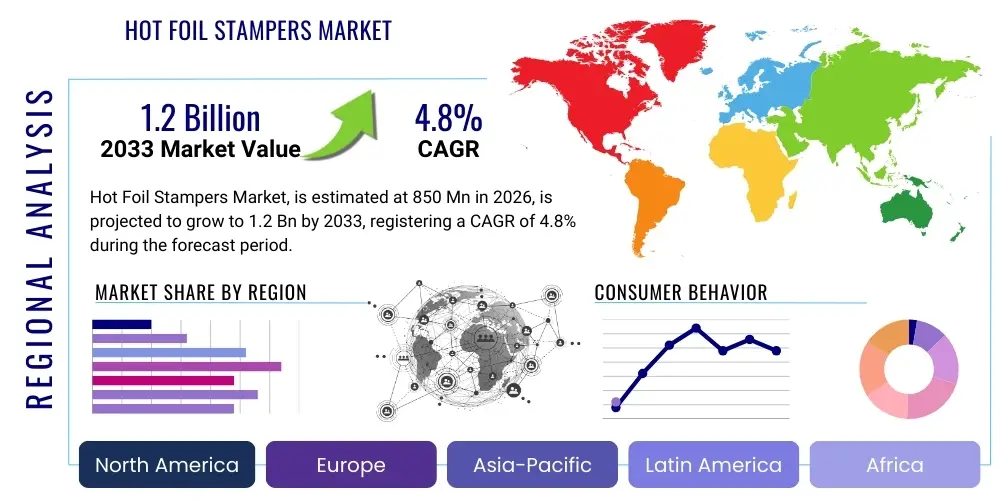

Hot Foil Stampers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442071 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hot Foil Stampers Market Size

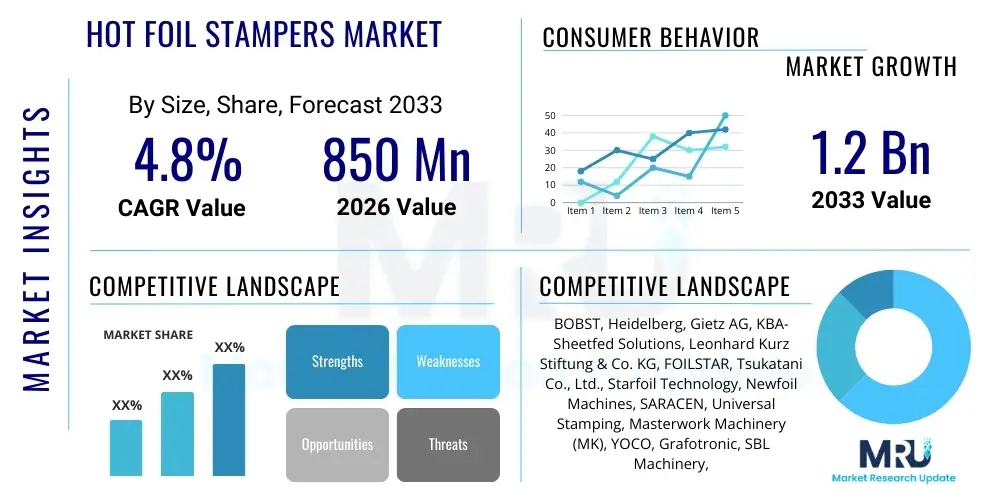

The Hot Foil Stampers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1.2 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the sustained global demand for premium packaging solutions and high-value graphic enhancements across diverse end-use industries, including cosmetics, consumer electronics, and luxury food and beverage products. The increasing sophistication of branding strategies, requiring tactile and visually striking finishes, positions hot foil stamping as an indispensable technology in the modern converting industry, ensuring stable revenue growth across major geographical regions.

Hot Foil Stampers Market introduction

The Hot Foil Stampers Market encompasses machinery designed to apply metallic or pigmented foil onto various substrates—such as paper, board, plastics, and leather—using heat and pressure. These machines range from manual, small-format tabletop models used for personalized items to highly automated, large-format industrial presses integrated into high-speed printing and converting lines. The core process involves heating a die (or cliché), pressing it against the foil and the substrate simultaneously, causing the foil’s release layer to melt and adhere permanently to the target material. This technique is crucial for achieving high-impact decorative finishes and enhanced security features, particularly in packaging and graphic arts, where aesthetic superiority is paramount for product differentiation and consumer appeal.

Major applications of hot foil stampers span a wide array of vertical markets. In the packaging sector, they are extensively utilized for premium cosmetic boxes, spirits labels, tobacco packaging, and confectionary wraps, providing a sense of luxury and quality that justifies a higher perceived product value. Beyond decorative purposes, the technology is vital for security printing, allowing for the incorporation of holographic foils and security marks essential for anti-counterfeiting measures on pharmaceuticals, financial documents, and high-value consumer goods. The versatility in substrate handling and the availability of diverse foil types—including diffraction, iridescent, and standard metallic foils—further cement the technology's importance in both short-run customization services and long-run industrial converting operations.

Key driving factors fueling the market growth include the pervasive trend of brand premiumization globally, where companies invest heavily in packaging aesthetics to capture market share and elevate their brand identity. Furthermore, continuous technological advancements in stamping machinery, such as improved register accuracy, faster processing speeds, and enhanced automation capabilities, are reducing operational costs and broadening the range of materials that can be efficiently foiled. The demand for sustainable packaging options, which often includes foil-stamped embellishments on recyclable board, presents new avenues for growth, requiring manufacturers to innovate with thinner foils and more environmentally friendly adhesive chemistries, thus ensuring the enduring relevance of this established finishing process.

Hot Foil Stampers Market Executive Summary

The Hot Foil Stampers Market is characterized by robust business trends focusing heavily on integration, efficiency, and material innovation. Manufacturers are increasingly integrating hot foil stamping units directly inline with printing and die-cutting systems to optimize production flow and minimize handling time, a critical factor for high-volume converters seeking maximum throughput. Furthermore, the market exhibits a clear shift toward digital hot foiling technologies, which allow for variable data stamping and eliminate the need for traditional dies, catering effectively to the burgeoning demand for highly personalized and short-run luxury packaging campaigns. Investment in high-precision registration systems, particularly in markets serving pharmaceutical and banknote security, underscores the commitment to quality and traceability within the manufacturing landscape, defining the current competitive strategy among leading equipment providers.

Regional trends indicate significant dynamism, with the Asia Pacific (APAC) region emerging as the primary growth engine, driven by rapid industrialization, burgeoning middle-class consumer segments demanding premium imported and domestic goods, and the establishment of large-scale contract packaging facilities. While mature markets like North America and Europe maintain stable demand, their focus is predominantly on replacing older hydraulic or mechanical presses with advanced, energy-efficient, and highly automated electronic models that comply with stricter environmental and safety regulations. Latin America and the Middle East & Africa (MEA) are witnessing moderate but accelerating growth, fueled by rising foreign direct investment in local manufacturing and the subsequent modernization of local printing and converting infrastructure, specifically targeting consumer goods packaging.

Segmentation trends reveal a strong preference for automatic and semi-automatic flatbed hot foil stampers, which offer superior versatility and productivity compared to manual models, especially within commercial printing and large-scale packaging operations. Segment growth is particularly pronounced in applications related to the cosmetics and personal care sector, where packaging quality directly correlates with brand perception and sales performance. Furthermore, there is an increasing adoption of specialized stampers designed for flexible packaging and narrow web applications, catering to the expanding market for sophisticated labels and pouches. The competitive environment is marked by companies differentiating themselves not only through machinery performance but also via comprehensive after-sales support, remote diagnostics, and tailored maintenance packages designed to maximize equipment uptime for global clients.

AI Impact Analysis on Hot Foil Stampers Market

Common user inquiries regarding AI's influence on the Hot Foil Stampers Market primarily revolve around automation capabilities, predictive maintenance integration, and quality control efficiencies. Users frequently question whether AI-driven vision systems can completely eliminate manual inspection for foil registration defects and how machine learning algorithms might optimize machine settings (heat, pressure, dwell time) based on real-time substrate variance and environmental factors, thereby maximizing material yield and minimizing setup waste. There is also substantial interest in how AI could forecast maintenance needs for high-wear components like heating plates and actuators, preventing costly unscheduled downtime, and how sophisticated algorithms could potentially suggest highly personalized and effective foil design layouts based on analyzed consumer preference data and emerging design trends, linking manufacturing processes closer to marketing strategy execution.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, and pressure data to forecast component failure (e.g., heating elements, hydraulic systems), significantly reducing unplanned machine downtime and optimizing spare parts inventory management.

- Automated Quality Inspection: AI-powered vision systems perform high-speed, 100% inspection of stamped products, instantly identifying minor registration errors, scuff marks, or missing foil segments with greater accuracy and consistency than human operators, ensuring superior output quality.

- Optimized Parameter Setting: Machine learning models utilize historical production data (substrate type, foil batch, environment) to auto-adjust stamping parameters (temperature, pressure, speed) in real-time, accelerating job setup and achieving optimal results with minimal material wastage, especially during changeovers.

- Supply Chain Optimization: AI can predict demand fluctuations for specific foil types and substrates, assisting manufacturers and converters in maintaining optimal stock levels and improving lead times across the complex value chain.

- Design Personalization Integration: Although nascent, AI is starting to be used to analyze consumer preferences to inform bespoke foiling patterns and variable data foiling (VDF) designs, streamlining the creative process directly into the production workflow.

DRO & Impact Forces Of Hot Foil Stampers Market

The dynamics of the Hot Foil Stampers Market are governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the unrelenting global push for premiumization in product packaging, which necessitates high-quality, tactile, and visually appealing finishes achievable only through hot foil stamping. This is coupled with the rising demand for enhanced security features, particularly in pharmaceutical and luxury goods sectors, where holographic and secure foils applied via stamping are crucial for authentication and brand protection. Furthermore, continuous innovations in automated machinery and the development of high-speed systems capable of complex multi-color foiling on large formats significantly boost overall market attractiveness by improving operational efficiencies for converters.

Conversely, significant restraints hinder growth and operational scaling. The high initial capital investment required for purchasing modern, automated hot foil stamping machinery often poses a barrier to entry for smaller printing houses or converters, particularly in developing economies where access to credit may be limited. Moreover, the technical complexity associated with achieving perfect registration on intricate designs, especially at high production speeds, requires highly skilled labor, leading to operational challenges and elevated training costs. Environmental concerns surrounding traditional foil materials, which can complicate the recyclability of the finished substrate, also represent a structural restraint that manufacturers are actively working to mitigate through the introduction of recyclable and compostable foil options.

Opportunities for expansion are abundant, centered largely around the integration of digital technologies and sustainable practices. The rapid maturation of digital foiling techniques, which bypass the need for physical dies and allow for variable data application, opens new avenues in customized short-run printing and rapid prototyping. Furthermore, the burgeoning demand for specialized foiling on non-traditional substrates, such as textiles, automotive components, and security laminates, presents diverse application opportunities beyond traditional paper and board packaging. Successful navigation of the market requires addressing environmental restraints through innovative, sustainable foil formulations and leveraging automation advancements to overcome complexity and labor skill shortages, positioning technology providers for long-term strategic growth.

Segmentation Analysis

The Hot Foil Stampers Market is meticulously segmented across machinery type, operational automation level, primary application, and key end-use industry, reflecting the diverse needs of the global converting sector. Analyzing these segments provides critical insight into purchasing behavior, technological preferences, and regional market saturation. Machinery type segmentation differentiates between flatbed, which is the most common for high-impact graphics and intricate designs, and rotary foil stampers, which are increasingly utilized for continuous web applications like labels and flexible packaging, demonstrating specialized requirements across different converting processes. Furthermore, the distinction between hydraulic, pneumatic, and servo-driven presses highlights technological maturity and the continuous industry shift towards precision, energy-efficient servo systems.

Operational automation is another crucial axis of segmentation, separating high-end fully automatic systems from semi-automatic and manual/tabletop machines. Fully automatic machines, which can be integrated inline with other processes such as die-cutting and folding-gluing, dominate the high-volume packaging and commercial printing segments in industrialized nations due to their superior throughput and minimal human intervention requirements. Conversely, manual and semi-automatic units retain significant relevance in niche markets, such as personalized stationery, bespoke leather goods, and small-volume specialty printing, offering lower capital cost entry points and greater flexibility for complex, custom jobs. This operational diversification ensures the market caters to businesses of all scales and specific production needs globally.

Application-based segmentation emphasizes the market's reliance on the packaging sector, which represents the largest revenue share, followed by graphic arts (greeting cards, book covers), and security printing (certificates, labels). Within end-use industries, the Cosmetics & Personal Care segment is the most significant driver, demanding highly decorative and luxurious finishes that heavily rely on foiling to enhance shelf appeal. The Food & Beverage and Consumer Electronics sectors also exhibit substantial growth, driven by fierce competition necessitating distinctive, premium packaging. Understanding these vertical demands allows machinery manufacturers to tailor product specifications—such as required press size, heating element consistency, and foil feeding mechanisms—to specific industry performance metrics and regulatory compliance needs, ensuring optimal market penetration and addressing specialized conversion challenges.

- By Type:

- Flatbed Hot Foil Stampers

- Rotary Hot Foil Stampers (Narrow Web, Wide Web)

- Cylinder Hot Foil Stampers

- By Automation:

- Automatic

- Semi-Automatic

- Manual/Tabletop

- By Application:

- Packaging (Folding Cartons, Flexible Packaging, Labels)

- Graphic Arts (Commercial Printing, Publishing)

- Security Printing

- Textiles and Leather

- By End-Use Industry:

- Cosmetics & Personal Care

- Food & Beverage

- Pharmaceuticals & Healthcare

- Consumer Electronics

- Tobacco

- Apparel and Accessories

Value Chain Analysis For Hot Foil Stampers Market

The value chain for the Hot Foil Stampers Market commences with the upstream suppliers responsible for raw material procurement and the manufacture of specialized components. This upstream segment is highly specialized, encompassing manufacturers of high-precision steel and copper dies (clichés), producers of specialized heating elements and temperature control systems, and critical suppliers of high-quality hot stamping foils and release films. The quality and consistency of these inputs—particularly the metallic and holographic foils, which are complex multi-layer materials—directly determine the final output quality of the stamping process. Effective relationships with reliable, large-scale foil suppliers capable of meeting stringent aesthetic and technical specifications are paramount for machinery manufacturers to ensure compatibility and consistent performance of their stamping presses in the downstream market.

The core of the value chain involves the machinery manufacturers themselves, who design, assemble, and test the complex hot foil stamping presses. This stage includes sophisticated engineering for accurate registration systems, integration of automated feeding and delivery mechanisms, and robust quality control checks to ensure the presses can operate reliably at high speeds with diverse substrates. Following machine production, the downstream segment is dominated by the converters and brand owners who utilize the equipment. Converters, including commercial printers, packaging specialists, and label manufacturers, purchase the machinery to offer premium finishing services, applying the foil to enhance clients' products. Brand owners, especially those in the luxury sectors, may also integrate these stampers in-house to maintain strict control over their branding execution and production timelines, highlighting a direct procurement channel.

Distribution channels for hot foil stampers are bifurcated into direct sales and indirect distribution networks. For high-value, bespoke industrial machinery (large flatbed or rotary presses), manufacturers often utilize a direct sales force to handle complex installation, training, and maintenance contracts, ensuring close customer relationship management. Conversely, smaller, standardized, or semi-automatic models are frequently distributed through a global network of authorized regional distributors and agents. These indirect channels provide necessary local sales support, stock spare parts, and offer immediate technical assistance, proving vital for reaching smaller enterprises and remote geographical markets. The efficiency of the distribution channel is directly impacted by the availability of specialized service technicians capable of maintaining the complex electronic and mechanical systems inherent in modern hot foil stamping technology.

Hot Foil Stampers Market Potential Customers

Potential customers for hot foil stampers are primarily concentrated in industries requiring high-impact visual differentiation and security features on their finished goods. The largest segment of end-users consists of commercial printing companies, packaging converters, and label manufacturers who offer specialized finishing services to a diverse clientele. These businesses invest in automatic and semi-automatic presses to cater to contract packaging demand from consumer goods companies. The converters act as the critical intermediary, executing intricate designs on folding cartons, rigid boxes, and flexible substrates for industries such as cosmetics, spirits, and premium foods, where tactile luxury and metallic sheen are non-negotiable branding elements for achieving differentiation on the retail shelf.

Beyond the converting intermediaries, a significant and rapidly growing customer base is the brand owners who engage in vertical integration. Large multinational corporations, particularly those in the luxury goods, pharmaceutical, and high-end electronics sectors, often purchase hot foil stamping equipment directly to manage their packaging production in-house. This strategy affords them enhanced control over quality, proprietary security feature implementation (such as unique holograms or variable data coding), and accelerated response times to market changes. For instance, pharmaceutical companies require extremely accurate foiling for security seals and compliance labeling, making in-house control over the stamping process strategically critical to meet stringent regulatory standards.

Furthermore, specialized niche markets represent valuable potential customers. These include manufacturers of security documents (passports, financial certificates), producers of personalized leather goods and apparel accessories, and specialized greeting card and stationery providers. While these customers may utilize smaller, more versatile manual or semi-automatic stampers, their demand is highly consistent due to the specialized nature of their products. This diversity in customer needs—ranging from high-volume, continuous operation required by industrial converters to precision, low-volume requirements of specialized artisans—ensures a broad and resilient customer base for hot foil stamper manufacturers across various machine capacities and technological sophistication levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BOBST, Heidelberg, Gietz AG, KBA-Sheetfed Solutions, Leonhard Kurz Stiftung & Co. KG, FOILSTAR, Tsukatani Co., Ltd., Starfoil Technology, Newfoil Machines, SARACEN, Universal Stamping, Masterwork Machinery (MK), YOCO, Grafotronic, SBL Machinery, Yawa, Cartes, Wenzhou Guangming, Impresa & Macchine da Stampa, Standard Register. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Foil Stampers Market Key Technology Landscape

The technological evolution within the Hot Foil Stampers Market is heavily focused on increasing precision, speed, and versatility, driven primarily by servo-driven mechanisms replacing traditional hydraulic and pneumatic systems. Modern presses utilize highly sophisticated servo motors and electronic controls to ensure micro-meter level registration accuracy, which is essential for applying intricate and multi-pass foiling designs, particularly in high-speed, demanding environments like pharmaceutical packaging. Furthermore, large-format sheet-fed presses are integrating advanced camera-based registration systems that instantaneously compensate for sheet movement or substrate deformation, ensuring flawless application even on challenging materials and accelerating the setup process dramatically by automating plate alignment procedures and reducing manual intervention.

A major disruptive technology emerging in the market is digital hot foiling, which uses specialized equipment to apply foil selectively without requiring a physical metal die. This process is rapidly gaining traction because it enables variable data foiling (VDF) and highly personalized print jobs, making short runs economically viable and minimizing turnaround times by eliminating the time and cost associated with die production. While digital foiling does not yet match the deep embossing quality of traditional die stamping, its flexibility and speed for two-dimensional foil application are transforming the label and small-format commercial printing segments. This parallel technological development forces manufacturers to offer hybrid solutions that combine the best aspects of both traditional die stamping and rapid digital application methods to meet the complete spectrum of customer requirements.

Furthermore, significant technological efforts are being directed toward energy efficiency and sustainability. Modern hot foil stamping machinery incorporates advanced zonal heating systems that minimize power consumption by only heating the necessary portions of the platen, reducing overall energy footprint compared to legacy systems. Continuous innovation in foil material science, including the development of thinner foils and foils with specialized release coatings optimized for higher speeds and improved adhesion to diverse substrates, ensures machinery performance remains aligned with material advancements. Remote diagnostic and monitoring systems, powered by IoT connectivity, allow manufacturers to track machine performance globally, preemptively address technical issues, and provide optimized operational feedback, ensuring maximum productivity for end-users operating in geographically dispersed locations.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate, fueled by robust expansion in the manufacturing base, particularly in China, India, and Southeast Asian nations. The growing middle-class population and increased discretionary spending are driving unparalleled demand for branded and premium consumer goods, necessitating advanced packaging embellishment solutions. Furthermore, government initiatives promoting domestic manufacturing and exporting high-value goods contribute significantly to the high adoption rate of automated hot foil stamping machinery in commercial printing and large packaging hubs across the region, making it the most dynamic market globally in terms of new installations.

- North America: Characterized by early adoption of highly automated and large-format machinery, the North American market maintains a strong emphasis on quality, efficiency, and compliance with stringent operational standards. Demand is driven by the mature luxury goods, high-end cosmetics, and pharmaceutical sectors, requiring absolute precision in foiling for both aesthetic superiority and complex security features. The market here focuses heavily on replacing legacy equipment with state-of-the-art servo-driven presses that offer reduced labor dependency and enhanced integration capabilities with existing digital workflows, ensuring the region remains a leader in high-tech finishing solutions.

- Europe: Europe represents a highly stable and mature market, with growth driven by innovation in sustainable packaging materials and adherence to eco-friendly production standards. European converters are actively seeking hot foil stampers compatible with recyclable substrates and utilizing energy-efficient operational profiles. Key markets such as Germany, Italy, and the UK, with their strong heritage in printing and luxury product manufacturing, continue to drive demand, particularly for machinery that provides deep embossing and high-quality tactile finishes, often supporting the global export of premium automotive and spirits packaging.

- Latin America (LATAM): Growth in LATAM is emerging steadily, supported by foreign investments and the modernization of local printing infrastructure. Countries like Brazil and Mexico are witnessing increased demand for localized premium packaging solutions. The market typically favors cost-effective, durable, and moderately automated semi-automatic stampers, although large international converters setting up regional operations are driving a gradual shift towards higher-capacity automatic equipment.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries, shows promising potential driven by the substantial local consumption of luxury retail items and cosmetics. The focus remains on establishing local production capabilities to reduce reliance on imported finished goods. Investment in hot foil stamping technology is aligned with the regional ambition to create high-quality, regionally distinct packaging that meets international luxury aesthetic standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Foil Stampers Market.- BOBST

- Heidelberg

- Gietz AG

- KBA-Sheetfed Solutions

- Leonhard Kurz Stiftung & Co. KG

- FOILSTAR

- Tsukatani Co., Ltd.

- Starfoil Technology

- Newfoil Machines

- SARACEN

- Universal Stamping

- Masterwork Machinery (MK)

- YOCO

- Grafotronic

- SBL Machinery

- Yawa

- Cartes

- Wenzhou Guangming

- Impresa & Macchine da Stampa

- Standard Register

Frequently Asked Questions

Analyze common user questions about the Hot Foil Stampers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot foil stamping and cold foiling, and which is dominant in the market?

Hot foil stamping uses heat and pressure to transfer metallic foil via a physical die, providing superior depth, gloss, and tactile feel, making it dominant for high-end luxury packaging and security features. Cold foiling uses UV-cured adhesive, typically applied inline on conventional printing presses; it is faster and more cost-effective for large surface areas and simpler graphics, although it generally lacks the tactile dimension of hot stamping.

How is the Hot Foil Stampers Market addressing sustainability and recyclability challenges?

The market is responding by developing specialized, ultra-thin foils and release mechanisms that minimize interference with paper recycling processes. Machinery manufacturers are also focusing on optimizing press settings to use less foil material and improve energy efficiency through advanced zonal heating and servo-driven components, aligning with global sustainable packaging goals.

Which end-use industry contributes most significantly to the revenue growth of hot foil stampers?

The Cosmetics and Personal Care industry is the leading contributor to revenue growth. This sector heavily relies on hot foil stamping to convey luxury, premium quality, and brand prestige through highly embellished, visually striking packaging, often necessitating complex and high-precision foiling applications on folding cartons and rigid boxes.

What is the role of automation and AI in modern hot foil stamping equipment?

Automation, driven by servo technology, enhances speed, precision, and efficiency, reducing labor requirements. AI integration focuses on predictive maintenance, real-time quality inspection using vision systems to detect minute defects, and optimizing operational parameters like heat and pressure for various substrates, thereby minimizing waste and maximizing uptime.

Is digital foiling expected to replace traditional die-based hot foil stamping?

Digital foiling is expanding rapidly, particularly for short-run customization, variable data applications, and faster turnaround times, as it bypasses the need for dies. However, it is not expected to completely replace traditional die-based stamping, which remains superior for achieving deep embossing, fine textures, and the unique tactile quality essential for the highest echelons of luxury packaging and intricate security printing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager