Hot Forging Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442672 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Hot Forging Machine Market Size

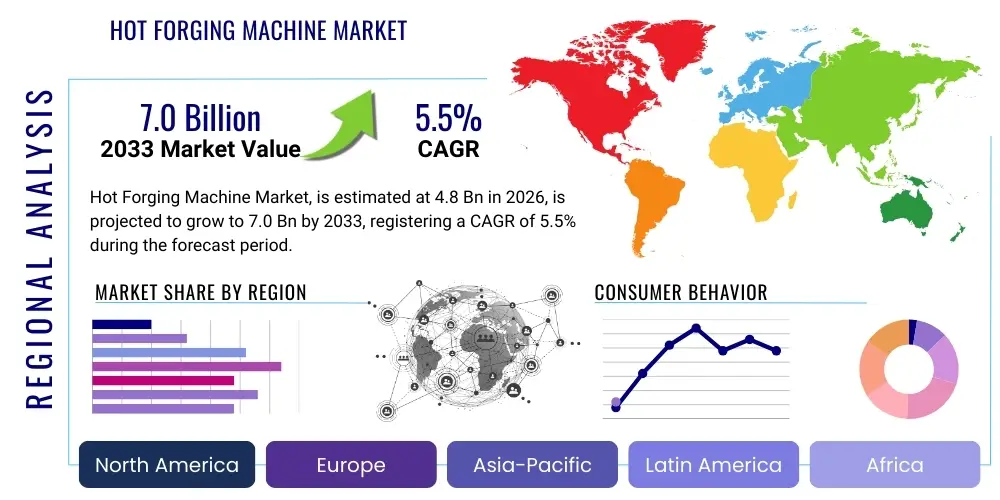

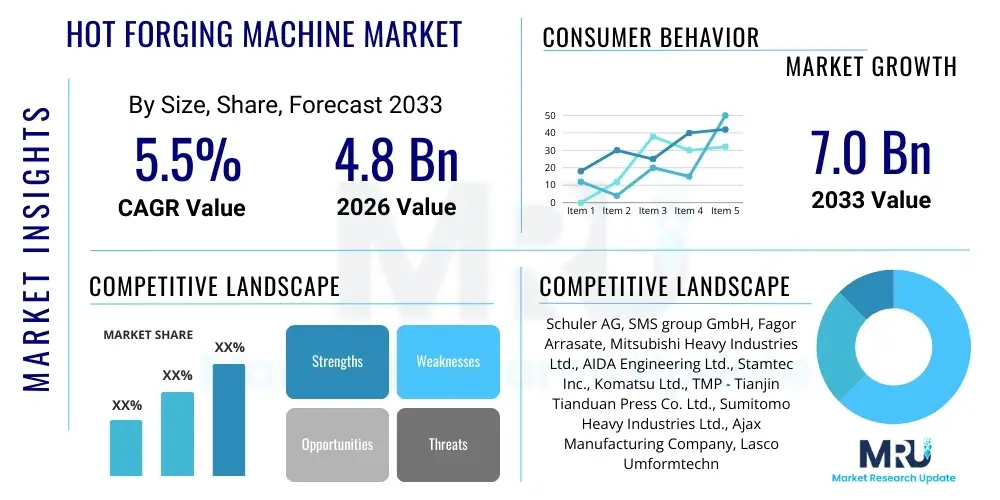

The Hot Forging Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Hot Forging Machine Market introduction

The Hot Forging Machine Market encompasses equipment used to plastically deform metallic materials, typically above their recrystallization temperature, yielding components characterized by superior mechanical strength, fatigue resistance, and refined grain structure. Hot forging equipment, which primarily includes mechanical presses, hydraulic presses, and screw presses, is essential for shaping difficult-to-form metals and producing large components rapidly. This process ensures material flow conforms precisely to the die contours, eliminating internal porosity and providing a high-integrity product.

Major applications of hot forging machines are concentrated within high-stress and safety-critical industries. The automotive sector utilizes these machines extensively for manufacturing components such as crankshafts, connecting rods, transmission gears, and axle beams, driven by the continuous need for lighter, yet stronger, powertrain and chassis parts. Similarly, the aerospace industry relies on hot forging for turbine blades, structural components, and landing gear parts, where failure is catastrophic, necessitating impeccable material properties. The robust nature and high throughput capability of modern hot forging equipment make it indispensable across general machinery manufacturing, construction equipment, and energy sectors.

The core benefit driving the market adoption is the ability of hot forging to enhance the internal grain flow of the metal, aligning it with the component’s functional stress lines, thereby improving impact strength and ductility significantly over casting or machining processes. Market growth is further fueled by accelerating industrialization in emerging economies, increasing defense spending globally which mandates high-performance metal components, and technological advancements focusing on automation, higher tonnage capacities, and energy efficiency. Specifically, the global shift toward electric vehicles (EVs) is generating new requirements for precision forged components used in battery casings and specialized transmission systems.

Hot Forging Machine Market Executive Summary

The Hot Forging Machine Market executive analysis highlights robust growth anchored by global industrial expansion and critical requirements from the automotive and aerospace sectors. Key business trends indicate a strong move towards integrated manufacturing solutions, where forging lines are equipped with robotics for material handling, automated temperature control systems, and advanced simulation software for die design and process optimization. Manufacturers are focusing heavily on developing servo-driven forging presses, which offer enhanced precision, flexibility in stroke control, and significantly reduced energy consumption compared to traditional mechanical and hydraulic alternatives, thereby aligning with stringent global sustainability mandates.

Regionally, the Asia Pacific (APAC) region remains the primary engine of market growth, attributed to massive investments in automotive manufacturing hubs, rapid infrastructure development, and substantial government emphasis on domestic defense production, particularly in China and India. North America and Europe, while mature, demonstrate sustained demand driven by the stringent quality requirements of the aerospace industry and the specialized manufacturing of high-performance components for renewable energy infrastructure. The market is also seeing consolidation among key players who are expanding their service portfolios to include predictive maintenance contracts and comprehensive tooling support, addressing the high capital cost and operational complexity faced by end-users.

Segment trends reveal that the mechanical press segment maintains market leadership due to its high production rate and reliability for mass production forging, despite the increasing penetration of specialized screw presses preferred for precision components requiring controlled energy application. Furthermore, the market for large-tonnage forging presses (over 6,000 tons) is witnessing elevated demand, particularly from the heavy machinery and oil and gas sectors, driven by the need to forge increasingly larger and more complex components in a single operation. The shift toward specialized materials, such as high-strength aluminum alloys and titanium, necessitated by vehicle lightweighting, is spurring demand for dedicated high-speed forging solutions capable of handling these challenging alloys.

AI Impact Analysis on Hot Forging Machine Market

Common user questions regarding AI’s influence on the Hot Forging Machine Market typically revolve around how artificial intelligence can mitigate the high cost of tooling, reduce unexpected downtime, and improve the consistency of final product quality. Users are keen to understand the feasibility of achieving 'zero-defect' production environments through intelligent monitoring. These queries highlight a central focus on predictive maintenance, automated quality inspection, and optimization of complex process parameters, which often rely on operator experience rather than empirical data models. Expectations are high that AI can transform hot forging from an art reliant on skill into a highly scalable, data-driven science, providing solutions for issues like inconsistent heating, material flow defects, and rapid die wear.

The integration of AI technologies, particularly machine learning (ML) algorithms, is fundamentally changing the operational landscape of forging facilities. AI-powered systems analyze real-time data streaming from numerous sensors—including temperature sensors, pressure transducers, and acoustic emission detectors—to predict potential equipment failures hours or days in advance, shifting maintenance strategies from reactive or scheduled to predictive. This significantly maximizes machine uptime, optimizes maintenance scheduling, and extends the operational life of highly capital-intensive assets. Furthermore, computer vision systems, leveraging deep learning models, are now being deployed for in-line quality inspection, automatically identifying surface defects or dimensional variations in forged parts with higher accuracy and speed than manual inspection.

Beyond maintenance and quality control, AI is being leveraged for process optimization and simulation enhancement. Machine learning models analyze historical forging runs, correlating input parameters (material composition, billet temperature, ram speed) with output quality metrics (hardness, dimensional accuracy). This analysis allows the system to autonomously recommend optimal settings for new product lines or compensate for variability in raw materials, ensuring consistent output and minimizing material scrap. This technological convergence enables manufacturers to achieve higher material yield, shorter cycle times, and a substantial reduction in the overall carbon footprint associated with repeated energy-intensive forging operations.

- AI enables predictive maintenance, forecasting critical component failure (e.g., bearings, hydraulic pumps) based on vibrational and thermal signatures, maximizing equipment uptime.

- Deep learning models power automated visual inspection systems (computer vision) for real-time, high-speed defect detection, ensuring immediate feedback on process drift.

- Machine Learning algorithms optimize forging parameters (temperature, pressure, velocity profile) based on material properties, reducing energy consumption and minimizing scrap rates.

- AI facilitates advanced simulation software, rapidly calibrating Finite Element Analysis (FEA) models for new component designs, accelerating time-to-market.

- Intelligent energy management systems utilize AI to schedule operations during off-peak power times and regulate press usage based on utility costs, lowering operational expenditures.

DRO & Impact Forces Of Hot Forging Machine Market

The dynamics of the Hot Forging Machine Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. A major driver is the persistent and increasing demand from the global automotive industry, particularly the mandatory requirement for safety-critical components that must withstand extreme operational stress and temperature variations. This need is amplified by regulatory pressures for vehicle safety and fuel efficiency, requiring lightweight, high-strength forged parts. The proliferation of industrial infrastructure projects in developing economies also serves as a critical driver, necessitating large volumes of high-integrity forged components for construction machinery, railways, and power generation equipment. The continuous refinement of forging technology toward higher tonnage capacity and enhanced automation also acts as a driving force, offering greater productivity and precision.

However, the market faces significant restraints, primarily stemming from the substantially high initial capital investment required for purchasing and installing heavy-duty forging machines, along with their ancillary equipment such as furnaces, automation systems, and trimming presses. Furthermore, the operational complexity and high maintenance requirements, particularly for large hydraulic and mechanical presses, necessitate a specialized workforce and substantial ongoing operational expenditures (OpEx), posing a barrier to entry for smaller manufacturers. Economic volatility, particularly concerning fluctuating raw material prices (steel and non-ferrous alloys) and global energy costs, introduces uncertainty into the manufacturing cost structure, restraining aggressive expansion.

Crucial opportunities exist in leveraging advanced manufacturing paradigms, specifically the rapid adoption of Industry 4.0 and the increasing integration of Internet of Things (IoT) devices within forging facilities. This technological integration allows for real-time monitoring and data collection, leading to optimized production cycles and proactive quality assurance. Furthermore, the growing global focus on sustainable manufacturing presents an opportunity for manufacturers specializing in energy-efficient servo-electric screw presses, which significantly reduce the substantial energy footprint typically associated with hydraulic or pneumatic forging systems. Expansion into specialized markets, such as aerospace parts made from difficult-to-forge nickel and titanium alloys, also offers premium growth potential for vendors capable of providing ultra-precision hot forging solutions.

Segmentation Analysis

The Hot Forging Machine Market is comprehensively segmented based on machine type, end-user application, and geographical region, reflecting the diversity in operational needs and performance requirements across various industrial sectors. Segmentation by machine type primarily distinguishes between mechanical presses, known for their high speed and suitability for mass production; hydraulic presses, valued for their consistent force application throughout the stroke and deep drawing capabilities; and screw presses, which offer precise energy control and are ideal for intricate or specialized component forging. This differentiation allows end-users to select equipment optimized for their specific material types and production volumes, directly influencing investment cycles and technological preferences.

End-user segmentation is critical, as the requirements of the automotive industry—which dominates the market share due to its consistent high volume demand for standardized components—differ significantly from the aerospace sector, which prioritizes meticulous quality control, traceability, and the use of specialized, expensive alloys. Other significant end-user segments include the general engineering sector, which requires machinery for tooling and component manufacturing, and the heavy equipment sector, demanding high-tonnage presses for large-scale components used in construction and mining. Understanding these varying segment requirements is crucial for manufacturers to tailor machine designs, automation features, and after-sales support accordingly, ensuring maximum market penetration and customer satisfaction.

The interplay between technology and application defines market penetration strategies. For instance, the growing focus on electrification and lightweighting within the automotive segment is driving demand for highly automated mechanical presses capable of handling materials like aluminum and high-strength low-alloy (HSLA) steels efficiently. Conversely, the aerospace segment demands hydraulic presses or advanced screw presses that can precisely control temperature and deformation rates for expensive, temperature-sensitive nickel-based superalloys. The resulting detailed segmentation provides a structured framework for analyzing competitive advantages and identifying high-growth pockets within the broader hot forging machine ecosystem.

- By Machine Type:

- Mechanical Hot Forging Presses

- Hydraulic Hot Forging Presses

- Screw Hot Forging Presses (Friction and Servo-Electric)

- Counterblow Hammers and Forging Rolls

- By Tonnage Capacity:

- Up to 2,000 Tons

- 2,001 Tons to 6,000 Tons

- Above 6,000 Tons

- By End-User Industry:

- Automotive (Passenger Vehicles and Commercial Vehicles)

- Aerospace and Defense

- Construction and Mining Equipment

- Oil and Gas

- General Engineering and Tools

- Power Generation and Renewable Energy

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Hot Forging Machine Market

The value chain for the Hot Forging Machine Market begins with the upstream suppliers responsible for raw materials and highly specialized components. This stage involves sourcing high-grade steel, specialized cast iron, and complex electronic and hydraulic components required for the construction of the forging machinery itself. Key upstream activities include the manufacture of heavy-duty frames, high-precision drives (crankshafts, hydraulic cylinders), advanced control systems (PLCs, servo drives), and proprietary die steels that can withstand immense pressure and high temperatures. Efficiency at this stage is crucial, as delays or quality issues in specialized components directly impact the final machine assembly time and reliability.

The manufacturing stage involves the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the complex forging systems. This stage is highly capital-intensive and technology-driven, requiring significant investment in high-precision machining centers and large assembly facilities. OEMs differentiate themselves through technological innovation, such as integrating advanced automation features, developing proprietary software for machine control, and ensuring compliance with stringent safety and environmental standards. The quality of engineering and the integration of robust thermal management systems within the machine structure are primary value drivers at this central stage.

Downstream activities involve the distribution channel and post-sale services. Due to the size and complexity of hot forging machines, distribution often relies on a mix of direct sales teams for major, customized projects, and specialized distributors or agents who handle sales and technical support in regional markets. Crucially, the long-term value chain extends into comprehensive after-sales services, including installation, commissioning, specialized training for operational staff, and continuous provision of spare parts and maintenance services. The profitability for OEMs is increasingly linked to long-term service contracts and modernization/retrofit programs, particularly in mature markets where customers seek to extend the life and enhance the productivity of existing forging assets.

Hot Forging Machine Market Potential Customers

The primary potential customers and end-users of hot forging machines are large, multinational manufacturers engaged in producing high-integrity metal components for sectors where reliability and structural soundness are non-negotiable. Tier 1 and Tier 2 suppliers within the global automotive industry constitute the largest customer segment, as they require massive volumes of components like engine valves, suspension knuckles, wheel hubs, and driveline parts. These customers demand highly reliable mechanical presses capable of continuous, high-speed production with minimal downtime, often operating in fully automated forging lines to meet stringent cost and volume targets imposed by major vehicle manufacturers.

A second critical segment comprises specialized manufacturers within the aerospace and defense sectors. Customers here, including engine component manufacturers and airframe structural part suppliers, require machines capable of forging high-performance, exotic materials such as titanium alloys, nickel superalloys, and specialized aluminum alloys. These customers typically favor high-precision hydraulic presses or servo-screw presses that offer exacting control over strain rate and temperature profile during the forging process to maintain the specific metallurgical properties required for safety-critical applications like turbine discs, blades, and landing gear components. They prioritize machine precision, repeatability, and comprehensive data logging capabilities.

Furthermore, major manufacturers of heavy machinery—including agricultural equipment, construction vehicles, and mining equipment—represent significant buyers, particularly for large-tonnage hydraulic and mechanical presses. These industries require substantial forged components such as large gear blanks, track links, and hydraulic cylinder ends, which must withstand extreme static and dynamic loads in harsh operating environments. Finally, companies involved in infrastructure, shipbuilding, and the burgeoning renewable energy sector (manufacturing large wind turbine components and specialized pipeline connections) also serve as key potential customers, seeking custom-engineered hot forging solutions tailored to complex, large-scale component production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler AG, SMS group GmbH, Fagor Arrasate, Mitsubishi Heavy Industries Ltd., AIDA Engineering Ltd., Stamtec Inc., Komatsu Ltd., TMP - Tianjin Tianduan Press Co. Ltd., Sumitomo Heavy Industries Ltd., Ajax Manufacturing Company, Lasco Umformtechnik GmbH, Kurimoto Ltd., ERMAKSAN, China National Forging Equipment Co. Ltd., Qingdao Hanlin Machinery Co. Ltd., Siempelkamp Maschinen- und Anlagenbau GmbH, Beckwood Press Co., Hefei Metalforming Machine Tool Co. Ltd., JIER Machine Tool Group, DAFENG MACHINE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Forging Machine Market Key Technology Landscape

The technological landscape of the Hot Forging Machine Market is defined by a strong emphasis on precision, efficiency, and system integration, moving decisively toward smart manufacturing principles. One of the most significant technological advancements is the widespread adoption of servo-electric drive systems, particularly in screw presses. Unlike traditional friction or hydraulic systems, servo technology allows for micro-level control over the ram's velocity and position throughout the stroke, enabling precise energy delivery and optimal control of material flow. This precision translates directly into higher component quality, reduced material waste, and vastly improved energy efficiency, making these machines attractive for manufacturers focused on sustainable operations and high-value, complex component production.

Integration of Industry 4.0 elements, including the Industrial Internet of Things (IIoT) and advanced sensor technology, is another pillar of the current technology landscape. Modern forging machines are now equipped with hundreds of sensors monitoring temperature, vibration, pressure, and acoustic emissions in real-time. This massive data stream is processed by sophisticated control systems and cloud-based platforms, enabling capabilities such as predictive maintenance, remote diagnostics, and automated process adjustments. Furthermore, this connectivity allows forging lines to communicate seamlessly with upstream heating equipment (furnaces) and downstream trimming and finishing cells, optimizing the entire production flow and ensuring components remain within specified thermal windows during processing.

Additionally, advanced simulation and modeling software, such as Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), have become indispensable tools for optimizing the hot forging process before physical production begins. These tools allow engineers to simulate material deformation, predict stress distribution, analyze die wear patterns, and optimize billet dimensions, thereby drastically reducing the reliance on costly physical prototyping and trial runs. Coupled with rapid tooling technologies, these simulation techniques shorten lead times for new product introduction (NPI) and ensure the manufacturing process is robust and capable of meeting stringent metallurgical requirements for critical applications in the aerospace and automotive sectors.

Regional Highlights

Regional dynamics significantly influence the Hot Forging Machine Market, with demand distribution reflecting global manufacturing shifts, regulatory environments, and capital investment levels across key geographies.

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by China and India. This growth is sustained by high production volumes in the domestic automotive industry, rapid industrialization, and massive government investment in infrastructure, railways, and defense manufacturing. The region favors high-speed mechanical presses and mid-range tonnage machines required for mass production of standardized components. Increased foreign direct investment (FDI) into the manufacturing sectors of Southeast Asian nations further fuels demand for reliable, high-capacity forging equipment.

- North America: North America represents a mature but technologically advanced market, distinguished by its stringent demand from the aerospace and defense industries. The focus here is less on volume and more on precision, materials expertise (titanium and specialized steel alloys), and high-tonnage capacity presses for large structural components. The market is characterized by strong adoption of cutting-edge technologies like servo-electric presses and advanced automation systems to maintain high quality and competitiveness against global counterparts. The resurgence of domestic manufacturing initiatives and significant defense procurement budgets are key market contributors.

- Europe: Europe is a key innovation hub, especially Germany, Italy, and the UK, known for their focus on precision engineering, advanced material processing, and stringent environmental regulations. European demand is driven by high-quality automotive components (especially for premium and luxury vehicles) and specialized industrial machinery. The region is a leading adopter of energy-efficient servo technology and sophisticated integration with Industry 4.0 frameworks, seeking to optimize operational expenditure and reduce environmental impact while maintaining extremely high product standards.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, demonstrates steady demand correlated with regional automotive assembly and construction sectors. Growth is often cyclical, dependent on local economic stability and global commodity prices, but maintains a stable requirement for foundational forging equipment to support heavy industry and vehicle production.

- Middle East and Africa (MEA): MEA exhibits niche demand, primarily concentrated in countries with significant oil and gas exploration and infrastructure development. The need for specialized piping, valves, and drilling components drives the demand for heavy-duty, high-tonnage forging presses. Market growth is gradually diversifying as industrialization efforts in economies like Saudi Arabia and the UAE expand beyond the energy sector into manufacturing and defense.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Forging Machine Market.- Schuler AG

- SMS group GmbH

- Fagor Arrasate

- Mitsubishi Heavy Industries Ltd.

- AIDA Engineering Ltd.

- Stamtec Inc.

- Komatsu Ltd.

- TMP - Tianjin Tianduan Press Co. Ltd.

- Sumitomo Heavy Industries Ltd.

- Ajax Manufacturing Company

- Lasco Umformtechnik GmbH

- Kurimoto Ltd.

- ERMAKSAN

- China National Forging Equipment Co. Ltd.

- Qingdao Hanlin Machinery Co. Ltd.

- Siempelkamp Maschinen- und Anlagenbau GmbH

- Beckwood Press Co.

- Hefei Metalforming Machine Tool Co. Ltd.

- JIER Machine Tool Group

- DAFENG MACHINE

- Qingdao Qili Machinery Co. Ltd.

- Santec Group

Frequently Asked Questions

Analyze common user questions about the Hot Forging Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical, hydraulic, and servo screw hot forging machines?

Mechanical presses offer high speed and repeatable stroke energy for mass production, generating force via a rotating crankshaft. Hydraulic presses provide consistent, full-tonnage force throughout the stroke, ideal for deep drawing and specialized materials. Servo screw presses offer the highest precision and energy control, enabling optimal process management and superior energy efficiency.

Which end-user industry accounts for the largest share of the Hot Forging Machine Market?

The Automotive industry holds the largest market share due to its massive, ongoing requirement for high-integrity, high-volume safety and powertrain components such as connecting rods, crankshafts, gears, and suspension parts, driving consistent demand for reliable, high-speed forging solutions.

How is the implementation of Industry 4.0 affecting hot forging machine operations?

Industry 4.0 integration, through IIoT and advanced sensors, is enabling predictive maintenance protocols, remote monitoring, and real-time process optimization. This allows manufacturers to reduce unplanned downtime, enhance process repeatability, and significantly improve overall equipment effectiveness (OEE).

What are the key restraint factors challenging the growth of the Hot Forging Machine Market?

The market is primarily restrained by the exceptionally high initial capital expenditure (CAPEX) required for purchasing large-scale forging equipment, along with significant ongoing operational costs related to high energy consumption and the need for highly specialized maintenance personnel.

Why is the Asia Pacific region dominating the global Hot Forging Machine Market?

The dominance of the APAC region is attributable to rapid industrialization, extensive expansion of automotive manufacturing capacity (particularly in China and India), large-scale infrastructure development projects, and favorable government policies supporting domestic heavy manufacturing and machinery production.

This report contains a deep analysis of the Hot Forging Machine Market, covering key technological shifts, regional investment patterns, and the critical influence of Industry 4.0 adoption. The market trajectory is strongly linked to global automotive lightweighting trends and escalating demand for precision components across aerospace and defense sectors. Further examination reveals that manufacturers prioritizing energy efficiency through servo technology and offering comprehensive lifecycle support services are best positioned for sustainable growth throughout the forecast period.

The transition toward more data-driven and automated forging cells is inevitable, requiring substantial CAPEX but promising higher throughput and superior component quality, thereby setting a new standard for high-performance metal forming globally. Understanding the nuances between mechanical, hydraulic, and screw press applications across different tonnage segments is essential for stakeholders looking to optimize their equipment acquisition strategy.

The substantial growth observed in emerging economies like China and India, fueled by domestic manufacturing policies and infrastructure build-out, continues to cement APAC's role as the pivotal growth engine for the hot forging equipment sector. Conversely, mature markets in North America and Europe will continue to drive demand for specialized, high-precision equipment required for aerospace and premium automotive applications, emphasizing quality over sheer volume.

Key players are strategically investing in R&D to enhance machine connectivity and integrate AI-driven diagnostics, moving beyond hardware sales to offering complete intelligent manufacturing solutions. This shift necessitates robust supply chain management, highly skilled technical support, and the capacity to deliver tailored, flexible forging solutions that address the specific material and process complexities inherent in modern industrial manufacturing.

The competitive landscape remains intense, characterized by a mix of established global giants offering comprehensive portfolios and specialized regional players focusing on niche technology segments, such as small-to-medium friction screw presses or large hydraulic presses for specific heavy industry applications. Successful market participation requires not only technological superiority but also strategic regional alignment and strong customer relationships built on reliability and exceptional post-sales service, particularly given the long operational lifespan of these heavy machines.

Future market evolution will likely be influenced by advancements in metallurgical sciences, requiring hot forging machines to handle increasingly difficult materials like advanced high-strength steels (AHSS) and high-performance superalloys with greater efficiency and control. This trend places increased importance on the precise temperature control and deformation rate capabilities offered by modern servo-driven systems, solidifying their role as the technology of choice for advanced forging operations seeking to meet future quality standards.

Furthermore, the global emphasis on carbon reduction and energy conservation is poised to accelerate the obsolescence of older, less efficient forging hammers and friction presses. Regulatory incentives and corporate sustainability targets are compelling end-users to adopt newer hydraulic and, crucially, servo-electric presses, which offer tangible reductions in energy consumption per cycle. This structural transition toward energy-optimized machinery represents a major long-term driver for replacement demand across mature markets, sustaining growth even as primary industrial expansion stabilizes.

In summary, the Hot Forging Machine Market is characterized by steady, technology-led growth. While high capital investment remains a barrier, the essential role of hot forged components in safety-critical applications—from mobility to defense—ensures consistent demand. Successful engagement in this market hinges on technological innovation, efficient energy utilization, and a strategic focus on the high-growth APAC manufacturing sector, alongside specialized, high-value niches in Western aerospace and defense production.

The current market analysis indicates that machine type segmentation reveals divergent growth patterns. Mechanical presses, driven by high-volume automotive production, will maintain stability, while the servo-electric screw press segment is anticipated to exhibit the highest CAGR due to its inherent advantages in precision and energy savings, appealing to manufacturers facing rising utility costs and demanding tighter tolerances. This dual trajectory underscores the need for machine manufacturers to offer diversified portfolios addressing both mass-market efficiency and high-precision specialization requirements.

Geographical expansion remains paramount, with manufacturers actively establishing production and service centers within key APAC markets to reduce lead times and shipping costs, while simultaneously providing localized technical expertise crucial for minimizing downtime. The competitive advantages of regional players, often benefiting from lower operating costs, are counterbalanced by the technological leadership and established reliability of major European and Japanese OEMs, creating a balanced but highly competitive international environment.

The continued digitalization of the forging process, enabled by advanced software tools and industrial IoT integration, is transforming the lifecycle management of hot forging machines. From virtual commissioning and predictive failure analysis to automated tooling changeovers, technology is lowering the operational dependency on manual expertise and elevating the overall productivity and consistency of forging operations worldwide. This ongoing transformation is key to unlocking the full efficiency potential of these capital-intensive manufacturing assets.

Investment patterns suggest a pivot towards systems capable of forging challenging lightweight materials essential for modern vehicle design, including specialized aluminum and magnesium alloys. These materials require tighter temperature control and faster processing speeds to prevent microstructural defects, demanding advanced features from the forging equipment that standard legacy systems often cannot provide. Therefore, the market for retrofit and modernization services focusing on control system upgrades and enhanced heating integration is also expected to grow substantially, supplementing new machine sales.

Stakeholders must closely monitor global trade regulations and supply chain stability, as the manufacturing of hot forging machines relies on complex, internationalized sourcing of high-precision components. Geopolitical shifts and tariffs can impact the cost structure and delivery timelines, requiring robust risk management strategies across the entire value chain, from raw material sourcing to final machine installation and service delivery.

Ultimately, the long-term viability of participants in the Hot Forging Machine Market depends on their ability to deliver integrated solutions that merge heavy-duty mechanical reliability with smart, AI-driven process control. The future belongs to OEMs who can effectively balance the need for high throughput demanded by the auto industry with the high precision and material complexity demanded by the aerospace and energy sectors, all while meeting increasingly stringent environmental and energy efficiency standards.

The market for training and technical education focused on the latest hot forging technologies is also growing, driven by the increasing complexity of these machines. As operators transition from managing traditional mechanical presses to troubleshooting integrated servo-hydraulic systems, specialized training services become a critical value-add offered by leading OEMs. This focus on human capital development is essential for ensuring the full utilization and longevity of advanced hot forging installations.

Furthermore, consolidation among global forging press manufacturers continues, as larger entities seek economies of scale and broader geographical reach. Mergers and acquisitions are often strategic, aimed at acquiring specific technological expertise (e.g., servo control systems) or securing deeper penetration into fast-growing regional markets, thereby intensifying the competitive pressure on smaller, independent players who lack comparable R&D resources or extensive global service networks.

The impact of electric vehicle (EV) manufacturing, while initially perceived as a potential threat due to the reduction in traditional internal combustion engine components, is now viewed as an opportunity. EVs require new types of precision forged parts for specialized transmission assemblies, differential casings, and structural chassis components designed for battery protection. Hot forging machines are adapting their processes and tooling to accommodate these novel component geometries and the lightweight materials mandated by EV design, ensuring continued relevance in the evolving mobility landscape.

Finally, the growing trend of custom manufacturing and small-batch production, enabled by flexible forging systems, is opening new avenues for medium-sized enterprises. Machines offering rapid setup and easy reconfiguration are addressing the demand for highly specialized, smaller volume runs, particularly in the tools, molds, and niche industrial machinery markets, which require high-quality forged parts but cannot justify the capital outlay for dedicated, high-volume lines.

The continuous evolution of hot forging machines, driven by sensor integration and sophisticated control software, is pushing the boundaries of what is possible in metal forming. This technological momentum ensures that hot forging remains a foundational and essential process for manufacturing components where structural integrity and mechanical performance are paramount, underpinning critical sectors of the global economy throughout and beyond the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager