High Temperature Electrical Insulating Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441276 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

High Temperature Electrical Insulating Film Market Size

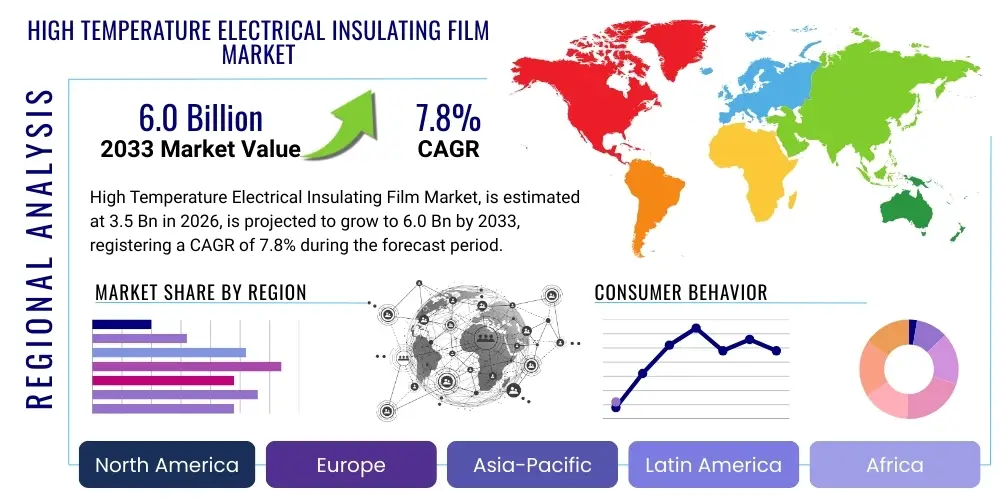

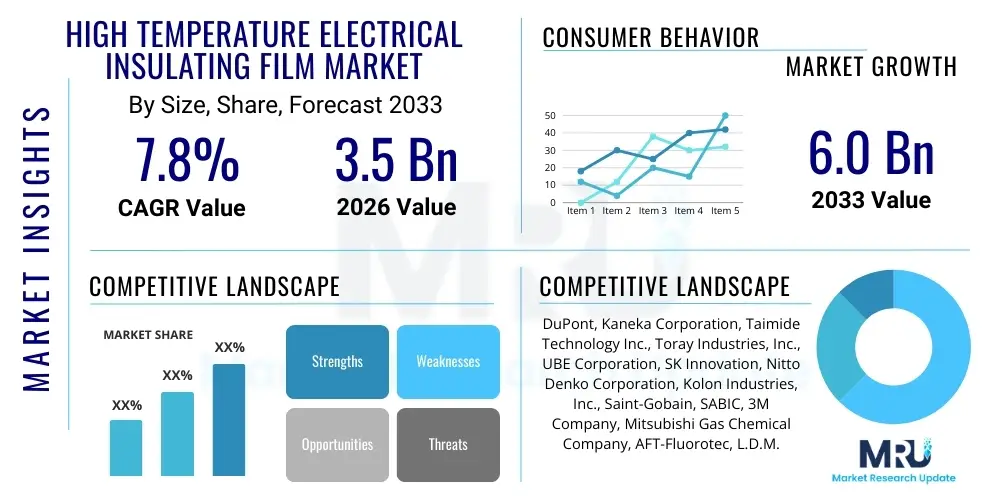

The High Temperature Electrical Insulating Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $6.0 Billion by the end of the forecast period in 2033.

High Temperature Electrical Insulating Film Market introduction

The High Temperature Electrical Insulating Film market encompasses specialized polymer films designed to maintain superior dielectric properties and mechanical integrity when exposed to extreme thermal conditions, typically exceeding 150°C. These films are critical components in advanced electrical systems, including motors, generators, transformers, and highly miniaturized flexible electronic circuits where conventional insulators fail due to thermal degradation or mechanical stress. The primary product types include Polyimide (PI), Polyethylene Naphthalate (PEN), and Polyether Ether Ketone (PEEK) films, each offering distinct advantages in terms of cost, dielectric constant, and upper temperature limits.

The core function of these insulating films is to prevent short circuits, manage thermal dissipation, and ensure long-term operational reliability in demanding environments such as aerospace systems, electric vehicle (EV) batteries, and high-frequency 5G infrastructure. Their exceptional performance, characterized by high dielectric strength, low dissipation factor, and excellent chemical resistance, makes them indispensable for maximizing efficiency and safety in power electronics and high-performance motors. Technological advancements, particularly in ultra-thin film fabrication and surface modification techniques, are continually enhancing the performance profile of these materials, driving adoption across innovative applications.

Key drivers propelling market expansion include the global push toward electrification in the automotive sector, demanding lightweight and reliable insulation for high-voltage battery packs and traction motors. Furthermore, the relentless trend of electronic device miniaturization requires insulating materials that can tolerate increased power density and operate reliably in confined, high-heat environments, thereby cementing the role of high temperature films as enabling technology for next-generation consumer and industrial electronics.

High Temperature Electrical Insulating Film Market Executive Summary

The global High Temperature Electrical Insulating Film Market is characterized by robust growth, primarily fueled by monumental shifts in the transportation and communication sectors, particularly the rapid adoption of electric vehicles and the deployment of 5G and 6G infrastructure. Market momentum is concentrated in the Asia Pacific region, which serves as the global hub for manufacturing high-volume consumer electronics, batteries, and automotive components. Polyimide films maintain market dominance due to their unparalleled thermal stability and excellent electrical properties, though rising prices and complexity in processing are opening avenues for competitive alternatives like PEN and specialized polyester films in less stringent applications.

Business trends indicate a strategic focus on vertical integration among leading manufacturers, aiming to secure raw material supply (especially specialized monomers) and control quality across the value chain, coupled with significant investment in R&D to develop ultra-thin films (under 25 micrometers) offering improved thermal conductivity. Regional trends show heavy capacity expansion in China and India to cater to domestic EV and renewable energy markets, while North America and Europe emphasize high-specification films for aerospace, medical devices, and high-performance industrial machinery, prioritizing performance over cost effectiveness.

Segmentation trends confirm that the application in traction motors and flexible printed circuits (FPCs) exhibits the highest growth trajectory. The push for faster charging and increased range in EVs necessitates insulating films that can withstand higher working voltages and dissipate heat more effectively than legacy materials. The competitive landscape is moderately concentrated, with key players focusing on proprietary coating techniques and specialized film modification processes to differentiate their products based on corona resistance and mechanical toughness under stress.

AI Impact Analysis on High Temperature Electrical Insulating Film Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the High Temperature Electrical Insulating Film sector overwhelmingly focus on material science optimization, predictive maintenance capabilities, and enhancing manufacturing efficiency. Users are keenly interested in how machine learning algorithms can accelerate the discovery and synthesis of novel polymer structures capable of achieving even higher thermal classes (e.g., Class H and higher) while maintaining cost-effectiveness. A major concern revolves around utilizing AI to model and predict the long-term degradation and failure points of films under combined thermal, electrical, and mechanical stress, allowing for more precise product life cycle estimates and reliability improvements in mission-critical applications like aerospace and high-voltage power grids. Furthermore, significant user expectation centers on leveraging AI for optimizing production parameters, minimizing material waste, and ensuring highly consistent film thickness and quality control during complex manufacturing processes such as solvent casting and calendering.

- AI optimizes polymer formulation design, reducing R&D cycles for new high-performance films.

- Machine learning models predict material degradation rates under specific operational thermal loads.

- AI-driven quality control systems identify microscopic defects in film production in real-time, improving yield.

- Predictive maintenance analytics, enabled by AI, extend the lifespan of electrical equipment utilizing these films.

- AI enhances supply chain visibility and risk management for sourcing critical monomers and raw materials.

- Simulation software uses AI to model thermal management and electrical field distribution in film stacks.

DRO & Impact Forces Of High Temperature Electrical Insulating Film Market

The High Temperature Electrical Insulating Film Market is profoundly influenced by the twin forces of electrification and miniaturization, which act as primary drivers compelling continuous innovation toward thinner, more durable, and thermally resilient films. Key drivers include the exponential growth in the EV and hybrid electric vehicle (HEV) markets, demanding insulation for high-voltage battery modules and powerful traction motors, coupled with the rapid expansion of 5G infrastructure requiring materials with excellent dielectric stability at microwave frequencies. Conversely, market restraints largely stem from the high initial capital expenditure required for sophisticated manufacturing facilities, coupled with the inherent cost volatility of specialized raw materials such as proprietary polyimide precursors. Furthermore, the complexity of processing ultra-thin films while maintaining uniformity and mechanical strength presents significant technical hurdles that limit adoption in certain price-sensitive applications.

Opportunities for growth are concentrated in the development of films tailored for extreme environments, such as deep-sea exploration and high-temperature downhole oil and gas applications, alongside the emerging need for insulating materials compatible with next-generation wide bandgap (WBG) semiconductors like SiC and GaN, which operate at significantly higher temperatures. The industry is also seeing opportunities in developing recyclable or biodegradable high-performance films to address growing sustainability mandates, positioning manufacturers that solve the end-of-life challenge for complex polymer films favorably. Impact forces are overwhelmingly weighted toward regulatory compliance in terms of flame retardancy and thermal class certification (UL standards), which dictates material selection, and intense competition among regional manufacturers focusing on cost optimization through advanced continuous production lines.

The market faces external pressure from evolving power electronics architectures; as system designs become more efficient, the insulating film must perform multiple roles—insulation, thermal path, and mechanical support—simultaneously. This demand profile necessitates multi-layer composite films and integrated solutions rather than standalone insulation sheets, driving manufacturers toward advanced coating and lamination technologies. Therefore, success is increasingly tied to the ability to provide customized, highly engineered film systems that integrate seamlessly into complex module assemblies, rather than just supplying bulk raw film material.

Segmentation Analysis

The High Temperature Electrical Insulating Film Market is segmented based on the type of material used, the specific application of the film, and the end-use industry utilizing the component. Material segmentation is crucial, differentiating between high-performance polymers such as Polyimide (PI), which offers the highest thermal rating, and more cost-effective options like Polyethylene Naphthalate (PEN) and specialized polyester films. Application analysis focuses on specific electrical components, including wire and cable insulation, flexible printed circuits (FPCs), motor and generator slot liners, and capacitor dielectrics. The end-use segment provides insights into demand patterns across crucial industries such as electronics, automotive (EV/HEV), aerospace and defense, and industrial machinery, highlighting where the most stringent requirements and highest growth rates reside.

- By Material:

- Polyimide (PI) Film

- Polyethylene Naphthalate (PEN) Film

- Polyether Ether Ketone (PEEK) Film

- Specialized Polyester (PET) Film

- Fluoropolymer Films (PTFE, PFA)

- By Application:

- Flexible Printed Circuits (FPCs)

- Motor & Generator Insulation (Slot Liners, Phase Insulation)

- Transformer Insulation

- Wire & Cable Insulation

- Capacitor Dielectrics

- Battery Pack Insulation & Thermal Interface Materials

- By End-Use Industry:

- Electronics & Communication (5G, Data Centers)

- Automotive (Electric Vehicles, HEVs)

- Aerospace & Defense

- Industrial Machinery & Equipment

- Energy (Renewable Energy, Power Transmission)

Value Chain Analysis For High Temperature Electrical Insulating Film Market

The value chain for High Temperature Electrical Insulating Films is intricate and capital-intensive, starting with upstream activities focused on the synthesis of high-purity specialized monomers, such as dianhydrides and diamines required for polyimide production. This upstream stage is dominated by a few chemical specialty companies and heavily influences the final film quality and cost, as the purity of precursors dictates the resulting film’s thermal stability and dielectric performance. Midstream activities involve the actual film manufacturing process, which includes solvent casting, extrusion, or calendering, followed by crucial post-processing steps like curing, plasma treatment for adhesion, and slitting/converting into specified widths and thicknesses. Manufacturers at this stage heavily rely on proprietary processes and cleanroom environments to produce defect-free, ultra-thin films.

Downstream activities involve the distribution, conversion, and integration of the insulating films into final electrical components. Converters and fabricators often specialize in cutting, laminating, or coating the raw film material to meet specific customer requirements, such as producing flexible circuits or customized insulation parts for motors. Distribution channels are typically a mix of direct sales to large, strategic original equipment manufacturers (OEMs) in the automotive and aerospace sectors, and indirect sales through specialized technical distributors who offer localized inventory and technical support to smaller electronics manufacturers and repair shops. Direct channels ensure tight control over product specifications and quality assurance, which is critical for high-reliability applications, while indirect channels provide broader market reach and quicker access for standard products.

The efficiency of the entire chain is increasingly being evaluated based on material utilization and waste reduction, given the high cost of raw materials. Integration is key; film manufacturers that also offer converting services or co-develop material specifications directly with major automotive or electronics OEMs gain a competitive edge by reducing lead times and optimizing film properties for precise component geometries. This trend toward co-creation minimizes downstream processing risks and ensures the film's specifications (e.g., thermal class, tensile strength, dielectric breakdown voltage) are perfectly aligned with the end-product's operational requirements.

High Temperature Electrical Insulating Film Market Potential Customers

The primary customers for High Temperature Electrical Insulating Films are large-scale industrial and manufacturing entities requiring reliable electrical insulation in demanding environments where heat, vibration, or chemical exposure is significant. The largest segment of end-users are manufacturers in the automotive sector, specifically those producing high-voltage battery systems, traction motors, and on-board chargers for electric and hybrid vehicles, demanding insulation capable of withstanding continuous operational temperatures above 180°C and transient peaks during fast charging. Another critical customer segment includes consumer electronics OEMs and their suppliers who produce flexible printed circuits (FPCs) and specialized components for 5G devices, smart wearables, and advanced display technologies, where extreme miniaturization mandates excellent heat management alongside dielectric stability.

Defense and aerospace contractors constitute a highly specialized, though smaller, customer base that procures films for critical applications in avionics, radar systems, and aircraft wiring, where failure is not permissible, driving demand for premium PEEK and specialized PI films with exceptional fire retardancy and radiation resistance. Furthermore, the industrial sector, encompassing manufacturers of high-efficiency industrial motors, power generation equipment (especially wind turbine generators), and large power transformers, consistently requires robust thermal insulation to maximize operational lifespan and energy efficiency. These diverse buyers are unified by the necessity for highly certified, high-reliability materials that meet stringent international performance and safety standards, making compliance and documented performance history key purchasing criteria.

Emerging customer groups include data center operators and suppliers developing high-density servers and cooling solutions. As data transmission speeds increase and server racks become denser, managing localized heat generated by high-performance processors becomes challenging, creating a niche market for high thermal conductivity insulating films that act as efficient thermal management layers while preventing electrical leakage. These customers prioritize films that offer a balance between thermal conductivity and dielectric strength to ensure optimal operational temperature control without compromising safety or signal integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Kaneka Corporation, Taimide Technology Inc., Toray Industries, Inc., UBE Corporation, SK Innovation, Nitto Denko Corporation, Kolon Industries, Inc., Saint-Gobain, SABIC, 3M Company, Mitsubishi Gas Chemical Company, AFT-Fluorotec, L.D.M. High-Performance Films, Panjin Haorui Chemical Industry Co., Ltd., Sichuan Dongfang Insulating Material Co., Ltd., Shin-Etsu Chemical Co., Ltd., Teijin Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Temperature Electrical Insulating Film Market Key Technology Landscape

The technological landscape of the High Temperature Electrical Insulating Film Market is defined by continuous process refinements aimed at enhancing material performance, consistency, and cost-efficiency, particularly in manufacturing methods for polyimide (PI) films which are technically challenging. A dominant technology remains solvent casting, where highly specialized polymer precursors are dissolved and cast onto a substrate, followed by controlled solvent evaporation and subsequent thermal curing (imidization). Advanced solvent casting techniques now focus on closed-loop solvent recovery systems and improved dope filtering to ensure minimal defects and achieve precise thickness control, essential for ultra-thin (under 10 micrometer) films used in flexible electronics.

Another crucial area of technological advancement involves surface modification and coating technologies. Films, particularly those used in motors and generators, require high resistance to partial discharge (corona resistance) and enhanced adhesion to copper conductors or thermal dissipation layers. Technologies like plasma etching, chemical vapor deposition (CVD) of silica or alumina, and specialized proprietary anti-corona coatings are increasingly utilized to augment the surface properties without compromising the film's core dielectric strength or thermal rating. Furthermore, co-extrusion and lamination technologies are gaining traction for creating multilayer composite films that combine the high thermal resistance of one material (like PI) with the cost-efficiency or superior mechanical properties of another layer (like specialized PET or adhesion promoters), offering tailored insulation solutions for complex system requirements.

The development of bio-based or highly recyclable high-temperature polymer films represents an emerging technology focus, driven by sustainability pressures. While true high-temperature electrical performance remains challenging to achieve with current bio-polymers, researchers are exploring novel monomer chemistries derived from renewable sources that can withstand continuous operating temperatures around 150°C, aiming to provide an environmentally responsible alternative for standard industrial applications. Automation and digitalization within manufacturing, including inline spectrophotometry and laser measurement systems, further contribute to the technology landscape by ensuring zero-defect production and maintaining the extremely tight dimensional tolerances required by modern component manufacturers.

Regional Highlights

The High Temperature Electrical Insulating Film Market exhibits significant geographical disparities driven by manufacturing concentrations and regional regulatory standards, heavily influencing demand and technological focus across key territories.

- Asia Pacific (APAC): APAC commands the largest market share and exhibits the fastest growth due to its overwhelming dominance in global electronics manufacturing (China, South Korea, Taiwan) and its position as the major production hub for electric vehicle batteries and high-efficiency motors. The immense scale of flexible printed circuit (FPC) production for consumer electronics and the substantial government support for renewable energy projects (solar inverters, wind power) further cements APAC's lead in volume consumption, particularly for Polyimide (PI) and Polyethylene Naphthalate (PEN) films.

- North America: This region is characterized by high demand for films tailored for mission-critical applications in the aerospace, defense, and specialized industrial sectors. North American companies focus on ultra-high performance films (often PEEK and high-end PI) that adhere to stringent military specifications (MIL-SPEC) and NASA standards, emphasizing quality and long-term reliability over cost. The increasing adoption of electric vehicles and sophisticated data center equipment also fuels consistent, high-value demand.

- Europe: European market growth is strongly influenced by strict automotive industry standards and a robust industrial machinery sector. Europe is a leader in implementing advanced electrification standards, driving demand for high-thermal-class insulation in traction motors and charging infrastructure. Regulatory frameworks emphasizing environmental performance and safety standards necessitate the use of specialized, compliant fluoropolymer and halogen-free PI films.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent developing markets for high temperature insulating films. Demand is primarily generated by infrastructure projects, including power generation and transmission network upgrades, and local assembly plants for automotive components. Growth in these areas is projected to accelerate as local manufacturing capabilities expand, leading to increased consumption of standard and mid-range thermal class films.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Temperature Electrical Insulating Film Market.- DuPont de Nemours, Inc.

- Kaneka Corporation

- Taimide Technology Inc.

- Toray Industries, Inc.

- UBE Corporation

- SK Innovation (SKC)

- Nitto Denko Corporation

- Kolon Industries, Inc.

- Saint-Gobain S.A.

- SABIC (Saudi Basic Industries Corporation)

- 3M Company

- Mitsubishi Gas Chemical Company, Inc.

- AFT-Fluorotec

- L.D.M. High-Performance Films S.A.

- Panjin Haorui Chemical Industry Co., Ltd.

- Sichuan Dongfang Insulating Material Co., Ltd.

- Teijin Limited

- Jiangsu Yabao Insulating Material Co., Ltd.

- Midas Co., Ltd.

- Flexcon Company, Inc.

Frequently Asked Questions

Analyze common user questions about the High Temperature Electrical Insulating Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the High Temperature Electrical Insulating Film Market growth?

The primary driver is the accelerating global adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). These vehicles require advanced insulation films for high-voltage battery packs and powerful traction motors that must withstand continuous high thermal loads and demanding operational environments, increasing demand for Polyimide and PEEK films.

How do Polyimide (PI) films compare to Polyethylene Naphthalate (PEN) films?

Polyimide (PI) films offer superior thermal stability, generally rated for higher continuous operating temperatures (typically >200°C) and higher dielectric strength, making them suitable for aerospace and high-end automotive applications. PEN films, while offering excellent thermal properties superior to standard PET, are more cost-effective and typically serve applications requiring lower continuous temperatures (up to 180°C), such as general motor insulation and certain flexible circuits.

Which end-use industry represents the largest consumer of high temperature insulating films?

The Electronics and Communication industry, particularly through the production of Flexible Printed Circuits (FPCs) for smart devices and components for 5G infrastructure, currently represents the largest volume consumer. However, the Automotive sector (EVs) is rapidly increasing its consumption and driving the highest growth in terms of value due to stringent performance requirements.

What role does film thickness play in electrical insulation performance?

Film thickness is critical for performance, especially in miniaturized electronics. While thinner films (under 25 micrometers) are required for space savings, maintaining adequate dielectric strength and minimizing the risk of partial discharge often requires specialized treatments or multilayer construction. Thinner films are prioritized for flexible circuits, while thicker films are used in motor slot liners for mechanical robustness.

What is the primary technical restraint limiting market expansion?

The most significant technical restraint is the inherently high cost and complexity associated with manufacturing ultra-pure, high-performance polymers like Polyimide and PEEK, coupled with the capital-intensive nature of advanced film processing techniques such as solvent casting, which results in high final product costs for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager