High Resolution Dispensing Systems and Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440753 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

High Resolution Dispensing Systems and Equipment Market Size

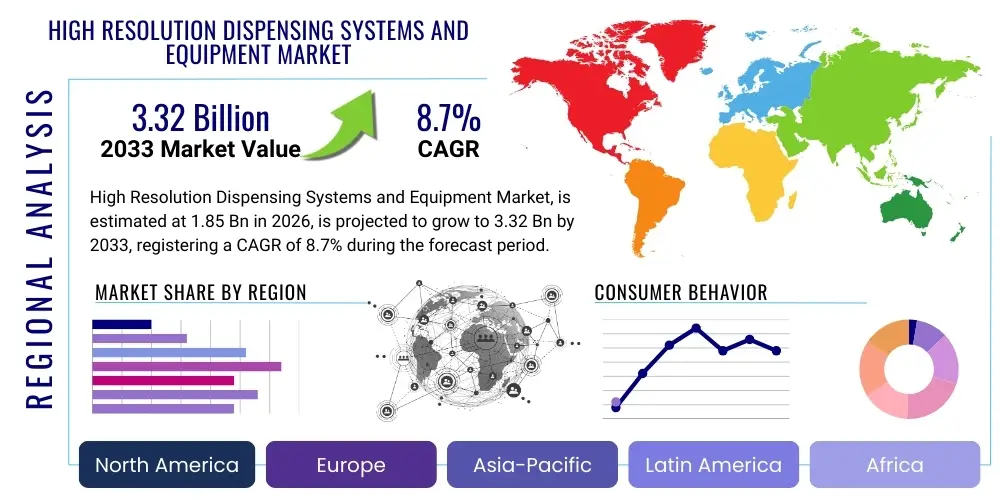

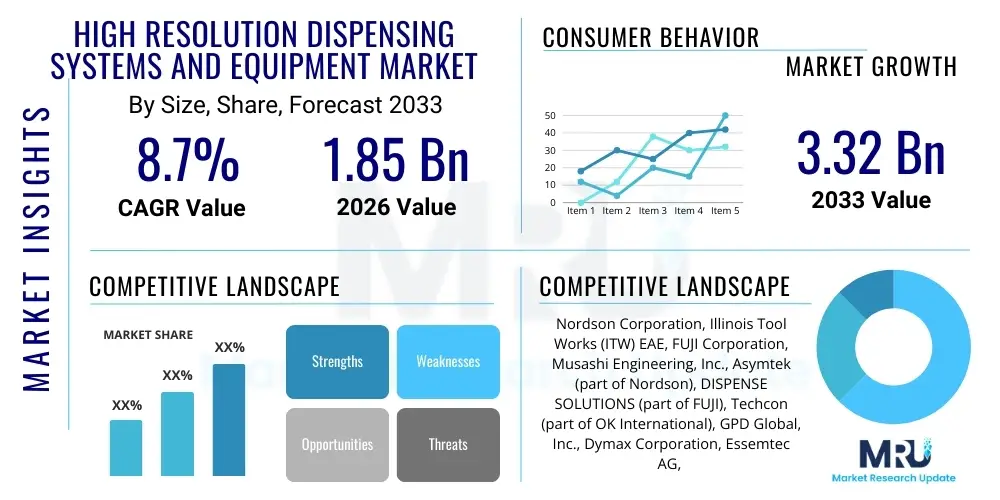

The High Resolution Dispensing Systems and Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.32 Billion by the end of the forecast period in 2033.

High Resolution Dispensing Systems and Equipment Market introduction

The High Resolution Dispensing Systems and Equipment Market encompasses advanced technologies designed for precise, accurate, and repeatable deposition of tiny volumes of materials across various industries. These systems are critical where micron-level accuracy and control over material placement are paramount, such as in electronics manufacturing, medical device assembly, advanced packaging, and microfluidics. The market includes a diverse range of equipment, from automated fluid dispensers, jetting systems, and spray systems to specialized printing technologies, all engineered to handle increasingly complex materials and intricate designs with exceptional precision.

Products within this market range from benchtop manual and semi-automatic systems to fully automated robotic dispensing platforms integrated into high-volume production lines. They utilize sophisticated control mechanisms, vision systems, and specialized nozzles or dispensing heads to ensure uniform and consistent material application, even with highly viscous, abrasive, or delicate fluids. Key applications span semiconductor packaging (e.g., underfill, dam-and-fill, die attach), medical diagnostics (e.g., reagent dispensing, biosensor manufacturing), display manufacturing, and the assembly of miniaturized electronic components, where failure to achieve precise material deposition can lead to significant performance issues or product defects.

The primary benefits of high-resolution dispensing systems include enhanced product quality, reduced material waste due to precise volumetric control, increased throughput through automation, and the ability to process novel materials and complex geometries that manual methods cannot achieve. Driving factors for market growth include the relentless miniaturization of electronic devices, the increasing demand for advanced packaging solutions (like 3D ICs and fan-out wafer-level packaging), the growth of the medical device and biotechnology sectors requiring sterile and precise fluid handling, and the continuous innovation in materials science demanding sophisticated deposition techniques. Additionally, the push for greater automation and efficiency in manufacturing processes across industries significantly fuels the adoption of these advanced dispensing solutions.

High Resolution Dispensing Systems and Equipment Market Executive Summary

The High Resolution Dispensing Systems and Equipment Market is characterized by robust growth, driven primarily by the escalating demand for miniaturization and precision in critical manufacturing sectors. Business trends indicate a strong emphasis on automation, smart manufacturing integration, and the development of versatile systems capable of handling a wide array of materials with varying viscosities and properties. Key players are investing heavily in R&D to enhance dispensing accuracy, speed, and integrate advanced features such as real-time process monitoring, artificial intelligence for predictive maintenance, and closed-loop feedback systems to optimize dispensing performance. The market is witnessing a shift towards modular and customizable solutions that can be easily adapted to evolving production requirements and new application fields, providing manufacturers with greater flexibility and a faster return on investment.

Regionally, Asia Pacific continues to dominate the market, largely due to its strong presence in electronics manufacturing, semiconductor production, and the burgeoning medical device industry, particularly in countries like China, South Korea, Japan, and Taiwan. North America and Europe are also significant markets, driven by innovation in aerospace, defense, advanced medical technologies, and automotive electronics. These regions are characterized by a high adoption rate of advanced manufacturing processes and a focus on high-value, specialized applications that demand the utmost precision. Emerging economies in Latin America and the Middle East & Africa are gradually increasing their adoption of high-resolution dispensing systems as industrialization efforts intensify and local manufacturing capabilities expand, albeit from a lower base.

In terms of segmentation, the market is broadly segmented by component (e.g., automated dispensers, jetting valves, controllers, robots, software), application (e.g., semiconductor packaging, medical devices, display assembly, automotive electronics), and end-user industry. The semiconductor and electronics segments are expected to maintain their leading positions, propelled by the continuous demand for advanced packaging technologies and micro-LED displays. The medical devices and life sciences segment is poised for significant growth, fueled by the development of point-of-care diagnostics, microfluidic devices, and drug delivery systems that require precise and sterile material deposition. Furthermore, the increasing complexity of materials, including highly specialized adhesives, epoxies, silicones, and conductive inks, is driving demand for systems capable of handling these diverse material requirements with consistent high resolution.

AI Impact Analysis on High Resolution Dispensing Systems and Equipment Market

Users are increasingly curious about how Artificial Intelligence (AI) will revolutionize high-resolution dispensing, specifically seeking insights into its potential for enhancing precision, predictive maintenance, and operational efficiency. Common questions revolve around AI's ability to optimize dispensing parameters in real-time, its role in improving defect detection through advanced vision systems, and its contribution to reducing material waste. There is also significant interest in AI's capacity to facilitate adaptive dispensing processes for complex geometries and novel materials, minimize downtime through intelligent diagnostics, and ultimately drive greater levels of automation and autonomy in dispensing operations. The overarching expectation is that AI will unlock new levels of performance and productivity, addressing current limitations in consistency, speed, and adaptability.

- Enhanced Precision and Repeatability: AI algorithms can analyze vast datasets from sensor feedback (e.g., vision systems, pressure sensors, temperature) to dynamically adjust dispensing parameters, ensuring consistent droplet size, placement, and volume, even in the face of environmental variations or material property changes.

- Predictive Maintenance: AI-powered analytics can monitor equipment performance in real-time, identify anomalies, and predict potential component failures (e.g., clogged nozzles, pump wear) before they occur, enabling proactive maintenance and significantly reducing unscheduled downtime.

- Optimized Process Control: Machine learning models can learn from past dispensing cycles to fine-tune dispensing programs, selecting optimal fluid parameters, dispense speeds, and patterns for specific materials and applications, thereby improving first-pass yield and reducing rework.

- Advanced Defect Detection: AI-driven vision systems can rapidly analyze dispensed patterns for defects (e.g., voids, bridges, misalignment) with greater accuracy and speed than traditional rule-based systems, enabling immediate corrective actions and higher quality control.

- Adaptive Dispensing for Complex Geometries: AI can enable systems to adapt dispensing paths and parameters on-the-fly for irregular or non-uniform surfaces, optimizing material coverage and adhesion, particularly critical in 3D printing and advanced packaging.

- Material Optimization and Waste Reduction: By precisely controlling dispense volumes and minimizing over-dispensing or rework, AI helps reduce costly material waste, especially significant for high-value fluids used in electronics and medical manufacturing.

- Increased Automation and Autonomy: AI contributes to more autonomous dispensing cells, where systems can self-calibrate, self-diagnose, and even learn to handle new product variations with minimal human intervention, leading to higher throughput and lower operational costs.

DRO & Impact Forces Of High Resolution Dispensing Systems and Equipment Market

The High Resolution Dispensing Systems and Equipment Market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its growth trajectory. Key drivers include the pervasive trend of miniaturization across consumer electronics, medical devices, and automotive components, which necessitates highly precise material deposition for increasingly smaller and more complex assemblies. The escalating demand for advanced packaging technologies, such as system-in-package (SiP), chip-on-wafer (CoW), and 3D ICs, further propels the need for sub-micron accuracy in dispensing underfill, epoxies, and solder pastes. Moreover, the growth in medical and life sciences applications, particularly in diagnostics, drug delivery, and biosensors, where sterile and exact fluid handling is critical, acts as a powerful market stimulant. The continuous push for automation in manufacturing to improve efficiency, reduce labor costs, and enhance product consistency also significantly contributes to the adoption of these sophisticated systems.

However, the market faces several notable restraints. The high initial capital investment required for purchasing and integrating advanced high-resolution dispensing systems can be a significant barrier, especially for small and medium-sized enterprises (SMEs). The complexity of operating and maintaining these intricate systems necessitates a highly skilled workforce, and a shortage of such expertise can impede wider adoption. Furthermore, the specialized nature of these systems often leads to a limited supply chain for specific components and consumables, which can affect pricing and lead times. Technical challenges associated with dispensing novel and highly viscous materials, as well as achieving consistent performance in varying environmental conditions, also present hurdles that manufacturers must continuously address through innovation.

Opportunities within this market are abundant and diverse. The emergence of new materials, including conductive inks for flexible electronics, biocompatible polymers for medical implants, and advanced adhesives for next-generation displays, presents new application avenues for high-resolution dispensing technologies. The expanding market for micro-LED and OLED displays, which require ultra-fine pixel deposition, offers substantial growth potential. Moreover, the integration of Industry 4.0 concepts, such as artificial intelligence, machine learning, and advanced robotics, is creating opportunities for developing smarter, more autonomous, and predictive dispensing systems that can optimize processes and minimize waste. The growing demand for personalized medicine and point-of-care diagnostics, requiring highly precise and customizable fluid dispensing, further opens up lucrative niches. As manufacturing processes continue to evolve globally, the continuous need for precision and efficiency ensures a steady stream of innovation and market expansion for high-resolution dispensing solutions.

Segmentation Analysis

The High Resolution Dispensing Systems and Equipment Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and end-user industries. This segmentation allows for precise market analysis, identifying key growth areas, competitive landscapes, and evolving technological demands. The market is primarily categorized based on the type of equipment, the resolution capabilities, the specific applications it serves, and the various industries that adopt these technologies. Understanding these segments is crucial for stakeholders to strategize effectively, develop targeted solutions, and capitalize on emerging opportunities within this highly specialized manufacturing domain.

- By Component:

- Automated Dispensing Systems

- Semi-Automated Dispensing Systems

- Manual Dispensing Systems

- Dispensing Valves/Heads (e.g., Jetting, Spray, Screw, Time-Pressure)

- Robotic Platforms

- Controllers and Software

- Vision Systems

- Syringes, Needles, and Consumables

- By Technology/Resolution:

- Micro-Dispensing (nanoliter to microliter volumes)

- Pico-Dispensing (picoliter volumes)

- Nano-Dispensing (nanometer accuracy)

- By Application:

- Semiconductor Packaging (e.g., Underfill, Die Attach, Dam & Fill, Encapsulation)

- Printed Circuit Board (PCB) Assembly

- Medical Device Manufacturing (e.g., Stents, Catheters, Diagnostic Strips)

- Display Manufacturing (e.g., OLED, Micro-LED, LCD)

- Automotive Electronics

- Aerospace and Defense

- Life Sciences and Biotechnology (e.g., Reagent Dispensing, Microfluidics)

- Optoelectronics

- General Industrial Assembly

- By End-User Industry:

- Electronics Industry

- Medical & Pharmaceutical Industry

- Automotive Industry

- Aerospace Industry

- Consumer Goods Industry

- Industrial Manufacturing

- Others (e.g., Research & Development)

Value Chain Analysis For High Resolution Dispensing Systems and Equipment Market

The value chain for the High Resolution Dispensing Systems and Equipment Market is intricate, spanning from raw material suppliers to end-users, with critical intermediary stages. Upstream activities involve the procurement of specialized raw materials and components, including precision-machined metals, polymers, advanced ceramics, electronic sensors, vision system components, and sophisticated control units. These suppliers are fundamental to the quality and performance of the final dispensing systems, often requiring high-purity and tight-tolerance specifications. Research and development also represent a significant upstream activity, driving innovation in dispensing technologies, fluid dynamics, material science, and automation software. The design and manufacturing of dispensing heads, pumps, nozzles, robotic arms, and system integration platforms constitute the core manufacturing phase, demanding highly skilled engineering and manufacturing expertise.

Midstream activities primarily involve the assembly, testing, and calibration of the high-resolution dispensing systems. This stage ensures that the equipment meets stringent performance criteria for accuracy, repeatability, and reliability. Value-added services at this stage include software development for process control, customization of systems for specific client applications, and integration with broader factory automation systems. Distribution channels play a crucial role, encompassing both direct and indirect sales. Direct sales involve manufacturers selling directly to large industrial clients, often accompanied by comprehensive installation, training, and ongoing support services. This approach fosters closer client relationships and allows for tailored solutions.

Indirect channels involve distributors, value-added resellers (VARs), and system integrators who market and sell products to a broader customer base, including SMEs. These partners often provide local support, maintenance, and integration services, expanding the market reach of the primary manufacturers. Downstream activities focus on the end-use applications, where the dispensing systems are deployed in production lines for electronics assembly, medical device manufacturing, and other precision-intensive industries. Post-sales support, including maintenance contracts, spare parts supply, technical assistance, and software updates, forms a critical part of the value chain, ensuring the longevity and optimal performance of the equipment throughout its lifecycle. This entire chain is driven by the end-user demand for precision, efficiency, and quality in their manufacturing processes.

High Resolution Dispensing Systems and Equipment Market Potential Customers

Potential customers for High Resolution Dispensing Systems and Equipment are primarily industries and enterprises that require extreme precision and control in depositing fluids and materials at microscopic levels. The largest segment of end-users comes from the electronics manufacturing sector, including semiconductor foundries, outsourced semiconductor assembly and test (OSAT) companies, and manufacturers of printed circuit boards (PCBs) and integrated circuits (ICs). These customers utilize high-resolution dispensing for critical processes like underfill application, die attach, encapsulation, thermal interface material deposition, and solder paste jetting, which are essential for advanced packaging, miniaturization, and improving device reliability. The continuous innovation in consumer electronics, driven by smartphones, wearables, and IoT devices, sustains robust demand from this segment, as does the burgeoning market for specialized electronics in automotive and aerospace.

Another significant customer base exists within the medical device and pharmaceutical industries. Manufacturers of medical devices such as pacemakers, catheters, diagnostic strips, and various sensors require precise dispensing of biocompatible adhesives, sealants, and reagents. The life sciences sector, including biotechnology companies and research institutions, utilizes these systems for microfluidics, drug discovery, genomic sequencing, and automated lab-on-a-chip applications, where nanoliter-scale fluid handling is imperative for accuracy and reproducibility. The demand for point-of-care diagnostics and personalized medicine is further expanding this customer segment, requiring high-throughput, high-precision dispensing solutions for mass production and specialized applications.

Beyond electronics and medical, the automotive industry, particularly in the manufacturing of advanced driver-assistance systems (ADAS), electric vehicle components, and in-car infotainment systems, is increasingly adopting high-resolution dispensing for potting, gasketing, and bonding sensitive electronic modules. Display manufacturers, producing OLED, Micro-LED, and other advanced screens, represent a growing customer segment requiring precise deposition of emissive materials and sealants. Aerospace and defense companies also utilize these systems for bonding, sealing, and protecting sensitive components in harsh environments. Essentially, any industry where product performance, reliability, and miniaturization depend on the accurate placement of small volumes of materials will be a potential customer for high-resolution dispensing systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.32 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Illinois Tool Works (ITW) EAE, FUJI Corporation, Musashi Engineering, Inc., Asymtek (part of Nordson), DISPENSE SOLUTIONS (part of FUJI), Techcon (part of OK International), GPD Global, Inc., Dymax Corporation, Essemtec AG, DELO Industrial Adhesives, PVA (Precision Valve & Automation), Speedline Technologies (part of ITW EAE), MYCRONIC AB, ADVANTEK, Inc., Shenzhen Fancort Engineering, Ltd., Henkel AG & Co. KGaA (equipment solutions), Hitachi High-Tech Corporation, EFD (part of Nordson), TENSUN (Suzhou) Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Resolution Dispensing Systems and Equipment Market Key Technology Landscape

The High Resolution Dispensing Systems and Equipment Market is defined by a dynamic and evolving technological landscape, driven by the continuous demand for increased precision, speed, and versatility. A cornerstone of this landscape is advanced fluidic control technology, which includes various dispensing methods such as jetting, volumetric positive displacement, time-pressure, and screw dispensing. Jetting technologies, particularly piezo-jetting, are gaining prominence for their ability to achieve non-contact dispensing of extremely small, uniform droplets at high frequencies, making them ideal for delicate substrates and high-volume applications like micro-LED display manufacturing and advanced semiconductor packaging. Volumetric positive displacement systems, on the other hand, offer exceptional accuracy and repeatability for a wide range of fluid viscosities, ensuring consistent material deposition regardless of external factors.

Automation and robotics form another critical technological pillar, with integrated robotic arms (e.g., Cartesian, SCARA, 6-axis articulated robots) providing multi-axis motion control and precise positioning for complex dispensing patterns. These robots are often combined with sophisticated vision systems that utilize high-resolution cameras and advanced image processing algorithms for fiducial recognition, pattern matching, and real-time defect detection. These vision systems enable automatic alignment, compensate for substrate variations, and provide closed-loop feedback for process optimization, significantly enhancing accuracy and reducing human error. Software control is equally vital, featuring intuitive graphical user interfaces (GUIs), CAD/CAM integration for importing complex dispense patterns, and advanced process control algorithms that allow for precise parameter adjustment and recipe management.

Material science innovation also heavily influences the technology landscape. Dispensing systems must be compatible with an ever-expanding array of highly specialized materials, including conductive inks, anisotropic conductive pastes (ACPs), UV-curable adhesives, epoxies, silicones, and various biological fluids. This necessitates the development of specialized nozzles, valves, and fluid paths that can handle different viscosities, abrasiveness, and curing properties without clogging or degradation. Furthermore, the integration of Industry 4.0 concepts like IoT connectivity, real-time data analytics, and artificial intelligence (AI) is transforming these systems into smart, self-optimizing machines. AI algorithms can predict maintenance needs, optimize dispensing parameters dynamically, and analyze process data to improve yield and efficiency, pushing the boundaries of what is achievable in high-resolution material deposition. The convergence of these advanced technologies continues to drive the market forward, enabling manufacturers to meet the stringent demands of modern precision manufacturing.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to its robust electronics manufacturing base, including semiconductor fabrication, advanced packaging, and display production hubs in China, South Korea, Japan, and Taiwan. Rapid industrialization and investment in high-tech manufacturing further fuel growth.

- North America: A significant market driven by strong R&D, innovation in medical devices, aerospace and defense, and a growing emphasis on smart manufacturing. High adoption of advanced technologies and demand for specialized applications characterize this region.

- Europe: Characterized by a strong automotive sector, advanced industrial machinery, and a growing medical technology industry, particularly in Germany, Switzerland, and the UK. Focus on automation, precision engineering, and specialized industrial applications.

- Latin America: An emerging market with increasing investment in electronics assembly and automotive manufacturing, driven by economic development and foreign direct investment. Adoption rates are steadily rising, though from a smaller base.

- Middle East and Africa (MEA): Shows nascent growth, primarily in areas of industrial development, infrastructure projects, and limited electronics assembly. Market expansion is anticipated with increasing technological adoption and diversification of economies away from traditional sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Resolution Dispensing Systems and Equipment Market.- Nordson Corporation

- Illinois Tool Works (ITW) EAE

- FUJI Corporation

- Musashi Engineering, Inc.

- Asymtek (part of Nordson)

- DISPENSE SOLUTIONS (part of FUJI)

- Techcon (part of OK International)

- GPD Global, Inc.

- Dymax Corporation

- Essemtec AG

- DELO Industrial Adhesives

- PVA (Precision Valve & Automation)

- Speedline Technologies (part of ITW EAE)

- MYCRONIC AB

- ADVANTEK, Inc.

- Shenzhen Fancort Engineering, Ltd.

- Henkel AG & Co. KGaA (equipment solutions)

- Hitachi High-Tech Corporation

- EFD (part of Nordson)

- TENSUN (Suzhou) Electronics Co., Ltd.

Frequently Asked Questions

What are the primary applications of high-resolution dispensing systems?

High-resolution dispensing systems are primarily used in semiconductor packaging (underfill, die attach), medical device manufacturing (adhesives, reagents), display production (OLED, Micro-LED), automotive electronics, and life sciences for precise material deposition.

Which technologies are driving innovation in this market?

Key technologies driving innovation include advanced jetting systems (e.g., piezo-jetting), robotic automation, sophisticated vision systems for real-time alignment and inspection, and the integration of AI/machine learning for predictive maintenance and process optimization.

What challenges does the market face?

The market faces challenges such as high initial capital investment, the need for a highly skilled workforce, and technical complexities associated with dispensing novel and highly viscous materials, as well as maintaining consistent performance under varying conditions.

How is AI impacting high-resolution dispensing?

AI is significantly impacting the market by enhancing precision through dynamic parameter adjustments, enabling predictive maintenance for reduced downtime, optimizing process control for better yields, and facilitating advanced defect detection in real-time.

Which region holds the largest market share for high-resolution dispensing equipment?

Asia Pacific (APAC) currently holds the largest market share, driven by its dominant position in electronics manufacturing, semiconductor production, and the rapidly expanding medical device and display industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager