High Purity Silane Gas Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441562 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

High Purity Silane Gas Market Size

The High Purity Silane Gas Market is a specialized segment within the industrial gases and chemical precursors industry, fundamentally driven by the escalating global demand for advanced electronic components and high-efficiency solar energy solutions. This market segment focuses exclusively on Silane (SiH4) with purity levels typically ranging from 5N (99.999%) to 7N (99.99999%), essential for delicate thin-film deposition processes. The rigorous quality standards required for deep sub-micron semiconductor fabrication and advanced photovoltaic technology directly dictate the market's value and expansion trajectory, making it highly sensitive to capital expenditures in the technology manufacturing sectors.

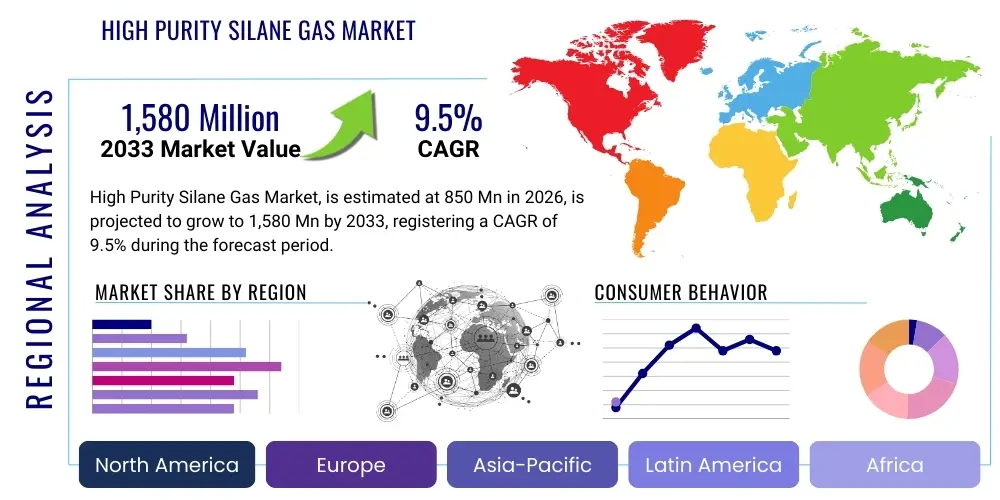

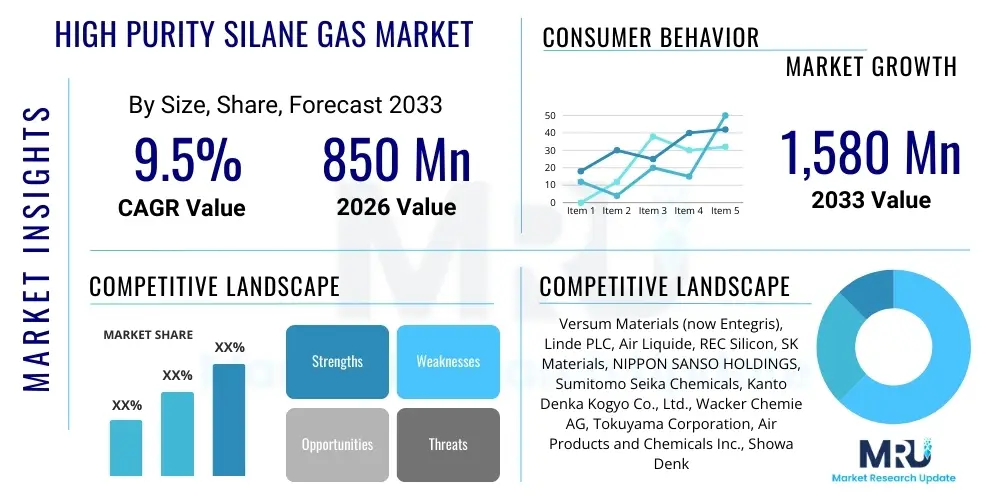

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The continuous technological push towards miniaturization in semiconductors, alongside government mandates promoting renewable energy adoption globally, provides robust underlying growth dynamics. The intrinsic dependency of next-generation technologies—such as 5G infrastructure, artificial intelligence (AI) hardware, and high-resolution display panels—on materials like High Purity Silane Gas ensures sustained investment, particularly in the Asia Pacific region which dominates global electronics production.

The market is estimated at $850 Million in 2026 and is projected to reach $1,580 Million by the end of the forecast period in 2033. This valuation reflects not only volume growth but also the increasing premium commanded by ultra-high purity grades (6N and 7N), which are critical for manufacturing advanced logic and memory chips (e.g., FinFET architectures and 3D NAND). Supply chain complexities, including safe transportation and stringent quality control, contribute significantly to the high entry barriers and stable pricing structure within this critical precursor chemicals market.

High Purity Silane Gas Market introduction

High Purity Silane Gas (SiH4) is a pivotal specialty chemical, recognized as the primary source material for silicon thin-film deposition utilized extensively across the semiconductor, photovoltaic, and display manufacturing industries. This colorless, pyrophoric gas is critical for processes such as Chemical Vapor Deposition (CVD), Plasma Enhanced Chemical Vapor Deposition (PECVD), and Epitaxial growth, forming pure silicon or silicon oxide/nitride layers with precise control over thickness and uniformity. Its high reactivity allows for efficient deposition at relatively low temperatures, a significant advantage in fabricating complex microelectronic structures and large-area solar panels. The definition of 'high purity' in this context dictates minimal contamination, often measured in parts per billion (ppb), as impurities can severely degrade the performance and yield of sophisticated electronic devices.

Major applications of High Purity Silane Gas are concentrated in fabricating silicon-based thin films. In the semiconductor sector, it is indispensable for manufacturing integrated circuits (ICs), memory chips (DRAM, Flash), and advanced logic devices, where 7N purity (99.99999%) is often the baseline requirement for front-end processing. The photovoltaic industry uses silane extensively for depositing amorphous silicon (a-Si) and microcrystalline silicon layers in thin-film solar cells, offering a pathway to lower manufacturing costs and flexible substrates. Furthermore, its application spans the production of Thin-Film Transistors (TFTs) essential for Liquid Crystal Displays (LCDs) and Organic Light Emitting Diode (OLED) screens, ensuring high pixel density and switching speed. The market's robust growth is underpinned by these converging demands from consumer electronics, computing infrastructure, and sustainable energy production.

The driving factors propelling the High Purity Silane Gas market include the global expansion of 5G and 6G technologies, demanding vast quantities of new semiconductor components; accelerated digitalization leading to increased data center construction; and significant governmental and private sector investment into solar energy infrastructure. Key benefits derived from using high-purity silane include achieving superior electrical properties in deposited films, maximizing device yield, and enabling the fabrication of features at the nanoscale (sub-10nm nodes). However, challenges related to safe storage, specialized transportation logistics due to the gas's pyrophoric nature, and the high capital expenditure required for purification facilities necessitate careful market navigation.

High Purity Silane Gas Market Executive Summary

The High Purity Silane Gas Market is characterized by a high degree of technological specialization, intense capital requirements, and critical importance to global high-tech supply chains. Current business trends indicate a strong focus on capacity expansion, particularly for 6N and 7N purity grades, driven by the shift towards advanced semiconductor manufacturing nodes (7nm, 5nm, and below) and the accelerating global ramp-up of solar photovoltaic (PV) installations. Vertical integration strategies, where major industrial gas suppliers control the entire value chain from polysilicon feedstock sourcing to final gas purification and delivery, are a persistent competitive feature, ensuring supply reliability for large-scale customers like TSMC, Samsung, and leading solar panel manufacturers. Furthermore, sustainability pressures are leading to increased R&D in optimizing silane usage efficiency and safer handling protocols to minimize environmental impact.

Regionally, the Asia Pacific (APAC) continues to assert overwhelming dominance, catalyzed by massive government subsidies and private investments in semiconductor fabrication plants (fabs) in China, South Korea, Taiwan, and Japan, complemented by robust solar PV capacity additions across Southeast Asia and India. North America and Europe, while smaller in production volume, represent critical centers for R&D and host major end-users, increasingly focusing on onshore manufacturing resilience in light of geopolitical trade tensions. The regional trend is marked by a geographic decentralization of demand but a concentration of production expertise and purification capacity largely remaining in East Asia, creating complex logistical requirements for global distribution.

Segment trends highlight the Application sector's decisive influence, with Semiconductors & Electronics maintaining the highest value share due to the stringent purity requirements translating into higher product pricing (7N). The Photovoltaics segment drives volume growth, utilizing predominantly 5N and 6N grades for thin-film deposition in solar cells. Within the Distribution Mode, the trend favors bulk delivery (Tube Trailers and Tankers) for high-volume PV manufacturers, while smaller, precision-focused semiconductor fabs rely on specialized cylinders designed for ultra-high purity integrity. The market trajectory is irrevocably linked to the investment cycles of technology manufacturers, making it inherently cyclical but with a strong underlying secular growth trend fueled by global digitalization and energy transition mandates.

AI Impact Analysis on High Purity Silane Gas Market

Common user inquiries regarding AI's influence on the High Purity Silane Gas Market predominantly center on optimizing manufacturing yield, enhancing predictive maintenance for complex purification systems, and improving the precision of chemical vapor deposition (CVD) processes. Users are concerned about how AI can mitigate the inherent risks and costs associated with handling this pyrophoric material, specifically asking about predictive failure analysis for containment vessels and piping. Furthermore, there is significant interest in using machine learning algorithms to correlate trace impurity levels in source silane with end-product defect rates in semiconductor fabrication, thereby optimizing the feedback loop between gas supplier and chip manufacturer. The key themes revolve around maximizing efficiency, reducing waste, ensuring ultra-high quality consistency, and leveraging data analytics to manage supply chain volatility.

The deployment of Artificial Intelligence and Machine Learning (ML) models is set to revolutionize the efficiency and safety parameters within the High Purity Silane gas ecosystem. By integrating real-time sensor data from purification columns, distillation towers, and quality monitoring instruments, AI algorithms can predict process deviations far before they lead to product contamination or production halts. This predictive capability is vital for 7N purity gas production, where even minor variations can necessitate expensive reprocessing. AI also plays a role in optimizing energy consumption during the cryogenic distillation and chemical processing stages, lowering the substantial operational costs associated with achieving ultra-high purity, thereby positively influencing the market's overall profitability.

In the downstream semiconductor application, AI is being integrated into process control systems for CVD and atomic layer deposition (ALD) equipment. ML models analyze parameters like gas flow rates, temperature profiles, and plasma conditions, adjusting inputs dynamically to achieve optimal thin-film properties and thickness uniformity across large wafers. This level of optimization drastically improves device yield, allowing semiconductor manufacturers to extract maximum value from the costly high-purity silane precursor. Consequently, the adoption of AI contributes to stabilized, high-quality demand for silane gas and shifts the competitive focus towards suppliers who can provide data-integrated quality assurance documentation.

- AI-driven Predictive Maintenance: Minimizes downtime in critical purification and compressor equipment, enhancing production reliability and safety.

- Process Optimization: Utilizes machine learning to fine-tune CVD/PECVD parameters (temperature, pressure, flow rate) for superior thin-film quality and wafer yield.

- Real-time Quality Control: Deploys sophisticated algorithms to rapidly detect and identify trace impurities in ultra-high purity grades (7N), ensuring compliance with stringent electronic standards.

- Supply Chain Logistics: Optimizes routing and inventory management for hazardous material, improving safety compliance and reducing transportation lead times.

- Energy Efficiency: AI models reduce utility consumption in energy-intensive cryogenic separation processes used for silane purification.

- Defect Correlation Analysis: Links slight variations in silane precursor purity to specific end-product defects, facilitating proactive material rejection or process adjustment.

DRO & Impact Forces Of High Purity Silane Gas Market

The High Purity Silane Gas market is highly influenced by dynamic forces, summarized by the Drivers, Restraints, and Opportunities (DRO). Major drivers include the relentless technological advancement in semiconductor nodes, necessitating materials with ultra-high purity levels to prevent electrical defects, alongside the massive expansion of the global photovoltaic (PV) capacity, which drives significant volume demand for lower-grade (5N/6N) silane. Restraints primarily involve the inherent hazards associated with handling and transporting pyrophoric gases, which demand extremely high safety standards and specialized logistics infrastructure, contributing to elevated operational costs. Opportunities emerge from the development of advanced materials like silicon germanium (SiGe) and silicon carbide (SiC) utilizing silane derivatives, as well as the potential for localized manufacturing to address geopolitical supply chain risks, particularly in North America and Europe. The resulting impact forces shape the strategic landscape, dictating investment in new production facilities, technology, and advanced purification methods.

The primary impact force driving market expansion is technological proliferation, specifically the transition to smaller feature sizes in microelectronics and the corresponding rise of technologies such as 5G, IoT devices, and High-Performance Computing (HPC). These applications are fundamentally dependent on high-quality thin-film deposition enabled by silane. Conversely, the high capital expenditure required to establish and maintain ultra-pure gas production facilities acts as a significant restraint, limiting market entry and concentrating production capability among a few specialized industrial gas giants. Furthermore, the volatility of polysilicon prices, the raw material for silane, introduces cost uncertainty throughout the value chain, presenting a financial challenge for suppliers.

Opportunities are strongly linked to the green energy transition and innovation in display technology. The burgeoning demand for higher efficiency, next-generation solar cells, including tandem and heterojunction architectures, requires precise silane usage. Additionally, the increasing complexity of display panels (e.g., AMOLED, MicroLED) drives the need for silane-derived silicon layers for high-mobility backplanes. The collective impact of these forces ensures a long-term, structurally positive outlook for the market, provided safety and supply chain integrity are meticulously managed by key stakeholders.

Segmentation Analysis

The High Purity Silane Gas market is comprehensively segmented based on Purity Level, Application, and Distribution Mode, reflecting the diverse and highly specialized requirements of various end-user industries. This segmentation is crucial as the pricing and volume dynamics differ drastically between the ultra-high purity grades demanded by advanced semiconductor fabrication and the high-volume, relatively lower-purity grades utilized in standard photovoltaic manufacturing. Analyzing these segments helps in understanding the disparate growth drivers, competitive intensities, and strategic investment areas across the entire market spectrum, allowing suppliers to tailor their product offerings and delivery infrastructure to specific industry needs.

The Purity Level segment is arguably the most critical determinant of value, with 7N purity (99.99999%) commanding a premium due to the rigorous purification processes required to eliminate trace contaminants like phosphine, arsine, and borane, which act as unwanted dopants in microchips. The Application segment defines the end-use functionality, with Semiconductors maintaining the highest revenue share due to their high-value outputs and dependency on uncompromising quality. The choice of Distribution Mode—cylinders, tube trailers, or on-site generation/pipeline—is dictated by the end-user's consumption volume, location, and internal safety protocols, directly impacting logistics costs and supply reliability.

Understanding the interplay between these segmentations reveals that the future growth acceleration is primarily concentrated in the 7N purity segment due to the global push towards sub-10nm chip manufacturing. However, the volume consumption and capacity utilization are heavily dominated by the Photovoltaics sector. Strategic market players must balance high-margin, low-volume supply (Semiconductors) with moderate-margin, high-volume operations (PV) to optimize profitability and maintain technological leadership in purification processes.

- Purity Level: 5N Grade (99.999%), 6N Grade (99.9999%), 7N Grade (99.99999%) and Above

- Application: Semiconductors & Electronics, Photovoltaics/Solar Cells, Flat Panel Displays (FPDs), LED Lighting, Others (e.g., Optical Fibers, Specialty Coatings)

- End-Use Industry: Semiconductor Manufacturing, Solar Energy Sector, Display Technology Providers, Specialty Chemical Production

- Distribution Mode: Cylinders (Standard and High-Pressure), Bulk Tankers (Tube Trailers), Pipeline Supply (On-site Generation)

Value Chain Analysis For High Purity Silane Gas Market

The value chain for High Purity Silane Gas is complex, spanning from basic chemical production to highly specialized distribution. Upstream analysis begins with the raw material, metallurgical grade silicon, which is processed into Polysilicon, often via the Siemens process or FBR (Fluidized Bed Reactor). Polysilicon is then reacted, typically with hydrochloric acid, to form trichlorosilane (TCS), which is further purified and reacted with hydrogen to produce Silane gas (SiH4). The ultra-purification stage, involving distillation, adsorption, and specialized scrubbing techniques to remove impurities to the parts-per-billion level, is the most crucial and value-adding step in the upstream process, largely conducted by specialty chemical manufacturers and major industrial gas companies.

The midstream involves packaging and specialized logistics. Given Silane's pyrophoric nature, transportation requires highly specialized cylinders (often internally electropolished and passivated for 7N purity) or multi-cylinder tube trailers, ensuring safety and preventing recontamination during transit. Distribution channels are predominantly direct, driven by the need for technical support and supply chain security for high-volume, sensitive customers. Major industrial gas companies operate vast distribution networks, utilizing both direct sales teams and technical service engineers who manage on-site storage and gas cabinet integration at the customer’s facility. Indirect channels, involving third-party distributors, are less common but exist for smaller end-users or specific geographic regions where the main supplier lacks extensive infrastructure.

Downstream analysis focuses on the end-use applications, primarily in semiconductor fabs, solar cell manufacturing plants, and display panel producers. The value extracted downstream is immense, as the high-purity silane enables the fabrication of high-performance, high-value components (e.g., microprocessors, high-efficiency solar modules). End-users demand stringent quality consistency, just-in-time delivery, and robust emergency response capabilities from their suppliers. The economic leverage tends to shift slightly downstream, as the failure of precursor materials can lead to catastrophic yield losses for semiconductor manufacturers, reinforcing the critical relationship between supplier and buyer and emphasizing long-term contractual agreements over spot market purchases.

High Purity Silane Gas Market Potential Customers

Potential customers for High Purity Silane Gas are concentrated within industries requiring precise, high-quality silicon thin-film deposition for functional layers, predominantly focused on advanced electronics and renewable energy. The most valuable segment comprises Tier 1 Semiconductor Manufacturing Companies, including Integrated Device Manufacturers (IDMs) and pure-play Foundries such as TSMC, Samsung Electronics, Intel, Micron Technology, and SK Hynix. These customers consume 6N and 7N purity silane for critical front-end-of-line (FEOL) processes, including gate oxide deposition, spacer formation, and shallow trench isolation, essential for fabricating advanced memory and logic chips. Their purchasing decisions are driven exclusively by purity specifications, supply chain resilience, and integrated technical support.

A second major customer group is the Photovoltaic (PV) Manufacturers, particularly those specializing in thin-film solar technologies (a-Si, CdTe, and hybrid architectures) and crystalline silicon wafer producers who utilize silane for antireflection coatings (SiN layers). Companies like First Solar, Jinko Solar, and Trina Solar are volume buyers of 5N and 6N silane, where cost-efficiency and large-scale bulk delivery capability are key purchasing criteria. Although the purity requirements are less demanding than those of semiconductor fabs, the sheer volume consumption makes this sector critical for overall market size and supplier capacity utilization.

The third major segment involves manufacturers of Flat Panel Displays (FPDs), including leaders in LCD and OLED technology such as LG Display, Samsung Display, and BOE Technology. These companies use high-purity silane for depositing the amorphous and polycrystalline silicon layers necessary for Thin-Film Transistors (TFTs) that control pixel switching. Furthermore, emerging high-growth customers include specialized players in LED and MicroLED manufacturing, advanced materials research laboratories, and developers of next-generation lithium-ion battery anodes (which often incorporate silicon). All these customers require guaranteed supply integrity, meticulous handling protocols, and highly detailed certificates of analysis (COA) verifying gas composition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,580 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Versum Materials (now Entegris), Linde PLC, Air Liquide, REC Silicon, SK Materials, NIPPON SANSO HOLDINGS, Sumitomo Seika Chemicals, Kanto Denka Kogyo Co., Ltd., Wacker Chemie AG, Tokuyama Corporation, Air Products and Chemicals Inc., Showa Denko K.K., Messer Group, PurityPlus Specialty Gases, Matheson Tri-Gas, Inc., Taiyo Nippon Sanso Corporation, Central Glass Co., Ltd., JSR Corporation, China Petroleum & Chemical Corporation (Sinopec), Mitsui Chemicals Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Silane Gas Market Key Technology Landscape

The technological landscape of the High Purity Silane Gas market is primarily defined by the methods used for gas synthesis, purification, and safe handling. The dominant synthesis route involves the disproportionation of trichlorosilane (TCS) derived from metallurgical silicon, but the critical technological differentiation lies in the purification stage. Suppliers leverage advanced techniques such as multi-stage cryogenic distillation, selective adsorption using specialized media (e.g., zeolites), and high-efficiency filtration to achieve 7N purity levels. These processes are inherently energy-intensive and require stringent monitoring to eliminate sub-ppb levels of harmful impurities like metal halides, hydrocarbons, and hydrides of arsenic and phosphorus, which could compromise semiconductor device performance.

In the application domain, the market is closely intertwined with innovations in thin-film deposition technologies. Chemical Vapor Deposition (CVD), especially Plasma-Enhanced CVD (PECVD), remains the core technique for using silane to deposit silicon films, silicon nitride (SiN), and silicon dioxide (SiO2). Recent technological advancements focus on optimizing silane precursors for Atomic Layer Deposition (ALD) systems, which are essential for producing conformal, ultra-thin films required for high-aspect ratio structures in 3D NAND and FinFET transistors. ALD demands even higher purity and consistent vapor pressure characteristics from the silane source, driving continuous investment in supplier R&D aimed at refining product specifications.

Furthermore, technology related to safety and supply integrity is paramount. This includes specialized cylinder and container technology, often featuring internal coating technologies to prevent wall-adsorption and contamination, alongside advanced real-time monitoring systems embedded in gas cabinets at customer sites. Innovation in on-site generation (OSG) of ultra-high purity silane is also a niche but growing trend, particularly for large-volume users, offering reduced transportation risk and enhanced supply chain control. The overall technological direction emphasizes purity maximization, deposition efficiency, and risk mitigation throughout the lifecycle of the hazardous material.

Regional Highlights

The global consumption and production landscape of High Purity Silane Gas is heavily skewed towards Asia Pacific (APAC), which accounts for the majority of global demand and purification capacity. This dominance is intrinsically linked to the geographical concentration of major semiconductor fabrication facilities (frequently referred to as 'fabs'), especially in Taiwan (TSMC), South Korea (Samsung, SK Hynix), China, and Japan. The APAC region also leads global photovoltaic production, with high-volume demand originating from solar cell manufacturers in China, India, and Southeast Asia. Strategic investments by governments in China and South Korea to achieve technological self-sufficiency in advanced electronics further solidify APAC's leading position, driving continuous demand for 7N purity grades. Logistical infrastructure in this region is highly specialized to manage the massive, continuous flow of specialty gases required by these large manufacturing hubs.

North America holds the second-largest market share, primarily driven by robust R&D activities, the presence of major IDMs (Intel, Micron), and ongoing initiatives to re-shore semiconductor manufacturing. Government incentives, such as the CHIPS Act in the U.S., are stimulating significant investment in new fab construction, which will substantially increase the regional consumption of high-purity silane over the forecast period. Demand here is characterized by high requirements for innovative purification and delivery systems, supported by major industrial gas suppliers with established domestic capabilities. The market growth in North America is projected to accelerate faster than the global average due to these governmental policy shifts aimed at supply chain diversification.

Europe represents a stable but moderate market, focused on niche high-tech applications, automotive electronics, and a concentrated solar manufacturing base. Key markets like Germany and Ireland host significant semiconductor and display manufacturing operations. Although European growth is less volume-driven compared to APAC, the demand for silane is supported by stringent quality standards and an emphasis on sustainable manufacturing practices. Latin America, the Middle East, and Africa (MEA) currently account for a marginal share, with demand predominantly linked to smaller solar farm installations and emerging electronic assembly operations, relying heavily on imported gas supplies from established global distribution networks.

- Asia Pacific (APAC): Dominant market in terms of production and consumption; driven by mass semiconductor and PV manufacturing centers (Taiwan, South Korea, China). Requires high volume of both 5N/6N (PV) and 7N (Semiconductors).

- North America: Key growth region fueled by massive governmental investment (e.g., CHIPS Act) and new fab construction; emphasis on technological resilience and 7N purity supply.

- Europe: Stable market characterized by high-quality requirements for automotive electronics and specialized industrial applications; slower volume growth but strong focus on safety protocols.

- Latin America and MEA: Emerging markets with modest demand tied mainly to utility-scale solar projects; heavily reliant on imports and specialized logistic chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Silane Gas Market.- Versum Materials (now Entegris)

- Linde PLC

- Air Liquide

- REC Silicon

- SK Materials

- NIPPON SANSO HOLDINGS

- Sumitomo Seika Chemicals

- Kanto Denka Kogyo Co., Ltd.

- Wacker Chemie AG

- Tokuyama Corporation

- Air Products and Chemicals Inc.

- Showa Denka K.K.

- Messer Group

- PurityPlus Specialty Gases

- Matheson Tri-Gas, Inc.

- Taiyo Nippon Sanso Corporation

- Central Glass Co., Ltd.

- JSR Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- Mitsui Chemicals Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Silane Gas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for High Purity Silane Gas in the current market?

The primary driver is the accelerating global transition to advanced semiconductor manufacturing nodes (7nm and below) and the massive expansion of the solar photovoltaic (PV) industry, both of which rely heavily on silane for thin-film deposition required for producing high-efficiency chips and solar cells.

Why is 7N purity silane gas essential, and which industry is the biggest consumer of this grade?

7N purity (99.99999%) is essential because even parts-per-billion impurities can act as electrical dopants, critically damaging the performance and yield of microelectronic devices. The Semiconductor Manufacturing industry, particularly foundries fabricating advanced logic and memory chips, is the biggest consumer of this ultra-high purity grade.

What are the main risks associated with High Purity Silane Gas transportation and handling?

The main risk stems from Silane’s pyrophoric nature, meaning it ignites spontaneously upon exposure to air. This necessitates highly specialized, pressurized containers, stringent safety protocols, dedicated logistics chains, and technical expertise to mitigate fire hazards and ensure the integrity of the ultra-high purity level during delivery.

Which geographical region dominates the production and consumption of this market, and why?

The Asia Pacific (APAC) region dominates both production and consumption. This dominance is due to the high concentration of global semiconductor fabrication facilities (fabs) and the world's largest solar cell manufacturing base located in countries like China, Taiwan, South Korea, and Japan.

How does the volatile price of polysilicon feedstock impact the High Purity Silane Gas market?

Polysilicon is the raw material precursor for silane gas production. Volatility in polysilicon prices directly influences the upstream production costs for silane gas suppliers. While high-purity silane prices are less elastic than solar-grade polysilicon, cost fluctuations introduce margin pressure and affect long-term strategic pricing agreements with major end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager