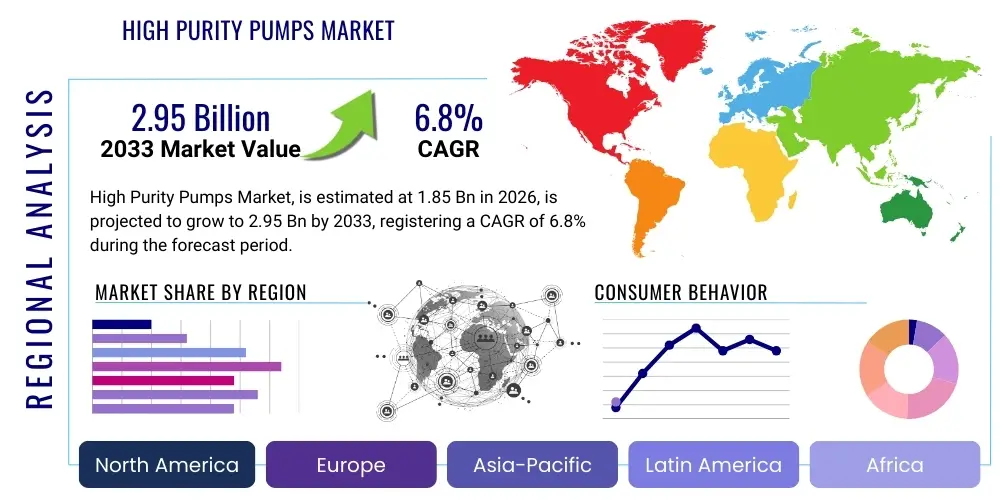

High Purity Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441917 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

High Purity Pumps Market Size

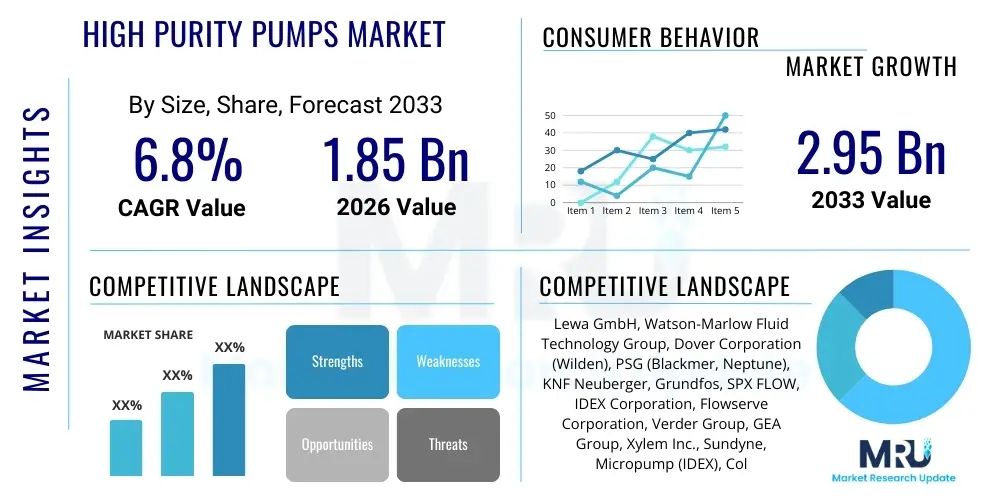

The High Purity Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.95 Billion by the end of the forecast period in 2033.

High Purity Pumps Market introduction

The High Purity Pumps Market encompasses fluid handling equipment specifically engineered to transfer ultra-clean, sensitive, or corrosive media without introducing contamination or shear stress. These critical components are integral to industries where maintaining product integrity, avoiding particulate generation, and ensuring sterile environments are paramount. High purity pumps differ fundamentally from standard industrial pumps through their design, material construction (often 316L stainless steel, PFA, or PTFE), and sealing mechanisms, which are designed to eliminate crevices where biological matter or process contaminants might accumulate. The demand is heavily influenced by stringent regulatory frameworks, particularly within the pharmaceutical, semiconductor, and biotechnology sectors, driving continuous innovation toward hermetic sealing and enhanced cleanability.

Products within this market range primarily include positive displacement pumps, such as diaphragm and piston pumps, and centrifugal pumps, with an increasing emphasis on magnetic drive technologies that eliminate traditional seals—the most common source of failure and potential contamination. Major applications span critical fluid transfer in drug manufacturing, including sterile filtration and filling, ultra-pure water circulation in semiconductor fabrication facilities (Fabs), and precision chemical dosing in specialized industrial processes. These pumps are designed to meet standards such as USP Class VI, FDA, and various ISO cleanroom specifications, ensuring validated performance in sensitive operations.

The principal benefits derived from deploying high purity pumps include superior operational reliability, enhanced product quality due to minimized contamination risk, and reduced maintenance downtime associated with traditional sealing systems. Key driving factors propelling this market forward include the exponential growth in global biomanufacturing capacity, particularly for monoclonal antibodies and vaccines; escalating complexity and demand for smaller feature sizes in semiconductor manufacturing, requiring ultrapure chemical delivery systems; and the ongoing global investment in advanced water treatment and purification technologies where purity standards are continuously tightening.

High Purity Pumps Market Executive Summary

The High Purity Pumps Market is exhibiting robust growth, propelled by sustained capital expenditure in the biopharmaceutical and microelectronics sectors globally. Business trends indicate a strong shift towards adoption of seal-less technologies, particularly magnetic drive and high-precision diaphragm pumps, as manufacturers prioritize zero-leakage systems and total cost of ownership (TCO) reduction. Strategic mergers, acquisitions, and technology licensing agreements are common as key players strive to expand their cleanroom manufacturing capabilities and geographical footprint, ensuring compliance with diverse international purity standards. Furthermore, the integration of Industry 4.0 principles is driving the development of 'smart pumps' equipped with sensors for predictive maintenance and real-time validation monitoring, streamlining complex regulatory reporting and improving uptime.

Regionally, the Asia Pacific (APAC) area is poised to become the fastest-growing market segment, fueled by massive government investment in domestic pharmaceutical production in countries like China and India, coupled with the dominance of semiconductor fabrication in Taiwan and South Korea. North America and Europe maintain leading market shares due to established regulatory environments, high levels of technological sophistication, and the presence of major global biopharma hubs. European demand is particularly characterized by strong adoption of specialized hygienic designs compliant with EHEDG guidelines, ensuring seamless integration into complex automated production lines across various segments, including premium food and beverage processing.

Segment trends reveal that the Pharmaceutical & Biotechnology application segment continues to dominate the market share, driven by complex API processing and sterile filling applications. From a product perspective, Positive Displacement Pumps, specifically highly accurate diaphragm pumps, are experiencing increased demand due to their metering precision and low shear characteristics, essential for handling sensitive biological formulations. The Material segment is seeing accelerated uptake of high-performance engineered plastics like PFA, especially in highly corrosive environments typical of semiconductor chemical delivery, offering excellent chemical resistance properties that surpass traditional 316L stainless steel in certain ultra-aggressive media applications.

AI Impact Analysis on High Purity Pumps Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Pumps Market center on three core themes: operational efficiency, predictive maintenance, and quality assurance/validation. Users frequently question how AI algorithms can improve the reliability of complex, expensive pumping systems and reduce the likelihood of contamination events, which can be catastrophic in high-purity environments. Key concerns also revolve around the integration challenges of legacy equipment with new sensor-driven AI platforms and the potential for AI-driven real-time data analysis to streamline regulatory compliance documentation (e.g., electronic batch records and validation protocols). The expectation is that AI will transform pump management from reactive or scheduled maintenance into a highly predictive, condition-based strategy, dramatically lowering operational risk and maximizing product throughput.

The application of AI is primarily focused on leveraging machine learning models trained on vibration analysis, fluid pressure fluctuations, temperature data, and flow rate deviations. These models can detect subtle anomalies indicative of impending failure—such as diaphragm fatigue, seal wear in magnet-coupled systems, or subtle clogging—long before traditional alarms are triggered. This capability is invaluable in environments like critical sterile filling lines where unscheduled downtime is costly and purity breaches are unacceptable. Furthermore, AI tools are beginning to optimize pump performance parameters dynamically, adjusting speed and pulsation dampening in real-time based on upstream and downstream process feedback, thereby ensuring consistent flow stability and minimizing shear stress on delicate biological materials.

Beyond maintenance, AI algorithms are playing a crucial role in enhancing the validation and qualification of high purity systems. By analyzing massive datasets collected during installation and operational qualification (IQ/OQ), AI can identify potential systemic weaknesses or variations in process parameters that might affect batch consistency. This data-driven validation provides manufacturers with a robust, auditable trail that supports regulatory submissions and compliance, moving beyond static documentation towards dynamic, continuously monitored validation status. This shift fundamentally improves the speed and integrity of product release cycles in pharmaceutical and semiconductor manufacturing.

- AI-driven Predictive Maintenance (PdM) reduces unscheduled downtime by forecasting component failure based on vibrational and thermal signatures.

- Optimization of Pumping Performance allows for real-time adjustments to flow rate and pressure, minimizing shear stress on sensitive media (e.g., biopharmaceuticals).

- Enhanced Regulatory Compliance through automated data logging, anomaly detection, and streamlined electronic validation protocols (e.g., continuous process verification).

- Improved Inventory Management by predicting component lifespan and optimizing spare parts stocking levels for critical pump assemblies.

- Development of Self-Diagnostic Pumps capable of identifying and reporting operational drifts or purity risks directly to supervisory control systems.

DRO & Impact Forces Of High Purity Pumps Market

The High Purity Pumps Market is shaped by a confluence of influential factors: robust demand drivers rooted in industrial necessity and strict regulatory mandates, significant cost and operational restraints, and compelling opportunities driven by technological advancement and geographic expansion. The dominant impact force is the stringent regulatory environment imposed by bodies such as the FDA, EMA, and SEMI, which mandates zero tolerance for contamination in sensitive production processes. This non-negotiable requirement for purity compels end-users to invest in state-of-the-art, validated pumping systems, overriding typical cost considerations and guaranteeing market sustainability.

Key drivers include the global proliferation of biopharmaceuticals (vaccines, gene therapies), which necessitates ultra-gentle and contamination-free fluid transfer, and the ongoing technological miniaturization within the semiconductor industry, demanding ultrapure chemical delivery with exceptional accuracy. These high-growth applications provide a resilient foundation for market expansion. However, the market faces significant restraints, primarily revolving around the high initial capital expenditure required for sophisticated materials (e.g., electropolished 316L, specialty fluoropolymers) and complex magnetic drive configurations. Furthermore, the specialized skills needed for installation, validation, and maintenance of these technically advanced pumps pose operational challenges, particularly in developing economies.

Opportunities for growth are concentrated in the increasing adoption of single-use (disposable) pump technologies in bioprocessing, which eliminate cross-contamination risks and significantly reduce sterilization time and costs. Technological advancements in magnetic coupling offer completely seal-less and leak-free solutions, appealing strongly to semiconductor Fabs. Furthermore, the untapped potential in emerging markets, particularly within the burgeoning generics and API manufacturing sectors in APAC, presents substantial avenues for market penetration, contingent upon successful adaptation to local manufacturing scales and regulatory standards. The balance between regulatory pressure (Driver) and high investment cost (Restraint) defines the competitive landscape, pushing innovation towards cost-effective, yet compliant, solutions.

Segmentation Analysis

The High Purity Pumps Market is systematically segmented based on Type, Material, Application, and End-User, reflecting the diverse and specialized requirements of the target industries. Understanding these segments is crucial for strategic planning, as performance demands vary significantly between, for instance, the gentle handling required for live cell cultures (biopharma) and the aggressive corrosion resistance needed for hydrofluoric acid delivery (semiconductor). Positive Displacement Pumps (PDPs) maintain dominance due to their precise metering capabilities, essential for dosing applications, while centrifugal pumps serve large-volume transfer needs, particularly for buffers and Water for Injection (WFI). The segmentation highlights the critical interplay between material compatibility and process requirements, defining product suitability and market size within each end-use sector.

Segmentation by material is perhaps the most defining characteristic, where stainless steel (316L) remains the standard for pharmaceutical contact surfaces, subjected to rigorous electro-polishing to achieve minimal surface roughness (Ra values) for improved cleanability. Conversely, engineered plastics, such as PTFE, PFA, and PVDF, are indispensable in chemical-intensive industries like semiconductor manufacturing, offering unparalleled resistance to highly oxidizing and corrosive agents, minimizing ion leaching which could otherwise destroy sensitive electronic components. The trend toward modular and customizable pump heads, allowing for easy material swaps based on fluid characteristics, is an emerging segment trend aimed at increasing pump versatility across manufacturing platforms.

Application-wise, the market is heavily weighted towards the Life Sciences, encompassing both pharmaceuticals (drug manufacturing, formulation, filling) and biotechnology (fermentation, cell harvesting, purification). However, the Semiconductor & Electronics segment is experiencing disproportionately high growth due to continuous capital investment in new fabrication plants and the perpetual demand for ultrapure process media. This growth dictates specific requirements for non-metallic pumps and ultra-smooth internal finishes. Finally, the End-User segmentation reflects the distinct purchasing and implementation cycles of OEMs (Original Equipment Manufacturers, supplying integrated skids) versus Direct Manufacturers (Pharmaceutical or Chemical plants purchasing for retrofit or expansion).

- By Type:

- Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps, Gear Pumps)

- Centrifugal Pumps

- Magnetic Drive Pumps (Seal-less)

- Peristaltic Pumps

- By Material:

- Stainless Steel (316L, Electropolished)

- Engineered Plastics (PTFE, PFA, PVDF)

- Alloys and Others (Hastelloy, Ceramic)

- By Application:

- Pharmaceuticals & Biotechnology (API, Formulation, Filling, Chromatography)

- Semiconductor & Electronics (Chemical Delivery Systems, Ultra-pure Water Treatment)

- Food & Beverage (Aseptic Processing, Dairy)

- Water Purification and Treatment (Ultrapure Water Systems)

- Cosmetics and Personal Care

- By End-User:

- Manufacturing Facilities

- Original Equipment Manufacturers (OEMs)

- Research and Development Laboratories

Value Chain Analysis For High Purity Pumps Market

The value chain for the High Purity Pumps Market is intricate and highly specialized, beginning with the upstream supply of specialized raw materials. Upstream activities involve sourcing high-grade, often custom-specified materials, primarily electropolished 316L stainless steel for hygienic applications and chemically inert fluoropolymers (PTFE, PFA) for semiconductor use. The quality and traceability of these raw materials are foundational, requiring strict certification to meet industry standards (e.g., ASME BPE, USP Class VI). Suppliers of critical components, such as high-strength magnets for seal-less drive systems, precision machining services for pump casings, and sophisticated electronic controls for monitoring, form the essential backbone of the upstream segment, demanding tight quality control to ensure final product integrity and cleanability.

Midstream activities encompass the actual design, manufacturing, assembly, and rigorous testing of the pumps. Manufacturing requires specialized cleanroom facilities (often ISO Class 7 or 8) and expertise in orbital welding, surface finishing, and assembly procedures to prevent particulate contamination. Key manufacturers invest heavily in advanced testing protocols, including hydrotesting, material certification, and performance validation tests (e.g., pulsation dampening efficiency and low shear stress testing), ensuring the pumps perform reliably under demanding operational parameters. Post-manufacturing validation documentation, required for pharmaceutical regulatory submissions (IQ/OQ/PQ), adds significant complexity and value at this stage.

Downstream activities focus on distribution, installation, service, and after-market support. The distribution channel typically relies on highly technical sales representatives or specialized industrial distributors who possess deep knowledge of pharmaceutical validation procedures or semiconductor chemical handling protocols. Direct channels are often employed for major, custom-engineered projects, ensuring close collaboration between the pump manufacturer and the end-user's engineering team. Indirect channels, utilizing regional distributors, are crucial for servicing maintenance, repair, and operational (MRO) needs. Post-sale services, including calibration, spare parts supply, and rapid response maintenance, are critical differentiators, especially given the mission-critical nature of these pumps in continuous production environments.

High Purity Pumps Market Potential Customers

The primary potential customers for High Purity Pumps are entities operating in highly regulated industries where product contamination or process instability is economically catastrophic and legally non-compliant. The largest segment of buyers resides within the global pharmaceutical and biotechnology manufacturing sector. These customers utilize high purity pumps across the entire production lifecycle, from initial media preparation and buffer solutions (requiring high flow, hygienic centrifugal pumps) to complex chromatography and tangential flow filtration (TFF) systems (requiring precise, low-shear peristaltic and diaphragm pumps), culminating in the final sterile filling lines. Their purchasing decisions are heavily influenced by documentation packages, validation support, and adherence to current Good Manufacturing Practices (cGMP).

A rapidly expanding customer base is found within the Semiconductor and Electronics industry, encompassing leading-edge wafer fabrication facilities (Fabs) and specialized component manufacturers. These customers require pumps for the ultra-precise, contamination-free delivery of highly corrosive chemicals (acids, solvents, etchants) used in cleaning, deposition, and lithography processes. For this segment, the critical purchasing criteria are chemical compatibility, metal ion contamination prevention (zero-leaching design), and exceptional operational reliability, favoring seal-less magnetic drive and engineered plastic diaphragm pumps. These facilities often require customized pump skids integrated into centralized chemical delivery systems (CDOs).

Other significant potential customers include organizations involved in sophisticated water treatment (producing USP purified water or ultrapure water for industrial use), aseptic food and beverage processing (especially dairy and premium beverages requiring sanitary design standards like 3-A or EHEDG), and specialized chemical manufacturing where trace impurities must be avoided. Furthermore, Original Equipment Manufacturers (OEMs) who build integrated processing skids—such as filtration units, filling machines, or chromatography systems—represent a continuous and substantial customer segment, purchasing high volumes of pumps for integration into their standardized product lines before selling the complete system to the ultimate end-user facility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lewa GmbH, Watson-Marlow Fluid Technology Group, Dover Corporation (Wilden), PSG (Blackmer, Neptune), KNF Neuberger, Grundfos, SPX FLOW, IDEX Corporation, Flowserve Corporation, Verder Group, GEA Group, Xylem Inc., Sundyne, Micropump (IDEX), Cole-Parmer, Ebara Corporation, Iwaki Co., Ltd., Wanner Engineering, Inc., Finish Thompson Inc., Yamada Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Pumps Market Key Technology Landscape

The technological landscape of the High Purity Pumps Market is dominated by innovations aimed at minimizing contamination risk, enhancing operational precision, and improving cleanability. Magnetic drive technology stands out as a critical advancement, fundamentally eliminating the need for dynamic shaft seals. These seals are traditionally the weakest link in terms of leakage and wear particulate generation. Magnetic coupling ensures a completely hermetically sealed fluid chamber, making it the preferred choice for handling highly toxic, expensive, or ultra-pure media in semiconductor and fine chemical industries. Continuous research focuses on optimizing the magnetic coupling materials and bearing systems (e.g., utilizing silicon carbide or proprietary ceramics) to improve dry-run capability and extend maintenance intervals while maintaining zero contact with the process fluid.

Another pivotal technological area is the development of advanced diaphragm and piston pump designs for Positive Displacement applications. Driven by the biopharma sector's need for accurate dosing and low shear stress, manufacturers are incorporating multilayered PTFE diaphragms and sophisticated electronic stroke control mechanisms. These innovations ensure high volumetric efficiency and minimize pulsation, which is essential for consistent flow in chromatography and filtration processes where pressure stability is paramount. Furthermore, the integration of advanced sensors—including pressure transducers and flow meters—directly into the pump head allows for instantaneous process feedback, paving the way for adaptive control systems that automatically adjust pump speed to maintain a constant, user-defined flow profile regardless of system pressure fluctuations.

The rise of Single-Use Technology (SUT) or disposable pump heads represents a transformative shift, particularly within clinical manufacturing and flexible bioproduction environments. SUT pumps utilize pre-sterilized, gamma-irradiated fluid paths (often housed in plastic cassettes or cartridges) that are disposed of after a single batch, completely eliminating the need for costly and time-consuming Cleaning-In-Place (CIP) and Sterilization-In-Place (SIP) validation cycles. While offering clear operational advantages in terms of turnaround time and cross-contamination elimination, the key technological challenge lies in ensuring the disposable plastic components maintain the same material integrity, precise geometry, and pressure handling capabilities as their reusable metallic counterparts, driving innovation in high-performance polymer molding and assembly automation.

Regional Highlights

- North America: North America, particularly the United States, holds a significant market share characterized by mature biopharmaceutical production capabilities, stringent regulatory oversight (FDA), and substantial investment in advanced R&D. The region is a primary adopter of cutting-edge technologies, including single-use and smart pump systems, driven by the presence of global pharmaceutical headquarters and massive clinical trial activities. The demand is further solidified by the large, capital-intensive semiconductor manufacturing base, requiring highly specialized, metallic-contamination-free pumping solutions for advanced node processes.

- Europe: Europe represents a robust market segment, strongly influenced by centralized regulatory bodies (EMA) and regional quality mandates (EHEDG for hygienic design). Germany, Switzerland, and Ireland are key hubs for pharmaceutical manufacturing and medical device production, generating high demand for stainless steel, hygienic centrifugal and positive displacement pumps. The European market exhibits a strong focus on energy efficiency and lifetime operational costs, favoring durable, easy-to-validate systems that comply with specific ATEX directives for hazardous environments common in chemical synthesis.

- Asia Pacific (APAC): APAC is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fueled by massive government funding towards domestic pharmaceutical self-sufficiency (e.g., China's Made in China 2025 initiative and India's focus on generics and APIs) and the world's leading concentration of semiconductor fabrication facilities (Taiwan, South Korea, China). The region's growth profile is marked by large-scale greenfield investments, favoring localized manufacturing and supply chains for high purity equipment, though price sensitivity remains higher than in Western markets.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller shares but offer nascent growth opportunities, particularly in Brazil, Mexico, Saudi Arabia, and South Africa. Growth is primarily tied to expanding healthcare infrastructure, localized vaccine production efforts, and increased industrialization. Market adoption is often initially focused on proven, cost-effective high-purity solutions, gradually transitioning to more advanced systems as regulatory frameworks mature and local technical expertise develops to support complex pump maintenance and validation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Pumps Market.- Lewa GmbH

- Watson-Marlow Fluid Technology Group

- Dover Corporation (Wilden)

- PSG (Blackmer, Neptune)

- KNF Neuberger

- Grundfos

- SPX FLOW

- IDEX Corporation

- Flowserve Corporation

- Verder Group

- GEA Group

- Xylem Inc.

- Sundyne

- Micropump (IDEX)

- Cole-Parmer

- Ebara Corporation

- Iwaki Co., Ltd.

- Wanner Engineering, Inc.

- Finish Thompson Inc.

- Yamada Corporation

Frequently Asked Questions

Analyze common user questions about the High Purity Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the High Purity Pumps Market growth?

The market is primarily driven by the escalating global demand for biopharmaceuticals and vaccines, stringent regulatory requirements mandating contamination-free processing in life sciences, and continuous capital expansion within the global semiconductor manufacturing sector requiring ultrapure chemical handling.

How do High Purity Pumps achieve contamination control?

Contamination control is achieved through superior design elements, including electropolished internal surfaces to prevent microbial adhesion, use of chemically inert materials like PTFE and PFA, and increasingly, the adoption of seal-less magnetic drive technology to eliminate potential leakage paths and wear particles.

Which application segment holds the largest share in the High Purity Pumps Market?

The Pharmaceutical and Biotechnology segment currently holds the largest market share. This is due to the critical nature of fluid handling in drug formulation, Active Pharmaceutical Ingredient (API) production, and sterile filling processes where adherence to cGMP and validation protocols is essential.

What is the significance of Single-Use Technology (SUT) in the High Purity Pumps Market?

SUT is significant because it utilizes disposable, pre-sterilized pump heads, eliminating the need for time-intensive Cleaning-In-Place (CIP) and Sterilization-In-Place (SIP) procedures. This drastically reduces turnaround time, eliminates cross-contamination risk, and lowers validation overhead, making it ideal for flexible bioprocessing.

Which material is preferred for pumps in the semiconductor industry?

For highly corrosive chemical delivery in semiconductor fabrication, engineered plastics such as PTFE and PFA are preferred over stainless steel. These materials provide exceptional resistance to aggressive acids and solvents, ensuring minimal metal ion leaching which is critical for maintaining ultra-pure process media integrity.

How does AI contribute to the operational efficiency of High Purity Pumps?

AI algorithms analyze sensor data (vibration, pressure, temperature) from pumps to enable highly accurate predictive maintenance. This shift from scheduled to condition-based maintenance prevents unexpected failures, maximizes uptime in critical production lines, and optimizes energy consumption.

What differentiates Positive Displacement Pumps (PDPs) in high purity applications?

PDPs, particularly diaphragm and piston types, are differentiated by their capability for highly accurate, metered dosing and low-shear fluid transfer. This precision is vital for handling expensive APIs, sensitive biological materials, and complex formulations where volumetric accuracy is non-negotiable.

What are the main regional growth opportunities for High Purity Pumps?

Asia Pacific (APAC) represents the fastest-growing opportunity, driven by massive investments in domestic biomanufacturing capacity and the expansion of advanced semiconductor fabrication facilities, particularly in China, South Korea, and Taiwan, rapidly increasing the demand for compliant fluid handling equipment.

What role does electropolishing play in hygienic pump design?

Electropolishing is a critical finishing process for 316L stainless steel pump components. It minimizes surface roughness (achieving low Ra values), which drastically reduces the potential for bacterial adhesion and biofilm formation, thus facilitating more effective and reliable sterilization and cleaning processes in pharmaceutical environments.

What key challenges restrict the wider adoption of high purity pumps?

The primary challenges include the substantial initial capital investment required due to complex design and specialized materials, the technical expertise needed for their precise installation and validation, and the high maintenance costs associated with specialized parts and calibration services.

Are magnetic drive pumps completely leak-proof, and why are they favored?

Yes, magnetic drive pumps are inherently leak-proof because they utilize a static containment shell rather than a dynamic shaft seal. They are favored in high purity applications, particularly in semiconductor and chemical dosing, because this seal-less design eliminates the risk of both process fluid leakage and external contaminants entering the system.

What standards govern the material quality for high purity pharmaceutical pumps?

High purity pharmaceutical pumps must adhere to rigorous standards, most notably the ASME Bioprocessing Equipment (BPE) standard for design and construction, and material compliance with guidelines such as USP Class VI requirements for biocompatibility and non-toxicity of fluid contact surfaces.

What is the 'Upstream Analysis' component of the High Purity Pumps value chain?

Upstream analysis covers the sourcing and supply of highly specialized raw materials, including certified 316L stainless steel, fluoropolymers (PTFE/PFA), and proprietary ceramics/magnets. Quality control and traceability of these materials are paramount to ensuring the purity and performance integrity of the final pump assembly.

How do smart pumps enhance validation processes?

Smart pumps integrate sensors and communication protocols that continuously monitor critical operating parameters (flow, pressure, vibration). This data allows for automated, real-time documentation and continuous process verification, significantly streamlining the Installation, Operational, and Performance Qualification (IQ/OQ/PQ) phases required by regulatory bodies.

Besides pharmaceuticals, where else are high purity pumps critical?

They are critical in semiconductor manufacturing for ultra-pure chemical delivery and handling of aggressive etching agents; in advanced water treatment for producing ultrapure water (UPW); and in aseptic food and beverage processing where sanitary standards are strictly enforced to prevent spoilage and maintain product safety.

Why is low shear stress capability important for biopharmaceutical pumps?

Low shear stress is crucial because many biological products, such as proteins, vaccines, and live cell cultures, are highly sensitive to mechanical agitation. High shear forces can damage or denature these sensitive components, reducing product efficacy or yield, necessitating the use of peristaltic or gentle diaphragm pumps.

What role do OEMs play in the High Purity Pumps Market?

Original Equipment Manufacturers (OEMs) are major customers who purchase high purity pumps in volume to integrate them into complex, pre-validated fluid handling skids, such as chromatography systems, filtration units, or filling machines, which are then sold as complete solutions to end-user pharmaceutical or semiconductor plants.

What is the current trend regarding pump size and microfluidics?

There is a growing trend towards miniaturization and micro-pumping technology. These microfluidic pumps are essential for precise, low-volume dosing in laboratory settings, R&D, and early-stage clinical manufacturing, requiring extreme precision and minimal fluid hold-up volume.

How does the total cost of ownership (TCO) factor into the purchasing decision?

While the initial capital expenditure for high purity pumps is high, TCO is a crucial factor. End-users weigh the initial cost against the long-term savings derived from reduced contamination risks, lower maintenance frequency (especially with seal-less designs), prolonged operational lifespan, and minimized downtime in critical production lines.

What impact does specialized welding have on pump integrity?

Specialized welding, specifically orbital welding, is required for joining high purity components (like 316L stainless steel tubing and pump ports). This automated technique ensures smooth, crevice-free welds that prevent particulate entrapment and facilitate complete drainage and effective sterilization, thereby maintaining system integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager