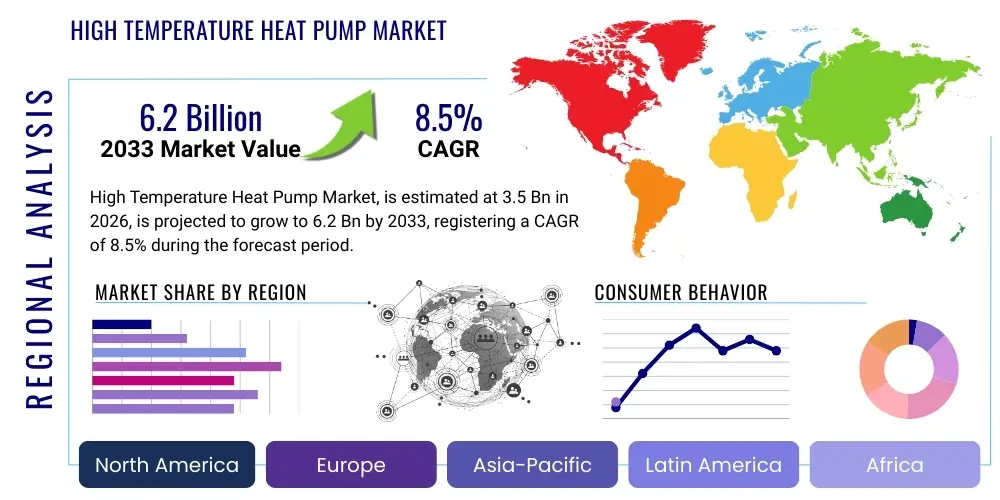

High Temperature Heat Pump Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443310 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

High Temperature Heat Pump Market Size

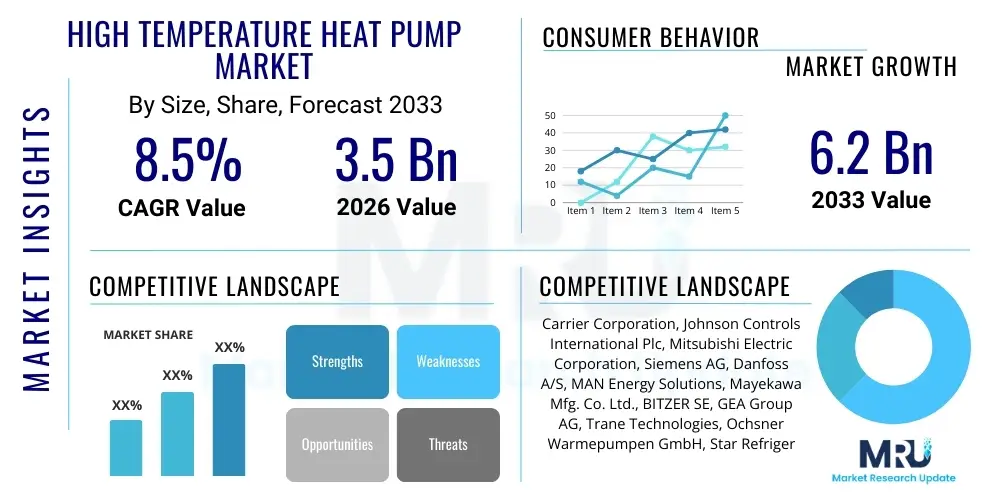

The High Temperature Heat Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

High Temperature Heat Pump Market introduction

The High Temperature Heat Pump (HTHP) market encompasses systems designed to efficiently provide process heat at temperatures significantly higher than conventional heat pumps, typically exceeding 100°C, and in some specialized industrial applications, reaching up to 200°C or more. These advanced thermal management solutions are crucial for industrial decarbonization efforts, allowing facilities to replace traditional fossil fuel boilers used for steam generation or drying processes. HTHPs operate by capturing waste heat from industrial processes or ambient sources and upgrading its temperature level using mechanical compression or chemical absorption cycles, thereby delivering substantial energy efficiency gains and reducing greenhouse gas emissions across various sectors. The primary product differentiation lies in the working fluid utilized, which often includes natural refrigerants like CO2 (R744), ammonia (R717), or high-performance synthetic fluids, enabling operation under stringent temperature and pressure regimes.

Major applications of High Temperature Heat Pumps span across energy-intensive industries suching as chemical manufacturing, pharmaceuticals, food and beverage processing, paper and pulp production, and particularly in district heating networks where high supply temperatures are required for effective heat distribution. In the food and beverage industry, HTHPs are deployed for sterilization, drying, and washing processes. In the chemical sector, they are critical for maintaining reaction temperatures and distillation processes. The inherent benefit of HTHPs is their remarkable coefficient of performance (COP), often significantly exceeding that of conventional heating systems, which translates directly into lower operational costs and a substantial decrease in energy consumption. This high efficiency is a core driver for their adoption, particularly amidst volatile energy prices and increasing regulatory pressures related to carbon pricing.

Key factors driving the rapid expansion of this market include ambitious national and international climate goals, such as those set forth in the European Union’s Green Deal and various national industrial decarbonization roadmaps. Furthermore, governmental incentives, subsidies, and tax credits aimed at promoting industrial electrification and energy efficiency investments are accelerating market penetration. The continuous innovation in compressor technology, particularly the development of robust screw and centrifugal compressors capable of handling high pressures associated with high-temperature lifts, along with the refinement of environmentally benign, high-performance refrigerants, ensures the technical viability of HTHPs in challenging industrial environments. The necessity for industries to future-proof their operations against tightening environmental regulations solidifies the HTHP market's position as a critical component of the future energy landscape.

High Temperature Heat Pump Market Executive Summary

The High Temperature Heat Pump Market is experiencing robust growth fueled by converging macro-environmental and technological trends, positioning it as a cornerstone technology for global industrial decarbonization. Business trends emphasize the shift from pilot projects to large-scale, integrated industrial installations, driven by multinational corporations committing to net-zero targets and requiring proven, reliable solutions for process heat. Key financial trends indicate substantial investment in R&D focused on expanding the temperature ceiling of heat pump technology and improving the Coefficient of Performance (COP) across higher temperature ranges. Strategic mergers, acquisitions, and collaborations between heat pump manufacturers and industrial automation firms are becoming commonplace, aimed at providing turnkey energy systems that seamlessly integrate HTHPs into existing factory infrastructure. Furthermore, service-based business models, such as Energy-as-a-Service (EaaS), are emerging to mitigate the high upfront capital expenditure for end-users, thereby lowering adoption barriers and accelerating market growth.

Regional trends highlight Europe as the immediate dominant market, primarily due to stringent EU energy efficiency directives, the rapid expansion of district heating modernization, and high energy costs which make the efficiency gains of HTHPs economically compelling. Policy frameworks like the REPowerEU plan specifically support the deployment of large industrial heat pumps. Asia Pacific, however, is projected to be the fastest-growing region, driven by extensive industrial expansion in economies like China, India, and South Korea, coupled with increasingly severe air quality regulations pushing industries away from coal and heavy oil reliance. North America is gaining traction, largely influenced by supportive legislation such as the Inflation Reduction Act (IRA) in the US, which provides substantial tax credits for clean technology deployment, focusing on areas like chemical processing and pulp and paper.

Segment trends underscore the dominance of the vapor compression segment, though the absorption heat pump segment is also seeing renewed interest in scenarios where abundant low-grade waste heat or natural gas is readily available to drive the process. In terms of output temperature, the 100°C to 150°C range currently holds the largest market share as it covers the vast majority of industrial steam and hot water applications. However, the segment exceeding 180°C is expected to witness the highest CAGR as technological advancements make these ultra-high-temperature solutions more feasible and cost-effective. Application-wise, the District Heating and Food & Beverage sectors remain primary revenue generators, while the Chemical and Pharmaceutical industries represent high-value growth pockets due to their significant and consistent demand for stable, high-temperature thermal energy.

AI Impact Analysis on High Temperature Heat Pump Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the High Temperature Heat Pump Market typically revolve around operational optimization, energy consumption predictability, and the integration complexity with existing Industrial Control Systems (ICS). Users frequently inquire about how AI can enhance the Coefficient of Performance (COP) by dynamically adjusting compressor speeds and refrigerant flow based on real-time process load changes and external environmental factors. Key concerns center on the reliability of AI algorithms in mission-critical, high-temperature industrial settings, the security of data infrastructure required for deep learning models, and the necessary skill set upgrades for maintenance technicians to handle AI-driven diagnostics and predictive failure analysis. Furthermore, there is significant interest in AI's role in optimizing complex, multi-stage HTHP cascade systems and managing the integration of intermittent renewable energy sources (e.g., wind or solar PV) to power the heat pumps, thus maximizing economic benefit and reducing carbon intensity. The consensus expectation is that AI will transform HTHPs from static, programmed assets into dynamic, highly adaptive energy recovery systems, unlocking performance levels currently unattainable through traditional control mechanisms.

AI's influence is pivoting the HTHP market towards 'smart thermal management,' where machine learning models analyze vast datasets encompassing historical operational data, ambient temperature forecasts, electricity price volatility, and real-time process demand profiles. This capability allows for highly accurate predictive maintenance, shifting component replacement from time-based schedules to condition-based, thereby minimizing costly unplanned downtime in critical industrial applications. Crucially, AI algorithms optimize energy source switching and load management, ensuring that the HTHP primarily operates during low-cost electricity periods or when the CO2 emission factor of the grid is lowest, achieving both economic and environmental objectives simultaneously. This predictive capability significantly improves the overall reliability and economic viability of HTHPs, addressing a major restraint—the perceived complexity and reliability concerns—associated with deploying these advanced systems in demanding industrial environments.

- AI enables real-time dynamic optimization of HTHP parameters (e.g., pressure ratios, cooling temperatures) to maximize Coefficient of Performance (COP) under fluctuating loads.

- Predictive maintenance schedules are generated using machine learning to forecast component failure (e.g., compressor bearings, expansion valves), reducing unplanned industrial downtime.

- Intelligent fault detection and diagnostics streamline troubleshooting by identifying subtle anomalies in operational data often missed by conventional control logic.

- Optimization of complex system integration, particularly in cascade or hybrid HTHP configurations, ensuring optimal heat recovery and utilization across multiple thermal loops.

- Demand-side management optimization allows HTHPs to modulate energy consumption based on real-time electricity pricing and grid constraints, enhancing economic performance.

- Automated control adjustments facilitate seamless integration with renewable energy sources, maximizing self-consumption and reducing reliance on grid power.

- Enhanced thermal process control using deep learning models ensures precise and stable temperature delivery, critical for quality control in sectors like pharmaceuticals and food processing.

DRO & Impact Forces Of High Temperature Heat Pump Market

The High Temperature Heat Pump Market is powerfully driven by stringent global decarbonization mandates and the urgent need for industrial energy efficiency, while simultaneously being restrained by high initial capital expenditure and complex integration requirements into legacy infrastructure. Opportunities are vast, particularly in leveraging waste heat recovery in large-scale industrial complexes and the modernization of expansive district heating networks across Europe and Asia. The impact forces are currently skewed toward the positive, with legislative support and technological advancements overcoming economic barriers, although macroeconomic volatility and supply chain instability represent persistent countervailing pressures. The interplay of these forces dictates the speed and geographical distribution of HTHP deployment, emphasizing the role of government policy in mitigating financial risk and stimulating early adoption.

The primary Drivers (D) include aggressive government policies targeting net-zero emissions, such as carbon taxes and phase-outs of high-GWP refrigerants, which incentivize the shift toward efficient electric heating solutions. The economic imperative of reducing operational expenditure in energy-intensive industries further accelerates adoption, as HTHPs offer superior energy efficiency compared to fossil fuel boilers. Additionally, the increasing availability of affordable renewable electricity makes the electrification pathway for industrial heat generation more sustainable and economically sound. Restraints (R), however, are significant: the specialized nature and high cost of components (e.g., high-pressure compressors, specialized heat exchangers) lead to elevated capital costs compared to conventional boilers. Furthermore, technical complexity surrounding the selection of the optimal refrigerant and the detailed engineering required for seamless integration into existing industrial processes necessitate specialized expertise, which is currently a limiting factor in many markets.

Opportunities (O) are centered on the vast, untapped potential for waste heat recovery across various manufacturing sectors. Utilizing low-grade waste heat—which would otherwise be rejected into the atmosphere—as the source for HTHPs transforms a liability into a valuable energy asset. The market is also presented with a significant opportunity in the deployment of large, multi-megawatt thermal output HTHPs for municipal district heating and cooling systems, providing reliable, low-carbon heat to urban centers. The Impact Forces (I) are predominantly driven by environmental and technological momentum. Environmental regulations and corporate sustainability pledges exert intense pressure on industrial emitters, favoring HTHP deployment. Technologically, the ongoing advancement in natural refrigerant systems (CO2, Ammonia, water) and high-performance magnetic bearing compressor designs are rapidly improving the reliability and temperature ceiling, making HTHPs viable for even the most demanding high-temperature industrial processes, thereby accelerating market acceptance and deployment worldwide.

Segmentation Analysis

The High Temperature Heat Pump market segmentation provides a critical view of the technological diversity and end-user requirements driving market adoption across different industrial landscapes. Segmentation is primarily based on the core operating principle (technology), the required temperature output, and the specific application sector. The core technology segments differentiate between established mechanical vapor compression systems—which currently dominate due to their maturity and efficiency—and emerging thermo-chemical systems like absorption and adsorption heat pumps, which are gaining traction in scenarios where excess low-grade heat is available to power the cycle. This framework enables manufacturers to tailor products to specific process needs, whether it's the high temperature lift required in chemical manufacturing or the stable, lower-grade heat needed for large-scale aquaculture.

Segmentation by output temperature is crucial as it directly correlates with the applicability of the HTHP solution to various industrial processes. The segment spanning 100°C to 150°C is robustly adopted as it caters to standard hot water and low-pressure steam needs prevalent across the food and beverage, textile, and light manufacturing sectors. Conversely, the smaller but rapidly growing segment of ultra-high-temperature pumps (above 180°C) is key for heavy industries like steel, cement, and petrochemicals, requiring specialized componentry and advanced working fluids. This tiered approach allows for targeted R&D investment toward high-lift technologies and supports market forecasting based on specific industrial heat demand profiles across different geographies, recognizing that European industrial requirements may differ significantly from those in emerging Asian markets.

- By Technology:

- Vapor Compression Heat Pumps (Mechanical, Screw, Centrifugal)

- Absorption Heat Pumps

- Adsorption Heat Pumps

- Thermo-Chemical Heat Pumps

- By Output Temperature:

- 100°C – 120°C

- 121°C – 150°C

- 151°C – 180°C

- Above 180°C

- By Application:

- Industrial Process Heating (Chemicals, Pulp & Paper, Metal)

- District Heating and Cooling

- Food & Beverage Processing

- Pharmaceuticals

- Textile and Drying Industries

- By Refrigerant Type:

- Natural Refrigerants (R744 - CO2, R717 - Ammonia, Water/Steam)

- HFO Refrigerants (Low GWP)

Value Chain Analysis For High Temperature Heat Pump Market

The Value Chain for the High Temperature Heat Pump market begins with the upstream supply of specialized components and raw materials, where complexity and quality are paramount. This stage involves the sourcing of high-grade steel and alloys for heat exchangers and casings designed to withstand extreme pressures and temperatures, along with the provision of highly customized, durable compressors (such as semi-hermetic or open-drive screw compressors) that are engineered for high-pressure ratios and specialized refrigerants like R744. The intellectual property and manufacturing expertise related to high-efficiency motor drives and magnetic bearings, often used to eliminate friction losses, are critical upstream differentiators. A major upstream challenge is securing the supply of natural refrigerants and ensuring compliance with evolving chemical regulations, which necessitates rigorous quality control and specialized handling during component assembly.

The midstream phase involves the core manufacturing, system integration, and quality assurance processes. This is where components are assembled into packaged HTHP units, requiring sophisticated thermodynamic modeling and system control design. Manufacturers in this phase often specialize in customizing unit specifications to meet the variable load requirements of different industrial clients, focusing on integrating advanced control systems (often AI-enabled) for optimal operational efficiency. Distribution channels are varied, including direct sales for large, complex industrial projects, and indirect channels relying on specialized HVAC integrators, engineering procurement and construction (EPC) firms, and authorized distributors who possess the necessary industrial application knowledge. The expertise of the distribution partner in pre-sales feasibility studies and post-sales commissioning is vital due to the high technical demands of HTHP deployment.

Downstream activities focus on installation, commissioning, maintenance, and long-term service agreements. Direct channels involve manufacturers engaging directly with large industrial end-users (e.g., major chemical plants or utility-owned district heating networks) to manage complex integration projects and provide tailored maintenance contracts, often guaranteeing specific COP levels. Indirect channels leverage local mechanical contractors and energy service companies (ESCOs) to reach smaller or medium-sized industrial customers. Post-sales service is critical; the requirement for rapid response and specialized diagnostic tools ensures system uptime, which is non-negotiable in continuous industrial processes. The lifetime operational performance, optimized through consistent maintenance and digital monitoring services, is a primary value driver in the downstream segment, extending the equipment's lifespan and validating the high initial investment.

High Temperature Heat Pump Market Potential Customers

The primary potential customers and end-users of High Temperature Heat Pumps are fundamentally defined by their high and consistent demand for thermal energy, coupled with a strong strategic or regulatory mandate to decarbonize operations. Leading the buyer spectrum are large-scale industrial complexes in sectors such as chemicals, oil & gas, and refining, which require significant amounts of process steam and hot fluids, often in the 150°C to 200°C range. These facilities prioritize operational reliability and energy cost reduction, viewing HTHPs as essential capital investments that offer a measurable return on investment through superior energy efficiency and immunity from escalating carbon pricing mechanisms. The feasibility for these heavy industrial users often hinges on the availability of a substantial, stable source of waste heat that can be upgraded by the HTHP system.

Another major customer segment consists of municipal and private entities responsible for operating and expanding District Heating (DH) networks. With global initiatives to transition DH systems away from centralized gas or coal-fired boilers, HTHPs offer a scalable and resilient solution to provide reliable hot water to residential and commercial consumers. European countries, in particular, are aggressively investing in this area. Furthermore, the Food & Beverage and Pharmaceutical industries represent high-growth buyer segments. These sectors require meticulously clean and precise temperature control for processes like pasteurization, sterilization, drying, and washing. While their temperature requirements may be slightly lower (often 100°C to 120°C), the imperative for hygiene, stability, and meeting corporate sustainability goals drives their purchasing decisions, making high-efficiency, natural-refrigerant HTHPs highly attractive alternatives to conventional heating methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrier Corporation, Johnson Controls International Plc, Mitsubishi Electric Corporation, Siemens AG, Danfoss A/S, MAN Energy Solutions, Mayekawa Mfg. Co. Ltd., BITZER SE, GEA Group AG, Trane Technologies, Ochsner Warmepumpen GmbH, Star Refrigeration, Enerblue s.r.l., Centrica Plc, Viessmann Group, NIBE Group, Emerson Electric Co., Kensa Heat Pumps, Daikin Industries, Ltd., and Alfa Laval AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Temperature Heat Pump Market Key Technology Landscape

The technological landscape of the High Temperature Heat Pump market is rapidly evolving, primarily focused on increasing the maximum achievable temperature lift and improving energy efficiency (COP) across that elevated temperature range. Vapor Compression remains the dominant technology, but innovation centers on enhancing the compressor design, moving toward more efficient and robust solutions like high-speed turbo compressors and advanced screw compressors optimized for high-pressure natural refrigerants, specifically supercritical CO2 (R744) systems. CO2 heat pumps are particularly favored for moderate to high temperature applications (up to 120°C) due to CO2's excellent thermal properties and low Global Warming Potential (GWP). Parallel development focuses on utilizing high-GWP-free fluids, such as ammonia (R717) and water/steam, which require stringent safety and material handling protocols but offer superior performance in certain high-capacity industrial settings, pushing the boundaries towards 180°C and beyond.

A second critical area of technological advancement is the integration of advanced heat exchanger designs, utilizing materials resilient to high temperature, pressure, and potential corrosive refrigerants. This includes the deployment of plate heat exchangers and shell-and-tube configurations optimized for minimal temperature glide and maximum heat transfer efficiency under extreme conditions. Furthermore, the development of hybridization technologies is gaining prominence, where HTHPs are combined with thermal storage systems or integrated alongside auxiliary heat sources (e.g., gas boilers) to manage peak loads and ensure thermal stability during process fluctuations. These hybrid systems offer greater flexibility, robustness, and lower overall operational risk, particularly in industries where uninterrupted heat supply is non-negotiable, thereby broadening the practical applicability of heat pump technology.

The emerging landscape is also heavily characterized by digital innovation, specifically the implementation of proprietary control algorithms and sensor technology. Advanced electronic expansion valves, variable speed drives, and sophisticated control logic enable the heat pump to dynamically adjust its operational parameters in response to subtle changes in source heat availability and sink temperature requirements, maximizing seasonal efficiency. Research into next-generation systems, such as magnetic refrigeration or thermoacoustic heat pumps, while still nascent, holds long-term promise for ultra-high temperature generation without the use of traditional refrigerants. Overall, the technological focus is a complex interplay between maximizing temperature output, minimizing environmental impact through natural refrigerants, and enhancing system reliability and controllability through advanced digital management.

Regional Highlights

Europe stands as the undisputed frontrunner in the adoption and technological maturity of the High Temperature Heat Pump market, driven by powerful policy incentives and a mature district heating infrastructure. The EU’s ambitious decarbonization targets, reinforced by directives like the Energy Efficiency Directive (EED) and the Renewable Energy Directive (RED III), create a compelling regulatory environment mandating the shift from fossil fuels in industrial and municipal heat generation. Nations such as Germany, Sweden, and the Netherlands lead deployment, actively subsidizing HTHP installations in sectors ranging from food processing to chemical manufacturing. The high cost of energy in Europe also provides a strong economic case, making the superior Coefficient of Performance (COP) offered by HTHPs highly attractive for minimizing operational costs. Furthermore, Europe possesses a dense network of specialized manufacturers and engineering firms, facilitating advanced system integration and pilot project deployment.

Asia Pacific (APAC) is forecast to exhibit the highest growth trajectory, primarily fueled by the sheer volume of industrial activity and rapid urbanization across the region. China and India, with their extensive manufacturing bases—including significant activity in textiles, metals, and cement—represent enormous potential for waste heat recovery and electrification of process heat. While initially lagging in high-temperature applications due to historical reliance on low-cost coal, rapidly deteriorating air quality concerns and increasingly stringent national emissions standards are forcing industrial overhaul. Government investment in public heating systems, particularly in Northern China, coupled with the rollout of large-scale renewable energy capacity, is creating the perfect economic and regulatory storm to accelerate HTHP deployment, specifically targeting the 100°C to 150°C segments for mass adoption.

North America is characterized by a strong market presence in the United States, propelled by favorable federal legislation such as the Inflation Reduction Act (IRA), which provides substantial, long-term tax credits for clean energy technologies, including industrial heat pumps. This legislation is successfully addressing the barrier of high upfront capital costs. The market focus in North America is generally bifurcated: on high-value applications in the petrochemical and refining industries in regions like the Gulf Coast, where high-temperature stable heat is essential, and on the modernization of commercial and institutional heating systems in colder northern climates. Canada is also a significant player, particularly through provincial initiatives aimed at improving energy efficiency in the pulp and paper industry. The region benefits from a robust technology supply chain and high R&D spending from major HVAC manufacturers, ensuring rapid access to cutting-edge HTHP systems capable of meeting diverse industrial demands.

- Europe: Leading market share, driven by EU Green Deal, REPowerEU, and extensive district heating modernization programs (e.g., Germany, Nordic countries).

- Asia Pacific (APAC): Fastest growing region; high industrial activity in China and India, increased focus on air quality regulations, and large-scale manufacturing decarbonization efforts.

- North America: Strong acceleration due to US Inflation Reduction Act (IRA) tax incentives, robust R&D investment, and focus on petrochemical and commercial sector high-temperature demands.

- Latin America: Emerging market with increasing adoption in mining and food processing sectors, primarily driven by long-term energy cost savings rather than immediate mandates.

- Middle East & Africa (MEA): Niche market focused on high-efficiency cooling integration and industrial process heating in sectors like aluminum smelting and water desalination, leveraging solar power integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Temperature Heat Pump Market, highlighting their strategic positioning, technology focus, and recent market developments.- Carrier Corporation

- Johnson Controls International Plc

- Mitsubishi Electric Corporation

- Siemens AG

- Danfoss A/S

- MAN Energy Solutions

- Mayekawa Mfg. Co. Ltd.

- BITZER SE

- GEA Group AG

- Trane Technologies

- Ochsner Warmepumpen GmbH

- Star Refrigeration

- Enerblue s.r.l.

- Centrica Plc

- Viessmann Group

- NIBE Group

- Emerson Electric Co.

- Kensa Heat Pumps

- Daikin Industries, Ltd.

- Alfa Laval AB

Frequently Asked Questions

Analyze common user questions about the High Temperature Heat Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a High Temperature Heat Pump (HTHP) and how does it achieve process temperatures above 100°C?

A High Temperature Heat Pump is an advanced thermodynamic system designed to transfer and upgrade low-grade waste or ambient heat to a useful temperature typically exceeding 100°C, and sometimes up to 200°C. They achieve this using specialized high-pressure compressors (screw or turbo) and high-performance refrigerants, often natural fluids like CO2 or ammonia, engineered to operate effectively at high pressure ratios and elevated discharge temperatures required for industrial processes like steam generation or drying.

What are the primary drivers accelerating the adoption of High Temperature Heat Pumps in industrial sectors?

The primary drivers are stringent global decarbonization mandates and carbon taxation schemes, coupled with the economic necessity for industrial energy efficiency. HTHPs significantly reduce operational costs by minimizing reliance on expensive fossil fuels for heating, utilizing waste heat, and providing a superior Coefficient of Performance (COP) compared to traditional boilers, thereby offering compelling return on investment.

What is the typical lifespan and required maintenance for an industrial High Temperature Heat Pump system?

Industrial HTHP systems typically have an operational lifespan of 15 to 25 years, comparable to industrial boilers, when properly maintained. Maintenance is focused on compressor health, monitoring refrigerant integrity (especially with natural refrigerants), and optimizing system controls. Predictive maintenance enabled by AI is becoming standard, ensuring high uptime and efficiency by detecting potential component failures before they occur.

Which industrial sectors are the largest consumers and key target applications for HTHPs?

The largest target applications include large municipal District Heating networks, which require significant volumes of hot water, and energy-intensive industrial process heating in sectors like Chemical manufacturing, Pulp and Paper, and Food & Beverage processing. These sectors utilize HTHPs for generating process steam, sterilization, distillation, and large-scale drying, demanding reliable heat delivery.

What technological factors currently limit the ultra-high temperature capability of heat pumps?

The primary technological limitations include the maximum pressure ratio achievable by commercially available compressors, the material limitations of heat exchangers under extreme pressure and temperature, and the thermal stability and efficiency profile of available high-performance refrigerants. Research is focused on magnetic bearings, advanced materials, and supercritical CO2 cycles to break the 200°C barrier reliably and cost-effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager