High Purity Trimethyl Aluminum Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442749 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

High Purity Trimethyl Aluminum Market Size

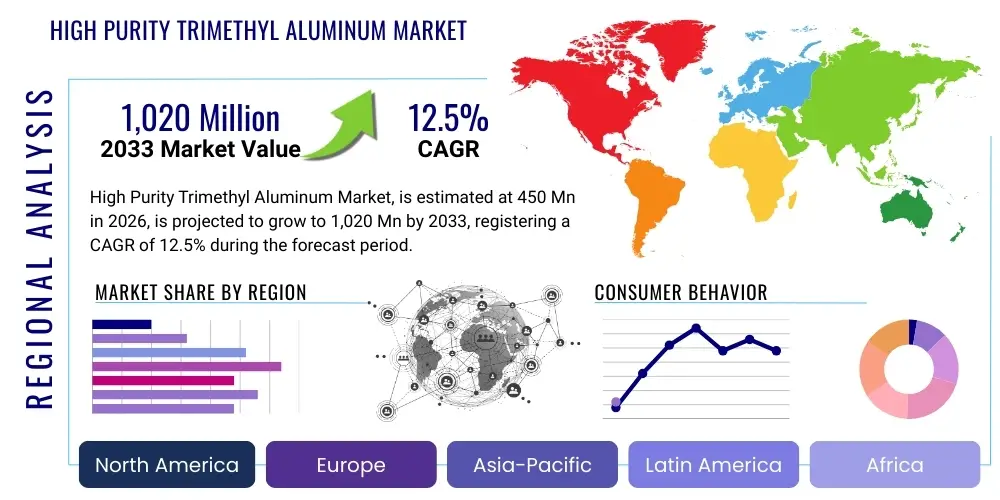

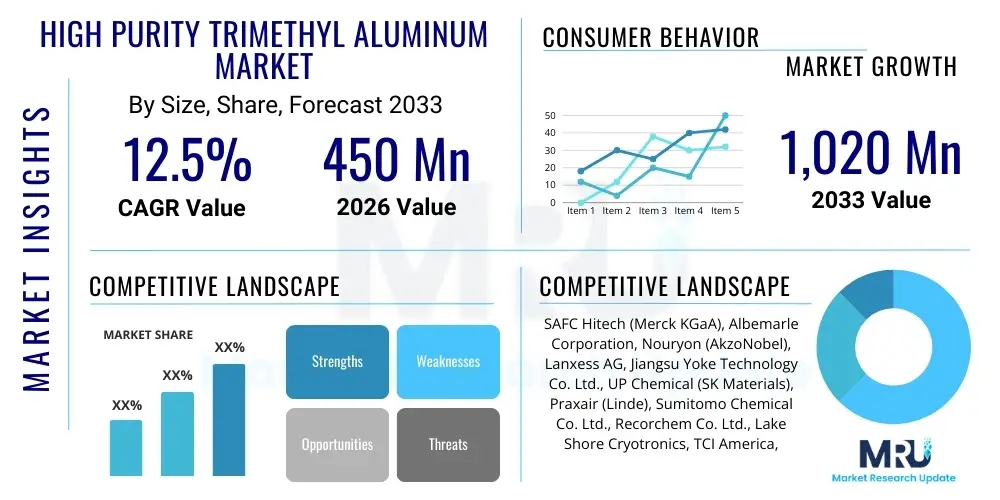

The High Purity Trimethyl Aluminum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

This robust growth trajectory is primarily fueled by the accelerating global demand for advanced compound semiconductors, specifically those utilizing Gallium Nitride (GaN) and Gallium Arsenide (GaAs). High Purity Trimethyl Aluminum (TMAl), serving as a crucial precursor chemical in the Metal-Organic Chemical Vapor Deposition (MOCVD) process, is indispensable for manufacturing LEDs, high-frequency radio frequency (RF) devices, and power electronics. The stringent quality requirements for epitaxial layers in these applications necessitate TMAl of 6N (99.9999%) purity or higher, driving premium pricing and increased consumption across Asia Pacific's manufacturing hubs.

Market expansion is further supported by significant investments in next-generation display technologies, including micro-LEDs, which require exceptionally uniform and high-quality epitaxial growth facilitated by high-purity precursors. Furthermore, the proliferation of 5G infrastructure, electric vehicles (EVs), and data centers demands greater efficiency and higher power density in semiconductor components, inherently increasing the demand for wide-bandgap materials like GaN, which in turn elevates the requirement for reliable sourcing of high-purity TMAl. Supply chain stability, purification technology advancements, and capacity expansions by key manufacturers are critical factors influencing the market size realization toward the projected USD 1,020 Million valuation.

High Purity Trimethyl Aluminum Market introduction

The High Purity Trimethyl Aluminum (TMAl) Market encompasses the manufacturing, distribution, and consumption of TMAl, a volatile organoaluminum compound specifically refined to ultra-high purity levels (typically 6N to 7N). TMAl serves as a foundational metal-organic precursor essential for the MOCVD growth of aluminum-containing compound semiconductors, most notably AlGaN and AlInGaP. The integrity and performance of devices like blue and white LEDs, laser diodes, high-electron-mobility transistors (HEMTs), and sophisticated solar cells are directly tied to the purity of the TMAl used, mandating stringent quality control throughout the production process from synthesis to final delivery in specialized canisters.

Major applications of high purity TMAl are concentrated within the high-technology sectors. The LED manufacturing industry remains a primary consumer, utilizing TMAl to form the active layers in light-emitting diodes, especially those based on GaN platforms. Furthermore, the burgeoning power electronics and RF device markets represent crucial growth areas. In these fields, TMAl facilitates the creation of robust AlGaN barriers and heterostructures critical for efficient operation in demanding environments, such as high-voltage converters and telecommunications base stations. The distinct benefits of using high purity TMAl include achieving precise film composition control, low unintentional impurity incorporation, and superior crystalline quality, which are non-negotiable for semiconductor device reliability and longevity.

The primary driving factors propelling this market include the global transition toward energy-efficient lighting (LEDs replacing conventional sources), rapid deployment of 5G and future 6G networks requiring high-performance RF chips, and the automotive industry’s shift toward EVs, which heavily relies on GaN and SiC power modules. Additionally, ongoing technological advancements in MOCVD reactor design and precursor delivery systems necessitate consistently higher purity levels of TMAl to maximize throughput and minimize material waste. Restraints often center on the volatility and pyrophoric nature of TMAl, which impose significant challenges related to safe handling, transportation logistics, and regulatory compliance, alongside the extremely high capital investment required for establishing ultra-high purification facilities, limiting the competitive landscape to specialized chemical manufacturers.

High Purity Trimethyl Aluminum Market Executive Summary

The High Purity Trimethyl Aluminum market is poised for substantial growth, driven by fundamental shifts in the electronics and energy sectors, primarily the mass adoption of wide-bandgap semiconductors (GaN). Business trends indicate a strong push towards vertical integration among precursor suppliers and major semiconductor foundries to secure quality supply chains and reduce vulnerability to geopolitical disruptions. Furthermore, innovation in precursor delivery systems, such as advanced bubblers and vaporizers, is becoming a competitive differentiator, enabling more efficient material utilization and higher epitaxial growth rates, crucial for cost reduction in high-volume manufacturing environments. Consolidation activity remains moderate but focused on acquiring specialized purification expertise, particularly in the Asian supply chain.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in consumption and manufacturing capacity, primarily due to the dominance of China, South Korea, Taiwan, and Japan in LED production, semiconductor fabrication, and consumer electronics assembly. While North America and Europe maintain technological leadership in research and development and specialized defense applications utilizing high-purity compounds, APAC dictates global demand volumes. There is a perceptible trend of manufacturing diversification away from a single geographic concentration, spurring cautious capacity additions in North America and Europe to bolster local semiconductor supply chain resilience, often incentivized by governmental policies such as the U.S. CHIPS Act and similar EU initiatives.

Segment trends reveal a distinct premiumization of higher purity grades. The demand for 7N TMAl and even customized ultra-high purity formulations is accelerating, particularly for advanced power electronics and high-frequency RF devices, where trace impurities significantly degrade device performance. By application, the semiconductor/epitaxy segment is growing faster than the traditional LED segment, driven by the explosive growth in GaN power devices used in fast chargers, automotive inverters, and enterprise servers. This segment shift emphasizes quality over sheer volume, demanding higher consistency and tighter impurity specifications, pushing manufacturers to invest heavily in advanced analytical techniques and continuous purification processes like fractional distillation and zone refining.

AI Impact Analysis on High Purity Trimethyl Aluminum Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Trimethyl Aluminum market commonly revolve around process optimization, predictive quality control, and supply chain management efficiency. Key concerns include how AI can mitigate the inherent risks associated with handling pyrophoric materials, predict precursor consumption fluctuations based on semiconductor production cycles, and automate the complex characterization of ultra-trace impurities (often in the parts per billion range). Users are expecting AI to transition MOCVD processes from reactive control to predictive optimization, ensuring higher yield rates and minimizing the financial losses associated with scrapped epitaxial wafers due to precursor inconsistencies.

The application of AI and Machine Learning (ML) algorithms is set to revolutionize the synthesis and purification stages of TMAl production. By analyzing vast datasets generated during chemical reactions, purification steps (e.g., distillation column parameters), and analytical measurements (e.g., ICP-MS results), AI models can identify subtle correlations between process variables and final product purity that are imperceptible through traditional statistical methods. This capability allows manufacturers to dynamically adjust process parameters in real-time, achieving tighter specifications for critical impurities such as silicon, oxygen, and moisture, which are detrimental to epitaxial growth. Furthermore, predictive maintenance, supported by AI analyzing sensor data from pumps, valves, and temperature controls, minimizes unscheduled downtime in capital-intensive purification plants.

In the MOCVD utilization phase, AI-driven process control is crucial. ML algorithms ingest data from in-situ monitoring tools (reflectance, pyrometry) and precursor delivery logistics (flow rates, pressure) to establish optimal delivery profiles for TMAl into the reactor chamber. This predictive optimization ensures highly uniform film thickness and composition across large-diameter wafers, essential for scaling up 8-inch GaN-on-Si manufacturing. The adoption of AI also extends to inventory management and supply chain resilience, predicting demand spikes from semiconductor fabs and optimizing logistics to manage the critical and hazardous nature of TMAl transportation, thereby improving overall market stability and responsiveness.

- AI optimizes MOCVD reactor parameters for high wafer yield and uniformity.

- Machine Learning predicts and corrects deviations in TMAl purification processes, ensuring consistent 6N/7N purity.

- AI algorithms enhance predictive maintenance for high-value precursor manufacturing equipment.

- Supply chain logistics are optimized using AI to manage the safe and timely delivery of hazardous TMAl canisters.

- Automated spectroscopic analysis leveraging AI improves the detection of ultra-trace impurities (ppb levels) in the final product.

- AI-driven consumption forecasting helps manufacturers align production capacity with fluctuating semiconductor demand cycles.

DRO & Impact Forces Of High Purity Trimethyl Aluminum Market

The High Purity Trimethyl Aluminum (TMAl) market is shaped by a confluence of powerful drivers, inherent restraints, and compelling opportunities that collectively dictate its growth trajectory and competitive landscape. The overarching driver is the exponential expansion of the compound semiconductor industry, specifically the move towards GaN-based devices for high-efficiency power management and advanced RF applications in 5G and military systems. Complementary drivers include government mandates for energy efficiency and significant investment in domestic semiconductor manufacturing capacity globally, notably in the U.S., Europe, and India. Restraints are predominantly centered on the extreme hazard profile of TMAl—it is pyrophoric and highly reactive, imposing substantial capital expenditures for safety infrastructure, specialized handling training, and complex, regulated transportation logistics. Furthermore, the specialized technology required for achieving ultra-high purity levels limits the number of credible suppliers, creating potential supply bottlenecks during periods of peak demand.

Opportunities for market players are vast, stemming primarily from the technological evolution toward micro-LED displays and the continued maturation of GaN-on-Si technology for cost-effective power devices. Micro-LEDs, demanding extremely high precision and wafer uniformity, require greater volumes of ultra-high purity precursors than conventional LEDs. Furthermore, the push for developing novel precursor delivery systems that offer higher efficiency, lower waste, and safer operation presents a significant innovation opportunity. The potential entry into emerging applications, such as specialized memory fabrication or next-generation solar technologies utilizing aluminum-containing layers, also offers avenues for diversification and sustained revenue growth beyond the traditional LED segment.

The impact forces influencing the market are heavily weighted toward technological push and regulatory adherence. The critical force is the requirement for relentless purity improvement; as device structures become smaller and more complex, even trace impurities can lead to device failure, forcing TMAl suppliers to continuously innovate purification and analytical methods. Geopolitical tensions and trade barriers constitute a major external impact force, potentially disrupting the highly concentrated supply chain rooted in specialized chemical production. Overall, the market remains highly inelastic concerning pricing due to the critical nature of the precursor—semiconductor manufacturers prioritize consistent purity and reliability over marginal cost savings, placing tremendous pressure on suppliers to maintain impeccable quality control and robust supply security.

Segmentation Analysis

The High Purity Trimethyl Aluminum market is systematically segmented based on Grade of Purity, the critical Application it serves, and the geographical region of consumption. Purity segmentation is paramount, as the required quality directly impacts both the manufacturing process complexity and the final cost, ranging from standard 6N to specialized 7N or higher. Application segmentation clearly delineates the key end-user industries, with MOCVD for LED manufacturing and epitaxy for power and RF semiconductor devices constituting the primary revenue generators. Understanding these segments is crucial for manufacturers to tailor product specifications, packaging, and regulatory documentation to specific customer needs and regional consumption patterns.

The market analysis reveals that the 6N purity segment holds the largest volume share, predominantly driven by high-volume, cost-sensitive LED production. However, the 7N and higher purity grades are demonstrating the fastest growth due to the accelerating adoption of GaN power devices and advanced RF components, which demand minimal defect introduction for reliability at high operating temperatures and frequencies. Regionally, Asia Pacific leads both in terms of volume and new capacity additions, reflecting its global dominance in electronics manufacturing. Within applications, the semiconductor/epitaxy segment is expanding its market share relative to the established LED segment, indicating a fundamental shift in the primary driver of TMAl demand from lighting towards advanced functional electronic devices.

- By Grade:

- 6N (99.9999% Purity)

- 7N (99.99999% Purity)

- Higher Purity Grades (e.g., customized formulations)

- By Application:

- LED Manufacturing (MOCVD)

- Semiconductor/Epitaxy (Power Devices, RF Components, Lasers)

- Solar Cell Production

- Research and Development

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For High Purity Trimethyl Aluminum Market

The value chain for High Purity Trimethyl Aluminum is characterized by high barriers to entry, driven by the specialized knowledge required for both the synthesis (upstream) and the ultra-purification stages. The upstream analysis begins with the sourcing of metallurgical-grade aluminum and highly specialized raw materials required for the Grignard or direct synthesis process to create the initial TMAl compound. This step is critically important as the initial purity sets the floor for the final product quality. Companies engaged in this stage must possess deep expertise in organometallic chemistry and robust infrastructure to manage hazardous reactions safely and efficiently. Integration between primary chemical manufacturers and purification specialists is often seen to control input quality, minimizing contaminants before the rigorous refinement begins.

The core of the value chain involves the refining and purification process, transforming the synthesized TMAl into 6N or 7N grade material, typically through repeated fractional distillation or specialized adsorption techniques, followed by rigorous analytical testing using sophisticated equipment like ICP-MS and GC-MS. This high-capital and high-technology step is where the value proposition is truly established. Once purified, the TMAl is filled into specialized, electropolished stainless steel canisters or bubblers under ultra-clean conditions to prevent secondary contamination. Downstream activities involve the distribution channel, which must adhere to stringent international regulations for hazardous materials. Direct distribution models are highly favored, allowing manufacturers to maintain tight control over product integrity, handling protocols, and technical support provided directly to high-volume semiconductor fabs and MOCVD users.

Direct channels are preferred for high-volume customers like leading LED and semiconductor manufacturers in Asia, ensuring rapid response times, specialized handling knowledge, and direct technical consultation regarding delivery system integration. Indirect distribution through specialized chemical distributors is used primarily for smaller R&D labs, regional niche players, or markets where local compliance expertise is essential. The entire distribution process, encompassing specialized fleet management, warehousing with inert gas environments, and adherence to strict safety protocols, adds substantial cost but is non-negotiable for preserving the ultra-high purity of the product until it reaches the MOCVD reactor.

High Purity Trimethyl Aluminum Market Potential Customers

The potential customers for High Purity Trimethyl Aluminum are concentrated within the global high-technology manufacturing ecosystem, primarily those utilizing MOCVD technology for epitaxial growth. The largest customer segment consists of major integrated device manufacturers (IDMs) and pure-play foundries specializing in compound semiconductors, including those focused on GaN-based power devices, RF front-end modules, and specialized sensors. These customers require TMAl in bulk quantities, demand stringent batch-to-batch consistency, and often enter into long-term supply agreements to secure their production pipeline, viewing precursor reliability as a fundamental competitive advantage.

A second significant customer base includes large-scale LED lighting manufacturers, especially those focused on high-efficiency, commercial, and automotive lighting applications. While this segment is mature, it represents high volume demand for 6N purity TMAl. Additionally, the emerging market segment of Micro-LED display developers, including manufacturers targeting augmented reality (AR) devices, smartwatches, and premium large-format displays, represents a high-value customer group. These users necessitate the highest available purity grades (7N and above) to achieve the pixel-level uniformity and efficiency required for next-generation display technology.

Finally, academic and industrial research institutions form a critical, albeit lower-volume, customer segment. These entities focus on materials science innovation, developing new compound semiconductor structures, and advancing MOCVD techniques. They are essential for testing new precursor formulations and processes, acting as early adopters of ultra-premium or specialized TMAl products. Consequently, precursor suppliers often engage closely with research customers to validate next-generation products and maintain a competitive edge in material innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAFC Hitech (Merck KGaA), Albemarle Corporation, Nouryon (AkzoNobel), Lanxess AG, Jiangsu Yoke Technology Co. Ltd., UP Chemical (SK Materials), Praxair (Linde), Sumitomo Chemical Co. Ltd., Recorchem Co. Ltd., Lake Shore Cryotronics, TCI America, Gelest Inc. (Mitshubishi Chemical), Strem Chemicals, Nanjing Tieliu Chemical Co. Ltd., Wacker Chemie AG, Jilin Guangda Semiconductor Material Co. Ltd., DOW Chemical, Chemetall GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Trimethyl Aluminum Market Key Technology Landscape

The core technology defining the High Purity Trimethyl Aluminum market landscape revolves around advanced chemical synthesis and sophisticated ultra-purification methodologies, which are proprietary and crucial for maintaining competitive advantage. Synthesis generally relies on highly controlled reactions, such as the reaction between aluminum metal, hydrogen, and olefins, or the Grignard method. However, the true technological complexity lies in achieving the required 6N or 7N purity levels. This involves multi-stage purification processes, primarily utilizing high-efficiency fractional distillation under extremely low pressure and temperature conditions to separate TMAl from common, yet highly detrimental, metal contaminants (like Si, Zn, and Fe) and residual solvents or moisture.

In addition to purification, the technology landscape includes specialized analytical techniques essential for certification. Ultra-trace impurity analysis demands equipment capable of detecting contaminants in the parts per billion (ppb) or parts per trillion (ppt) range, such as High-Resolution Inductively Coupled Plasma Mass Spectrometry (HR-ICP-MS) and specialized Gas Chromatography (GC) techniques. The technological edge also extends to the packaging and delivery systems. Suppliers must employ proprietary canister conditioning processes, including electropolishing and chemical passivation, followed by ultra-high vacuum baking, ensuring the TMAl remains uncontaminated during storage and transport. Advances in integrated vaporizers and precursor delivery units (PDUs) linked directly to MOCVD reactors are optimizing material utilization and safety, representing an area of intense technological focus.

Furthermore, research into alternative precursor chemistries, though peripheral, influences the TMAl landscape by setting benchmarks for performance and safety. While TMAl remains the industry standard for aluminum sources, continuous efforts are made to develop liquid or less volatile analogues that might offer easier handling and higher safety profiles without compromising epitaxial performance. However, due to the proven track record and established MOCVD protocols centered around TMAl, technological investment largely remains focused on enhancing its purity, delivery reliability, and yield optimization within existing reactor architectures, ensuring consistency as the industry rapidly transitions to large-diameter (8-inch) wafer processing for GaN applications.

Regional Highlights

The global consumption and production of High Purity Trimethyl Aluminum are heavily skewed toward Asia Pacific (APAC), which serves as the central manufacturing hub for compound semiconductors and LEDs.

- Asia Pacific (APAC): Dominates the global market in terms of consumption volume, primarily fueled by massive production capacities in China, South Korea, Taiwan, and Japan. China is experiencing rapid expansion in domestic GaN power device manufacturing and LED production, driving sustained high demand for both 6N and 7N TMAl grades. South Korea and Taiwan remain leading centers for advanced semiconductor and display technologies, focusing on ultra-high purity materials for complex epitaxial structures. The region is characterized by high competitive intensity and ongoing infrastructure investments.

- North America: A significant region for R&D, specialized military/aerospace applications, and the initial development of advanced GaN and GaAs devices. Although consumption volume is smaller than APAC, the demand is heavily concentrated on the highest purity grades (7N and customized formulations). The U.S. government's emphasis on semiconductor supply chain independence (via the CHIPS Act) is encouraging domestic precursor manufacturing and attracting targeted investments from global suppliers.

- Europe: Characterized by strong pockets of excellence in automotive electronics (Electric Vehicles) and industrial power management, creating specific demand for GaN power devices manufactured using TMAl. Countries like Germany and the Netherlands are key contributors, focusing on materials science innovation and collaborating closely with MOCVD equipment manufacturers. European growth is steady, supported by EU initiatives aimed at reinforcing regional semiconductor capabilities.

- Latin America, Middle East, and Africa (LAMEA): These regions currently hold a minor share of the high-purity TMAl market. Consumption is largely limited to academic research, small-scale specialized production, and maintenance needs. Future growth potential exists, particularly in MEA, driven by strategic government investments in technology diversification, although this remains highly nascent compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Trimethyl Aluminum Market.- SAFC Hitech (Merck KGaA)

- Albemarle Corporation

- Nouryon (AkzoNobel)

- Lanxess AG

- Jiangsu Yoke Technology Co. Ltd.

- UP Chemical (SK Materials)

- Praxair (Linde PLC)

- Sumitomo Chemical Co. Ltd.

- Recorchem Co. Ltd.

- Lake Shore Cryotronics

- TCI America

- Gelest Inc. (Mitshubishi Chemical)

- Strem Chemicals

- Nanjing Tieliu Chemical Co. Ltd.

- Wacker Chemie AG

- Jilin Guangda Semiconductor Material Co. Ltd.

- DOW Chemical

- Chemetall GmbH

- BASF SE

- Entegris Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Trimethyl Aluminum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for High Purity Trimethyl Aluminum (TMAl)?

The primary driver is the Metal-Organic Chemical Vapor Deposition (MOCVD) process used in manufacturing compound semiconductors, specifically Gallium Nitride (GaN) power devices, high-frequency radio frequency (RF) components, and high-brightness Light Emitting Diodes (LEDs).

Why is 6N or 7N purity essential for Trimethyl Aluminum in semiconductor manufacturing?

Ultra-high purity (6N or 7N) is essential because trace metallic contaminants (parts per billion level) severely disrupt the epitaxial crystal growth process, leading to defects, reduced device efficiency, and premature failure in advanced semiconductor components like high-electron-mobility transistors (HEMTs).

What are the major safety challenges associated with handling High Purity TMAl?

TMAl is highly pyrophoric, meaning it ignites spontaneously upon contact with air or moisture. This necessitates specialized, inert-atmosphere handling equipment, rigorously trained personnel, and complex, controlled logistics and storage environments to prevent dangerous incidents.

Which geographical region leads the global consumption of High Purity TMAl?

The Asia Pacific (APAC) region, primarily driven by China, South Korea, and Taiwan, leads global consumption due to its concentrated production capacity for LEDs, advanced displays (micro-LEDs), and GaN-based power and RF semiconductor devices.

How does the shift to GaN power devices impact the demand for TMAl purity grades?

The shift to GaN power devices demands higher reliability and performance, accelerating the market trend toward ultra-premium grades, specifically 7N TMAl, as these applications are significantly more sensitive to impurities than traditional LED manufacturing.

The detailed analysis of the High Purity Trimethyl Aluminum market reveals a sector fundamentally tethered to the growth and technological progression of the global semiconductor industry, particularly the rapid adoption of compound semiconductors over conventional silicon platforms. The need for efficient, high-power, and high-frequency electronic components in electric vehicles, 5G infrastructure, and data centers provides an unyielding demand floor for TMAl precursors. The market's complexity stems not just from the volume requirement but critically from the purity specifications, which escalate with every new generation of semiconductor device architecture. Manufacturers are continuously pressured to invest in more advanced purification technologies, moving beyond conventional fractional distillation to incorporate proprietary chemical scrubbing and adsorption techniques to meet the 7N purity threshold and satisfy the most demanding fabs in Asia and North America. This technical arms race among precursor suppliers is a key factor sustaining the high value and competitive intensity of the market.

Furthermore, supply chain resilience is emerging as a critical competitive battlefield. Given the hazardous nature of TMAl, transportation and logistics constitute a substantial portion of the cost and risk profile. Semiconductor manufacturers are actively seeking geographically diversified supply sources to mitigate geopolitical risks and ensure a steady, reliable flow of precursors, especially since the market is currently dominated by a few highly specialized producers. This drive for diversification is fostering opportunities for expansion in regions like North America and Europe, supported by governmental incentives aimed at localizing critical materials production. The technological convergence with AI further enhances this trend, allowing for better predictive inventory management and optimized, safer handling protocols across the complex international distribution network.

The future growth of the TMAl market is directly correlated with two specific areas of technology scaling: the transition to 8-inch GaN-on-Si wafers and the commercialization of micro-LED displays. Both technologies require unprecedented levels of epitaxial uniformity and material stability, inherently elevating the criticality of the precursor quality. Suppliers who successfully integrate advanced in-situ monitoring and AI-driven process control into their purification plants will be best positioned to capture market share. Ultimately, the High Purity Trimethyl Aluminum market, while specialized and niche, acts as a barometer for the health and acceleration of the entire advanced compound semiconductor ecosystem, demonstrating robust long-term potential fueled by global digitization and energy transition goals. The strict focus on minimizing metallic and oxygen impurities will remain the non-negotiable standard for market participation and leadership throughout the forecast period.

The high capital investment required to enter the market and achieve competitive purity standards serves as a significant structural barrier. Developing a robust synthesis and purification facility capable of reliably producing 6N and 7N TMAl demands deep technical expertise, specialized infrastructure to manage the highly reactive nature of the compound, and an established track record of quality assurance necessary to gain acceptance from leading semiconductor foundries. This exclusivity limits competition and allows established players to command premium pricing, particularly for the ultra-high purity grades critical for cutting-edge devices like AlGaN/GaN HEMTs used in high-power radar and 5G base stations. Furthermore, the regulatory environment surrounding the handling and transport of pyrophoric materials adds another layer of complexity, demanding comprehensive compliance programs and specialized logistics partnerships.

In terms of technological evolution, the development of MOCVD reactor technology also directly influences TMAl market dynamics. As reactor designs move toward larger capacity and enhanced precision, the demands placed on precursor flow stability and consistency increase exponentially. Precursor manufacturers are responding by innovating delivery systems, such as improved bubbler designs and integrated flow control modules, that ensure highly reproducible vapor delivery into the reactor chamber, irrespective of residual liquid levels. This focus on system-level integration with the MOCVD tool represents a crucial area of differentiation for leading precursor suppliers, moving them beyond being mere chemical providers to becoming integral solution partners in the epitaxial growth process. The successful synergy between precursor chemistry, purification methods, and delivery apparatus is essential for unlocking the next generation of compound semiconductor performance.

The segmentation by application further underscores the market's trajectory towards high-value electronics. While LED manufacturing stabilized the market over the past decade, the semiconductor/epitaxy segment—encompassing power, RF, and specialized optoelectronics—is now the engine of growth. The transition from Silicon Carbide (SiC) to GaN in certain high-frequency and fast-switching power applications is accelerating, primarily in the automotive and data center sectors. Since TMAl is indispensable for creating the Al-containing layers required for efficient GaN device operation, this technological migration ensures sustained, high-growth demand for the precursor. Conversely, solar cell production remains a relatively smaller consumer, constrained by the highly cost-sensitive nature of the photovoltaic market and the limited percentage of cells that utilize high-purity aluminum precursors grown via MOCVD methods.

The market faces external risks primarily related to raw material sourcing and geopolitical trade dynamics. While aluminum is abundant, the specific high-purity feedstocks required for initial TMAl synthesis must be meticulously controlled to minimize contaminants, linking precursor producers to a highly specialized upstream supply chain. Any disruption in this upstream supply, or the implementation of restrictive export/import tariffs on specialized chemicals and semiconductor manufacturing materials between major economic blocs, poses an immediate threat to the established TMAl supply flow, potentially leading to price volatility and capacity shortfalls at semiconductor fabs globally. Consequently, major TMAl producers are increasingly focused on dual sourcing strategies and establishing regional redundancy in their production and purification capabilities to mitigate these systemic risks and ensure operational continuity for their critical semiconductor customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager