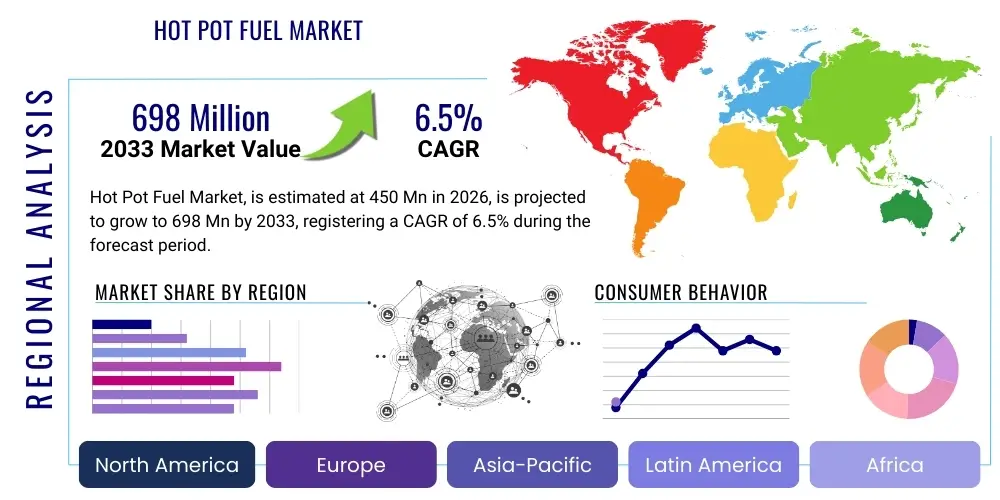

Hot Pot Fuel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440964 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hot Pot Fuel Market Size

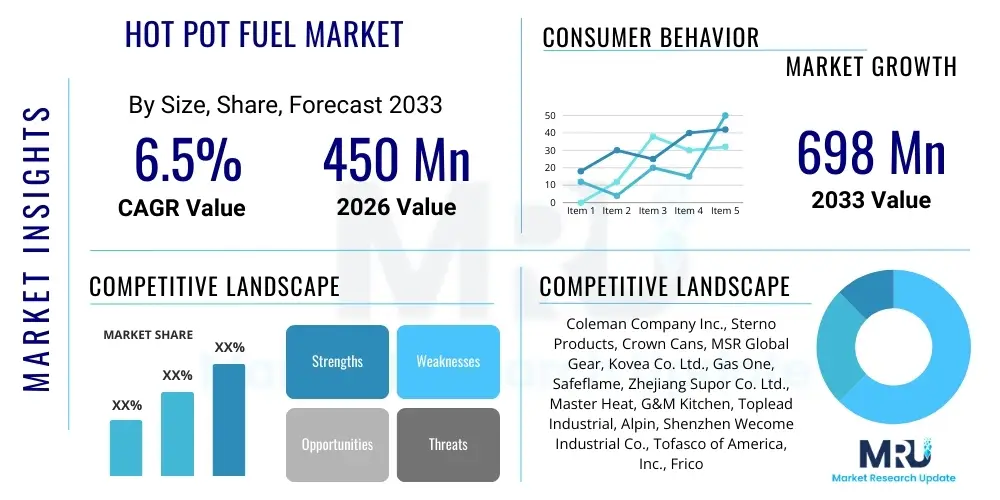

The Hot Pot Fuel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Hot Pot Fuel Market introduction

The Hot Pot Fuel Market encompasses various chemical and solid substances utilized to generate heat for the traditional cooking method known as hot pot, prevalent primarily in Asian cuisines but experiencing global penetration. These fuels are essential for maintaining the continuous simmering required for tableside cooking, ranging from pressurized gas canisters like butane and propane to specialized alcohol-based gels and solid fuel tablets. The primary products include high-purity butane canisters favored in commercial settings and portable setups, along with methanol or ethanol gel fuels often used in less demanding residential or outdoor environments due to their ease of handling and inherent safety features.

Major applications for hot pot fuel span both the commercial foodservice sector, including dedicated hot pot restaurants and general Asian eateries, and the residential consumer market, driven by cultural culinary traditions and increasing enthusiasm for home dining experiences. In the commercial domain, reliable, high-output fuels are paramount to ensure efficiency during peak hours. Residential use often prioritizes safety, minimal odor, and convenience. The diverse application base dictates the demand for varied fuel types, with sustainability and cost-efficiency emerging as significant determinants of consumer and institutional purchasing decisions.

Key benefits driving market adoption include the inherent social and communal nature of hot pot dining, which boosts the demand for reliable heating sources, and the rising popularity of global Asian cuisine across Western markets. Driving factors include increasing urbanization, which leads to greater consumption of convenience-oriented dining solutions, and technological advancements in fuel canister design, enhancing both portability and safety. Furthermore, the robust growth of the global restaurant industry, particularly in fast-casual and experiential dining formats, provides a steady commercial foundation for continued market expansion, complemented by strategic marketing targeting diverse consumer demographics seeking authentic culinary experiences.

Hot Pot Fuel Market Executive Summary

The Hot Pot Fuel Market is characterized by robust growth, primarily propelled by the globalization of Asian culinary culture and continuous innovation in fuel safety and efficiency. Current business trends indicate a strong shift toward environmentally sustainable fuel options, such as bio-ethanol gels and cleaner-burning butane variants, driven by heightened consumer awareness and stringent regulatory pressures concerning volatile organic compounds (VOCs). The market is seeing increased vertical integration among major manufacturers aiming to control supply chains, particularly the sourcing of high-purity components required for fuel stability. Furthermore, strategic partnerships between fuel suppliers and specialized restaurant equipment manufacturers are becoming commonplace, ensuring compatibility and optimizing combustion performance for specific hot pot equipment designs.

Regionally, the Asia Pacific (APAC) continues to dominate the market, anchored by China, Japan, and South Korea, where hot pot dining is deeply ingrained culturally and commercially. However, North America and Europe are exhibiting the fastest growth rates, spurred by increasing immigration, the proliferation of international dining establishments, and high disposable incomes supporting specialized home cooking hobbies. This geographic diversification is driving demand for localized packaging and compliance with varied regional safety standards. The Middle East and Africa (MEA), though nascent, represent a long-term opportunity, particularly as culinary tourism and luxury dining segments expand, potentially adopting premium, high-end fuel solutions.

Segment-wise, the market sees Butane Fuel dominating the value share due to its consistent performance and widespread commercial deployment, though Gel/Ethanol Fuel is experiencing rapid adoption in the residential segment due to superior safety profiles and ease of transport. The commercial application segment remains the largest revenue generator, demanding bulk supply and high-performance products. Distribution trends highlight the growing importance of B2B e-commerce platforms for commercial buyers, providing streamlined procurement and competitive pricing, while traditional supermarket and specialty retail channels maintain dominance for residential consumers seeking immediate purchase options and brand familiarity. Ongoing regulatory scrutiny on portable cooking appliances and fuels is influencing product development across all segments, pushing toward non-toxic and low-emission alternatives.

AI Impact Analysis on Hot Pot Fuel Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hot Pot Fuel Market typically center on supply chain optimization, predictive demand forecasting, and enhancing consumer safety through smart device integration. Key concerns revolve around whether AI could automate inventory management to reduce waste (a significant issue for volatile fuels), optimize logistics routes to lower distribution costs, and implement advanced quality control in manufacturing processes. There is a strong user expectation that AI algorithms will eventually facilitate personalized fuel recommendations based on customer usage patterns (e.g., residential vs. commercial intensity), leading to more efficient consumption and reduced environmental impact. Furthermore, users frequently question how AI integration, specifically in smart burners and safety monitoring systems, could proactively mitigate risks associated with fuel storage and accidental ignition, thereby raising overall product safety standards across the industry.

- AI-driven Predictive Maintenance: Utilizing sensor data from hot pot burners to predict maintenance needs or fuel consumption abnormalities, optimizing commercial operations.

- Dynamic Supply Chain Optimization: Implementing machine learning algorithms to forecast demand fluctuations based on seasonal trends, cultural holidays, and localized weather conditions, reducing inventory holding costs and minimizing stockouts of niche fuel types.

- Enhanced Manufacturing Quality Control: Employing computer vision and AI analytics during the filling and sealing process of fuel canisters to detect minute defects immediately, significantly improving product safety and compliance.

- Personalized Consumer Recommendations: Using AI to analyze home consumer cooking frequency and style, suggesting the most cost-effective and appropriate fuel type (e.g., gel vs. small butane cans) via e-commerce platforms.

- Intelligent Safety Monitoring: Integrating AI into smart hot pot heating units to automatically detect unsafe gas concentrations or excessive heat, triggering automatic shutdown mechanisms, particularly in residential use cases.

DRO & Impact Forces Of Hot Pot Fuel Market

The dynamics of the Hot Pot Fuel Market are shaped by powerful Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory and competitive intensity. A primary driver is the phenomenal growth of international Asian cuisine, transforming hot pot from a regional specialty into a global dining phenomenon, increasing both commercial establishment needs and home consumer adoption. Conversely, the market faces significant restraints, notably the stringent and complex global regulations surrounding the transportation and storage of pressurized flammable gases, which inflate logistics costs and limit market entry for smaller players. Opportunities abound in the development of safer, eco-friendly, and bio-based fuel alternatives that promise reduced emissions and greater appeal to environmentally conscious millennials and Generation Z consumers. These forces create an environment where innovation in product safety and sustainability is directly correlated with market success, positioning fuel efficiency and clean combustion as major competitive differentiators.

Impact forces currently at play include the rapid digitalization of distribution channels, which is lowering the barrier for specialized fuel types to reach niche markets, while simultaneously intensifying price competition due to transparent online comparisons. Political and economic volatility, especially concerning oil and gas feedstock prices, frequently influences the manufacturing cost of hydrocarbon-based fuels, causing short-term pricing instability. Sociocultural trends, such as the preference for experiential dining and the resurgence of communal cooking post-pandemic, continually reinforce market demand. Furthermore, intense competition among regional manufacturers compels continuous investment in R&D to improve canister design, fuel mixtures, and shelf life, ensuring product reliability in diverse climatic conditions, solidifying consumer trust and brand loyalty.

The regulatory environment acts as a persistent impact force, particularly concerning international shipping standards (e.g., UN safety requirements for dangerous goods), forcing continuous compliance updates and complex packaging redesigns. The commercial segment is highly sensitive to operational costs, meaning that even marginal gains in fuel efficiency or reduction in procurement complexity can significantly sway purchasing decisions from high-volume restaurant chains. Conversely, the growing momentum behind corporate social responsibility (CSR) initiatives places pressure on suppliers to demonstrate a commitment to low-carbon footprint production and packaging, transforming sustainability from a niche selling point into a core market expectation.

Segmentation Analysis

The Hot Pot Fuel Market is systematically segmented primarily based on the type of fuel used, the intended application setting (commercial versus residential), and the distribution channel employed for sales. This comprehensive segmentation allows market participants to tailor product development, pricing strategies, and marketing efforts to specific consumer needs and regulatory landscapes. Analysis reveals that segmentation by fuel type, particularly differentiating between hydrocarbon gases (butane, propane) and alcohol-based gels (methanol, ethanol), highlights variations in performance, safety profiles, and cost structures, which are critical determinants for end-user selection. Understanding these segment dynamics is essential for accurately forecasting demand and identifying underserved market niches, especially concerning emerging non-toxic or bio-based fuel formulations designed for eco-conscious consumers.

- By Fuel Type

- Butane Fuel

- Propane Fuel

- Gel Fuel (Methanol/Ethanol Based)

- Solid Fuel (Hexamine, Trioxane)

- Others (e.g., specialized mixed gases)

- By Application

- Commercial (Restaurants, Catering Services)

- Residential (Home Use, Portable Outdoor Use)

- By Distribution Channel

- Online Retail (E-commerce Platforms)

- Offline Retail (Supermarkets, Specialty Stores, Wholesalers)

Value Chain Analysis For Hot Pot Fuel Market

The value chain of the Hot Pot Fuel Market begins with upstream activities involving the sourcing and refinement of raw materials—primarily hydrocarbons (butane/propane) or petrochemicals (for gel components) and high-quality metal/aluminum for canister fabrication. Key upstream suppliers include large-scale oil and gas refiners and specialized chemical producers. Efficiency in this stage is crucial, as the fluctuating costs of crude oil and natural gas directly influence the final price point of the fuel products. Quality control at the sourcing level ensures fuel purity, which is vital for safe and consistent combustion performance, thus mitigating risks of burner failure or residue buildup during use.

Midstream processing involves specialized manufacturing, blending, and rigorous testing processes. Fuel manufacturers receive the raw materials, purify them further, blend stabilizers (if needed), and then execute the high-precision filling and sealing of the canisters or packaging of the gel/solid fuels. This stage requires significant capital investment in advanced machinery compliant with international safety standards (e.g., pressure testing). Downstream activities focus on logistics, warehousing, and distribution. Given the classification of these products as hazardous materials, specialized logistics providers capable of handling and transporting volatile goods safely and compliantly are integral to ensuring efficient market penetration.

The distribution channel is dichotomized into direct and indirect routes. Direct sales often involve large manufacturers supplying major commercial restaurant chains or institutional caterers through dedicated B2B sales teams, offering volume discounts and customized supply schedules. Indirect distribution utilizes wholesalers, specialized equipment suppliers, and retailers (both brick-and-mortar supermarkets and e-commerce platforms) to reach smaller commercial entities and the vast residential consumer base. E-commerce platforms are increasingly serving as a critical indirect channel, offering convenience and broader regional reach, though facing challenges related to shipping restrictions for pressurized canisters. Effective distribution management ensures product availability across diverse geographic and regulatory environments, maximizing market reach and minimizing stock-out scenarios.

Hot Pot Fuel Market Potential Customers

The primary end-users and buyers of hot pot fuel are broadly categorized into the Commercial Foodservice Sector and the Residential Consumer Base. The Commercial segment represents the largest volume purchaser, encompassing dedicated hot pot specialty restaurants, general Asian restaurants (Chinese, Korean, Vietnamese), catering companies, and institutional food services (hotels, convention centers). These buyers prioritize performance (high BTU output), reliability, bulk packaging options, and consistent supply continuity to manage high-throughput operations. The decision-makers here are typically procurement managers or head chefs, focusing heavily on cost-per-hour efficiency and adherence to local fire safety codes.

The Residential segment consists of individual consumers who prepare hot pot at home, driven by cultural tradition, social gatherings, or simply enjoying the culinary style. This segment is highly sensitive to product safety, ease of storage, minimal odor, and user-friendly designs (e.g., self-sealing valves). Within the residential market, sub-segments include young professionals seeking portable solutions for apartment living and larger families seeking traditional, high-capacity fuels for frequent use. Growth in this area is heavily influenced by marketing that emphasizes convenience and safety, often favoring gel fuels or smaller, standardized butane canisters available readily through local retail outlets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coleman Company Inc., Sterno Products, Crown Cans, MSR Global Gear, Kovea Co. Ltd., Gas One, Safeflame, Zhejiang Supor Co. Ltd., Master Heat, G&M Kitchen, Toplead Industrial, Alpin, Shenzhen Wecome Industrial Co., Tofasco of America, Inc., Frico, Coghlan's Ltd., Jetboil Inc., Primus AB, GSI Outdoors, Esbit GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Pot Fuel Market Key Technology Landscape

The technology landscape for the Hot Pot Fuel Market is primarily centered on enhancing safety, improving energy efficiency, and promoting sustainability through advanced material science and engineering. For butane and propane fuels, major technological advancements involve the design of self-sealing safety valves and explosion-proof canisters, which are critical for mitigating risks associated with accidental overpressure or high heat exposure. Modern canisters utilize high-strength, lightweight alloys and sophisticated welding techniques to ensure structural integrity under extreme conditions, often exceeding required regulatory thresholds. Furthermore, proprietary blending techniques are employed to optimize the purity and chemical composition of the fuel mix, ensuring cleaner combustion, reduced soot, and maximized heat output (BTU) for commercial applications.

In the realm of gel and solid fuels, innovation focuses heavily on developing non-toxic, odorless, and cleaner-burning formulations. The shift toward bio-ethanol and plant-derived gels represents a significant technological leap, addressing consumer demands for eco-friendly products. Research and Development (R&D) efforts are concentrated on stabilizing these natural compositions to provide long burn times and consistent, adjustable flame intensity, matching the performance traditionally offered by petrochemical alternatives. Packaging technology is also crucial; advancements in polymer-based containers for gel fuels ensure zero leakage, extended shelf life, and ease of disposal, thereby appealing strongly to the residential user base who prioritize cleanliness and convenience.

Beyond the fuel itself, the interconnected technology of the heating apparatus is pivotal. Modern portable hot pot stoves are increasingly incorporating advanced piezoelectric ignition systems for reliable startup and precise heat regulation mechanisms. Thermal management technology, often utilizing ceramic or insulated metal components, minimizes heat loss to the surrounding environment, thereby increasing the effective transfer of heat to the hot pot vessel and reducing overall fuel consumption. The integration of IoT (Internet of Things) sensors in high-end commercial burners allows for real-time monitoring of fuel levels, pressure, and temperature, enabling predictive maintenance and enhanced safety compliance, signaling a move towards smart kitchen infrastructure within the foodservice sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter and largest market for hot pot fuel, characterized by deeply entrenched cultural acceptance and high population density, particularly in China, Japan, and South Korea. The market here is highly competitive, dominated by large-scale domestic manufacturers and characterized by high consumption of butane in commercial settings and solid/gel fuel in traditional residential or roadside dining. Growth is steady but substantial, driven by urbanization and expanding middle-class disposable income, allowing for increased dining-out experiences and home entertainment. Regulatory harmonization across ASEAN nations concerning fuel standards remains a key development area.

- North America: North America represents the fastest-growing region, fueled by immigration from Asian countries, the rapid growth of specialized ethnic restaurants, and a significant increase in consumer interest in international home cooking. The market here demands high-safety compliance, premium packaging, and convenient distribution, favoring standardized butane canisters and high-quality bio-ethanol gels. E-commerce plays a crucial role in reaching geographically dispersed consumers, often focusing on branded, high-margin specialty fuels.

- Europe: The European market shows moderate, consistent growth, concentrated primarily in major metropolitan areas with diverse cultural populations (e.g., London, Paris, Berlin). Demand is split between commercial catering services and residential users seeking novel dining experiences. Regulatory bodies such as the European Union impose strict environmental and safety directives (e.g., REACH regulations), driving innovation towards safer, low-VOC (Volatile Organic Compound) fuel solutions.

- Latin America (LATAM): While traditionally small, the LATAM market is gradually expanding, particularly in urban centers like São Paulo and Mexico City, reflecting diversifying culinary tastes and increased international investment in the hospitality sector. Demand is primarily nascent and focused on imported, standardized butane products, with price sensitivity being a significant factor influencing purchasing decisions.

- Middle East and Africa (MEA): The MEA market is currently the smallest but holds long-term potential, especially within the luxury hospitality sector and high-income expatriate communities. Adoption is linked to the expansion of premium international hotel chains and specialized Asian fusion restaurants, demanding reliable, high-specification fuels that can perform consistently in high ambient temperatures prevalent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Pot Fuel Market.- Coleman Company Inc.

- Sterno Products

- Crown Cans

- MSR Global Gear

- Kovea Co. Ltd.

- Gas One

- Safeflame

- Zhejiang Supor Co. Ltd.

- Master Heat

- G&M Kitchen

- Toplead Industrial

- Alpin

- Shenzhen Wecome Industrial Co.

- Tofasco of America, Inc.

- Frico

- Coghlan's Ltd.

- Jetboil Inc.

- Primus AB

- GSI Outdoors

- Esbit GmbH

Frequently Asked Questions

Analyze common user questions about the Hot Pot Fuel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the safest type of fuel for residential hot pot use?

Gel Fuel (Methanol/Ethanol based) is generally considered the safest option for residential use due to its non-pressurized nature, minimal risk of leakage, and ease of storage and disposal, minimizing potential combustion hazards compared to compressed gases.

How does the global growth of Asian cuisine impact hot pot fuel demand?

The globalization of Asian cuisine significantly drives demand by increasing the number of commercial hot pot restaurants worldwide and introducing the dining style to new residential consumers, thereby raising the overall volume requirement for reliable, high-performance fuel sources.

Are butane canisters in the market recyclable and environmentally friendly?

Modern butane canisters are typically made from recyclable steel or aluminum. However, they must be completely empty and processed according to local hazardous waste guidelines to be recycled safely. The industry is increasing focus on bio-based fuels to improve overall environmental sustainability.

What are the primary factors driving commercial adoption of high-purity butane fuel?

Commercial establishments prefer high-purity butane fuel due to its consistent, high heat output (BTU), which speeds up cooking times and maximizes operational efficiency, coupled with standardized sizing that ensures compatibility with professional-grade portable burners.

How is regulatory pressure influencing innovation in hot pot fuel technology?

Strict safety regulations, particularly in North America and Europe, are compelling manufacturers to innovate in areas such as explosion-proof canister designs, self-sealing valves, and the rapid development of low-odor, non-toxic, and bio-degradable fuel formulas to ensure global compliance and consumer safety.

Detailed Market Dynamics and Competitive Landscape

In-Depth Analysis of Market Drivers

The overarching driver for the Hot Pot Fuel Market is the cultural phenomenon surrounding communal dining, specifically the rising popularity of the hot pot experience beyond its traditional Asian boundaries. This cultural transfer is not merely a transient food trend but a sustainable shift in consumer preferences towards interactive and customizable dining formats. Restaurants specializing in hot pot are expanding rapidly, requiring scalable and dependable fuel solutions. This growth necessitates continuous bulk supply of commercial-grade fuels, creating a stable, high-volume demand foundation for manufacturers. Moreover, increased domestic travel and outdoor recreational activities, such as camping and portable grilling, are driving the residential segment's need for compact, easily transportable fuel options, often relying on small butane or solid fuel canisters which contribute significantly to segment revenue.

Technological refinement in burner and appliance design also acts as a powerful driver. As portable hot pot burners become more efficient and safer, consumer adoption increases. Modern burners are optimized to maximize heat transfer while minimizing fuel waste, incentivizing users to maintain the hot pot dining routine. This symbiosis between appliance innovation and fuel quality requires manufacturers to continuously refine fuel purity and consistency. For instance, the introduction of advanced safety mechanisms in burners requires corresponding high-specification fuel canisters to ensure operational integrity and consumer confidence. This feedback loop ensures that advancements in one area spur demand and quality improvement in the other, reinforcing the market’s positive trajectory.

Economic factors, such as rising disposable incomes globally, particularly in emerging markets across APAC, further accelerate market growth. Higher purchasing power allows consumers to allocate more budget towards specialized cooking methods and dining experiences, both at home and in premium restaurants. The convenience factor associated with ready-to-use fuel systems, eliminating the complexity of traditional heating methods like charcoal or bulky electrical setup, is highly appealing to urban dwellers seeking efficient culinary solutions. This blend of cultural appeal, technological efficiency, and economic capacity creates a robust demand environment for diverse hot pot fuel products.

Detailed Analysis of Market Restraints

One of the most significant restraints is the complex and stringent regulatory landscape governing the production, transport, and storage of compressed flammable gases. International shipping regulations (e.g., IATA, IMO standards for Dangerous Goods) impose high logistical barriers, increasing costs and complexity for cross-border trade of butane and propane canisters. Manufacturers must invest heavily in compliance, specific hazard testing, and specialized packaging, which often raises the final consumer price and limits the ability of smaller enterprises to compete effectively on an international scale. Non-compliance can lead to severe penalties, product recalls, and reputational damage, making regulatory adherence a critical, costly operational hurdle.

Another restraint involves the inherent volatility and price fluctuations of raw materials, primarily crude oil and natural gas derivatives. Since butane and propane are petroleum byproducts, geopolitical tensions, and global commodity price swings directly impact the cost of manufacturing hot pot fuel. This volatility makes long-term pricing contracts challenging and creates uncertainty in margin planning for fuel suppliers. Rapid increases in raw material costs must either be absorbed by the manufacturer, compressing profitability, or passed on to the end consumer, potentially dampening demand, especially in price-sensitive markets.

Furthermore, safety concerns and incidents related to fuel misuse or faulty equipment continue to pose a restraint on residential market expansion. Despite advancements in safety features, public perception of pressurized gas canisters carries an inherent risk of leakage or explosion if improperly handled or stored. Negative media coverage of accidents, though rare, can significantly impact consumer confidence and prompt shifts towards perceived safer alternatives like electric hot pots or non-pressurized gel fuels. This necessitates ongoing public education and investment in robust, consumer-facing safety assurance programs by market leaders to mitigate adverse public perception.

Strategic Market Opportunities

The transition toward sustainable and bio-based fuel alternatives presents a monumental market opportunity. Consumers are increasingly demanding products with a low carbon footprint, creating a niche for bio-ethanol, recycled plant oil-based gels, and other novel, environmentally friendly combustion sources. Companies that successfully invest in R&D to commercialize stable, high-performing green fuels that meet regulatory standards will capture a significant first-mover advantage, particularly in mature Western markets where environmental consciousness is high. This opportunity extends beyond just the fuel composition to include sustainable packaging, such as recyclable materials and reduced plastic usage.

Digitalization and the expansion of specialized B2B e-commerce platforms offer a significant avenue for growth, particularly for supplying the fragmented commercial market. By utilizing online channels, fuel providers can bypass traditional, often inefficient, wholesaler networks, offering direct-to-restaurant bulk sales. This improves transparency, reduces lead times, and allows for customized inventory management solutions for high-volume buyers. Leveraging digital platforms to offer subscription models or automated reordering systems enhances customer loyalty and secures recurring revenue streams, optimizing the supply chain for both manufacturers and commercial end-users.

Geographic market penetration, particularly focusing on emerging secondary cities in APAC and high-growth urban centers in Latin America and MEA, represents untapped potential. As consumer wealth and cultural curiosity grow in these areas, localized manufacturing and distribution partnerships will be crucial. Tailoring products to meet specific regional heat output needs, safety regulations, and pricing sensitivities can unlock significant new market share, diversifying dependence away from hyper-competitive established markets like China and South Korea.

Commercial Application Deep Dive

The commercial segment is the bedrock of the Hot Pot Fuel Market, encompassing thousands of specialized restaurants, general Asian eateries, and extensive catering operations. The defining characteristic of this segment is the demand for extreme reliability and high thermal efficiency. Commercial users operate burners continuously for multiple hours during peak service times, requiring fuels that offer consistent pressure, minimal residual odor that could interfere with dining ambiance, and exceptional value per usage hour. Butane and mixed gas fuels dominate this application due to their superior calorific value and the standardized equipment designed around these fuel types, enabling seamless integration into professional kitchen operations.

Procurement within the commercial sector is highly cost-sensitive, yet quality remains non-negotiable, particularly safety certifications. Restaurant owners and procurement managers prioritize long-term supply agreements that guarantee stable pricing and reliable delivery, often demanding bulk packaging solutions to minimize waste and handling labor. The trend towards centralized kitchen management and standardized operational protocols across restaurant chains further drives demand for certified, consistent product batches. Manufacturers who can demonstrate superior safety records, consistent BTU ratings, and streamlined B2B logistics gain a decisive competitive edge in servicing large-scale commercial contracts.

As the foodservice industry recovers and grows post-pandemic, the use of portable hot pot systems in outdoor dining and specialized catering events is also surging, broadening the commercial demand base beyond fixed-location restaurants. This expansion requires fuel suppliers to offer versatile products suitable for varied climatic conditions and rapid deployment, emphasizing ease of use and safety protocols suitable for temporary setups. The commercial segment is thus not only large but also highly demanding in terms of performance specifications, compliance, and logistics efficiency, dictating the quality benchmarks for the entire market.

- Key Commercial Requirements:

- High Thermal Output (BTU) and Consistent Pressure.

- Standardized Canister Sizes for Universal Equipment Fit.

- Volume Discounts and Reliable Bulk Delivery Schedules.

- Strict Adherence to Commercial Fire Safety and Health Codes.

- Dominant Fuel Types:

- Butane Fuel (High Purity)

- Butane/Propane Mixed Gases (for high altitude or cold environments)

- Primary Purchase Drivers:

- Cost Efficiency Per Hour of Operation.

- Brand Reputation for Safety and Reliability.

- Streamlined Supply Chain Management.

Residential Application Deep Dive

The residential application segment is characterized by rapid growth and a high focus on consumer safety, convenience, and aesthetic design. Residential users typically purchase smaller quantities of fuel for intermittent use, such as social gatherings or weekly home cooking. This segment is less concerned with peak thermal output required by commercial entities and more focused on odor neutrality, ease of storage in small living spaces, and tamper-proof safety features. The growing popularity of electric hot pots poses a competitive threat, pushing fuel manufacturers to heavily market the portability and cultural authenticity offered by traditional fuel-based hot pot methods.

Gel fuels and smaller, color-coded butane canisters are highly favored in the residential market. Gel fuels, derived from alcohol, are often preferred for their visible flame, non-pressurized packaging, and minimal risk of leakage, making them suitable for indoor dining tables. Marketing efforts here often leverage social media and culinary influencers, highlighting the experience and social aspects of hot pot dining at home. Furthermore, the residential market demonstrates higher brand loyalty for established names recognized for their robust safety records and clear user instructions, mitigating consumer hesitation associated with flammable products.

The distribution landscape for the residential segment relies heavily on immediate retail availability. Supermarkets, hypermarkets, and specialized Asian grocery stores serve as primary sales points, where consumers can easily integrate fuel purchases with their weekly food shopping. E-commerce facilitates the purchase of specialized accessories and fuel bundles, particularly targeting consumers in areas lacking dedicated ethnic food retailers. Innovation in this segment is centered on creating 'smart' packaging that clearly indicates usage instructions and residual fuel levels, enhancing the overall user experience and promoting responsible consumption.

- Key Residential Requirements:

- Superior Safety Features and Low Explosion Risk.

- Odorless or Minimal Odor Combustion.

- Compact Size and Ease of Storage.

- Availability at Standard Retail and Grocery Stores.

- Dominant Fuel Types:

- Gel Fuel (Bio-ethanol focus)

- Standardized Small Butane Canisters

- Primary Purchase Drivers:

- Perceived Safety and Ease of Handling.

- Price Point and Shelf Accessibility.

- Brand Trust and Positive User Reviews.

Fuel Type Segmentation Analysis

Segmentation by fuel type is critical as it defines performance, cost, and usage suitability across applications. Butane fuel holds the largest market share globally, primarily due to its high efficiency in commercial settings and its standardized compatibility with widely available portable stoves. Butane burns cleanly and provides high heat, making it ideal for the rapid boiling and continuous simmering required in hot pot restaurants. However, butane's performance is temperature-sensitive; its boiling point is near freezing, making it unsuitable for very cold environments or high altitudes without blending it with propane, leading to the use of mixed gases.

Gel fuel, predominantly composed of methanol or ethanol, represents the fastest-growing segment, especially in the residential and catering markets. Its key advantage is safety—it is not pressurized and burns as a liquid, virtually eliminating the risk of explosion associated with compressed gases. Although gel fuels typically offer a lower BTU output compared to butane, their convenience, ease of transport, and lack of specialized regulatory storage requirements make them increasingly popular. The shift towards bio-ethanol formulations addresses sustainability concerns, further enhancing its appeal to environmentally conscious consumers.

Propane fuel, often supplied in larger refillable tanks or specialized small canisters, primarily serves the outdoor, camping, and large-scale catering segment where robust performance in varied weather conditions is necessary. While highly efficient, propane equipment tends to be bulkier and often requires specialized burners, limiting its widespread adoption in standard indoor residential or small-scale commercial hot pot settings. Solid fuels, such as hexamine tablets, cater to the highly portable, ultra-lightweight market niche, such as hiking or emergency use, but their limited burn time and potential for residual smell restricts their use in conventional indoor hot pot dining.

- Butane Fuel Characteristics:

- High Calorific Value and Rapid Heat Generation.

- Cost-effective for bulk commercial usage.

- Performance limitations in cold climates.

- Gel Fuel Characteristics:

- Non-pressurized, superior safety profile.

- Ideal for residential use and upscale catering.

- Focus on bio-based and odorless formulations.

- Propane Fuel Characteristics:

- Excellent performance in low temperatures and high altitudes.

- Requires specialized, often larger, equipment.

- Primary use in outdoor and large event settings.

Distribution Channel Analysis

The distribution of hot pot fuel is a complex logistical exercise due to its classification as a hazardous material. The Offline Retail channel, encompassing supermarkets, hypermarkets, specialty Asian grocery stores, and wholesale clubs, remains the dominant route for residential consumers seeking immediate product availability. Wholesalers also act as critical intermediaries, consolidating shipments and providing local distribution to smaller commercial restaurants and independent retailers, ensuring broad physical market coverage and enabling consumers to purchase familiar brands conveniently during routine shopping trips.

The Online Retail channel, including proprietary manufacturer websites and major e-commerce marketplaces (e.g., Amazon, regional giants), is growing rapidly. This channel is crucial for reaching niche markets and geographically dispersed customers, particularly in North America and Europe, where specialized Asian grocery stores may be scarce. However, online sales of pressurized butane canisters face significant regulatory hurdles and increased shipping costs associated with hazardous material handling, often requiring specialized carrier agreements and compliance documentation. Consequently, online platforms frequently promote gel and solid fuels that are easier and cheaper to ship.

Direct Distribution, where manufacturers deal directly with large national or international restaurant chains, is vital for securing high-volume, long-term contracts in the commercial segment. This direct approach allows for stringent quality control, customized product specifications (e.g., specific valve types), and optimized just-in-time inventory management, reducing the reliance on intermediaries and ensuring predictable pricing for commercial buyers. Effective distribution management, regardless of the channel, requires significant investment in inventory tracking technology and logistics expertise to navigate global trade regulations efficiently.

- Offline Retail (Dominant for Volume):

- Supermarkets and Hypermarkets (High consumer traffic).

- Specialty/Ethnic Grocery Stores (Targeted consumer base).

- Wholesalers (Supply chain consolidation for small businesses).

- Online Retail (Fastest Growth):

- E-commerce Marketplaces (Broad geographical reach).

- Manufacturer Direct Websites (Brand loyalty and niche products).

- Logistical Challenge: Compliance with hazardous material shipping rules.

- Direct Distribution (Commercial Focus):

- Large Contract Management with Restaurant Chains.

- Guaranteed supply and customized logistic solutions.

Future Outlook and Emerging Trends

The future of the Hot Pot Fuel Market will be heavily defined by sustainability mandates and the integration of smart technology. The widespread implementation of net-zero targets globally will accelerate the shift away from purely fossil-fuel-derived hot pot fuels toward bio-alcohols and synthetic, clean-burning alternatives. Regulatory bodies are expected to impose stricter carbon taxes and emission limits, making sustainable sourcing a critical competitive factor. Furthermore, standardization efforts focusing on recyclable canister design and biodegradable packaging will dominate material science R&D over the next decade. These developments signal a fundamental transformation of the industry towards a more environmentally conscious operational model.

From a consumer perspective, the market is poised to see greater differentiation between the commercial and residential segments. Commercial users will increasingly adopt IoT-enabled burners that communicate fuel consumption data back to central inventory systems, optimizing ordering and reducing waste. Residential consumers, driven by safety concerns, will continue to increase demand for electric or induction hot pot systems, compelling fuel manufacturers to focus on highly portable, high-quality, and niche application products, such as premium fuels for specialized outdoor/gourmet cooking that electricity cannot easily replicate. The rise of hybrid dining models—combining outdoor communal cooking with indoor experiential dining—will also generate demand for versatile fuel options.

Geographically, while APAC maintains its market leadership, market expansion will hinge on successful penetration of secondary tier cities in China and India, alongside sustained rapid growth in North America and Western Europe. Success in these emerging high-growth zones requires strategic marketing that bridges the gap between traditional Asian cuisine and local consumer preferences, often emphasizing the fuel's role in creating an authentic, safe, and convenient dining experience. Cross-border mergers and acquisitions among regional fuel suppliers and global appliance manufacturers are anticipated, aimed at consolidating market share and leveraging integrated technologies across the value chain, ensuring comprehensive market coverage from raw material to end-user appliance.

Economic Impact and Investment Analysis

The Hot Pot Fuel Market contributes significantly to the global portable cooking industry ecosystem. Investment analysis shows robust capital flows into R&D for safety technology, particularly in self-venting and pressure-relief mechanisms within canisters, attracting specialized engineering firms. The market supports a complex global supply chain involving chemical processing plants, specialized metal fabricators for canister production, and a vast network of logistics companies trained in handling dangerous goods. Economic stability is tied closely to oil and gas markets, making investment vulnerable to commodity price volatility, yet mitigated by the steady, non-cyclical demand for food services.

For investors, the market offers stable returns due to the recurring nature of consumption, particularly within the high-volume commercial sector. Key investment areas include companies specializing in high-purity butane blending technology, manufacturers who hold extensive international safety certifications (e.g., DOT, TUV), and emerging startups focused on novel bio-fuel development. Regional investment disparities exist; APAC investment often targets large-scale, high-efficiency manufacturing capacity, while North American and European investments focus on brand premiumization and compliance with increasingly demanding environmental and safety regulations, prioritizing margin over sheer volume.

The socio-economic impact includes providing employment in specialized manufacturing and logistics roles. Furthermore, the

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager