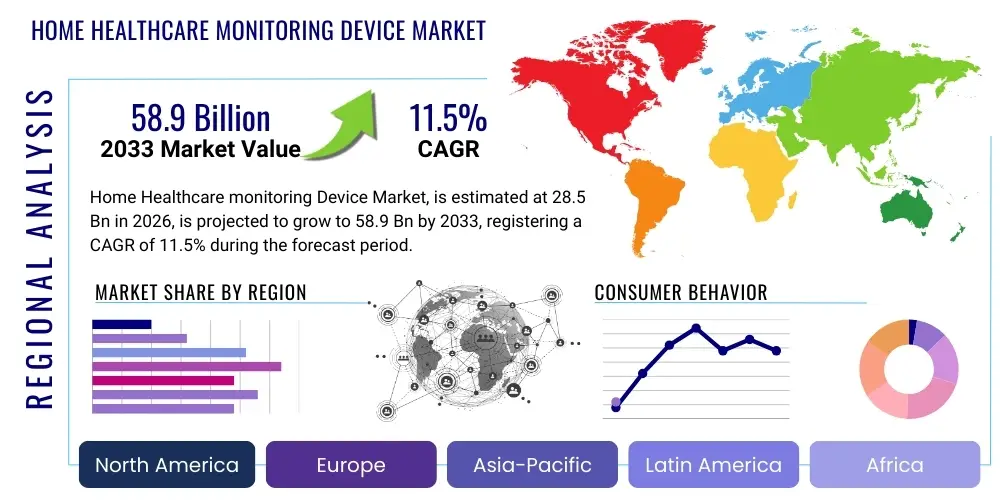

Home Healthcare monitoring Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441401 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Home Healthcare monitoring Device Market Size

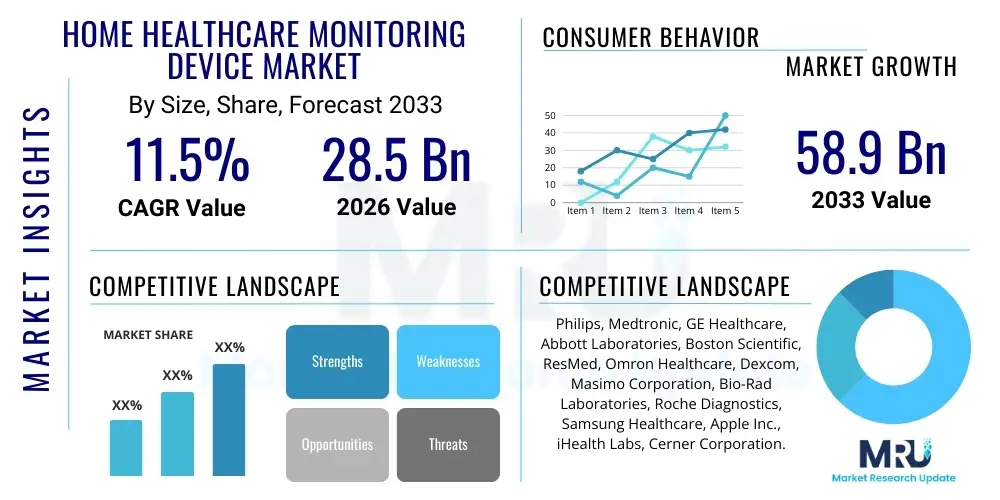

The Home Healthcare monitoring Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $28.5 Billion in 2026 and is projected to reach $58.9 Billion by the end of the forecast period in 2033.

Home Healthcare monitoring Device Market introduction

The Home Healthcare Monitoring Device Market encompasses a diverse range of medical technologies designed for use outside traditional clinical settings, primarily centered on enabling remote patient monitoring (RPM) and personal health tracking. This market includes devices for measuring essential physiological parameters such as blood glucose levels, blood pressure, cardiac rhythm (ECG/EKG), oxygen saturation (pulse oximeters), and temperature, offering crucial tools for managing chronic conditions like diabetes, hypertension, and cardiovascular diseases. The primary function of these devices is to provide continuous or intermittent data collection, empowering both patients and healthcare providers to intervene promptly, enhancing overall quality of life while mitigating costly hospital readmissions.

The widespread adoption of these devices is significantly driven by global demographic shifts, notably the rapidly expanding geriatric population which requires sustained, long-term care management. Furthermore, the increasing prevalence of chronic lifestyle diseases necessitates constant health surveillance that traditional, episodic healthcare models cannot sustainably support. Home monitoring technologies serve as the backbone of telehealth and virtual care models, fundamentally restructuring the delivery of healthcare services from centralized institutions toward decentralized, patient-centric homes. This transformation is strongly supported by advancements in miniaturization, sensor technology, and wireless connectivity, making devices more accurate, less intrusive, and easier for lay users to operate.

Major applications span preventive wellness tracking, acute post-operative recovery monitoring, and complex disease management programs. Key benefits include improved patient adherence to treatment plans, reduced time and cost associated with hospital visits, and the ability for timely clinical intervention based on real-time data analysis. The market is propelled by favorable regulatory landscapes supporting telehealth reimbursement, technological convergence allowing seamless integration with electronic health records (EHRs), and growing consumer awareness regarding proactive health maintenance. These elements collectively establish a robust foundation for sustained market expansion, defining the trajectory of future healthcare delivery.

Home Healthcare monitoring Device Market Executive Summary

The Home Healthcare Monitoring Device Market is characterized by vigorous growth, primarily fueled by the accelerating transition toward value-based care models globally, which prioritize patient outcomes and cost efficiency over volume. Business trends indicate a strong shift from simple data logging devices to sophisticated, connected platforms that incorporate software services, predictive analytics, and AI algorithms, moving the competitive focus from hardware manufacturing to integrated solution provision. Key players are aggressively pursuing mergers, acquisitions, and strategic partnerships with technology firms and telecommunications providers to enhance data transmission reliability and improve interoperability standards. Furthermore, investment is rapidly increasing in cybersecurity measures to secure sensitive patient data transmitted via these remote networks, recognizing data privacy as a critical barrier to widespread consumer trust and adoption.

Regional trends reveal North America maintaining market dominance, driven by robust reimbursement policies for remote patient monitoring services (especially in the US), a mature technological infrastructure, and high consumer willingness to adopt new healthcare technologies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, propelled by massive untapped patient populations, increasing government investment in digital health infrastructure (particularly in China and India), and the urgent need to address healthcare access disparities across vast geographic areas. European markets exhibit steady, regulation-driven growth, often influenced by national health systems defining clear pathways for digital medical devices (such as Germany’s DiGA framework), ensuring quality control and safety before widespread deployment.

Segmentation trends highlight the increasing significance of wearable monitoring devices, which offer superior convenience and compliance compared to traditional handheld or stationary units. Within the application segment, monitoring for cardiovascular diseases and diabetes management remain the largest revenue generators due to high disease incidence globally. The market is also witnessing rapid expansion in specialized segments like neurological and respiratory monitoring, driven by recent advances in sensor accuracy and the heightened focus on respiratory health following recent global health crises. End-user trends show a greater emphasis on solutions tailored for institutional buyers, such as hospitals and specialized clinics, which utilize RPM systems to manage large patient cohorts efficiently, alongside direct-to-consumer models for fitness and wellness tracking.

AI Impact Analysis on Home Healthcare monitoring Device Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Home Healthcare Monitoring Device Market frequently center on its capacity to transform reactive monitoring into proactive, predictive healthcare. Common user questions probe the accuracy of AI algorithms in detecting early signs of decline, how AI systems manage and secure the vast amounts of patient data generated by continuous monitoring, and the potential for AI-driven personalization of treatment protocols delivered remotely. There is significant interest in understanding how AI can filter out false positives and reduce alarm fatigue for clinical staff, which is a major constraint in current RPM systems. Users also express concerns regarding the ethical implications, particularly surrounding algorithmic bias, data ownership, and ensuring that AI integration does not erode the essential human element of healthcare interaction, especially for vulnerable elderly populations relying on these devices.

The integration of AI acts as a fundamental catalyst, moving home monitoring beyond mere data collection toward intelligent data interpretation and actionable clinical decision support. AI algorithms, particularly machine learning models, are being deployed to analyze complex, multi-variate physiological data streams (e.g., correlating blood pressure changes with activity levels and sleep patterns) to establish personalized baseline health parameters for each user. This capability allows the system to identify subtle deviations that precede acute health events, such as impending septic shock, heart failure exacerbations, or diabetic ketoacidosis, enabling pre-emptive intervention by care teams. Furthermore, AI optimizes resource allocation by prioritizing patients who require immediate attention, improving the efficiency of care coordination, especially in environments where clinician staffing is constrained.

The transformative effect extends into optimizing device performance and user experience. AI contributes to enhancing sensor fusion, filtering noise from data captured in uncontrolled home environments, thereby significantly improving diagnostic accuracy. Additionally, AI-powered conversational agents and personalized coaching interfaces are being embedded into monitoring apps to improve patient engagement, medication adherence, and provide customized feedback loops based on analyzed health outcomes. This deep integration ensures that the devices are not just passive data collectors but active components of a patient’s personalized wellness and disease management strategy, leading to superior clinical effectiveness and market value creation.

- AI enables predictive analytics, forecasting health crises (e.g., heart failure exacerbation) days before symptomatic onset.

- Machine learning algorithms enhance data accuracy by filtering noise and calibrating sensor readings for personalized use.

- AI facilitates personalized intervention protocols and automated feedback loops for medication and lifestyle adherence.

- Natural Language Processing (NLP) supports virtual health assistants, improving patient engagement and usability of monitoring devices.

- Optimized resource allocation and triage systems for remote clinical teams based on real-time risk scoring provided by AI.

- Enhanced cybersecurity measures and anomaly detection in data transmission protecting sensitive patient information.

DRO & Impact Forces Of Home Healthcare monitoring Device Market

The dynamics of the Home Healthcare Monitoring Device Market are heavily influenced by a potent combination of driving forces related to demographic shifts and technological advancements, counterbalanced by significant restraints associated with data security and regulatory fragmentation, while opportunities emerge through expanding connectivity infrastructure and evolving care models. The primary driver remains the overwhelming societal cost associated with chronic disease management in institutional settings, compelling governments and payers to incentivize less expensive, home-based care alternatives. Technological miniaturization and improved battery life have simultaneously driven product efficacy and user convenience, overcoming previous hurdles related to device bulkiness and frequent charging requirements. However, a major restraint involves the lack of universal standards for device interoperability and data exchange, creating silos of patient information and hindering seamless integration into existing hospital EHR systems. Impact forces are currently leaning toward positive growth acceleration, largely due to the systemic shock of global health events forcing rapid regulatory acceptance of telehealth and RPM, fundamentally changing consumer and clinician behavior permanently.

Key drivers include the global aging population, specifically the segment over 65, which often requires multiple health parameters monitored concurrently, and the increasing patient empowerment trends where individuals prefer managing their health discreetly and comfortably from home. Furthermore, substantial investment in 5G and low-power wide-area network (LPWAN) technologies is solving geographical limitations regarding data transmission speed and reliability, particularly in rural or underserved areas, greatly expanding the addressable market. Conversely, restraints are deeply rooted in regulatory complexities: obtaining FDA or CE mark approval for medical devices that involve software as a medical device (SaMD) and AI components is challenging and time-consuming. Additionally, cybersecurity threats and patient data privacy breaches remain high-risk deterrents; users are increasingly cautious about sharing continuous physiological data, demanding robust, end-to-end encryption solutions that add to the device manufacturing cost.

Opportunities are abundant in emerging markets, where penetration rates are low but healthcare infrastructure is rapidly developing, presenting a clean slate for implementing advanced digital health systems rather than retrofitting legacy systems. Specific application opportunities exist in preventative cardiology, remote neurological monitoring (e.g., seizure detection, Parkinson's progression), and the integration of behavioral health monitoring with physical health data streams. The major impact force currently reshaping the competitive landscape is the convergence of consumer electronics manufacturers (like Apple and Samsung) entering the regulated medical device space, forcing traditional medical device companies to drastically improve their user experience and industrial design appeal. This competitive pressure encourages innovation, lowers consumer costs, and accelerates the obsolescence cycle for older, less integrated monitoring technologies, collectively ensuring rapid, though often disruptive, market evolution.

Segmentation Analysis

The Home Healthcare Monitoring Device Market is meticulously segmented across product type, application, and end-user, reflecting the diverse range of monitoring needs and the complexity of the patient care journey. Segmentation is critical for market players to tailor device functionalities, regulatory strategies, and distribution channels to specific user cohorts. The primary product segments include vital sign monitors (like blood pressure and pulse oximeters), specialized monitors (such as ECG/EKG devices and continuous glucose monitors or CGMs), and safety and security monitors (including fall detection and emergency response systems). The complexity of integration is highest in specialized monitors, which often require extensive software and cloud infrastructure for processing and clinical alerting, thus commanding premium pricing and attracting higher R&D investment relative to simpler vital sign devices.

Application-wise, the market is dominated by chronic disease management, which encompasses major global health burdens such as cardiovascular disorders, diabetes, and respiratory ailments. This segment drives volume due to the necessity for long-term, continuous monitoring to prevent acute complications and manage medication efficacy. Other significant application segments include fitness and wellness tracking, which relies on consumer-grade wearable devices, and post-acute care monitoring, where devices are temporarily used after discharge to prevent readmission. The increasing awareness of preventative healthcare is steadily blurring the lines between clinical-grade devices and consumer wellness trackers, pushing manufacturers toward obtaining regulatory clearance for features previously restricted to medical environments.

End-user segmentation differentiates between clinical organizations (hospitals, clinics, and long-term care facilities) utilizing these systems for population health management, and individual end-users (patients and caregivers) purchasing devices for personal health management. Institutional adoption is driven by economies of scale, integration capabilities, and robust data security features required for compliance. Conversely, individual user adoption is heavily influenced by ease of use, aesthetics, device portability, and direct cost, often necessitating simplified interfaces and streamlined connectivity to personal smartphones or tablets. The future trajectory involves greater convergence between these end-user needs, with clinical systems requiring consumer-grade usability and consumer devices requiring clinical-grade accuracy.

- By Product Type:

- Blood Glucose Monitors (CGMs, BGM)

- Blood Pressure Monitors

- ECG/EKG Monitors

- Pulse Oximeters

- Temperature Monitors

- Sleep Apnea Monitors

- Pedometers and Activity Monitors

- Specialized Monitors (Neurological, Respiratory)

- By Application:

- Chronic Disease Management (Cardiovascular, Diabetes, COPD)

- Fitness and Wellness Monitoring

- Post-Acute and Transitional Care Monitoring

- Geriatric Monitoring and Safety

- Pregnancy and Neonatal Monitoring

- By End-User:

- Hospitals and Clinics (for remote management programs)

- Home Healthcare Agencies

- Individual Consumers/Patients

Value Chain Analysis For Home Healthcare monitoring Device Market

The Value Chain for the Home Healthcare Monitoring Device Market is intricate, spanning from raw material acquisition and component manufacturing (upstream) through complex software integration and rigorous testing, culminating in highly specialized distribution and service delivery (downstream). Upstream analysis focuses heavily on the procurement of high-quality biosensors, microprocessors, connectivity modules (e.g., Bluetooth, Wi-Fi, cellular), and advanced battery technologies. Manufacturing relies on precision engineering to ensure miniaturization and durability, meeting strict medical device standards (ISO 13485). The key value addition at this stage is the integration of these components into a seamless, user-friendly device form factor that also maintains clinical accuracy, often requiring specialized cleanroom assembly and calibration processes that are crucial for device efficacy and regulatory clearance.

Downstream activities are dominated by the intricate network of distribution channels and the provision of continuous data services. Distribution primarily utilizes both direct channels (selling directly to large hospital systems or specialized RPM service providers) and indirect channels (pharmaceutical distributors, retail pharmacies, and e-commerce platforms for consumer-grade devices). Direct distribution is typically favored for high-value, prescription-required devices, ensuring controlled deployment and mandatory training. Indirect channels maximize reach for over-the-counter wellness devices. A significant differentiating element in the downstream value chain is the cloud-based data platform and associated technical support; the device itself provides limited value without robust, compliant software infrastructure for data storage, analysis, and secure transmission to Electronic Health Record (EHR) systems.

Service providers, including specialized telehealth companies and third-party monitoring centers, constitute the final, most crucial element of the downstream value chain, translating raw device data into actionable clinical insights. These entities handle the triage, remote coaching, and clinical alerting that close the loop between the patient’s home and the healthcare system. The increasing complexity of integrated solutions demands strong partnerships between device manufacturers and software vendors to ensure seamless data flow and compliance with global health data privacy regulations (e.g., HIPAA, GDPR). Profit margins are increasingly shifting away from the hardware sale toward recurring revenue generated by software subscriptions and professional monitoring services, driving manufacturers to focus on establishing robust and scalable service platforms.

Home Healthcare monitoring Device Market Potential Customers

The potential customers and end-users of Home Healthcare Monitoring Devices are highly diversified, extending beyond individual patients to encompass institutional buyers, payers, and specialized healthcare service providers, each seeking unique benefits from these technologies. The core customer base comprises individuals managing chronic conditions, particularly the elderly (over 65) suffering from multiple comorbidities such as hypertension, diabetes, and Chronic Obstructive Pulmonary Disease (COPD). For these individuals and their immediate caregivers, the primary value proposition is convenience, comfort, and the ability to maintain independence while ensuring clinical surveillance.

Institutional customers, primarily hospitals and Integrated Delivery Networks (IDNs), represent a rapidly growing segment. They acquire these systems not just for individual patient care but for implementing large-scale Remote Patient Monitoring (RPM) programs aimed at reducing readmission rates, optimizing bed utilization, and adhering to value-based care mandates. For hospitals, the return on investment (ROI) is measured in reduced length of stay and penalties avoided through better post-discharge management. Health insurance providers and governmental payers (e.g., CMS in the US) are indirect, yet highly influential, customers; their reimbursement decisions determine market accessibility and profitability, as they seek cost savings through preventative, home-based care.

A third crucial segment includes specialized home healthcare agencies and long-term care facilities. These organizations rely on monitoring devices to efficiently manage geographically dispersed patient populations, ensuring regulatory compliance and enhancing staff productivity by substituting manual in-person checks with automated, real-time data collection. Finally, the segment of health-conscious younger consumers and athletes also constitutes a growing market for consumer-grade vital sign and activity trackers, driving innovation in device aesthetics and connectivity, although their purchase rationale is wellness and performance optimization rather than clinical management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $28.5 Billion |

| Market Forecast in 2033 | $58.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips, Medtronic, GE Healthcare, Abbott Laboratories, Boston Scientific, ResMed, Omron Healthcare, Dexcom, Masimo Corporation, Bio-Rad Laboratories, Roche Diagnostics, Samsung Healthcare, Apple Inc., iHealth Labs, Cerner Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Healthcare monitoring Device Market Key Technology Landscape

The technological landscape of the Home Healthcare Monitoring Device Market is defined by the synergistic advancements in four critical areas: Internet of Things (IoT) connectivity, highly sensitive biosensors, cloud computing for data management, and sophisticated cybersecurity protocols. The proliferation of medical IoT devices allows for seamless, continuous data capture and transmission without active user intervention, transforming passive monitoring into active surveillance. Modern devices leverage ultra-low-power chipsets and improved protocols like Bluetooth Low Energy (BLE) and emerging cellular IoT standards (e.g., NB-IoT) to ensure long battery life and reliable, always-on connectivity, which is paramount for critical monitoring applications such as cardiac event detection or continuous glucose monitoring (CGM). This reliance on IoT architecture dictates that manufacturers prioritize systems engineering alongside medical accuracy.

Sensor technology constitutes the core innovation engine. Recent breakthroughs include non-invasive sensors capable of measuring complex physiological parameters previously requiring clinical instruments, such as continuous non-invasive blood pressure monitoring or multi-wavelength pulse oximetry for improved accuracy in diverse skin tones. Miniaturization of these sensors enables integration into comfortable, inconspicuous wearable formats (e.g., patches, rings, smart fabrics), significantly improving patient compliance and extending the monitoring window far beyond traditional bedside devices. The accuracy and durability of these biosensors directly influence the device's clinical utility and regulatory approval trajectory, making materials science and signal processing critical areas of competitive differentiation.

Cloud computing platforms provide the necessary infrastructure to handle the exponential increase in data volume generated by thousands of connected devices. These platforms must offer robust scalability, immediate processing capabilities for real-time alerting, and strict adherence to regional health data storage and residency laws. Furthermore, the integration of advanced analytics, often utilizing machine learning, occurs primarily in the cloud, enabling complex pattern recognition and predictive modeling that forms the basis of next-generation personalized care. Finally, robust cybersecurity technology, including advanced encryption, tokenization, and multi-factor authentication, is non-negotiable. As devices become entry points into personal health networks, ensuring the integrity and confidentiality of patient data against sophisticated cyber threats dictates the trust and eventual scale of adoption in this highly sensitive market.

Regional Highlights

- North America (USA and Canada): North America stands as the largest market, primarily due to the established infrastructure supporting telehealth and proactive policy changes regarding reimbursement for remote patient monitoring (RPM) services, particularly under Medicare and private payers in the United States. High prevalence of chronic diseases, coupled with high per capita expenditure on healthcare technology, ensures early adoption of cutting-edge devices like sophisticated continuous glucose monitoring (CGM) and complex cardiac monitoring systems. The region is characterized by intense competition and a strong focus on regulatory compliance, driving manufacturers to continually innovate in terms of data security and EHR integration capabilities. The market dynamics are highly sensitive to adjustments in federal reimbursement codes and clinical guidelines set by major health organizations.

- Europe (Germany, UK, France, Italy, Spain): The European market is characterized by diverse national healthcare systems, leading to varying adoption rates based on local public health priorities and regulatory frameworks. Germany, with its Digital Healthcare Applications (DiGA) framework, leads the way by allowing medical apps and devices to be reimbursed by statutory health insurance, driving innovation in regulated digital health solutions. The UK and France show strong growth fueled by government initiatives aimed at managing elderly populations at home and reducing the burden on centralized hospitals. The restraint in Europe often lies in the bureaucratic process of national procurement and achieving unified cross-border data transfer standards (GDPR compliance heavily influences development).

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is the fastest-growing market globally, driven by two key factors: the sheer size of its population, including vast underserved rural areas, and the presence of super-aging societies (Japan and South Korea) necessitating efficient geriatric care solutions. Governments in countries like China and India are heavily investing in digital health infrastructure to leapfrog traditional healthcare delivery challenges. Local manufacturers are emerging rapidly, focusing on affordability and integrating devices with regional mobile communication ecosystems. Market potential is massive, though hindered by lower per capita health spending in some countries and a need for greater standardization in connectivity infrastructure.

- Latin America (LATAM): The market in Latin America is still nascent but experiencing accelerated growth, particularly in major economies like Brazil and Mexico. Expansion is driven by increasing penetration of mobile health technology and the need to address healthcare access inequalities, especially in remote areas. Regulatory environments are often less mature than in North America or Europe, which can present both opportunities for rapid market entry and challenges regarding product standardization and quality assurance. Economic stability and disposable income directly influence the adoption rate of higher-cost, specialized monitoring devices.

- Middle East and Africa (MEA): Growth in MEA is uneven, concentrated primarily within the affluent Gulf Cooperation Council (GCC) countries which possess substantial resources for high-tech healthcare investments, often focusing on advanced monitoring solutions for chronic lifestyle diseases prevalent in the region (e.g., diabetes). African markets, while offering huge potential due to large populations, face significant challenges related to infrastructural deficits, inconsistent power supply, and low reimbursement rates, often necessitating device solutions designed for extreme durability and limited connectivity environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Healthcare monitoring Device Market.- Philips (Koninklijke Philips N.V.)

- Medtronic plc

- GE Healthcare

- Abbott Laboratories

- Boston Scientific Corporation

- ResMed Inc.

- Omron Healthcare, Inc.

- Dexcom, Inc.

- Masimo Corporation

- Bio-Rad Laboratories, Inc.

- Roche Diagnostics (F. Hoffmann-La Roche Ltd)

- Bayer AG

- Tunstall Group

- Cerner Corporation (now Oracle Health)

- iHealth Labs, Inc.

- Samsung Healthcare

- Apple Inc.

- Honeywell International Inc.

- LivaNova PLC

- Nonin Medical, Inc.

Frequently Asked Questions

Analyze common user questions about the Home Healthcare monitoring Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Home Healthcare Monitoring Device Market?

The primary driver is the accelerating global aging population coupled with the rising prevalence of chronic diseases (like diabetes and cardiovascular conditions). This demographic shift necessitates cost-effective, continuous monitoring solutions that reduce the dependency on expensive hospital stays and facilitate long-term disease management at home.

How is AI impacting the clinical utility of home monitoring devices?

AI significantly enhances clinical utility by transforming raw data into actionable intelligence. AI algorithms provide predictive alerts, identifying subtle physiological trends that may precede an acute health event, thereby enabling proactive intervention by clinicians and greatly improving patient outcomes through personalized remote care management.

What major challenges exist regarding data security in home healthcare monitoring?

The major challenges involve ensuring end-to-end data security and maintaining patient privacy (HIPAA, GDPR compliance) as continuous physiological data is transmitted over public networks. Manufacturers must integrate robust encryption, authentication protocols, and secure cloud storage to mitigate the risk of sophisticated cyberattacks and maintain consumer trust.

Which product segment holds the highest market share and why?

The Vital Sign Monitoring Devices segment, which includes blood pressure monitors, pulse oximeters, and temperature monitors, holds a high share due to their widespread application in managing common chronic conditions and their accessibility as both clinical-grade and over-the-counter consumer devices. Continuous Glucose Monitors (CGMs) are also a rapidly growing, high-value sub-segment.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This accelerated growth is primarily attributed to large, untapped patient populations, increased government investments in digital healthcare infrastructure, and the urgent need to expand access to healthcare services across developing economies in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Home Healthcare Monitoring Device Market Statistics 2025 Analysis By Application (Home, Hospital), By Type (Software, Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Home Healthcare Monitoring Device Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Fetal & Neonatal Monitoring Devices, Respiratory Monitoring Devices, Multiparameter Monitoring Devices, Remote Patient Monitoring Devices, Weight Monitoring Devices, Temperature Monitoring Devices), By Application (Hospitals & Clinics, Home Settings, Ambulatory Surgical Centers (ASC)), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager