upstream Sector, focusing on the production of high-grade fluoropolymer raw materials. This stage involves the synthesis and processing of virgin PTFE, PFA, and PVDF resins, requiring stringent quality control to ensure non-leaching properties and suitability for ultra-pure environments. Key activities here include polymerization, compounding, and molding of precision fluoropolymer components, such as the bellows itself, check valves, and internal diaphragms. A stable, high-quality raw material supply is paramount, as any contamination introduced at this stage compromises the final product's high-purity designation, making the sourcing of materials a critical competitive advantage.

The core Manufacturing and Assembly stage follows, where specialized engineering firms design and produce the pump chassis, motor drives, and integrate the proprietary sealing technology. Due to the high precision required, particularly for metering applications, assembly often takes place in controlled cleanroom environments. Manufacturers focus on maximizing component purity through non-metallic fluid paths and optimizing motor control electronics for pulsation minimization. Distribution channels are twofold: Direct Sales are often utilized for large OEM customers (e.g., semiconductor equipment manufacturers like Applied Materials or Lam Research) requiring custom integration, deep technical support, and strict supply chain verification. Indirect Sales leverage specialized industrial distributors and system integrators who add value through local inventory, application expertise, and after-sales service to smaller end-user facilities and aftermarket customers.

The Downstream sector involves installation, system integration, and critical maintenance, primarily carried out at end-user sites like semiconductor fabs or sterile drug manufacturing facilities. System integrators play a vital role, connecting the pumps into complex chemical delivery modules (CDMs) or skid-mounted systems. Long-term value capture is heavily reliant on the Aftermarket segment, encompassing spare parts (especially bellows and valve heads, which are wear components) and highly specialized maintenance services. The complexity and criticality of the applications mean that reliable, quick access to certified spare parts and expert technical support is essential, often dictating the overall TCO and brand loyalty among high-purity pump users.

High Purity Bellows Pumps Market Potential Customers

The primary customers for high-purity bellows pumps are organizations involved in processes that mandate zero contamination, chemical resistance, and precise fluid metering. The largest segment of buyers consists of Original Equipment Manufacturers (OEMs) specializing in semiconductor manufacturing equipment, such as wet process stations, chemical delivery systems (CDMs), and CMP slurry supply units. These OEMs purchase pumps in bulk for integration into their capital equipment sold to global fabrication plants (fabs). The purchasing criteria for OEMs are rigorous, focusing intensely on Mean Time Between Failure (MTBF), flow accuracy verification, material trace analysis certification, and the pump’s ability to interface seamlessly with complex automated process control systems. Their demand is highly correlated with capital expenditure cycles in the microelectronics industry.

The second major group includes end-users within the Pharmaceutical and Biotechnology sectors. These buyers—encompassing drug manufacturers, contract manufacturing organizations (CMOs), and vaccine producers—use bellows pumps for handling critical buffers, media, and active ingredients under strict cGMP (current Good Manufacturing Practices) environments. Their purchasing decisions are heavily influenced by the pump's cleanability (SIP/CIP compatibility), documentation for validation processes, and material compliance with USP Class VI standards. The sterile and precise transfer of expensive biological materials means reliability and absolute absence of leaching are the highest priorities, often overriding cost considerations.

Furthermore, specialty chemical manufacturers, particularly those producing high-grade reagents, laboratory research facilities, and companies involved in advanced photovoltaic (solar cell) manufacturing, constitute significant secondary customer bases. These entities require bellows pumps to safely and accurately handle hazardous or highly corrosive precursor materials where traditional metallic pumps would fail or introduce unacceptable levels of metal ion contamination. The growth in specialized battery production and advanced material science research also represents an emerging segment demanding ultra-pure fluid handling capabilities, expanding the customer landscape beyond traditional electronics and life sciences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 905 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KNF Neuberger, IDEX Corporation (Trebor/Micropump), Flowserve Corporation, Iwaki America Inc., Parker Hannifin Corp., Verder International B.V. (Verderflex), WIKA Instruments, Graco Inc., Yamada Corporation, AS ONE Corporation, Cole-Parmer, ProMinent GmbH, Fluid Metering, Inc., Entegris Inc., Savant Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Bellows Pumps Market Key Technology Landscape

The technological landscape of the High Purity Bellows Pumps Market is defined by innovations centered on material science, actuation precision, and digitalization to meet the increasing demands for purity and reliability. A core technology advancement involves the engineering of bellows components themselves, shifting toward Modified PTFE (mPTFE) which offers lower cold flow deformation and enhanced mechanical memory compared to standard PTFE, thus extending the pump's lifespan and improving metering accuracy under continuous high-cycle operation. Furthermore, the development of specialized welding and assembly techniques, such as non-contact welding for PFA components, ensures that the fluid path remains entirely non-metallic and free from particulate matter, achieving the demanding SEMI F57 purity standards necessary for sub-10nm semiconductor fabrication.

In terms of actuation, the transition from traditional pneumatic or mechanically linked drives to high-resolution stepper motors and linear drives is a significant technological shift. These advanced drive systems allow for precise control over stroke volume and frequency, dramatically reducing flow pulsation (critical for processes like CMP slurry delivery) and enabling highly accurate micro-dosing capabilities essential for expensive photoresists and catalytic agents. Integrated closed-loop control systems, leveraging sensors for real-time pressure and temperature feedback, allow the pump to self-adjust, maintaining flow consistency regardless of minor changes in system viscosity or backpressure, thereby improving overall process yield and quality predictability in automated manufacturing environments.

The integration of smart technology is rapidly transforming the operational landscape. Modern bellows pumps frequently incorporate embedded microprocessors and communication modules (e.g., Ethernet/IP, IO-Link) enabling remote monitoring and integration into Industrial Internet of Things (IIoT) architectures. Sensor technologies used include acoustic emission sensors for early detection of fluid path anomalies and non-contact displacement sensors for monitoring bellows wear without internal intrusion. This focus on connectivity and predictive diagnostics allows maintenance teams to transition from scheduled replacements to condition-based monitoring, optimizing resource use and minimizing downtime in extremely high-cost-of-failure environments like advanced cleanrooms. These technological enhancements are crucial for delivering the necessary precision, reliability, and low total cost of ownership demanded by leading-edge manufacturers globally.

Regional Highlights

The demand landscape for High Purity Bellows Pumps is markedly regional, dictated largely by the location of high-tech manufacturing capital investments and established regulatory frameworks.

- Asia Pacific (APAC): This region is the undisputed powerhouse of the high-purity bellows pumps market, driven primarily by the massive concentration of semiconductor fabrication facilities (fabs) in countries like China, Taiwan, South Korea, and Japan. Governments in these nations have heavily subsidized the expansion of logic, memory, and foundry capacities, leading to unparalleled demand for ultra-pure chemical delivery systems, of which bellows pumps are a fundamental component. China's push for self-sufficiency in semiconductor production is particularly driving capacity expansion, ensuring that APAC remains the fastest-growing and largest consuming region throughout the forecast period.

- North America: The market in North America, anchored by the United States, is characterized by high investment in sophisticated R&D and advanced pharmaceutical manufacturing, including rapidly expanding gene and cell therapy production sites. While semiconductor volume is smaller than APAC, the demand for highly specialized, ultra-reliable pumps for critical, low-volume processes (such as new drug development and specialty chemical synthesis) is strong. The market is mature, focusing on technological integration, sustainability, and adherence to FDA validation requirements.

- Europe: Europe maintains a substantial share driven by its robust pharmaceutical sector (Germany, Switzerland, Ireland) and high-quality specialty chemical manufacturing. The regulatory environment (e.g., EMA guidelines) necessitates contamination control, supporting stable demand. While the region is making concerted efforts to rebuild its semiconductor manufacturing base (e.g., EU Chips Act), current demand is more balanced across life sciences, chemical R&D, and established microelectronics facilities. Technological adoption focuses heavily on energy efficiency and smart factory integration.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller market shares, but exhibit growth potential in pharmaceutical packaging, commodity chemical processing, and nascent electronics assembly industries. Demand is typically project-based, tied to foreign direct investment in new industrial plants or modernizing existing infrastructure. Adoption rates are lower due to fluctuating economic conditions and less stringent immediate purity requirements compared to first-tier semiconductor markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Bellows Pumps Market.- KNF Neuberger GmbH

- IDEX Corporation (Trebor International)

- Flowserve Corporation

- Iwaki America Inc.

- Parker Hannifin Corporation

- Verder International B.V. (Verderflex)

- WIKA Instruments, Ltd.

- Graco Inc.

- Yamada Corporation

- AS ONE Corporation

- Cole-Parmer (Antylia Scientific)

- ProMinent GmbH

- Fluid Metering, Inc.

- Entegris Inc.

- Savant Systems Inc.

- Goulds Pumps (Xylem Inc.)

- T-Rex Corporation

- Optima Pumpen- und Mischtechnik GmbH

- Fuji Techno Industries Corp.

- Dürr AG

Frequently Asked Questions

Analyze common user questions about the High Purity Bellows Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a bellows pump over a traditional diaphragm pump in high-purity applications?

The primary advantage of a bellows pump is its inherent design that minimizes or eliminates pulsation and reduces shear stress on the fluid. Unlike diaphragm pumps which typically use dynamic seals or flexible diaphragms that can introduce particulates or leaching risks, the precise linear motion of the bellows and the sealless configuration ensure exceptionally high accuracy in metering and maintain the critical ultra-pure integrity of the fluid, especially vital for photoresists and sensitive biological media.

Which material segment (PTFE, PFA, PVDF) dominates the High Purity Bellows Pumps Market and why?

PTFE (Polytetrafluoroethylene) currently holds a significant market share due to its established manufacturing base, excellent chemical inertness against the widest range of corrosive media, and overall cost-effectiveness. However, PFA is rapidly gaining ground, particularly in advanced semiconductor applications, because it offers superior mechanical stability and higher thermal resistance, allowing the pump to handle heated, highly aggressive chemicals required for processes like wet etching and cleaning in advanced nodes.

How are High Purity Bellows Pumps used in advanced semiconductor fabrication processes?

In semiconductor fabrication, these pumps are critical for the precise delivery and recirculation of Ultra-Pure Chemicals (UPC) such as acids, bases, solvents, and specialized slurries used in cleaning, etching, and Chemical Mechanical Planarization (CMP). They ensure the fluid is delivered without metallic ion contamination or particulate generation, which is essential to achieve high yields and reliability in sub-10nm chip manufacturing.

What impact does Industry 4.0 technology, specifically IoT and sensors, have on the reliability of these pumps?

Industry 4.0 integration, utilizing IoT sensors and smart controllers, enables predictive maintenance for bellows pumps. By continuously monitoring operational metrics like stroke count, temperature, and vibration signatures, AI algorithms can predict component fatigue or impending failure (e.g., bellows rupture) before it occurs. This maximizes uptime, drastically reduces the risk of contamination caused by pump failure, and lowers the overall Total Cost of Ownership (TCO).

What are the main regional drivers propelling the growth of the High Purity Bellows Pumps Market?

The primary regional driver is the massive capital investment and expansion of semiconductor fabrication capacity across the Asia Pacific (APAC) region, specifically in Taiwan, South Korea, and China. This high volume of advanced chip manufacturing necessitates substantial deployment of ultra-pure chemical handling infrastructure, securing APAC's position as the leading consumer and growth engine for bellows pumps.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager