Horticulture Led Grow Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442923 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Horticulture Led Grow Lights Market Size

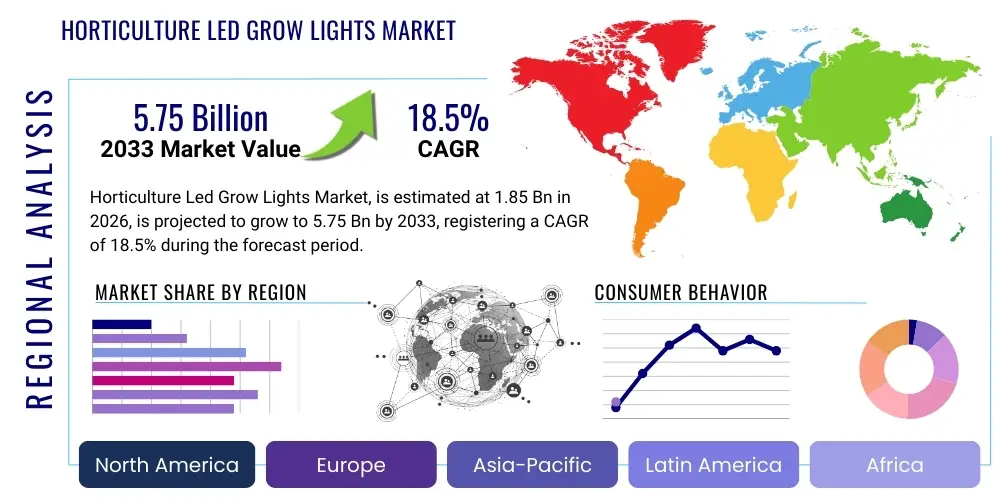

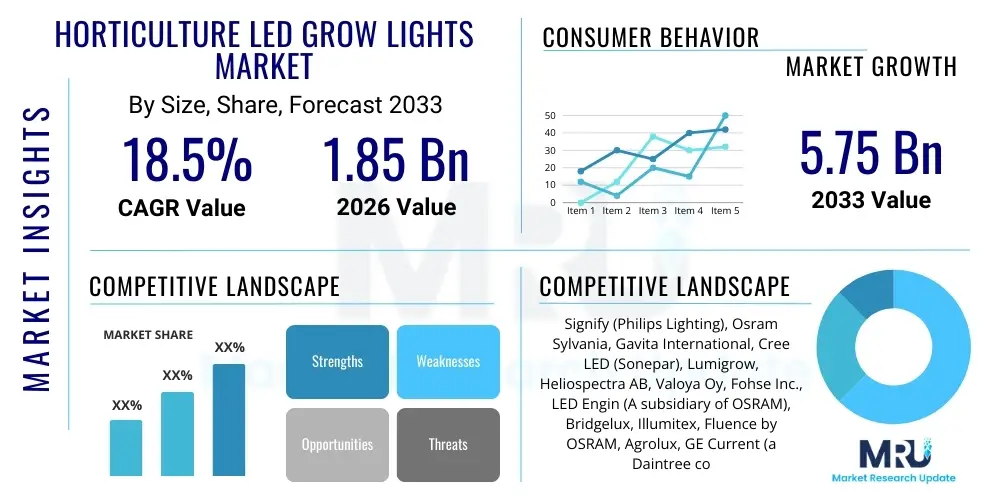

The Horticulture Led Grow Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 5.75 Billion by the end of the forecast period in 2033.

Horticulture Led Grow Lights Market introduction

The global Horticulture LED Grow Lights Market is undergoing rapid transformation, driven primarily by the escalating demand for controlled environment agriculture (CEA), particularly vertical farming and greenhouses, aiming to enhance crop yields and resource efficiency across diverse climatic zones. Horticulture LED grow lights are advanced artificial lighting systems engineered to emit optimal spectra—often focusing on blue (400–500 nm) and red (600–700 nm) wavelengths—critical for photosynthesis, photomorphogenesis, and the induction of desired secondary metabolite production across various plant growth stages. These sophisticated systems offer decisive competitive advantages over traditional High-Intensity Discharge (HID) lamps, including vastly superior energy efficiency, granularly customizable spectral output, exceptionally long operational lifespans exceeding 50,000 hours, and significantly reduced radiative heat emission, which markedly simplifies and reduces the operational expenditure associated with climate control within cultivation facilities.

Major applications of these highly efficient lighting solutions span massive commercial greenhouse operations, fully enclosed indoor farms (including modular container farms), high-precision academic and governmental research laboratories focused on plant genetics, and the expanding segment of high-tech domestic gardening. The core benefit derived from utilizing these systems lies in the capability to completely decouple food and specialty crop production from unpredictable external factors such as adverse weather conditions, seasonal light variations, and geographical limitations, thereby guaranteeing a stable, predictable, and year-round supply of high-value crops. This stability is crucial for ensuring food security, minimizing vulnerability to supply chain shocks, and supporting the massive global trend toward localized, urban-based agricultural production, particularly for fresh produce like leafy greens, medicinal plants (e.g., cannabis), and various fruits.

Key driving factors propelling the accelerating market expansion include widespread supportive governmental policies that actively promote energy-efficient cultivation methodologies and sustainable resource utilization, the rapidly rising adoption of precision agriculture techniques leveraging advanced sensor technology and data analytics to fine-tune growing parameters, and the strong, sustained consumer preference for locally sourced, transparently grown, and often pesticide-free or organic produce. Furthermore, the increasing global wave of legalization and commercial-scale cultivation of cannabis and hemp in multiple regulatory jurisdictions represents a substantial and technologically demanding end-user segment. These facilities require extremely sophisticated, high-power LED lighting infrastructure to precisely modulate light quality and quantity, essential for maximizing critical compounds like tetrahydrocannabinol (THC) and cannabidiol (CBD) yields while adhering to strict compliance standards. The continued technological maturity, specifically the relentless reduction in LED manufacturing costs combined with consistent improvements in light efficacy (μmol/J) output, continues to hasten market penetration across previously cost-prohibitive crop types and diverse geographical markets.

Horticulture Led Grow Lights Market Executive Summary

The Horticulture LED Grow Lights market is currently demonstrating exceptionally robust growth, fundamentally transforming the landscape of commercial crop production toward higher resource efficiency, climate resilience, and unprecedented sustainability levels. Business trends overwhelmingly point toward a major industry shift toward integrated, intelligent cultivation solutions, where advanced lighting systems are increasingly bundled with sophisticated environmental control software platforms, highly sensitive sensors, and data analytics tools. This integration allows for dynamic, autonomous light management—including spectral shifting, intensity regulation (dimming), and tailored photoperiod control—all based on real-time feedback regarding plant physiological needs, maximizing the Photosynthetic Photon Flux Density (PPFD) utilization. Strategic activities such as mergers, acquisitions, and extensive partnership formation between specialized lighting manufacturers and broader Controlled Environment Agriculture (CEA) technology providers are rapidly intensifying competitive dynamics and collectively accelerating the pace of necessary technological innovation across the sector. Moreover, manufacturers are heavily dedicating resources to improving fixture light efficacy (PPF/W) to critically reduce the operational expenditure (OPEX) burden for commercial growers, simultaneously driving necessary system replacement cycles and further solidifying market expansion.

From a regional perspective, North America currently maintains a definitive leading position in terms of market valuation and technological adoption, primarily driven by massive, centralized investment in highly controlled commercial cannabis cultivation and the presence of numerous established, large-scale greenhouse complexes primarily in the US and Canada. In contrast, the Asia Pacific (APAC) region is dynamically emerging as the fastest-growing market segment globally, significantly fueled by determined governmental backing for resilient and sustainable agriculture in densely populated nations such as China, Japan, and India. This regional growth is coupled with widespread, significant expansion in innovative urban vertical farming initiatives specifically aimed at enhancing localized food production and minimizing distribution logistics in heavily urbanized areas. Europe exhibits stable and highly sustainable growth, characterized by the existence of a mature, high-tech greenhouse industry (particularly in the Benelux and Mediterranean regions) that is systematically adopting advanced LED solutions to strategically replace aging, energy-inefficient high-pressure sodium (HPS) installations, with a primary focus on premium fruit and vegetable cultivation.

Analysis of market segment trends distinctly reveals that the 'Fixed Spectrum' segment currently captures the largest immediate market share due to its inherent reliability, reduced complexity, and lower initial capital outlay, making it accessible for growers focusing on single-crop systems. However, the 'Adjustable Spectrum/Dynamic Lighting' segment is decisively projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is directly attributable to the increasing demand for flexible and customizable light delivery required in complex plant research facilities and extensive large-scale commercial operations that need to cultivate diverse crops or precisely optimize specific phytochemical synthesis during distinct phenological stages. Regarding installation type, the 'New Installation' segment dominates initial revenue streams driven by new facility construction, while the 'Retrofit Installation' segment, primarily fueled by the essential replacement of energy-intensive HPS lights, contributes substantially to ongoing market volume, strongly reflecting the industry’s overarching commitment to a widespread and systematic energy transition towards sustainable technologies.

AI Impact Analysis on Horticulture Led Grow Lights Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) frequently center on the potential for AI to autonomously optimize complex light recipes, execute highly accurate predictive maintenance of large-scale lighting grids, and automate seamless environmental responses within CEA facilities. Users express keen interest in understanding how advanced machine learning algorithms can rapidly move beyond simple data logging and basic automation toward truly prescriptive control—specifically, how these platforms can analyze vast, multi-modal datasets concerning climate variables, specialized nutrient uptake metrics, specific plant stress biomarkers, and growth morphology to dynamically and instantly adjust LED spectral output, intensity, and photoperiod in real-time. The goal is clear: maximize both measurable crop yield (biomass) and overall energy efficiency (PPF/W utilization). There is a high industry expectation that deep AI integration will drastically minimize the reliance on human intervention and specialized horticultural expertise required for managing highly complex CEA operations efficiently. Furthermore, potential adopters widely question the cost implications, data privacy concerns, and formidable integration challenges associated with linking sophisticated AI platforms seamlessly with both existing legacy and new-generation LED hardware infrastructure, fully recognizing the absolute necessity for installing high-fidelity sensors and robust network capabilities to realize the transformative, full potential of smart, autonomous lighting controls.

The integration of Artificial Intelligence (AI) and associated Machine Learning (ML) methodologies is fundamentally and rapidly transforming the utilization, management, and long-term economic viability of Horticulture LED Grow Lights, successfully moving the industry toward truly smart, highly autonomous cultivation systems capable of self-optimization. AI algorithms are designed to process and synthesize complex environmental datasets—which include localized CO2 levels, humidity fluctuation patterns, temperature gradients, and precise nutrient delivery rates—concurrently analyzing data captured from specialized sensor networks and high-resolution hyperspectral cameras that constantly monitor plant health indicators and intricate growth morphology. This advanced analysis allows the AI engine to develop and deploy highly specific "light recipes" tailored precisely not just to the broad crop species (e.g., tomato), but to the specific genetic cultivar and its current, real-time stage of development. This ensures the optimal delivery of light (measured by intensity, precise duration, and spectral composition) critically necessary for achieving specific desired commercial outcomes, such as dramatically enhancing specific desired phytochemical production (e.g., in medicinal herbs) or accelerating biomass accumulation while simultaneously minimizing energy waste to unprecedented levels.

This capability for prescriptive, data-driven control represents the single largest market differentiator and technological advancement, enabling large-scale commercial growers to achieve unparalleled levels of uniformity, consistency, and repeatability in crop production outcomes, entirely independent of external climatic variability or operational scale complexities. For instance, advanced AI systems can detect extremely subtle, nascent signs of plant disease or environmental stress significantly earlier and more reliably than standard human operators, primarily by analyzing slight, algorithmically-determined changes in chlorophyll fluorescence patterns induced by specific LED spectral inputs, allowing for immediate, localized, and automated adjustments in lighting conditions or associated environmental controls to mitigate risk before it spreads. This profound industry shift from traditional manual control and simple scheduled automation toward autonomous, continuously learning, data-driven optimization is strategically positioned to accelerate the large-scale adoption of premium, adjustable-spectrum LED systems specifically engineered for seamless API integration and interoperability with these cutting-edge computational platforms, ensuring they become the standard in future CEA facilities.

- AI enables dynamic, real-time spectral adjustment based on continuous plant physiological feedback loops (photosynthesis and transpiration rates).

- Predictive maintenance algorithms monitor LED fixture efficiency, thermal signatures, and driver performance, accurately identifying potential hardware failures significantly before operational interruptions occur.

- Optimization of energy consumption by precisely matching light output (PPFD) to the instantaneous photosynthetic saturation point requirements of the specific crop and environment.

- Automated early anomaly detection (e.g., nutrient deficiencies, pests, or biotic stress) using multi-spectral imaging guided by sophisticated AI pattern recognition.

- Development and proprietary safeguarding of complex, high-yield, and energy-efficient light recipes through continuous machine learning cycles, vast data aggregation, and iterative testing.

DRO & Impact Forces Of Horticulture Led Grow Lights Market

The Horticulture LED Grow Lights market is strategically positioned and characterized by immensely powerful drivers intrinsically linked to global mandates for sustainability, resource conservation, and energy efficiency, a momentum slightly tempered by significant restraints centered on high initial investment requirements and the technical sophistication needed for implementation. The core foundational driver is the acute and growing global need for extreme resource optimization within agriculture, particularly regarding rapidly dwindling water and limited arable land resources, which makes energy-efficient Controlled Environment Agriculture (CEA) lighting a highly critical, non-negotiable component of modern food production strategy. Conversely, market restraints predominantly involve the substantially high upfront Capital Expenditure (CAPEX) mandated for procuring, installing, and integrating sophisticated, fully programmable LED systems, especially when compared directly to the simple installation costs of conventional legacy lighting. This restraint is compounded by the inherent technical complexity associated with precisely optimizing complex spectral output profiles for diverse, high-value crops, a task which often necessitates specialized horticultural expertise and advanced system integration capabilities.

Opportunities for profound market penetration are vast and geographically widespread, particularly within the rapidly evolving, high-margin market for medicinal plants, specialized nutraceutical ingredients, and high-value niche crops (such as unique culinary herbs, specialized roots, or delicate berries cultivated indoors), where controlled environments are essential to guarantee absolute product consistency, quality, and purity standards. Furthermore, the massive global structural effort required to convert and modernize existing conventional greenhouses—which currently predominantly rely on outdated, energy-guzzling High-Pressure Sodium (HPS) lights—through systematic retrofit programs offers a substantial, reliable, short-to-medium-term revenue stream for established lighting manufacturers and system integrators worldwide. Long-term structural success and sustainable expansion of the market are critically contingent on the continuous advancement of technological innovation in light efficacy (PPF/W or μmol/J) and fixture durability, driving down the Total Cost of Ownership (TCO) sufficiently to make the technology not just cost-competitive, but economically overwhelmingly superior for large-scale, lower-margin staple crop production in closed-loop systems.

Impact forces significantly shape the long-term market trajectory through a powerful combination of escalating governmental regulatory pressure, intense competitive rivalry among major international players, and the relentless evolution of core lighting technology. Regulations rigorously supporting global carbon neutrality goals, actively promoting sustainable resource use, and implementing energy consumption taxes (e.g., stringent European Union energy efficiency directives and similar national mandates) provide a powerful and non-optional external impetus for widespread adoption of LEDs. Concurrently, intense horizontal and vertical competition among established key players forces aggressive pricing strategies, drives down manufacturing unit costs, and necessitates rapid differentiation through the development of premium features like advanced thermal management solutions, seamless digital controls, and proprietary, high-output spectral recipes. The most enduring, overarching impact force remains the consistent, predictable decline in the price-to-performance ratio of high-efficacy LEDs. This ongoing economic improvement makes the technology increasingly accessible and economically justified across historically lower-margin agricultural segments, thereby irreversibly solidifying LED grow lights’ dominance over all available legacy lighting solutions.

Segmentation Analysis

The Horticulture LED Grow Lights Market is subject to precise segmentation based on several critical dimensions, including the underlying technology type of the diodes and fixtures, the nature of the light spectrum provided, the specific end-use application, the installation scenario (new vs. retrofit), and the geographical market, enabling highly granular market sizing, accurate forecasting, and effective strategic targeting. Segmentation by technology type fundamentally distinguishes between low-power, mid-power, and high-power LED systems, a distinction that directly correlates with the required operational scale, light intensity, and fixture density necessitated by various types of cultivation environments, from small research plots to expansive multi-acre greenhouses. Spectrum segmentation is arguably the most crucial technological differentiator, separating readily available fixed spectrum solutions, which deliver a static, pre-optimized light recipe suitable for consistent single-stage growth, from advanced adjustable spectrum solutions, which provide dynamic, software-controlled flexibility over wavelength composition, intensity, and duration to maximize diverse outcomes and accommodate multi-crop rotations.

Application segmentation precisely highlights the immense diversity of the end-user base, robustly covering major operational categories such as commercial greenhouses, which are typically very large facilities requiring high-output supplemental lighting only during seasonal low-light periods; dedicated indoor farms and vertical farms, which operate in fully enclosed spaces and depend absolutely on 100% artificial lighting for survival; and specialized research laboratories and plant breeding centers, which critically demand unparalleled precision in spectral control for highly controlled experimentation and genetic optimization. Installation type segmentation is vital for understanding market dynamics, cleanly separating the market into new installations, representing significant capital expenditure allocated toward greenfield projects, new facility expansions, or specialized modular setups, and retrofit installations, which involve the systematic, large-scale replacement of older, significantly less efficient lighting, most commonly high-pressure sodium (HPS) lamps, with modern, energy-saving LED fixtures.

The collective analysis of these multifaceted segmentations clearly reveals that while established commercial greenhouses currently contribute the largest immediate market volume and steady demand due to the mature nature of their operations, the highest sustainable growth potential is unambiguously concentrated within the Vertical Farming, Indoor Agriculture, and Adjustable Spectrum technology segments. This clear segment shift strongly reflects the increasing technological sophistication of advanced agricultural practices worldwide, the necessity of achieving maximum resource efficiency in highly competitive markets, and the persistent industry-wide emphasis on rigorously optimizing crop-specific outcomes, particularly within high-density urban agricultural settings and the lucrative cultivation of high-value specialty crops such as medical cannabis, high-end herbs, and niche exotic produce, driving demand for intelligent, integrated lighting solutions.

- By Technology Type:

- Low Power (< 100W, typically used in tissue culture and research)

- Mid Power (100W – 300W, common in multi-tier vertical racks)

- High Power (> 300W, utilized for deep canopy penetration in greenhouses)

- By Spectrum:

- Fixed Spectrum (optimized blue/red ratio for specific needs)

- Adjustable Spectrum/Dynamic Lighting (full spectral control via software)

- By Installation Type:

- New Installation (new facilities, greenfield projects)

- Retrofit Installation (replacement of HPS/MH systems)

- By Application:

- Commercial Greenhouses (supplemental lighting)

- Vertical Farms/Indoor Farms (sole-source lighting)

- Research and Development (R&D) Facilities (precise environmental control)

- Other Applications (e.g., Home Gardening, Tissue Culture, propagation)

- By Crop Type:

- Fruits and Vegetables (e.g., Tomatoes, Cucumbers, Strawberries, Peppers)

- Flowers and Ornamental Plants (e.g., cut flowers, potted plants)

- Cannabis and Medicinal Plants (high-value, highly regulated crops)

- Others (e.g., Herbs, Microgreens, Algae, Seedlings)

Value Chain Analysis For Horticulture Led Grow Lights Market

The highly specialized value chain for the Horticulture LED Grow Lights market is inherently complex, initiating with critical upstream sourcing of fundamental raw materials and specialized semiconductor manufacturing, seamlessly progressing through essential component provision and meticulous fixture assembly, and culminating in highly specialized distribution, integration, and dedicated installation services meticulously tailored for demanding agricultural environments. Upstream analysis focuses intensely on the critical sourcing and quality control of key constituent components, including high-efficacy LED chips (semiconductor diodes), sophisticated driver electronics (power supplies), passive and active heat sinks, specialized secondary optics (lenses and reflectors), and custom engineered phosphors necessary for precision spectral tuning and high Photosynthetic Photon Flux (PPF) output. A small number of dominant global semiconductor giants control the mass production of high-performance LED chips, thereby exerting significant direct influence on the overall cost structure, technological trajectory, and inherent innovation capacity throughout the entire downstream value chain. Achieving robust and efficient thermal management solutions, such as deploying advanced heat sinks and heat pipe technology, represents a crucial input that directly dictates the final fixture lifespan and sustained performance metrics, demanding highly specialized materials science and engineering capabilities from upstream suppliers.

Midstream activities involve the crucial stages of sophisticated design, precise assembly, rigorous testing, and quality assurance of the final LED fixture, effectively converting discrete electronic and mechanical components into highly reliable, application-specific lighting solutions ready for deployment. Leading manufacturers in this segment often strategically specialize in engineering robust, chemically resistant, and completely water-resistant (IP-rated) fixtures, explicitly designed to reliably withstand the characteristic high humidity, volatile temperature swings, and chemical exposure inherent in both large-scale greenhouse and high-density vertical farm environments. This specialization ensures long-term operational integrity and minimizes failure rates. Downstream analysis focuses sharply on the indispensable role of highly specialized distribution channels, which must possess deep technical knowledge of horticulture and light planning. Direct sales channels are frequently employed for highly customized large commercial projects where extensive consultative services—including detailed light layout planning, specific spectral recipe recommendation, and crucial energy consumption analysis—are absolutely necessary and provided by the manufacturer’s own experts.

The dominant distribution channel structure is currently undergoing a strategic shift toward reliance on expert agricultural integrators and specialized technology consultants (indirect channels), as major commercial growers increasingly demand bundled, unified solutions that seamlessly integrate lighting systems with critical functions like irrigation, advanced HVAC (Heating, Ventilation, Air Conditioning), and predictive data monitoring platforms. Direct sales remain fundamentally vital for securing key strategic accounts, managing immense governmental infrastructure projects, and maintaining closer, proprietary control over competitive pricing strategies and crucial technical customer feedback loops. The overarching effectiveness and economic viability of the entire value chain are critically determined by the speed, efficiency, and fidelity with which relentless technological advancements (e.g., substantial increases in PPF efficacy and reductions in unit cost) are successfully translated into durable, highly reliable, and installation-ready products. These must be delivered to the highly demanding and specialized end-user community with comprehensive technical support, robust warranty coverage, and essential post-sale advisory services integrated as non-negotiable parts of the final commercial offering, maximizing grower return on investment (ROI).

Horticulture Led Grow Lights Market Potential Customers

The primary end-users and dedicated buyers of Horticulture LED Grow Lights constitute a highly diverse yet technically sophisticated group, ranging extensively from established, large multinational agricultural conglomerates operating expansive, technologically advanced greenhouse complexes to specialized, high-margin cannabis cultivators and pioneering, rapidly scaling vertical farming startups. Commercial greenhouses represent the largest existing and established customer base globally, strategically seeking high-intensity supplemental LED lighting exclusively during periods of naturally low external light (e.g., cloudy days or winter months), especially in northern temperate regions (such as Northern Europe and specific regions of North America) to reliably extend the effective growing seasons and dramatically improve winter yields of highly demanded crops like tomatoes, peppers, and high-quality cut flowers. These traditional customers primarily prioritize exceptional energy efficiency, leading to the lowest possible operating costs (OPEX), coupled with unparalleled uniformity of light delivery across massive coverage areas to prevent crop variability.

Vertical farms and specialized indoor agriculture facilities collectively constitute the highest growth-rate segment of future potential customers. These advanced operations are characterized by their complete, absolute dependency on artificial light sources (sole-source lighting) and consequently require highly dense, multi-layer, low-heat emission lighting solutions suitable for stacked racks. Their complex procurement decisions are intensely influenced by the crucial factors of high power density (to fit within tight spaces), advanced spectral programmability (to control morphology), and minimal radiant heat output (to drastically reduce ancillary cooling costs). Vertical farm operators typically focus on rapid-rotation specialty crops, including various leafy greens, high-end microgreens, and delicate culinary herbs, where exceptionally quick harvest cycles, precise quality consistency, and predictable yields are paramount to achieving their core business model profitability, thereby driving sustained, high demand for technologically advanced, integrated lighting systems often autonomously controlled by sophisticated AI platforms.

A highly lucrative, strategically specific, and technically demanding customer segment includes all legally licensed producers of medicinal cannabis, recreational cannabis, and specialized hemp crops. Due to the extremely stringent regulatory environments and the absolute commercial necessity of maximizing the concentration of highly specific secondary metabolites (e.g., desired ratios of THC, CBD, and complex terpenes), these sophisticated growers require exceptional levels of precision in spectral tuning and light intensity management. They collectively represent a premium-tier market, consistently willing to invest substantially in high-end, dynamically adjustable LED fixtures that can be precisely programmed to optimize and drive the synthesis of specific cannabinoid profiles during critical vegetative and flowering stages. Other vital recurring buyers and end-users include academic institutions, governmental agricultural research centers, and private plant breeding companies utilizing these advanced lights to conduct highly controlled experiments focused on plant genetics, disease pathology studies, and iteratively optimizing future commercial crop performance metrics under simulated real-world conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 5.75 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), Osram Sylvania, Gavita International, Cree LED (Sonepar), Lumigrow, Heliospectra AB, Valoya Oy, Fohse Inc., LED Engin (A subsidiary of OSRAM), Bridgelux, Illumitex, Fluence by OSRAM, Agrolux, GE Current (a Daintree company), Hubbell Incorporated, SANANBIO, Plessey, Shenzhen Xst-Led Technology, Kessil (A Division of DiCon Fiberoptics), LumiGrow Inc., P.L. Light Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Horticulture Led Grow Lights Market Key Technology Landscape

The technological landscape dominating the Horticulture LED Grow Lights market is characterized by extreme dynamism and intense innovation, primarily driven by core research and development efforts strictly focused on maximizing luminous efficacy, perfecting advanced thermal management solutions, and significantly enhancing the granularity of control over complex light spectra. A cornerstone technological focus is the constant, rigorous refinement of LED chip efficiency metrics, which are quantitatively measured using the Photosynthetic Photon Flux Efficacy (PPF/W or μmol/J) standard. Contemporary high-performance, commercial-grade LEDs are now capable of routinely exceeding 3.0 μmol/J, resulting in a dramatic reduction in the electrical consumption required per unit of usable light delivered to the plant canopy. This breakthrough efficiency is the critical economic factor making year-round, intensive CEA operations financially viable across major agricultural markets. Manufacturers are strategically employing specialized phosphor coatings and highly optimized combinations of gallium nitride (GaN) and aluminum gallium arsenide (AlGaAs) chips to achieve hyper-precise wavelengths meticulously tailored for both photoperiodic signaling and maximum photosynthetic responses, moving decisively beyond simplistic red/blue binary configurations to now include essential components like green, far-red, and specific near-UV light components.

Thermal management constitutes another extremely critical technology area, given that overall LED performance, sustained output efficacy, and guaranteed operational lifespan are exceptionally sensitive to fluctuations in junction temperature. Advanced passive and highly integrated active cooling techniques, which encompass specialized high-conductivity aluminum alloys, ceramic substrates, and sophisticated heat pipe technology, are systematically employed to dissipate generated heat with extreme efficiency. This meticulous management ensures that the lighting fixtures maintain their specified optimal performance parameters consistently over their projected operational lifespans, which frequently exceed 50,000 to 100,000 hours. Failure in adequate thermal management not only immediately reduces luminous efficacy and increases power consumption but also inevitably causes undesirable spectral shift over extended operating periods. The ongoing development of ruggedized, high-IP-rated, entirely fanless fixture designs capable of reliably withstanding the often corrosive, chemically rich, and highly humid environmental conditions characteristic of agricultural settings is absolutely paramount for guaranteeing long-term system durability and substantially reducing the necessary maintenance overhead for large-scale commercial growers.

Beyond the core hardware infrastructure, the highly advanced control technology segment forms an increasingly vital part of the market landscape and competitive differentiation. This includes the development and deployment of sophisticated driver electronics capable of ultra-precise current regulation and digital dimming protocols (e.g., 0-10V analog control or high-frequency pulse-width modulation - PWM) and enabling exceptionally rapid, fine-grained spectral shifting in dynamic adjustable systems. The rapid, pervasive adoption of pervasive IoT (Internet of Things) communication protocols and reliable wireless connectivity standards (such as Zigbee, dedicated horticultural Wi-Fi networks, and reliable Ethernet backbone connections) allows these massive lighting systems to be seamlessly and centrally managed, fully integrated with all climate control subsystems (HVAC, irrigation), and remotely monitored by operators located anywhere globally. The ultimate, transformative technological frontier is the mandatory seamless integration of this advanced, intelligent lighting infrastructure with powerful AI/ML platforms, enabling truly autonomous, predictive optimization of light delivery based on continuous high-fidelity sensor feedback and complex predictive models of plant physiological needs and projected growth trajectories, ultimately driving resource efficiency and yield optimization to previously unattainable limits.

Regional Highlights

Regional variations in characteristic climate patterns, specific regulatory frameworks governing energy use and agriculture, localized energy costs, and deep-seated agricultural traditions exert significant, measurable influence on the adoption rates, growth trajectories, and competitive dynamics of the Horticulture LED Grow Lights Market across the globe.

- North America (NA): Represents the dominant market in terms of both annual market share and cumulative technological adoption, fundamentally fueled by the massive, highly capitalized, and strictly regulated indoor cultivation industry for medicinal and recreational cannabis, particularly concentrated across the United States and Canada. Sustained, strong venture capital investment in expansive vertical farming startups and established governmental support programs focused on energy efficiency heavily solidify this region's strategic lead in the high-end segments.

- Europe: Characterized by a high and accelerating rate of technology adoption, strategically driven by an established and technically mature commercial greenhouse sector (led by the Netherlands, Belgium, and Spain) focusing intensely on high-value, protected-culture fruits, vegetables, and ornamentals. Strict governmental mandates regarding carbon neutrality and energy consumption (e.g., European Green Deal initiatives) actively incentivize and subsidize the systematic replacement of conventional HPS systems with highly efficient LED retrofits, ensuring steady and predictable demand for specialized, high-intensity supplemental lighting solutions.

- Asia Pacific (APAC): The fastest-growing regional segment globally, fueled by rapid, large-scale urbanization patterns that necessitate highly localized, resilient food supply chains via vertical farms and urban agriculture initiatives in densely populated countries such as Singapore, mainland China, South Korea, and Japan. Proactive government initiatives supporting technological modernization, climate-resilient agriculture, and competitive, large-scale domestic manufacturing capabilities (especially in China) are identified as the primary, potent catalysts for explosive regional market growth.

- Latin America (LATAM): Identified as a rapidly emerging market segment focused intensely on modernizing traditional agricultural export sectors and strategically expanding high-value flower and medicinal plant cultivation (prominently in Colombia, Ecuador, and Mexico). Market growth is currently moderate but is projected to accelerate substantially, particularly in jurisdictions that are actively legalizing, regulating, or heavily commercializing specialized medicinal crop production, driving initial demand for basic and mid-range LED fixtures.

- Middle East and Africa (MEA): Represents a specialized, niche market primarily driven by critical necessity; advanced LED grow lights provide an essential, viable technological solution for localized food production in extremely arid climates and regions characterized by critically limited natural water resources (e.g., UAE, Saudi Arabia, Israel). The primary focus remains on massive, high-tech desert greenhouse projects, advanced agricultural research centers, and supporting sophisticated sovereign food security initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Horticulture Led Grow Lights Market.- Signify (Philips Lighting)

- Osram Sylvania

- Gavita International

- Cree LED (Sonepar)

- Lumigrow

- Heliospectra AB

- Valoya Oy

- Fohse Inc.

- LED Engin (A subsidiary of OSRAM)

- Bridgelux

- Illumitex

- Fluence by OSRAM

- Agrolux

- GE Current (a Daintree company)

- Hubbell Incorporated

- SANANBIO

- Plessey

- Shenzhen Xst-Led Technology

- Kessil (A Division of DiCon Fiberoptics)

- LumiGrow Inc.

Frequently Asked Questions

Analyze common user questions about the Horticulture Led Grow Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of LED grow lights over traditional HPS lighting?

The primary driver is the significantly superior energy efficiency, as modern LED fixtures consume substantially less electrical power per unit of Photosynthetic Photon Flux (PPF) delivered, resulting in critical reductions in operational energy costs (OPEX) and superior thermal management for large-scale commercial growers compared to High-Pressure Sodium (HPS) systems.

How does spectral tuning benefit commercial crop cultivation in advanced CEA setups?

Spectral tuning, or dynamic adjustable spectrum control, empowers growers to precisely match specific light wavelengths (e.g., blue, red, far-red, UV) and intensity levels to the exact physiological and photoperiodic requirements of the plant at different growth stages, maximizing biomass yield, significantly improving desired flavor profiles, and enhancing the controlled production of desired secondary metabolites in high-value, regulated crops.

Which application segment holds the largest potential for future market growth (CAGR)?

While established commercial greenhouses currently dominate the immediate installation volume market, the Vertical Farming and Dedicated Indoor Agriculture segment is reliably projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, primarily due to rising global private and public investment in urban farming projects and the total reliance of these systems on advanced, controlled sole-source LED lighting.

What are the main financial constraints hindering widespread, rapid LED adoption across all agricultural segments?

The most significant financial constraint is the substantial initial capital expenditure (CAPEX) required for sophisticated, dynamically controllable LED fixture procurement, specialized installation, and seamless integration with complex centralized environmental control and monitoring systems, which represents a highly significant upfront investment barrier compared to legacy lighting technologies.

How is AI fundamentally impacting the operational functionality of modern Horticulture LED Grow Lights?

AI is successfully enabling the industry transition toward autonomous, prescriptive control, allowing advanced lighting systems to dynamically adjust light intensity, spectral composition, and photoperiod in real-time. This is achieved based on continuous machine learning analysis of plant health data (e.g., sensor and camera inputs), thereby optimizing Photosynthetic Photon Flux Density (PPFD) and maximizing overall energy utilization efficiency (μmol/J) autonomously across the facility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager