Home Appliance Color Coated Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441855 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Home Appliance Color Coated Sheet Market Size

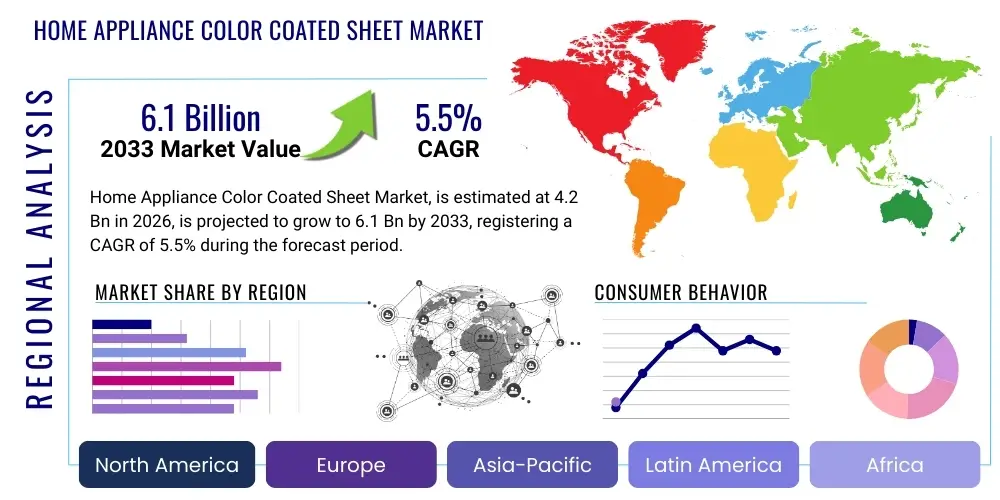

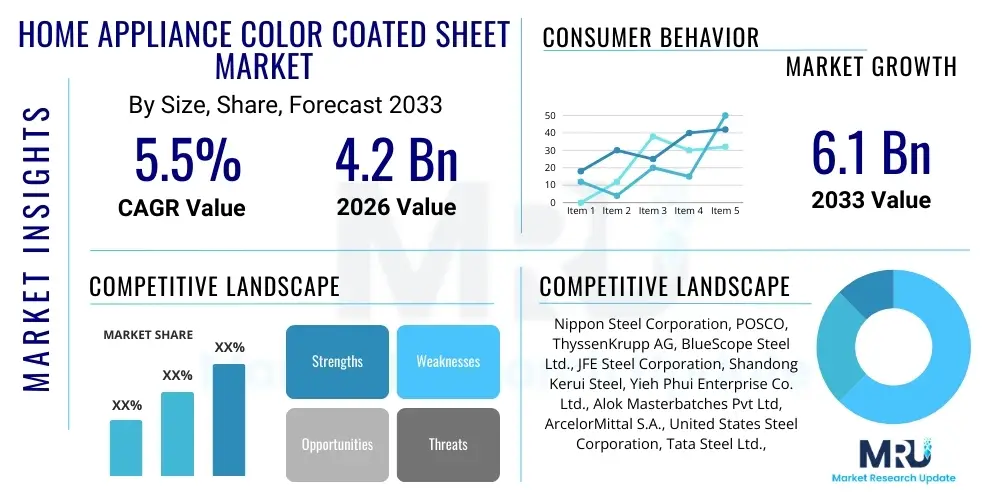

The Home Appliance Color Coated Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Home Appliance Color Coated Sheet Market introduction

The Home Appliance Color Coated Sheet Market encompasses the production and supply of pre-painted or pre-finished metal sheets primarily utilized in the external casings and internal components of white goods and major appliances. These sheets, typically made of galvanized steel or aluminum, undergo a coil coating process where organic coatings, such as polyester (PE), polyurethane (PU), or polyvinylidene fluoride (PVDF), are applied, cured, and sometimes laminated. This specialized material serves a dual purpose: providing aesthetic appeal through a wide range of colors and finishes, and offering crucial protection against corrosion, abrasion, and chemicals, thereby extending the lifespan and maintaining the integrity of appliances such as refrigerators, washing machines, microwaves, and air conditioning units.

The core product offerings within this market include Pre-Coated Metal (PCM) and Vinyl Coated Metal (VCM). PCM sheets offer superior hardness and cost-effectiveness, making them standard for high-volume appliance manufacturing. Conversely, VCM, often featuring a decorative film laminated onto the metal substrate, provides enhanced decorative flexibility and fingerprint resistance, appealing to the premium segment seeking sophisticated aesthetics. The continuous advancements in coating technology focus on achieving higher gloss retention, improved scratch resistance, and incorporating functional features such as anti-bacterial or easy-to-clean surfaces, aligning with evolving consumer demands for durable and hygienic appliances.

Market growth is predominantly driven by global urbanization, rising disposable incomes in emerging economies, and the continuous innovation within the appliance manufacturing sector, particularly the shift towards energy-efficient and aesthetically pleasing smart appliances. Key benefits derived from using these coated sheets include manufacturing efficiency (as painting is done upstream, reducing downstream processing costs for OEMs), enhanced product durability, and compliance with stringent environmental regulations, particularly concerning VOC (Volatile Organic Compounds) emissions, as the coil coating process is significantly cleaner than post-painting operations. These factors collectively establish color coated sheets as an indispensable material in modern home appliance production.

Home Appliance Color Coated Sheet Market Executive Summary

The Home Appliance Color Coated Sheet Market is characterized by robust growth, primarily fueled by the accelerating production of consumer electronics and white goods in Asia Pacific, which serves as the global manufacturing hub. Business trends indicate a strong focus on sustainability, pushing manufacturers to develop and adopt eco-friendly, chrome-free pretreatment processes and low-VOC coating systems. Furthermore, there is a pronounced shift towards premiumization, demanding coatings that mimic high-end materials like brushed metal or glass, driving innovation in laminated and textured VCM sheets. Strategic partnerships between coil coating specialists and major appliance original equipment manufacturers (OEMs) are crucial for customized color development and supply chain stability, influencing market competitive dynamics significantly.

Regionally, Asia Pacific (APAC) dominates the market share due to the presence of large-scale manufacturing operations in countries like China, South Korea, and India, catering not only to domestic demand but also to global export markets. Europe and North America, while exhibiting slower volume growth, drive innovation in high-performance and specialty coatings, especially those mandated by strict regional environmental standards. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, characterized by increased infrastructural development and rising middle-class consumption, stimulating demand for standard and mid-range appliance models utilizing cost-effective PCM solutions.

Segment trends reveal that the refrigeration application segment maintains the largest market share, owing to the massive volume of units produced globally and the necessity for highly durable, temperature-resistant, and aesthetically pleasing exterior panels. Material segmentation shows that galvanized steel remains the primary substrate due to its strength and cost advantages, while polyester coatings are the most widely used type due to their excellent balance of price, performance, and versatility. Future growth is anticipated to be particularly strong in the segment of functional coatings, including those providing anti-condensation or easy-to-clean properties, directly addressing core consumer pain points in appliance maintenance and hygiene.

AI Impact Analysis on Home Appliance Color Coated Sheet Market

User queries regarding AI’s influence in this sector primarily revolve around optimizing manufacturing efficiency, enhancing product quality consistency, and predicting raw material volatility. Users frequently ask: "How can AI reduce defects in the coil coating line?", "Can machine learning predict the optimal curing parameters for new coating formulations?", and "What role does AI play in forecasting customized color demand for appliance OEMs?" The analysis reveals a clear expectation that AI will transition the traditional, capital-intensive coating process into a highly data-driven and predictive manufacturing environment, minimizing waste and accelerating the introduction of advanced materials. The core themes include quality control automation, predictive maintenance of expensive coating machinery, and sophisticated demand and supply chain management.

The primary direct impact of Artificial Intelligence and Machine Learning (ML) is observed in the optimization of the coil coating process itself. AI algorithms are deployed to analyze vast datasets collected from sensors along the coating line—monitoring parameters such as coating thickness, curing oven temperature profiles, and paint viscosity in real-time. This predictive analytics capability allows operators to preemptively adjust machine settings to maintain stringent quality tolerances, thereby significantly reducing material waste associated with off-specification coils. Furthermore, ML models are becoming essential tools for rapid color matching and formulation, drastically cutting the time needed to develop and approve new custom colors requested by appliance manufacturers, improving market responsiveness.

Beyond the manufacturing floor, AI significantly enhances supply chain resilience and strategic procurement. Given that the cost structure of color coated sheets is highly sensitive to fluctuations in steel prices and chemical inputs (resins, pigments), AI-driven forecasting models provide superior accuracy in predicting future raw material costs and availability. This allows major sheet manufacturers to optimize inventory levels and hedge procurement strategies effectively. Moreover, AI systems are integrating consumer purchasing data with OEM production schedules to provide precise demand forecasts for specific coating types and aesthetic finishes, ensuring production capacity alignment with market needs and contributing to overall operational excellence across the value chain.

- AI-powered machine vision systems enable 100% automated surface defect detection, improving quality consistency dramatically.

- Machine Learning algorithms optimize curing oven energy consumption and speed based on real-time coating thickness and composition.

- Predictive maintenance schedules for coating rollers, chemical baths, and laminating equipment minimize unplanned downtime.

- AI models forecast shifts in consumer color preference and texture demand, guiding R&D and inventory stocking decisions.

- Optimization of raw material blend ratios (pigments and resins) using predictive modeling ensures color consistency across different batches.

DRO & Impact Forces Of Home Appliance Color Coated Sheet Market

The market is predominantly driven by increasing global appliance production, fueled by rising urbanization and expanding middle-class populations in Asia and Latin America, necessitating durable and aesthetically appealing components. Key restraints include the inherent volatility in the pricing of core raw materials—specifically steel substrate (Hot Rolled Coil) and petrochemical-derived coating resins—which directly impacts manufacturers' profit margins and pricing stability. Opportunities emerge from the growing demand for high-end, differentiated products, such as smart refrigerators requiring specialized non-magnetic or textured surfaces, alongside regulatory pressures favoring sustainable, low-VOC, and anti-microbial coatings. These elements collectively shape a dynamic environment where adaptation to cost pressures and technological advancement determines competitive advantage.

Drivers: The modernization and replacement cycle of aging appliances in developed economies, coupled with significant housing construction and infrastructure development in emerging markets, create sustained high volume demand for white goods. The shift in consumer behavior towards appliances that are energy-efficient, visually appealing, and feature enhanced hygiene functions (e.g., anti-bacterial coatings for refrigerator interiors) further necessitates the use of high-quality color coated sheets. Manufacturers are continuously pressured by OEMs to offer innovative solutions, such as fingerprint-resistant finishes and coatings that resist the wear and tear associated with frequent cleaning and use, sustaining the market for higher-margin specialty products.

Restraints: Beyond raw material price fluctuations, the market faces challenges related to stringent environmental regulations, particularly concerning hexavalent chromium usage in pre-treatment processes and high solvent content in certain coatings. Compliance requires significant capital investment in eco-friendly alternatives, often leading to increased production costs. Furthermore, the high capital expenditure required to set up modern, high-speed coil coating lines acts as a substantial barrier to entry for new players, limiting competition and potentially slowing down capacity expansion necessary to meet booming demand in certain regions.

Opportunities: Significant potential lies in functional coatings—such as self-cleaning (hydrophilic or hydrophobic) surfaces, thermal reflective coatings for energy efficiency, and advanced anti-corrosion systems tailored for humid or harsh coastal environments (especially relevant for outdoor AC units). Market participants who successfully integrate smart manufacturing technologies, including IoT and AI for process optimization, can achieve cost leadership while simultaneously delivering superior quality. Moreover, the growing emphasis on the circular economy promotes demand for coatings and substrates that are easily recyclable or derived from recycled content, opening up niche market segments.

- Drivers: Global growth in housing starts and urban population; increasing demand for high-performance and aesthetic appliance finishes; regulatory push for energy-efficient appliances (requiring thin, durable insulation-compatible sheets).

- Restraints: Volatility in steel and chemical resin prices; intense competition leading to pressure on profit margins; strict environmental regulations imposing costs on coating formulation reformulation.

- Opportunity: Development of advanced functional coatings (anti-microbial, self-cleaning); expansion into high-growth emerging economies (India, Southeast Asia); adoption of sustainable and bio-based coating resins.

- Impact Forces: Strong influence of material costs (High); Moderate substitution threat from plastics/composites (Medium); High bargaining power of major appliance OEMs due to large volume procurement (High).

Segmentation Analysis

The Home Appliance Color Coated Sheet Market is primarily segmented based on material substrate, coating type, application in appliances, and the specific finish characteristics. Analyzing these segments provides a detailed understanding of market dynamics, revealing where investment and technological focus are concentrated. The substrate segmentation highlights the ongoing preference for steel due to its mechanical properties, though aluminum usage is rising in niche applications requiring lighter weight or enhanced corrosion resistance. Coating type segmentation is critical, defining the sheet's protective capabilities and aesthetic range, with commodity coatings like polyester coexisting with high-performance fluorocarbon systems. Application breakdown reveals the core demand drivers across various household sectors.

From a commercial perspective, segmentation by coating type, specifically focusing on Pre-Coated Metal (PCM) versus Vinyl Coated Metal (VCM), determines the market's value distribution. PCM dominates volume due to its cost-efficiency and suitability for standard models, while VCM captures higher margins through its superior aesthetic flexibility, durability, and texture options, increasingly favored in premium appliances. Furthermore, the segmentation by finish type (e.g., high gloss, matte, textured, or metallic effect) directly correlates with consumer design trends, pushing coating manufacturers to continuously innovate their pigment and additive technologies to meet sophisticated interior design requirements globally.

- By Substrate Material:

- Galvanized Steel

- Electro-Galvanized Steel

- Aluminum

- By Coating Type:

- Polyester (PE)

- Silicone Modified Polyester (SMP)

- Polyurethane (PU)

- Polyvinylidene Fluoride (PVDF)

- Vinyl Coated Metal (VCM) / Film Laminated

- By Application:

- Refrigeration (e.g., external doors, side panels)

- Washing Machines and Dryers (e.g., casings, control panels)

- Air Conditioning Systems (e.g., outdoor unit casings, indoor panels)

- Microwave Ovens and Small Cooking Appliances

- Water Heaters and Dishwashers

- By Finish Type:

- Glossy Finish

- Matte Finish

- Textured Finish

- Metallic/Special Effect Finish

Value Chain Analysis For Home Appliance Color Coated Sheet Market

The value chain for Home Appliance Color Coated Sheets initiates with the upstream supply of raw materials, primarily hot rolled steel coil or aluminum sheets, along with the chemical inputs required for coating formulations, such as resins, pigments, solvents, and pre-treatment chemicals. Steel mills and specialized chemical companies hold significant influence at this stage, as the quality and price of their inputs directly determine the final product characteristics and cost structure. The midstream segment, which involves the specialized coil coating companies, is highly capital-intensive, requiring advanced continuous coating lines for cleaning, pre-treatment (now often chrome-free), primer application, topcoat application, and curing. Efficiency and scale are paramount in this stage to maintain competitive pricing.

Downstream analysis focuses on the large-volume consumers, namely the Original Equipment Manufacturers (OEMs) in the home appliance sector, such as Haier, Samsung, LG, Whirlpool, and BSH. These OEMs integrate the finished color coated coils into their production lines where the coils are slit, blanked, formed, and assembled into appliance components. The bargaining power of these OEMs is considerable due to their massive procurement volumes and rigid quality specifications. The downstream relationship is often characterized by long-term contracts and collaborative development of custom colors and specifications, ensuring just-in-time delivery and minimal inventory holding for the appliance manufacturer.

The distribution channel typically operates through direct sales and contract agreements between the coil coater and the appliance OEM. Due to the specialized nature, large sizes, and specific quality requirements of the coils, indirect distribution through general metal distributors is less common for major appliance components, though smaller distributors may handle supply to tier-two component manufacturers. Direct sales models facilitate close technical collaboration, prompt quality issue resolution, and streamlined logistics, which are critical for maintaining the high-volume, continuous manufacturing schedules inherent in the appliance industry. The efficiency of this direct link significantly impacts the final time-to-market for new appliance models.

Home Appliance Color Coated Sheet Market Potential Customers

The primary customers for Home Appliance Color Coated Sheets are the global Original Equipment Manufacturers (OEMs) who dominate the white goods sector. These companies require vast quantities of precisely specified, high-quality, pre-finished metal sheets for external cladding, internal compartment liners, and structural elements of their products. Key customers include manufacturers focused on high-volume production of refrigerators, which are the largest consumer of these sheets due to their size and aesthetic demands, followed closely by producers of washing machines, dryers, and air conditioners, which require durable, weather-resistant outer casings, particularly for outdoor AC units.

Beyond the major global players, the customer base also extends to smaller regional or niche appliance manufacturers specializing in specific segments like commercial refrigeration, built-in kitchen appliances, or specialty cooking equipment (e.g., high-end induction cooktops and professional ventilation hoods). These customers often require specialized, smaller-batch orders focusing on unique aesthetic finishes or enhanced functional properties, such as extra corrosion resistance or specific thermal insulation capabilities. The purchasing decisions of all these buyers are driven by a triad of factors: material cost-effectiveness, consistency in quality (color, gloss, thickness), and the ability of the supplier to meet stringent environmental and safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel Corporation, POSCO, ThyssenKrupp AG, BlueScope Steel Ltd., JFE Steel Corporation, Shandong Kerui Steel, Yieh Phui Enterprise Co. Ltd., Alok Masterbatches Pvt Ltd, ArcelorMittal S.A., United States Steel Corporation, Tata Steel Ltd., SSAB AB, Dongkuk Steel Mill Co., Ltd., China Steel Corporation, Novalis Coil Coating, A. C. T. Metal Deck, Hubei Color Coated Coil, Hesheng Group, HBIS Group, Baosteel Group Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Appliance Color Coated Sheet Market Key Technology Landscape

The technological landscape of the Home Appliance Color Coated Sheet Market is primarily defined by advancements in coating formulations and application techniques designed to enhance durability, aesthetic quality, and environmental sustainability. A major focus is the transition towards advanced polyurethane and fluorocarbon (PVDF) coatings, which offer superior resistance to UV light, scratches, and chemical abrasion compared to traditional polyester coatings, catering specifically to premium and outdoor appliance applications (e.g., heat pump units). Parallel innovation in surface pre-treatment involves the widespread adoption of chrome-free conversion coatings to meet international regulatory standards, ensuring excellent adhesion while eliminating toxic heavy metals from the process chain, significantly reducing the environmental footprint of the final product.

Furthermore, technology is rapidly evolving in the realm of functional coatings and novel application methods. Nano-coating technology is being integrated to embed properties such as anti-microbial protection (using silver or zinc ions) or easy-to-clean functionality (hydrophobic surfaces) directly into the appliance exterior, increasing product value and consumer appeal, particularly in hygiene-sensitive areas like kitchen appliances. In application technology, the adoption of high-speed, precision roller coating systems minimizes coating waste and ensures highly uniform film thickness, crucial for maintaining color consistency across multi-coil orders. UV-curing and Electron Beam (E-beam) curing methods are also gaining traction, offering faster processing times and lower energy consumption compared to conventional thermal curing, accelerating production cycles significantly.

The manufacturing process itself is increasingly reliant on sophisticated digital technologies, including IoT sensors for real-time process monitoring and sophisticated closed-loop control systems. These systems allow for instantaneous adjustments to line speed, oven temperature, and coating volume, ensuring zero-defect output and highly efficient material usage. The future technology trajectory is centered on integrating sustainability features—developing bio-based or water-borne coating systems that further reduce VOC emissions—without compromising the mechanical performance or aesthetic quality demanded by leading appliance OEMs. This continuous integration of chemical science, mechanical engineering, and digital control defines the competitive edge in this technologically advanced material sector.

Regional Highlights

The global market for Home Appliance Color Coated Sheets demonstrates significant regional variance driven by manufacturing concentration, consumer purchasing power, and regulatory environments.

- Asia Pacific (APAC): APAC is the unequivocally dominant region, accounting for the largest share of the market, primarily due to the concentration of global white goods manufacturing hubs in China, South Korea, Japan, and Southeast Asian nations (Vietnam, Thailand). China, in particular, drives immense volume demand, catering both to its massive domestic market and global exports. The trend in APAC leans towards high-volume, cost-effective galvanized steel sheets with standard polyester or SMP coatings, alongside increasing demand for specialized coatings for premium smart appliance models produced by regional giants like Samsung and LG. Rapid urbanization and growing middle-class disposable income in India and Southeast Asia promise continued high growth rates, necessitating capacity expansion by regional coil coating players.

- Europe: Europe is a mature market characterized by stringent quality and environmental regulations, particularly the REACH legislation, which accelerates the adoption of advanced, eco-friendly, chrome-free pre-treatment technologies and low-VOC coating formulations. While volume growth is steady but slower than APAC, the region commands high value due to a strong preference for sophisticated, matte, and textured finishes often used in premium built-in kitchen appliances. Innovation in PVDF and specialty polyurethane coatings, emphasizing durability and design integration, is a primary focus for European manufacturers.

- North America: North America maintains a significant market presence, driven by high consumer spending and replacement demand. The region exhibits high demand for durable coatings, especially for large capacity refrigeration and sophisticated laundry appliances. The market shows a pronounced trend towards materials offering fingerprint resistance and advanced anti-corrosion performance, vital for the longevity of appliances. Local manufacturing, though facing global competition, remains strong in specialized coating applications and high-end consumer models, emphasizing energy efficiency and material robustness.

- Latin America (LATAM): LATAM represents a growing market, fueled by economic recovery and increased household electrification and modernization. Brazil and Mexico are the key consumer and manufacturing centers. Demand is concentrated in the mid-range segment, prioritizing cost-to-performance ratio. Market dynamics are heavily influenced by local economic stability, but the long-term outlook is positive due to rising urbanization, creating sustained demand for foundational appliance categories.

- Middle East and Africa (MEA): This region is an emerging yet important market, particularly due to significant infrastructural investments in Gulf Cooperation Council (GCC) countries and growing economies in South Africa and Nigeria. The demand here focuses on extreme durability and temperature resistance, specifically for air conditioning units and outdoor appliance casings, requiring coatings engineered to withstand high heat, dust, and coastal salinity. Local assembly plants are increasingly sourcing color coated sheets, signaling manufacturing growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Appliance Color Coated Sheet Market.- Nippon Steel Corporation

- POSCO

- ThyssenKrupp AG

- BlueScope Steel Ltd.

- JFE Steel Corporation

- Shandong Kerui Steel

- Yieh Phui Enterprise Co. Ltd.

- Alok Masterbatches Pvt Ltd (Focused on Additives/Masterbatches)

- ArcelorMittal S.A.

- United States Steel Corporation

- Tata Steel Ltd.

- SSAB AB

- Dongkuk Steel Mill Co., Ltd.

- China Steel Corporation

- Novalis Coil Coating

- A. C. T. Metal Deck (Focusing on Construction, but relevant sheet producer)

- Hubei Color Coated Coil

- Hesheng Group

- HBIS Group

- Baosteel Group Corporation

Frequently Asked Questions

Analyze common user questions about the Home Appliance Color Coated Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary coating types used for home appliance sheets?

The primary coatings include Polyester (PE) for standard durability and cost-efficiency, Silicone Modified Polyester (SMP) offering improved weather resistance, Polyurethane (PU) known for excellent scratch and abrasion resistance, and Vinyl Coated Metal (VCM) which involves film lamination for superior aesthetic effects and texture versatility, particularly in premium appliance segments.

How does the coil coating process benefit appliance manufacturers (OEMs)?

Coil coating provides significant benefits by shifting the painting process upstream, eliminating the need for expensive, high-VOC post-painting lines at the OEM facility. This results in superior, uniform finish quality, reduced manufacturing time and cost, and enhanced compliance with environmental regulations regarding solvent emissions, promoting overall production efficiency.

Which application segment holds the largest share in the color coated sheet market?

The Refrigeration segment (including refrigerators and freezers) holds the largest market share. This is due to the consistently high volume of units manufactured globally and the substantial surface area required for external doors and side panels, which demand aesthetic quality, durability, and specialized thermal performance coatings.

What technological trends are driving sustainable material development in this market?

Sustainability trends are driven by the adoption of chrome-free pre-treatment chemistries, essential for adhesion without toxic heavy metals, and the development of low-VOC or zero-VOC coating systems, such as water-borne and bio-based resins, which significantly reduce environmental impact during the manufacturing and curing processes while maintaining high performance standards.

What is the main driver of market growth in the Asia Pacific region?

The main driver of market growth in Asia Pacific is the region's position as the global manufacturing center for white goods, coupled with rapid urbanization and a substantial increase in disposable income among the burgeoning middle-class population, leading to massive scale production and high domestic consumption of new home appliances.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager