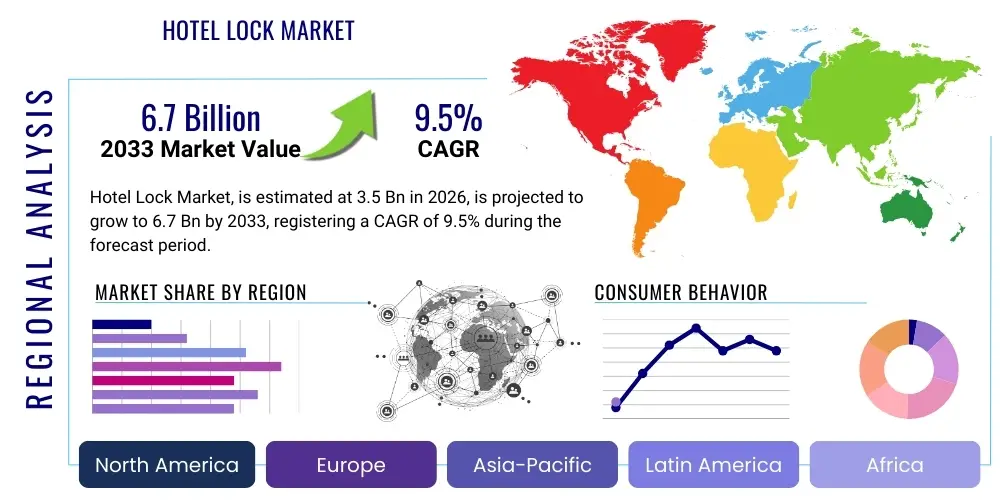

Hotel Lock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440966 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hotel Lock Market Size

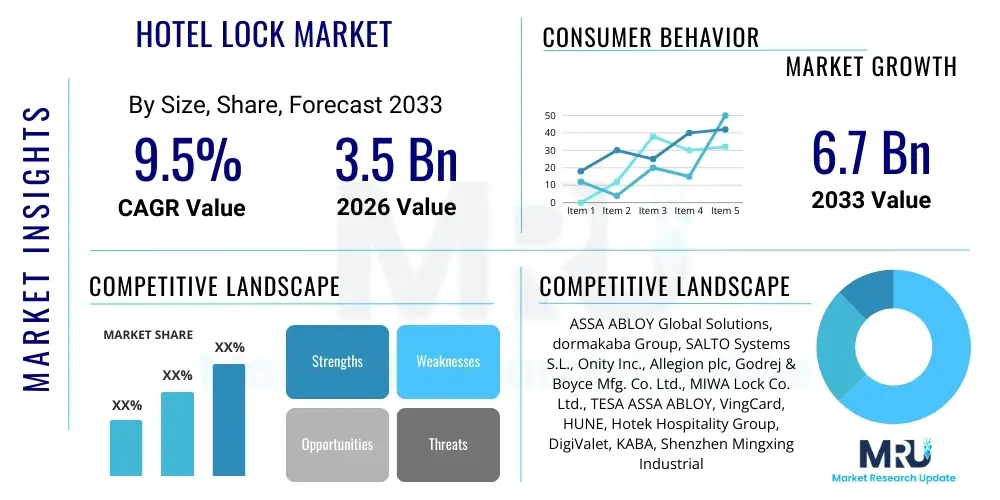

The Hotel Lock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Hotel Lock Market introduction

The Hotel Lock Market encompasses the manufacturing, distribution, and utilization of sophisticated access control systems designed specifically for lodging establishments, ranging from budget accommodations to luxury five-star resorts. This market has undergone a profound transformation, migrating rapidly from traditional mechanical key-based systems to highly secure and efficient electronic solutions, including magnetic stripes, RFID cards, and increasingly, mobile-based keyless entry. Modern hotel locks are critical components of the guest experience, merging security, convenience, and operational efficiency into a single, integrated platform. The scope of this market is defined by continuous innovation in connectivity and data security standards, ensuring robust protection against unauthorized entry while facilitating seamless interaction for authorized personnel and guests. The systems often integrate deeply with Property Management Systems (PMS) and other hotel operational technologies, providing real-time data on room status and maintenance requirements.

Major applications of hotel lock technology extend beyond simple guest room access, now covering back-of-house areas, administrative offices, parking facilities, and restricted amenity zones such as executive lounges or fitness centers. The primary benefit derived from adopting advanced hotel lock systems is the enhancement of guest security and privacy, coupled with a significant reduction in operational expenditure related to key management and replacement. Furthermore, these systems dramatically improve the efficiency of hotel staff by allowing instant key issuance, cancellation, and reissuance, minimizing wait times during check-in and check-out. The shift towards mobile-enabled access, leveraging Bluetooth Low Energy (BLE) or Near Field Communication (NFC) technologies, offers an unmatched level of convenience, enabling guests to bypass the front desk entirely, which is a major draw in the post-pandemic travel landscape where contactless interactions are prioritized.

The Hotel Lock Market is fundamentally driven by several intertwined factors, chief among them being the global resurgence and expansion of the tourism and hospitality sector, particularly in emerging economies where new hotel construction is rampant. Regulatory compliance related to fire safety and accessibility standards also mandates the adoption of modern electronic lock systems that offer fail-safe mechanisms and audit trails. Technological advancements act as a continuous catalyst, pushing manufacturers to develop more secure, durable, and interconnected products. The inherent need for hotels to maintain a competitive edge necessitates the adoption of cutting-edge technology that elevates the perceived value of the stay. Furthermore, the persistent cycle of lock system upgrades and replacements in established markets ensures sustained demand, as older magnetic stripe technology is phased out in favor of more robust and secure RFID and mobile solutions.

Hotel Lock Market Executive Summary

The Hotel Lock Market Executive Summary reveals dynamic business trends characterized by aggressive mergers and acquisitions aimed at consolidating technology portfolios and market share, particularly among global security solution providers. The industry is witnessing a robust shift toward cloud-hosted access management platforms, which allow hoteliers centralized control over multiple properties and facilitate instantaneous security updates and key management via the internet. This trend supports the growing move toward subscription-based software service models alongside traditional hardware sales. Business innovation is also centered around developing highly integrated systems that operate seamlessly with existing Property Management Systems (PMS), energy management systems, and guest services applications, ensuring a unified smart hotel ecosystem. Small and medium-sized enterprises (SMEs) in the hospitality sector are increasingly adopting affordable, entry-level electronic locks, broadening the market base beyond large international chains.

Geographically, regional trends highlight Asia Pacific (APAC) as the fastest-growing region, fueled by massive infrastructure investments in countries like China, India, and Southeast Asian nations that are rapidly expanding their tourism capacities and constructing new lodging facilities. North America and Europe, representing mature markets, show steady demand primarily driven by replacement cycles, system upgrades to mobile key technology, and stringent regulatory demands requiring higher security standards. These regions are prioritizing highly secure, encrypted communication protocols. Latin America and the Middle East & Africa (MEA) are emerging as critical growth pockets, particularly the Gulf Cooperation Council (GCC) nations, where mega-tourism projects and high-end luxury developments necessitate the implementation of state-of-the-art biometric and smart lock technology to cater to affluent international travelers. Regional competitive dynamics are often defined by compliance with local security standards and the ability of vendors to provide localized support and installation services.

Segmentation analysis underscores the dominant growth of the electronic lock segment, specifically RFID and Mobile Access technologies, which are rapidly displacing magnetic card systems due to superior security and durability. The market is segmented heavily by access method, with mobile keys showing the highest growth trajectory, reflecting consumer preference for smartphone dependency. Furthermore, segmentation by property type shows luxury and upscale hotels are the primary adopters of advanced, high-feature locks, including those with advanced biometric capabilities. In contrast, mid-scale and budget hotels focus on reliable, cost-effective RFID solutions. A crucial trend within segmentation is the increasing importance of the lock’s integration capabilities; systems offering open APIs for seamless connectivity with third-party vendors are gaining significant traction, defining the future standard for hotel access control management systems.

AI Impact Analysis on Hotel Lock Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Hotel Lock Market revolve heavily around enhancing proactive security, predictive maintenance, and personalized guest experiences. Users frequently inquire: "How can AI prevent lock hacking or key card cloning?" "Will AI reduce the need for physical keys entirely by using facial recognition or gait analysis?" and "Can AI predict when a lock battery or mechanism will fail, saving maintenance costs?" These inquiries reflect a dual focus: the immediate need for heightened cyber and physical security, and the long-term expectation that AI will automate operational tasks and personalize access controls. Key concerns often center on data privacy—specifically, how biometric and behavioral data collected by AI-enabled locks will be stored, processed, and protected against breaches, highlighting the tension between utility and privacy rights. Users also expect AI integration to simplify complex system management, moving beyond simple access logging to real-time, intelligent threat detection.

The influence of AI in this domain is transformative, moving access systems from reactive logging mechanisms to proactive security platforms. AI algorithms are being employed to analyze historical access patterns, identify anomalies indicative of potential security threats—such as repeated failed attempts or unusual entry timings—and automatically flag or lockdown rooms based on predefined risk parameters. This predictive layer significantly enhances the hotel's security posture by identifying internal and external threats before they escalate. Furthermore, AI contributes substantially to optimizing energy consumption; smart locks integrated with AI-driven building management systems can learn guest occupancy patterns and signal lighting and HVAC systems to power down or activate based on predicted presence, achieving substantial environmental and cost savings without compromising guest comfort.

Machine learning (ML), a core component of AI, is revolutionizing predictive maintenance for hotel locks. ML models analyze thousands of data points related to lock usage—including frequency of use, battery drain rates, electronic component performance, and environmental factors like temperature and humidity—to accurately forecast mechanical or electronic failure. This capability allows hotel maintenance teams to replace batteries or repair components proactively during scheduled room cleanings, minimizing disruptive service calls and ensuring a flawless guest experience. This shift from reactive repair to predictive maintenance is a major operational advantage enabled solely by AI, reducing downtime for rooms and extending the lifespan of expensive hardware components. The convergence of AI with IoT sensors embedded in the locks creates a truly intelligent access ecosystem that learns and adapts to both guest behavior and hardware condition.

- AI-driven predictive maintenance forecasting hardware failure and battery replacement schedules.

- Enhanced threat detection through machine learning analysis of unusual access patterns and behavioral anomalies.

- Integration with facial recognition and biometric systems for highly secure, keyless, and frictionless access control.

- Optimization of in-room energy consumption based on real-time occupancy data generated by smart locks.

- Personalization of guest access, adjusting permissions and access levels dynamically based on guest profiles and stay duration.

- Automated incident reporting and security auditing capabilities, generating detailed, compliance-ready logs.

- Cybersecurity hardening through AI algorithms that detect and mitigate unauthorized network access attempts to the lock system infrastructure.

DRO & Impact Forces Of Hotel Lock Market

The dynamics of the Hotel Lock Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces on market growth and direction. Key drivers include the exponential growth in global travel and tourism, necessitating frequent large-scale hotel infrastructure development and subsequent demand for sophisticated access solutions. The persistent push toward frictionless guest experiences, driven by high consumer expectations and the popularity of mobile technologies, is accelerating the adoption of smart, keyless systems. Simultaneously, opportunities abound in developing markets where urbanization and rising disposable incomes fuel hotel expansion, offering greenfield sites for the deployment of the latest technology. There is also a significant opportunity in integrating hotel locks with broader Internet of Things (IoT) ecosystems within the hotel room, creating value-added services such as voice-controlled environments and personalized temperature settings linked to room entry.

However, the market faces considerable restraints that temper rapid expansion. The primary restraint is the high initial capital expenditure associated with implementing advanced electronic and smart lock systems, especially in smaller, independent hotels or in older properties requiring extensive wiring and infrastructure upgrades. Furthermore, the increasing sophistication of the technology introduces complex security risks, particularly relating to data privacy compliance (like GDPR or CCPA) when utilizing biometric or extensive personal data for access. System compatibility and integration complexity also pose a challenge; ensuring that a new lock system integrates seamlessly with diverse legacy Property Management Systems and existing network infrastructure requires specialized expertise and significant customization, which can be costly and time-consuming for hotel operators.

The Impact Forces fundamentally center on the rapid pace of technological innovation versus the slow, regulated pace of hospitality capital investment and standardization. The strong driving force of technological leaps—such as the transition from NFC to highly encrypted BLE and the introduction of decentralized access solutions like blockchain-based keys—continually opens new market opportunities. However, this velocity creates market fragmentation and uncertainty, acting as a restraint, as hoteliers delay purchases waiting for the next technology standard to emerge. Ultimately, the market elasticity is highly sensitive to both global economic conditions affecting travel and the continuous improvement in component security (microchips, encryption protocols). Successful market participants are those who can balance cutting-edge technology with rigorous security standards and backward compatibility, offering scalable solutions that cater to both new construction and refurbishment projects across all hotel tiers.

Segmentation Analysis

The Hotel Lock Market is structurally segmented based on crucial operational and technological characteristics, allowing for detailed market assessment across various purchasing behaviors and deployment scales. Key segmentation variables include the type of lock technology deployed, the operational structure of the hotel property, and the specific application within the lodging facility. The increasing heterogeneity in access methods—moving from simple magnetic stripes to complex biometric scanning—reflects the market’s responsiveness to both security demands and guest convenience. Understanding these segments is vital for manufacturers to tailor their product offerings, sales strategies, and service agreements to match the distinct needs and budget constraints of different hotel categories, thereby maximizing market penetration and revenue growth across various geographies.

- By Type

- Electronic Locks (Card Based, Keypad Based)

- Smart Locks (Mobile Access, Biometric Recognition)

- Mechanical Locks (Declining Segment)

- By Technology

- Radio Frequency Identification (RFID)

- Bluetooth Low Energy (BLE) / Near Field Communication (NFC)

- Magnetic Stripe

- Biometrics (Fingerprint, Facial Recognition)

- By Property Type

- Luxury and Upscale Hotels

- Mid-Scale and Budget Hotels

- Resorts and Casinos

- Vacation Rentals and Extended Stay Properties

- Institutional Lodging (Hospitals, Universities)

- By Application

- Guest Room Doors

- Common Areas and Amenities (Pools, Gyms, Elevators)

- Back-of-House and Administrative Offices

- Staff and Service Entry Points

- By Component

- Hardware (Lock Sets, Readers, Encoders)

- Software (Access Management Systems, Mobile Key Apps)

- Services (Installation, Maintenance, Support)

Value Chain Analysis For Hotel Lock Market

The Value Chain for the Hotel Lock Market begins with complex upstream activities focused on sourcing highly specialized raw materials and electronic components. Upstream analysis involves suppliers of high-grade metals (aluminum, stainless steel) for lock casings, critical semiconductor chips for electronic processing units, and sophisticated encryption modules. The quality and reliability of these upstream suppliers directly impact the final product’s durability and security certification. Key strategic concerns at this stage include managing supply chain vulnerability, particularly concerning global shortages of electronic components, and ensuring ethical sourcing practices. Manufacturers must maintain robust relationships with a diverse set of specialized component providers to ensure both cost efficiency and continuity of supply, particularly for components critical to advanced technologies like BLE and biometric scanning.

Moving downstream, the distribution channel is highly diversified, relying heavily on system integrators and specialized technology consultants who manage the complex installation and integration of locks with the hotel’s existing Property Management System (PMS). Direct sales channels are typically reserved for large international hotel chains that negotiate global contracts, ensuring standardization across numerous properties. However, for smaller independent hotels and refurbishments, indirect distribution through authorized dealers, regional security providers, and general hospitality equipment suppliers is the prevailing model. These third-party distributors play a crucial role by providing localized technical support, post-sale maintenance, and training for hotel staff, essential functions given the electronic nature of the product.

The transition between direct and indirect distribution strategies often defines market reach. Direct sales allow manufacturers greater control over pricing and branding but require substantial investment in a dedicated global sales and support force. Conversely, indirect channels leverage the local expertise and established client base of partners but require careful management of partner quality and consistency in service delivery. In recent years, the emergence of digital platforms and B2B e-commerce has influenced procurement, allowing smaller hoteliers to research and purchase standardized electronic locks more efficiently, although the installation and integration aspects remain dependent on skilled local labor. Effective value chain management, therefore, necessitates optimizing logistics for global hardware delivery while guaranteeing specialized software and service support through well-trained regional partners.

Hotel Lock Market Potential Customers

The primary consumers and end-users of hotel lock solutions are globally recognized luxury hotel chains and upscale resort properties, which demand the highest levels of security, aesthetic design integration, and seamless technology experience. These customers prioritize smart locks, especially those capable of mobile access (BLE/NFC) and integration with advanced guest experience applications, often viewing cutting-edge access control as a crucial differentiator in their service offering. Their purchasing decisions are often centralized, based on global contracts and stringent security compliance requirements, necessitating large-volume purchases and long-term service agreements from vendors. These properties frequently refresh their technology every 5-7 years to remain competitive and utilize the latest security advancements, ensuring a predictable demand cycle for premium products.

Mid-range and budget hotels form the largest volume customer segment, driven primarily by standardization, reliability, and cost-effectiveness. While these customers may adopt less costly RFID card-based solutions over advanced biometrics, they still prioritize systems that offer robust security audit trails and are easy for staff and guests to manage. For this segment, the total cost of ownership (TCO), including the cost of installation and long-term maintenance, is a dominant purchasing factor. The increasing global proliferation of budget hotel franchises, particularly in rapidly developing nations, provides a sustained and expanding customer base for standardized electronic locking systems that offer high volume and high value propositions.

A significant secondary customer base includes institutional lodging facilities, such as large university dormitories, military bases, cruise ships, hospitals, and long-term residential or serviced apartment complexes. These end-users require robust, multi-user access control systems that can manage complex authorization matrices and frequently changing user populations. Furthermore, the burgeoning vacation rental sector, fueled by platforms like Airbnb and Vrbo, is rapidly becoming a high-growth customer segment for smart, remote-managed locks. Property Management Companies (PMCs) managing portfolios of vacation rentals or extended-stay housing seek locks that support virtual key issuance and cancellation without requiring physical staff presence, leveraging cloud-based management software as a core operational tool.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY Global Solutions, dormakaba Group, SALTO Systems S.L., Onity Inc., Allegion plc, Godrej & Boyce Mfg. Co. Ltd., MIWA Lock Co. Ltd., TESA ASSA ABLOY, VingCard, HUNE, Hotek Hospitality Group, DigiValet, KABA, Shenzhen Mingxing Industrial Co., GAT Access Systems, Spectrum Security Systems, Messerschmitt Systems GmbH, Be-Tech, LockState, and ADEL Lock. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotel Lock Market Key Technology Landscape

The Hotel Lock Market is underpinned by a rapidly evolving technological landscape, driven primarily by the need for enhanced security, greater convenience, and seamless integration capabilities. The foundational technologies include Radio Frequency Identification (RFID) and Near Field Communication (NFC), which replaced the less secure magnetic stripe systems and remain highly popular due to their robustness, speed, and reliability. RFID locks, leveraging high-frequency contactless cards, are the current standard for high-volume installations in mid-scale and budget hotels. Concurrently, Bluetooth Low Energy (BLE) technology has emerged as the cornerstone for mobile key solutions, allowing smartphones to communicate securely with the lock mechanism. The adoption rate of BLE is rapidly accelerating, especially in premium and luxury properties, as it enables highly efficient, contactless check-in experiences.

Beyond the core access methods, the technological landscape is defined by sophisticated software integration capabilities and the migration of management systems to the cloud. Property Management System (PMS) integration via standardized APIs is now non-negotiable, allowing hotels to issue and revoke keys dynamically based on booking schedules and check-in status. Cloud-based Access Management Systems (AMS) enable centralized control over multiple properties, facilitate instantaneous remote key updates, and provide crucial real-time auditing and diagnostics. This cloud shift is crucial for security hardening, allowing manufacturers to push urgent firmware updates and patches globally almost immediately, protecting against evolving cyber threats aimed at lock system networks. Furthermore, the increasing incorporation of high-level encryption standards (such as AES 256-bit) in both hardware and software ensures secure communication between the mobile device, the lock, and the central server.

Emerging technologies, specifically advanced biometrics and IoT connectivity, are shaping the future trajectory of the market. Biometric access control, utilizing fingerprint or facial recognition, is gaining traction in ultra-luxury and highly secure environments, offering an unmatched level of security and convenience by eliminating physical key dependence entirely. Although high in cost and facing privacy scrutiny, the reliability and speed of modern biometric scanners are improving dramatically. Simultaneously, the broader IoT framework allows locks to serve as intelligent sensors within the room, providing data on room occupancy, door ajar status, and energy usage, feeding into holistic smart room management systems. Future innovations are expected to include self-diagnostic locks and systems powered by localized energy harvesting, further reducing maintenance and operational complexities associated with battery management.

Regional Highlights

- North America: This region is characterized by high adoption rates of advanced smart lock technologies, particularly mobile access (BLE). The market is driven primarily by hotel renovation and upgrade cycles, with major hotel chains investing heavily in integrated security platforms to meet high guest expectations regarding seamless and secure access. Stringent regulatory compliance and a strong focus on data security influence purchasing decisions, favoring vendors that offer robust encryption and cloud-based management systems. The demand for systems that integrate smoothly with existing smart room technologies is high, ensuring this market segment remains dominated by large, established security providers offering comprehensive service packages and reliable long-term support.

- Europe: Europe represents a mature market with a stable demand fueled by strict adherence to data privacy regulations (GDPR) and regional security standards. Western European nations, especially the UK, Germany, and France, are rapidly transitioning from older magnetic card systems to RFID and BLE technology, reflecting a commitment to modernization and guest experience improvement. Southern and Eastern European markets are experiencing faster growth rates driven by new hotel development linked to expanding tourism, particularly budget and mid-scale properties seeking cost-effective, durable electronic solutions. The European market highly values longevity and energy efficiency in its lock systems.

- Asia Pacific (APAC): APAC is the epicenter of global market growth for hotel locks, driven by explosive development in hospitality infrastructure, particularly in China, India, and Southeast Asia. This region exhibits a dual market structure: high-end luxury resorts and international hotels adopt the latest mobile and biometric solutions, while the vast number of new mid-scale and budget accommodations fuel immense demand for reliable RFID systems. Government investment in tourism and major international events frequently catalyze large-scale technology deployments. The unique challenge in APAC is managing the diverse range of local system integrators and ensuring security compliance across varying national standards.

- Latin America: This region offers significant potential, with growth concentrated in major metropolitan centers and popular tourist destinations, particularly Mexico, Brazil, and Colombia. Market growth is moderately strong, often delayed compared to North America due to investment sensitivities. Electronic lock adoption is growing steadily, motivated by the desire to enhance security against rising local crime rates and to attract international business and leisure travelers who expect modern access technology. Cost sensitivity remains a key factor, leading to a strong preference for competitive, reliable electronic systems with proven track records.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries (UAE, Saudi Arabia, Qatar), is defined by massive investment in luxury and mega-tourism projects, driving demand for the most sophisticated and feature-rich hotel lock systems, including custom-designed hardware and high-security biometrics. The focus is on establishing a global image of technological leadership and superior guest experience. The African market, while smaller, is emerging rapidly, with increasing urbanization and foreign investment leading to the construction of new mid-to-upscale hotels requiring modern electronic access control systems to meet international standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotel Lock Market.- ASSA ABLOY Global Solutions (VingCard, Elsafe)

- dormakaba Group (KABA, Ilco)

- SALTO Systems S.L.

- Onity Inc. (A Carrier Company)

- Allegion plc

- Godrej & Boyce Mfg. Co. Ltd.

- MIWA Lock Co. Ltd.

- TESA ASSA ABLOY

- HUNE Co., Ltd.

- Hotek Hospitality Group

- DigiValet

- Be-Tech Security System Co., Ltd.

- Shenzhen Mingxing Industrial Co., Ltd. (Adel)

- GAT Access Systems

- Spectrum Security Systems

- Messerschmitt Systems GmbH

- Bittel Intelligent Technology Co., Ltd.

- LockState (Remotelock)

- Chilock Systems

- Intelligent Access Systems

Frequently Asked Questions

Analyze common user questions about the Hotel Lock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most secure type of hotel lock technology available today?

The most secure current technologies are encrypted Mobile Access (using BLE/NFC with dynamic, time-sensitive key encryption) and advanced Biometric Systems. These solutions offer superior protection compared to traditional magnetic or standard RFID cards because they utilize multi-factor authentication and highly secure communication protocols that are extremely difficult to clone or intercept.

How does the shift to mobile keys benefit hotel operations and guest experience?

Mobile keys significantly enhance operational efficiency by enabling contactless check-in and reducing front desk congestion. For guests, this translates into a seamless, modern, and highly convenient experience, allowing them to use their personal smartphone for immediate room access without needing to carry physical key cards. It also lowers the operational cost associated with key card replacement and reprogramming.

What are the primary challenges in integrating new hotel lock systems with existing Property Management Systems (PMS)?

The main challenge is ensuring seamless interoperability and data consistency between the new lock software and the hotel’s legacy PMS, requiring robust Application Programming Interfaces (APIs). Custom integration work is often necessary, which can lead to high initial implementation costs, potential downtime during deployment, and ongoing complexity in system maintenance and software updates.

Is the Hotel Lock Market being impacted by cybersecurity threats, and how are manufacturers addressing this?

Yes, the shift to interconnected smart locks increases vulnerability to cyber threats, including denial-of-service attacks and unauthorized network intrusion. Manufacturers are addressing this by implementing stringent security measures, including end-to-end data encryption, continuous penetration testing, rapid remote firmware updates via cloud platforms, and layered physical and digital security protocols to protect sensitive lock networks.

Which geographic region is expected to drive the largest growth in the demand for hotel locks between 2026 and 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate in the Hotel Lock Market during the forecast period. This rapid expansion is fundamentally driven by massive new hotel construction, significant investment in tourism infrastructure, and the widespread adoption of modern electronic access solutions across emerging economies in the area.

The strategic imperative for market players in the hotel lock sector involves not only the creation of physically robust hardware but also the development of flexible, scalable software platforms capable of future-proofing hotel operations. The long-term durability and maintenance burden associated with electronic components, such as microprocessors and battery life management systems, are increasingly becoming critical decision points for hotel procurement officers. Manufacturers are responding by focusing research and development efforts on low-power consumption technologies and predictive maintenance features, often utilizing sophisticated algorithms to monitor battery health and component wear in real-time. This emphasis on reliability reduces the total cost of ownership (TCO) over the product lifespan, making advanced systems more attractive to cost-conscious independent hoteliers.

Furthermore, sustainability concerns are beginning to subtly influence the hotel lock market. Hotels are increasingly seeking eco-friendly solutions, prompting manufacturers to use recyclable materials, minimize packaging waste, and design locks that integrate with energy management systems to reduce overall carbon footprint. While not yet the primary driver, the convergence of green building standards with advanced security features presents a burgeoning segment for innovation, particularly in European and North American markets where corporate social responsibility is a key investment criterion. This shift demands a holistic product design approach that considers environmental impact from raw material sourcing through to end-of-life disposal, adding a new layer of complexity to the manufacturing value chain.

In terms of competitive landscape, the market exhibits high barriers to entry due to the necessity of meeting stringent international security certifications and possessing the technological expertise required for robust encryption and integration. The dominant players, such as ASSA ABLOY and dormakaba, leverage their extensive global distribution networks, established brand trust, and vast intellectual property portfolios to maintain market leadership. Smaller, specialized firms often differentiate themselves by focusing on niche technologies, such as advanced biometric solutions or blockchain-based access control, catering to specific high-security or tech-forward clientele. Strategic partnerships between hardware manufacturers and software developers specializing in hospitality technology are becoming increasingly common, ensuring that the lock hardware remains an integral part of the larger, interconnected smart room ecosystem.

The regulatory environment across various regions also necessitates tailored product development. For instance, fire safety regulations in many jurisdictions require specific mechanical override features or emergency egress capabilities that must be integrated seamlessly into the electronic design. Compliance with international standards bodies is mandatory for global sales and deployment, often requiring significant investment in testing and certification processes. This regulatory overhead favors larger companies with the resources to manage diverse compliance requirements globally. The intersection of physical security regulations and digital data privacy laws creates a challenging environment where innovation must proceed cautiously to maintain strict legal adherence while providing cutting-edge access control functionality.

Analysis of potential market disruption indicates that the rapid adoption of smartphone technologies coupled with evolving consumer preferences for minimalist and keyless interfaces poses the greatest threat to established magnetic and RFID segments. Hotels that fail to adopt mobile key solutions risk being perceived as technologically outdated, negatively impacting guest satisfaction and competitive standing. This dynamic pressures manufacturers to accelerate their pivot towards software-defined access solutions, where the physical lock becomes primarily a secure receiver for digital credentials rather than the centerpiece of the access process. This technological shift implies a fundamental reorganization of business models, focusing on recurring software licensing revenues rather than relying solely on high-margin hardware sales. Consequently, expertise in API management, cloud architecture, and application development is becoming as valuable as traditional mechanical engineering competence within this sector.

The emerging role of predictive analytics, particularly in large hotel chains, is further changing procurement priorities. Hoteliers are moving beyond merely logging access events to demanding systems that provide actionable insights into guest behavior, operational bottlenecks, and security vulnerabilities. For example, analytics derived from door usage patterns can inform cleaning schedules, optimize staff movement, and even provide data points for dynamic pricing strategies based on perceived room usage. This data monetization potential elevates the smart lock system from a security device to a strategic asset, driving higher investment in fully networked and cloud-connected hardware capable of broadcasting vast quantities of usage data reliably and securely.

The implementation phase of hotel lock systems presents unique challenges, often requiring highly skilled technicians for precise installation and configuration. Unlike consumer smart locks, hotel systems must handle high traffic volumes, integrate with centralized power grids, and comply with rigorous fire and safety codes. The complexity of wiring and networking components across vast hotel complexes, often involving retrofit scenarios in historical buildings, necessitates significant pre-installation planning and project management expertise. Therefore, the service component—including initial consultation, certified installation, staff training, and ongoing technical support—is a crucial differentiator in vendor selection, often outweighing marginal differences in hardware cost or feature sets.

Future growth will largely depend on the ability of manufacturers to address the inherent tensions between user convenience and robust data privacy. As biometric and advanced mobile identification methods become standard, hotel operators and their vendors must navigate a complex regulatory landscape concerning personal identity information. Solutions incorporating decentralized identifiers or privacy-enhancing technologies, such as edge computing that processes biometric data locally rather than transmitting it to the cloud, are expected to gain prominence. Successfully resolving these privacy concerns will be key to unlocking mass adoption of truly keyless, biometric-based access systems across the global hospitality sector. Moreover, the integration of hotel locks into broader city-level smart infrastructure projects, where room access could be linked to transit passes or event ticketing, represents a long-term strategic growth opportunity for highly interconnected smart lock platforms.

The financial viability of the market is strongly linked to the global construction pipeline for commercial real estate, particularly in the hospitality segment. Fluctuations in global interest rates and commodity prices directly impact construction costs, influencing the frequency and scope of new hotel developments, which are primary drivers of large-scale lock system procurement. Manufacturers must employ flexible pricing strategies and tiered product offerings to mitigate the effects of economic downturns, ensuring viable options remain available for budget-conscious properties while continuing to innovate at the premium end of the spectrum. Successful market navigation requires a keen understanding of macro-economic indicators alongside micro-level technological trends.

The long-term outlook for the Hotel Lock Market remains highly positive, driven by the irreversible trend towards digitalization in the hospitality industry. The increasing demand for contactless services, accelerated by recent global health concerns, has cemented the relevance of mobile and keyless entry as essential rather than optional features. As 5G network infrastructure expands, enabling faster and more reliable connectivity within hotel environments, the potential for real-time, instantaneous key management and diagnostics will dramatically increase. This advancement will further solidify the market transition toward fully networked, software-centric access solutions, creating substantial opportunities for both established security conglomerates and innovative technology startups.

Key Technology Landscape expansion includes the incorporation of advanced tamper-proofing measures, not just physically but electronically. This involves hardware security modules (HSMs) embedded within the lock circuitry to protect encryption keys and digital certificates against extraction. The increasing sophistication of attack vectors, including both physical intrusion attempts and targeted cyber attacks on the network infrastructure, necessitates this heightened security integration at the component level. Furthermore, standardization bodies are working towards universal protocols that simplify the integration process across different vendors' hardware and software, a move that is expected to accelerate adoption rates, particularly for smaller hoteliers who lack dedicated IT integration teams.

The segmentation by Component highlights the growing revenue share derived from Software and Services. While hardware historically represented the bulk of the transaction value, the reliance on proprietary cloud management platforms, mobile key subscription services, and specialized integration consultancy means that recurring revenue streams are becoming a significant portion of the market value. This shift encourages vendors to prioritize customer retention and continuous software improvement, ensuring their ecosystems remain current, secure, and compatible with the ever-changing landscape of mobile operating systems and hospitality software. This strategic pivot ensures a more stable financial foundation for market players, reducing dependency on cyclical capital expenditures in the hotel construction sector.

Potential customers, particularly those managing large, distributed portfolios, are increasingly evaluating vendors based on their ability to provide unified global support. A luxury chain with properties across three continents requires consistent system performance, identical security protocols, and 24/7 technical support regardless of location. This demand places a premium on vendors with established international service infrastructures and certified partner networks capable of delivering standardized quality control and technical expertise worldwide. For end-users such as large hotel groups, the consistency of maintenance and rapid response to technical issues are often more critical than minor variations in initial product pricing. This elevates the importance of the service dimension within the competitive matrix of the Hotel Lock Market.

Regional Highlights in emerging markets like Africa are driven by international investors setting new standards for modern hospitality infrastructure. In hubs such as South Africa, Nigeria, and Kenya, there is a clear demand for robust, weather-resistant electronic locks that can handle local environmental conditions while providing the high-security audit trails required by international management standards. Conversely, in the highly sophisticated MEA region, the emphasis is less on volume and more on bespoke aesthetic integration—demanding locks that can be seamlessly concealed or customized to match extravagant architectural designs without compromising cutting-edge security features like multi-modal biometrics and highly encrypted mobile credentials. This demonstrates the market's high degree of segmentation based not just on price but also on functionality and luxury integration requirements across diverse geographies.

The competition among top key players is fierce, focusing on intellectual property rights related to keyless entry and power consumption management. Companies are heavily investing in proprietary encryption methods and battery optimization techniques to gain a competitive edge. Strategic alliances with major mobile technology providers (e.g., Apple, Google) are also critical for ensuring seamless compatibility with evolving smartphone operating systems and native wallet applications, which are integral to the mobile key user experience. The acquisition of smaller, specialized software firms further accelerates the integration of advanced features such as guest messaging and loyalty program integration directly into the lock management platform, extending the functionality beyond basic access control.

The hotel lock industry’s future trajectory is inextricably linked to the broader evolution of the Smart Building concept. Locks are transitioning from isolated security components into networked data nodes, contributing essential information to the larger Building Management System (BMS). This integration facilitates true automation, where a key card insertion or mobile key authorization triggers a cascade of actions: adjusting room temperature, activating personalized media settings, and sending real-time occupancy status to housekeeping and maintenance teams. This seamless, data-driven operational model represents the ultimate value proposition for next-generation hotel access control systems, maximizing efficiency and guest satisfaction simultaneously.

In conclusion, achieving sustained success in the Hotel Lock Market requires a delicate balance between hardware excellence, software innovation, cybersecurity resilience, and robust global service capabilities. The market is increasingly demanding holistic solutions rather than isolated components, pushing vendors towards becoming comprehensive hospitality technology partners. The continued expansion of tourism, coupled with relentless technological advancement, guarantees a robust and evolving market characterized by a rapid shift from physical security devices to intelligent, networked access control platforms that are central to the modern guest experience and hotel operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager