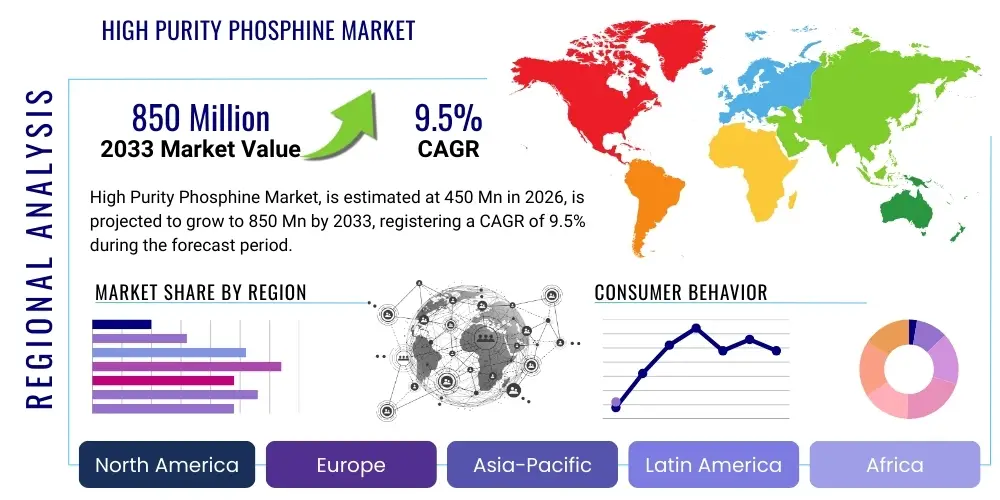

High Purity Phosphine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442948 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

High Purity Phosphine Market Size

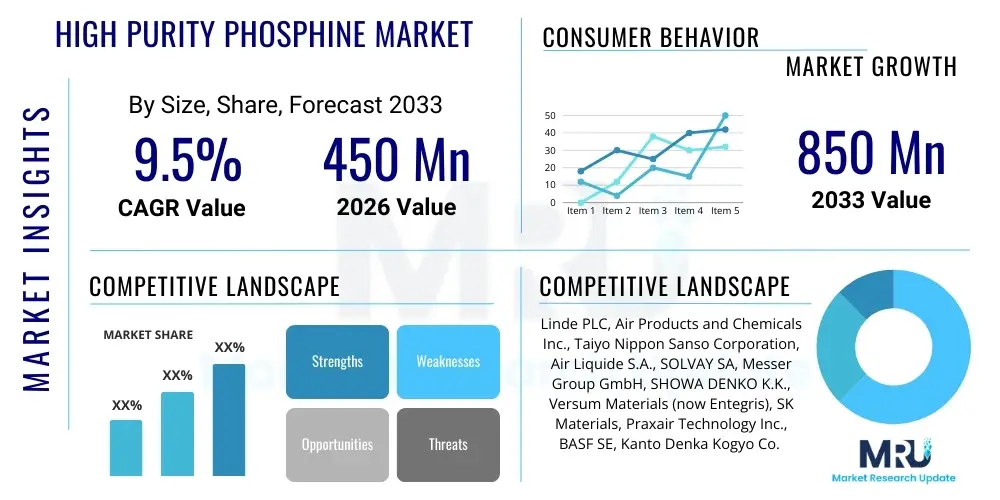

The High Purity Phosphine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033.

High Purity Phosphine Market introduction

High Purity Phosphine (PH3) is a critically important specialty gas primarily utilized in the semiconductor industry for the manufacturing of compound semiconductors, light-emitting diodes (LEDs), and thin-film transistors (TFTs). Recognized for its role as a phosphorus source in epitaxial growth processes such as Metal Organic Chemical Vapor Deposition (MOCVD) and Chemical Vapor Deposition (CVD), high purity phosphine is essential for depositing precise layers of phosphorus-containing materials. The stringent demands of advanced electronic manufacturing necessitate PH3 purity levels typically exceeding 99.999% (5N) to minimize defect formation and ensure optimal device performance, directly correlating market growth with the overall expansion and technological progression of the global electronics sector.

The product description encompasses PH3 gas delivered in various concentrations, often highly diluted in inert carrier gases like hydrogen or nitrogen to ensure safe handling and accurate dosing during the manufacturing process. Key applications span the creation of sophisticated optoelectronic devices, including high-brightness LEDs (HB-LEDs) used in general lighting and displays, as well as advanced microprocessors and memory chips. The reliability and stability of the source material significantly impact the yield and efficiency of the fabricated semiconductor devices, driving sustained demand for ultra-high purity grades that meet the exacting standards of sub-10nm chip architectures.

The primary benefit of utilizing high purity phosphine lies in its efficiency as a doping agent and precursor for compound semiconductor materials, particularly Gallium Phosphide (GaP) and Indium Phosphide (InP). Driving factors for market expansion include the exponential growth in data centers and cloud computing infrastructure, demanding high-speed components; the accelerating global penetration of 5G and subsequent 6G wireless technologies, necessitating advanced radio frequency (RF) components; and the persistent trend of miniaturization in consumer electronics, which relies heavily on high-quality thin films and complex semiconductor structures. Furthermore, the rapid expansion of the electric vehicle (EV) market, requiring advanced power electronics and sensors, provides a robust, long-term growth trajectory for this specialized chemical market.

High Purity Phosphine Market Executive Summary

The High Purity Phosphine market exhibits dynamic growth primarily fueled by relentless technological advancements in the semiconductor and optoelectronics sectors. Business trends indicate significant capital expenditure in wafer fabrication facilities (fabs), especially across Asia Pacific, leading to increased localized demand for precursor gases. Key suppliers are focusing on optimizing logistics and improving purification technologies to ensure sustained supply of ultra-high purity grades, a critical competitive differentiator. Strategic partnerships between gas suppliers and leading semiconductor manufacturers are becoming prevalent to guarantee long-term supply stability and co-development of safer handling and delivery systems for these toxic materials.

Regionally, Asia Pacific dominates the market, largely due to the concentration of major semiconductor manufacturing hubs in countries such as Taiwan, South Korea, China, and Japan. This region not only accounts for the majority of consumption but is also the focal point for innovation in MOCVD and advanced chip fabrication techniques. North America and Europe, while smaller in consumption volume, represent key markets for R&D and specialized high-end applications, particularly in defense, aerospace, and advanced power management devices. The global supply chain remains tightly integrated, but there is a growing trend towards regional self-sufficiency stimulated by geopolitical considerations and the desire for supply chain resilience.

Segmentation analysis reveals that the electronics/semiconductor application segment holds the largest market share, driven specifically by the demand for logic devices and memory chips. Within the purity grades segment, 6N (99.9999%) and higher purity grades are experiencing the fastest growth rate, reflecting the industry's shift towards smaller process nodes and increased sensitivity to impurities. Furthermore, the mode of delivery segment shows a distinct preference for cylinder-based delivery systems, although bulk and on-site generation solutions are gaining traction among very large-scale fab operators seeking cost efficiencies and enhanced safety protocols for managing phosphine precursors.

AI Impact Analysis on High Purity Phosphine Market

User queries regarding the intersection of Artificial Intelligence (AI) and the High Purity Phosphine market frequently center on two main areas: how AI-driven demand for computing power translates into market growth for PH3, and how AI is being leveraged within the semiconductor manufacturing process itself. Users are keenly interested in understanding if the exponential requirements of Generative AI, machine learning training, and large language models (LLMs) will create a massive, sustained spike in demand for advanced logic and memory chips, directly correlating to higher consumption of precursor gases like PH3. Furthermore, there is significant inquiry into the application of AI and machine learning for predictive maintenance, yield optimization, and quality control within high-purity gas production and delivery systems, aiming to reduce waste and improve the consistency of PH3 purity levels used in advanced fabrication processes.

- AI drives demand for advanced semiconductor manufacturing, requiring higher volumes of PH3 precursors for complex chip fabrication.

- Increased complexity and density of AI-specific chips (e.g., GPUs, specialized accelerators) necessitate stringent precursor purity (6N and higher), pushing technology boundaries for PH3 suppliers.

- AI algorithms are being integrated into MOCVD and CVD processes to optimize epitaxial growth parameters, potentially leading to lower PH3 waste and improved material utilization efficiency.

- Predictive analytics powered by AI enhance safety and reliability in PH3 storage and delivery systems, minimizing leakage risks and downtime in critical fab environments.

- AI supports supply chain resilience by modeling geopolitical risks and optimizing logistics routes for specialized, high-hazard materials like phosphine.

- Automation facilitated by AI reduces human intervention in hazardous gas handling, improving operational safety profiles for high purity phosphine applications.

DRO & Impact Forces Of High Purity Phosphine Market

The High Purity Phosphine market is fundamentally shaped by a delicate balance of strong demand drivers emanating from the technological sector and severe constraints related to safety and environmental regulations. The primary drivers include the global push for advanced digitalization, the rollout of 5G infrastructure requiring massive volumes of Indium Phosphide components, and the burgeoning market for high-brightness LEDs, particularly in general lighting and automotive applications. However, market growth is severely restrained by the extreme toxicity and flammability of phosphine gas, which necessitates specialized and highly expensive handling, storage, and transportation infrastructure, significantly limiting the number of capable suppliers and increasing operational costs for end-users.

Opportunities for market expansion are centered around innovation in alternative delivery mechanisms, such as on-site generation technologies and safer solid-state precursors, aimed at mitigating the risks associated with cylinder-based transportation of compressed PH3. Furthermore, the development of new compound semiconductor materials beyond traditional SiC and GaN, particularly those utilizing phosphorus for enhanced thermal and electronic properties in power management devices, presents a substantial niche growth area. The impact forces acting on this market are characterized by intense regulatory scrutiny from governmental bodies concerning worker safety and environmental impact, coupled with the high bargaining power of large semiconductor manufacturers who dictate purity standards and pricing pressure.

These forces collectively ensure that technological innovation in purity and safety becomes a paramount factor for competitive success. Suppliers must continually invest in advanced separation and purification technologies (e.g., cryogenic distillation and getter systems) to meet the ever-increasing purity requirements (e.g., 9N purity) demanded by leading-edge foundry operations. Moreover, the inherent hazards of PH3 necessitate continuous investment in safety training, leak detection systems, and emergency response planning, making compliance a major operating cost and barrier to entry for new market participants. The growth trajectory is therefore steep, but strictly constrained by the high cost of ensuring zero-defect safety and ultra-high purity in the supply chain.

Segmentation Analysis

The High Purity Phosphine Market is meticulously segmented based on purity grade, application type, and mode of delivery, reflecting the diverse and highly specialized needs of end-user industries, predominantly electronics. The purity grade segmentation is vital, as purity levels directly influence the quality and yield of semiconductor components; higher purity (6N and above) commands a premium and is critical for advanced logic and memory manufacturing, while lower purity grades might suffice for specific LED or solar applications. Analyzing these segments provides strategic insights into demand patterns, technological roadmaps of semiconductor manufacturers, and the required investment in purification technology by gas suppliers.

- By Purity Grade:

- 5N (99.999%)

- 6N (99.9999%)

- 7N and Above (99.99999% and higher)

- By Application:

- Semiconductors and Electronics (Memory, Logic Devices, Power Devices)

- Optoelectronics (LEDs, Laser Diodes)

- Photovoltaics (Solar Cells)

- Chemical Synthesis and Others (Pharmaceuticals, Dopants)

- By Mode of Delivery:

- Cylinder-based Delivery

- On-Site Generation

- Pipeline/Bulk Supply

Value Chain Analysis For High Purity Phosphine Market

The value chain for High Purity Phosphine is intensive, starting with raw material procurement and ending with its highly controlled injection into the semiconductor manufacturing process. Upstream analysis involves the sourcing of elemental phosphorus and the subsequent chemical reaction processes required to synthesize crude phosphine gas. This stage is capital-intensive and subject to volatile raw material costs. Following synthesis, the critical midstream segment focuses heavily on sophisticated, multi-stage purification technologies, such as distillation, adsorption, and catalytic conversion, to achieve the requisite 5N to 7N+ purity levels demanded by chipmakers. The efficiency and yield of this purification process are paramount, distinguishing leading vendors in the market.

The downstream segment encompasses packaging, specialized hazardous material logistics, and distribution. Given the extreme toxicity of PH3, packaging involves specialized cylinders and containers designed for high pressure and robust containment, often requiring continuous monitoring during transport. The distribution channel is highly specialized, typically involving direct sales teams and a limited network of authorized distributors equipped to handle ultra-high purity, hazardous gases. Direct distribution is favored for major fab operations to ensure secure, uninterrupted supply and technical support, especially for customized blend concentrations required for specific wafer processes.

Indirect channels sometimes involve chemical distributors who serve smaller research institutions or niche specialty chemical manufacturers, though the majority of high-volume semiconductor business is managed directly by large industrial gas companies. The final link involves the integration of the PH3 gas into the end-user's CVD/MOCVD tools, where precision delivery systems are used to control the flow and concentration of the precursor. Safety compliance and technical service support at the point of use are essential components of the overall value proposition, creating a high barrier to entry for potential competitors not possessing the necessary expertise in hazardous gas management and semiconductor process integration.

High Purity Phosphine Market Potential Customers

Potential customers for the High Purity Phosphine market are concentrated within the highly demanding and technologically advanced sectors that require precise control over material doping and thin-film deposition. The primary end-users are large integrated device manufacturers (IDMs) and pure-play foundry operators specializing in advanced silicon and compound semiconductor wafer fabrication. These companies require PH3 as a critical precursor for the production of sophisticated logic chips, NAND and DRAM memory, and next-generation power management devices, dictating the largest share of market demand due to their large-scale production volumes and strict purity requirements.

A second significant customer base includes manufacturers of optoelectronic devices. This segment comprises companies producing high-brightness LEDs, particularly those using GaP and InP substrates, for applications ranging from automotive lighting to general illumination and advanced display backlights. Furthermore, laser diode manufacturers utilized in fiber optics, data transmission, and emerging sensing technologies are crucial, consistent buyers. These optoelectronics firms require PH3 to achieve precise bandgap control necessary for specific light emission wavelengths and efficiency metrics.

Finally, niche yet important customers include specialized solar cell manufacturers, particularly those focusing on high-efficiency multi-junction solar cells or thin-film photovoltaic technologies where phosphine acts as a vital n-type dopant source. Research laboratories, governmental defense contractors developing specialized sensor technology, and smaller specialty chemical companies requiring highly reactive phosphorus sources for organic synthesis also constitute a peripheral customer segment, though their individual consumption volumes are significantly lower than major semiconductor fabs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation, Air Liquide S.A., SOLVAY SA, Messer Group GmbH, SHOWA DENKO K.K., Versum Materials (now Entegris), SK Materials, Praxair Technology Inc., BASF SE, Kanto Denka Kogyo Co. Ltd., CHEMETALL GmbH, Suzhou Jinhong Gas Co. Ltd., Nikkiso Co. Ltd., Critical Process Systems Group, Zhejiang Kaishan Chemical Co., Iwatani Corporation, Matheson Tri-Gas Inc., Giga Chemical Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Phosphine Market Key Technology Landscape

The technology landscape for the High Purity Phosphine market is centered around achieving and maintaining ultra-high levels of chemical purity and ensuring the safe and reliable delivery of this hazardous gas. The core technology employed in production is advanced purification, primarily involving multi-stage cryogenic distillation coupled with proprietary adsorption and filtration media (getters). These sophisticated systems are necessary to remove trace contaminants such as water vapor, oxygen, silanes, and other metal impurities down to parts per billion (ppb) levels, which are critical for preventing defects in delicate semiconductor layers. Continuous innovation is focused on improving the selectivity and capacity of these purification systems to cost-effectively produce 7N purity PH3 required for next-generation logic chips.

In addition to purification, safety and delivery technologies are paramount. Specialized cylinder and valve technologies, often employing electropolished stainless steel and advanced sealing mechanisms, are mandatory to prevent gas leakage and contamination during storage and transport. Furthermore, advanced gas monitoring systems, including highly sensitive leak detection apparatus and remote telemetry, are integrated into delivery infrastructure at the fab site. These technologies provide real-time data on gas consumption, pressure, and purity, ensuring process stability and immediate response capability in case of an incident. The industry is also exploring safer alternatives, such as the use of solid PH3 precursors (e.g., organophosphorus compounds) that generate PH3 upon heating or reaction, though these have yet to fully replace the traditional cylinder delivery method for high-volume applications.

A burgeoning technological trend is the implementation of on-site phosphine generation (OSPG) systems. OSPG technology allows end-users, particularly large volume fabs, to generate high-purity phosphine on demand from less hazardous feedstocks (e.g., solid aluminum phosphide or sodium hypophosphite) directly within the fabrication plant. While involving higher initial capital investment, OSPG significantly reduces the logistical and safety risks associated with transporting large volumes of compressed PH3 cylinders, offering greater supply security and potentially lower long-term operating costs. This shift represents a significant technological disruption, moving control over the final product quality and supply closer to the point of use, thereby enhancing overall operational efficiency and safety protocols within the semiconductor manufacturing environment.

Regional Highlights

The High Purity Phosphine market exhibits substantial regional disparity, highly correlated with the geographic distribution of global semiconductor manufacturing capacity.

- Asia Pacific (APAC): Dominates the global market, driven by Taiwan, South Korea, China, and Japan, which together host the majority of the world's advanced wafer fabrication facilities (fabs). Demand is exceptionally high due to aggressive investment in memory (DRAM/NAND) and logic chip production, alongside robust growth in high-brightness LED manufacturing across China and Southeast Asia. Regulatory environments here are rapidly evolving but the sheer volume of consumption solidifies APAC as the central hub for PH3 demand and supply logistics.

- North America: Represents a mature market characterized by demand for ultra-high-end applications, including military and aerospace components, advanced R&D, and the recent resurgence in domestic semiconductor manufacturing capacity driven by governmental incentives (e.g., the CHIPS Act). Consumption focuses on the highest purity grades (7N and above) for leading-edge processor technology and specialized compound semiconductors (e.g., GaAs, InP).

- Europe: Characterized by strong R&D activities and significant usage in specialized power electronics, automotive semiconductor manufacturing, and sensor technology. Demand is steady, focused particularly in Germany and France, where investments are tied to the electric vehicle sector and industrial automation. The regulatory environment concerning hazardous gas handling is extremely stringent, favoring suppliers with impeccable safety records and superior containment technology.

- Latin America (LATAM) and Middle East & Africa (MEA): Currently represent niche markets with limited consumption, primarily serving small-scale electronics assembly, solar power installations, and general chemical synthesis. Future growth potential is tied to local governmental initiatives aimed at building initial semiconductor packaging or solar manufacturing capabilities, though volume demand for high purity PH3 remains low compared to the major regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Phosphine Market.- Linde PLC

- Air Products and Chemicals Inc.

- Taiyo Nippon Sanso Corporation

- Air Liquide S.A.

- SOLVAY SA

- Messer Group GmbH

- SHOWA DENKO K.K.

- Versum Materials (now part of Entegris)

- SK Materials

- Praxair Technology Inc. (now part of Linde)

- BASF SE

- Kanto Denka Kogyo Co. Ltd.

- CHEMETALL GmbH

- Suzhou Jinhong Gas Co. Ltd.

- Nikkiso Co. Ltd.

- Critical Process Systems Group

- Zhejiang Kaishan Chemical Co.

- Iwatani Corporation

- Matheson Tri-Gas Inc.

- Giga Chemical Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Phosphine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Phosphine (PH3) primarily used for in the industry?

High Purity Phosphine is predominantly used as a critical precursor gas and n-type dopant source in the semiconductor industry, particularly for manufacturing compound semiconductors (like InP and GaP), advanced memory chips, and high-brightness LEDs, utilizing processes such as MOCVD and CVD.

Which purity grades of Phosphine are most critical for advanced semiconductor manufacturing?

For cutting-edge semiconductor fabrication (sub-10nm nodes), Purity Grades of 6N (99.9999%) and 7N (99.99999%) and higher are increasingly critical, as trace impurities can severely impact device yield and electrical performance during epitaxial growth.

What is the main challenge restraining growth in the High Purity Phosphine market?

The primary restraint is the extreme toxicity and flammability of PH3 gas, which imposes rigorous safety regulations, mandates specialized high-cost handling and transportation infrastructure, and restricts the development of alternative delivery methods.

How is the High Purity Phosphine supply chain ensuring enhanced safety for end-users?

The supply chain focuses on enhancing safety through the implementation of advanced cylinder containment technologies, real-time remote monitoring systems, and the adoption of safer alternatives like on-site phosphine generation (OSPG) technology to reduce transportation risk.

Which geographic region currently dominates the consumption of High Purity Phosphine?

Asia Pacific (APAC), particularly the semiconductor manufacturing hubs in Taiwan, South Korea, and China, dominates the consumption of High Purity Phosphine due to massive capital investment in advanced wafer fabrication and high-volume optoelectronics production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager