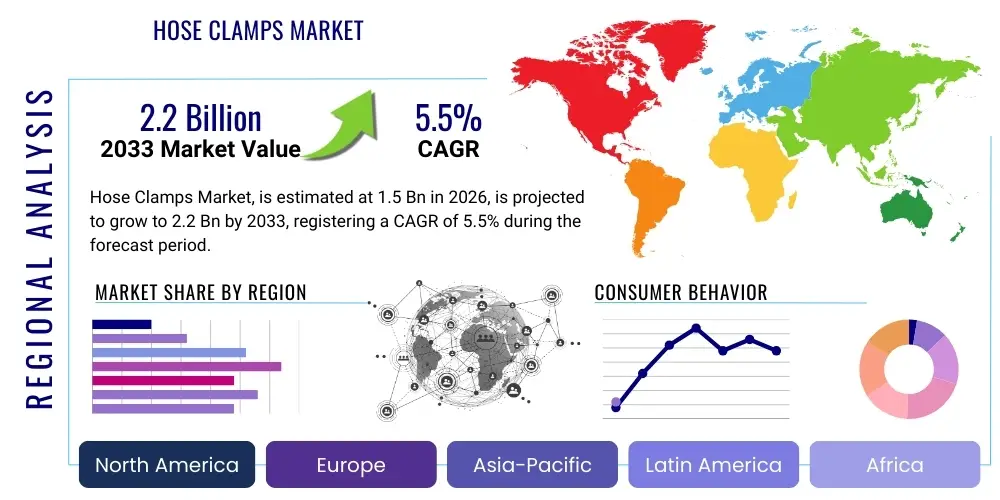

Hose Clamps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443607 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hose Clamps Market Size

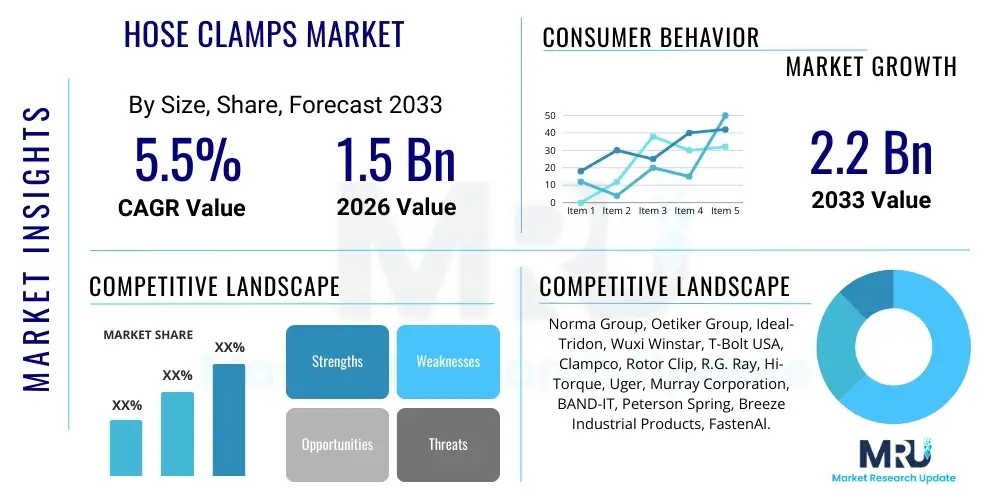

The Hose Clamps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Hose Clamps Market introduction

The Hose Clamps Market encompasses a diverse range of mechanical devices designed specifically to secure a hose over a fitting, ensuring a leak-proof and durable connection, particularly in fluid and air conveyance systems. These essential components are fabricated from various materials, including stainless steel, carbon steel, and specialized plastics, catering to diverse operating environments characterized by fluctuating temperatures, chemical exposure, and high pressure. The selection of the appropriate clamp is critical, often dictated by the application’s requirements regarding clamping force, material compatibility, and resistance to corrosion or vibration fatigue. Key types range from traditional worm gear clamps and T-bolt clamps, widely used in automotive and heavy-duty industrial settings, to spring clamps and quick-release clamps designed for easier installation and specific thermal cycling environments. The market is characterized by stringent quality standards, particularly in sectors such as aerospace and medical devices, driving continuous innovation in material science and design precision.

Hose clamps find major applications across a spectrum of industries where reliable fluid and air management is paramount. The automotive sector constitutes a primary consumer, utilizing clamps extensively in cooling systems, exhaust systems, fuel lines, and air intake systems, where performance and reliability under constant vibration and heat are mandatory. Beyond automotive, applications proliferate in construction equipment, agricultural machinery, marine vessels, and general industrial maintenance, repair, and overhaul (MRO) operations. Furthermore, specialized sectors such as HVAC (Heating, Ventilation, and Air Conditioning) rely on precise clamping mechanisms to ensure system efficiency and prevent refrigerant leakage. The increasing complexity of fluid systems in manufacturing processes and the growing emphasis on environmental regulation, specifically concerning emissions and chemical spills, further elevate the importance of high-performance clamping solutions.

The primary benefits offered by high-quality hose clamps include enhanced operational safety, prevention of costly fluid loss, and extension of equipment lifespan. Market growth is primarily driven by the robust expansion of the global automotive manufacturing base, especially the transition towards electric vehicles (EVs) which necessitate advanced thermal management systems requiring specialized, highly reliable clamping technologies. Simultaneously, accelerating urbanization and infrastructure development worldwide fuel demand from the construction and industrial machinery sectors. Technological advancements in clamp design, such as constant tension clamps that automatically adjust to temperature changes, address issues related to cold flow and heat expansion in demanding environments, solidifying their role as critical components in modern engineering.

Hose Clamps Market Executive Summary

The Hose Clamps Market is exhibiting robust growth, propelled primarily by enduring demand from the transportation and manufacturing sectors, alongside stringent regulatory pressures mandating leak prevention in industrial fluid systems. Key business trends include a notable shift towards specialized, high-performance materials such as Grade 316 stainless steel to address highly corrosive environments prevalent in marine, chemical processing, and wastewater treatment industries. Furthermore, Original Equipment Manufacturers (OEMs) are increasingly integrating automated clamping solutions during assembly lines, driving demand for pre-torqued, easy-install clamp designs. Consolidation among smaller players and strategic acquisitions by major market leaders focusing on diversifying product portfolios, particularly into constant tension and advanced sealing technologies, are defining the competitive landscape. Supply chain resilience, following recent global disruptions, is prompting companies to explore regionalized manufacturing hubs to shorten lead times and reduce logistics costs, impacting overall cost structures and pricing strategies.

Geographically, the Asia Pacific (APAC) region continues to dominate the market, driven by massive automotive production output in China, India, and Japan, coupled with rapid industrialization and infrastructure investment across Southeast Asia. North America and Europe, while exhibiting slower volume growth, lead in terms of technological adoption and value, characterized by high demand for complex, engineered clamping solutions for premium automotive brands and highly regulated aerospace and medical applications. Emerging regional trends include the rising demand for lightweight plastic clamps in weight-sensitive applications, particularly in European automotive markets aiming to meet strict emission reduction targets. Furthermore, maintenance and repair operations (MRO) remain a steady revenue stream across all regions, emphasizing the necessity of robust distribution networks for immediate component availability.

Segmental analysis highlights the dominance of the worm gear clamp segment based on volume due to its versatility and cost-effectiveness, though T-bolt clamps are gaining traction in heavy-duty applications requiring superior clamping force and stability. The application segment sees the automotive industry holding the largest market share, closely followed by the industrial machinery sector, which requires clamps resistant to high vibration and continuous operation cycles. Materially, stainless steel remains the material of choice globally, particularly types 304 and 316, due to their excellent balance of strength and corrosion resistance. However, the market is seeing accelerating growth in segments focused on specialized materials and constant-tension designs, reflecting the industry's focus on long-term reliability and reduced maintenance frequency in critical systems.

AI Impact Analysis on Hose Clamps Market

User queries regarding AI's impact on the Hose Clamps Market often center on its role in optimizing manufacturing quality, predicting component failure, and streamlining complex supply chains. Specifically, users frequently ask: "How can AI improve the quality control of critical hose clamp welds?" "Will predictive maintenance models reduce unscheduled downtime caused by clamp failure?" and "Can machine learning algorithms optimize inventory levels for the vast array of clamp sizes and materials?" The analysis reveals a consensus that while AI may not directly influence the core function of the clamp itself, it is poised to revolutionize the peripheral processes of design validation, production efficiency, and aftermarket servicing. Key themes summarize the expectations around AI driving hyper-customization, minimizing material waste through precise machine vision inspection, and enabling highly responsive, demand-driven manufacturing schedules that cope with global logistics volatility.

The immediate and tangible impacts of Artificial Intelligence and machine learning are being seen in the manufacturing phase. Advanced machine vision systems, powered by AI algorithms, are capable of inspecting every manufactured clamp for micro-fractures, dimensional inconsistencies, and welding defects far faster and more accurately than traditional methods or human inspection. This enhancement in Quality Control (QC) is crucial for safety-critical applications like aerospace and high-pressure fluid systems, where component failure can lead to catastrophic consequences. Furthermore, optimizing stamping and rolling processes using AI-driven feedback loops minimizes scrap rates, leading to substantial cost savings and higher material utilization, which is particularly relevant given the fluctuating costs of specialized steel and metal alloys.

In the realm of aftermarket support and supply chain management, AI is crucial for maintaining market responsiveness. By analyzing historical failure data, operational parameters (temperature, pressure, vibration), and geographical usage patterns, machine learning models can accurately predict the lifespan of different clamp types in specific applications. This predictive capability allows OEMs and MRO providers to implement Condition-Based Monitoring (CBM) systems, ensuring clamps are replaced proactively rather than reactively, significantly enhancing equipment uptime and reliability. Concurrently, AI algorithms are optimizing inventory management by forecasting regional demand fluctuations for thousands of SKUs, ensuring that high-demand items are available in local distribution centers, thereby mitigating risks associated with extended lead times and reducing overall warehousing costs.

- AI-driven machine vision systems enhance quality control and defect detection during manufacturing, minimizing failure rates in critical applications.

- Predictive maintenance models utilize operational data to forecast clamp lifespan, enabling proactive replacement and maximizing equipment uptime.

- Machine learning algorithms optimize raw material usage in stamping and forming processes, leading to reduced scrap rates and increased manufacturing efficiency.

- AI-powered demand forecasting improves inventory management and supply chain resilience for diverse clamp sizes and materials globally.

- Generative design tools, influenced by AI, are being explored to optimize clamp geometry for specific stress requirements, potentially leading to lightweight, high-strength solutions.

DRO & Impact Forces Of Hose Clamps Market

The dynamics of the Hose Clamps Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces across the value chain. A primary driver is the continuous growth in global automotive production, specifically the accelerating shift towards Electric Vehicles (EVs) which require highly specialized, durable clamps for intricate battery thermal management loops and complex coolant systems operating under varying pressures and temperatures. Simultaneously, stringent regulatory standards, such as EURO 7 and equivalent regulations globally, mandate zero-leak systems to minimize environmental pollutants, forcing manufacturers to adopt precision-engineered clamps over standard alternatives. These drivers ensure a baseline demand while pushing technological limits for material endurance and sealing performance.

However, the market faces significant restraints, chiefly related to the volatility and increasing cost of raw materials, particularly stainless steel and nickel, which form the basis of high-performance clamps. Furthermore, the market is characterized by fragmentation, leading to intense price competition, especially in the commodity clamp segment, which pressures margins for manufacturers of standard products. Another challenge is the rise of alternative joining technologies, such as quick-connect couplings and advanced adhesive bonding systems, which, in certain low-pressure and non-critical applications, offer faster assembly times, potentially displacing traditional clamps. These restraints necessitate strategic differentiation through quality, specialization, and supply chain efficiency to maintain profitability.

Significant opportunities arise from the expanding industrial infrastructure sector in developing economies and the ongoing modernization of aging systems in developed markets, particularly in oil and gas, chemical processing, and municipal water utilities. The demand for constant tension (CT) clamps is poised for substantial growth as system architects seek components that automatically compensate for dimensional changes caused by thermal cycling, offering superior long-term sealing integrity. The increasing adoption of lightweight materials, including composite plastics and specialized alloys, provides a strategic opportunity for manufacturers to innovate and capture niches in weight-sensitive applications like aerospace and high-end automotive, leveraging advanced manufacturing techniques like additive manufacturing for rapid prototyping and tool design optimization. The impact forces are thus heavily weighted towards demanding higher quality and smarter component designs, rather than mere volume expansion.

Segmentation Analysis

The Hose Clamps Market is meticulously segmented based on key variables including type, material, application, and distribution channel, providing a granular view of market dynamics and facilitating targeted strategy development. The type segmentation reveals the technological maturity and application specificity across different clamp designs, ranging from the ubiquity of worm gear clamps to the high-reliability requirement satisfied by spring clamps and T-bolt clamps. Material segmentation is crucial as it dictates the clamp's performance characteristics, such as corrosion resistance, temperature tolerance, and strength, with stainless steel (304 and 316) dominating the high-performance spectrum, while galvanized steel serves cost-sensitive, general-purpose needs. Understanding these segmentations is vital for manufacturers aiming to align their product offerings with specific industry requirements and prevailing regulatory standards.

Application analysis further defines market consumption, with the automotive sector being the perennial leading consumer, encompassing engine coolant lines, fuel delivery, and increasingly complex thermal management systems for electric vehicle batteries. The industrial sector, including heavy machinery, chemical processing plants, and HVAC systems, represents the second largest segment, demanding robust and corrosion-resistant solutions for continuous operation in harsh environments. Regional segmentation highlights differential growth rates and technology adoption, where rapidly industrializing Asian economies drive volume demand, while North America and Europe prioritize specialized, high-specification clamps necessary for regulatory compliance and advanced engineering requirements. This structure allows for a clear understanding of where growth capital should be deployed and which product innovations will yield the highest return.

The distribution channel breakdown segments the market into OEM (Original Equipment Manufacturer) sales and the aftermarket/MRO channel. While OEM sales provide large, consistent volumes directly integrated into product manufacturing lines, the aftermarket segment offers higher margins and steady demand driven by replacement and maintenance cycles across existing infrastructure. The increasing digitalization of the supply chain, driven by e-commerce platforms and specialized B2B marketplaces, is beginning to disrupt traditional distribution models, providing new avenues for smaller manufacturers to reach a wider MRO customer base directly. The ongoing shift towards specialized clamps necessitates closer collaboration between manufacturers and end-users to ensure optimal component selection, emphasizing the importance of technical service and support within the distribution framework.

- By Type:

- Worm Gear Clamps

- T-Bolt Clamps

- Spring Clamps

- V-Band Clamps

- Quick Release Clamps

- Constant Tension Clamps

- Band Clamps

- By Material:

- Stainless Steel (Grade 304, Grade 316)

- Carbon Steel/Galvanized Steel

- Plastics/Composites

- Specialized Alloys

- By Application:

- Automotive (Cooling, Fuel, Exhaust, Thermal Management)

- Industrial Machinery and Equipment

- Marine and Offshore

- Construction and Agriculture

- HVAC and Plumbing

- Aerospace and Defense

- By Distribution Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket/MRO (Maintenance, Repair, and Overhaul)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hose Clamps Market

The Value Chain of the Hose Clamps Market commences with the upstream activities involving the sourcing and processing of raw materials, primarily steel coils (stainless and carbon), and specialized plastics. The efficiency and cost-effectiveness at this stage are paramount, as material costs constitute a significant portion of the final product price. Key upstream factors include global commodity market volatility, the availability of high-grade stainless steel alloys, and the energy costs associated with initial material preparation and milling. Manufacturers must establish robust, diversified supplier relationships to mitigate risks associated with supply disruptions or sudden price spikes. The quality of the raw material directly influences the clamp's mechanical properties, such as tensile strength and corrosion resistance, dictating its suitability for high-stress applications.

The core manufacturing process involves highly specialized forming, stamping, welding, and finishing operations, requiring precision tooling and often automated assembly lines. Downstream activities focus heavily on distribution and logistics. Finished hose clamps are transported through two primary channels: direct sales to Original Equipment Manufacturers (OEMs) and sales through distributors/wholesalers serving the Maintenance, Repair, and Overhaul (MRO) aftermarket. OEM relationships are characterized by high volume, stringent quality audits, and just-in-time delivery schedules, requiring significant inventory management capabilities. Conversely, the MRO channel relies on wide geographical coverage and the ability to stock a vast array of niche products, often requiring specialized packaging and fulfillment services.

Direct distribution often includes technical consultation and engineering support provided by the manufacturer, particularly for specialized or custom-designed clamps destined for critical applications in aerospace or medical technology. Indirect distribution, leveraging major industrial supply houses and regional specialty distributors, provides broad market access and reaches small to medium-sized enterprises (SMEs). The effectiveness of the indirect channel is increasingly influenced by digital platforms and e-commerce capabilities, which offer competitive advantages in inventory visibility and rapid order fulfillment. The overall health of the value chain relies on optimized logistics, maintaining high quality standards at every production stage, and ensuring responsive interaction with both OEM partners and diverse MRO end-users.

Hose Clamps Market Potential Customers

The primary potential customers and end-users of hose clamps span across sectors that require reliable, leak-proof connections for fluid, gas, or air systems, where operational integrity is non-negotiable. The largest and most consistent buying segment remains the global automotive industry, including both traditional internal combustion engine (ICE) vehicle manufacturers and, increasingly, Electric Vehicle (EV) and hybrid vehicle producers. These customers demand high-tolerance, often constant-tension clamps for critical engine, battery thermal management, and exhaust components, prioritizing longevity, vibration resistance, and lightweight design. Suppliers must meet rigorous quality certifications (such as IATF 16949) to be integrated into the automotive supply chain, often through multi-year contracts based on specified vehicle platforms.

Beyond automotive, heavy industrial sectors represent another major customer base. This includes manufacturers of agricultural machinery, construction equipment (excavators, loaders), and large-scale industrial processing plants (chemical, petrochemical, food and beverage). These applications necessitate clamps made from highly corrosion-resistant materials (e.g., Grade 316 stainless steel) capable of withstanding extreme environmental conditions, abrasive media, and high operating pressures. Buying decisions in this segment are typically driven by total cost of ownership, durability, and compliance with specific industry safety standards, rather than initial unit price, favoring high-quality, specialized products.

The third significant customer category is the vast Maintenance, Repair, and Overhaul (MRO) segment, which consists of independent repair shops, industrial maintenance departments, and utility providers (water, gas). This segment purchases clamps for replacement purposes and system upgrades, driven primarily by component failure or planned preventative maintenance schedules. MRO customers value availability, ease of installation, and a broad product portfolio accessible through local distributors or online platforms. Furthermore, specialized niche customers like aerospace manufacturers, who demand custom-engineered V-band clamps for turbojet exhaust systems, and medical device companies, requiring sanitary clamps for fluid transfer systems, represent high-value opportunities demanding strict traceability and superior material purity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Norma Group, Oetiker Group, Ideal-Tridon, Wuxi Winstar, T-Bolt USA, Clampco, Rotor Clip, R.G. Ray, Hi-Torque, Uger, Murray Corporation, BAND-IT, Peterson Spring, Breeze Industrial Products, FastenAl. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hose Clamps Market Key Technology Landscape

The technological landscape of the Hose Clamps Market is rapidly evolving, driven primarily by the need for enhanced reliability, ease of installation, and adaptation to new materials used in hose and pipe systems. The most critical technological advancements center around Constant Tension (CT) technologies. CT clamps utilize specialized Belleville washers or internal springs that automatically expand and contract to maintain consistent sealing pressure despite temperature fluctuations that cause thermal expansion and contraction of the hose material. This technology is indispensable in modern automotive engine bays and EV battery thermal management loops where operating temperatures vary widely and polymer hoses exhibit significant cold flow characteristics, ensuring long-term leak prevention without the need for manual re-tightening.

Material science and manufacturing precision are also key technological areas. There is an increasing adoption of specialized alloys, such as higher grades of stainless steel (e.g., Duplex steels for extremely corrosive environments) and the introduction of advanced composite materials for lightweight clamps, particularly in applications where weight reduction is crucial for fuel efficiency or performance. Manufacturing technology is shifting towards highly automated stamping, laser welding, and robotic assembly processes, which ensure micron-level tolerances and superior consistency across large production batches. Furthermore, surface treatment technologies, including proprietary coatings for enhanced salt spray resistance and lubricity, are becoming standard requirements for meeting OEM specifications in harsh marine or external applications, extending the operational life of the component significantly.

Digitalization technologies, encompassing CAD/CAE tools, are essential for simulating stress distribution and optimizing clamp geometry for specific application profiles before physical prototyping. Finite Element Analysis (FEA) allows manufacturers to predict clamping force performance under extreme operational loads and thermal cycles, accelerating the design validation process and minimizing costly iteration cycles. Furthermore, Quick-Connect (QC) or quick-release mechanisms are gaining technological importance, offering tool-free installation and removal for MRO applications, significantly reducing downtime and labor costs while maintaining high-pressure integrity. The integration of advanced testing protocols, including sophisticated pressure cycling and vibration testing rigs, ensures compliance with increasingly stringent performance benchmarks set by Tier 1 automotive suppliers and industrial regulatory bodies.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for hose clamps, fueled by immense automotive and heavy manufacturing growth, particularly in China and India. The region serves as a global manufacturing hub, driving high volume demand for both standard worm gear and specialized T-bolt clamps. Infrastructure development projects and increasing adoption of factory automation further amplify demand across various industrial segments.

- North America: Characterized by high technological maturity, North America focuses on high-value, specialized clamping solutions, particularly constant tension and robust stainless steel clamps for demanding applications in aerospace, oil and gas, and heavy truck manufacturing. Strict environmental regulations necessitate the use of premium, leak-proof components, supporting market value over sheer volume.

- Europe: This region is a leader in adopting lightweight and innovative clamping technologies, driven by rigorous EU environmental and emissions standards, necessitating material specialization (e.g., plastic composites) and sophisticated thermal management systems in vehicles. Germany, France, and the UK are key markets, emphasizing quality, precision engineering, and adherence to specialized industry certifications.

- Latin America (LATAM): Growth in LATAM is driven by recovering automotive production in Mexico and Brazil, coupled with infrastructure investment in energy and agricultural sectors. The market is more price-sensitive than North America or Europe, leading to strong demand for cost-effective carbon steel and entry-level stainless steel clamps for MRO operations and local OEM assembly.

- Middle East and Africa (MEA): Demand in MEA is highly concentrated in the petrochemical, construction, and oil and gas industries, requiring high-corrosion-resistant clamps, often Grade 316 stainless steel, to withstand harsh desert and maritime environments. Investment in large-scale energy projects and infrastructure upgrades are the primary market drivers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hose Clamps Market.- Norma Group

- Oetiker Group

- Ideal-Tridon

- Wuxi Winstar

- Breeze Industrial Products

- Clampco Products, Inc.

- Rotor Clip Company, Inc.

- Murray Corporation

- T-Bolt USA

- JCS Hi-Torque Ltd.

- Peterson Spring

- R.G. Ray Corporation

- BAND-IT (IDEX Corp.)

- UGER Clamping Systems

- FastenAl (Distributor/Manufacturer)

- Topy America, Inc.

- Shenzhen Huitong Precision Industry Co., Ltd.

- LISI Automotive

- Master Clamp

- Klingspor Abrasives

Frequently Asked Questions

Analyze common user questions about the Hose Clamps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for constant tension (CT) hose clamps?

The increasing complexity and thermal variation in modern fluid systems, particularly in automotive engine bays and electric vehicle battery cooling loops, drive demand for CT clamps. These clamps automatically compensate for dimensional changes in hose material (cold flow/thermal expansion) to maintain a consistent seal, preventing leaks and reducing maintenance needs.

Which material is most commonly preferred for hose clamps in high-corrosion industrial environments?

Grade 316 Stainless Steel is the preferred material for high-corrosion industrial environments, such as marine, chemical processing, and wastewater treatment applications. It offers superior resistance to pitting and crevice corrosion compared to the more common Grade 304 Stainless Steel, ensuring longevity and system integrity.

How is the Electric Vehicle (EV) transition impacting the hose clamps market?

The EV transition is positively impacting the market by generating demand for specialized, high-reliability clamps for battery thermal management systems. These systems require precise sealing for coolant lines operating under higher internal pressures and requiring extreme material compatibility to prevent electrochemical corrosion.

What are the key differences between OEM and Aftermarket distribution channels in this market?

OEM distribution involves high-volume sales directly integrated into the manufacturing supply chain, requiring strict quality control and long-term contracts. The Aftermarket/MRO channel focuses on replacement and repair parts, characterized by higher pricing margins, fragmented purchasing, and reliance on broad distributor networks for immediate availability.

What role does automation play in the future of hose clamp manufacturing?

Automation, including robotic assembly and AI-powered machine vision, is critical for achieving the high precision and quality consistency required by safety-critical applications. It optimizes material usage, reduces scrap rates, and ensures clamps meet the increasingly stringent technical specifications demanded by global regulators and premium automotive clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager