Hospital Linen Supply Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441809 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hospital Linen Supply Market Size

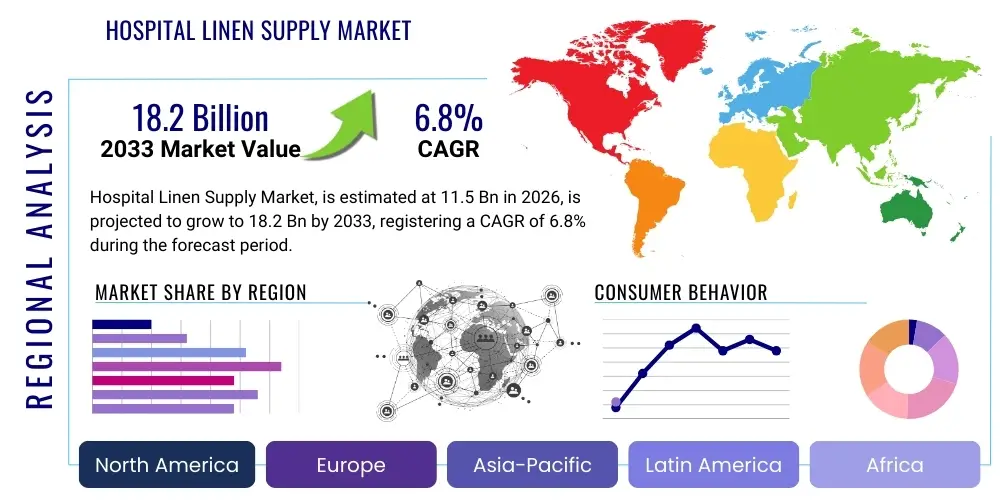

The Hospital Linen Supply Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033.

Hospital Linen Supply Market introduction

The Hospital Linen Supply Market encompasses the manufacturing, distribution, and services related to textiles used in healthcare settings, including sheets, blankets, patient gowns, surgical drapes, scrubs, and towels. These supplies are critical components of maintaining hygiene, patient comfort, infection control, and operational efficiency within hospitals, clinics, and specialized care facilities. The necessity for these products is intrinsically linked to patient volumes, surgical procedure rates, and stringent regulatory requirements regarding cleanliness and sterilization.

Major applications of hospital linen range from standard patient care (bedding and apparel) to specialized surgical environments (sterile barrier systems and operating room towels). The primary benefits driving market demand include enhanced infection prevention through professional laundering and standardization, improved patient experience, and cost optimization achieved by outsourcing laundry and supply management tasks. Key driving factors accelerating market expansion involve the global aging population necessitating increased healthcare utilization, the rising prevalence of Hospital-Acquired Infections (HAIs) compelling stricter adherence to linen management protocols, and the continuous expansion of healthcare infrastructure, particularly in emerging economies.

Hospital Linen Supply Market Executive Summary

The Hospital Linen Supply Market is characterized by robust growth, primarily driven by outsourcing trends and stringent regulatory frameworks mandating high standards of hygiene. Business trends indicate a shift towards technologically advanced laundering processes, including Radio Frequency Identification (RFID) tracking for inventory management and utilization analysis, which enhances efficiency and reduces loss. Consolidation among major service providers is also a defining feature, leading to economies of scale and sophisticated service offerings that span processing, delivery, and compliance reporting. Furthermore, sustainability is becoming a key competitive differentiator, with providers increasingly offering eco-friendly materials and energy-efficient processing methods.

Regional trends highlight North America and Europe as mature markets focused on innovation in sterile processing and advanced material utilization, while the Asia Pacific region presents the most significant growth opportunity, fueled by rapid expansion of private hospital chains and improving public health expenditure. Segment trends indicate that the rental services segment dominates the market due to the high capital expenditure and logistical complexity associated with in-house operations. The segment covering specialized linen, such as surgical gowns and drapes, is experiencing faster growth owing to the escalating number of complex surgical procedures and the preference for single-use or high-performance reusable materials that meet stringent barrier protection standards.

AI Impact Analysis on Hospital Linen Supply Market

Common user questions regarding AI's impact on the Hospital Linen Supply Market center on optimizing inventory levels, predicting demand fluctuations based on seasonal illnesses or surgical schedules, and enhancing the quality control in laundry processing. Users are particularly keen on understanding how AI can minimize linen loss (a significant operational cost) and ensure compliance with hygiene standards without human bias. The key themes revolve around achieving predictive supply chain management, automating quality inspection of washed textiles, and utilizing data analytics derived from RFID or IoT sensors embedded in linen to improve overall utilization rates across large healthcare systems.

While AI does not directly manufacture textiles, its influence is transformative in the service delivery and logistics components. AI algorithms are increasingly being integrated into supply chain platforms to analyze historical usage data, current hospital occupancy rates, and planned surgical volumes. This integration allows for highly accurate forecasting, minimizing overstocking or shortages, which translates directly into reduced operational expenditure for hospitals. Furthermore, predictive maintenance models powered by machine learning are being applied to large-scale industrial laundry equipment, ensuring maximum uptime and reliability in the crucial sterilization process.

The adoption of computer vision and deep learning models is starting to revolutionize quality assurance in large-scale laundering facilities. These systems can automatically scan returned linen for minor defects, staining, or compromised integrity that might be missed by human inspectors, ensuring that only clinically appropriate textiles are returned to circulation. This automated inspection system enhances patient safety and provides an auditable record of quality control, supporting compliance documentation required by healthcare accreditation bodies.

- AI algorithms enable precise demand forecasting based on patient flow and procedure scheduling, reducing inventory buffers.

- Machine learning optimizes routing and logistics for linen collection and delivery, lowering transportation costs and delivery times.

- Computer vision systems automate quality control checks in laundries, identifying textile defects or improper sterilization completion.

- Predictive analytics powered by AI minimizes equipment downtime in industrial laundry facilities through proactive maintenance alerts.

- Integration of AI with RFID data enhances trackability, significantly reducing linen shrinkage and loss rates for hospitals.

DRO & Impact Forces Of Hospital Linen Supply Market

The Hospital Linen Supply Market dynamics are shaped by powerful Drivers, Restraints, and Opportunities (DRO). The primary drivers include the escalating focus on infection control and patient safety, the growth in surgical volumes globally, and the operational advantages derived from outsourcing services. These are counterbalanced by major restraints such as the high initial investment required for sophisticated industrial laundry setups, the stringent and varying regulatory compliance across different geographic regions, and the environmental concerns surrounding water and energy consumption in the laundering process. Opportunities predominantly lie in technological adoption (like RFID) and penetration into underserved markets, particularly rural and specialized care centers.

Impact forces refer to the external pressures and competitive landscape influencing market operations. The intensity of competition among major laundry service providers (Porter’s Five Forces: Competitive Rivalry) is high, pushing companies toward cost-efficiency and superior service quality. The bargaining power of large healthcare systems (Buyers’ Bargaining Power) is significant, often requiring providers to offer long-term, fixed-price contracts. Conversely, the threat of substitutes is relatively low, as reusable or disposable linen remains essential and non-negotiable for clinical standards, though shifts between reusable and high-grade disposable options affect segment growth.

The shift towards sustainable and eco-friendly practices also represents a significant operational force. Hospitals are increasingly prioritizing suppliers who use recycled water, biodegradable detergents, and sustainable textile sourcing, adding a layer of complexity to supply chain management but also creating a premium market for environmentally responsible suppliers. Moreover, the constant threat of pandemics or major public health crises necessitates extreme flexibility and scalability in linen supply, forcing providers to maintain excess capacity and robust contingency plans, impacting capital expenditure decisions.

Segmentation Analysis

The Hospital Linen Supply Market is critically segmented based on product type, material, end-user, and service model, providing diverse avenues for strategic market engagement. The complexity of clinical requirements dictates specialized segment offerings, ranging from general patient bedding to sterile surgical products. Understanding these segments is crucial for manufacturers and service providers to tailor their operations, focusing on specialized certifications (like ISO standards for sterile supplies) and logistical frameworks appropriate for each user group. The growth trajectories vary significantly across these segments, with sterile linens and rental services showing the strongest expansion potential.

- By Product Type:

- Bedding (Sheets, Blankets, Pillowcases)

- Wound Care Supplies

- Surgical Linen (Drapes, Towels, Gowns)

- Patient and Staff Apparel (Gowns, Scrubs)

- Utility Linen (Cleaning Cloths, Curtains)

- By Material:

- Cotton

- Blends (Cotton/Polyester)

- Microfiber

- Disposable/Non-woven Materials

- By End-User:

- Hospitals (Public and Private)

- Clinics and Specialty Centers

- Long-Term Care Facilities

- Ambulatory Surgical Centers (ASCs)

- By Service Model:

- In-house Laundry Services

- Rental/Outsourced Laundry Services

- Purchased Linen Supply

Value Chain Analysis For Hospital Linen Supply Market

The value chain for the Hospital Linen Supply Market begins with upstream activities focused on raw material procurement, primarily encompassing cotton and synthetic fiber production, textile manufacturing, and specialized coating applications (e.g., fluid resistance). Key upstream considerations include ensuring sustainable sourcing of natural fibers and maintaining quality control over synthetic material composition to meet high durability and wash resistance standards. Manufacturers then convert these materials into specific linen products (bedding, gowns), adhering to clinical specifications and relevant regulatory standards such as AAMI (Association for the Advancement of Medical Instrumentation) levels for barrier protection.

Midstream activities primarily involve logistics, sterilization, and laundry processing. For rental services, the service provider manages large, industrial-scale laundering operations, which involve rigorous washing, drying, inspection, repair, and terminal sterilization cycles. Distribution channels are critical, linking centralized laundry facilities directly to hospitals. These channels often employ complex logistical frameworks, utilizing direct delivery models or managed inventory systems where the supplier maintains stock levels within the hospital premises. The efficiency of this midstream process directly impacts the provider's profitability and the hospital’s operational success.

Downstream activities focus on the end-user hospitals and subsequent disposal or reprocessing. Direct engagement occurs when hospitals contract directly with large textile service providers for full-service rental programs, covering everything from procurement to distribution and soiled collection. Indirect channels may involve third-party distributors for smaller hospitals or the direct purchase of new linen from textile manufacturers. The final stage involves managing soiled linen handling and disposal, a critical step governed by strict biohazard regulations, which completes the closed-loop system for reusable linen, ensuring hygiene integrity and sustainability.

Hospital Linen Supply Market Potential Customers

The primary end-users and buyers of hospital linen supply are large, multi-location hospital systems, which require centralized supply management solutions to maintain cost efficiency and brand standardization. These integrated delivery networks (IDNs) represent the most lucrative customer segment, often opting for comprehensive rental and outsourcing agreements to divest themselves of the non-core competency of industrial laundry. They prioritize providers capable of handling massive volumes, offering highly reliable logistics, and demonstrating transparent compliance reporting regarding infection control standards. Their purchasing decisions are heavily weighted towards Total Cost of Ownership (TCO) rather than just initial product cost.

Secondary, yet rapidly growing, customer segments include Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics. While they require lower volumes than acute care hospitals, their need for sterile surgical linen and quick turnaround times is extremely high. ASCs often prefer full-service rental models due to limited physical space and lack of capital for in-house laundry equipment. Long-term care facilities and nursing homes form another stable customer base, primarily focused on patient comfort and routine linen needs, where durability and stain management are key selection criteria. The demand from these facilities is less sensitive to procedural volume fluctuations but more sensitive to budgetary constraints and operational simplicity.

Governmental healthcare providers and public sector hospitals represent a distinct customer group, usually procuring linen services through centralized tenders and long-term contracts. These procurement processes emphasize competitive pricing and strict adherence to publicly mandated quality standards. Private equity-backed specialty centers (e.g., orthopedics, oncology) are also significant buyers, often demanding premium, high-tech linen materials that support advanced procedural requirements and reflect a higher standard of patient experience, allowing providers to differentiate based on fabric innovation and aesthetic quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Angelica Corporation, Aramark, Elis SA, Synergy Health (Steris), HCSC (Healthcare Services Group), Unitex Healthcare Laundry Services, E-town Laundry Company, Fazzi Healthcare Services, ImageFIRST Healthcare Laundry Specialists, Mission Linen Supply, TRSA (Textile Rental Services Association) members, Medline Industries, Crothall Healthcare, Encompass Group, Standard Textile. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Linen Supply Market Key Technology Landscape

The Hospital Linen Supply Market is increasingly integrating advanced technology to enhance transparency, efficiency, and compliance throughout the supply chain. One of the most significant technological shifts is the widespread adoption of Radio Frequency Identification (RFID) technology. RFID chips embedded in reusable linens allow service providers and hospitals to accurately track items throughout their lifecycle, from washing and sterilization cycles to specific departmental usage. This technology provides granular data on inventory location, usage frequency, and lifespan, drastically reducing loss rates (shrinkage) and optimizing the utilization of high-value items like surgical gowns and specialized blankets.

Furthermore, technology is revolutionizing the industrial laundry process itself. Advanced washing and sterilization equipment now incorporate sophisticated metering and dosing systems to ensure precise chemical use, maximizing pathogen elimination while minimizing textile degradation. Automated handling systems, including robotic sorting and folding, improve processing speed and reduce labor costs. On the material science front, the development of antimicrobial textiles and smart fabrics that incorporate bio-sensors represents a futuristic capability, offering enhanced infection control and potentially monitoring patient vital signs, although widespread adoption is still nascent.

Software solutions form the backbone of modern linen management. Cloud-based inventory platforms and predictive analytics software utilize historical and real-time data to forecast demand and manage logistics, integrating seamlessly with hospital enterprise resource planning (ERP) systems. These platforms support Answer Engine Optimization (AEO) efforts by providing immediate, verifiable data on sterilization compliance, inventory levels, and operational performance, satisfying complex contractual obligations and audit requirements from healthcare regulators.

Regional Highlights

Regional dynamics within the Hospital Linen Supply Market are highly differentiated by healthcare expenditure patterns, regulatory stringency, and the maturity of outsourcing infrastructure. North America and Europe currently hold the largest market shares, characterized by high adoption rates of sophisticated rental models and a strong focus on advanced infection control technologies like RFID tracking and automated quality assurance. In these regions, market growth is sustained primarily through technological upgrading, material innovation (e.g., fluid-resistant materials), and consolidation among service providers to achieve greater geographical reach and service specialization.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, particularly the establishment of private multispecialty hospitals in countries like China and India. The increasing middle-class population demanding higher quality healthcare services drives investment in modern, high-standard linen supply chains. While in-house laundry operations are still common in parts of APAC, the trend is steadily shifting toward outsourcing as facilities recognize the benefits of guaranteed sterilization compliance and reduced capital expenditure.

Latin America and the Middle East & Africa (MEA) represent emerging markets where growth is highly dependent on governmental health initiatives and foreign investment in healthcare facilities. In MEA, the influx of medical tourism is spurring demand for premium, international-standard linen services, often supplied by international players. However, market fragmentation and inconsistent regulatory environments in certain MEA and LatAm countries pose logistical challenges, leading to varied adoption rates of advanced linen management technologies compared to Western markets.

- North America: Dominates market share due to established outsourcing culture, stringent FDA and CDC infection control guidelines, and high penetration of RFID-based asset management systems.

- Europe: Characterized by strong regulatory oversight (e.g., EN standards), focus on sustainability in laundering, and robust competition among key regional service providers.

- Asia Pacific (APAC): Fastest-growing region, driven by massive healthcare infrastructure investment, rising disposable incomes, and the shift from in-house to specialized outsourced services.

- Latin America: Growth driven by expanding private healthcare sector and modernization efforts; faces challenges related to economic instability impacting long-term investment.

- Middle East & Africa (MEA): Growth bolstered by high-end medical tourism in the Gulf Cooperation Council (GCC) nations and increasing public health investment in South Africa and North Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Linen Supply Market.- Angelica Corporation

- Aramark

- Elis SA

- Synergy Health (Steris)

- HCSC (Healthcare Services Group)

- Unitex Healthcare Laundry Services

- E-town Laundry Company

- Fazzi Healthcare Services

- ImageFIRST Healthcare Laundry Specialists

- Mission Linen Supply

- Standard Textile

- Medline Industries

- Crothall Healthcare

- Encompass Group

- Cintas Corporation

- Servall Uniform/Linen Supply

- G&K Services (A subsidiary of Cintas)

- Clean Uniform Company

- Alsco Inc.

- Tetsudo Linen Service Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hospital Linen Supply market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Hospital Linen Supply Market?

The primary driver is the stringent regulatory requirement for infection control and prevention of Hospital-Acquired Infections (HAIs). Hospitals increasingly outsource linen management to specialized firms to ensure professional sterilization and compliance, minimizing clinical risk and focusing internal resources on patient care.

How is technology impacting operational efficiency in linen supply?

Technology, particularly Radio Frequency Identification (RFID) and IoT sensors, provides real-time tracking of linen assets. This integration significantly improves inventory accuracy, reduces shrinkage (loss), and automates logistics, leading to substantial cost savings and optimized utilization cycles for healthcare facilities.

Which service model dominates the hospital linen market?

The Rental/Outsourced Laundry Services model dominates the market. This model relieves hospitals of high capital expenditure on industrial laundry equipment and the operational burden of managing complex sterilization processes, providing reliable, compliant supply through predictable contract agreements.

What are the key materials used in hospital linen manufacturing?

Key materials include cotton, durable cotton/polyester blends for standard bedding and apparel, and specialized non-woven or synthetic materials (disposables) for critical areas like surgical drapes and gowns, where fluid resistance and high barrier protection are paramount.

Is the Hospital Linen Supply Market moving towards sustainability?

Yes, sustainability is a growing focus. Service providers are increasingly adopting energy-efficient laundering machinery, using sustainable chemicals, and optimizing water consumption. There is also a push towards using sustainably sourced textiles and implementing robust lifecycle management for reusable linen to reduce waste.

What is the main challenge faced by hospitals regarding linen supply?

The primary challenge for hospitals is managing linen shrinkage or loss, which represents a significant unrecoverable operational expense. High turnaround times and ensuring absolute compliance with sterilization standards across vast quantities of textiles also present continuous logistical and quality control hurdles.

How does AI contribute to supply chain resilience in this market?

AI contributes by enabling predictive demand modeling, analyzing patient data and seasonal trends to forecast required linen volumes accurately. This capability ensures supply chain resilience by preventing stockouts during peak demand periods or public health emergencies, maintaining continuous operational flow.

Which geographical region offers the highest growth potential?

The Asia Pacific (APAC) region offers the highest growth potential, driven by rapid urbanization, significant government and private investment in healthcare infrastructure expansion, and increasing adoption of professional outsourced services to meet rising standards of care.

What role do specialized linens play in surgical settings?

Specialized surgical linens, such as drapes and gowns, serve as sterile barriers essential for infection control. They are crucial for maintaining the sterile field during operations, adhering to stringent material standards (like AAMI levels) to prevent microbial transmission and protect both patients and surgical staff.

What defines a sophisticated value chain in this industry?

A sophisticated value chain integrates upstream material sourcing with automated, centralized midstream logistics, employing technologies like RFID for tracking and cloud-based software for transparent inventory management and compliance reporting to the downstream hospital client.

How is the threat of substitutes perceived in this market?

The threat of substitutes is low because linen is a fundamental requirement for clinical care. However, internal market competition exists between high-performance reusable linen and single-use disposable barrier products, which often compete on cost, barrier effectiveness, and logistical complexity.

What is the current trend regarding in-house versus outsourced laundry services?

The prevailing trend globally is a continued shift towards outsourced laundry services, especially among large hospital networks. Outsourcing allows hospitals to convert fixed capital costs into variable operating costs and benefit from the advanced scale and sterilization expertise of specialized vendors.

How important are certifications for linen supply providers?

Certifications, such as those related to ISO standards for quality management and specific regulatory approvals for sterilization processes, are critically important. They serve as non-negotiable proof points guaranteeing that the linen meets the necessary high standards for patient safety and clinical use.

What impact does the aging population have on linen demand?

The aging population necessitates increased hospitalization, long-term care, and surgical interventions, directly driving up the volume and frequency of linen usage across all healthcare segments, serving as a fundamental, long-term market driver.

What are the implications of material science advancements?

Advancements focus on creating more durable textiles that withstand hundreds of washes, improving antimicrobial properties for enhanced infection control, and developing materials that are lighter, softer, and more comfortable for patients while maintaining necessary clinical barrier performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager