Hospice Care Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443000 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hospice Care Market Size

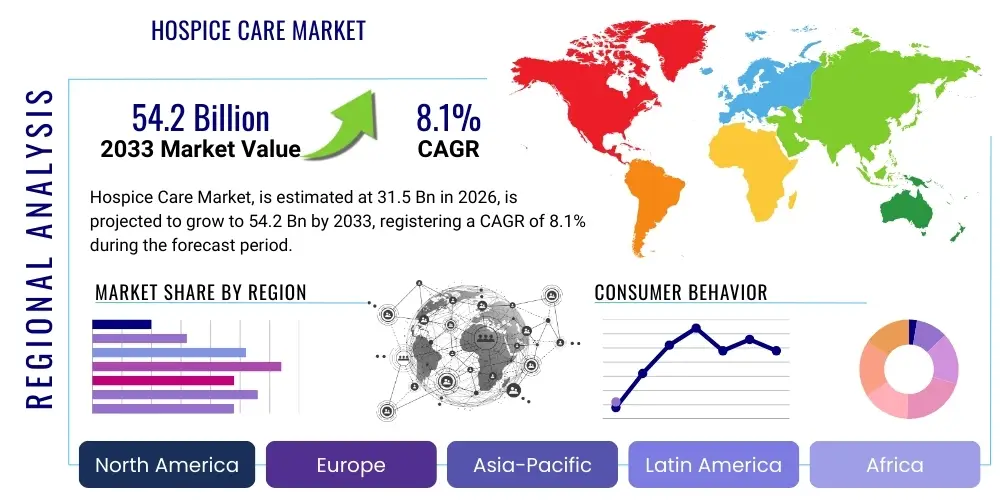

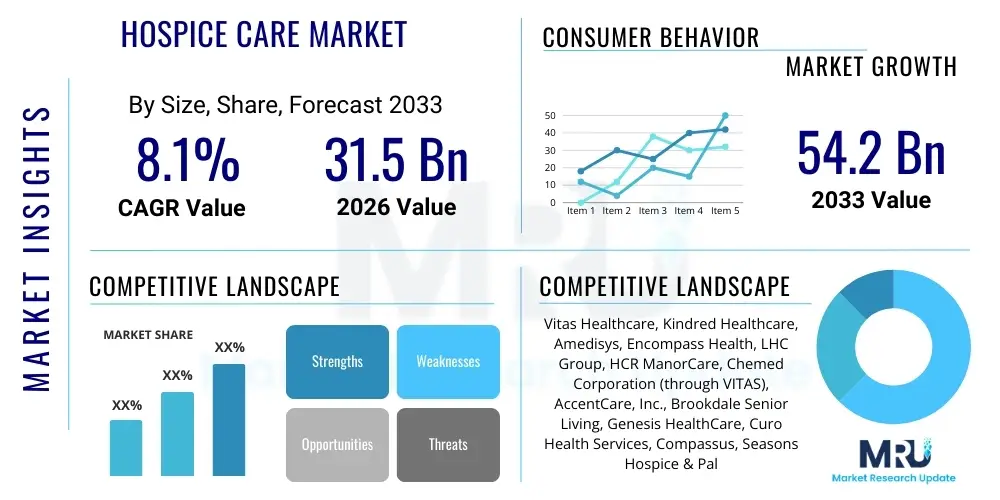

The Hospice Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $31.5 Billion in 2026 and is projected to reach $54.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is fundamentally driven by the accelerating demographic shift towards an aging global population, particularly in developed economies, coupled with a discernible patient preference for receiving end-of-life care within familiar environments, primarily residential settings. Furthermore, continuous advancements in pain management protocols and increased awareness regarding the benefits of holistic palliative approaches contribute significantly to market expansion, positioning hospice care as an indispensable component of the modern healthcare continuum.

Hospice Care Market Introduction

The Hospice Care Market encompasses comprehensive, multidisciplinary services provided to individuals facing a life-limiting illness, with a prognosis typically of six months or less, focusing entirely on comfort, dignity, and quality of life rather than curative treatment. This specialized area of healthcare delivers physical, emotional, spiritual, and social support not only to the patient but also to their family unit. Essential components include expert pain and symptom management, medication provisioning, equipment rental, and continuous support from trained medical professionals, including physicians, registered nurses, social workers, and certified nursing assistants. The overarching goal of hospice care is to ensure the patient's final phase of life is as comfortable and fulfilling as possible, aligning with their personal wishes and values.

Major applications of hospice care are wide-ranging, serving patients dealing with terminal diagnoses such as advanced cancer, end-stage heart and respiratory diseases (e.g., COPD, CHF), neurodegenerative disorders (e.g., Alzheimer’s, Parkinson’s), and chronic kidney failure. The increasing adoption of hospice services is closely tied to their demonstrated benefits, which include improved symptom control, reduced emergency room visits, decreased hospitalization rates in the final weeks of life, and enhanced psychological support for grieving families. This shift reflects a broader societal recognition that end-of-life care should emphasize maximizing comfort and peace rather than aggressively pursuing treatments that offer marginal benefit or significantly diminish quality of life.

The market is primarily driven by three core factors: the demographic bulge of the geriatric population globally; governmental and private payer policies increasingly recognizing and funding comprehensive hospice services, especially through Medicare in the United States; and the growing public and professional acceptance of palliative medicine as a specialized and crucial discipline. Moreover, educational initiatives aimed at reducing the stigma associated with end-of-life planning and promoting advance care directives are contributing to earlier referrals, allowing patients and families to benefit from hospice services for longer, more impactful durations, thus propelling sustained market demand across key geographical regions.

Hospice Care Market Executive Summary

Current business trends within the Hospice Care Market indicate significant market consolidation, with larger national providers actively acquiring smaller, regional agencies to achieve economies of scale and expand geographical reach. This trend is catalyzed by the demanding regulatory environment and the transition towards value-based purchasing models, which necessitate robust technological infrastructure and sophisticated compliance frameworks—assets more readily available to larger enterprises. Furthermore, providers are increasingly investing in specialized programs, such as dementia care or pediatric hospice, to capture niche markets and differentiate their offerings in a competitive landscape, focusing heavily on enhancing referral source relationships and improving clinical outcomes reporting.

Regionally, North America, spearheaded by the extensive regulatory and funding mechanisms of the U.S. Medicare system, maintains the dominant market share, characterized by high penetration rates and sophisticated service delivery networks. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapidly aging populations in countries like Japan and China, coupled with rising healthcare expenditure and nascent but growing government support for formalized palliative and hospice care structures. European markets demonstrate maturity, focusing on integration with national health systems and continuous quality improvement measures, while Latin America and MEA are still developing standardized models, often relying on charitable or faith-based organizations for provision.

Segment trends reveal that the Routine Home Care (RHC) level of service continues to dominate the market by volume, reflecting the strong preference among patients and families to receive care in their own residences. Within the location segment, freestanding hospice centers are gaining traction as they offer a hybrid environment combining specialized medical facilities with a comforting, non-hospital setting for patients requiring intense symptom management or short-term respite. The payer segment remains heavily reliant on public funding, particularly Medicare, which sets the benchmark for service standards and reimbursement rates, making policy changes related to Medicare coverage pivotal determinants of market profitability and growth trajectory.

AI Impact Analysis on Hospice Care Market

Analysis of common user inquiries regarding AI in hospice care reveals primary concerns centered on balancing technological efficiency with the indispensable need for human empathy and personalized, compassionate touch. Users frequently question how AI can improve operational workflow, specifically in documentation and scheduling, without dehumanizing the intimate end-of-life experience. Key themes include the use of AI for predictive modeling of patient decline to optimize resource allocation, the potential for personalized pain management dosing via machine learning, and ethical considerations surrounding data privacy and autonomous decision-making in highly sensitive care settings. The prevailing expectation is that AI should serve as an enhancement tool for clinicians, freeing up time for direct patient interaction, rather than acting as a replacement for human caregivers.

The implementation of Artificial Intelligence and Machine Learning algorithms promises transformative improvements in several operational and clinical facets of hospice administration. Predictive analytics, for instance, can utilize Electronic Health Record (EHR) data to forecast critical events, such as impending hospitalizations or rapid symptom escalation, allowing hospice teams to intervene proactively and adjust care plans, thereby improving quality metrics and reducing unnecessary institutional transfers. Furthermore, AI-driven tools are being developed to streamline the burdensome administrative requirements inherent in hospice care, including automated billing, eligibility verification, and scheduling optimization, ensuring that resources are allocated efficiently and compliance standards are rigorously met.

Beyond operational gains, AI holds promise in supporting complex clinical decision-making, particularly concerning pain and symptom management. Machine learning models can analyze vast datasets of patient responses to various pharmacological interventions, generating highly personalized recommendations for opioid titration or non-pharmacological modalities based on individual physiological profiles and co-morbidities. While these advancements are significant, the market acknowledges that ethical governance and robust training for clinical staff are crucial to maintain trust and ensure that the integration of AI respects the core philosophy of hospice care—patient autonomy, dignity, and compassionate human connection.

- AI enhances predictive analytics for acute symptom management and decline forecasting, optimizing staffing and reducing crises.

- Machine learning streamlines administrative burdens, improving efficiency in charting, billing, and regulatory documentation.

- Natural Language Processing (NLP) extracts insights from unstructured clinical notes to support clinical audits and quality improvement programs.

- AI-powered decision support systems offer personalized recommendations for complex pain and symptom protocols.

- Telemonitoring solutions, often integrated with AI, allow for continuous, remote patient monitoring, enabling timely interventions without compromising comfort.

DRO & Impact Forces Of Hospice Care Market

The Hospice Care Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive demographic aging trend across established economies, significantly increasing the pool of potential patients requiring end-of-life support. This trend is amplified by a cultural shift promoting open dialogue around death and dying, leading to earlier referrals and higher utilization rates. Furthermore, consistent governmental reimbursement frameworks, such as those provided by Medicare in the U.S., provide financial stability and encourage investment in service expansion, ensuring accessibility for a vast majority of the target population and underpinning market volume growth.

However, the market faces significant restraints that temper its explosive growth potential. Foremost among these is the critical and chronic shortage of skilled hospice and palliative care professionals, including registered nurses, physicians certified in palliative medicine, and certified nursing assistants. This staffing constraint limits the capacity of providers to meet surging demand, particularly in rural or medically underserved areas. Additionally, the regulatory scrutiny concerning eligibility criteria and fraudulent billing practices is increasingly stringent, demanding substantial resources for compliance and auditing, which particularly burdens smaller, independent operators and introduces operational complexity and risk across the entire market ecosystem.

Opportunities for future expansion are predominantly centered on technological integration and service diversification. The rise of "Telehospice" services, utilizing telehealth platforms for non-physical visits, counseling, and remote monitoring, offers a scalable solution to geographical barriers and staffing limitations, especially post-pandemic. Another major opportunity lies in the deeper integration of hospice and palliative care services, enabling providers to serve patients earlier in their disease trajectory, potentially transitioning to curative care if appropriate, thereby broadening their service scope and increasing overall patient lifetime value within the healthcare system. The expansion into specialized programs, such as hospice for veterans or pediatric populations, also represents targeted growth avenues.

Segmentation Analysis

The Hospice Care Market is systematically segmented based on various critical parameters, including the physical location where care is delivered, the specific type or level of care required, the age group of the patient, and the primary source of reimbursement. This detailed segmentation allows stakeholders—providers, policymakers, and payers—to gain nuanced insights into consumption patterns, operational challenges, and geographical variations in demand and supply. Analyzing these segments is essential for strategic planning, determining resource allocation, and developing specialized clinical pathways tailored to distinct patient demographics and financial realities. The complexity of segmentation reflects the diverse needs and regulatory mandates inherent in delivering highly personalized end-of-life services across a broad spectrum of clinical settings.

Within the location segment, the home hospice care setting overwhelmingly dominates, aligning with patient preferences for receiving care in the comfort and familiarity of their residence, which also tends to be the most cost-effective option for payers. Conversely, General Inpatient (GIP) care, offered in specialized hospice facilities or dedicated hospital units, though the smallest segment by volume, is crucial for managing acute, unmanaged symptoms that necessitate a higher level of continuous professional oversight and specialized medical equipment. Segmentation by service type further differentiates market activities, with Routine Home Care (RHC) being the mainstay, while Continuous Home Care (CHC) addresses short-term crises, often requiring 24/7 nursing presence at the patient's bedside.

Age group segmentation highlights the geriatric population (65 years and older) as the predominant recipient of hospice services, reflecting disease progression patterns and life expectancy. However, attention is increasingly being directed toward specialized pediatric hospice care, though numerically smaller, demanding unique training protocols and family support structures. Finally, the payer segmentation underscores the market's dependence on governmental funding, particularly Medicare in the U.S., which dictates the standards and financial viability for private insurers and other payment sources. Understanding these segment dynamics is paramount for market participants seeking competitive advantage through targeted service offerings and efficient operational models optimized for specific reimbursement schedules and demographic needs.

- Location: Home Hospice Care, Hospice Centers, Hospitals, Nursing Homes

- Type/Level of Service: Routine Home Care (RHC), Continuous Home Care (CHC), Inpatient Respite Care (IRC), General Inpatient Care (GIP)

- Age Group: Pediatric, Adult, Geriatric

- Payer Type: Medicare, Medicaid, Private Insurance, Out-of-Pocket

Value Chain Analysis For Hospice Care Market

The Value Chain for the Hospice Care Market is characterized by a high reliance on non-tangible services, focusing on integrated care delivery and strong referral relationships, rather than manufacturing. The upstream analysis focuses on key resource inputs necessary for service delivery. This includes the sourcing of essential medical supplies (e.g., wound care products, durable medical equipment like hospital beds and oxygen concentrators), pharmaceuticals for pain and symptom management, and, most crucially, the acquisition and continuous professional development of highly skilled clinical staff (nurses, social workers, spiritual counselors). Efficient procurement and effective human resource management are paramount at this stage to maintain quality of care and cost control in a heavily regulated environment.

The core value-add activities occur in the mid-stream—the direct provision of comprehensive, interdisciplinary care. This phase involves patient intake and assessment, individualized care plan development, ongoing clinical oversight (including physician certification), and the constant monitoring and adjustment of pain protocols. Distribution in this context is heavily reliant on highly efficient, localized care teams dispatched to patient homes, ensuring timely response and continuous availability, especially for crisis management (Continuous Home Care). The quality of the care provided, measured by patient and family satisfaction, bereavement services offered, and adherence to established clinical guidelines, forms the primary competitive differentiator in the market.

Downstream analysis focuses on patient outcomes, compliance, and financial management. Distribution channels for patient acquisition are primarily indirect, relying on robust referral networks established with primary care physicians, oncologists, geriatric specialists, and discharge planners within hospitals and skilled nursing facilities. Direct distribution, while less common, includes community outreach and educational programs promoting advance care planning. Successful downstream operations require seamless coordination with payers (Medicare/Medicaid) for accurate and prompt reimbursement, sophisticated compliance systems to manage eligibility audits, and comprehensive bereavement support, which completes the holistic service cycle and reinforces the provider’s reputation within the community.

Hospice Care Market Potential Customers

The primary direct beneficiaries and end-users of hospice care services are individuals diagnosed with a terminal illness, typically defined by a physician prognosis of six months or less if the disease runs its expected course, who have chosen to prioritize comfort care over curative treatment. This population segment primarily consists of the geriatric demographic facing end-stage chronic conditions such as metastatic cancer, severe congestive heart failure (CHF), chronic obstructive pulmonary disease (COPD), and advanced dementia or Alzheimer’s disease. However, potential customers also critically include their immediate family members and caregivers, who receive vital emotional, psychological, and logistical support, including respite care and professional bereavement counseling, thereby extending the definition of the 'customer' beyond the patient itself.

A second crucial group of potential customers comprises the institutional referral sources, as these entities act as the gatekeepers to service utilization. Hospitals, particularly discharge planning departments, skilled nursing facilities (SNFs), physician group practices, oncology centers, and geriatric clinics, are integral to the hospice care ecosystem. These professional entities require reliable, high-quality hospice partners who demonstrate seamless intake processes, excellent communication, and verifiable clinical competence to ensure their patients receive appropriate continuity of care upon discharge. Establishing strong, trustworthy relationships with these professional referrers is fundamental to a hospice provider's ability to maintain high patient census and market penetration.

The evolving landscape also highlights payer organizations, including governmental bodies like Centers for Medicare & Medicaid Services (CMS) and private insurance providers, as indirect customers. While they do not consume the service, they define the operational framework, financial incentives, and quality metrics that providers must adhere to. Providers must constantly cater to the payer segment’s requirements by demonstrating cost-effectiveness, adherence to clinical pathways, and achieving measurable quality outcomes (e.g., pain assessment frequency, patient satisfaction scores). Therefore, successful market participation requires understanding the nuanced needs of patients, the logistical demands of referral sources, and the compliance requirements of the paying entities simultaneously.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $31.5 Billion |

| Market Forecast in 2033 | $54.2 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vitas Healthcare, Kindred Healthcare, Amedisys, Encompass Health, LHC Group, HCR ManorCare, Chemed Corporation (through VITAS), AccentCare, Inc., Brookdale Senior Living, Genesis HealthCare, Curo Health Services, Compassus, Seasons Hospice & Palliative Care, SeniorCare Centers, Inc., Crossroads Hospice, HCA Healthcare, Interim HealthCare, ResCare, Mission Healthcare, Bayada Home Health Care. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospice Care Market Key Technology Landscape

The technological landscape within the Hospice Care Market is rapidly evolving, driven by the need for enhanced connectivity, regulatory compliance, and improved patient monitoring, particularly as care increasingly shifts to remote home settings. Central to this evolution are advanced Electronic Health Record (EHR) systems customized for hospice workflows, which ensure seamless documentation across interdisciplinary teams, facilitate compliance with complex Medicare billing rules, and provide real-time access to patient data for clinicians operating in diverse locations. These systems must prioritize interoperability, allowing for smooth data exchange with referring hospitals and external laboratories, which is critical for coordinating transitions of care and optimizing medication management.

Telemedicine and remote patient monitoring (RPM) technologies represent the fastest-growing segment of technology adoption. Telehospice platforms enable virtual consultations, facilitating crucial psychosocial and spiritual counseling, and allowing nurses to assess non-acute symptoms via secure video links, thereby reducing unnecessary travel time and expenses. Remote patient monitoring devices, such as wearable sensors that track vital signs (heart rate, respiration, activity levels), allow hospice teams to identify subtle shifts in a patient's condition earlier. This proactive monitoring capability significantly reduces the likelihood of emergency crises, aligns with the goal of keeping patients comfortable at home, and improves overall resource utilization efficiency.

Furthermore, sophisticated data analytics and business intelligence tools are being integrated to manage the financial and operational health of hospice organizations. These tools analyze trends in patient acuity, referral patterns, staffing ratios, and reimbursement data, enabling executive teams to make data-driven decisions regarding expansion, quality improvement initiatives, and cost management. The implementation of robust cybersecurity measures is also critical, given the sensitive nature of patient health information (PHI) being transmitted and stored, ensuring compliance with privacy regulations such as HIPAA, and maintaining the trust essential for this sensitive sector of healthcare.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, holds the largest share of the global hospice care market, primarily due to the established and generously funded Medicare Hospice Benefit, which covers the vast majority of end-of-life care costs for eligible seniors. The region is characterized by high market maturity, intensive competition, and leading adoption of technological innovations like Telehospice and advanced EHR integration. Growth is stable, focusing on quality metrics, regulatory compliance management, and market consolidation among major national players.

- Europe (Steady Growth and Integration): The European market displays steady, sustainable growth, largely driven by mature national health systems (e.g., NHS in the UK, centralized systems in Germany) that increasingly integrate palliative care services earlier into chronic disease management pathways. Key focus areas include standardizing care protocols across national borders and increasing public awareness to facilitate earlier hospice enrollment, thereby maximizing patient benefit. The primary challenges revolve around navigating diverse funding mechanisms and overcoming regional disparities in specialized staffing availability.

- Asia Pacific (APAC) (Highest Growth Rate): APAC is projected to be the fastest-growing region. This exponential growth is fueled by rapidly aging populations in major economies like China, India, and Japan, coupled with rising middle-class disposable incomes that increase access to private healthcare services. While the formal hospice structure is less pervasive than in the West, there is increasing government and philanthropic investment in developing structured, community-based palliative and hospice care frameworks, signaling a significant shift away from traditional acute hospital-centric death management.

- Latin America (Emerging Regulatory Frameworks): The market in Latin America is nascent and highly fragmented, often relying on non-governmental organizations and faith-based initiatives to provide foundational hospice services. Market development is slow but accelerating due to growing healthcare access and increasing recognition by national governments of the need for formal palliative care legislation and dedicated funding streams, particularly in economically developing nations such as Brazil and Mexico.

- Middle East and Africa (MEA) (Low Penetration, High Potential): MEA represents a region with generally low market penetration due to cultural factors, limited healthcare infrastructure devoted to end-of-life care outside of major urban centers, and insufficient dedicated public funding. Future growth potential is substantial, driven by increasing public and private investments in developing specialized tertiary care hospitals that include defined palliative and hospice units, particularly in wealthy Gulf Cooperation Council (GCC) countries focusing on comprehensive health service modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospice Care Market.- Vitas Healthcare

- Kindred Healthcare (now part of LHC Group/Select Medical)

- Amedisys

- Encompass Health

- LHC Group

- HCR ManorCare

- Chemed Corporation (VITAS Healthcare)

- AccentCare, Inc.

- Brookdale Senior Living

- Genesis HealthCare

- Curo Health Services

- Compassus

- Seasons Hospice & Palliative Care (part of AccentCare)

- SeniorCare Centers, Inc.

- Crossroads Hospice

- HCA Healthcare

- Interim HealthCare

- ResCare

- Mission Healthcare

- Bayada Home Health Care

Frequently Asked Questions

Analyze common user questions about the Hospice Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Hospice Care Market?

The key drivers are the global demographic shift toward an aging population, the increasing prevalence of chronic, life-limiting diseases, and a strong preference among patients for receiving end-of-life care at home, supported by established government funding programs like the U.S. Medicare Hospice Benefit.

How does the Medicare Hospice Benefit impact market dynamics?

The Medicare Hospice Benefit fundamentally stabilizes the market by providing comprehensive, structured funding for hospice services, which dictates quality standards, reimbursement rates, and service delivery models across the industry, setting the benchmark for private payers and ensuring widespread accessibility for seniors.

What technological trends are most significantly transforming hospice service delivery?

Telehospice and remote patient monitoring (RPM) are the most significant technological trends, enabling virtual consultations, continuous monitoring of patient vital signs at home, and improving operational efficiency through advanced Electronic Health Record (EHR) integration and AI-driven predictive analytics.

Which geographical region holds the largest market share for Hospice Care?

North America currently holds the largest market share, predominantly driven by the United States due to its mature hospice infrastructure, high utilization rates, and the robust governmental funding framework provided by the Medicare system, which is the world's most comprehensive hospice reimbursement model.

What is the main challenge facing Hospice Care providers today?

The primary challenge is the persistent, critical shortage of specialized clinical staff, including hospice-certified nurses and palliative care physicians, which limits the capacity of providers to meet the accelerating demand and often necessitates significant investment in recruitment, retention, and innovative care models like Telehospice.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hospice Care Market Statistics 2025 Analysis By Application (Home Settings, Hospitals, Specialty Nursing Homes, Hospice Care Centers), By Type (Nursing Services, Medical Supply Services, Physician Services, Other Type of Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hospice Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Acute Care, Respite Care), By Application (Home Settings, Hospitals, Specialty Nursing Homes, Hospice Care Centers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Home Inspection Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud, SaaS, Web, Installed Mac, Installed Windows), By Application (Hospice Care Agencies, Home Care Agencies, Therapy Agencies, Private Duty Agencies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager