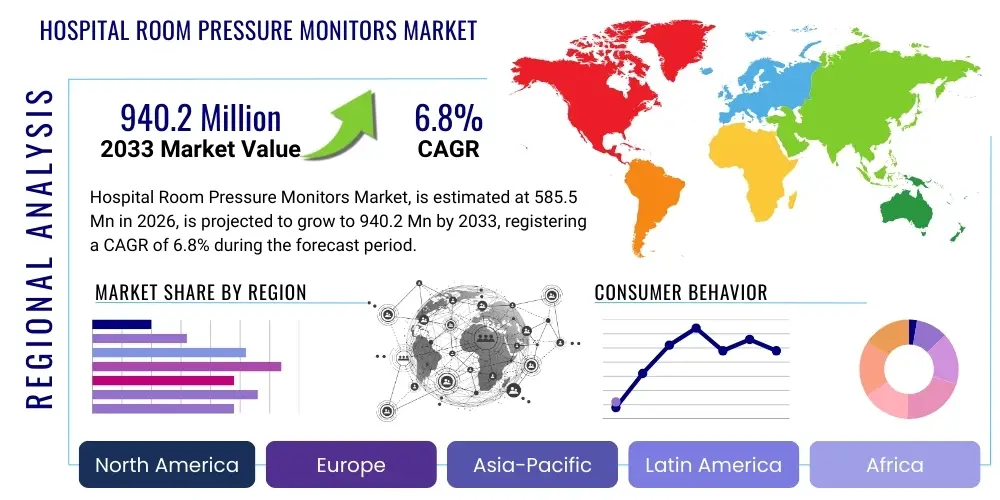

Hospital Room Pressure Monitors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441119 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Hospital Room Pressure Monitors Market Size

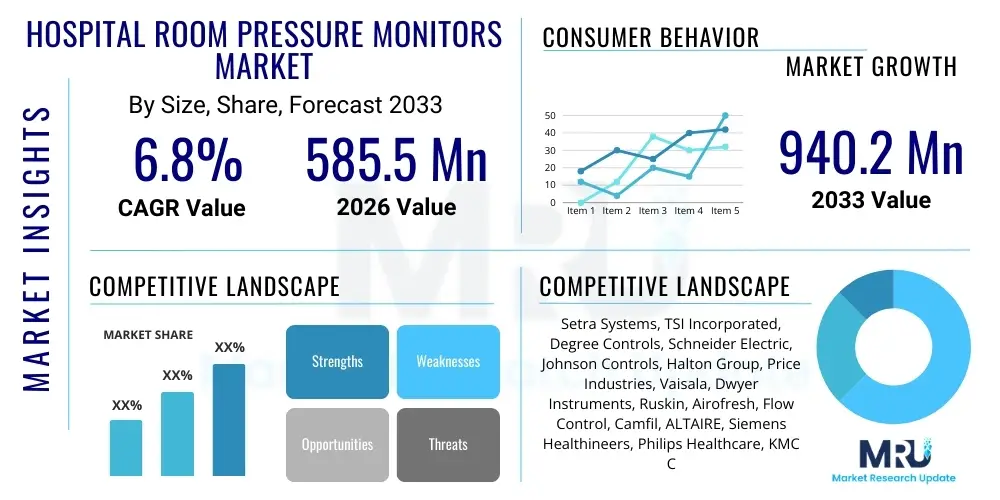

The Hospital Room Pressure Monitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 585.5 Million in 2026 and is projected to reach USD 940.2 Million by the end of the forecast period in 2033. This consistent growth is primarily fueled by stringent regulatory requirements mandating precise air quality and differential pressure control in critical healthcare environments, such as isolation rooms and operating theaters, coupled with the global focus on mitigating Hospital-Acquired Infections (HAIs) and airborne pathogen transmission.

Hospital Room Pressure Monitors Market introduction

The Hospital Room Pressure Monitors Market encompasses devices and systems designed to measure, display, and control the differential air pressure between adjacent spaces within a clinical setting. These monitoring systems are crucial for maintaining controlled environments, particularly in isolation rooms (Negative Pressure for infectious diseases like tuberculosis or COVID-19, and Positive Pressure for protecting immunocompromised patients from external contaminants). The core product involves highly accurate pressure sensors, sophisticated display interfaces, and integrated control systems that communicate with Heating, Ventilation, and Air Conditioning (HVAC) infrastructure to ensure regulatory compliance and patient safety.

Major applications of these monitors span critical areas including operating rooms (ORs), compounding pharmacies (USP 797/800 compliance), intensive care units (ICUs), and dedicated infectious disease wards. The primary benefits derived from these technologies include enhanced infection control, immediate alert notifications for pressure deviations, streamlined regulatory auditing processes, and quantifiable assurance of air containment or protection protocols. By providing real-time data and automated calibration checks, modern pressure monitors minimize the risk associated with human error and environmental failures, which are critical in sensitive hospital environments where air quality directly impacts patient outcomes.

The driving factors for market expansion are multifaceted. Key among them is the increasing global investment in healthcare infrastructure modernization, especially in emerging economies, coupled with heightened awareness following global health crises that underscored the necessity of robust airborne infection isolation rooms (AIIRs). Furthermore, the continuous evolution of international standards, such as those set by ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) and national accreditation bodies, compels hospitals to upgrade or install advanced pressure monitoring equipment. Technological integration, particularly with Building Management Systems (BMS) and Electronic Health Records (EHRs), further solidifies the essential role of these devices in modern hospital operations.

Hospital Room Pressure Monitors Market Executive Summary

The Hospital Room Pressure Monitors Market demonstrates robust resilience driven by non-discretionary spending in healthcare compliance and patient safety infrastructure. Key business trends include the shift towards wireless and IoT-enabled monitoring solutions that reduce installation complexity and enhance data accessibility for facilities management. Manufacturers are increasingly focusing on user-friendly, tamper-proof interfaces and systems capable of rapid deployment, responding directly to the pressures placed on hospital administrators regarding operational efficiency and regulatory scrutiny. Strategic mergers and acquisitions among sensor manufacturers and specialized HVAC control system providers are common, aiming to offer integrated, comprehensive environmental management packages to large hospital networks.

Regionally, North America maintains market leadership due to stringent regulatory frameworks (e.g., CDC guidelines, Joint Commission standards) and significant healthcare expenditure, driving high adoption rates of advanced monitoring systems. Asia Pacific, however, represents the fastest-growing region, fueled by massive infrastructure development in countries like China and India, coupled with increasing government focus on addressing hospital overcrowding and improving infection control standards post-pandemic. European markets are characterized by maturity and a strong preference for highly accurate, certified systems that integrate seamlessly with existing smart hospital technologies, emphasizing energy efficiency alongside clinical efficacy.

Segmentation trends reveal a strong performance in the segment utilizing wireless/Wi-Fi connected devices, favored for their flexibility and remote monitoring capabilities over traditional wired systems. By application, infectious disease isolation rooms and surgical suites remain the dominant segments, although the demand from specialized pharmacy compounding areas (driven by pharmaceutical compliance changes) is experiencing rapid acceleration. Device type analysis indicates growing preference for high-end, dedicated digital monitors capable of continuous data logging and automated reporting, providing auditable trails necessary for stringent healthcare accreditation processes.

AI Impact Analysis on Hospital Room Pressure Monitors Market

User queries regarding AI's influence typically revolve around how artificial intelligence can move pressure monitoring beyond mere sensing and alerting into predictive failure analysis, automated regulatory documentation, and optimizing HVAC operational efficiency in real-time. Users are keen to understand if AI can predict when a pressure breach is likely to occur based on historical data patterns or external factors (like ambient weather changes) and proactively initiate corrective actions within the Building Management System (BMS). Another major theme involves AI's role in correlating pressure fluctuations with other environmental variables (temperature, humidity, air changes per hour) to create a comprehensive, intelligent environmental compliance model, reducing reliance on manual checks and potentially lowering overall energy consumption without compromising patient safety.

AI's initial impact centers on enhancing the data processing capabilities of pressure monitoring systems. By applying machine learning algorithms to continuous pressure, flow, and HVAC operational data, AI can identify subtle patterns indicative of impending system failure—such as a filter blockage or fan degradation—long before a critical pressure drop occurs. This transition from reactive alerting to predictive maintenance is transformative for hospital facilities management, minimizing costly downtime in critical areas like ORs or sterile compounding labs. Furthermore, AI-driven systems can dynamically adjust required differential pressures based on current room occupancy or procedural requirements, maximizing energy efficiency while adhering strictly to safety margins, thereby yielding significant operational savings.

In the long term, AI integration promises to revolutionize compliance and auditing. AI models can automatically generate comprehensive, time-stamped compliance reports required by accreditation bodies (e.g., Joint Commission, ISO). By cross-referencing pressure data with maintenance logs, calibration certificates, and patient records (anonymized), AI ensures that every minute of operation in a controlled environment is fully documented and verifiable. This level of automated regulatory assurance drastically reduces administrative burden and liability risks for healthcare providers, driving the adoption of increasingly sophisticated, AI-ready pressure monitoring hardware.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast potential system failures (e.g., filter saturation, motor issues) impacting pressure stability.

- Automated Compliance Reporting: Generating real-time, auditable documentation required for regulatory bodies and accreditation purposes.

- Dynamic Pressure Optimization: Using machine learning to adjust differential pressure setpoints based on real-time factors (e.g., occupancy, door usage frequency) for energy saving.

- Enhanced Anomaly Detection: Identifying non-obvious factors causing pressure fluctuations that human monitoring might miss.

- Integration with Smart Hospital Ecosystems: Serving as the intelligent nexus for environmental control, linking HVAC, access control, and patient monitoring systems.

DRO & Impact Forces Of Hospital Room Pressure Monitors Market

The dynamics of the Hospital Room Pressure Monitors Market are dictated by a confluence of regulatory enforcement, technological maturity, and infrastructural investment cycles. The market is primarily driven by global governmental emphasis on infection control standards, particularly post-2020, leading to mandates for controlled environment expansion and renovation. Restraints include the high initial capital outlay required for installation and integration into legacy hospital infrastructure, along with the persistent challenge of maintaining sensor calibration accuracy in highly dynamic hospital environments. Opportunities arise from technological advancements, specifically in wireless, battery-powered systems and the integration of IoT for remote diagnostics, catering to the decentralized nature of modern healthcare facilities. These factors combine to exert significant impact forces on procurement decisions, supply chain integrity, and long-term service contracts within the medical technology sector.

Key drivers center on public health mandates and the economic burden of Hospital-Acquired Infections (HAIs). Regulatory bodies increasingly impose severe penalties for non-compliance regarding air quality control in critical patient areas, compelling rapid adoption of continuous monitoring solutions. Furthermore, the expansion of ambulatory surgical centers and dedicated specialty clinics globally, which must also adhere to strict cleanroom protocols, broadens the traditional hospital-centric customer base. The continuous improvement in sensor technology, offering higher accuracy (down to sub-Pascal measurements) and improved drift stability, also acts as a core driver, encouraging facility managers to replace older, less reliable analog systems with advanced digital counterparts.

Conversely, significant restraints impede faster market penetration. The complexity of integrating new digital monitoring networks with existing, often proprietary, Building Management Systems (BMS) in older hospital structures presents a major hurdle, requiring substantial customized engineering and integration costs. Additionally, the perception of pressure monitoring devices as non-revenue-generating capital equipment often places them lower on the priority list during budget allocation, particularly in resource-constrained public healthcare systems. Opportunities are strongest in preventative maintenance service contracts and software subscriptions related to data analytics, which provide manufacturers with recurring revenue streams and hospitals with predictable compliance costs. The development of modular, scalable systems that can be easily repurposed or expanded offers further opportunity for market penetration in smaller medical facilities.

Segmentation Analysis

The Hospital Room Pressure Monitors market is analyzed based on several dimensions including product type, technology, application, and end-user, allowing for a granular understanding of purchasing behaviors and market growth vectors. Product types are broadly divided into fixed/mounted systems and portable/handheld devices, catering to permanent installations versus ad-hoc compliance verification needs, respectively. Technology segmentation highlights the transition from analog gauges to sophisticated digital and wireless monitoring networks. Application analysis confirms the dominance of highly critical environments like operating theaters and protective environments, while end-user segmentation clearly defines the primary buyers, predominantly large hospitals and specialized clinics, which maintain the highest regulatory burden.

- By Product Type:

- Fixed/Wall-Mounted Pressure Monitors

- Portable/Handheld Pressure Monitors

- By Technology:

- Analog Pressure Monitors

- Digital Pressure Monitors (Wired)

- Wireless/IoT-Enabled Pressure Monitors

- By Application:

- Infectious Disease Isolation Rooms (Negative Pressure)

- Protective Environment Rooms (Positive Pressure)

- Operating Theaters and Surgical Suites

- Compounding Pharmacies (Sterile and Non-Sterile)

- Intensive Care Units (ICUs) and Critical Care Wards

- Laboratories and Research Facilities

- By End-User:

- Hospitals (Large, Medium, Small)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (e.g., Cancer Centers)

- Pharmaceutical and Biotechnology Manufacturing Facilities

Value Chain Analysis For Hospital Room Pressure Monitors Market

The value chain for hospital room pressure monitors begins with the upstream segment, dominated by specialized sensor and microchip manufacturers (e.g., MEMS sensor technology providers) and raw material suppliers for enclosure fabrication (plastics, metals). Highly precise differential pressure sensors are the most critical, high-cost component. Following material sourcing, the midstream activities involve the design, assembly, software integration, and calibration of the final monitoring units. This stage includes sophisticated industrial design to meet healthcare-specific aesthetic and cleaning requirements, along with rigorous software development for compliance features and network integration capabilities. Certification and quality control checks, often specific to medical device standards (e.g., FDA, CE Marking), add substantial value here.

Downstream activities involve the marketing, sales, and distribution channels. Due to the highly technical nature and regulatory context of the product, distribution is typically handled by specialized medical device distributors or Value-Added Resellers (VARs) who possess expertise in HVAC integration and healthcare compliance consulting. Direct sales channels are often employed by major global players for large hospital network contracts, allowing for detailed customization and long-term service agreements. Post-sale activities, including installation, calibration, preventive maintenance, and regulatory auditing support, form a crucial part of the downstream value proposition, often generating significant recurring revenue for the provider.

The distinction between direct and indirect channels is pronounced. Direct channels offer control over pricing, installation quality, and immediate feedback for product improvement, often utilized for high-volume or highly customized projects. Indirect channels, through specialized third-party integrators and distributors, are essential for reaching smaller regional hospitals and optimizing geographic coverage, particularly in fragmented international markets. Effective channel management requires comprehensive training for distributors on specific regulatory requirements and the proper maintenance of system accuracy, ensuring that installation quality meets the necessary clinical standards, thereby protecting the integrity of the manufacturer's brand and product reliability.

Hospital Room Pressure Monitors Market Potential Customers

The primary consumers of Hospital Room Pressure Monitors are institutions that require highly controlled environmental conditions to mitigate infection risk, protect vulnerable patients, or comply with pharmaceutical compounding regulations. End-users fall predominantly within the specialized healthcare sector, where air quality management is directly linked to accreditation status and patient safety outcomes. These buyers prioritize reliability, measurement accuracy, ease of integration with existing hospital infrastructure, and robust data logging capabilities that support regulatory auditing requirements. The purchase decision often involves complex committees comprising facilities management personnel, infection control specialists, chief medical officers, and procurement teams, necessitating comprehensive documentation on both clinical efficacy and operational cost-effectiveness.

The largest volume buyers are large, multi-site hospital systems and academic medical centers (AMCs), which operate numerous critical areas simultaneously, including complex surgical wings and extensive dedicated isolation facilities. These customers often seek enterprise-level monitoring solutions that offer centralized dashboard control and system-wide standardization for maintenance and training purposes. Furthermore, the increasing establishment of dedicated COVID-19 or specialized respiratory illness wings globally continues to drive cyclical demand for rapid deployment of pressure monitoring technology in both temporary and permanent structures.

A rapidly growing customer segment includes specialized pharmaceutical compounders and biotechnology firms operating within or adjacent to hospital facilities. Driven by strict mandates such as USP General Chapters <797> and <800> in the US, these entities require highly reliable pressure monitoring for cleanrooms and containment primary engineering controls (PECs) to ensure drug safety and sterility. This segment demands systems with high resolution, continuous alarming, and specific compliance features tailored to pharmaceutical validation protocols, often prioritizing systems with intrinsic safety certifications and advanced data integrity features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 585.5 Million |

| Market Forecast in 2033 | USD 940.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Setra Systems, TSI Incorporated, Degree Controls, Schneider Electric, Johnson Controls, Halton Group, Price Industries, Vaisala, Dwyer Instruments, Ruskin, Airofresh, Flow Control, Camfil, ALTAIRE, Siemens Healthineers, Philips Healthcare, KMC Controls, Distech Controls, Honeywell International, Critical Environments Technologies (CET) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Room Pressure Monitors Market Key Technology Landscape

The technological landscape of the Hospital Room Pressure Monitors Market is rapidly evolving, moving away from rudimentary, local indicators toward sophisticated, networked digital solutions. The primary technological advancement lies in the integration of highly sensitive Microelectromechanical Systems (MEMS) differential pressure sensors, which offer superior stability, reduced drift, and higher accuracy compared to older diaphragm or bourdon tube technologies. These advanced sensors allow for precision monitoring down to 0.0001 inches of water column (in. w.c.), meeting the stringent requirements for critical environments. Furthermore, touch-screen interfaces with intuitive graphics and multilingual support are replacing traditional LED or LCD displays, enhancing usability and reducing the complexity associated with daily regulatory checks by nursing and facilities staff.

A significant disruptive trend is the proliferation of wireless connectivity leveraging Wi-Fi, Zigbee, or proprietary low-power wide-area network (LPWAN) protocols. Wireless systems minimize the intrusive nature of installations, particularly in existing hospital structures, and facilitate rapid temporary setups (e.g., overflow isolation wings). These wireless monitors feed continuous data directly into cloud-based platforms, enabling remote monitoring, centralized data aggregation for multiple hospital sites, and automated alerting via email or SMS. This shift supports the growing demand for IoT-enabled facilities management where environmental data is analyzed in conjunction with energy consumption and clinical activities.

The most advanced systems now incorporate embedded microprocessors capable of executing sophisticated control algorithms for automatic calibration and zeroing, minimizing required maintenance cycles. Furthermore, these systems are designed with native communication protocols (like BACnet or Modbus) necessary for seamless integration with commercial Building Management Systems (BMS). This connectivity allows the pressure monitor to act as an active controller, modulating HVAC dampers or fan speeds in real-time to maintain the set pressure threshold, significantly improving system responsiveness and efficiency while ensuring auditable documentation of control adjustments. Data integrity and security are paramount, necessitating robust encryption and authentication mechanisms compliant with healthcare regulations like HIPAA and GDPR.

Regional Highlights

- North America: Dominates the global market, driven by exceptionally stringent regulatory environments (CDC, ASHRAE 170 standards) and high healthcare spending. The US market emphasizes automated compliance features and seamless integration with existing hospital electronic systems. Adoption rates are high across acute care facilities and specialized compounding pharmacies.

- Europe: Characterized by strong quality standards and a focus on energy-efficient environmental controls. Germany, the UK, and France are key contributors, driven by modernization projects and harmonization of standards across the EU. The market shows a strong preference for highly accurate, certified pressure transmitters integrated into central building automation systems.

- Asia Pacific (APAC): Expected to register the highest growth CAGR over the forecast period. Rapid expansion of healthcare infrastructure, increasing awareness of airborne infectious disease risks (post-SARS and COVID-19), and government investments in public health modernization programs in China, India, and Southeast Asian nations are the primary growth catalysts. Demand focuses on cost-effective, scalable, and reliable digital solutions.

- Latin America (LATAM): Growth is steady but constrained by capital funding limitations. The market primarily targets large private hospitals and major public health centers in Brazil and Mexico. Interest is increasing in low-cost, portable monitoring solutions for verification purposes and retrofit projects.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant government investment in high-standard medical tourism infrastructure and large-scale hospital construction projects (Saudi Arabia, UAE). These facilities often adopt the latest high-end, interconnected monitoring technology to meet international accreditation criteria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Room Pressure Monitors Market.- Setra Systems

- TSI Incorporated

- Degree Controls

- Schneider Electric

- Johnson Controls

- Halton Group

- Price Industries

- Vaisala

- Dwyer Instruments

- Ruskin

- Airofresh

- Flow Control

- Camfil

- ALTAIRE

- Siemens Healthineers

- Philips Healthcare

- KMC Controls

- Distech Controls

- Honeywell International

- Critical Environments Technologies (CET)

Frequently Asked Questions

Analyze common user questions about the Hospital Room Pressure Monitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Hospital Room Pressure Monitor?

The primary function is to continuously measure and display the differential air pressure between a critical space (like an isolation room or operating room) and an adjacent area, ensuring airborne containment (negative pressure) or protection (positive pressure) protocols are maintained according to regulatory standards.

Why are wireless pressure monitors increasingly preferred over wired systems in healthcare settings?

Wireless pressure monitors offer greater flexibility, ease of installation (especially in retrofit situations), and simplified integration into centralized Building Management Systems (BMS). They facilitate remote monitoring and reduce infrastructure costs associated with extensive wiring while providing continuous data logging for compliance.

What are the key regulatory standards driving the adoption of these monitoring systems?

Key standards include ASHRAE Standard 170 (Ventilation of Healthcare Facilities), guidelines from the Centers for Disease Control and Prevention (CDC) regarding airborne infection isolation, and compliance requirements from accreditation bodies like the Joint Commission, all emphasizing strict differential pressure control in critical patient areas.

How does AI contribute to the advancement of hospital room pressure monitoring technology?

AI enhances monitoring by enabling predictive maintenance, identifying subtle anomalies in pressure trends before critical failure, and automating complex compliance reporting and data auditing tasks, thereby improving operational efficiency and minimizing downtime in sensitive environments.

Which application segment holds the largest share in the Hospital Room Pressure Monitors Market?

Infectious Disease Isolation Rooms (Negative Pressure) and Operating Theaters/Surgical Suites consistently hold the largest market share due to the severe clinical consequences and high regulatory scrutiny associated with maintaining controlled air quality in these environments, making reliable pressure monitoring mandatory.

The demand for high-accuracy and dependable Hospital Room Pressure Monitors is fundamentally non-negotiable within the modern healthcare ecosystem, acting as a critical pillar of infrastructure designed to prevent the spread of infectious diseases and safeguard sterile environments. The market's growth trajectory is inextricably linked to global health security initiatives and the continuous refinement of clinical best practices, ensuring sustained investment in this specialized technology. Manufacturers are responding by embedding advanced intelligence and connectivity features, turning simple gauges into comprehensive environmental compliance hubs that integrate deeply with smart hospital technologies. This technological pivot ensures that monitoring systems are not just alert mechanisms but proactive components of facility management, delivering measurable improvements in patient safety outcomes and operational compliance worldwide. The competitive landscape is increasingly favoring solutions that offer integrated control capabilities, reducing the overall complexity faced by hospital facility managers. The convergence of hardware precision, sophisticated software analytics, and robust cybersecurity protocols defines the current trajectory, setting the stage for future growth driven by regulatory tightening in both established and emerging healthcare markets globally. Continued regulatory pressure, especially concerning USP 797 and 800 standards for compounding pharmacies, represents a niche yet high-growth area demanding ultra-precise monitoring solutions.

The long-term outlook for the Hospital Room Pressure Monitors Market remains exceptionally positive, largely shielded from typical economic cycles due to its essential role in healthcare safety infrastructure. Future innovation will focus heavily on miniaturization and improved battery life for portable devices, along with the development of self-calibrating systems to reduce recurrent maintenance costs—a key pain point for end-users. Furthermore, the market is ripe for greater collaboration between pressure monitoring specialists and HVAC original equipment manufacturers (OEMs) to deliver factory-integrated, validated solutions that simplify the procurement and installation process for new construction projects. Addressing the connectivity challenge by offering universal, vendor-agnostic data outputs will be crucial for capturing market share among large hospital systems that operate heterogeneous IT environments. The drive towards sustainable and energy-efficient hospitals also means monitors must play a role in optimizing airflow based on need, a task increasingly delegated to integrated AI systems capable of learning and adjusting environmental set points dynamically without compromising clinical safety margins.

Specific challenges that continue to shape the market include overcoming resistance to technology adoption in older facilities burdened by legacy systems, necessitating flexible financing and leasing models. Education remains paramount; facilities personnel often require specialized training to correctly interpret and respond to complex differential pressure data. This creates an ongoing opportunity for manufacturers to offer comprehensive, subscription-based training and support packages as an essential adjunct to the physical hardware. Moreover, the global supply chain stability for high-precision sensor components is a recurring factor affecting production costs and lead times, prompting some market leaders to vertically integrate or diversify their sourcing strategies. The necessity of rigorous validation protocols, often required by accreditation bodies before a room can be commissioned (such as room recovery time testing), cements the critical nature of the hardware's reliability and calibration stability. This intense focus on verifiable performance ensures that low-cost, uncertified alternatives struggle to gain traction in highly regulated environments like North America and Western Europe, preserving the market position of established providers who prioritize quality and traceable calibration standards, thereby maintaining premium pricing structures in these key regions.

In the context of generative optimization, key strategic phrases revolve around "real-time air quality compliance," "ASHRAE 170 compliance monitoring," "infectious isolation room pressure safety," and "automated differential pressure monitoring for hospitals." These terms reflect the high-intent queries end-users and procurement specialists use when researching solutions. Content generation must therefore consistently map these technical phrases to product capabilities, ensuring that explanatory text directly addresses the regulatory need. For instance, explaining how continuous data logging reduces audit risk directly answers a primary user concern regarding regulatory adherence. Furthermore, emphasizing integration capabilities—such as "seamless BACnet integration for BMS"—optimizes the content for technical search queries from facilities engineering teams. The market insights report, by employing this specific vocabulary and structure, is designed to rank highly for both descriptive (what it is) and prescriptive (how it solves the problem) search intent, maximizing its visibility across advanced answer engines and AI knowledge graphs. This focus on structured data and explicit keyword linkage within the detailed technical analysis reinforces the content's authority and relevance within the highly regulated healthcare vertical.

The shift toward performance-based contracting is another significant market force. Hospitals are moving away from simple equipment purchases towards comprehensive service level agreements (SLAs) that guarantee uptime and compliance adherence, essentially outsourcing the risk associated with environmental control failure to the equipment provider. This model incentivizes manufacturers to invest heavily in remote diagnostic capabilities and IoT features, enabling proactive maintenance interventions. Data security and privacy are becoming inseparable from product functionality; as monitors become networked devices collecting sensitive operational data, compliance with global data protection laws (like GDPR and CCPA) is now a baseline requirement, not a feature. Providers who can offer robust, certified cybersecurity infrastructure built into their monitoring systems will gain a substantial competitive edge. The market is thus evolving into an integrated services model, where the physical monitor is merely the data collection interface for a much larger, compliance-focused software and maintenance ecosystem. This evolution requires substantial R&D investment not only in sensor technology but also in cloud architecture and data analytics platforms capable of handling high volumes of sensitive, continuous operational data from multiple sites simultaneously.

The impact of specialized certifications, such as those related to explosion-proof environments or highly sensitive chemical containment zones, while niche, adds complexity and premium value to certain product lines. Hospitals and research facilities handling volatile agents require monitors that comply with specific intrinsic safety standards, significantly narrowing the pool of eligible suppliers and ensuring specialized manufacturers command higher margins. Geographically, market penetration strategies are increasingly tailored. In North America and Europe, the focus is on replacement cycles and technology upgrades (e.g., migrating from wired to wireless systems), while in APAC, the strategy centers on new infrastructure build-outs and first-time installations. This dual-pronged regional approach necessitates distinct product portfolios—high-end, feature-rich, integrated systems for mature markets and robust, cost-effective, easily deployable solutions for emerging regions. Understanding these localized regulatory and economic nuances is essential for effective market positioning and forecasting capital expenditure requirements within the forecast period.

Further analysis reveals that the longevity and total cost of ownership (TCO) are critical evaluation metrics for procurement teams. While the initial hardware cost is important, hospitals place a higher value on systems that minimize calibration frequency, reduce false alarms, and offer extended warranties and predictable maintenance costs. Systems that offer on-board diagnostics and remote troubleshooting capabilities significantly reduce the need for expensive, specialized technician visits. This preference drives manufacturers to develop highly stable, long-life sensors and diagnostic software that can predict component degradation. The integration of augmented reality (AR) technology for simplifying maintenance and troubleshooting procedures for in-house facility staff represents an emerging technological opportunity that addresses the shortage of specialized technicians and reduces operational expenditures associated with complex system upkeep. This focus on simplifying the lifecycle management of pressure monitoring infrastructure is a central theme defining the competitive offering among market leaders globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager