Hotel Smart TV system Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443129 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Hotel Smart TV system Market Size

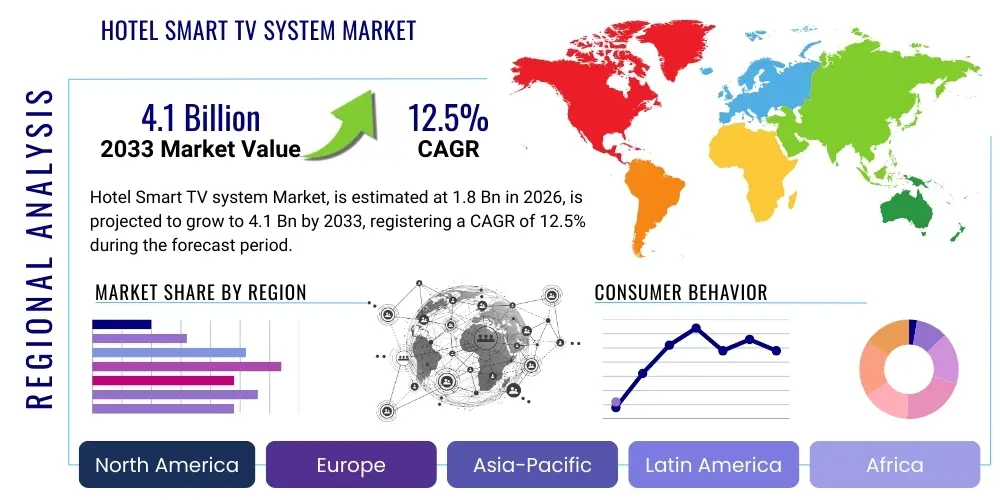

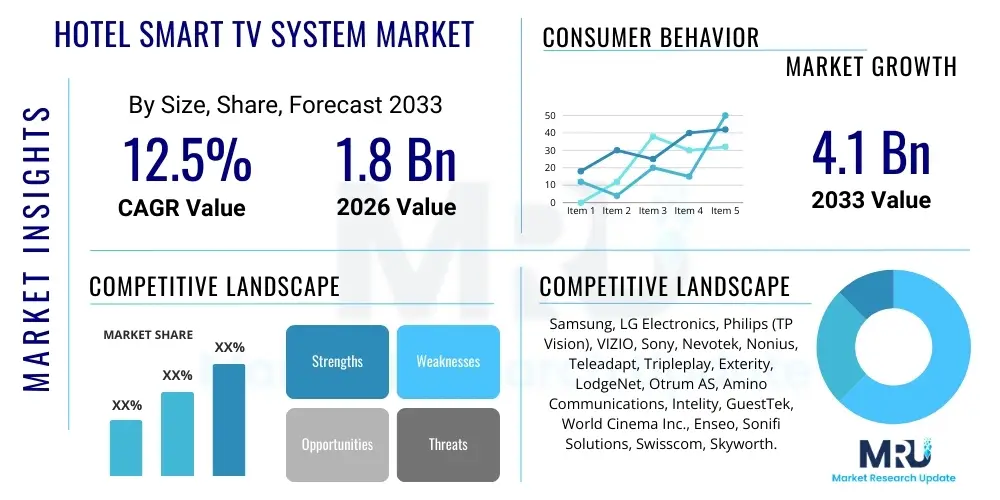

The Hotel Smart TV system Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Hotel Smart TV system Market introduction

The Hotel Smart TV system Market encompasses the deployment of advanced television technology within hospitality environments, moving far beyond basic entertainment. These systems integrate interactive services, casting capabilities, content on demand (CoD), and property management system (PMS) integration, transforming the in-room TV into a central digital concierge and guest experience platform. Modern smart TV solutions utilize Internet Protocol Television (IPTV) and Over-the-Top (OTT) technologies to deliver highly personalized content and operational efficiencies. The primary objective is to elevate guest satisfaction, provide seamless connectivity, and offer tailored services that differentiate the hotel brand in a highly competitive industry landscape. This evolution is crucial as guests increasingly expect the same level of digital convenience and personalized media access they enjoy at home, making robust and user-friendly smart TV infrastructure indispensable for contemporary hotels.

The core product offering includes smart hospitality televisions equipped with specialized operating systems (like customized Android or webOS), dedicated middleware, and necessary networking infrastructure, often cloud-managed, to ensure scalability and reliability across large properties or global chains. Major applications span entertainment, communication, and operational management. For guests, this means access to high-definition content, personalized welcome messages, localized information services, room service ordering, bill viewing, and seamless screen mirroring from personal devices (BYOC - Bring Your Own Content). For hotels, the systems facilitate targeted marketing, streamline internal communication, and provide valuable data on guest preferences and content consumption patterns, aiding in strategic service adjustments and revenue generation through promotional channels displayed directly on the screen.

The market growth is fundamentally driven by the global expansion of the hospitality sector, coupled with the rising demand for premium, digitally enhanced guest experiences. Benefits derived from adopting these systems are multifaceted, including increased guest loyalty through personalized interactions, improved operational efficiency by automating service requests, and enhanced revenue opportunities through ancillary service promotion. The shift towards cloud-based solutions offering easier deployment and lower upfront capital expenditure, alongside advancements in ultra-high-definition (UHD) and 4K display technologies, further accelerates adoption. Furthermore, regulatory compliance related to accessibility standards and increasing competition among hotel operators to provide cutting-edge technology are key propelling factors stimulating market innovation and investment across various hotel categories, from luxury resorts to budget-conscious properties seeking differentiation.

Hotel Smart TV system Market Executive Summary

The global Hotel Smart TV system Market is characterized by vigorous innovation focused on seamless integration and enhanced user personalization, driving significant business trends. A crucial trend involves the migration from expensive, hardware-centric IPTV solutions to flexible, software-defined, and cloud-hosted systems. This shift reduces total cost of ownership (TCO) for hotels and allows for rapid deployment of new features, such as advanced voice control and secure casting integration compatible with all major consumer streaming platforms (e.g., Netflix, Hulu, Disney+). Furthermore, strategic partnerships between technology providers (middleware developers, TV manufacturers) and global hotel chains are consolidating market dominance, focusing on creating unified, brand-specific digital ecosystems that maintain service consistency globally. Sustainability trends are also influencing product design, favoring energy-efficient displays and modular systems that reduce electronic waste, aligning with corporate social responsibility goals.

Regionally, North America and Europe maintain leading positions due to high technological adoption rates, the presence of major hotel headquarters, and strong consumer expectations for advanced in-room technology. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by explosive growth in tourism, rapid urbanization, and massive investment in new hotel construction, particularly in China, India, and Southeast Asian nations. This rapid expansion in APAC necessitates scalable and cost-effective smart TV solutions, driving intense price competition and localized content development. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, are investing heavily in luxury tourism infrastructure, resulting in high demand for premium, ultra-customized, and secure smart TV systems that cater to an affluent, international clientele.

Segmentation analysis reveals that the market is bifurcating based on deployment type and hotel category. Cloud-based solutions are rapidly overtaking on-premise deployments across all segments due to their inherent scalability and reduced maintenance burden. Concurrently, the mid-range and business hotel categories represent the fastest-growing segment in terms of volume adoption, recognizing smart TV systems as a necessary amenity rather than just a luxury upgrade. Technologically, solutions supporting sophisticated two-way communication, such as interactive ordering and personalized recommendations driven by Machine Learning (ML), are experiencing the highest revenue growth. The demand for robust cybersecurity features remains paramount across all segments, ensuring guest data privacy and secure transactions are maintained, especially given the increased complexity associated with casting personal content onto the hotel network.

AI Impact Analysis on Hotel Smart TV system Market

User inquiries regarding AI's influence on the Hotel Smart TV system Market frequently revolve around personalization capabilities, operational efficiency improvements, and data security implications. Users commonly ask: "How can AI enhance the in-room entertainment experience beyond basic recommendations?" "Will AI reduce the need for hotel staff interaction for services?" and "What are the privacy risks associated with AI analyzing guest viewing habits?" The consensus expectation is that AI will transform the system from a passive entertainment device into an active, intelligent concierge capable of anticipating guest needs. Key concerns center on ensuring data collected about guest preferences is handled ethically and securely, maintaining a balance between highly personalized service and preserving guest anonymity. Expectations are high regarding predictive maintenance and automated system troubleshooting, aiming to minimize downtime and ensure seamless technological functionality throughout the stay.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to fundamentally revolutionize the Hotel Smart TV system market, moving interaction models from reactive to predictive. AI algorithms analyze historical guest data, real-time engagement patterns, and integrated PMS information to offer hyper-personalized content recommendations, tailored language settings, and customized service promotions (e.g., spa offers, restaurant bookings) directly on the screen. This level of personalization significantly elevates the guest experience, driving higher engagement rates with hotel services and potentially boosting ancillary revenue streams. Furthermore, AI-powered natural language processing (NLP) integrated into voice-controlled remote interfaces allows guests to seamlessly control room amenities (lights, temperature) and request services (housekeeping, maintenance) through intuitive conversation, drastically improving operational responsiveness and simplifying the interaction process.

Beyond the guest-facing interface, AI’s operational impact is substantial. Machine Learning models are being deployed for predictive maintenance, analyzing system performance metrics in real-time to identify potential hardware failures or software glitches before they impact the guest. This proactive approach significantly reduces maintenance costs and ensures system reliability, a critical factor for hotel reputation management. Additionally, AI can optimize bandwidth management within the hotel network, prioritizing streaming quality based on occupancy and time of day, thereby guaranteeing high-quality video delivery. The data analytics derived from AI processing—insights into average viewing times, popular content genres, and preferred interactive services—provide hotel management with unprecedented business intelligence, allowing them to refine marketing strategies, optimize content licensing agreements, and tailor service offerings more effectively to their specific clientele demographics.

- AI enables hyper-personalization of content and interface settings based on historical guest profiles.

- Voice control integration via NLP significantly simplifies interaction for room control and service requests.

- Predictive maintenance algorithms minimize system downtime and reduce operational repair costs.

- AI-driven analytics provide actionable business intelligence on guest content consumption trends.

- Automated system monitoring ensures optimal bandwidth allocation and service quality across the property.

DRO & Impact Forces Of Hotel Smart TV system Market

The Hotel Smart TV system market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological trajectory. The primary Driver is the increasing expectation among global travelers for seamless, high-quality digital entertainment and connectivity comparable to their home environments. This 'consumerization of IT' forces hotels to continually upgrade their technology infrastructure. This driver is amplified by the opportunity presented by the rapid adoption of cloud computing, which lowers the barrier to entry for advanced smart TV systems by minimizing capital expenditure and offering superior scalability. However, a significant Restraint is the high initial cost associated with replacing existing legacy coaxial infrastructure with modern, high-speed IP networks (especially in older properties), coupled with concerns over data security and compliance with stringent international privacy regulations like GDPR, especially concerning guest casting functionalities and data tracking. These forces create a compelling market dynamic where innovation in cost-effective deployment methods, such as utilizing existing wiring with advanced transmission technologies (e.g., G.hn or MoCA), becomes crucial for market penetration.

Key drivers include the global expansion of the hospitality sector, particularly the emergence of branded luxury and mid-scale hotels in developing regions, which prioritize cutting-edge guest technology as a competitive differentiator. Furthermore, the proliferation of Over-The-Top (OTT) streaming services (Netflix, Hulu, etc.) necessitates smart TV systems that can securely and legally integrate screen mirroring and authentication features, a massive undertaking that technology providers are capitalizing on. Opportunities are abundant in the integration of smart TV systems with the broader Internet of Things (IoT ecosystem within the hotel room, allowing the TV to act as the central control hub for lighting, climate, and security. Another vital opportunity lies in the development of specialized software solutions tailored for small and medium-sized properties (SMEs) which traditionally lack the budget for bespoke enterprise-level systems, opening up a large, underserved market segment. The emphasis on revenue generation through personalized upsells via the TV interface further drives investment and feature development in interactive capabilities.

The impact forces generated by these DRO factors push the market towards solutions that emphasize integration ease and cybersecurity robustness. The high switching cost (a restraint) motivates vendors to offer long-term service contracts and flexible financing models, thereby softening the immediate financial impact for hotels. The opportunity for IoT integration accelerates the convergence of entertainment and room control systems, leading to more holistic technology solutions. The overarching Impact Force is technological convergence: smart TV systems are transitioning from mere entertainment devices to comprehensive guest relationship management and operational efficiency tools. This force dictates that future competitive advantage will depend less on screen resolution and more on the quality of the middleware, the seamlessness of system integration with PMS and IoT platforms, and the demonstrable security protocols protecting guest data, ensuring the system contributes directly to both guest satisfaction and hotel profitability metrics.

Segmentation Analysis

The Hotel Smart TV system Market is systematically segmented based on key functional, operational, and structural attributes to provide detailed insights into demand patterns and growth drivers across different hotel landscapes. Primary segmentation criteria include deployment model (On-premise vs. Cloud-based), screen size, technology type (IPTV vs. Coaxial/Hybrid), and application/end-user segment (Luxury, Mid-Scale, Budget, etc.). Analyzing these segments is crucial for vendors developing targeted product strategies and for hoteliers making informed investment decisions regarding their digital infrastructure overhaul. The segmentation reflects the diverse needs of the global hospitality industry, ranging from large, newly constructed luxury resorts requiring fully customized, high-bandwidth IPTV systems to existing budget properties seeking cost-effective, hybrid solutions that can leverage existing wiring while still offering basic smart features.

The shift in segmentation preference is notably leaning towards cloud-based and managed service models. While on-premise systems traditionally offered greater control and high data processing speed, the massive scalability, simplified maintenance, and lower upfront capital expenditure associated with cloud-based deployments are proving more attractive across all hotel categories, especially multi-property chains looking for centralized management and standardized guest experiences. Within technology type, IPTV solutions dominate new constructions due to their superior bandwidth and capability to deliver interactive services, but hybrid solutions remain relevant for retrofitting older properties. Screen size segmentation indicates a clear trend towards larger displays (43 inches and above), driven by falling panel costs and heightened guest expectations for immersive viewing experiences, with UHD and 4K resolution becoming the standard requirement rather than a premium feature.

End-user segmentation reveals contrasting demands. Luxury hotels prioritize flawless user interfaces, seamless integration with proprietary mobile apps, and highly personalized services, often requiring bespoke middleware and content licensing. Mid-scale hotels focus heavily on reliability, cost-efficiency, and core features like robust casting capabilities that satisfy the fundamental requirements of business and leisure travelers. The growing volume of boutique and independent hotels forms a vital sub-segment, seeking flexible, subscription-based smart TV services that can be rapidly deployed and customized to reflect their unique brand identities without the burden of complex IT management. Understanding these distinct segment needs allows manufacturers to optimize product portfolios, focusing on modular software architecture that can be adapted quickly to specific operational or budget constraints, ensuring broader market reach and penetration.

- By Deployment Type:

- On-Premise

- Cloud-based

- By Technology:

- IPTV (Internet Protocol Television)

- Coaxial/Hybrid Systems

- By Screen Size:

- Below 32 inches

- 32 to 43 inches

- 43 to 55 inches

- Above 55 inches

- By End-User/Hotel Category:

- Luxury and Upper Upscale Hotels

- Mid-Scale and Business Hotels

- Budget and Economy Hotels

- Boutique and Independent Hotels

Value Chain Analysis For Hotel Smart TV system Market

The Value Chain for the Hotel Smart TV system Market begins with upstream activities dominated by core component manufacturing and intellectual property (IP) development. This initial stage involves large electronics conglomerates responsible for producing high-definition display panels, semiconductor chipsets, and specialized operating systems (e.g., customized Android or Linux kernels). Key suppliers also include software developers specializing in the complex middleware—the critical layer that connects the physical TV hardware to the hotel's Property Management System (PMS) and network infrastructure. Upstream competitive advantage is heavily dependent on economies of scale in hardware manufacturing, continuous innovation in display technology (4K, 8K, Mini-LED), and establishing robust cybersecurity standards at the chip and operating system level, ensuring data integrity before the product even reaches the integrator stage.

The midstream component of the value chain focuses on integration, customization, and distribution. Global system integrators (SIs) and specialized hospitality technology vendors take the raw components and customize the software interface (GUI), manage content licensing rights (crucial for in-room entertainment), and ensure seamless connectivity with the hotel's existing IT ecosystem. Distribution channels are varied, incorporating both direct and indirect routes. Major global hospitality technology providers often employ a direct sales model for large, multi-property contracts with major chains, offering end-to-end service from design to deployment. Conversely, smaller properties or those in geographically challenging regions rely heavily on a network of indirect value-added resellers (VARs) and local distributors who provide localized installation support, maintenance, and faster response times, bridging the gap between sophisticated technology and localized operational needs.

Downstream activities center on deployment, maintenance, and end-user engagement, directly impacting the hotel operator and the final guest experience. This phase includes the physical installation of the TVs and network components, comprehensive training for hotel staff, and crucially, long-term technical support and system monitoring, often delivered as a managed service. Direct engagement occurs when hotels purchase software licenses and hardware directly from manufacturers and manage the system internally, which is typical for large chains with dedicated IT teams. Indirect engagement, utilizing integrators and VARs for ongoing maintenance, is more common, ensuring systems remain updated, secure, and compatible with evolving guest devices and streaming standards. The efficiency of this downstream segment—measured by system uptime and responsiveness to technical issues—is paramount for maintaining high guest satisfaction scores and protecting the hotel’s investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, LG Electronics, Philips (TP Vision), VIZIO, Sony, Nevotek, Nonius, Teleadapt, Tripleplay, Exterity, LodgeNet, Otrum AS, Amino Communications, Intelity, GuestTek, World Cinema Inc., Enseo, Sonifi Solutions, Swisscom, Skyworth. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotel Smart TV system Market Potential Customers

The primary potential customers and end-users of Hotel Smart TV systems are diverse entities within the global hospitality industry, ranging from large multinational hotel chains to independent, single-property operators. These buyers are fundamentally driven by the need to modernize their guest experience, enhance operational efficiencies, and remain competitive against disruptive short-term rental services that often offer superior digital amenities. Global and regional hotel chains (e.g., Marriott, Hilton, Accor) represent the largest volume buyers, typically demanding standardized, highly scalable, and securely integrated solutions that can be managed centrally across hundreds of locations. Their purchasing decisions are driven by total cost of ownership (TCO), brand consistency, and the vendor's ability to provide comprehensive global support and continuous software innovation, often favoring subscription-based models for simplified budgeting and feature upgrades.

A rapidly growing segment of potential customers includes mid-scale and business-focused hotels, who view the Smart TV system as an essential, non-negotiable amenity for attracting corporate travelers. For this segment, the emphasis is less on elaborate bespoke features and more on robust functionality, especially high-speed connectivity, reliable screen casting (BYOC), and seamless integration with basic hotel services. The purchasing criteria here are heavily weighted towards ease of deployment, low maintenance requirements, and quick return on investment (ROI). These customers often opt for hybrid or cloud-based plug-and-play solutions offered by specialized hospitality integrators, valuing reliable performance over complex customization, and representing a high-volume market for standardized product offerings.

Furthermore, specialized hospitality venues constitute a significant customer base, including cruise lines, healthcare facilities, and long-stay serviced apartments. Cruise lines, for example, require robust, marine-grade systems capable of operating reliably in challenging environments with intermittent connectivity, focusing heavily on locally stored content and interactive features for shore excursion booking and navigation information. Healthcare facilities utilize these systems for patient education, communication with nurses, and personalized entertainment during recovery. These niche buyers prioritize unique features such as multi-language support, compliance with specific industry regulations (e.g., HIPAA for healthcare), and integration with specialized operational systems distinct from standard PMS architectures, demanding highly adaptable and specialized software modules tailored to their specific, non-traditional hospitality needs.

Hotel Smart TV system Market Key Technology Landscape

The technological landscape of the Hotel Smart TV system market is defined by the convergence of high-definition display technology, robust IP networking, and sophisticated middleware designed specifically for the hospitality environment. Core technologies include Internet Protocol Television (IPTV), which utilizes the hotel’s high-speed data network to deliver content, allowing for highly interactive, personalized services far beyond traditional cable offerings. Key advancements include the transition to UHD (4K) and increasing adoption of 8K displays in luxury segments, demanding higher bandwidth infrastructure. Crucially, middleware platforms are evolving to be device-agnostic and cloud-native, utilizing standardized protocols like REST APIs for streamlined integration with other hotel systems (PMS, POS, IoT controllers). Security technology, specifically DRM (Digital Rights Management) and network isolation protocols for guest casting (e.g., Google Cast, Apple AirPlay), is fundamental to ensure compliance with content licensing and protect guest data integrity from network vulnerabilities.

A central technological focus is on enhancing the "Bring Your Own Content" (BYOC) experience through advanced casting and screen mirroring solutions. This relies heavily on secure network segmentation (VLANs) and proprietary software bridges that allow guests to authenticate and cast content securely to their specific in-room TV without exposing the general hotel network or other guest devices. Modern solutions are employing dedicated casting devices or integrated software modules that automatically pair and unpair upon check-in and check-out, leveraging high-speed Wi-Fi 6 technology to guarantee low latency and high quality streaming. Furthermore, the incorporation of voice recognition technology, often utilizing specialized remote controls or integrated microphones, is becoming mainstream, driven by advancements in cloud-based Natural Language Processing (NLP) engines that provide hands-free control over the TV interface and associated smart room features, improving accessibility and user convenience.

The future technology trajectory is heavily invested in modular, service-oriented architecture (SOA) and the deeper integration of Artificial Intelligence. SOA allows hotels to selectively deploy features, such as interactive digital compendiums, custom hotel applications, or specific international content packages, providing greater flexibility than monolithic systems. AI and ML are crucial for enhancing the content delivery mechanism, optimizing the user interface based on real-time feedback, and conducting predictive analytics for system maintenance. Furthermore, the adoption of open-source operating systems optimized for large-scale deployment, such as specialized versions of Android TV, enables rapid customization and deployment of new third-party applications and services. The continuous demand for seamless system updates and remote diagnostics is pushing the industry toward a fully managed, Software-as-a-Service (SaaS) model for the underlying middleware platform, minimizing the reliance on local hotel IT staff for system management.

Regional Highlights

The demand and implementation trends for Hotel Smart TV systems vary significantly across global regions, reflecting economic maturity, tourism volume, and local technological infrastructure. North America represents a mature, highly competitive market characterized by high consumer expectations and rapid adoption of cutting-edge features like 4K streaming and advanced voice control. The region sees consistent demand from major hotel chains focused on TCO reduction through cloud-based managed services and integrating smart TV systems deeply with existing property IoT platforms. Europe is similarly advanced but faces distinct regulatory challenges, particularly stringent data privacy laws (GDPR), which dictate the design and security features of guest data handling and casting services. Western Europe drives innovation in personalized, multilingual content delivery, while Eastern Europe is a rapidly emerging market driven by new hotel construction and modernization projects, prioritizing value-driven, scalable IPTV solutions.

The Asia Pacific (APAC) region stands out as the primary engine for volume growth, fueled by unprecedented growth in both domestic and international tourism, coupled with significant investment in new hospitality infrastructure, particularly in China, India, and Southeast Asia. Market dynamics in APAC are dominated by competition focused on localized content partnerships, multilingual interface support, and solutions that accommodate varied internet speeds and network reliability across different countries. There is a strong preference for hybrid solutions or specialized IPTV systems that can handle both entertainment and operational messaging in large-scale urban hotels and integrated resorts. The rapid construction cycle demands systems that are quick to deploy and easily scaled, often favoring partnerships with major local electronics manufacturers.

Latin America (LATAM) and the Middle East and Africa (MEA) offer unique market profiles. LATAM's growth is steady, focusing primarily on budget-conscious yet functional smart TV systems that enhance the guest experience affordably, often utilizing robust hybrid technologies where IP infrastructure is still developing. MEA, particularly the GCC countries, represents the highest concentration of demand for ultra-luxury and highly customized solutions. Hotels in Dubai, Abu Dhabi, and Doha invest in bespoke, high-end systems featuring the largest screens, premium personalized interfaces, and secure, world-class content delivery systems tailored to a highly affluent international clientele. The MEA market prioritizes security, luxury aesthetics, and proven reliability for flagship hospitality developments, necessitating close collaboration with specialized integrators to deliver complex, bespoke installations.

- North America: Focus on cloud-managed services, integration with IoT, and high adoption of voice control features.

- Europe: Driven by strict GDPR compliance, strong demand for multilingual content, and modernization of existing hotel portfolios.

- Asia Pacific (APAC): Highest volume growth; intense competition, demand for localized content, and rapid adoption in new constructions.

- Middle East & Africa (MEA): High investment in luxury segment, demanding customized, secure, premium 4K/8K systems in flagship developments.

- Latin America (LATAM): Steady growth characterized by demand for cost-effective, scalable solutions and emphasis on regional content availability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotel Smart TV system Market.- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Philips (TP Vision)

- Sony Corporation

- Nonius

- Teleadapt Ltd.

- Tripleplay (A Mood Media Company)

- Exterity Limited

- LodgeNet (Sonifi Solutions)

- Otrum AS

- Amino Communications

- Intelity

- GuestTek Interactive Entertainment Ltd.

- World Cinema Inc.

- Enseo, Inc.

- Swisscom Hospitality Services (Econocom)

- Nevotek

- Skyworth Group Co., Ltd.

- VingCard Elsafe (ASSA ABLOY Global Solutions)

- Mansion Technology

Frequently Asked Questions

Analyze common user questions about the Hotel Smart TV system market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional hotel TV and a Smart TV system?

The primary distinction is interactivity and connectivity. Traditional systems offer passive content via coaxial cable, whereas a Smart TV system uses IP networking (IPTV) and specialized middleware to offer interactive services, personalized messaging, secure casting (BYOC), integrated hotel services (room service, billing), and AI-driven content recommendations, making it a comprehensive digital guest concierge.

Are cloud-based Smart TV systems more secure than on-premise solutions?

Cloud-based systems often offer superior security infrastructure and faster updates due to centralized management by the vendor. While on-premise offers local control, cloud solutions leverage professional-grade security protocols, network segmentation for guest privacy, and continuous monitoring to manage cyber threats and ensure compliance with global data protection regulations like GDPR and CCPA more effectively.

How does the integration of AI improve guest experience and hotel operations?

AI enhances guest experience through hyper-personalized content and service recommendations, streamlined communication via voice control (NLP), and intuitive interface navigation. Operationally, AI enables predictive maintenance, monitors system health to prevent service disruption, and provides deep business intelligence on guest behavior, optimizing content licensing and service delivery.

What is "Bring Your Own Content" (BYOC) and why is it essential for modern hotels?

BYOC refers to the ability for guests to securely cast personal streaming service accounts (e.g., Netflix, YouTube) from their mobile devices directly to the in-room Smart TV. This feature is essential because modern travelers demand the same level of digital freedom they enjoy at home, and robust BYOC capabilities significantly increase guest satisfaction and loyalty in a competitive market.

What is the expected long-term Return on Investment (ROI) for installing Smart TV systems?

ROI is realized through multiple channels: increased guest satisfaction leading to higher review scores and repeat bookings; operational cost savings via automated service requests and reduced reliance on printed materials; and direct revenue generation through personalized, on-screen promotions and upsells for hotel services, demonstrating that the system is a revenue center, not just a capital expenditure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager