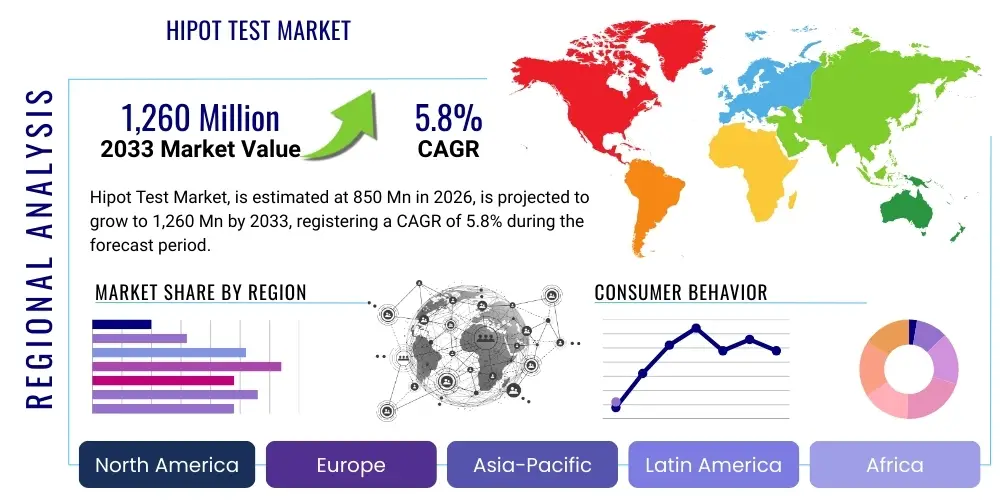

Hipot Test Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443056 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hipot Test Market Size

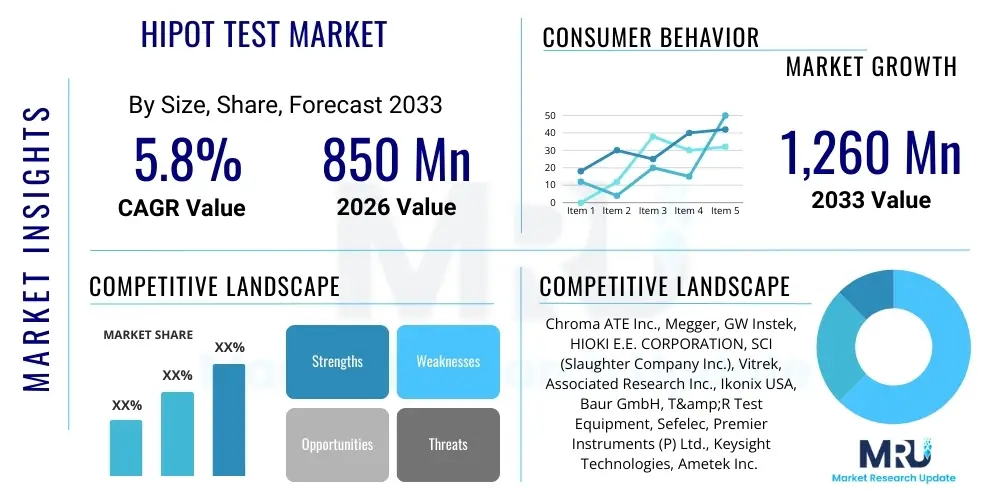

The Hipot Test Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating global focus on electrical safety compliance across diverse industrial sectors, particularly in high-voltage applications such as electric vehicle manufacturing, renewable energy infrastructure development, and advanced consumer electronics production. The implementation of increasingly stringent international safety standards, coupled with the rapid adoption of automated testing procedures in mass production environments, necessitates robust and reliable high potential (Hipot) testing equipment. Market growth is further underpinned by technological advancements that allow for more precise, faster, and integrated testing solutions capable of handling complex insulation systems and mixed-signal components, ensuring product integrity and mitigating catastrophic failures associated with insulation breakdown.

The valuation reflects not only the sales of new testing equipment—including AC, DC, and AC/DC combination testers—but also the associated software, calibration services, and accessories required to maintain operational compliance. Geographically, the market expansion is highly influenced by industrial output shifts, with the Asia Pacific region acting as a primary growth engine due to its dominance in electronics manufacturing and the burgeoning electric vehicle ecosystem. Companies are investing heavily in developing portable and multi-functional testers that can integrate seamlessly into existing production lines, thereby enhancing efficiency and reducing overall testing cycle times. The transition towards higher operating voltages in systems like high-power data centers and grid-scale energy storage solutions creates a perpetual demand for advanced Hipot testers capable of evaluating insulation withstand capabilities under extreme conditions, validating the strong growth trajectory anticipated through 2033.

Hipot Test Market introduction

The Hipot Test Market revolves around the manufacturing, distribution, and utilization of electrical safety testing equipment designed to verify the adequacy of electrical insulation for devices and components operating at high voltages. Hipot, short for High Potential, testing is a fundamental non-destructive preventive maintenance and quality assurance procedure that assesses whether the insulation of a component or product is robust enough to withstand voltage spikes and surges far exceeding normal operating conditions, thereby guaranteeing operator safety and long-term product reliability. These testers apply a high voltage (AC or DC) across the insulation barrier and monitor leakage current to detect weak points, insufficient creepage, clearance distances, or defects like pinholes and contaminants. Major applications span critical infrastructure, including automotive components, aerospace systems, medical devices, power distribution equipment, and general consumer electronics, where insulation failure could lead to electrocution or fire hazards. The core benefit of employing dedicated Hipot testing apparatus is ensuring rigorous compliance with mandatory regulatory bodies such as UL, CE, TUV, and IEC, preventing costly recalls, minimizing liability, and establishing brand trust through verifiable safety metrics.

Product descriptions within this market segment range from benchtop, manually operated testers used in laboratory settings to fully automated, integrated systems deployed on high-speed assembly lines, often incorporating features like programmable testing sequences, automated data logging, and network connectivity for centralized reporting. The equipment typically measures insulation resistance, dielectric breakdown voltage, and dielectric withstand voltage, providing comprehensive insights into insulation integrity. Driving factors for market growth are profoundly linked to global trends in electrification, particularly the exponential rise in Electric Vehicle (EV) production, which relies heavily on high-voltage battery packs and powertrains requiring stringent Hipot checks. Furthermore, the expansion of smart grid technologies, renewable energy installations (solar and wind power), and the continuous innovation in compact, powerful electronic devices necessitate more sophisticated and frequent insulation testing. Regulatory pressure requiring zero-defect output in safety-critical applications ensures that Hipot testing remains an indispensable phase in the manufacturing lifecycle, pushing demand upward globally.

Hipot Test Market Executive Summary

The Hipot Test Market Executive Summary reveals a landscape characterized by robust technological integration, significant regional divergence in demand profiles, and competitive pressure centered on automation and data analytics capabilities. Business trends highlight a pronounced shift from manual, analog testing devices toward digital, integrated, and modular solutions that support Industry 4.0 paradigms, featuring capabilities like remote calibration, cloud-based data storage, and integration with Manufacturing Execution Systems (MES). Key players are focusing their research and development efforts on creating hybrid testers capable of performing multiple safety tests (Hipot, Ground Bond, Leakage Current) simultaneously, optimizing testing time and floor space. Mergers and acquisitions are common strategies deployed by larger entities seeking to consolidate expertise in high-voltage component testing, particularly in sectors tied to rapidly evolving standards, such as power electronics used in 5G infrastructure and high-efficiency motor drives. The market also observes an increasing demand for rental and leasing services for high-end testers, especially among small to mid-sized enterprises (SMEs) that require intermittent access to advanced safety validation tools without the prohibitive capital expenditure.

Regionally, the market is decisively bifurcated between established regulatory compliance markets and rapid manufacturing hubs. Asia Pacific (APAC) dominates the consumption of Hipot testers, fueled by massive production volumes in China, South Korea, Japan, and Taiwan related to consumer electronics, automotive components, and battery manufacturing. This region primarily drives demand for high-throughput, automated systems. Conversely, North America and Europe, while having lower production volumes compared to APAC, exhibit higher demand for premium, high-precision, and certified testing equipment required for aerospace, medical device production, and critical infrastructure maintenance, where failure tolerance is near zero. Regional trends also show an acceleration in localized regulatory requirements that necessitate region-specific equipment certifications, influencing product adaptation strategies. Segment trends underscore the rapid growth of the AC/DC combination tester segment due to its versatility, and a sustained, high-value demand for testers dedicated to high-voltage component testing within the burgeoning Electric Vehicle (EV) and energy storage sectors, signifying a critical pivot in end-user focus from traditional electronics to high-power applications.

AI Impact Analysis on Hipot Test Market

Common user questions regarding AI's impact on the Hipot Test Market frequently center on themes of enhanced measurement accuracy, predictive maintenance capabilities, and the potential for completely autonomous testing environments. Users are primarily concerned with how AI algorithms can interpret complex, multivariate test data—such as minor leakage current fluctuations or partial discharge phenomena—which might be missed by traditional threshold-based analyses. They inquire whether machine learning can predict insulation failure before it occurs, moving testing from simple pass/fail categorization to sophisticated reliability forecasting. Furthermore, there is significant interest in AI's role in optimizing testing parameters dynamically based on component history or environmental factors, thereby accelerating testing throughput without compromising precision. The prevailing expectation is that AI integration will mitigate human error in test setup, streamline compliance reporting by automating data categorization, and ultimately reduce overall operational costs associated with safety testing, positioning AI not just as a tool for analysis but as a core component of future safety verification protocols.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning the Hipot Test Market from static quality control (QC) procedures to dynamic, predictive quality assurance (QA) frameworks. AI algorithms are being deployed to analyze vast datasets generated by high-volume testing, enabling the identification of subtle patterns indicative of potential long-term insulation degradation that standardized pass/fail criteria often overlook. This advanced pattern recognition capability drastically improves the reliability assessment of manufactured products, particularly complex systems like EV battery modules or high-power transformers. By correlating small variances in insulation resistance, leakage current, and temperature data with eventual failure points, AI systems facilitate proactive intervention in the manufacturing process, allowing engineers to adjust material specifications or assembly processes before defects proliferate.

Moreover, AI is pivotal in automating the decision-making process within sophisticated testing sequences. Automated testing rigs equipped with machine learning can dynamically adjust test voltages, dwelling times, and reporting granularity based on the specific material composition and geometric properties of the Device Under Test (DUT), maximizing test efficiency and reducing the risk of overstressing viable insulation. The long-term impact involves the development of self-calibrating and self-optimizing Hipot testers, which minimize required human oversight, thus addressing labor cost concerns and enhancing overall test integrity across global manufacturing facilities. This shift towards intelligent testing is crucial for industries transitioning to highly integrated smart factories where continuous, verifiable safety data streams are essential for operational continuity and regulatory adherence.

- Enhanced Defect Detection: AI algorithms analyze minor leakage current anomalies and partial discharge signatures, identifying defects that conventional threshold limits might ignore.

- Predictive Failure Modeling: Machine learning predicts the likelihood and timeline of insulation breakdown based on historical test data and operational variables.

- Automated Parameter Optimization: AI dynamically adjusts test voltage ramp rates and duration based on component type, improving test efficiency and minimizing non-destructive testing stress.

- Reduced False Positives/Negatives: Sophisticated data correlation minimizes erroneous results, leading to more accurate quality control decisions and higher production yields.

- Streamlined Compliance Reporting: AI automates the categorization, structuring, and auditing of test data, ensuring rapid and compliant documentation suitable for global regulatory standards.

- Integration with Smart Manufacturing: AI-enabled testers communicate directly with MES and Enterprise Resource Planning (ERP) systems, providing real-time quality feedback into the production chain.

DRO & Impact Forces Of Hipot Test Market

The dynamics of the Hipot Test Market are shaped by a powerful interplay between compelling regulatory imperatives and significant technological hurdles, which collectively define the trajectory for both growth and operational constraints. Drivers are primarily fueled by global mandates for electrical safety and energy transition initiatives, particularly the widespread integration of high-voltage components in renewable energy systems and the burgeoning Electric Vehicle (EV) sector. These sectors require zero-tolerance for insulation failure, creating non-negotiable demand for accurate and rigorous Hipot testing. Opportunities lie in the technological advancements enabling portable, high-frequency testing, and the integration of IoT for remote monitoring and diagnostics, which expand the utility of Hipot testers beyond factory floors into field service and maintenance applications. However, these positive forces are mitigated by serious restraints, including the high capital investment required for automated, high-precision equipment, coupled with the inherent technical complexity and risk of damage to the Device Under Test (DUT) if testing protocols are incorrectly applied. The balance of these forces dictates market profitability and investment strategies, especially concerning the adoption pace of next-generation digital testing platforms.

Key drivers include the global harmonization of electrical safety standards (e.g., IEC 61010-1, UL 61010-1), which mandate comprehensive dielectric withstand testing for all electrical apparatus sold internationally. Furthermore, the massive infrastructural investment in high-voltage DC (HVDC) transmission lines and grid modernization projects globally necessitates continuous high-level insulation testing for maintenance and quality assurance. Restraints, conversely, encompass the scarcity of skilled labor capable of accurately interpreting complex partial discharge readings and managing sophisticated automated test systems, leading to operational bottlenecks. Another significant restraint is the cyclical nature of capital expenditure in manufacturing sectors; economic downturns often lead to delayed investments in new testing equipment. The impact forces are currently skewed toward market growth due to the overwhelming global commitment to vehicle electrification and sustainable energy, sectors where Hipot testing is non-negotiable for public safety and operational longevity. Opportunities are maximized by vendors who can successfully leverage digital platforms to offer subscription-based software services for data analysis and compliance management, creating recurring revenue streams and reducing the entry barrier for smaller users seeking advanced analytical capabilities.

The strongest impact force currently accelerating market demand is the transition to 800V architectures in high-performance EVs, requiring specialized Hipot testers designed to handle significantly higher DC voltages and maintain precision under extreme thermal and environmental conditions encountered in automotive assembly lines. This demand segment not only drives equipment sales but also fuels innovation in sensing technologies and data integrity systems. Conversely, the high cost of maintenance and calibration for precision Hipot testing equipment acts as a persistent dampener, especially in cost-sensitive regional markets. Overall, the market remains highly resilient due to its essential nature in preventing catastrophic failures. Companies that focus on user-friendly interfaces, automated calibration checks, and robust data security features are best positioned to capitalize on the sustained global push for verifiable electrical safety.

Segmentation Analysis

The Hipot Test Market is systematically segmented based on criteria such as the type of test applied, the application environment, and the end-use industry utilizing the equipment. This segmentation provides a granular view of market dynamics, highlighting key growth areas and varying procurement preferences across different sectors. The primary segmentation revolves around the Test Type, distinguishing between AC (Alternating Current) Hipot testers, DC (Direct Current) Hipot testers, and combination AC/DC units. DC testers are typically favored for high-capacitance components like cables and capacitors, while AC testers are standard for general household appliances and low-capacitance products. Combination testers offer flexibility and are increasingly preferred in research and development settings and by third-party testing labs. Further segmentation by Application covers component testing (e.g., transformers, relays), system testing (e.g., panels, assemblies), and field maintenance testing, each requiring specialized equipment characteristics, such as portability for field units versus high-speed automation for component testing on production lines.

The End-Use Industry segmentation is crucial for understanding demand elasticity and regulatory compliance drivers. Key industries include Automotive and Transportation (driven heavily by EVs), Electronics and Electrical Manufacturing (consumer goods, semiconductors), Energy and Utilities (power generation, transmission), and Aerospace and Defense (high-reliability, custom systems). Each industry is governed by unique safety standards (e.g., ISO for automotive, specific MIL-STD for defense), influencing the necessary features and certification requirements of the Hipot testers purchased. The trend toward modular and customizable testing platforms allows vendors to address these diverse segment needs more effectively, offering software packages tailored to specific industry compliance requirements. For instance, automotive manufacturers prioritize high-speed, automated systems with seamless traceability, whereas utility companies require highly rugged, portable DC testers suitable for remote outdoor cable testing, illustrating the specialized nature of demand across the segments.

- By Test Type:

- AC Hipot Testers

- DC Hipot Testers

- AC/DC Combination Hipot Testers

- Insulation Resistance (IR) Testers (often integrated)

- By Voltage Range:

- Low Voltage (Up to 5 kV)

- Medium Voltage (5 kV to 50 kV)

- High Voltage (Above 50 kV)

- By Operation Mode:

- Manual/Benchtop Testers

- Automated/Programmable Systems

- Portable/Field Testers

- By Application:

- Component Testing (e.g., Transformers, Motors, Coils)

- System/Assembly Testing (e.g., Wiring Harnesses, Control Panels)

- Cable Testing and Diagnostics

- Research and Development (R&D)

- By End-Use Industry:

- Electronics and Electrical Manufacturing

- Automotive and Transportation (Electric Vehicles)

- Energy and Utilities (Power Grid, Renewables)

- Aerospace and Defense

- Medical Devices

- Industrial Machinery

Value Chain Analysis For Hipot Test Market

The Value Chain for the Hipot Test Market begins with upstream analysis, focusing on the suppliers of critical electrical and electronic components necessary for manufacturing the test equipment itself. These foundational components include high-precision voltage sources, sensitive current measurement circuitry (microammeters), microprocessors for control and data logging, robust relays and switches for high voltage handling, and specialized insulating materials for test probes and internal circuitry. Key upstream challenges involve securing a reliable supply of high-linearity amplifiers and analog-to-digital converters (ADCs) crucial for accurate leakage current measurement, especially as testing requirements become more stringent (measuring picoamperes). Price fluctuations and technological obsolescence of semiconductor components directly impact the manufacturing cost and final price of Hipot testers. Successful manufacturers maintain strong, long-term relationships with specialized component vendors to ensure supply chain resilience and component quality, which is critical given the safety-critical nature of the final equipment.

The midstream segment involves the core activities of the Hipot test equipment manufacturers. This phase encompasses research and development (R&D) focused on miniaturization, increased automation, software integration (including AI/ML features for diagnostics), and compliance with evolving global safety standards. Manufacturing involves stringent calibration and quality control processes to ensure the accuracy and stability of high voltage output and current measurement capabilities. Downstream analysis focuses on the distribution channels and the end-user interaction. Distribution is highly specialized, often relying on direct sales teams for major industrial accounts (e.g., automotive OEMs) that require custom integration and specialized training. Indirect channels, such as authorized distributors and technical resellers, are essential for reaching SMEs and geographically dispersed customers. These distributors often provide localized calibration, repair services, and technical support, adding significant value and acting as a bridge between the manufacturer and the end-user.

The final stage of the value chain involves service and support, which is a major revenue stream for leading players. This includes mandatory annual calibration services, software updates for compliance reporting, application support, and comprehensive training programs for maintenance personnel. The shift towards connected testers utilizing IoT protocols means that data and software services—including cloud storage for test results and remote diagnostic capabilities—are increasingly integrated into the product offering, moving the model towards a service-centric approach. Efficient distribution channels, coupled with robust aftermarket service offerings, are critical competitive differentiators, ensuring that the end-users—ranging from high-volume manufacturers to field service engineers—can maintain continuous regulatory compliance and maximize equipment uptime. This integrated approach ensures customer loyalty and captures the recurring revenue associated with necessary calibration and software maintenance.

Hipot Test Market Potential Customers

The potential customer base for the Hipot Test Market is expansive and highly specialized, encompassing any industrial entity involved in the design, manufacture, installation, or maintenance of electrical products where insulation integrity is paramount for operational safety and regulatory compliance. The primary consumers are Original Equipment Manufacturers (OEMs) across sectors such as Automotive, Medical Devices, and Consumer Electronics. Within the automotive industry, the surging production of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) makes them critical buyers, specifically requiring advanced DC Hipot testers for battery packs, charging systems, and high-voltage harnesses. These customers demand highly automated, fast, and networked testing systems capable of integration into high-volume production lines. Secondly, the Electronics and Electrical Manufacturing sector, including producers of switching power supplies, electric motors, transformers, and wiring harnesses, represents a foundational customer segment, relying on Hipot testers to ensure compliance before product launch and shipment, thereby mitigating recall risks.

Another significant customer segment is the Energy and Utilities sector, which includes power generation companies (especially renewable energy developers like solar and wind farms) and utility companies responsible for transmission and distribution infrastructure. These customers require high-voltage, often portable, DC Hipot testers for cable fault detection, maintenance testing of transformers, and substation components, emphasizing ruggedness and accuracy under field conditions. Furthermore, independent third-party testing laboratories and calibration houses constitute a specialized, high-value customer group. These labs serve multiple industries, requiring a diverse range of highly accurate, certified AC/DC combination testers to fulfill various regulatory certification requirements for client products. As global regulations become more complex, the reliance on these labs and, consequently, their demand for certified, high-end testing equipment continues to rise, ensuring robust and sustained market demand from these service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chroma ATE Inc., Megger, GW Instek, HIOKI E.E. CORPORATION, SCI (Slaughter Company Inc.), Vitrek, Associated Research Inc., Ikonix USA, Baur GmbH, T&R Test Equipment, Sefelec, Premier Instruments (P) Ltd., Keysight Technologies, Ametek Inc. (Compliance Test Solutions), Kikusui Electronics Corp., Adwelt, Zes Zimmer, EATON Corporation, High-Volt Test Systems, Shanghai Mairui Electrical Equipment Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hipot Test Market Key Technology Landscape

The technological landscape of the Hipot Test Market is currently dominated by advancements focused on enhancing precision, automation, and data connectivity. The core technology remains the generation and accurate measurement of high voltage (AC, DC, or impulse) applied to the Device Under Test (DUT), coupled with ultra-sensitive current sensing circuitry capable of detecting leakage currents in the microampere and picoampere ranges. Key innovations include the development of wide-bandgap (WBG) semiconductor components, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN), within the internal high-voltage switching power supplies of the testers. This adoption allows for significantly more compact, lightweight, and energy-efficient testers capable of generating higher voltages and more stable outputs with reduced harmonic distortion, crucial for accurate dielectric measurements. Furthermore, the convergence of AC and DC testing capabilities into single, integrated benchtop units has streamlined laboratory operations, replacing the need for separate equipment, saving space, and simplifying compliance adherence across mixed component types.

A major technological pivot is the rapid proliferation of automated testing platforms integrated with industrial communication protocols such as Ethernet/IP, Profibus, and SCADA systems. These programmable systems feature multi-channel scanning capabilities, enabling manufacturers to test numerous points simultaneously on complex products like wiring harnesses or control panels, dramatically reducing test cycle times. Software is now a critical differentiator, providing features like integrated compliance libraries (pre-set test routines for specific UL or IEC standards), automated data logging with timestamps and serial number tracking, and sophisticated graphical user interfaces for intuitive test sequence programming. The rise of partial discharge (PD) detection technology is another vital area, especially for high-voltage cable and transformer testing. Modern Hipot testers are often integrated with advanced PD monitoring modules, utilizing specialized sensors and sophisticated signal processing algorithms to detect and locate insulation micro-defects before they evolve into full breakdown, moving beyond simple pass/fail testing towards detailed diagnostic analysis.

The most forward-looking technological trend involves the deployment of IoT and cloud-based solutions for remote asset management and predictive maintenance. Testers are now designed with network connectivity to facilitate centralized data management, allowing manufacturers operating multiple facilities globally to standardize testing protocols and audit results seamlessly. Remote calibration verification and diagnostics, powered by cloud connectivity, reduce downtime and maintenance costs. Furthermore, the increased focus on safety mandates the use of advanced safety interlocks, often utilizing light curtains or safety mats integrated directly with the tester’s control system, ensuring that high voltage cannot be applied unless the DUT is safely enclosed and secured. This combination of WBG power electronics, integrated automation, advanced diagnostics (PD), and connectivity (IoT/Cloud) defines the competitive edge in the modern Hipot test equipment landscape, pushing boundaries in speed, precision, and usability.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Electrification

The Asia Pacific region maintains the largest market share and exhibits the highest growth rate globally for Hipot test equipment, primarily driven by the region's immense contribution to global electronics, automotive, and semiconductor manufacturing output. Countries like China, South Korea, Japan, and Taiwan house the majority of the world's production facilities for consumer electronics and electric vehicle components, where stringent safety testing is mandatory for export to Western markets. The massive scale of manufacturing in APAC necessitates the widespread adoption of high-throughput, fully automated Hipot testing systems capable of continuous operation with minimal human intervention. Furthermore, government policies supporting massive investments in renewable energy infrastructure, particularly solar power generation and large-scale battery energy storage systems, fuel significant demand for medium to high-voltage DC testers used for cable and component quality control during installation and commissioning.

India and Southeast Asian nations are emerging as secondary manufacturing hubs, attracting foreign investment and expanding their domestic production capabilities, which further propels the regional market growth. The competitive nature of the APAC manufacturing environment means buyers prioritize cost-effectiveness and high reliability, pushing local and international vendors to offer robust equipment at competitive price points. Regulatory compliance, driven by the desire to meet global safety standards (e.g., CE, UL) to access lucrative North American and European markets, ensures sustained demand for certified and traceable Hipot testing solutions across the electronics and automotive supply chains within the region.

- North America: Focus on Aerospace, Medical, and High-Precision R&D

North America, encompassing the United States and Canada, represents a mature market characterized by high demand for premium, high-precision, and technologically advanced Hipot testing equipment. While manufacturing volumes are lower compared to APAC, the high-value sectors such as aerospace and defense, certified medical devices, and advanced research and development (R&D) facilities create a steady need for specialized testers. Regulatory adherence is extremely strict in these sectors, leading to a strong preference for US-based or certified European manufacturers known for superior accuracy, comprehensive data traceability, and robust service support. The rapid expansion of electric vehicle R&D and manufacturing capacity, particularly in battery technology and charging infrastructure, acts as a significant market driver, requiring specialized high-voltage testing solutions tailored to complex power electronics.

The market trend in North America emphasizes software capabilities, integration with laboratory information management systems (LIMS), and secure, cloud-based data archiving to meet strict documentation requirements from bodies like the FDA and FAA. Furthermore, the region is a leader in adopting specialized high-end technologies, such as integrated Partial Discharge (PD) analysis features, especially for testing critical components destined for high-reliability applications, thereby maintaining a leading position in expenditure per unit of equipment and driving technological innovation among vendors.

- Europe: Stringent Safety Standards and Energy Transition

The European market is heavily influenced by the European Union’s stringent safety directives (e.g., Low Voltage Directive, Machinery Directive) and the robust commitment to environmental and energy transition goals. This necessitates mandatory and regular Hipot testing across numerous industries, ensuring high standards of electrical safety and operational integrity. Germany, France, and the UK are major consumers, particularly in the industrial machinery, high-speed rail, and automotive sectors. The aggressive push toward renewable energy, particularly offshore wind power and centralized HVDC transmission, drives significant demand for specialized, high-voltage AC and DC test sets used for installation, commissioning, and periodic maintenance of critical infrastructure assets.

The European market shows a strong preference for locally manufactured or certified equipment, emphasizing accuracy, longevity, and adherence to ISO quality standards. Vendors in this region often focus on providing integrated solutions that combine Hipot, ground bond, and leakage current testing into compact, modular systems for greater efficiency on the factory floor. Furthermore, due to the high labor costs, there is a persistent demand for highly automated systems that minimize manual intervention and integrate seamlessly with existing smart factory setups. Aftermarket services, including local calibration and rapid repair, are critical factors in purchasing decisions within this compliance-driven regional market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hipot Test Market.- Chroma ATE Inc.

- Megger

- GW Instek

- HIOKI E.E. CORPORATION

- SCI (Slaughter Company Inc.)

- Vitrek

- Associated Research Inc.

- Ikonix USA

- Baur GmbH

- T&R Test Equipment

- Sefelec

- Premier Instruments (P) Ltd.

- Keysight Technologies

- Ametek Inc. (Compliance Test Solutions)

- Kikusui Electronics Corp.

- Adwelt

- Zes Zimmer

- EATON Corporation

- High-Volt Test Systems

- Shanghai Mairui Electrical Equipment Co.

Frequently Asked Questions

Analyze common user questions about the Hipot Test market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between AC and DC Hipot testing, and when should each be used?

AC Hipot testing uses alternating current and is typically preferred for testing general electronic products and appliances with low capacitance, as it simulates operating conditions and detects insulation weaknesses that fail under repeated stress. DC Hipot testing uses direct current and is generally favored for testing high-capacitance components like cables, motors, and capacitors, as it minimizes charging current effects, allowing for more accurate leakage current measurement. DC testing is also widely used in the rapidly growing Electric Vehicle (EV) battery and powertrain sector due to the high-voltage DC systems involved.

How do global regulatory standards influence the design and procurement of Hipot testing equipment?

Global regulatory bodies such as IEC (International Electrotechnical Commission), UL (Underwriters Laboratories), and regional mandates (e.g., CE marking in Europe) establish the specific voltage levels, ramp rates, dwell times, and maximum leakage current thresholds required for product certification. These standards directly mandate the necessary precision, voltage range, and safety features incorporated into Hipot testers. Manufacturers prioritize equipment that offers programmable compliance testing routines and automated, tamper-proof data logging to simplify audit trails and demonstrate adherence to multiple international standards simultaneously.

What technological advancements are driving the shift towards automated Hipot testing systems?

The key drivers for automation include the need for faster testing cycles in high-volume manufacturing, the requirement for seamless integration with Industry 4.0 systems, and the implementation of AI/ML for advanced diagnostics. Automated systems utilize multi-channel scanners, robotic handling, and integrated software platforms that manage test sequences, data archiving, and compliance reporting without manual intervention. This automation significantly reduces operator variability, increases throughput, and ensures objective quality control across high-speed assembly lines, particularly in the automotive and consumer electronics sectors.

What role does Partial Discharge (PD) analysis play in modern Hipot testing?

Partial Discharge (PD) analysis moves beyond basic pass/fail Hipot testing by detecting localized electrical discharges within the insulation system that do not necessarily cause immediate breakdown but indicate incipient defects or voids. Integrated PD analysis modules in advanced Hipot testers provide diagnostic information about the health of the insulation (especially for high-voltage cables and transformers), allowing maintenance teams to preemptively identify and repair degradation before complete catastrophic failure occurs, thereby enhancing long-term system reliability.

What are the primary factors affecting the cost and return on investment (ROI) for advanced Hipot testers?

The cost of advanced Hipot testers is primarily influenced by the maximum voltage output capacity, the level of measurement precision (especially leakage current sensitivity), and the degree of automation and software integration (e.g., data logging, network connectivity). ROI is realized through reduced manual labor costs, minimized product liability risks due to ensured safety compliance, and decreased production waste resulting from accurate, non-destructive failure detection early in the manufacturing cycle. Premium, automated systems offer faster ROI due to superior throughput and reduced operational error rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager