Hospital Linen and Laundry Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441525 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hospital Linen and Laundry Services Market Size

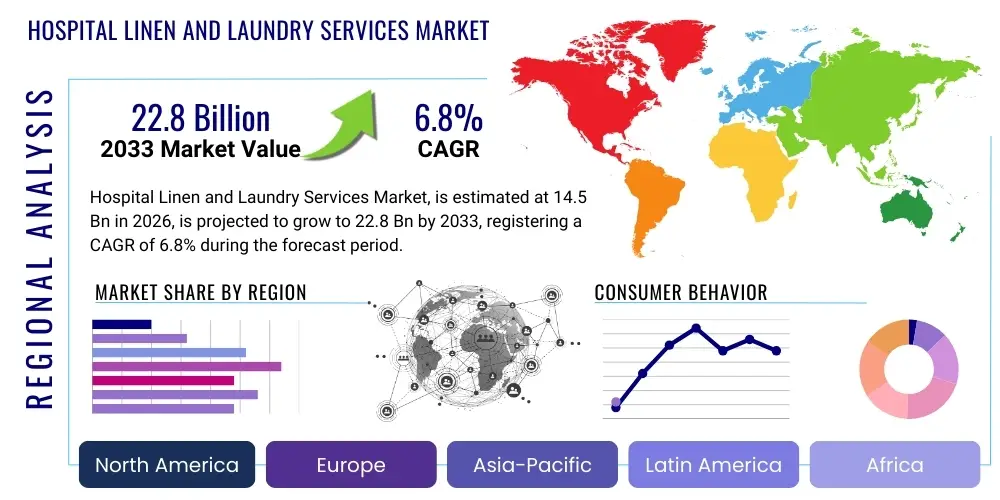

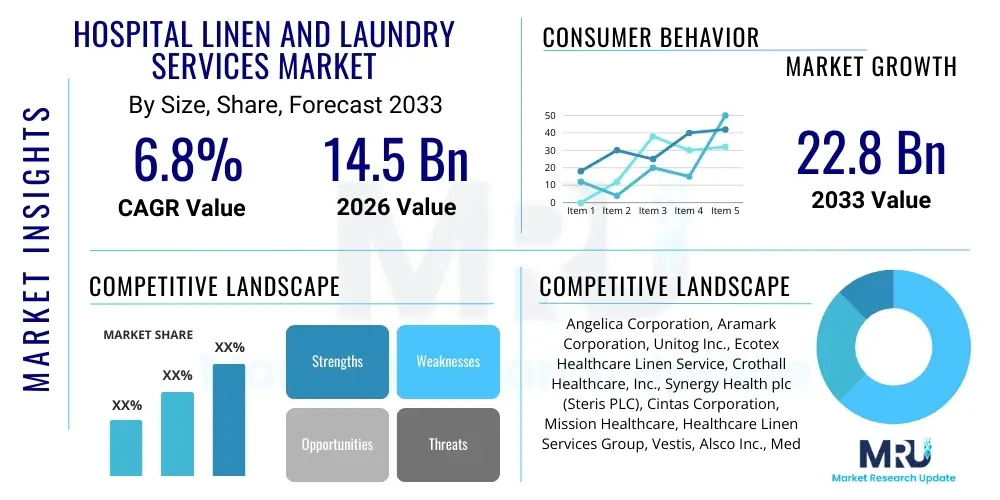

The Hospital Linen and Laundry Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 22.8 Billion by the end of the forecast period in 2033.

Hospital Linen and Laundry Services Market introduction

The Hospital Linen and Laundry Services Market encompasses the provision of professional management, cleaning, sterilization, and supply chain logistics related to textile products utilized within healthcare facilities, including acute care hospitals, specialized clinics, and long-term care centers. These services are crucial for maintaining stringent hygiene standards, infection control, and operational efficiency within the highly regulated healthcare environment. The scope of services ranges from routine cleaning of patient gowns, bedding, and surgical drapes to the specialized handling of contaminated and infectious materials, adhering strictly to global healthcare regulations and quality management systems. Providers in this sector leverage specialized machinery and chemical protocols to ensure textiles meet the rigorous standards necessary for patient safety and clinical integrity, distinguishing themselves from general commercial laundry operations through certified processes and enhanced traceability systems. This specialization makes outsourcing an increasingly attractive, often mandatory, solution for modern healthcare providers seeking to mitigate infection risks.

The core products addressed by this market include reusable textiles such as patient linens, operating room (OR) towels, uniforms, blankets, and various specialty textile items required for patient care. Outsourcing linen and laundry management has become a prevalent business model due to the high capital investment required for in-house facilities, coupled with the necessity for expertise in handling sophisticated sanitization protocols, especially for surgical textiles. Professional service providers offer streamlined inventory management using sophisticated logistics platforms, ensuring a consistent and timely supply of sterile linen directly to the point of use. This strategic partnership model helps hospital administrators reallocate substantial capital and human resources away from non-core, logistical functions, enabling them to concentrate clinical focus and expenditure directly on advanced patient care and therapeutic services, thereby improving overall organizational efficiency and mission delivery.

Major applications of these services span across various functional areas in healthcare, including surgical units, which rely on certified sterile barrier systems and surgical gowns; general patient wards, demanding high volumes of comfortable and clean bedding; and outpatient departments, requiring uniforms and smaller specialty items. The primary driving factors for market expansion include the increasing volume of surgical procedures worldwide, driven by demographic shifts and medical advancements, the pervasive global emphasis on preventing Healthcare-Associated Infections (HAIs), and the continuous expansion and modernization of global healthcare infrastructure, particularly in emerging economies. As accreditation bodies impose stricter standards, centralized, industrial laundry systems capable of guaranteed disinfection are replacing outdated, decentralized models, strongly boosting market penetration and growth potential over the forecast period.

Hospital Linen and Laundry Services Market Executive Summary

The global Hospital Linen and Laundry Services Market exhibits robust and sustained growth, principally driven by structural shifts in healthcare delivery, specifically the increasing reliance on outsourcing non-core clinical support functions to specialized and certified third-party providers. Current business trends underscore a massive push towards technological integration, notably the implementation of advanced track-and-trace systems, primarily leveraging Radio Frequency Identification (RFID) technology, which optimizes textile utilization rates, drastically reduces replacement costs due to loss, and furnishes hospitals with transparent utilization data. Regionally, North America and Western Europe maintain their market dominance, characterized by highly stringent regulatory environments and extensive adoption of large-scale, automated industrial laundries that service vast integrated delivery networks. Concurrently, the Asia Pacific region is rapidly accelerating its market presence, positioning itself as the key growth engine, propelled by significant governmental investment in new healthcare infrastructure and a burgeoning private hospital sector demanding world-class operational hygiene.

Analysis of segment trends reveals that the Rental Services segment remains the paramount revenue generator, valued for offering healthcare clients an all-inclusive, risk-transfer model that encompasses linen supply, cleaning, maintenance, and perpetual management under a single contract, thereby minimizing hospital capital outlay. Furthermore, a deep dive into facility type indicates that Acute Care Hospitals retain their status as the largest consumer base due to their complex operational requirements and high throughput of critical sterile linens, while specialty clinics and ambulatory surgical centers (ASCs) are the fastest-growing sub-segments, increasingly seeking bespoke, flexible laundry solutions. Sustainability has emerged as a crucial competitive differentiator, with market leaders committing substantial resources to adopting environmentally responsible practices, including utilizing biodegradable detergents, implementing sophisticated water recovery and recycling systems, and investing in high-efficiency machinery, aligning with corporate sustainability mandates and influencing procurement decisions.

The competitive landscape is defined by continuous efforts from key market participants to expand their geographical reach and consolidate their service offerings through strategic mergers and acquisitions (M&A) or alliance formation, enabling them to capitalize on economies of scale and offer nationwide or international coverage. Successful navigation of the market hinges critically on providers demonstrating unwavering compliance with global sterilization standards (such as ISO 13485 for medical devices and relevant public health standards) and possessing the logistical capability to manage highly complex, time-sensitive supply chains. Innovation in service delivery, coupled with robust quality assurance protocols and superior client relationship management, are essential factors influencing market positioning and long-term contract retention within this high-stakes service industry.

AI Impact Analysis on Hospital Linen and Laundry Services Market

User inquiries regarding AI's influence in the hospital linen sector frequently center on assessing the potential for complete automation, achieving highly accurate predictive inventory management, and fundamentally enhancing infection control protocols through automated detection systems. Common questions specifically address how Artificial Intelligence and machine learning models can be trained to optimize complex operational processes, such as determining the most efficient mixture of chemicals and wash cycles based on contamination type, predicting localized linen demand fluctuations based on real-time patient census, surgical schedules, and disease outbreaks, and significantly reducing human error in automated quality checks for contamination or damage. Users anticipate considerable Return on Investment (ROI) from implementing AI-driven technologies, particularly robotic sorting systems and advanced visual inspection apparatuses, expecting substantial improvements in processing speed, significant reductions in highly manual labor costs, and superior, traceable compliance with rigorous healthcare hygiene mandates. The primary financial concern voiced is the substantial initial capital expenditure required for sophisticated AI system deployment and the infrastructural demands for collecting, securing, and processing the vast amounts of proprietary data required to train effective AI models specific to decentralized hospital inventory management challenges.

- AI-driven Predictive Inventory Management: Utilizes advanced machine learning algorithms to forecast daily, weekly, and seasonal linen demand with high precision, correlating usage patterns with hospital admission rates and surgery volumes, which minimizes stockouts and drastically reduces expensive overstocking.

- Automated Quality Control and Inspection: AI-powered computer vision systems rapidly and consistently scan all cleaned linens, post-laundering, checking for minute residual stains, microscopic damage, or textile inconsistencies, ensuring only textiles that strictly comply with pre-defined quality parameters reach patient care areas, thereby significantly enhancing safety.

- Optimized Logistics and Route Planning: Advanced algorithms process real-time traffic data, operational constraints, and priority schedules to dynamically determine the most efficient pickup and delivery routes for specialized transport fleets, resulting in reduced fuel consumption, lower carbon emissions, and significantly improved adherence to promised turnaround times for centralized laundries.

- Enhanced Infection Tracing and Auditing: AI integrated with RFID tracking systems allows for instantaneous, detailed tracking of specific linen batches. This capability links them precisely to specific wards, operating theaters, or even individual patient rooms, providing critical, granular data essential for effective public health outbreak investigation, containment procedures, and comprehensive auditing trails.

- Robotic Sorting and Handling: AI guides sophisticated robotic systems to efficiently sort soiled linens upon intake, categorizing them accurately by textile type, contamination level, and the precise required cleaning cycle. This automation improves industrial throughput rates, minimizes biological exposure risk for human workers, and ensures optimal processing efficiency.

- Resource Optimization (Water/Energy): Machine learning monitors and adjusts tunnel washer parameters in real time (temperature, water levels, chemical dosage) based on the load composition and contamination profile, achieving maximum cleanliness with the minimum possible consumption of water and energy, supporting sustainability goals.

DRO & Impact Forces Of Hospital Linen and Laundry Services Market

The Hospital Linen and Laundry Services Market operates under intense pressure, where market dynamics are shaped equally by the compelling need to uphold the highest clinical safety standards and the constant organizational drive to secure cost efficiencies within highly constrained healthcare budgets. A primary structural driver is the alarming escalation in the global prevalence of Healthcare-Associated Infections (HAIs), which mandates the use of ultra-sterile and certified textiles, forcing hospitals toward providers who can guarantee standardized disinfection protocols. Coupled with this is the robust economic case for outsourcing, which permits hospitals to strategically convert substantial, high fixed capital costs related to owning and maintaining industrial laundry equipment into more predictable, manageable operational expenses (OpEx), freeing up capital for direct clinical investments. However, these positive drivers are substantially constrained by factors such as the extremely high initial capital outlay required to build or retrofit a modern, automated, and compliant industrial laundry facility, alongside the complex logistical hurdles inherent in successfully managing highly dynamic, vast, and geographically dispersed textile inventory networks across multi-site healthcare systems, especially concerning accountability and loss prevention.

A second, extremely significant, and non-negotiable impact force is the dynamic regulatory and accreditation environment. Global health organizations and stringent national regulatory bodies, such as the US Joint Commission, European health agencies, and ISO committees, continually update and enforce complex guidelines for textile handling, high-level disinfection, and mandatory sterilization in clinical environments. Ensuring absolute compliance with these rigorous standards often demands highly specialized, continuously calibrated equipment and complex procedural processes that are frequently impractical or prohibitively expensive for individual, non-specialized hospitals to manage internally. This regulatory intensity powerfully reinforces the value proposition of specialized outsourcing partners who possess the scale and expertise required for certified compliance. The unyielding global public health pressure to reduce HAIs acts as an irreversible market driver, aggressively compelling service providers to invest in and adopt sophisticated barrier systems, advanced chemical and thermal disinfection protocols, and verifiable monitoring technologies, thereby indirectly stimulating and expanding the market for highly assured, premium outsourcing services.

Despite these growth factors, the market faces constraints related to maintaining absolute service standardization and consistent quality control, particularly evident in highly fragmented regional markets where numerous small-scale, localized providers may severely lack the requisite technological or capital capacity to deliver the industrial-scale, verified sterilization necessary for major acute care facilities. Price sensitivity represents another critical restraint, especially among mid-sized or smaller healthcare institutions in developing regions, where budget restrictions might lead them to select cheaper, often non-certified or locally sourced laundry services over standardized, higher-cost global solutions, potentially compromising patient safety. Nonetheless, the widespread and accelerating trend of vertical integration within the service provider segment, coupled with the ongoing consolidation of large-scale hospital networks, presents substantial opportunities. This environment allows major industrial laundry operators to secure large, lucrative, multi-facility contracts, enabling them to enforce comprehensive, standardized quality metrics across an entire health system footprint, effectively leveraging immense economies of scale to overcome existing cost and quality hurdles.

Segmentation Analysis

The Hospital Linen and Laundry Services Market is meticulously segmented across multiple dimensions—service type, product composition, contract arrangement, and end-user facility—a structure that is essential for precise strategic planning, tailored service portfolio development, and accurate market forecasting. The primary segmentation by Service Type clearly distinguishes between routine Laundry and Cleaning Services and the critically important Sterilization Services, which reflects the highly differentiated capital and regulatory requirements for basic textile hygiene versus high-level disinfection necessary for surgical instrument wraps and critical patient contact items. Segmentation by Product Type furnishes essential insights into varying demand elasticity and volume patterns across items such as general Patient Wear, high-volume Bedding, and specialized Surgical Textiles, with the latter often commanding significantly higher pricing and requiring stringent processing due to the critical nature of their application in sterile environments. Comprehensive analysis across these segmentation tiers allows industry stakeholders to accurately determine where substantial technological investment is most warranted, how complex supply chain logistics should be optimized, and how nuanced pricing structures must be established to reflect the inherent risk, complexity, and regulatory stringency associated with distinct textile management workflows.

- By Service Type:

- Laundry and Cleaning Services (Routine washing, folding, and delivery of general linens and apparel).

- Sterilization Services (High-level disinfection and terminal sterilization of surgical drapes, packs, and reusable OR items, requiring specialized autoclave or chemical processing).

- By Product Type:

- Bedding and Linens (Patient sheets, specialized mattress covers, pillowcases, and blankets).

- Patient Apparel (Gowns, robes, patient pajamas, and specialized demographic wear).

- Surgical Textiles (Reusable Surgical Drapes, highly absorbent OR towels, certified surgical gowns, and instrument wraps).

- Staff Uniforms and Scrubs (Clinical and non-clinical staff protective and identifying clothing).

- Other Specialty Linens (Cleaning cloths, mop heads, privacy curtains, and reusable incontinence pads).

- By Contract Type/Arrangement:

- Rental Services (Full-service model: Provider owns the inventory, handles maintenance, washing, supply, and delivery; dominates the mature markets).

- Contract Services (Hospital owns the inventory; Provider manages only the laundering, cleaning, and necessary maintenance based on a fixed service contract).

- Internal/In-house Management (Hospital maintains, manages, and operates its own dedicated laundry facility; declining trend).

- By End-User:

- Hospitals (Acute Care, General Hospitals, Pediatric, Tertiary Care, and Specialized Cancer Centers).

- Ambulatory Surgical Centers (ASCs) (High demand for sterility with low volume compared to hospitals).

- Specialty Clinics and Diagnostics Centers (Limited volume of general linens and uniforms).

- Long-Term Care Facilities and Nursing Homes (High volume of general bedding and patient clothing, with focus on comfort and durability).

Value Chain Analysis For Hospital Linen and Laundry Services Market

The operational value chain for hospital linen and laundry services initiates firmly in the upstream segment with the essential sourcing of high-performance raw materials, predominantly durable blends of cotton and synthetic microfibers, which are manufactured to strict hygienic standards for medical environments. Upstream analysis critically focuses on efficient supplier relationships for acquiring textiles engineered for maximum durability, fluid resistance, and longevity, capable of withstanding hundreds of high-temperature wash cycles, alongside procurement of industrial-grade chemicals, including detergents, specialized disinfectants, and environmentally compliant finishing agents. Cost optimization and efficiency at this initial stage are inherently tied to large-volume, long-term purchasing agreements and continuous material science innovation aimed at substantially extending textile lifespan, directly mitigating the most significant variable cost for service providers: linen replacement frequency. Ensuring material quality and supply chain resilience upstream is paramount to delivering a cost-effective and reliable service downstream.

Midstream activities constitute the core value-adding processes and are concentrated within large-scale, centralized industrial laundry facilities. This phase involves a sophisticated sequence of operations: the controlled collection and safe transfer of contaminated materials; high-speed automated sorting (often assisted by advanced sensor technology); the washing and disinfection process utilizing industrial tunnel washers optimized for efficiency and compliance (adhering to strict thermal and chemical inactivation standards); drying, pressing, meticulous repair protocols; and comprehensive quality assurance checks utilizing visual inspection and often AI. The integration of barrier technology, separating the 'dirty' input side from the 'clean' output side, is a defining feature of the midstream value chain, mandated by infection control requirements. Efficiency gains in this segment are primarily realized through high levels of automation, maximizing throughput while minimizing labor costs and ensuring absolute adherence to hygiene certification standards.

The downstream segment centers on the final logistics, highly precise distribution, and the crucial point-of-use service delivery to the end-user hospitals. Direct service channels, where the laundry company contracts directly with the healthcare institution, overwhelmingly dominate, as this model guarantees complete accountability, centralized inventory tracking, and seamless integration with hospital operations, utilizing dedicated, biosecure transport fleets. While less prevalent, indirect channels may sometimes incorporate external Third-Party Logistics (3PL) providers for non-critical transport functions or involve large Integrated Facility Management (IFM) firms that subcontract the laundry specialism. The overall success of the downstream operation is rigorously measured by metrics such as guaranteed Just-In-Time (JIT) delivery reliability, exceptionally low inventory variance rates (minimizing lost linen), and the comprehensive deployment of tracking technologies (like RFID) that ensure a fully auditable and transparent chain of custody from the moment linen leaves the laundry until it reaches the specific ward or OR shelf.

Hospital Linen and Laundry Services Market Potential Customers

The primary end-users and highly sought-after potential buyers for professional, outsourced hospital linen and laundry services are institutions operating within the highly regulated healthcare sector that necessitate continuous, high-volume supplies of immaculately cleaned, disinfected, and frequently sterilized textiles for supporting critical patient care and procedural environments. Acute care hospitals, encompassing major government-owned facilities, large private tertiary care centers, and university teaching hospitals, represent the indisputable largest customer segment. This dominance stems from their colossal inventory requirements, constant high patient census turnover, and the complex demands of surgical suites requiring certified sterile barrier systems. These facilities fundamentally prioritize uncompromising quality assurance, mandatory regulatory compliance (such as ISO certifications), and proven supply chain reliability, positioning them as essential long-term clients for large, sophisticated industrial laundry organizations capable of reliably managing operations at national and international scale.

A second crucial and rapidly accelerating segment of potential customers includes the growing number of Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics, entities which typically lack the available physical space, the necessary capital reserves, or the specialized expertise required to effectively manage stringent in-house laundry operations. For ASCs, the decision to outsource is an immediate and clear economic imperative, enabling them to maintain surgical-grade sterility standards for all procedures without diverting scarce capital or administrative focus away from essential clinical technology procurement. Moreover, the extensive category of long-term care facilities, including licensed nursing homes, sub-acute rehabilitation centers, and specialized assisted living complexes, constitutes a steadily expanding customer base, primarily demanding high-volume, general laundry services (bedding, personal apparel) where textile durability, patient comfort, and fundamental infection prevention compliance are key procurement criteria.

In terms of crucial buyer criteria, potential customers rigorously evaluate prospective service providers on several non-negotiable operational metrics: adherence to third-party accreditation standards (e.g., Healthcare Laundry Accreditation Council - HLAC or relevant European EN standards), guaranteed turnaround time metrics (crucial for OR supply), advanced inventory tracking and loss reporting capabilities, and demonstrable disaster resilience or contingency planning to ensure zero interruption of supply during major crises or disease outbreaks. Large government healthcare systems and centralized public procurement bodies represent massive, highly attractive procurement opportunities, generally requiring lengthy and complex public tenders that place equal emphasis on demonstrable long-term cost-efficiency, transparent reporting, and quantifiable sustainable operational practices, thus incentivizing vendors to offer highly integrated, technology-enabled, holistic service solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 22.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Angelica Corporation, Aramark Corporation, Unitog Inc., Ecotex Healthcare Linen Service, Crothall Healthcare, Inc., Synergy Health plc (Steris PLC), Cintas Corporation, Mission Healthcare, Healthcare Linen Services Group, Vestis, Alsco Inc., MediCleanse Ltd., ImageFIRST, Paris Healthcare Linen Services, Foussard C&R, Specialized Laundry Systems, Standard Textile Co. Inc., CLEAN International, K-Bro Linen Systems Inc., Tetsudo Linen Service Co. Ltd., Tingue Brown & Co., Encompass Group LLC, G&K Services (Aramark Subsidiary), ADI Linen, HCSC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Linen and Laundry Services Market Key Technology Landscape

The contemporary technological landscape defining the Hospital Linen and Laundry Services market is highly refined, focused rigorously on maximizing automation efficiency, ensuring comprehensive traceability, and drastically improving environmental sustainability metrics. A fundamental enabling technology remains the high-capacity, automated industrial tunnel washer system, which has evolved to incorporate precise chemical injection and continuous monitoring systems to rigorously ensure complex thermal and chemical disinfection compliance for infectious materials, concurrently maximizing water usage efficiency through multi-stage recycling and ultra-filtration systems. Beyond the central washing process, the most impactful technological innovations are concentrated on dramatically enhancing the efficiency and accountability of the entire inventory management lifecycle, moving textiles from patient use to reprocessing and back with absolute reliability. Radio Frequency Identification (RFID) tagging is now considered an industry benchmark technology for all high-value and surgical linens, providing granular, real-time tracking of each item’s exact location, cumulative wash count, utilization patterns, and predicted life expectancy, which significantly curtails shrinkage (loss rates) and provides sophisticated data for optimal procurement scheduling.

Furthermore, specialized technology plays an indispensable role in safely managing the biological risk and infectious nature inherent in soiled hospital textiles. Barrier technology remains paramount; this engineering concept utilizes strictly segregated intake and output sections within the laundry facility, connected solely by the sealed, highly automated washing equipment, a system explicitly designed to eliminate any possibility of cross-contamination between biologically soiled and clean, processed textile streams, thereby enforcing rigorous adherence to global hygiene standards, such as those stipulated by ISO 14065 and local public health authorities. Additionally, sophisticated automated material handling systems, including complex networks of conveyor belts, pneumatic chutes, and advanced robotic sorting machines equipped with weight, optical, and sometimes chemical sensors, substantially enhance operational speed and significantly reduce dependence on manual labor, particularly within the arduous and high-risk soiled sorting environment. These integrated systems markedly improve operational throughput efficiency, protect worker health and safety, and directly influence the competitive pricing and reliable service delivery strategies of large-scale, automated industrial laundries.

The current adoption of advanced data analytics and unified cloud-based enterprise management platforms represents the leading technological edge and a crucial source of contemporary service differentiation. These sophisticated platforms dynamically integrate massive streams of operational data originating from diverse sources, including individual RFID scan points, minute-by-minute washing machine performance metrics, real-time energy and water consumption sensors, and direct feeds from hospital Electronic Health Records (EHRs) regarding patient census and operating room schedules. This integration facilitates the creation of highly accurate predictive models for demand forecasting, optimized maintenance scheduling, and automated, auditable quality assurance reporting. This unprecedented level of transparency and actionable operational intelligence empowers service providers to transition into offering high-value, consultative services to their hospital clients, focusing on sophisticated linen utilization optimization, proactive loss reduction strategies, and long-term cost management partnership. The consistent investment in environmentally sustainable technologies, such as advanced heat recovery exchangers, high-efficiency boilers, and localized solar energy integration, further defines the progressive technology landscape, successfully meeting the accelerating institutional demand for certified "green laundry" services from major healthcare systems committed to reducing their collective environmental footprint.

Regional Highlights

- North America: This region maintains its dominant market position globally, characterized by an exceptionally high, structural rate of outsourcing (driven by cost and compliance pressures), mandatory and extensive regulatory requirements (e.g., HLAC accreditation is critical), and a highly consolidated market structure dominated by several immense, technologically advanced service providers. The prevalence of sophisticated Integrated Healthcare Networks (IHNs) drives continuous, substantial demand for advanced, standardized inventory management, comprehensive supply chain transparency, and validated sterile services. Technological integration, particularly the ubiquitous deployment of RFID systems, advanced robotics, and AI-driven logistics, is significantly higher here than in any other global market.

- Europe: The European market, while mature, displays a high degree of fragmentation, with notable variance in outsourcing maturity levels between individual countries. Western Europe (led by Germany, the UK, and France) features rigorous regulatory oversight (driven by EU directives) and a strong, early-mover focus on sustainable laundry operations, leading to significant capital investment in high-efficiency, energy-saving industrial machinery and chemical protocols. Conversely, Central and Eastern European markets are currently undergoing rapid, government-funded modernization, experiencing accelerated adoption of outsourced models fueled by the harmonization of regional quality standards and necessary expansion of aging healthcare infrastructure.

- Asia Pacific (APAC): APAC is emphatically projected to be the fastest-growing market globally, buoyed by multi-billion dollar government and private sector investments into new hospital construction and capacity expansion, rapidly increasing per capita healthcare expenditure in economies such as China, India, and Southeast Asia, and a sharp increase in awareness and implementation of international infection control standards. While traditional in-house laundry systems persist within parts of the public sector, the explosion of the private, specialty hospital sector is driving intense demand for high-quality, professional, certified sterile processing services, offering immense greenfield opportunity for both regional and international service providers.

- Latin America (LATAM): Market growth in LATAM is recorded as steady and incremental, largely driven by continuing urbanization trends and increasing accessibility to private sector healthcare services among the middle class. Market sophistication varies widely by nation; established economies like Brazil, Chile, and Mexico exhibit greater adoption of centralized, industrial-scale laundry systems, but the overall market size and potential remain moderately constrained by regional economic volatility and a comparatively slower rate of integration of high-cost tracking technologies when benchmarked against North America.

- Middle East and Africa (MEA): The MEA market growth trajectory is heavily shaped by vast, state-sponsored healthcare infrastructure megaprojects, especially within the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar), which are establishing new "medical cities" demanding premium, certified sterile services and integrated facility management. Growth here is inherently robust, highly focused on securing absolute quality and guaranteed supply chain integrity, frequently favoring established international providers capable of guaranteeing proven adherence to the most exacting global infection control benchmarks and compliance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Linen and Laundry Services Market.- Angelica Corporation

- Aramark Corporation

- Unitog Inc.

- Ecotex Healthcare Linen Service

- Crothall Healthcare, Inc.

- Synergy Health plc (Steris PLC)

- Cintas Corporation

- Mission Healthcare

- Healthcare Linen Services Group

- Vestis

- Alsco Inc.

- MediCleanse Ltd.

- ImageFIRST

- Paris Healthcare Linen Services

- Foussard C&R

- Specialized Laundry Systems

- Standard Textile Co. Inc.

- CLEAN International

- K-Bro Linen Systems Inc.

- Tetsudo Linen Service Co. Ltd.

- Tingue Brown & Co.

- Encompass Group LLC

- G&K Services (Aramark Subsidiary)

- ADI Linen

- HCSC

Frequently Asked Questions

Analyze common user questions about the Hospital Linen and Laundry Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased outsourcing trend in hospital laundry services?

The primary driver is the necessity for stringent, verified infection control standards (essential for HAI reduction) and the compelling financial benefit derived from converting high fixed capital costs associated with maintaining compliant in-house industrial facilities into predictable, manageable operational expenses (OpEx), thereby allowing hospitals to focus capital exclusively on core clinical investments and patient care technologies.

How does RFID technology fundamentally enhance efficiency in hospital linen management?

RFID tags embedded within linens provide granular, real-time visibility into the exact location, cumulative wash count, precise usage cycle, and current inventory levels of every textile item. This technological capability drastically reduces linen loss, optimizes stock rotation and inventory parity, minimizes unnecessary procurement cycles, and provides critical, rapid tracking data essential for infection control auditing.

Which service segment holds the largest global market share and why is it dominant?

The Rental Services segment, characterized by the service provider owning the entire textile inventory, managing all maintenance, laundering, supply, and loss replacement, holds the largest global market share. Its dominance is attributed to its offering a capital-light, all-inclusive, risk-transfer model that significantly simplifies logistics and minimizes upfront capital expenditure for healthcare end-users.

What are the major operational challenges currently facing industrial laundry service providers in this specialized market?

Major operational challenges include consistently maintaining verifiable quality control and absolute regulatory compliance across vast, complex service networks; mitigating the inherently high, fluctuating energy and water consumption costs associated with large-scale industrial laundering processes; and efficiently managing the labor intensity and logistical complexities required for multi-site sorting, collection, and precision distribution.

What is the forecast growth trajectory and key driver for the Asia Pacific (APAC) regional market?

The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) globally. This accelerated growth is fundamentally driven by massive government-led investments in expanding private and public healthcare infrastructure, coupled with rapidly increasing institutional adoption of international sterile processing guidelines and the shift towards sophisticated, centralized, professional outsourced laundry systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager