Home Appliance MCU Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443098 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Home Appliance MCU Market Size

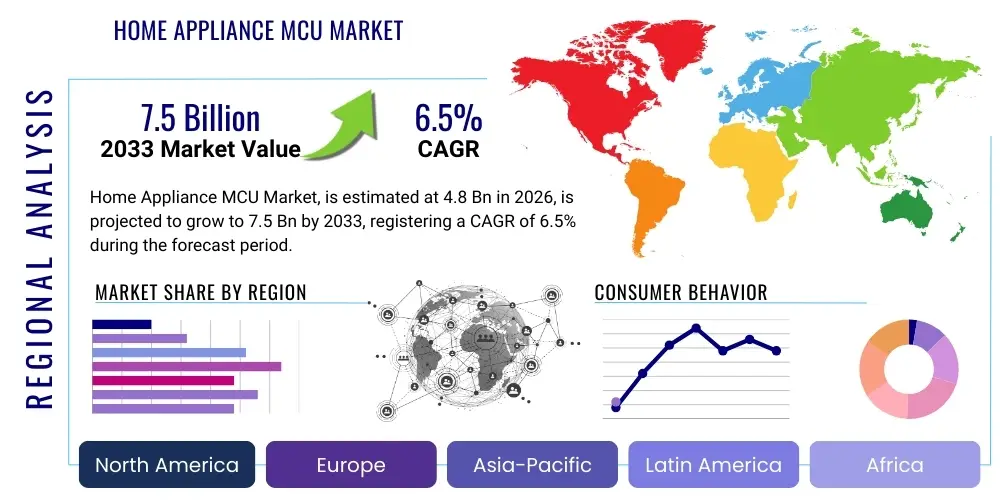

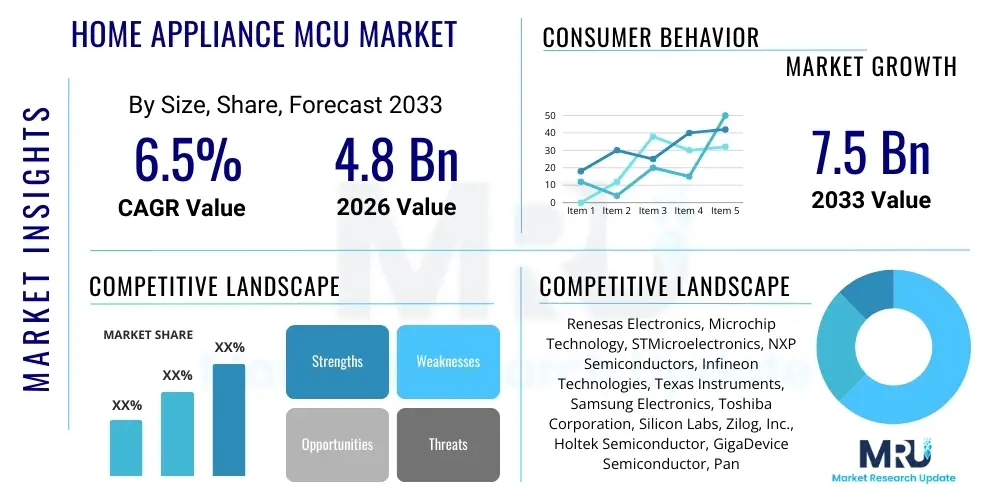

The Home Appliance MCU Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Home Appliance MCU Market introduction

The Microcontroller Unit (MCU) Market for Home Appliances encompasses semiconductor devices specifically designed to manage and control operational tasks within household electronic equipment. These specialized integrated circuits act as the "brain" of modern appliances, executing complex instructions, processing sensor data, and managing power consumption. MCUs are fundamental components across a vast range of products, from basic coffee makers and vacuum cleaners to sophisticated smart refrigerators and washing machines, driving features such such as inverter motor control, touch display interfacing, and communication protocols. The product description emphasizes low-power consumption, high integration density, robust operating temperature ranges, and compatibility with various real-time operating systems (RTOS) necessary for appliance reliability.

Major applications of Home Appliance MCUs span three primary categories: white goods (refrigerators, washing machines, dryers), brown goods (entertainment systems, though less central to this MCU definition), and small home appliances (microwaves, air purifiers, robotic vacuums). The core benefits provided by MCUs include enhanced energy efficiency through precise motor control algorithms (e.g., Permanent Magnet Synchronous Motor or PMSM control), improved user experience via intuitive graphical interfaces, and the enablement of smart connectivity features, allowing appliances to integrate into the Internet of Things (IoT) ecosystem for remote monitoring and predictive maintenance. These capabilities are crucial differentiators in a competitive consumer market.

The market is primarily driven by the escalating demand for smart and connected homes, rapid urbanization, and stringent global energy efficiency regulations (such as Energy Star and EU directives). Consumers are increasingly prioritizing appliances that offer automation, energy savings, and seamless interaction through digital interfaces, necessitating powerful and cost-effective MCUs. Furthermore, the decreasing average selling price (ASP) of advanced 32-bit MCUs is accelerating their adoption in previously 8-bit dominated applications, enabling more sophisticated features at a lower manufacturing cost, thereby fueling overall market expansion.

Home Appliance MCU Market Executive Summary

The Home Appliance MCU Market demonstrates robust growth, fundamentally propelled by the pervasive global trend toward appliance intelligence and connectivity. Business trends indicate a significant strategic pivot by semiconductor manufacturers, shifting focus from general-purpose MCUs to highly integrated System-on-Chip (SoC) solutions tailored for specific appliance applications, particularly those requiring advanced motor control and wireless communication capabilities (Wi-Fi, Bluetooth). Key industry players are increasingly engaging in strategic partnerships with major Original Equipment Manufacturers (OEMs) like Haier, LG, and Whirlpool, ensuring early design-in processes and customized silicon development. Furthermore, supply chain resilience, particularly post-2020 semiconductor shortages, remains a critical operational focus, leading to increased investment in localized manufacturing and dual-sourcing strategies across different geographic regions to mitigate future risks.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by its expansive consumer base, rapid disposable income growth, and status as the global manufacturing hub for home appliances. China and India are experiencing exceptional demand for energy-efficient, mid-to-high-end smart appliances, creating a sustained requirement for advanced MCUs. North America and Europe, while mature markets, are leading the adoption curve for high-margin, connectivity-focused MCUs, primarily fueled by the strong penetration of smart home ecosystems and strict regulatory mandates promoting power efficiency. Latin America and MEA are emerging markets, characterized by faster growth in basic and mid-range appliance segments, gradually transitioning towards smart features as infrastructure improves.

In terms of segmentation trends, the 32-bit MCU segment is exhibiting the fastest growth rate, quickly displacing older 8-bit and 16-bit architectures, especially in high-performance applications like inverter air conditioners and washing machines that require complex real-time processing and sophisticated algorithms. Application-wise, the Laundry Appliances and Air Control Appliances segments are primary drivers, directly benefiting from stricter energy efficiency standards that necessitate superior motor control managed by advanced MCUs. Connectivity segmentation reveals that Wi-Fi-enabled MCUs are the most dynamic sub-segment, critical for implementing remote diagnostics, over-the-air (OTA) updates, and seamless integration with virtual assistants, effectively solidifying the transition from standalone units to networked smart devices.

AI Impact Analysis on Home Appliance MCU Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Home Appliance MCU market primarily revolve around three core themes: the feasibility of running machine learning (ML) models on low-power, constrained MCU hardware (Edge AI); the necessary hardware requirements (e.g., neural processing units or NPUs integrated into MCUs) to support advanced functions like predictive maintenance and personalized user experiences; and the subsequent shift in MCU vendor strategy regarding software tools and ecosystem support. Users are keenly interested in how AI will enable appliances to autonomously adapt to user behavior (e.g., smart climate control learning usage patterns) and perform real-time diagnostics, thereby reducing operational failures and enhancing energy management. A key concern is the trade-off between increased processing power needed for AI inference and the fundamental requirement for ultra-low power consumption typical of battery-operated or standby appliances, demanding highly optimized hardware and firmware designs from MCU providers.

The integration of AI capabilities, even rudimentary inference models, directly transforms the requirements for Home Appliance MCUs, necessitating significant enhancements in memory (RAM and Flash), processing speed, and dedicated hardware accelerators. AI-enabled MCUs are shifting the market focus from simple control logic to data-driven decision-making, enabling features like fabric type recognition in washing machines, inventory management and food spoilage detection in refrigerators, and advanced air quality sensing and purification protocols. This technological evolution increases the complexity and average selling price of the semiconductor components, but simultaneously opens up premium market segments for appliance manufacturers who can offer true personalization and higher utility through embedded intelligence.

This shift is prompting MCU manufacturers to incorporate specialized ML cores or optimized DSPs within their standard MCU architecture. Furthermore, the development ecosystem must mature, offering robust toolchains, optimized compilers, and lightweight AI frameworks (like TensorFlow Lite Micro) that allow appliance OEMs to easily deploy pre-trained models. Successful AI integration is the key differentiator for high-end smart appliances, making AI-ready MCUs a strategic imperative for market dominance. This integration ensures appliances are not just connected, but are truly adaptive, leading to sustainable competitive advantages for companies that adopt this technology early and effectively.

- MCUs are integrating dedicated Neural Processing Units (NPUs) or specialized DSPs for efficient, low-latency AI inference at the edge.

- Increased demand for higher Flash memory and volatile RAM capacity to store and execute complex machine learning models.

- AI enables predictive maintenance, allowing appliances to self-diagnose and alert users or service providers before critical failures occur.

- Enhanced user personalization through behavioral learning, optimizing operational cycles (e.g., climate control, dishwasher settings) based on historical data.

- AI drives advanced sensor fusion applications, improving accuracy in control systems (e.g., precise motor speed adjustment based on load sensing).

- Accelerated development of robust, secure firmware capable of Over-The-Air (OTA) updates to push new ML models or security patches.

DRO & Impact Forces Of Home Appliance MCU Market

The dynamics of the Home Appliance MCU market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively summarized as Impact Forces. The primary driver is the accelerating penetration of the Internet of Things (IoT) in the residential sector, creating an essential need for MCUs capable of handling robust wireless communication protocols (Wi-Fi, Zigbee, Thread) and advanced security features. Complementing this is the stringent regulatory pressure worldwide demanding higher energy efficiency, compelling OEMs to adopt high-performance 32-bit MCUs for sophisticated motor and power management algorithms (e.g., vector control for inverter compressors and motors), which significantly minimizes power consumption and meets mandates like Energy Star ratings. These drivers ensure continuous technological upgrades and increased component value within appliances.

However, the market faces significant restraints, most notably the high initial investment required for sophisticated AI-enabled and connected appliances, which can deter cost-sensitive consumers in emerging economies. Furthermore, the global semiconductor supply chain volatility, although improving, still poses risks, leading to potential component shortages, extended lead times, and increased procurement costs for appliance manufacturers. Another substantial restraint is the complexity of integrating diverse connectivity and security standards, demanding specialized engineering expertise which adds to the overall design cycle time and firmware development cost for appliance OEMs.

The primary opportunities lie in the rapid proliferation of Edge AI and Machine Learning (ML) deployment within home appliances, enabling features such as predictive analytics, personalized usage optimization, and advanced fault detection. The shift towards higher-bit MCUs (32-bit) in previously 8-bit dominated low-end appliances presents a massive market penetration opportunity for advanced MCU vendors. Additionally, the growing focus on enhanced cybersecurity protocols within smart devices, necessitated by increasing connectivity, creates a lucrative niche for MCUs incorporating integrated hardware security modules (HSMs) and secure boot capabilities. These opportunities, when strategically leveraged, allow market participants to capture higher value segments and solidify long-term customer relationships.

Segmentation Analysis

The Home Appliance MCU Market is meticulously segmented based on bit-architecture (Type), specific appliance category (Application), and the level of connectivity implemented (Connectivity). The segmentation by type is pivotal, distinguishing the complexity and performance capabilities of the MCUs, ranging from simple 8-bit controllers used in basic timers and displays to highly complex 32-bit controllers managing advanced motor drives and graphical user interfaces. Application segmentation highlights the differing requirements across kitchen, laundry, and air control appliances, where motor control intensity and sensor processing needs vary drastically. Connectivity segmentation, particularly the distinction between connected and non-connected devices, is the primary indicator of growth potential, directly correlating with the smart home adoption curve globally.

- By Type:

- 8-bit MCU

- 16-bit MCU

- 32-bit MCU (Dominant and fastest-growing segment due to complexity requirements)

- By Application:

- Kitchen Appliances (Refrigerators, Microwaves, Ovens, Dishwashers)

- Laundry Appliances (Washing Machines, Dryers)

- Air Control Appliances (Air Conditioners, Air Purifiers, Humidifiers)

- Other Appliances (Vacuum Cleaners, Robot Vacuums, Water Heaters)

- By Connectivity:

- Connected Appliances (Wi-Fi, Bluetooth, Zigbee, Thread)

- Non-Connected Appliances

- By End-User:

- Residential

- Commercial (e.g., specialized appliances for small businesses/hotels)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Home Appliance MCU Market

The value chain for the Home Appliance MCU Market is characterized by highly specialized stages, beginning with upstream raw material suppliers, moving through semiconductor fabrication, design houses, and concluding with downstream appliance manufacturing and distribution. Upstream analysis involves suppliers of critical raw materials such as high-purity silicon wafers, photoresists, and specialty gases, where a few key global players hold significant leverage over pricing and supply consistency. Following this are the design and Intellectual Property (IP) providers who define the core architecture (e.g., ARM Cortex cores are foundational), followed by the fabrication process (foundries like TSMC or integrated device manufacturers (IDMs) like STMicroelectronics and Infineon) where the actual silicon is manufactured. The efficiency and yield at the fabrication stage are critical determinants of final product cost and market competitiveness.

Mid-chain activities are dominated by the Integrated Device Manufacturers (IDMs) and fabless companies that package, test, and brand the MCUs, often bundling proprietary software libraries, development tools, and RTOS support tailored specifically for appliance control (e.g., motor control libraries). The distribution channel for MCUs is complex and involves direct sales to major multinational OEMs (e.g., LG, Samsung) for high-volume, customized designs, and sales through electronic component distributors (e.g., Arrow, Avnet) to smaller appliance manufacturers and original design manufacturers (ODMs). Direct engagement allows for deep technical collaboration and optimized design-in, whereas indirect channels provide broad market access and inventory flexibility for standardized components.

Downstream analysis focuses on the Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who integrate the MCUs into final products. This stage involves complex embedded software development and rigorous testing to ensure compliance with global safety and energy standards. Distribution of the final appliance product relies on traditional retail channels, specialized appliance stores, and increasingly, e-commerce platforms. The overall value capture is shifting towards the mid-chain (MCU design and software) due to the increasing sophistication of embedded intelligence and the high demand for robust, secure connectivity solutions, driving significant strategic focus on strengthening relationships with tier-one appliance manufacturers to secure long-term, high-volume contracts and influence future appliance roadmaps directly.

Home Appliance MCU Market Potential Customers

Potential customers in the Home Appliance MCU market are primarily the large multinational Original Equipment Manufacturers (OEMs) who design, manufacture, and market household appliances globally. These customers, including names like Whirlpool, Haier, LG Electronics, Samsung, and Midea Group, represent the highest volume buyers, demanding specific, customized MCU features related to motor control efficiency, display interfaces, and proprietary connectivity standards. Their purchase decisions are heavily influenced by the MCU vendor's ability to provide a comprehensive ecosystem, including robust software development kits (SDKs), excellent technical support, long product lifecycle support, and competitive volume pricing, often necessitating multi-year supply agreements to ensure production continuity.

A secondary, but rapidly growing, segment of potential customers includes smaller, innovative appliance companies and Original Design Manufacturers (ODMs) focusing on niche markets, such as robotic vacuums, smart air purifiers, or specialized kitchen gadgets. These buyers typically require standardized, readily available MCUs purchased through indirect distribution channels. Their priorities center around ease of use, swift time-to-market, and integration with existing cloud platforms (like Amazon AWS or Google Cloud). These customers often favor MCU platforms that offer extensive online community support and simplified integration tools to minimize R&D expenditure and accelerate product iteration cycles.

The end-user or ultimate buyer of the product is the residential consumer, whose shifting preferences directly influence OEM procurement strategies for MCUs. The consumer demand for energy efficiency, smart connectivity, voice control integration, and durable performance dictates the features required in the underlying MCU hardware. Therefore, MCU manufacturers must continually innovate to meet the feature requirements of the OEM, effectively serving the ultimate end-user. Further potential exists in the B2B sector, where commercial entities such as hospitality chains or laundromats purchase industrial-grade appliances demanding even higher reliability and advanced diagnostic capabilities, often relying on specialized high-end MCUs with industrial certification and robust security features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Renesas Electronics, Microchip Technology, STMicroelectronics, NXP Semiconductors, Infineon Technologies, Texas Instruments, Samsung Electronics, Toshiba Corporation, Silicon Labs, Zilog, Inc., Holtek Semiconductor, GigaDevice Semiconductor, Panasonic Corporation, ON Semiconductor, ROHM Semiconductor, MediaTek, Espressif Systems, Analog Devices, Maxim Integrated, Cypress Semiconductor |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Appliance MCU Market Key Technology Landscape

The technological landscape of the Home Appliance MCU market is rapidly evolving, driven primarily by the need for higher integration, ultra-low power consumption, and enhanced security features necessary for connected devices. A core technological trend is the transition from legacy 8-bit and 16-bit architectures, which typically handle basic functions, to high-performance 32-bit MCUs, predominantly based on the ARM Cortex-M architecture. This shift allows for the execution of complex real-time operating systems (RTOS) and sophisticated control algorithms, such as Field-Oriented Control (FOC) for brushless DC (BLDC) and PMSM motors, which are essential for achieving the highest levels of energy efficiency in compressors and pumps found in modern refrigerators and AC units. Advanced process nodes (e.g., 40nm and below) are also being utilized to pack more processing power and integrated memory onto smaller chips.

Connectivity remains a crucial technology area, with MCUs increasingly integrating built-in radio frequency (RF) modules supporting Wi-Fi 6, Bluetooth Low Energy (BLE), and emerging standards like Thread and Zigbee. This integration significantly reduces the Bill of Materials (BOM) and complexity for OEMs. Security technology is equally vital; modern MCUs feature hardware-based security elements, including secure boot mechanisms, cryptographic accelerators, true random number generators (TRNGs), and isolated execution environments (like TrustZone), protecting both the Intellectual Property (IP) of the appliance manufacturer and the sensitive data transmitted by the consumer device, which is a major purchasing criteria in smart home ecosystems.

Furthermore, the emergence of Edge AI capabilities is reshaping the MCU technology landscape. Vendors are incorporating specialized processing units, often Digital Signal Processors (DSPs) or lightweight Neural Processing Units (NPUs), optimized for running inference tasks using tinyML frameworks with minimal latency and power drain. These advancements enable features such as acoustic signature analysis for fault detection in motors, object recognition in smart ovens, and personalized usage optimization. The robust software ecosystem, including highly optimized motor control libraries and comprehensive development environments provided by leading vendors, is as important as the silicon itself, ensuring that OEMs can quickly bring complex, technology-laden products to market efficiently.

Regional Highlights

The global Home Appliance MCU market exhibits significant regional variances in terms of growth rates, technology adoption, and underlying regulatory drivers. Asia Pacific (APAC) dominates the market share due to its massive population, status as the world’s primary manufacturing base for home appliances (notably China, South Korea, and Japan), and a rapidly expanding middle class demanding upgraded appliances. The regulatory push for higher energy efficiency in countries like China and India, coupled with widespread government support for smart city initiatives, accelerates the adoption of high-performance 32-bit MCUs in white goods and air conditioning units. The sheer volume of production in this region makes it the most critical market for high-volume MCU procurement.

North America represents a high-value market characterized by early adoption of premium and smart appliances. The region's focus is less on volume and more on high-margin, feature-rich devices that seamlessly integrate into existing smart home platforms (e.g., Amazon Alexa, Google Home). Demand is concentrated on MCUs with advanced connectivity features, robust security, and sophisticated processing power required for voice recognition and local AI inference. Stringent regulatory environments, particularly concerning energy consumption and electromagnetic compatibility (EMC), further dictate the technical specifications and quality requirements for MCUs utilized in this region.

Europe mirrors North America in its focus on smart features and high energy efficiency, particularly driven by the European Union’s Energy Labelling and Ecodesign Directives, which mandate continuous improvement in appliance performance. Western European countries demonstrate high penetration rates for connected appliances, favoring MCUs that support open standards and offer robust IoT security frameworks compliant with EU data protection regulations (e.g., GDPR implications on connected devices). Latin America and the Middle East and Africa (MEA) currently represent smaller market shares but are exhibiting higher growth potential, transitioning from basic, non-connected appliances toward entry-level smart devices as connectivity infrastructure improves and consumer disposable incomes rise, signaling future growth opportunities for 8-bit and 16-bit controllers migrating to 32-bit architectures.

- Asia Pacific (APAC): Acts as the largest consumer base and global manufacturing hub; primary driver for high-volume MCU sales, fueled by urbanization and energy efficiency mandates (China and India).

- North America: Focused on high-value, smart, and connected appliance segments; strong demand for MCUs with advanced security and integration capabilities for established smart home ecosystems.

- Europe: Driven by strict EU energy efficiency and environmental regulations; high adoption of connected appliances requiring sophisticated motor control and comprehensive IoT security compliance.

- Latin America (LATAM): Emerging market characterized by gradual transition towards mid-range and entry-level smart appliances; growth reliant on improving infrastructure and economic stability.

- Middle East and Africa (MEA): Smallest but fastest-growing regional segment; increasing appliance replacement cycles and government investments in smart infrastructure spurring MCU demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Appliance MCU Market.- Renesas Electronics

- Microchip Technology

- STMicroelectronics

- NXP Semiconductors

- Infineon Technologies

- Texas Instruments

- Samsung Electronics

- Toshiba Corporation

- Silicon Labs

- Zilog, Inc.

- Holtek Semiconductor

- GigaDevice Semiconductor

- Panasonic Corporation

- ON Semiconductor

- ROHM Semiconductor

- MediaTek

- Espressif Systems

- Analog Devices

Frequently Asked Questions

Analyze common user questions about the Home Appliance MCU market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from 8-bit and 16-bit MCUs to 32-bit MCUs in home appliances?

The shift to 32-bit MCUs is primarily driven by the increasing need for complex processing capabilities essential for modern features such as advanced motor control (Field-Oriented Control or FOC for energy efficiency), sophisticated graphical user interfaces, and the execution of real-time operating systems required for secure network connectivity (Wi-Fi, IoT). 32-bit architectures offer higher processing throughput and greater memory capacity at decreasing costs, enabling smarter, feature-rich appliances that meet stringent global energy standards.

How is Edge AI implemented within Home Appliance Microcontroller Units?

Edge AI is implemented through highly optimized 32-bit MCUs that integrate dedicated hardware accelerators, such as specialized Digital Signal Processors (DSPs) or lightweight Neural Processing Units (NPUs). This hardware allows the MCU to run inference—the process of applying pre-trained machine learning models—directly on the device using data from local sensors, enabling features like predictive maintenance, adaptive control, and localized pattern recognition without constant cloud communication, significantly reducing latency and bandwidth requirements.

What are the key connectivity technologies impacting the Home Appliance MCU market growth?

The key connectivity technologies are Wi-Fi (especially Wi-Fi 6 for higher throughput and reduced power consumption), Bluetooth Low Energy (BLE) for local control and device pairing, and low-power mesh networking protocols such as Zigbee and Thread. These technologies are crucial as they allow appliances to integrate seamlessly into smart home ecosystems, enabling remote diagnostics, over-the-air (OTA) firmware updates, and interaction with voice assistants, significantly enhancing product utility and lifespan.

Which geographical region holds the largest market share for Home Appliance MCUs?

The Asia Pacific (APAC) region currently holds the largest market share for Home Appliance MCUs. This dominance is attributed to its vast manufacturing capacity, the presence of major global appliance OEMs, and the significant consumer base with rapidly increasing demand for smart, energy-efficient household goods, particularly in high-growth economies like China and India which are driving both production volume and consumption.

What are the main security challenges addressed by modern Home Appliance MCUs?

Modern Home Appliance MCUs address security challenges through integrated hardware features designed to protect against unauthorized access and cyber threats. These features include secure boot capabilities to verify firmware integrity, dedicated cryptographic accelerators for efficient encryption and decryption of data, and hardware security modules (HSMs) or trusted execution environments (TEEs) that isolate sensitive data and cryptographic keys, ensuring data privacy and protecting the intellectual property of the embedded software.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager