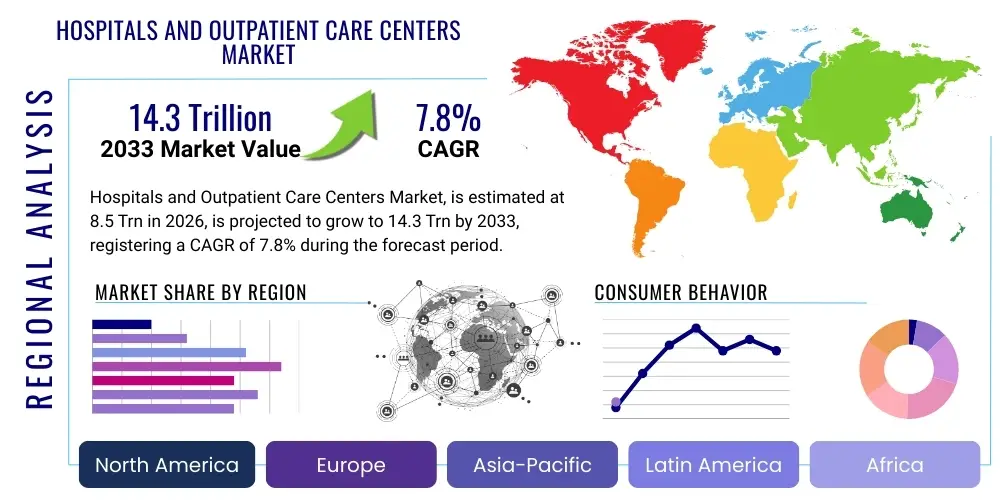

Hospitals and Outpatient Care Centers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442079 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Hospitals and Outpatient Care Centers Market Size

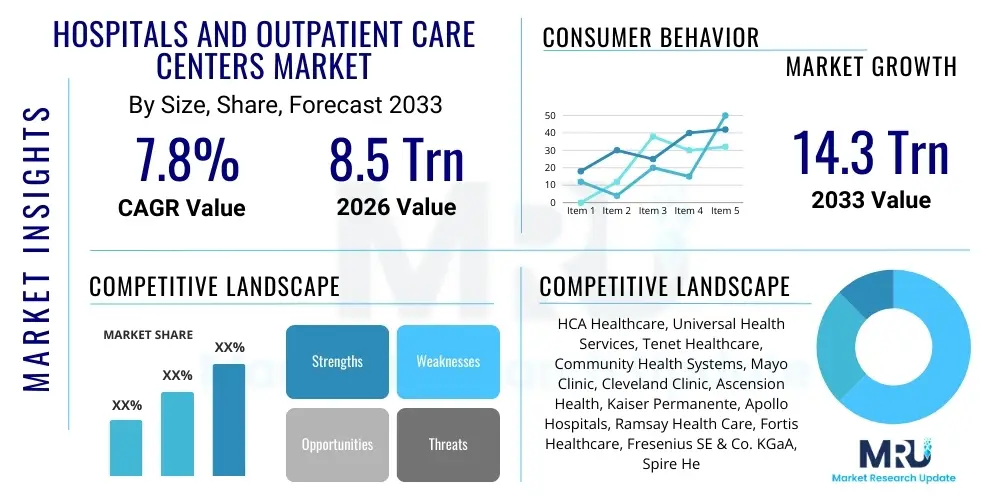

The Hospitals and Outpatient Care Centers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 8.5 Trillion in 2026 and is projected to reach USD 14.3 Trillion by the end of the forecast period in 2033.

Hospitals and Outpatient Care Centers Market introduction

The Hospitals and Outpatient Care Centers Market encompasses a vast and essential component of the global healthcare ecosystem, providing a spectrum of medical services ranging from primary care and routine procedures to specialized surgical interventions and intensive care. This market is fundamentally defined by institutional providers that deliver patient diagnosis, treatment, and continuous care, either in an overnight inpatient setting (hospitals) or a same-day setting (outpatient care centers, including ambulatory surgical centers, urgent care clinics, and specialized physician offices). The primary services delivered include preventive care, diagnostic imaging, laboratory services, emergency services, acute treatment, and long-term rehabilitative support. The operational scale and complexity within this sector necessitate significant capital investment, stringent regulatory compliance, and a highly skilled workforce, making it a critical barometer of national health system efficiency and economic development.

A key trend driving the evolution of this market is the pronounced shift toward outpatient service delivery, primarily fueled by advancements in minimally invasive technologies, cost containment pressures from payers, and patient preferences for convenience and faster recovery times. Outpatient centers are increasingly handling procedures that traditionally required hospital stays, thereby reducing the average length of stay for hospital inpatients and refocusing hospital resources on complex, acute, and chronic disease management. Furthermore, the product description of this market is broadening beyond core medical services to include digital health solutions, telehealth consultations, remote patient monitoring systems, and personalized medicine pathways, all integrated to enhance patient outcomes and optimize resource utilization across the care continuum. Strategic investments in infrastructural upgrades, particularly in regions experiencing rapid urbanization and aging populations, underscore the market's sustained long-term growth trajectory.

Major applications of services within this market span across cardiology, orthopedics, oncology, maternal health, and emergency medicine, impacting virtually every demographic group globally. The core benefit derived from this market structure is improved accessibility to specialized medical care, enhanced efficiency through coordinated care networks, and the implementation of standardized protocols that elevate safety and quality metrics. Driving factors include escalating prevalence of non-communicable diseases, increasing governmental spending on healthcare infrastructure, expansion of insurance coverage globally, and technological innovation such as robotic surgery and advanced diagnostic imaging modalities. These forces collectively shape a market environment characterized by intense competition, continuous technological adoption, and a persistent focus on value-based care delivery models designed to reward quality over volume.

Hospitals and Outpatient Care Centers Market Executive Summary

The global Hospitals and Outpatient Care Centers Market is undergoing a significant transformation, characterized by substantial shifts in service delivery models and organizational structures, driven primarily by macroeconomic pressures and technological acceleration. Business trends highlight a strong movement toward consolidation, where large hospital systems acquire or merge with smaller independent facilities and specialized outpatient centers to achieve economies of scale, enhance geographical reach, and optimize supply chain management. This consolidation wave is often coupled with aggressive digitization strategies, focusing on implementing Electronic Health Records (EHRs), integrating telemedicine platforms, and utilizing predictive analytics to manage patient flow and resource allocation effectively. Financial viability is increasingly tied to the transition from fee-for-service to value-based care models, compelling providers to prioritize preventative care and chronic disease management to reduce readmission rates and overall treatment costs, thereby fostering synergistic collaborations between clinical teams and financial management departments.

Regional trends indicate divergent growth patterns influenced by varying regulatory landscapes and levels of healthcare infrastructure maturity. North America and Europe currently represent the largest market shares, primarily due to established private insurance systems, high expenditure on cutting-edge medical technologies, and the presence of sophisticated care networks. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by substantial government investment in healthcare capacity expansion, rising disposable incomes, and the rapid expansion of private healthcare providers catering to densely populated urban centers. Latin America, the Middle East, and Africa (MEA) are also experiencing growth, driven by medical tourism initiatives, infrastructure development projects funded by international organizations, and improvements in overall public health access, though challenges related to uneven distribution of medical resources and political instability persist, impacting immediate market penetration and expansion strategies.

Segmentation trends reveal that the General Medical and Surgical Hospitals segment maintains the largest revenue share, reflecting the foundational necessity of inpatient acute care provision, despite the increasing shift towards decentralized care. Conversely, specialized segments like Ambulatory Surgical Centers (ASCs) and Urgent Care Centers are demonstrating superior growth rates, capitalizing on the demand for convenient, cost-effective, and specialized procedures. The rising geriatric population disproportionately influences the demand for chronic disease management services and specialized orthopedic and cardiovascular care, reinforcing the market importance of specialized treatment centers. Furthermore, ownership structure segmentation reveals a growing role for private sector investment, particularly in advanced outpatient facilities, due to the ability of private entities to rapidly deploy new technologies and streamline operational efficiencies compared to often bureaucratic public healthcare systems, indicating a future where integrated networks of public and private facilities provide comprehensive care solutions.

AI Impact Analysis on Hospitals and Outpatient Care Centers Market

User queries regarding the impact of Artificial Intelligence (AI) in the Hospitals and Outpatient Care Centers Market predominantly center on three core themes: operational efficiency gains, clinical decision support, and the ethical/data privacy implications of AI implementation. Users frequently ask how AI can reduce administrative burdens, optimize scheduling and patient flow (e.g., waiting times, bed management), and predict equipment maintenance needs. Clinically, key questions revolve around AI’s role in diagnostic accuracy, particularly in radiology and pathology, and its capability to assist clinicians in developing personalized treatment plans, often exploring its efficacy in identifying complex diseases earlier than traditional methods. A persistent concern involves data governance—specifically, ensuring patient confidentiality (HIPAA compliance) when large datasets are utilized for AI training, and establishing clear accountability frameworks when AI algorithms influence critical care decisions. The overall expectation is that AI will be transformative, leading to both cost reduction and significant improvements in quality of care, necessitating substantial investment in robust data infrastructure and specialized talent acquisition.

- Enhanced diagnostic accuracy through image recognition and pattern analysis in radiology and pathology.

- Optimization of hospital operations, including predictive staffing, resource allocation, and bed turnover management.

- Automation of administrative tasks (e.g., billing, coding, documentation), reducing labor costs and human error.

- Development of personalized medicine pathways by analyzing patient genetic data and treatment histories.

- Improved public health surveillance and outbreak prediction through analysis of real-time community data.

- Triage efficiency enhancement in emergency departments using AI algorithms to prioritize critical cases.

- Facilitation of remote patient monitoring and virtual consultations via sophisticated AI-driven telehealth platforms.

DRO & Impact Forces Of Hospitals and Outpatient Care Centers Market

The dynamics of the Hospitals and Outpatient Care Centers Market are governed by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). Key drivers fundamentally include global demographic shifts, specifically the rapid increase in the geriatric population demanding chronic and long-term care services, coupled with the rising incidence of lifestyle-related diseases such as diabetes, cardiovascular conditions, and certain cancers, which necessitate frequent specialized interventions. Furthermore, substantial technological advancements, particularly in surgical robotics, diagnostic imaging, and health IT infrastructure, are enabling higher quality and more efficient care delivery, thereby increasing the willingness of consumers and payers to invest in modern healthcare facilities. Government initiatives in various countries aimed at universal healthcare coverage and significant capital expenditure on upgrading outdated public health infrastructure also act as powerful market accelerators, ensuring a sustainable environment for market expansion and innovation adoption.

However, the market faces significant restraints that temper overall growth and profitability. The high operational costs associated with running hospitals and advanced care centers, particularly labor costs for highly specialized medical professionals and the expense of acquiring and maintaining cutting-edge medical equipment, pose financial hurdles. Regulatory complexities and the need for rigorous compliance with evolving healthcare standards—such as patient safety protocols, data privacy mandates (like GDPR and HIPAA), and stringent licensing requirements—add substantial administrative overhead and restrict rapid service expansion. Furthermore, workforce shortages, particularly of nurses and specialized technicians in many developed and rapidly developing nations, create service capacity constraints. These financial and operational pressures often lead to tight margins, especially in public or mandated-payer systems, requiring constant efficiency seeking measures.

Opportunities for future growth are significant, primarily driven by the expansion of integrated care models that connect hospitals, outpatient centers, rehabilitation facilities, and home healthcare services through unified digital platforms. The burgeoning potential in emerging economies, where healthcare infrastructure is rapidly developing and unmet medical needs are high, offers lucrative investment avenues for private operators. The widespread adoption of telehealth and remote monitoring services post-pandemic provides a mechanism for efficient patient management outside traditional settings, significantly improving patient access in rural or underserved areas. The impact forces underscore the market’s reliance on capital expenditure, technological disruption, and policy shifts. Positive impact forces include innovation in payment models (value-based care) and digital integration, while negative forces include macroeconomic instability, inflation affecting medical supply costs, and regulatory uncertainty regarding reimbursement rates, collectively influencing strategic investment decisions across the care delivery spectrum.

Segmentation Analysis

The Hospitals and Outpatient Care Centers Market is systematically segmented based on facility type, service type, and ownership, providing a granular view of market dynamics and differential growth prospects within the healthcare delivery landscape. Facility type segmentation distinguishes between large inpatient facilities, such as General Medical and Surgical Hospitals, which focus on acute and intensive care, and specialized facilities like Psychiatric and Substance Abuse Hospitals and specialized surgical centers. Service type segmentation analyzes the revenue generated from core medical disciplines, including diagnostics, cardiology, oncology, and primary care, reflecting specific disease burden and treatment area demand. Ownership structure analysis differentiates between public (government-owned), private (investor-owned), and not-for-profit entities, which exhibit distinct operational characteristics, investment priorities, and target patient populations, providing insights into competitive advantages and capital flow within the sector.

The primary driver for segmentation is the growing specialization and decentralization of healthcare delivery. As medical technology allows for increasingly complex procedures to be performed safely outside of a traditional inpatient setting, the Outpatient Care Centers segment (including ambulatory surgical centers and urgent care) has experienced accelerated growth, challenging the traditional dominance of large hospitals. This decentralization allows providers to cater to specific patient needs, offering greater convenience and often lower costs, which aligns with payer cost-containment strategies. Furthermore, the segmentation by service type is critical for identifying high-growth therapeutic areas, such as advanced oncology treatments and minimally invasive cardiac procedures, which require continuous infrastructure and technology investment, dictating where capital expenditure is most strategically placed by major market participants.

Analysis by ownership structure reveals that privately owned entities often lead in technology adoption and operational efficiency, driven by profit motives and the imperative to maximize shareholder value. Conversely, public hospitals often serve as vital safety nets, focusing on universal access and complex trauma care, regardless of profitability, heavily relying on government funding and policy directives. Not-for-profit organizations often reinvest surpluses back into community benefits, staff training, and specialized equipment. Understanding these nuances is crucial for strategic planning, merger and acquisition activity, and for governmental bodies formulating effective reimbursement and regulatory policies aimed at balancing accessibility, quality, and financial sustainability across the entire spectrum of care delivery facilities.

- By Facility Type:

- General Medical and Surgical Hospitals

- Specialty Hospitals (e.g., Cardiac, Orthopedic, Psychiatric)

- Ambulatory Surgical Centers (ASCs)

- Urgent Care Centers

- Diagnostic and Imaging Centers

- By Service Type:

- Inpatient Services (Acute Care, Intensive Care, Long-term Care)

- Outpatient Services (Day Surgery, Diagnostics, Consultations)

- Emergency Services

- Rehabilitation Services

- By Ownership:

- Public/Government Owned

- Private (For-Profit)

- Not-for-Profit

Value Chain Analysis For Hospitals and Outpatient Care Centers Market

The value chain for the Hospitals and Outpatient Care Centers Market is intricate, spanning upstream suppliers, core service delivery, and downstream distribution of patient care. Upstream activities involve the procurement of essential resources, including high-tech medical devices (e.g., MRI machines, robotic surgery systems), pharmaceuticals, medical consumables (PPE, specialized instruments), and highly specialized human capital (physicians, nurses, administrative staff). Efficient upstream management is critical, as fluctuations in global supply chains, material costs, and labor availability directly impact service delivery costs and quality. Strategic partnerships with key medical device manufacturers and pharmaceutical companies are essential for securing preferential pricing and ensuring access to cutting-edge therapies, requiring sophisticated inventory management and just-in-time logistics to maintain high service standards while minimizing operational waste.

The core of the value chain is the service provision itself, encompassing diagnosis, treatment, patient management, and post-discharge care. This stage involves complex interactions across various departments—from emergency and surgical units to laboratory and administrative services—all supported by underlying IT infrastructure (EHRs). Downstream analysis focuses on how the provided care reaches the patient, primarily through various distribution channels, which include direct patient access (walk-ins, scheduled appointments), and increasingly, indirect channels facilitated by digital platforms such as telehealth portals, remote monitoring services, and integration with local primary care networks. The effectiveness of the downstream distribution dictates patient utilization rates, geographical reach, and overall market competitiveness, emphasizing the need for robust patient engagement and efficient referral systems to maximize throughput and optimize service capacity.

The increasing importance of technology dictates that direct services are now supplemented by indirect technological delivery. Direct distribution occurs when the patient physically visits the hospital or care center for treatment. Indirect channels, however, involve third-party payers (insurance companies, government schemes), managed care organizations (MCOs), and digital health aggregators that guide patient selection and access to providers. The interaction between providers and these intermediaries defines reimbursement rates and patient volumes. Value chain optimization is focused on leveraging technology to integrate these stages, ensuring seamless data transfer from upstream procurement (tracking pharmaceutical batch numbers) through core service delivery (EHR documentation) to downstream billing and follow-up (digital patient portals), ultimately reducing administrative friction and enhancing the overall patient experience.

Hospitals and Outpatient Care Centers Market Potential Customers

The primary customers or end-users of the Hospitals and Outpatient Care Centers Market are broadly categorized into individual patients, third-party payers, and corporate entities providing occupational health services. Individual patients, encompassing all demographics from pediatrics to geriatrics, represent the fundamental demand source, seeking necessary medical interventions, routine check-ups, specialized treatments, and emergency care. The behavior of individual customers is increasingly influenced by factors such as health literacy, access to insurance, geographical proximity to facilities, and reputation of the healthcare provider, emphasizing the competitive necessity of superior patient experience and outcome transparency. Demographic shifts, particularly the rising segment of elderly patients with complex, co-morbid conditions, necessitates that providers tailor services and facilities toward chronic disease management and accessibility requirements.

Third-party payers, which include government insurance programs (e.g., Medicare, Medicaid, NHS), private commercial insurance companies, and managed care organizations, constitute the critical indirect customer segment, controlling the vast majority of revenue flow into the market. These entities dictate pricing, reimbursement rates, and quality metrics, forcing hospitals and care centers to adhere to strict utilization review protocols and negotiate competitive service contracts. The relationship with payers is characterized by intense negotiation and the ongoing need for providers to demonstrate value through evidence-based outcomes and cost efficiency, particularly under evolving risk-sharing and capitated payment models designed to shift financial risk onto the providers. Success in this market is fundamentally dependent on maintaining favorable contractual terms and securing inclusion in high-volume insurance networks.

A third, rapidly growing customer segment comprises large employers and corporations utilizing occupational health services, primary care, and wellness programs for their workforce. These customers often contract directly with hospital systems or specialized outpatient centers for comprehensive employee health benefits, aiming to reduce absenteeism, improve productivity, and manage rising health benefit costs. Furthermore, international governmental bodies and NGOs purchasing services in emerging markets, especially related to vaccination programs, public health crisis management, and infrastructure development, also represent significant large-scale buyers of capacity, consumables, and specialized expertise from established market players, driving specific demand for scalability and robust logistical capabilities in provider networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Trillion |

| Market Forecast in 2033 | USD 14.3 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HCA Healthcare, Universal Health Services, Tenet Healthcare, Community Health Systems, Mayo Clinic, Cleveland Clinic, Ascension Health, Kaiser Permanente, Apollo Hospitals, Ramsay Health Care, Fortis Healthcare, Fresenius SE & Co. KGaA, Spire Healthcare Group plc, Bumrungrad International Hospital, NMC Health, Providence St. Joseph Health, Sutter Health, CommonSpirit Health, DaVita Inc., Trinity Health |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospitals and Outpatient Care Centers Market Key Technology Landscape

The technology landscape within the Hospitals and Outpatient Care Centers Market is rapidly evolving, moving far beyond basic Electronic Health Records (EHRs) to incorporate sophisticated digital tools that enhance both clinical outcomes and operational efficiency. Central to this transformation is the integration of advanced medical imaging technologies, such as high-resolution MRI and CT systems, combined with AI algorithms that aid in faster and more accurate interpretation of scans, reducing diagnostic lag and improving treatment planning accuracy, particularly in complex fields like neurosurgery and oncology. Furthermore, the increasing adoption of robotic-assisted surgical systems allows for minimally invasive procedures with greater precision, reducing patient recovery times and hospital stays, directly supporting the market shift towards high-value outpatient service delivery. Investment in these capital-intensive technologies is a primary differentiator for facilities seeking to attract specialized surgeons and complex patient cases.

Beyond clinical technologies, Information Technology (IT) forms the backbone of modern care centers. Interoperable EHR systems are crucial for achieving care coordination across different departments and integrating external data sources, such as pharmacies and labs, ensuring a holistic patient view. Cloud computing infrastructure is increasingly utilized to manage massive volumes of patient data securely and facilitate access for dispersed care teams, enabling sophisticated analytics and predictive modeling capabilities that assist in demand forecasting and resource management. Crucially, the proliferation of telehealth platforms, remote patient monitoring devices, and patient-facing mobile applications has transformed the accessibility of care, allowing providers to manage chronic conditions remotely, reduce unnecessary in-person visits, and improve adherence to treatment protocols, thereby extending the hospital’s reach beyond its physical walls and significantly optimizing operational expenditure.

Future technological advancements are focused heavily on personalized medicine, genomics, and advanced data security measures. The integration of genomic data into clinical practice, leveraging advanced bioinformatics tools, is enabling precision prescribing and targeted therapeutic interventions. Simultaneously, cybersecurity technologies are becoming paramount to protect sensitive patient data from increasingly sophisticated threats, requiring continuous investment in robust network security, encryption, and compliance training to maintain regulatory standing and patient trust. Wearable medical devices and sensors are feeding real-time physiological data back into clinical systems, allowing for proactive health management and early detection of potential complications. These technological developments are collectively driving the mandate for continuous digital transformation, turning hospitals into highly connected, data-driven entities capable of delivering integrated, patient-centric care models.

Regional Highlights

Regional variations in the Hospitals and Outpatient Care Centers Market are pronounced, reflecting differences in healthcare spending, demographic profiles, regulatory environments, and technological adoption rates. North America, encompassing the United States and Canada, stands as the largest market, characterized by mature healthcare infrastructure, significant private sector investment, high reimbursement rates for advanced procedures, and rapid adoption of cutting-edge technologies like robotic surgery and AI-driven diagnostics. The region is driven by complex private insurance structures and a strong focus on specialized care and managed care models. High operational costs and intense regulatory scrutiny, particularly regarding billing practices and quality standards, characterize this region, leading to continuous system consolidation and vertical integration among major hospital chains seeking greater efficiency and market leverage in payer negotiations.

Europe represents another mature, yet complex, market. It is largely dominated by public healthcare systems (like the NHS in the UK or state systems in Germany and France) which prioritize universal access and cost containment. While technological adoption is high in Western Europe, investment often follows strict budgetary guidelines, resulting in slower infrastructure turnover compared to the US. The shift toward outpatient care is extremely strong in Europe, driven by government policies aimed at reducing inpatient costs and optimizing hospital utilization. Conversely, Eastern European nations are experiencing faster growth in private investment as governments seek to modernize infrastructure and improve service quality through public-private partnerships, stimulating localized market development and addressing historic underinvestment.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This exponential growth is underpinned by massive population bases, rising affluence leading to higher out-of-pocket health expenditure, and government efforts in countries like China, India, and Southeast Asia to expand health insurance penetration and construct new hospital capacity. Rapid urbanization and the growing burden of chronic diseases necessitate vast scaling of healthcare services. However, this market is highly fragmented, with stark differences between the highly modernized healthcare systems in Japan, South Korea, and Australia, and the rapidly developing but resource-constrained systems in emerging nations, where the focus remains on essential primary care access and infrastructure establishment. Latin America and the Middle East and Africa (MEA) are also growing, supported by medical tourism initiatives in the Gulf countries and incremental infrastructure investment fueled by international aid and domestic economic growth, focusing heavily on specialized tertiary care facilities.

- North America: Dominates revenue share; characterized by high private investment, advanced technology adoption, and extensive consolidation efforts among large hospital systems.

- Europe: Strong emphasis on shifting services to outpatient settings; public healthcare systems prioritize efficiency and cost control, while Eastern Europe sees accelerated private investment.

- Asia Pacific (APAC): Highest projected CAGR due to rising disposable income, massive government healthcare investments, and increasing prevalence of chronic diseases across large populations.

- Latin America (LATAM): Growth driven by expanding middle class and regional efforts to improve access to modern specialized surgical and diagnostic facilities.

- Middle East and Africa (MEA): Key growth areas include medical tourism (especially UAE, Saudi Arabia) and infrastructure expansion projects addressing severe unmet health needs across the African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospitals and Outpatient Care Centers Market.- HCA Healthcare

- Universal Health Services

- Tenet Healthcare

- Community Health Systems

- Mayo Clinic

- Cleveland Clinic

- Ascension Health

- Kaiser Permanente

- Apollo Hospitals Enterprise Ltd.

- Ramsay Health Care

- Fortis Healthcare

- Fresenius SE & Co. KGaA

- Spire Healthcare Group plc

- Bumrungrad International Hospital

- NMC Health

- Providence St. Joseph Health

- Sutter Health

- CommonSpirit Health

- DaVita Inc.

- Trinity Health

Frequently Asked Questions

Analyze common user questions about the Hospitals and Outpatient Care Centers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Hospitals and Outpatient Care Centers Market?

The market is primarily driven by global demographic shifts, specifically the rapid aging population requiring specialized chronic care, coupled with continuous technological advancements in diagnostic and surgical procedures, and increasing governmental focus on expanding healthcare infrastructure and insurance coverage worldwide.

How is the shift toward outpatient care impacting traditional hospital revenue models?

The shift to outpatient care, supported by minimally invasive techniques and ambulatory surgical centers (ASCs), is forcing traditional hospitals to rely less on routine overnight stays and increasingly focus revenue generation on complex, high-acuity, and specialized inpatient services, as well as integrating their own ASC networks to maintain market share.

What role does digital transformation play in optimizing hospital operations and patient care?

Digital transformation is crucial for operational optimization, using technologies like AI for predictive staffing and resource allocation, and advanced EHRs for seamless patient data management. Clinically, telehealth and remote monitoring extend care delivery, improve patient access in remote areas, and enhance efficiency by reducing unnecessary physical visits.

Which geographical region holds the highest growth potential for the market?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to massive government investments in healthcare capacity expansion, rising private health expenditure, and the urgent need to address the health demands of rapidly urbanizing and large populations in countries like China and India.

What are the main regulatory and financial challenges faced by healthcare providers in this market?

Major challenges include managing persistently high operational costs (labor and specialized equipment), navigating stringent and complex regulatory compliance requirements (e.g., data privacy and quality standards), and adapting to fluctuating reimbursement rates imposed by government and private payers under value-based care models, which pressures profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager