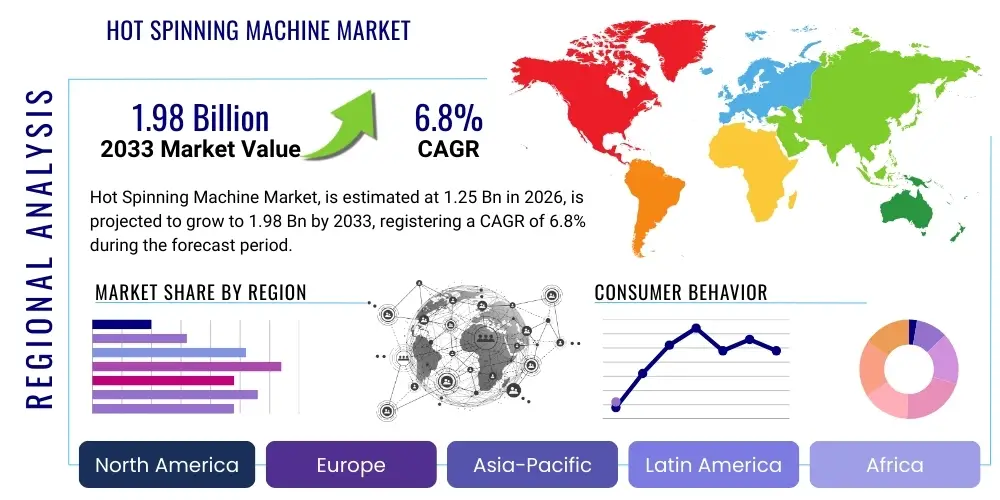

Hot Spinning Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443574 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hot Spinning Machine Market Size

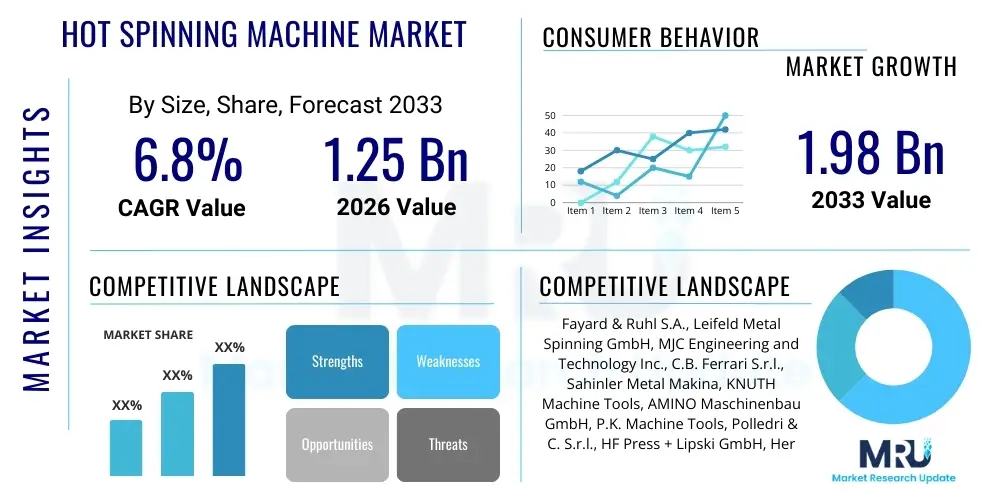

The Hot Spinning Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by increasing demand for high-strength, lightweight, and complex symmetrical components across strategic industries such as aerospace, automotive manufacturing, and pressure vessel production, necessitating advanced metal forming capabilities that only hot spinning techniques can efficiently deliver.

Hot Spinning Machine Market introduction

The Hot Spinning Machine Market encompasses advanced metal forming equipment utilized to manufacture seamless, rotationally symmetrical hollow components. This specialized process involves applying localized heat and rotational force to a flat metal blank or preform, causing the material to deform precisely over a mandrel. Hot spinning is particularly critical when working with materials that exhibit low ductility at ambient temperatures, such as high-strength steel alloys, nickel-based superalloys, and titanium, which require elevated temperatures to facilitate plastic deformation and prevent cracking or excessive work hardening. The resulting products are characterized by exceptional structural integrity, fine grain structure, and uniform wall thickness, making them ideal for high-stress applications in modern engineering.

Major applications for hot spinning technology span several high-value sectors. In the aerospace industry, hot spinning machines produce critical components such as rocket motor casings, missile domes, jet engine cones, and lightweight fuel tanks, where component consistency and material performance are paramount. Within the automotive sector, hot spinning is increasingly used for manufacturing high-performance wheel rims, specialized drivetrain components, and exhaust system parts that require superior thermal and mechanical resistance. Furthermore, the technology is indispensable for producing seamless ends and shells for pressure vessels, gas cylinders, and heat exchangers in the energy and chemical processing industries. The inherent benefits of hot spinning, including material savings, near-net shape production, improved mechanical properties due to grain flow alignment, and reduced machining time, collectively serve as powerful driving factors for sustained market growth globally, particularly as manufacturers prioritize efficiency and component reliability.

The market is defined by continuous innovation focused on enhancing machine precision, thermal control, and automation capabilities. Modern hot spinning machines integrate advanced Computer Numerical Control (CNC) systems, multi-axis roller mechanisms, and sophisticated induction heating units to manage complex geometric specifications and material temperature profiles with high accuracy. The current market landscape is characterized by competition focused on machine reliability, maximum component size capacity, and the ability to handle exotic materials. As industrial requirements shift towards lighter, stronger materials (crucial for electric vehicle range extension and hypersonic applications), the demand for robust and highly controllable hot spinning solutions is escalating, solidifying its position as a cornerstone technology in precision metal fabrication.

Hot Spinning Machine Market Executive Summary

The Hot Spinning Machine Market is undergoing significant transformation driven by intersecting trends in industrial automation, material science advancements, and global supply chain reconfigurations. Business trends indicate a clear pivot toward fully automated, integrated manufacturing cells where hot spinning machines operate seamlessly with robotic material handling and in-line quality verification systems. Manufacturers are increasingly seeking customized solutions capable of handling exotic alloys like Inconel and specialized titanium grades, pushing equipment providers to develop machines with higher spindle power, advanced thermal management, and sophisticated adaptive control software. Consolidation among smaller, specialized machine builders and larger, diversified industrial equipment suppliers is shaping the competitive landscape, focused on optimizing global service networks and intellectual property rights related to proprietary forming algorithms, ensuring specialized expertise remains a core differentiator in equipment sales.

Regional trends reveal the Asia Pacific (APAC) region continuing its dominance in terms of volume manufacturing capacity, largely driven by massive infrastructure projects, burgeoning automotive production (including a heavy focus on EV components requiring lightweight parts), and expanding defense manufacturing capabilities, particularly in China and India. Conversely, North America and Europe are distinguished by their focus on high-precision, low-volume production for the aerospace and defense sectors, prioritizing technological superiority, process traceability, and compliance with rigorous regulatory standards (e.g., FAA, EASA, TUV). Investment in retrofitting older machinery with modern CNC and sensor technology is a prevailing trend in mature markets to extend equipment lifespan and improve efficiency without the full commitment of capital expenditure for new installations, highlighting the need for robust aftermarket and service support across all major industrial geographies.

Segment trends demonstrate strong growth in the medium-to-large capacity machine segment, driven by the increasing size requirements for aerospace components and industrial pressure vessels. The market for multi-roller spinning systems, which offer superior control over wall thickness distribution and material flow, is expanding rapidly compared to conventional single-roller systems. Material segmentation shows escalating demand for machines optimized specifically for high-temperature and refractory metals, driven by energy sector applications and next-generation aircraft engine components. Furthermore, the rising integration of IoT sensors and data analytics platforms within hot spinning equipment, designed to offer real-time process monitoring and predictive maintenance, is defining the premium segment, enabling manufacturers to optimize yield rates and minimize costly downtime associated with high-precision forming operations.

AI Impact Analysis on Hot Spinning Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hot Spinning Machine Market frequently center on themes of process optimization, quality assurance, and predictive maintenance. Users are keen to understand how AI-driven predictive modeling can eliminate the trial-and-error approach often necessary for setting optimal spinning parameters (like roller speed, feed rate, and temperature gradient) for new materials or geometries. Concerns also revolve around integrating AI for real-time defect detection during the spinning process itself, moving beyond post-process inspection to ensure zero-defect manufacturing in highly critical components. Furthermore, industrial stakeholders are exploring how AI can manage the complex thermal profiles involved in hot spinning, ensuring material properties are maintained throughout the deformation cycle, thereby enhancing overall yield and reducing material waste, which is particularly expensive when dealing with superalloys.

The implementation of AI algorithms, particularly Machine Learning (ML), is fundamentally transforming the operational paradigm of hot spinning machines from static programs to dynamically adaptive systems. ML models are trained on massive datasets comprising historical operational parameters, sensor readings (temperature, pressure, torque), and corresponding quality metrics (dimensional accuracy, microstructure analysis). This allows the AI to develop highly accurate predictive models that recommend or automatically adjust spinning parameters in real-time based on the material's actual response during deformation. For instance, if minor variations in raw material composition or initial blank temperature are detected, the AI can instantaneously modify roller path or heat input to maintain the specified final geometry and metallurgical integrity, ensuring consistent component quality even in the presence of inherent manufacturing variability, a significant leap forward in precision forming.

Beyond process control, AI is crucial for optimizing the machine lifecycle and maintenance scheduling. By analyzing vibration data, motor current fluctuations, and cooling system performance trends, AI can predict potential component failures in critical parts like mandrels, rollers, or induction heating coils long before catastrophic failure occurs. This shift from time-based or reactive maintenance to condition-based predictive maintenance (PdM) significantly reduces unplanned downtime, maximizes machine availability, and lowers overall operational costs. The synthesis of sensor data via AI also plays a vital role in supply chain resilience, forecasting tool wear and material consumption rates with greater accuracy, allowing manufacturers to optimize inventory levels and ensuring that specialized tools and raw material stock are precisely managed based on forecasted production requirements and equipment health status.

- AI-driven predictive maintenance reducing unplanned downtime by optimizing component replacement schedules.

- Real-time adaptive control of spinning parameters (temperature, feed rate, roller pressure) based on material feedback.

- Machine Vision and Deep Learning algorithms for instantaneous detection and classification of surface and internal defects during the spinning operation.

- Optimization of energy consumption by dynamically adjusting induction heating cycles based on material temperature requirements and process stage.

- Enhanced tool life management through ML analysis of stress patterns and wear rates on mandrels and forming rollers.

DRO & Impact Forces Of Hot Spinning Machine Market

The dynamics of the Hot Spinning Machine Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing investment and technological development. A primary Driver is the relentlessly increasing demand for lightweight and high-strength components, particularly within the commercial aerospace and rapidly expanding electric vehicle (EV) sectors. The need for larger, seamless rocket casings and lightweight, durable EV battery casings and motor components necessitates the precision and material properties achievable through hot spinning. Furthermore, global defense modernization programs, requiring high-tolerance parts for missile systems and advanced aircraft, continue to ensure a stable and high-value customer base for this advanced manufacturing technology. The ability of hot spinning to minimize material waste compared to traditional subtractive manufacturing processes also makes it highly attractive in the context of rising raw material costs and sustainability mandates across mature industrial economies.

Conversely, the market faces significant Restraints, most notably the exceedingly high capital expenditure required for acquiring and installing advanced hot spinning machinery, which represents a substantial barrier to entry for smaller manufacturers and limits widespread adoption. These machines require specialized infrastructure, including sophisticated thermal management and controlled atmosphere capabilities, adding to the initial investment burden. A related constraint is the severe shortage of highly skilled operators and maintenance technicians capable of programming, troubleshooting, and operating these complex CNC-controlled systems. The hot spinning process, especially when handling exotic alloys, requires deep expertise in metallurgy and forming mechanics, a skill set that takes years to cultivate, creating operational bottlenecks and driving up labor costs in key manufacturing hubs worldwide. Furthermore, the inherent limitations in achieving highly non-symmetrical component geometries can restrict its application scope compared to other forming methods.

Opportunities for growth are concentrated in the continuous integration of Industry 4.0 technologies and the development of hybrid manufacturing techniques. The integration of robotic automation for loading, unloading, and in-process component manipulation offers immense potential for improving throughput and ensuring operator safety in high-temperature environments. Another significant opportunity lies in developing hot spinning techniques capable of working with novel materials like metal matrix composites or customized additive manufactured preforms, potentially allowing for the creation of components with functional graded properties. Expanding into emerging markets, especially those investing heavily in domestic infrastructure and manufacturing capacity (e.g., Southeast Asia, Brazil, and parts of the Middle East), presents untapped geographical opportunities. Finally, equipment manufacturers focusing on providing modular, easily reconfigurable systems that can quickly adapt to changing production specifications will gain a competitive edge by lowering the total cost of ownership for end-users, addressing a key restraint.

Segmentation Analysis

The Hot Spinning Machine Market is segmented primarily based on machine type, component application, process configuration, and end-user industry. Analyzing these segments provides strategic insights into areas of highest growth and technological differentiation. Machine type segmentation differentiates between vertical and horizontal configurations, determined by the size and geometric orientation of the components being spun. Application segmentation highlights the specific products manufactured, such as shells, cones, tubes, and specialized domes, which dictate the machine’s required torque and thermal capacity. The fastest-growing segment often revolves around machines designed for high-tonnage multi-roller configurations, offering superior dimensional accuracy and material control necessary for demanding aerospace and energy components, thereby maximizing operational flexibility and material strength properties.

- By Machine Type:

- Horizontal Spinning Machines

- Vertical Spinning Machines

- CNC Spinning Machines

- Conventional Spinning Machines

- By Configuration:

- Single-Roller Systems

- Multi-Roller Systems

- Shear Spinning Machines

- Flow Forming Machines

- By End-User Industry:

- Aerospace and Defense

- Automotive (Including EV Components)

- Oil and Gas / Pressure Vessels

- Industrial Machinery

- Chemical and Petrochemical

- By Application/Component:

- Cones and Nozzles

- Cylinders and Tubes

- Tank Heads and Domes

- Wheel Rims and Turbine Components

- By Material Processed:

- High-Strength Steel Alloys

- Aluminum Alloys

- Titanium Alloys

- Nickel-Based Superalloys

Value Chain Analysis For Hot Spinning Machine Market

The Value Chain for the Hot Spinning Machine Market commences with the upstream analysis involving raw material and specialized component suppliers, including high-precision bearing manufacturers, sophisticated CNC controller providers, and specialized suppliers of high-power induction heating elements and sensors. Critical reliance is placed on proprietary software developers who provide the complex modeling and simulation packages essential for designing and optimizing the spinning process before physical manufacturing begins. The primary value addition step is performed by the Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the final machines. This phase requires intense R&D investment focused on developing proprietary forming kinematics and thermal management systems that differentiate market leaders based on machine performance, reliability, and the ability to process challenging materials at scale and high precision, encapsulating significant intellectual property value within the machine design.

The downstream analysis focuses on the distribution and end-use stages. Distribution channels are typically a mix of direct sales engagement for large, highly customized machinery and indirect channels utilizing regional distributors or sales representatives who provide localized support and technical expertise, especially in emerging markets. Direct sales are preferred for large defense or aerospace contracts where detailed negotiation and long-term service agreements are required, establishing close partnerships between the machine builder and the end-user. After-sales service, including periodic maintenance, calibration, spare parts supply (particularly for rollers and mandrels), and software upgrades, constitutes a significant revenue stream and a crucial element of sustained customer satisfaction and machine uptime, defining the long-term relationship within the value chain.

The end-users, primarily large-scale component manufacturers in the aerospace, automotive, and energy sectors, form the final link. Their feedback loop is vital for machine evolution, driving demands for higher automation, improved efficiency, and enhanced safety features. The successful transfer of value relies heavily on the integration services provided by the OEM or system integrator, ensuring the hot spinning machine is effectively deployed within the client's existing production line, often alongside robotic handling systems and centralized monitoring platforms. The strategic importance of the product—high-integrity, complex components—means that reliability and precise technical support are highly weighted in the procurement decision, making robust service infrastructure an essential competitive differentiator throughout the entire value chain structure.

Hot Spinning Machine Market Potential Customers

Potential customers for Hot Spinning Machines are specialized manufacturers whose core business involves producing high-specification, rotationally symmetrical components requiring exceptional mechanical integrity and dimensional accuracy. The largest customer base resides within the aerospace and defense sector, including OEMs and Tier 1 suppliers responsible for manufacturing airframe parts, rocket motor bodies, missile casings, and specialized turbine components. These organizations require machines capable of handling superalloys and ensuring rigorous quality compliance mandated by regulatory bodies like the Federal Aviation Administration (FAA) and international defense standards. The component requirements in this sector are driven by performance under extreme conditions, prioritizing reliability and material homogeneity achieved through controlled hot deformation processes.

The second major group comprises high-performance automotive manufacturers, particularly those involved in the electric vehicle revolution. As EVs push for maximum range and efficiency, the demand for lightweight yet extremely strong components, such as custom aluminum wheel rims, lightweight battery enclosures, and motor housings, is surging. Hot spinning offers a material-efficient method for producing these parts with aligned grain structures that enhance fatigue life. Furthermore, suppliers to the pressure vessel and energy sector, including those manufacturing high-pressure gas cylinders, seamless tubes for heat exchangers, and spherical tank heads for chemical processing, represent a steady and significant customer segment, driven by global energy infrastructure investments and stringent safety regulations regarding containment integrity.

Finally, general industrial machinery and precision engineering firms that fabricate parts for heavy equipment, mining, and specialized manufacturing tooling also utilize hot spinning technology for durable, high-wear components. These firms prioritize machine versatility and robustness, often requiring machines that can switch efficiently between different material types and component sizes. The procurement decisions across all these end-user segments are heavily influenced by factors such as machine tolerance capabilities, the maximum diameter and length the machine can handle, cycle time efficiency, and the total cost of ownership, including energy consumption and maintenance requirements, ensuring a meticulous and technical evaluation process before purchase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fayard & Ruhl S.A., Leifeld Metal Spinning GmbH, MJC Engineering and Technology Inc., C.B. Ferrari S.r.l., Sahinler Metal Makina, KNUTH Machine Tools, AMINO Maschinenbau GmbH, P.K. Machine Tools, Polledri & C. S.r.l., HF Press + Lipski GmbH, Herkules Wetzlar, N.A.R.S. (Nanjing Automation Research Institute), Vitsy Spinning Machines, Zhauns Manufacturing, WMEC Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Spinning Machine Market Key Technology Landscape

The technological evolution of the Hot Spinning Machine Market is characterized by a strong emphasis on precision control, thermal management, and integration with advanced digital manufacturing paradigms. Central to this evolution is the transition from conventional hydraulic and cam-operated machines to high-speed, multi-axis Computer Numerical Control (CNC) systems. Modern CNC technology provides manufacturers with unparalleled control over the roller path trajectory, enabling the forming of highly complex geometries with tight tolerances that were previously unattainable. These systems utilize advanced servo drives and closed-loop feedback mechanisms to monitor and adjust roller position in real-time, compensating for material spring back and thermal expansion during the forming process, guaranteeing repeatability across large production batches, a crucial factor in safety-critical sectors like aerospace.

A critical technology differentiator in hot spinning is the heating mechanism. While conventional methods relied on external furnaces or open flames, which often lead to temperature inconsistencies, the current standard utilizes precise, localized induction heating systems. Induction heating allows for extremely rapid and localized heating of the workpiece segment immediately ahead of the roller contact point, maintaining the rest of the blank at a controlled temperature. This focused thermal management is vital for working with temperature-sensitive superalloys and high-strength steels, minimizing detrimental grain growth and oxidation across the entire component while ensuring the working zone achieves optimal ductility for deformation. Furthermore, the integration of infrared pyrometry sensors provides continuous, non-contact temperature measurement, feeding data back to the CNC controller to dynamically adjust the induction power, thereby ensuring metallurgical integrity is maintained throughout the spin cycle.

The convergence of mechanical design and digital technology, frequently termed Industry 4.0 readiness, is reshaping the competitive landscape. Modern machines are equipped with extensive sensor arrays—monitoring vibration, torque, acoustic emission, and hydraulic pressure—all integrated via Industrial Internet of Things (IIoT) protocols. This data is leveraged for sophisticated monitoring, allowing for predictive analytics and remote diagnostics, maximizing Operational Equipment Effectiveness (OEE). Furthermore, simulation and Digital Twin technology are becoming integral to the pre-production phase. Advanced Finite Element Analysis (FEA) software allows engineers to accurately model the entire hot spinning process, predicting material flow, residual stress distribution, and potential defects under varying conditions. This virtual prototyping drastically reduces the physical setup and tooling costs associated with introducing new components, substantially shortening time-to-market for complex, novel designs and reinforcing the market's trajectory towards highly adaptable manufacturing solutions.

Regional Highlights

- North America: This region is characterized by high investment in the aerospace and defense sectors, driving demand for high-precision, low-volume hot spinning capabilities, particularly for large-diameter rocket and missile components made from titanium and high-nickel alloys. Manufacturers here prioritize technological sophistication, process traceability, and certification compliance (e.g., AS9100). The growth in advanced manufacturing and R&D activities related to next-generation aviation and space exploration ensures continued investment in the most advanced, often proprietary, hot spinning systems, with a strong emphasis on automation to mitigate high labor costs.

- Europe: Europe, led by Germany, Italy, and the UK, maintains a robust market driven by the high-performance automotive sector and strict quality standards within the industrial machinery and energy segments. European manufacturers emphasize efficiency, energy consumption reduction, and modular machine design. Key market drivers include the demand for high-strength steel pressure vessels and specialized components for European aerospace programs (Airbus, ESA). The region is a leader in developing hybrid forming processes that integrate hot spinning with other technologies, focusing on achieving superior surface finishes and extremely precise dimensional tolerances for critical engine parts.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, fueled by massive infrastructure development, explosive growth in domestic automotive manufacturing (including China and India's EV initiatives), and expanding shipbuilding and defense production. The market here is volume-driven, demanding robust, high-throughput hot spinning machines capable of continuous operation. While price sensitivity exists, the rapid adoption of CNC technology and increasing focus on quality standardization (moving away from conventional methods) across regional manufacturing hubs indicates a shift towards more sophisticated equipment procurement to compete globally.

- Latin America (LATAM): The LATAM market, while smaller, exhibits steady growth primarily driven by the oil and gas sector (especially in Brazil and Mexico) and burgeoning regional automotive production. Demand is focused on machines capable of producing components for energy transmission, exploration infrastructure, and heavy industrial machinery parts. The adoption rate is often cautious, favoring proven, reliable technology, with investment cycles closely tied to global commodity price fluctuations and government policy regarding domestic industrial capacity building and foreign direct investment.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around oil, gas, and petrochemical processing infrastructure projects, requiring large-capacity machines for pressure vessel heads and specialized piping. Defense spending, particularly in the UAE and Saudi Arabia, also contributes to demand for advanced forming equipment. The region relies heavily on imports and technical expertise from European and North American suppliers, often prioritizing comprehensive service contracts and localized training programs due to limited local high-skilled labor availability in advanced metal forming processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Spinning Machine Market.- Leifeld Metal Spinning GmbH

- MJC Engineering and Technology Inc.

- Fayard & Ruhl S.A.

- Sahinler Metal Makina

- C.B. Ferrari S.r.l.

- KNUTH Machine Tools

- AMINO Maschinenbau GmbH

- P.K. Machine Tools

- Polledri & C. S.r.l.

- HF Press + Lipski GmbH

- Herkules Wetzlar

- N.A.R.S. (Nanjing Automation Research Institute)

- Vitsy Spinning Machines

- Zhauns Manufacturing

- WMEC Engineering

- Rotary Forming Inc.

- YSD CNC Machine Tools

- A.M.E.S. Spindelservice

- Forming Technology Inc. (FTI)

- Metal Form Engineering Co.

Frequently Asked Questions

Analyze common user questions about the Hot Spinning Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of hot spinning over cold spinning or deep drawing for complex components?

Hot spinning is crucial for materials with poor cold-ductility (like titanium and superalloys), facilitating plastic deformation without cracking. It produces seamless components with superior material utilization, improved mechanical properties due to favorable grain flow, and eliminates the need for welding secondary components, ensuring higher structural integrity for critical applications.

Which industries are the largest end-users of CNC Hot Spinning Machines?

The largest end-users are the aerospace and defense industries, requiring high-precision rocket casings and engine components, followed closely by the automotive sector (especially for specialized, lightweight EV parts) and the oil & gas industry for high-pressure seamless vessel manufacturing.

How does AI technology enhance the operational efficiency of hot spinning equipment?

AI significantly enhances efficiency through predictive maintenance (reducing unexpected downtime), real-time adaptive process control (optimizing parameters based on material feedback), and machine vision systems for instant quality control and defect detection, leading to higher yield rates and reduced waste.

What are the key technical constraints that limit the growth of the Hot Spinning Machine Market?

Key constraints include the substantial initial capital investment required for high-precision CNC hot spinning systems, the complexity of tooling design, and the scarcity of highly skilled labor necessary to operate and maintain these specialized, technologically sophisticated metal forming machines effectively.

What differentiates vertical hot spinning machines from horizontal machines in terms of application?

Vertical hot spinning machines are typically preferred for forming large-diameter, short components like tank heads or shallow cones, utilizing gravity to simplify alignment and loading. Horizontal machines are better suited for long, cylindrical components such as tubes, shafts, and missile bodies, offering ease of handling and precise support for elongated workpieces.

What are the typical materials processed using hot spinning technology?

Hot spinning is primarily used for demanding materials including various grades of high-strength stainless steels, nickel-based superalloys (such as Inconel), titanium alloys, and specialized refractory metals, all of which require elevated temperatures to achieve the necessary plasticity for complex forming operations.

In the context of Hot Spinning, what is meant by 'Shear Spinning' and 'Flow Forming'?

Shear spinning involves the roller moving parallel to the mandrel surface, significantly reducing the thickness of the material while maintaining the diameter, often used for conical or dome shapes. Flow forming is a similar process, usually applied to tubular preforms, where the wall thickness is reduced and the length is increased, yielding extremely precise components like rocket motor tubes with exceptional surface finish and uniformity.

How does the integration of Industry 4.0 technologies influence machine longevity and maintenance costs?

Industry 4.0, facilitated by IIoT sensors and cloud analytics, allows for highly accurate predictive maintenance (PdM). By continuously monitoring machine health parameters like vibration and temperature, potential failures are anticipated, enabling scheduled rather than reactive repairs. This integration drastically reduces unscheduled downtime and minimizes catastrophic component failure, ultimately lowering overall maintenance costs and maximizing operational lifespan.

Which regional market holds the highest growth potential for hot spinning machine manufacturers in the forecast period?

The Asia Pacific (APAC) region is projected to hold the highest growth potential, driven by massive domestic infrastructure investments, rapid expansion of local aerospace and defense manufacturing capabilities, and significant governmental support for the transition to electric vehicle production, all requiring high-volume precision metal forming solutions.

How important is the thermal management system in the hot spinning process?

Thermal management is absolutely critical; precise control of the temperature gradient, typically achieved via induction heating and integrated pyrometry, ensures the material remains ductile only in the working zone. This precision prevents excessive grain growth, minimizes oxidation, and preserves the desired mechanical and metallurgical properties of the final component, which is crucial for high-performance applications.

What is the role of simulation software (FEA) in modern hot spinning operations?

Finite Element Analysis (FEA) software allows manufacturers to create a digital twin of the spinning process. This enables virtual prototyping to accurately predict material flow, stress distribution, and potential wall thickness variations under various processing conditions, thereby optimizing tooling, minimizing material waste, and significantly reducing the number of physical trials needed before full-scale production begins.

How are hot spinning machine OEMs addressing sustainability concerns?

OEMs address sustainability by designing machines that offer superior material utilization (near-net-shape forming), reducing raw material scrap compared to machining. Furthermore, integrating energy-efficient induction heating and optimizing machine operating cycles via smart control systems reduces overall energy consumption per component produced, aligning with global industrial efficiency mandates.

What defines a 'multi-roller system' in hot spinning, and why is it preferred for high-precision tasks?

A multi-roller system employs two or more rollers acting simultaneously or sequentially on the workpiece. This configuration allows for greater control over material flow, minimizes radial forces, and can distribute deformation more evenly, resulting in superior dimensional stability, reduced chatter, and exceptional wall thickness uniformity, particularly important for thin-walled, long components.

In the aerospace supply chain, what quality certifications are mandatory for hot spinning component suppliers?

Suppliers must typically adhere to stringent quality management standards such as AS9100. Furthermore, specific processes and component traceability often require compliance with Nadcap (National Aerospace and Defense Contractors Accreditation Program) for special processes, ensuring complete quality assurance throughout the highly regulated production chain.

How does the shortage of skilled labor specifically impact the market adoption of hot spinning technology?

The need for highly skilled technicians to program, troubleshoot, and perform complex metallurgical assessments limits the capacity of manufacturers to maximize machine utility. This shortage increases operational costs and restricts the rate at which companies can adopt and scale up hot spinning technology, making automation solutions increasingly vital for market expansion.

What is the expected long-term impact of lightweighting trends in the automotive sector on hot spinning machine demand?

The focus on lightweighting, driven primarily by electric vehicle efficiency and range requirements, will significantly increase demand for hot spinning machines capable of processing high-strength aluminum and advanced steel alloys. Hot spinning minimizes material density while maximizing structural strength, making it an essential manufacturing process for new generation vehicle components.

How do global trade tariffs and supply chain disruptions affect the procurement of hot spinning machinery?

Global trade tariffs increase the acquisition cost of imported machinery, potentially slowing down capital expenditure, especially in developing markets. Supply chain disruptions primarily impact the availability and lead times for crucial high-precision components (like CNC controllers and specialized bearings), necessitating machine manufacturers to diversify their sourcing strategies and increase inventory buffers.

What role does tool material play in the efficiency of the hot spinning process?

Tool material selection is critical due to the high temperatures and significant forces involved. Rollers and mandrels must withstand thermal fatigue and abrasive wear. High-performance, heat-resistant tool steels and specialized ceramics are necessary to maintain dimensional accuracy, minimize downtime for tool replacement, and ensure the metallurgical quality of the spun component.

What is the competitive landscape focused on among leading hot spinning machine manufacturers?

Leading manufacturers compete fiercely on three main fronts: maximizing machine capacity (handling larger diameters/lengths), integrating advanced automation and Industry 4.0 capabilities (AI/PdM), and providing specialized systems capable of reliably processing the most challenging, high-value exotic materials required by the aerospace and energy sectors.

How does temperature variability during hot spinning impact the final product quality?

Uncontrolled temperature variability can severely compromise product quality by causing inconsistent material ductility, leading to surface defects, internal micro-cracks, and non-uniform grain structure. Precise thermal management via localized induction heating is necessary to ensure consistent material properties and dimensional integrity across the entire batch.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager