High Vacuum Baffle Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441952 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

High Vacuum Baffle Valve Market Size

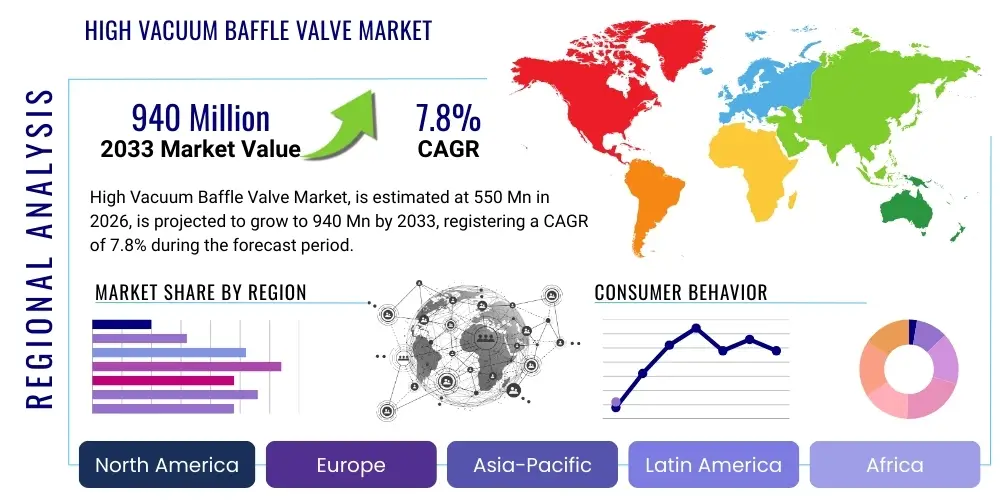

The High Vacuum Baffle Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 940 Million by the end of the forecast period in 2033. This consistent and robust growth trajectory is intrinsically linked to the global expansion of high-technology manufacturing sectors that rely critically on contaminant-free, highly controlled vacuum environments. The valuation reflects the increasing complexity of vacuum systems, where baffle valves are utilized not only for simple isolation but also as sophisticated pressure regulation and contamination control devices, often integrated with complex heating or cooling jackets to enhance performance. The market size calculation incorporates revenues from the sales of new valves, aftermarket replacement components, and associated maintenance services across all key application areas, including semiconductor, scientific research, and advanced coating industries. The sustained investment in next-generation fabrication technologies, particularly those moving into sub-10nm nodes and requiring Extreme Ultraviolet (EUV) lithography, necessitates constant replacement and upgrading of vacuum components to meet ever-stricter purity standards, guaranteeing continued capital expenditure in this specialized valve segment through 2033. The rapid scaling of 3D NAND flash memory and advanced logic chip production is a primary macroeconomic driver translating directly into demand for ultra-reliable, high-conductance baffle valves capable of handling increasingly complex and often corrosive process gas chemistries, further cementing the high growth forecast for the specialized vacuum component market segment.

High Vacuum Baffle Valve Market introduction

The High Vacuum Baffle Valve Market comprises specialized fluid control components engineered to operate reliably in environments characterized by pressures significantly below atmospheric conditions, typically in the range of 10-5 to 10-8 Torr, often extending into the Ultra-High Vacuum (UHV) regime. These valves serve the dual critical function of isolating vacuum sections during process changes or maintenance and, crucially, preventing the migration of harmful contaminants—such as hydrocarbon vapors from rotary or diffusion pumps—back into the clean process chamber. The internal structure of the baffle valve, which distinguishes it from standard gate or angle valves, is designed with precise geometric surfaces or integrated cooling elements (baffles) that condense and trap contaminant molecules, thus maintaining the high degree of vacuum purity essential for modern technological processes. This preservation of cleanliness is non-negotiable in critical applications, as even minute levels of organic or particulate contamination can drastically reduce device yield or compromise experimental results, making the baffle valve a high-value, mission-critical component within any sophisticated vacuum system setup. Product offerings vary widely, including motorized, pneumatic, and manual actuation mechanisms, and are constructed from robust materials like 316L stainless steel and high-purity aluminum, selected specifically for their low outgassing properties and resistance to corrosive process chemistries, ensuring long-term operational integrity and compatibility with stringent industry standards.

Major applications driving the market demand are overwhelmingly concentrated in the microelectronics sector, where High Vacuum Baffle Valves regulate gas flow during critical steps such as Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), and various plasma etching processes necessary for semiconductor fabrication. Beyond semiconductors, substantial demand originates from the vacuum coating industry, specifically in the production of architectural glass, optical filters, and advanced solar photovoltaic cells, where uniform and pure thin films are deposited under high vacuum conditions. Furthermore, academic and governmental research institutions, particularly those operating particle accelerators, fusion reactors (e.g., tokamaks), and complex analytical tools like scanning electron microscopes (SEMs) and mass spectrometers, require the precise isolation and contamination control that baffle valves provide. The inherent benefit of using these valves lies in significantly increased operational yields due to contamination control, extended Mean Time Between Failure (MTBF) for expensive vacuum pumps and chambers, and improved process repeatability and stability, which are core requirements for advanced manufacturing. The escalating complexity and miniaturization of devices across computing and display technologies directly correlate with the rising need for ultra-clean vacuum environments, ensuring the market's sustained expansion and investment in higher-performance, contamination-mitigating valve technologies. Market participants continually focus on innovations related to better sealing technologies, enhanced conductance optimization, and integration with digital monitoring systems to meet the increasingly demanding performance specifications set by leading technology manufacturers globally, focusing heavily on minimizing particle generation and achieving superior leak tightness under differential pressure conditions.

High Vacuum Baffle Valve Market Executive Summary

The High Vacuum Baffle Valve Market demonstrates strong resilience, underpinned by robust business trends centered around industrial digitization and the global semiconductor boom. The principal business trend involves increasing adoption of magnetically coupled and pneumatic actuated baffle valves over manual systems, facilitating greater automation and precision control, crucial for Industry 4.0 integration. Manufacturers are focusing on modular designs that allow easier maintenance and integration into complex process tools, lowering the total cost of ownership for end-users, while also developing sophisticated diagnostic capabilities integrated directly into the valve's control mechanism. Supply chain trends show a move towards localized production hubs in Asia Pacific to mitigate geopolitical risks and reduce lead times for major semiconductor and display manufacturers operating in the region, simultaneously fostering stronger regional competition. Technological advancements emphasize materials science for enhanced corrosion resistance, particularly against fluorine and chlorine plasma chemistries, and improved thermal management capabilities through integrated cooling jackets, essential for maintaining component integrity during high-temperature deposition processes. The market structure remains moderately consolidated, yet specialized niche players continue to thrive by focusing exclusively on Ultra-High Vacuum (UHV) or highly customized aerospace applications where technical superiority overrides cost considerations.

Regionally, Asia Pacific, spearheaded by China, Taiwan, South Korea, and Japan, remains the dominant revenue generator and growth engine, owing to massive state and private investment directed towards advanced semiconductor fabrication plants (Fabs) and the proliferation of OLED and LCD display manufacturing. North America and Europe maintain stable demand driven primarily by high-end R&D, aerospace applications, and specialized vacuum coating markets, though their growth rate is somewhat tempered compared to the explosive growth observed in APAC manufacturing bases. The North American market is poised for accelerated growth following initiatives aimed at reshoring microchip manufacturing, driving significant CapEx in new vacuum infrastructure. Europe’s stability is bolstered by its strong automotive and academic research sectors, which mandate reliable, long-life, and regulatory-compliant vacuum components. These regional dynamics create a bifurcated market: high volume, moderate specialization in APAC; and lower volume, extreme specialization and high ASPs in North America and Europe. Effective market strategy requires segment-specific approaches, acknowledging the distinct purchasing drivers and technical requirements across these major geographies.

Within market segmentation, the Semiconductor Manufacturing application segment is overwhelmingly the largest contributor due to the continuous technological refresh cycle and the stringent cleanliness requirements inherent to lithography and etching processes, consuming both angle and straight-through valve types in high volumes. By actuation, pneumatic valves command the largest installed base in automated factories for high-speed operation, though the share of motorized, sensor-equipped valves is rapidly expanding due to the demand for precise throttling control. The long-term outlook suggests continued high growth, driven not just by traditional applications but increasingly by emerging fields such as fusion energy research and advanced battery manufacturing technologies requiring stringent vacuum integrity and contamination avoidance features. Manufacturers are proactively investing in smart component development, integrating diagnostic electronics to satisfy the market’s rising expectation for predictive maintenance capability, positioning the industry for a technologically intensive future focused on maximizing process uptime and component longevity. The shift towards miniaturization and higher performance in electronic components necessitates even stricter vacuum standards, solidifying the market position of these specialized valves, particularly those designed for UHV environments.

AI Impact Analysis on High Vacuum Baffle Valve Market

User inquiries regarding AI's influence on the High Vacuum Baffle Valve Market primarily revolve around predictive maintenance, optimization of vacuum cycling processes, and the integration of smart sensors within valve systems. Key themes highlight the expectation that AI and Machine Learning (ML) will transform reactive maintenance into proactive scheduling, significantly reducing unexpected downtime in critical semiconductor fabrication lines where every minute of inactivity translates into substantial financial loss. Users are concerned with how existing valve infrastructure can be retrofitted with smart monitoring capabilities and what data streams (e.g., vibration, temperature differentials, actuation cycle times, and subtle changes in opening/closing force profiles) are most valuable for ML algorithms to predict potential component failure, such as seal degradation or mechanical fatigue in the baffle mechanism. Expectations center on AI optimizing pump-down sequences by dynamically adjusting valve opening and closing rates based on real-time pressure decay curves and gas load characteristics, thus increasing overall system throughput and energy efficiency, a crucial factor in reducing operational costs in large-scale facilities. The analytical power of AI allows for the complex correlation of slight changes in valve operational parameters with vacuum system health metrics that are often too subtle for human operators to discern manually, ensuring preemptive action is taken based on statistically robust models of failure probability.

There is also significant interest in using AI for quality control and process repeatability, specifically in analyzing vast amounts of process data to correlate minor valve performance deviations—such as slow response times or slight inconsistencies in sealing pressure—with immediate product quality metrics, enabling immediate calibration or replacement before defect batches occur. The ability of AI to model the thermal and mechanical stress on internal components, especially critical seals and bellows, provides valuable feedback for future valve design improvements aimed at maximizing Mean Time Between Failure (MTBF) under rigorous operational conditions. The underlying concern remains the high cost of implementation and the need for standardized data protocols across diverse vacuum system components manufactured by different vendors, posing a significant hurdle to seamless AI integration into legacy manufacturing environments. Furthermore, ensuring the reliability and security of the data collected, often sensitive operational information, necessitates robust cybersecurity measures and secure cloud or edge processing infrastructure. Despite these integration challenges, the competitive pressure in semiconductor manufacturing, demanding near-perfect uptime, is forcing major valve suppliers to prioritize AI and digital twin capabilities as standard offerings for their premium product lines, redefining the expected functionality beyond simple mechanical control.

- Predictive Maintenance Implementation: AI monitors valve actuation cycles, temperatures, and vibration signatures to forecast mechanical failures, minimizing unplanned system shutdowns by enabling scheduled, condition-based maintenance windows and optimizing resource allocation.

- Optimized Vacuum Cycling: Machine Learning algorithms dynamically adjust valve speed and position during pump-down and venting cycles based on real-time gas loads, enhancing throughput, reducing cycle time by up to 15%, and improving energy consumption efficiency compared to static control recipes.

- Automated Anomaly Detection: AI systems analyze sensor data streams to identify minute performance deviations indicative of seal leaks, internal contamination, or subtle pressure inconsistencies before they impact product yield in sensitive processes like sputtering or deposition, ensuring process stability.

- Enhanced Data Integration: AI platforms facilitate the standardization and fusion of operational data from baffle valves with other vacuum components (pumps, gauges, chambers), providing a holistic view of system health and allowing for complex system-level optimization strategies.

- Remote Diagnostics and Calibration: AI enables sophisticated remote troubleshooting, self-diagnosis, and automated calibration adjustments to maintain optimal valve performance, reducing the need for immediate physical intervention by highly specialized technicians and lowering MRO costs.

DRO & Impact Forces Of High Vacuum Baffle Valve Market

The dynamics of the High Vacuum Baffle Valve Market are shaped by a complex interplay of inherent growth drivers (D), market limitations (R), significant expansion opportunities (O), and overarching external impact forces. Key drivers include the relentless technological scaling in the semiconductor industry, specifically the move towards 3D NAND, advanced memory fabrication, and Extreme Ultraviolet (EUV) lithography, which demand ultra-high vacuum standards and highly precise gas handling, making reliable, low-contamination baffle valves indispensable for process integrity and contamination control. Further propulsion comes from the exponential growth of advanced vacuum coating applications in display technology (OLED/QLED, micro-LED) and the solar energy sector, requiring large-format, high-throughput valves. The global trend towards smart manufacturing (Industry 4.0) also acts as a driver, necessitating the adoption of advanced, sensor-equipped valves capable of providing real-time diagnostic data and seamless integration with factory automation systems. This demand for reliability under high duty cycles and corrosive environments continuously pushes the performance envelope for baffle valve technology, ensuring consistent investment in the sector.

Restraints largely center on the high initial capital expenditure required for sophisticated, high-reliability valves, particularly those engineered for ultra-clean UHV environments, and the extended sales cycles associated with qualifying components within stringent, risk-averse manufacturing protocols. The cost of materials, especially high-purity, low-outgassing stainless steels and specialized sealing compounds, contributes significantly to the high unit cost. Additionally, the technical complexity involved in integrating and maintaining these components, requiring specialized technical expertise in vacuum engineering and contamination control, often limits adoption in less mature industrial settings or places a premium on vendor support. The increasing prevalence of oil-free vacuum pump technologies (e.g., advanced turbopumps and dry pumps) slightly mitigates the historical need for dedicated oil-vapor baffle systems, though baffle valves remain crucial for particle control, pressure regulation, and thermal management. Furthermore, intense competition in the general industrial vacuum segment leads to price erosion for standard valve types, challenging profitability for manufacturers not focused on high-end specialized applications where performance outweighs cost.

Opportunities are abundant in the emerging fields of advanced energy technology and strategic national security applications. The development of advanced battery manufacturing, particularly solid-state battery technology, presents a substantial new vertical market requiring large, high-capacity vacuum systems utilizing complex valve arrangements for precise moisture and gas control. Significant global investment in fusion energy research (e.g., inertial and magnetic confinement fusion projects) requires massive, custom-designed, extremely robust UHV valves capable of operating under high radiation and challenging environmental conditions, presenting a high-margin, long-term opportunity niche. The strategic global focus on resilient supply chains also creates opportunities for manufacturers in North America and Europe to capture increased domestic demand due to government incentives encouraging regional manufacturing. Major impact forces include geopolitical trade tensions, which can disrupt global supply chains and shift manufacturing footprints, and intense regulatory pressure regarding material traceability, safety certifications, and compliance with environmental directives (like RoHS and REACH), requiring continuous investment in material and process compliance to maintain market access globally, particularly in sensitive sectors like medical and aerospace applications.

Segmentation Analysis

The High Vacuum Baffle Valve Market segmentation provides a crucial framework for understanding the diverse applications, technological requirements, and consumption patterns across various industrial sectors. This market is highly diversified based on product characteristics such as actuation mechanism, material construction, and valve geometry, which are tailored to meet specific process vacuum levels and contamination sensitivity needs. The most significant segment contributors are defined by their application in high-growth industries like microelectronics and advanced materials processing, where the specific function of the baffle valve—controlling differential pressure while minimizing contamination risk—is paramount. Analyzing these segments helps stakeholders identify core growth pockets, such as the increasing demand for stainless steel valves in corrosive environments and the preference for pneumatic actuation systems in high-throughput manufacturing lines. Understanding these segment dynamics is essential for strategic planning, allowing companies to tailor their product offerings, sales channels, and regional focus to maximize market penetration and capital expenditure returns. Furthermore, detailed segmentation reveals that while semiconductor applications drive volume and value, emerging niche segments like specialized R&D facilities often demand custom-engineered, ultra-high purity valves, presenting high-margin opportunities due to the rigorous specifications required for UHV compatibility and specialized operation.

Segmentation by valve geometry is critical: Angle Baffle Valves, due to their 90-degree bend, are excellent at trapping contaminants and particles and are often used near critical processes. Conversely, Straight-Through Baffle Valves are preferred in applications where maximum gas conductance and minimal flow resistance are necessary, typically connecting large pumping systems to chambers. The segmentation by material directly reflects the process environment; 316L Stainless Steel maintains dominance in chemically harsh or UHV environments due to its exceptional low outgassing and corrosion resistance. Aluminum alloys, however, are increasingly utilized in large, non-corrosive processes like PVD coating, where their lighter weight and cost-effectiveness provide operational advantages. The fastest-growing segment in actuation is Motorized/Electric, due to its ability to provide proportional control (throttling), essential for precise pressure ramping and maintaining tight tolerances in advanced deposition processes, replacing traditional on/off pneumatic functionality in sophisticated toolsets. Ultimately, the high vacuum baffle valve market is characterized by customization, where the intersection of material, geometry, pressure rating, and actuation mechanism defines the component selection for highly specific end-user processes.

- By Type: Angle Baffle Valves (90-degree flow path, optimized for contaminant trapping), Straight-Through Baffle Valves (linear flow, optimized for high conductance), Inline Baffle Valves, T-Baffle Valves (specialized geometries).

- By Material: Stainless Steel Valves (304L, 316L, High-Grade Alloys for chemical resistance), Aluminum Alloy Valves (Lightweight, cost-effective for large chambers), Special Alloy Valves (e.g., Titanium for extreme environmental compatibility).

- By Operation/Actuation: Manual Baffle Valves (cost-sensitive labs), Pneumatic Baffle Valves (high-speed, automated cycling), Motorized (Electric) Baffle Valves (precision throttling and control), Magnetic Levitation Actuation (ultra-high reliability, contamination-free).

- By Application: Semiconductor Manufacturing (Etch, PVD, CVD, ALD), Vacuum Coating Systems (Optical, Decorative, PV/Solar, Thin Films), Scientific Instruments and R&D (Mass Spectrometry, Particle Accelerators, Fusion Research), Aerospace and Defense (Environmental Testing), General Industrial Vacuum Processes.

- By Pressure Range: High Vacuum (HV, up to 10-7 Torr), Ultra-High Vacuum (UHV, 10-8 to 10-11 Torr), Extreme High Vacuum (XHV).

Value Chain Analysis For High Vacuum Baffle Valve Market

The value chain for the High Vacuum Baffle Valve Market initiates with the rigorous upstream process of specialized raw material sourcing. This demands extreme quality control in acquiring certified low-outgassing metals, predominantly 316L stainless steel and high-purity aluminum, from limited suppliers capable of meeting stringent metallurgical specifications concerning porosity, inclusion levels, and surface finish preparation. The manufacturing stage is capital-intensive, involving complex, multi-axis CNC machining, specialized welding (like electron beam welding for UHV models), and precision assembly conducted exclusively in certified cleanrooms (Class 10 or Class 100). The primary value addition at this stage stems from the proprietary ultra-cleaning processes, often involving multi-step chemical cleaning and high-temperature vacuum bake-outs, which are essential to achieve and certify the guaranteed low outgassing rates required for the most demanding applications. Quality assurance, including sophisticated helium leak detection and mechanical cycle testing, ensures the component's integrity, forming a critical, high-cost component of the upstream process.

The midstream segment involves integration, distribution, and commercialization. Large Original Equipment Manufacturers (OEMs) in the semiconductor and display tool sectors typically procure baffle valves via direct sales relationships, often requiring deep collaboration on customized specifications, mechanical and electrical integration, and specific qualification testing. This direct distribution model is crucial for high-volume, critical components. Conversely, smaller end-users, academic institutions, and the general MRO market are typically served by indirect channels, relying on specialized technical distributors and representatives who maintain local inventory, provide first-level technical support, and offer rapid replacement services. The efficiency of the logistics network is paramount, as baffle valves, having undergone extensive cleaning, must be meticulously packaged using vacuum-sealed, cleanroom-compatible materials and handled with extreme care to prevent contamination during transit, adding specialized requirements to the distribution process and increasing operational complexity compared to standard industrial components.

Downstream value realization is concentrated in the performance benefits delivered to the end-users: maximized production yield, minimized downtime, and enhanced process repeatability. Potential customers, spanning semiconductor fabs, advanced coating facilities, and high-energy physics labs, view these valves not merely as components but as vital guarantors of system purity and productivity. The downstream sector provides a stable, high-margin revenue stream through comprehensive aftermarket services, including maintenance contracts, rapid repair, refurbishment, and technology upgrades (e.g., sensor retrofits). The value chain is thus heavily skewed towards technical expertise and long-term partnership, where the manufacturer's ability to provide responsive, expert technical field support significantly influences customer retention and future purchasing decisions, making service quality a key differentiator that is often more important than the initial purchase price of the physical hardware itself. This technical dependency ensures that high vacuum baffle valve manufacturers are fundamentally integrated into the operational success of high-technology end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 940 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VAT Group, Pfeiffer Vacuum, Agilent Technologies, MKS Instruments, Leybold GmbH, ULVAC, Kurt J. Lesker Company, HVA LLC, Nor-Cal Products, Brooks Automation, V-Tex, Ikonisys, F&K Delvotec, MDC Vacuum Products, GNB Corporation, Fujikin Inc., Edwards Vacuum, Varian Medical Systems, Atlas Copco (Vacuum Technique), Inficon, AJA International, Swagelok, Hositrad Vacuum Components, Schunk Group, Telemark Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Vacuum Baffle Valve Market Key Technology Landscape

The core technological advancement in the High Vacuum Baffle Valve Market revolves around achieving and maintaining ultra-clean, contamination-free operation with enhanced mechanical reliability and longevity. A primary area of innovation focuses on actuator design; the market is seeing a progressive shift away from traditional bellows-sealed designs, which are prone to particle generation and eventual mechanical fatigue, towards highly advanced magnetic fluid seals or entirely magnetically coupled mechanisms. Magnetically coupled valves eliminate the need for dynamic seals in the vacuum path, drastically reducing internal particle shedding, minimizing potential leak sources, and allowing for substantially higher cycle counts (often exceeding one million cycles) before maintenance is required. This reliability is paramount in 24/7 semiconductor fabrication environments. Furthermore, manufacturers are continually optimizing the internal geometry of the baffle plates through sophisticated Computational Fluid Dynamics (CFD) modeling. This optimization maximizes gas conductance (throughput) while ensuring efficient molecular trapping of residual pump oils and particulate matter, a crucial balance required for both rapid pump-down and maintaining base pressure purity, leading to complex, proprietary internal vane designs that minimize flow turbulence.

Material science remains a critical technology frontier, particularly concerning sealing elements and construction alloys. Research is dedicated to developing ultra-low outgassing elastomers and high-performance metallic sealing surfaces, such as aluminum knife-edge seals or copper gaskets, specifically for Ultra-High Vacuum (UHV) applications where even minor gas release can compromise system performance. Advanced surface treatments are increasingly integral; processes like electropolishing, specific plasma cleaning routines, and proprietary inert coatings are applied to internal surfaces to reduce the effective surface area for adsorption and desorption of water vapor and atmospheric contaminants, leading to faster pump-down times and lower ultimate base pressures. This focus on surface preparation ensures the valve itself does not become a major source of contamination. Simultaneously, there is a burgeoning technological focus on integrating smart capabilities; next-generation baffle valves include embedded sensor arrays for non-intrusive diagnostics, measuring temperature profiles across the valve body, analyzing vibration frequencies, and precisely tracking mechanical stroke speed and position. These sensors are foundational for enabling AI-driven predictive maintenance strategies, providing real-time operational feedback to centralized control systems regarding valve health and impending failure modes.

The integration of digital communications, often leveraging protocols like EtherCAT or proprietary industrial Ethernet variants, allows these smart valves to function as integral components within the broader IoT (Internet of Things) framework of the manufacturing facility. This facilitates remote condition monitoring, real-time fault reporting, and remote calibration adjustments, significantly minimizing the need for manual inspection and maximizing equipment uptime. Furthermore, the development of specialized heating and cooling jackets integrated into the valve body allows for precise temperature management, which is essential for bake-out procedures (to remove adsorbed gases) or for chilling the baffle plate to enhance the condensation efficiency of volatile process byproducts, particularly critical in certain PVD and etching chemistries. The confluence of advanced mechanical engineering (magnetic coupling), material science (low outgassing polymers/metals), and digital integration (sensors/AI) defines the current state-of-the-art in high vacuum baffle valve technology, ensuring the components meet the stringent requirements of sub-10nm manufacturing nodes and other high-purity scientific applications by delivering unparalleled reliability and cleanliness performance.

Regional Highlights

- Asia Pacific (APAC): APAC commands the dominant market share due to its unparalleled concentration of advanced manufacturing capabilities, specifically in the semiconductor and flat panel display (FPD) sectors. Countries such as China, Taiwan, South Korea, and Japan continuously drive demand through sustained, aggressive capital investment in new fabrication plants and technological upgrades, often exceeding investment levels seen elsewhere globally. China, in particular, is witnessing rapid localization efforts in the vacuum technology supply chain, spurred by governmental support aimed at achieving technological self-sufficiency, leading to exceptionally high growth rates for mid-to-high-end vacuum components, including baffle valves suitable for 300mm wafer processing and large-area coating systems.

- North America: This region is characterized by technological intensity and high Average Selling Prices (ASPs), focusing on specialized, customized solutions for high-end R&D, aerospace, and defense applications. Key drivers include government-funded research facilities (e.g., particle physics laboratories) and the recent revitalization of domestic semiconductor manufacturing facilitated by legislative support (e.g., CHIPS Act), which mandates large-scale investment in new cleanroom infrastructure requiring high-specification UHV baffle valves. North American demand prioritizes advanced features, integration capabilities with complex control systems, and proven long-term reliability over sheer volume, driving innovation in magnetic coupling and smart monitoring technologies.

- Europe: Europe represents a mature and technologically sophisticated market, underpinned by strong industrial automation, high-precision engineering, and leading academic research in physics and material science. Demand is stable and driven by the automotive industry (vacuum coating for specialized components), specialized optics manufacturing, and major pan-European scientific collaborations (e.g., European Organization for Nuclear Research – CERN, ITER). European users place a high premium on sustainability, energy efficiency, and compliance with stringent environmental regulations (e.g., RoHS, REACH), pushing manufacturers toward eco-friendly actuation mechanisms and detailed material traceability, contributing to continuous product refinement.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions constitute emerging markets with concentrated demand derived primarily from the oil and gas sector (analytical instruments), expanding educational research infrastructure, and localized investments in sustainable energy projects (solar PV manufacturing). While current market size is relatively small, growth potential is significant as industrialization accelerates and technology transfer from global players increases. Demand here is often weighted towards cost-effective, robust valves suitable for general industrial vacuum applications, though high-specification valves are required for specialized analytical equipment acquisition and nascent aerospace programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Vacuum Baffle Valve Market.- VAT Group

- Pfeiffer Vacuum

- Agilent Technologies

- MKS Instruments

- Leybold GmbH

- ULVAC

- Kurt J. Lesker Company

- HVA LLC

- Nor-Cal Products

- Brooks Automation

- V-Tex

- Ikonisys

- F&K Delvotec

- MDC Vacuum Products

- GNB Corporation

- Fujikin Inc.

- Edwards Vacuum

- Varian Medical Systems

- Atlas Copco (Vacuum Technique)

- Inficon

- AJA International

- Swagelok

- Hositrad Vacuum Components

- Schunk Group

- Telemark Inc.

Frequently Asked Questions

Analyze common user questions about the High Vacuum Baffle Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a baffle valve in a high vacuum system and why is it essential?

The primary function is two-fold: to isolate sections of the vacuum system and, critically, to prevent the backstreaming of mechanical or diffusion pump fluids and particulate contaminants into the process chamber. This contamination control is essential for maintaining the high purity levels required for semiconductor yields and precise thin-film deposition.

How do the material types (Stainless Steel vs. Aluminum) affect the valve application?

Stainless steel (typically 316L) is preferred for applications requiring Ultra-High Vacuum (UHV), high temperatures, or exposure to corrosive process gases due to its superior chemical resistance and low outgassing properties. Aluminum alloys are chosen for large-area coating systems where lightweight construction, cost-efficiency, and better thermal conductivity for temperature control are prioritized.

Which type of actuation (Manual, Pneumatic, or Motorized) is favored in automated manufacturing environments?

Pneumatic actuation is most favored in high-throughput automated manufacturing due to its fast response speed, high cycling capability, and robustness. Motorized (electric) actuation is increasingly used where continuous, highly precise control over gas flow and pressure ramping is required, often integrated with smart factory control systems.

What role does Artificial Intelligence play in optimizing baffle valve performance?

AI is used primarily for predictive maintenance, analyzing sensor data (vibration, temperature, cycle time) to forecast potential component failures, thereby enabling scheduled replacements and minimizing costly unscheduled downtime. AI also optimizes vacuum cycling routines for faster throughput and greater energy efficiency.

Which regional market shows the highest growth potential for High Vacuum Baffle Valves?

Asia Pacific (APAC) exhibits the highest growth potential, driven by massive and ongoing investments in semiconductor fabrication facilities (Fabs) across China, Taiwan, and South Korea, coupled with significant expansion in advanced display (OLED) and solar photovoltaic manufacturing infrastructure.

What is the most significant restraint challenging the market's growth?

The most significant restraint is the extremely high initial capital expenditure required for high-specification, cleanroom-compatible valves, coupled with the rigorous and lengthy qualification cycles demanded by large OEMs, which poses barriers for new technological adoption and smaller manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager