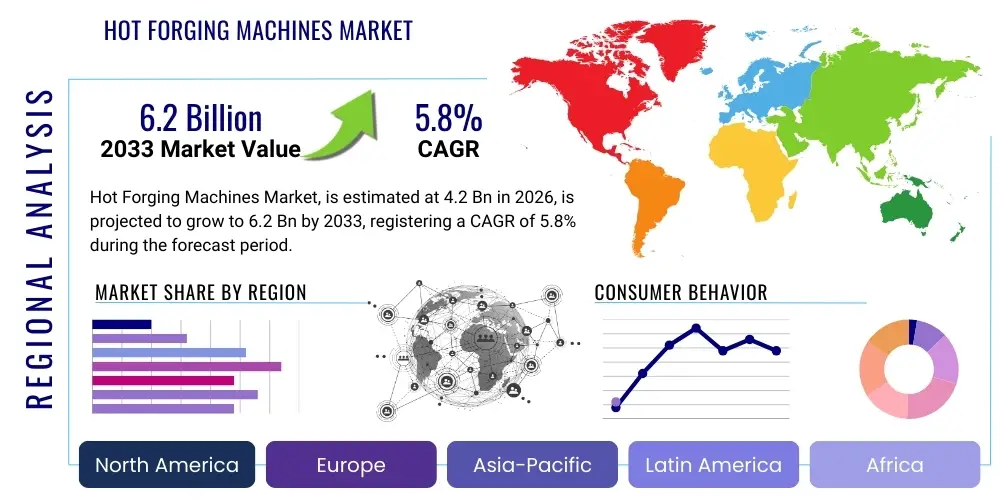

Hot Forging Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442230 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Hot Forging Machines Market Size

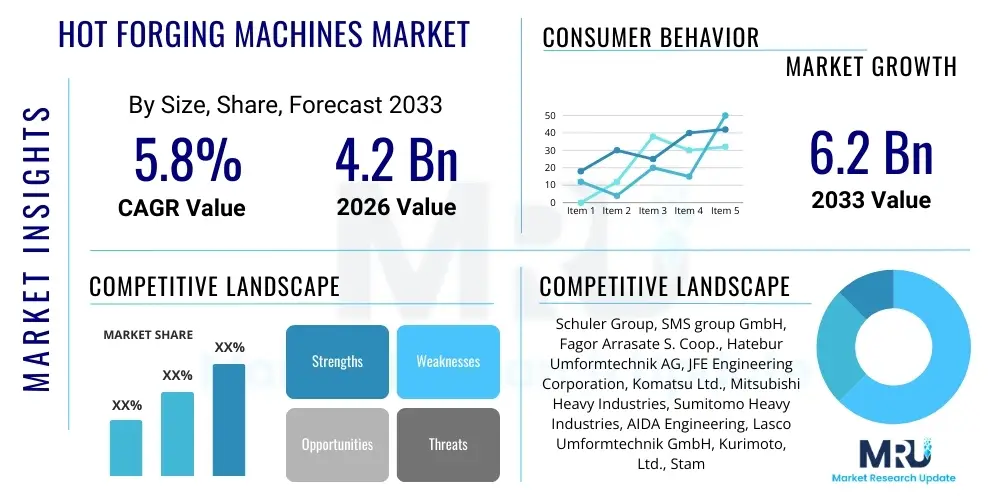

The Hot Forging Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the sustained demand for high-strength, lightweight components across critical industries such as automotive, aerospace, and energy. Manufacturers are increasingly prioritizing automated and high-precision forging solutions to meet stringent quality standards and enhance production efficiency, which necessitates continuous investment in advanced hot forging machinery.

Hot Forging Machines Market introduction

The Hot Forging Machines Market encompasses sophisticated industrial equipment designed to shape metal components at elevated temperatures, typically above the material’s recrystallization point. This process reduces the yield strength of the metal, making it more ductile and easier to form intricate shapes while enhancing mechanical properties like tensile strength and fatigue resistance. Key machines within this market segment include mechanical presses, hydraulic presses, screw presses, and forging hammers, each optimized for specific material types, component sizes, and production volumes. The primary function of these machines is to deliver high impact force or sustained pressure to form pre-heated billets into precision parts.

The major applications of hot forging machines are concentrated in sectors requiring components that can withstand extreme stresses and harsh operating conditions. The automotive industry is the largest consumer, utilizing hot-forged parts for engine components (crankshafts, connecting rods), transmission systems, and structural safety parts. Beyond automotive, the aerospace and defense sectors rely heavily on hot forging for critical components like turbine blades, landing gear parts, and structural airframe elements where component integrity is paramount. Furthermore, the oil and gas sector uses these machines to produce high-pressure valves, fittings, and drilling tools, driving consistent demand for robust and reliable machinery.

Driving factors for market expansion include the global push toward vehicle lightweighting to improve fuel efficiency and reduce emissions, necessitating strong yet light forged aluminum and specialized steel components. Technological advancements, particularly the integration of automation, real-time monitoring, and predictive maintenance capabilities, are enhancing the productivity and efficiency of these machines, making them more attractive investments for manufacturers. The benefits offered by hot forging—superior grain structure, minimal material waste, and exceptional mechanical strength—position it as an indispensable manufacturing process, ensuring long-term market stability and growth, particularly in emerging industrial economies like China and India.

Hot Forging Machines Market Executive Summary

The Hot Forging Machines Market is characterized by a high degree of technological sophistication and is experiencing moderate to high growth, driven predominantly by industrial digitalization and the escalating complexity of engineered components. Current business trends indicate a strong move towards fully automated forging lines integrated with robotics and IoT sensors to minimize human error and maximize throughput. Key manufacturers are focusing their R&D efforts on developing high-speed mechanical presses and energy-efficient servo-driven hydraulic presses that offer greater control over the forging process. Furthermore, sustainability has become a critical business imperative, pushing companies to invest in machinery with reduced energy consumption and improved material utilization rates.

Regionally, Asia Pacific (APAC) stands as the dominant market, fueled by the massive automotive manufacturing base in China, the expanding defense sector in India, and robust general manufacturing growth across Southeast Asia. North America and Europe, while mature, remain crucial markets, characterized by high demand for advanced, customized machinery tailored for high-precision applications, especially within the aerospace and medical device sectors. These regions are the primary adopters of cutting-edge technologies like digital twin simulations for process optimization. Emerging markets in Latin America and the Middle East are showing accelerated investment, particularly linked to infrastructure development and localized automotive assembly expansion, signaling future growth centers.

Segment trends reveal that the Mechanical Press segment currently holds the largest market share due to its high production rate and suitability for mass manufacturing applications, especially within the Tier 1 and Tier 2 automotive supply chain. However, the Screw Press segment is projected to exhibit the fastest growth rate, attributable to its versatility, energy efficiency, and superior control over ram velocity and impact energy, making it ideal for processing challenging alloys. In terms of end-use, the Automotive segment remains the undisputed leader, though Aerospace & Defense is increasingly driving demand for ultra-high tonnage and highly specialized machine capabilities required for forging superalloys and complex geometries for modern aircraft engines and structural elements.

AI Impact Analysis on Hot Forging Machines Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hot Forging Machines Market overwhelmingly focus on operational efficiency, predictive quality control, and the potential for autonomous manufacturing. Common concerns revolve around how AI can minimize defects (e.g., surface cracks, incomplete filling), optimize machine parameters (temperature, pressure, cycle time) in real-time, and reduce energy waste. There is a strong user expectation that AI algorithms will move beyond simple monitoring to active, prescriptive control, enabling self-correcting forging processes. Users also frequently inquire about the integration challenges associated with retrofitting AI systems onto legacy machinery and the skills required for maintenance personnel to manage these smart systems. The consensus highlights that AI is viewed not just as an improvement tool, but as a fundamental shift towards lights-out forging operations, enhancing both productivity and metallurgical consistency.

AI's influence is rapidly transforming the operational landscape of hot forging facilities, primarily through the deployment of advanced machine learning models trained on vast datasets of sensor readings, material properties, and outcome quality metrics. These models can predict potential equipment failures hours or days in advance, allowing for preemptive maintenance and drastically reducing costly downtime—a significant concern in high-throughput environments. Furthermore, AI-powered computer vision systems are being implemented for immediate, non-destructive inspection of forged parts, accelerating quality checks and ensuring that only compliant components proceed to subsequent manufacturing stages. This real-time feedback loop allows for instantaneous parameter adjustment, pushing the forging process closer to zero-defect manufacturing.

The adoption of AI is also critically impacting the design and simulation phase of hot forging. Utilizing generative design and topology optimization algorithms, engineers can simulate numerous forging scenarios in virtual environments (digital twins) before the physical die is manufactured. This significantly cuts down on prototyping costs and time-to-market. AI optimizes die life by analyzing stress patterns and temperature fluctuations, recommending precise material feeds and cooling schedules. Consequently, the combination of predictive maintenance, real-time quality control, and optimized process simulation is cementing AI’s role as a core competitive differentiator, enabling manufacturers to handle increasingly complex materials and component designs with higher levels of precision and cost-effectiveness.

- Enhanced Predictive Maintenance: AI monitors vibrational, thermal, and acoustic data to forecast equipment failure, minimizing unplanned outages.

- Real-Time Process Optimization: Machine learning algorithms adjust press parameters (speed, force, temperature) dynamically to maintain optimal forging conditions.

- Automated Quality Inspection: Computer vision and deep learning models provide instant, 100% inspection of components for surface defects and dimensional accuracy.

- Optimized Die Design and Life: AI predicts wear patterns and stress points, extending tool lifespan and reducing operational expenditures.

- Energy Consumption Reduction: Algorithms manage machine usage patterns to minimize idle time and optimize heating schedules, enhancing sustainability.

DRO & Impact Forces Of Hot Forging Machines Market

The Hot Forging Machines Market is driven by the perpetual need for robust and high-performance metal components, particularly stemming from the global automotive industry's electrification trend which requires new, durable lightweight parts for battery enclosures and structural frameworks. Restraints include the high initial capital investment required for modern hot forging equipment and associated tooling, which creates a significant barrier to entry for smaller manufacturers. Opportunities are abundant in integrating Industry 4.0 technologies—such as IoT, cloud connectivity, and robotics—to create fully automated, scalable forging cells. These intersecting forces ensure that while the market is capital-intensive, the payoff in terms of superior product quality and operational efficiency drives consistent technological advancement and expansion.

Drivers: The most significant driver is the increasing complexity and stringent performance requirements of components used in aerospace and high-end automotive applications. Modern engines and structural parts require materials like titanium, superalloys, and advanced high-strength steels (AHSS), which necessitate specialized hot forging processes to achieve the required mechanical integrity. Secondly, the rapid industrialization and infrastructural development in economies across Asia Pacific and Latin America are boosting demand for construction machinery, heavy vehicles, and localized manufacturing capabilities, directly translating into higher sales of forging equipment. The replacement cycle of aging machinery in mature markets also provides a stable baseline demand for new, energy-efficient models.

Restraints: The market faces substantial resistance from the high upfront costs associated with acquiring, installing, and commissioning high-tonnage hot forging presses. These machines require extensive foundations, specialized ancillary equipment (induction heaters, manipulators), and highly trained technicians, making the total cost of ownership prohibitive for many potential investors. Furthermore, intense competition from alternative metal forming processes, such as casting and machining, particularly for less critical components, sometimes limits the market's penetration. Regulatory pressures regarding environmental emissions and noise pollution also impose significant operational constraints and require expensive abatement technologies.

Opportunity: Key opportunities lie in the diversification of applications beyond traditional industries. The burgeoning renewable energy sector, specifically wind turbine manufacturing, requires large, precision-forged components (e.g., shafts and bearing rings), opening a new high-value market segment. Moreover, the integration of advanced automation and digitalization offers manufacturers an opportunity to differentiate their offerings by providing turnkey, smart factory solutions. Developing nations also offer lucrative opportunities for companies that can provide refurbished, cost-effective machinery combined with necessary localized technical support and financing options, enabling smaller players to upgrade their capabilities.

Segmentation Analysis

The Hot Forging Machines Market is structurally diverse, segmented based on the mechanism employed, the degree of automation, and the end-use industry served. Understanding these segments provides critical insights into market dynamics, identifying areas of accelerated growth and technological focus. The segmentation by machine type—Mechanical Press, Hydraulic Press, Screw Press, and Hammer—is fundamental, reflecting the trade-offs between speed, control, and force delivery capabilities. Segmentation by end-use further illustrates the market's dependency on global industrial health, with the automotive sector remaining the central pillar of demand, followed closely by the demanding requirements of aerospace and energy infrastructure projects worldwide.

The differentiation between machine operation—Automatic, Semi-Automatic, and Manual—is crucial for assessing the market's maturity and regional preferences. Highly developed markets often lean towards fully automatic systems integrated into production lines for maximum efficiency and labor cost reduction. Conversely, emerging markets might still favor semi-automatic or manual systems due to lower capital expenditure and reliance on relatively cheaper labor. This layered segmentation allows suppliers to tailor their product offerings, whether focusing on high-volume, standardized presses for automotive supply chains or highly customizable, high-tonnage hydraulic presses for specialized aerospace components requiring meticulous force control over the forging sequence.

- By Machine Type:

- Mechanical Press

- Hydraulic Press

- Screw Press

- Forging Hammer (Drop and Counterblow)

- By Operation:

- Automatic

- Semi-Automatic

- Manual

- By Tonnage (Force Capacity):

- Less than 1,000 Tons

- 1,000 Tons to 5,000 Tons

- More than 5,000 Tons

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Aerospace & Defense

- General Manufacturing & Machinery

- Oil & Gas and Energy

- Construction and Mining

Value Chain Analysis For Hot Forging Machines Market

The value chain for the Hot Forging Machines Market begins with the upstream procurement of essential raw materials and specialized components. This includes high-grade steel and composite materials required for manufacturing the press frames, high-precision hydraulic cylinders, servo motors, electrical control systems (PLCs), and specialized tooling steel for dies. Key upstream activities involve meticulous quality control of raw materials and the precise machining of critical moving parts that determine the lifespan and accuracy of the forging machine. Reliable sourcing and management of these high-value, technical components are paramount, as lead times and component quality directly impact the final machine delivery schedule and performance specifications.

Mid-stream, the core activities revolve around the machine assembly, integration of sophisticated control software, and rigorous testing and validation processes. Distribution channels play a vital role in reaching the end-users. Direct distribution is common for high-value, custom-engineered machines (such as heavy hydraulic presses) where the original equipment manufacturer (OEM) handles sales, installation, training, and long-term maintenance contracts, maintaining direct relationships with major Tier 1 and aerospace clients. Indirect distribution involves leveraging specialized regional distributors or agents, particularly in geographically dispersed markets, who manage localized sales, financing, and after-sales support for standardized or smaller-capacity machines, thereby expanding the OEM's market reach efficiently.

Downstream activities focus on the end-use applications and the provision of aftermarket services. Forging companies, particularly those serving the automotive and aerospace industries, represent the primary downstream consumers, utilizing the machines to produce finished or near-net-shape components. Crucial downstream support includes the supply of spare parts, regular maintenance, and modernization or retrofitting services to extend the operational life of installed equipment. The quality of after-sales technical support, including rapid resolution of operational issues and specialized training for operator proficiency, significantly influences customer loyalty and future purchase decisions within this capital-intensive machinery market.

Hot Forging Machines Market Potential Customers

The primary consumers and end-users of hot forging machines are large-scale manufacturing enterprises and specialized forging houses that require components with superior strength-to-weight ratios and high material integrity. The most prominent end-users are within the global Automotive Supply Chain, including Tier 1 suppliers and major OEMs who need continuous, high-volume production of critical safety and powertrain parts like gear blanks, flanges, axle beams, and steering knuckles. Their purchasing decisions are driven by factors such as production speed, automation level, repeatability, and the ability of the machine to handle various material compositions used in both internal combustion engine (ICE) and electric vehicle (EV) platforms.

Another major segment of potential customers includes manufacturers operating in the highly regulated Aerospace and Defense industries. These buyers require specialized, high-tonnage hydraulic and screw presses capable of forging superalloys, titanium, and nickel-based materials under extreme temperature and pressure control. For aerospace buyers, precision, traceability, and the ability to produce large, monolithic structures (like turbine discs or landing gear struts) are the key purchasing criteria, often demanding customized machine solutions built to stringent industry specifications (e.g., NADCAP standards). These customers often engage directly with top-tier machine manufacturers for integrated manufacturing systems.

Beyond these leading sectors, potential customers also encompass heavy machinery manufacturers (Construction and Mining), energy equipment providers (Oil & Gas fittings, valve bodies, power generation turbine components), and general fabrication industries. Utility companies and infrastructure developers represent a growing buyer base for hot-forged fittings and pipeline components requiring extreme durability. The procurement process for these capital goods is typically lengthy, involving extensive technical evaluations, financial negotiations, and long-term service agreements, focusing on total lifecycle cost rather than just the initial acquisition price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler Group, SMS group GmbH, Fagor Arrasate S. Coop., Hatebur Umformtechnik AG, JFE Engineering Corporation, Komatsu Ltd., Mitsubishi Heavy Industries, Sumitomo Heavy Industries, AIDA Engineering, Lasco Umformtechnik GmbH, Kurimoto, Ltd., Stamtec Inc., Ajex & Turner, China National Erzhong Group Co. (CHEC), Qingdao Worldbest Precision Machinery Co., Ltd., Hefei Metalforming Machine Tool Co., Ltd., TMP-Technical Machine Products, KAMA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Forging Machines Market Key Technology Landscape

The technological landscape of the Hot Forging Machines Market is rapidly evolving, driven by the need for higher energy efficiency, enhanced precision, and deeper integration with digital manufacturing ecosystems (Industry 4.0). A paramount technological trend is the increasing adoption of Servo-Driven Technology, particularly in mechanical and hydraulic presses. Servo technology replaces traditional flywheel, clutch, or valve systems with highly precise electric motors, offering unparalleled control over the ram's stroke curve, velocity, and force application. This flexibility allows manufacturers to tailor the forging profile to specific material requirements, resulting in higher quality parts, reduced material waste, and significant energy savings compared to conventional systems.

Another crucial technological advancement is the integration of advanced sensor networks and Industrial Internet of Things (IIoT) capabilities. Modern forging machines are equipped with hundreds of sensors monitoring parameters such as die temperature, hydraulic pressure, vibration, acoustic emissions, and press load in real time. This data is fed into sophisticated Cloud-Based Analytics platforms, enabling predictive modeling for equipment maintenance and providing detailed traceability logs for every component forged. These systems facilitate the development of 'digital twins' of the forging process, allowing engineers to simulate and optimize parameters offline before deployment, substantially reducing setup time and maximizing Overall Equipment Effectiveness (OEE).

Furthermore, the focus on enhancing tooling longevity and reducing thermal fatigue has spurred innovation in Advanced Die Heating and Cooling Systems. Induction heating systems are becoming more precise and energy efficient for billet pre-heating, ensuring consistent material input temperature. For the dies themselves, sophisticated internal cooling channels and temperature monitoring systems regulated by proportional valves help maintain optimal die surface temperature, which is critical for preventing thermal cracking and ensuring dimensional stability of the forged part. This synergy of mechanical, electrical, and digital technologies ensures that modern hot forging machines can meet the extremely demanding tolerances required by next-generation components, particularly those made from challenging superalloys.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in terms of market size and growth rate, primarily driven by China and India. China's massive automotive production volume and its strategic investments in infrastructure and defense manufacturing fuel continuous demand for high-tonnage, high-speed mechanical and hydraulic presses. India’s focus on localized manufacturing (Make in India initiative) is rapidly expanding its domestic forging industry, requiring substantial investment in both new and modern second-hand machinery. The region is characterized by aggressive price competition but also high technological adoption rates in established forging centers.

- North America: This region is a mature market defined by a strong emphasis on quality, precision, and technological integration, particularly in the Aerospace & Defense and high-end Oil & Gas sectors. Demand is concentrated on specialized, customized equipment (e.g., isothermal and near-net-shape forging presses) capable of handling exotic materials like titanium and nickel superalloys. The implementation of automation, robotics, and AI-driven quality control systems is significantly higher here, prioritizing operational efficiency and labor cost reduction over sheer volume.

- Europe: Europe represents a key innovation hub, leading in the development and adoption of highly efficient, sustainable forging technologies, notably servo-presses and fully automated forging lines. Germany, Italy, and France maintain strong domestic automotive and industrial machinery sectors. The regional market growth is steady, focusing heavily on modernizing existing facilities to comply with stringent EU environmental regulations and achieve higher energy efficiency standards required for sustainable manufacturing processes.

- Latin America: This region, led by Brazil and Mexico, demonstrates moderate growth, tied closely to the health of their domestic automotive assembly industries and local mining operations. Investment is often cautious, favoring reliable, proven technology and requiring favorable financing structures. The market primarily targets medium-tonnage mechanical presses for standard components, with increasing demand for modern equipment as regional industries strive for global competitiveness.

- Middle East and Africa (MEA): Growth in MEA is highly localized and project-driven, largely dictated by investments in the Oil & Gas sector (demanding specialized valves and fittings) and ongoing infrastructure development. Saudi Arabia and the UAE are investing in localized industrial base expansion, driving niche demand for robust forging solutions. The African market remains nascent but shows long-term potential linked to future industrialization and infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Forging Machines Market.- Schuler Group GmbH

- SMS group GmbH

- Fagor Arrasate S. Coop.

- Hatebur Umformtechnik AG

- Komatsu Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Sumitomo Heavy Industries, Ltd.

- AIDA Engineering, Ltd.

- Lasco Umformtechnik GmbH

- Kurimoto, Ltd.

- Stamtec Inc.

- Ajex & Turner

- Sankyo Seisakusho Co., Ltd.

- Qingdao Worldbest Precision Machinery Co., Ltd.

- TMP-Technical Machine Products

- Jiangsu Qiaolian Machine Tool Co., Ltd.

- China National Erzhong Group Co. (CHEC)

- Hefei Metalforming Machine Tool Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hot Forging Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Hot Forging Machines Market?

The Hot Forging Machines Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing demands from the automotive and aerospace industries for precision components.

Which machine type dominates the hot forging segment?

Mechanical Presses currently hold the largest market share due to their high speed, reliability, and cost-effectiveness for mass production applications, making them indispensable for high-volume automotive component manufacturing.

How is Industry 4.0 impacting hot forging operations?

Industry 4.0 is profoundly impacting the market through the integration of AI, IoT sensors, and predictive maintenance systems, enabling real-time process optimization, automated quality checks, and significant reductions in machine downtime and energy consumption.

Which geographical region represents the largest market for hot forging machines?

Asia Pacific (APAC), particularly driven by the immense manufacturing bases in China and India, represents the largest and fastest-growing regional market, fueled by robust industrialization and infrastructure investments.

What is the primary technical advantage of Servo-Driven Forging Presses?

Servo-Driven Presses offer superior control over the ram stroke profile and velocity, allowing for material-specific forming sequences that enhance component quality, reduce tooling wear, and drastically improve overall energy efficiency compared to traditional hydraulic systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager