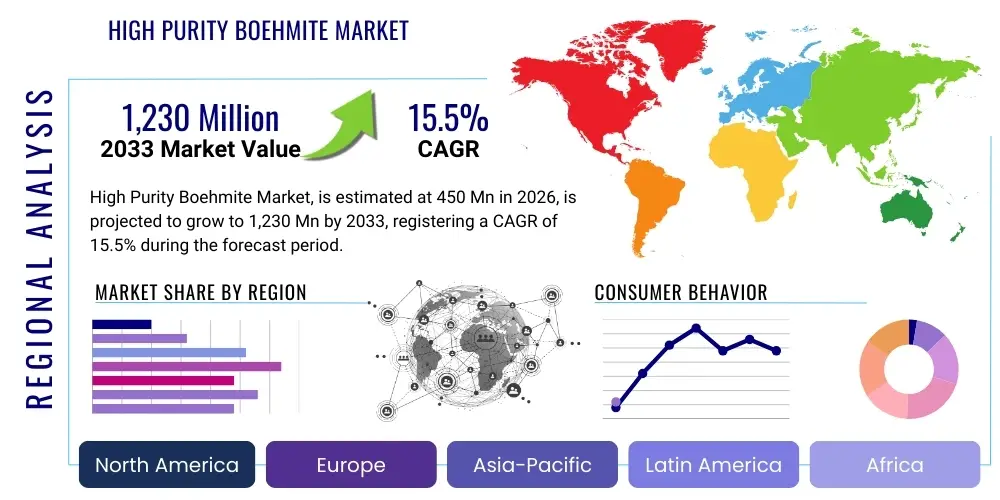

High Purity Boehmite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442941 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

High Purity Boehmite Market Size

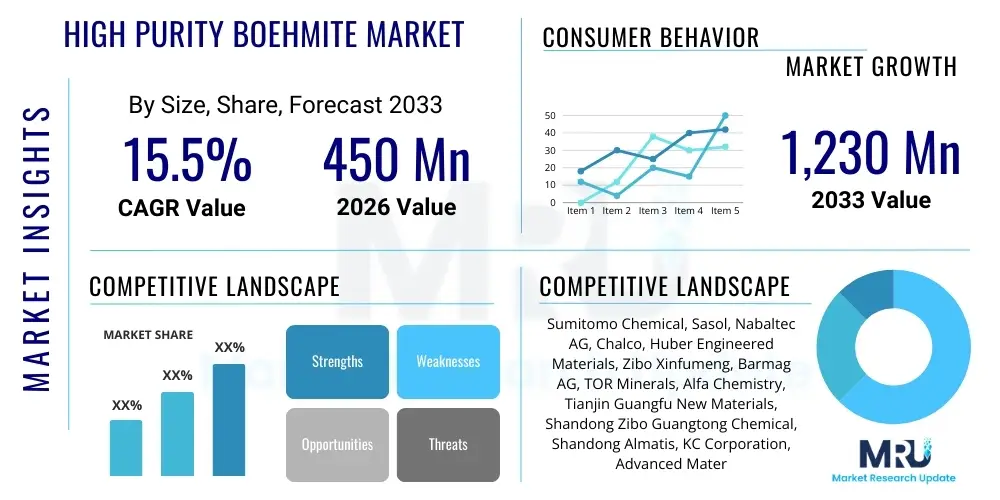

The High Purity Boehmite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,230 Million by the end of the forecast period in 2033.

High Purity Boehmite Market introduction

The High Purity Boehmite market is fundamentally driven by the escalating global demand for advanced materials used primarily in the electric vehicle (EV) battery sector and sophisticated catalytic applications. High Purity Boehmite (HPB), chemically aluminum oxy-hydroxide (AlOOH), is recognized for its exceptional thermal stability, high surface area, and controllable particle morphology, making it an indispensable material, particularly as a separator coating in lithium-ion batteries (LiBs). This coating enhances safety, improves cyclability, and significantly boosts the overall performance characteristics of energy storage devices. The market’s growth trajectory is inextricably linked to the rapid electrification of transportation and the expansion of consumer electronics, which demand safer and higher-density power sources.

The product’s versatility extends beyond energy storage, finding critical use in petrochemical refining as a catalyst support or binder, where its high porosity and chemical inertness contribute to more efficient catalytic processes. Furthermore, HPB is employed in advanced ceramics, flame retardant additives, and specialized polishing applications due to its excellent mechanical strength and thermal properties. Major applications, therefore, span the automotive, electronics, chemical processing, and aerospace industries. The primary benefit derived from HPB, particularly in LiBs, is the prevention of thermal runaway by increasing the thermal resistance of the battery separator, a key safety feature.

Driving factors include stringent global safety regulations concerning battery performance, massive investments in renewable energy infrastructure requiring advanced grid storage solutions, and technological advancements in synthesis methods enabling the production of tailored HPB particles with extremely narrow size distributions. The geopolitical focus on energy independence and sustainable technologies further amplifies the need for high-performance materials like HPB, positioning the market for sustained, aggressive growth throughout the forecast period.

High Purity Boehmite Market Executive Summary

The High Purity Boehmite Market is poised for robust expansion, primarily steered by critical business trends focusing on material optimization and supply chain resilience within the burgeoning electric vehicle and energy storage sectors. Key manufacturers are increasingly concentrating on vertical integration and strategic partnerships with battery producers (gigafactories) to secure long-term supply agreements and tailor product specifications for enhanced battery performance, particularly targeting improved thermal stability and fast charging capabilities. The trend towards ultra-high purity grades (99.99% and above) reflects the escalating performance requirements in premium electronics and high-capacity automotive batteries, necessitating significant capital investment in advanced purification and synthesis technologies, such as continuous precipitation and hydrothermal methods.

Regionally, Asia Pacific (APAC) currently dominates the market, owing to the massive presence of leading LiB manufacturers in countries like China, South Korea, and Japan. This region serves as the epicenter for both demand and production, driven by favorable government policies promoting EV adoption and domestic battery manufacturing capacity expansion. However, North America and Europe are exhibiting the fastest growth rates, catalyzed by strong regulatory support (e.g., EU Green Deal, Inflation Reduction Act in the US) aimed at localizing the battery supply chain and reducing reliance on APAC imports. This geographical shift is fostering new production facility establishments and competitive dynamics among regional suppliers.

Segment trends highlight the overwhelming dominance of the Lithium-ion Batteries application segment, which is expected to witness the highest CAGR due to the proliferation of EVs and portable electronic devices. Within product segmentation, the 99.99% purity grade is gaining significant traction over standard 99.9% grades, reflecting the industry's need for minimal impurities to prevent undesirable side reactions within high-energy-density cells. Furthermore, the downstream catalyst and ceramics segments remain stable but increasingly specialized, focusing on customized particle morphology for enhanced catalytic activity or superior structural integrity in aerospace components.

AI Impact Analysis on High Purity Boehmite Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Purity Boehmite market commonly center on optimizing synthesis processes, predicting material performance under varied conditions, and enhancing quality control throughout the production chain. Users are particularly interested in how AI can minimize batch-to-batch variability and reduce production costs, crucial factors given the high capital expenditure required for high-purity material manufacturing. Concerns also revolve around AI’s role in material discovery—specifically, whether machine learning algorithms can accelerate the identification of novel HPB modifications or composite coatings that offer even greater thermal resistance and ionic conductivity without compromising cost efficiency.

The consensus suggests that AI integration will fundamentally revolutionize HPB production, moving manufacturing away from traditional trial-and-error methods towards predictive process modeling. Machine learning models can analyze vast datasets from synthesis reactors (temperature, pressure, pH, mixing speeds) to precisely control parameters, ensuring uniform particle size distribution and crystal structure, which are paramount for performance in battery applications. Furthermore, AI-powered image analysis of particle morphology and defect detection in separator coatings significantly improves quality assurance, thereby reducing waste and boosting material reliability for critical applications, ensuring that manufacturers can meet the rigorous purity standards demanded by Tier 1 automotive suppliers.

- AI optimizes hydrothermal synthesis parameters for achieving uniform particle size distribution.

- Machine learning models predict yield and impurity levels based on feedstock characteristics, enhancing material sourcing efficiency.

- Predictive maintenance schedules for high-pressure reactors and purification equipment reduce unplanned downtime.

- AI-driven image recognition systems accelerate quality control of particle morphology and coating thickness on battery separators.

- Simulation models utilize AI to predict the thermal runaway performance of batteries coated with specific HPB types.

- Generative AI assists in designing novel HPB surface treatments for improved chemical compatibility with battery electrolytes.

DRO & Impact Forces Of High Purity Boehmite Market

The High Purity Boehmite market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively dictate the direction of market expansion and technological innovation. The primary driver is the accelerating global transition to electric vehicles (EVs), necessitating vast quantities of high-performance Li-ion batteries where HPB serves a vital safety function as a thermal barrier. This demand is further amplified by escalating energy storage system installations for grid stabilization and renewable energy integration. Opportunities arise from the continuous development of next-generation batteries, such as solid-state and high-nickel cathodes, which may utilize HPB in novel ways or require even stricter purity standards, opening new avenues for product differentiation and premium pricing.

However, the market faces considerable restraints, including the high cost associated with achieving and maintaining ultra-high purity levels. The intricate synthesis and purification processes require significant capital investment and energy consumption, leading to high selling prices that can pressure margins for battery manufacturers. Furthermore, the dependence on bauxite as a primary raw material introduces supply chain vulnerabilities, while regulatory hurdles and complex intellectual property surrounding specific synthesis techniques can restrict market entry for new players. The ongoing search for alternative, potentially cheaper, or easier-to-process materials that offer comparable thermal performance in battery separators also poses a long-term competitive threat.

Impact forces currently shaping the competitive landscape are centered around technological innovation and global trade policies. Regulatory pressure concerning battery safety (Impact Force: Safety Mandates) compels manufacturers to adopt HPB coatings, reinforcing demand. Simultaneously, geopolitical tensions and trade barriers (Impact Force: Geopolitical Supply Chains) push key consuming regions like North America and Europe toward localized production, offering substantial opportunities for regional suppliers. The rapid pace of LiB technology evolution (Impact Force: Technological Disruption) demands continuous R&D investment to ensure HPB remains compatible with and optimized for future battery chemistries, placing pressure on manufacturers to maintain flexibility and adapt quickly to shifting technological standards.

Segmentation Analysis

The High Purity Boehmite market is segmented based on critical performance metrics and end-user applications, allowing for precise market analysis and strategic targeting. The segmentation by purity grade, primarily 99.9% and 99.99%, reflects the tiered requirements of different end-use industries, with battery and high-end electronics demanding the stricter 99.99% purity to mitigate internal resistance and thermal instability. Segmentation by application clearly defines the market's reliance on the energy sector, where lithium-ion batteries represent the largest and fastest-growing segment, significantly outpacing traditional uses in catalysts and abrasives. Geographic analysis further outlines the regional consumption patterns, dominated by the Asia Pacific region due to established manufacturing infrastructure.

- By Purity Grade:

- 99.9% High Purity Boehmite

- 99.99% High Purity Boehmite (Ultra-High Purity)

- Others (99.999% and specialized grades)

- By Application:

- Lithium-ion Batteries (Separator Coatings)

- Catalyst and Catalyst Supports

- Ceramics (Advanced Technical Ceramics)

- Flame Retardants

- Abrasives and Polishing Materials

- Others (Cosmetics, Adsorbents)

- By End-Use Industry:

- Automotive (Electric Vehicles)

- Electronics (Portable Devices, Laptops)

- Chemical and Petrochemical

- Aerospace and Defense

- Healthcare and Medical Devices

Value Chain Analysis For High Purity Boehmite Market

The High Purity Boehmite value chain begins with the upstream sourcing of raw materials, primarily high-grade bauxite or aluminum hydroxide, which requires specialized mining and refining processes to ensure initial low impurity levels necessary for HPB synthesis. Upstream analysis focuses on the supply stability and geopolitical risks associated with bauxite extraction, alongside the chemical industry capacity required to convert aluminum raw materials into precursor solutions. Efficient refining processes, often leveraging advanced acid dissolution or Bayer process modifications, are crucial here. Vertical integration among raw material suppliers and Boehmite producers is a growing trend aimed at securing purity and minimizing feedstock costs.

The midstream focuses on the specialized manufacturing of HPB itself, involving complex precipitation, hydrothermal synthesis, calcination, and rigorous purification steps to achieve the desired morphology and purity grade. This stage demands significant technological expertise and capital investment in specialized reactors and particle size control equipment. Distribution channels, linking manufacturers to end-users, typically involve a combination of direct sales for major battery or catalyst companies and indirect distribution through specialized chemical distributors for smaller or localized customers. Due to the technical nature of HPB, technical support and co-development often characterize the direct sales route.

Downstream analysis centers on the integration of HPB into final products, predominantly the application onto Li-ion battery separators (e.g., polyethylene or polypropylene membranes) via slurry coating processes. Success in the downstream market hinges on achieving high dispersion stability and consistent coating thickness. End-users, such as major automotive OEMs and battery cell manufacturers, dictate specifications, driving innovation back up the chain. The high purity required means that quality control at every stage, from bauxite processing to the final coated separator, is paramount, influencing both direct and indirect sales channels through strict certification and compliance requirements.

High Purity Boehmite Market Potential Customers

Potential customers for High Purity Boehmite span several high-growth, technology-intensive sectors, with the primary focus being manufacturers involved in advanced energy storage solutions. These customers include large-scale lithium-ion battery cell producers, particularly those supplying the automotive industry for electric vehicles (EVs) and hybrid vehicles, as well as manufacturers specializing in residential and industrial energy storage systems (ESS). These buyers require HPB for coating polyolefin separators to enhance thermal stability and battery safety, making consistent purity (99.99% and higher) and specific particle size distribution non-negotiable purchasing criteria.

Another major segment of buyers comprises chemical and petrochemical companies utilizing HPB as a binder, catalyst support, or precursor in their industrial processes. These customers often seek tailored surface area properties and specific pore volumes for applications like hydrocracking, hydrotreating, and synthetic fuel production. Demand from this segment is more mature but requires specialized, high-performance grades compatible with harsh chemical environments. Furthermore, companies in the advanced ceramics industry, particularly those serving aerospace, defense, and electronics cooling applications, purchase HPB for its superior thermal shock resistance and mechanical properties when used in composite materials.

The aerospace and defense sectors, along with certain high-end electronics manufacturers (e.g., specialized semiconductors and medical devices), represent premium niche buyers. These end-users demand the absolute highest purity levels and customized morphology for critical applications where material failure is unacceptable, such as lightweight structural components or specialized thermal management systems. The purchasing decision for all potential customers is heavily influenced by factors such as supplier reliability, adherence to global safety standards (e.g., UL, CE certifications), and the ability of the supplier to provide technical consultation for seamless integration into complex manufacturing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,230 Million |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, Sasol, Nabaltec AG, Chalco, Huber Engineered Materials, Zibo Xinfumeng, Barmag AG, TOR Minerals, Alfa Chemistry, Tianjin Guangfu New Materials, Shandong Zibo Guangtong Chemical, Shandong Almatis, KC Corporation, Advanced Material Resources, Skyrock Technologies, MicroPowder Inc., Saint-Gobain, Ruitai Materials, Nippon Light Metal, Dalian Barmag. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Boehmite Market Key Technology Landscape

The technology landscape for High Purity Boehmite production is defined by sophisticated chemical engineering aimed at controlling particle characteristics precisely, as performance in Li-ion batteries is highly dependent on morphology, size, and surface area. Currently, the most dominant technological approaches involve controlled precipitation methods (e.g., using aluminum salts or sodium aluminate solutions) and advanced hydrothermal synthesis. Hydrothermal techniques are gaining prominence because they allow for the production of highly crystalline, nano-sized HPB particles with a very narrow size distribution, which is crucial for creating ultra-thin, uniform separator coatings that maximize energy density while maintaining thermal integrity. Continuous process manufacturing, utilizing advanced monitoring and feedback control, is replacing traditional batch methods to improve efficiency and consistency across large production volumes.

Beyond synthesis, purification technology is equally critical. Achieving 99.99% purity often necessitates rigorous, multi-stage washing, filtration, and calcination processes to remove trace elements like sodium, iron, and silicon, which can severely compromise battery performance. Membrane filtration, ion exchange resins, and ultra-high temperature purification chambers represent leading-edge technologies employed to reach these exacting standards. Furthermore, surface modification technologies are essential; manufacturers are increasingly focusing on specialized surface treatments and doping techniques to enhance the affinity between the boehmite coating and the separator material, improving adhesion and overall battery longevity, particularly under high-voltage cycling conditions.

The innovation trajectory is now shifting towards integrating these processes seamlessly and making them more sustainable. Technological development is focused on reducing energy consumption during the calcination phase and minimizing the use of environmentally sensitive chemicals in the synthesis process. Furthermore, advancements in material characterization, utilizing high-resolution electron microscopy and automated spectroscopy, are being deployed to provide real-time feedback during manufacturing. This technological drive towards precision engineering and environmental compliance is defining the competitive advantage for leading HPB suppliers globally, especially those focused on automotive-grade battery materials.

Regional Highlights

The High Purity Boehmite market exhibits distinct consumption and production patterns across major global regions, heavily influenced by local manufacturing infrastructure and governmental support for the electric vehicle ecosystem. Asia Pacific (APAC) currently holds the dominant share, driven by robust battery manufacturing hubs in China, South Korea, and Japan. China, in particular, leads both in terms of HPB production capacity and consumption, fueled by the massive domestic EV market and the presence of world-leading gigafactories. The region benefits from established supply chains and significant government incentives supporting battery materials R&D and manufacturing localization, making it the primary growth engine for HPB demand globally.

North America is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to monumental policy efforts, such as the U.S. Inflation Reduction Act (IRA), which mandates local content sourcing for EV components and batteries, thereby stimulating substantial investment in domestic HPB production facilities. The strategic impetus in North America is to decouple the battery supply chain from Asian dominance, creating a significant market opportunity for both incumbent global players and new regional entrants aiming to supply automotive giants establishing or expanding production within the continent.

Europe represents another rapidly expanding market, characterized by stringent environmental regulations and ambitious electrification targets set by the European Union. Initiatives like the European Battery Alliance aim to establish a self-sufficient battery ecosystem, driving demand for high-purity materials like Boehmite. Germany, France, and Scandinavian countries are focal points for battery cell manufacturing, translating into high regional demand. While Europe is currently reliant on imports for some high-purity grades, local production capacity is expected to rapidly increase, supported by substantial government funding and public-private partnerships focused on sustainable and secure material sourcing. Latin America, the Middle East, and Africa (MEA) currently maintain smaller market shares, though MEA shows emerging potential due to investments in petrochemical refining (catalyst applications) and localized renewable energy projects demanding stationary storage.

- Asia Pacific (APAC): Dominates the market share due to vast Li-ion battery manufacturing capacity in China, South Korea, and Japan; epicenter of global EV production.

- North America: Expected to show the fastest CAGR, driven by the Inflation Reduction Act (IRA) and localization efforts in the battery supply chain; focus on automotive-grade HPB.

- Europe: High growth fueled by the European Battery Alliance and regulatory mandates pushing for indigenous, sustainable battery material sourcing; strong demand from German and Scandinavian gigafactories.

- Latin America (LATAM): Moderate growth, primarily serving chemical industries and specialized ceramics applications; potential increase with domestic EV assembly growth.

- Middle East & Africa (MEA): Growth concentrated in catalyst support applications within petrochemical refining; nascent but growing demand from large-scale solar and energy storage projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Boehmite Market.- Sumitomo Chemical

- Sasol

- Nabaltec AG

- Chalco (Aluminum Corporation of China Limited)

- Huber Engineered Materials

- Zibo Xinfumeng

- Barmag AG

- TOR Minerals

- Alfa Chemistry

- Tianjin Guangfu New Materials

- Shandong Zibo Guangtong Chemical

- Shandong Almatis

- KC Corporation

- Advanced Material Resources

- Skyrock Technologies

- MicroPowder Inc.

- Saint-Gobain

- Ruitai Materials

- Nippon Light Metal

- Dalian Barmag

Frequently Asked Questions

Analyze common user questions about the High Purity Boehmite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Boehmite (HPB) primarily used for in the rapidly growing energy sector?

High Purity Boehmite is overwhelmingly utilized as a coating material for separators in lithium-ion batteries, particularly those used in electric vehicles (EVs). Its primary function is to enhance thermal stability and battery safety by preventing separator shrinkage and internal short circuits during high-temperature conditions, thereby mitigating the risk of thermal runaway.

Which geographical region is expected to lead market growth for HPB between 2026 and 2033?

While Asia Pacific currently dominates the production and consumption volume, North America is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by massive government investments and regulatory pushes (like the IRA) aimed at localizing the entire EV battery supply chain within the region.

What is the main technological challenge in manufacturing ultra-high purity grades of Boehmite?

The main challenge is achieving and consistently maintaining ultra-low impurity levels, specifically the removal of trace elements such as sodium, iron, and silicon. This requires highly complex and energy-intensive multi-stage purification and filtration processes, often using advanced hydrothermal synthesis methods, which significantly contributes to the overall high cost of the final material.

How does the purity grade of Boehmite affect its application in the electronics industry?

Higher purity grades, typically 99.99% and above, are essential for critical electronics and high-energy-density batteries because even minute traces of metallic impurities can interfere with electrochemical reactions, increase self-discharge rates, and compromise the long-term cycling stability of the device. The strictest purity standards ensure optimal performance and longevity.

Beyond batteries, what are the secondary significant applications driving demand for HPB?

Secondary demand drivers include the use of HPB as a catalyst and catalyst support in the chemical and petrochemical refining industries, where its high surface area and thermal stability improve catalytic conversion efficiency. It is also used in the production of advanced technical ceramics, abrasives, and as a component in high-performance flame retardant systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager