Household Cleaning Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441408 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Household Cleaning Market Size

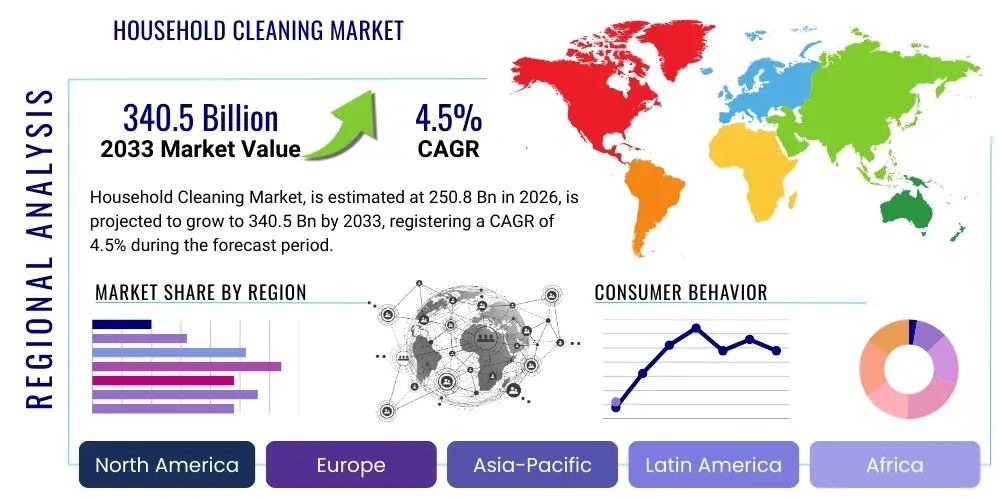

The Household Cleaning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This robust growth is primarily driven by heightened consumer awareness regarding hygiene, the proliferation of specialized cleaning products, and increasing disposable incomes in emerging economies. The necessity for effective sanitation solutions, especially in a post-pandemic context, has permanently shifted consumer behavior towards higher frequency and quality of cleaning product usage, sustaining market momentum well into the forecast period.

The market is estimated at $250.8 Billion in 2026 and is projected to reach $340.5 Billion by the end of the forecast period in 2033. This substantial valuation reflects the non-discretionary nature of household cleaning expenditures and the continuous innovation within the sector, particularly the integration of eco-friendly and natural ingredients. Companies are investing heavily in product differentiation through claims of biodegradability, reduced chemical footprint, and superior efficacy, thereby capturing premium segments of the market and contributing significantly to revenue growth.

Furthermore, urbanization and the trend towards smaller households globally are indirectly boosting the demand for convenient, ready-to-use cleaning formats, such as wipes and concentrated pods. The expansion of modern retail channels, coupled with the exponential growth of e-commerce platforms, facilitates wider product availability and consumer accessibility across diverse geographical regions. These structural developments support the projected market expansion, positioning the household cleaning industry as a stable yet dynamic component of the fast-moving consumer goods (FMCG) sector.

Household Cleaning Market introduction

The Household Cleaning Market encompasses a wide range of products designed to maintain cleanliness, hygiene, and aesthetic appeal within residential environments. These products span categories including laundry care, dishwashing, surface cleaners, toilet cleaners, and specialized products like floor and glass cleaners. The fundamental product description involves chemical formulations, often incorporating surfactants, enzymes, disinfectants, and fragrances, tailored to tackle specific types of grime, stains, and microbial contamination. Recent innovations emphasize formulations that balance cleaning efficacy with environmental sustainability and safety for human health, moving away from harsh chemicals toward bio-based and plant-derived alternatives.

Major applications for household cleaning products are ubiquitous across domestic settings, ranging from daily upkeep in kitchens and bathrooms—critical areas for germ control—to periodic deep cleaning of textiles, floors, and general living spaces. The benefit derived by end-users extends beyond mere visible cleanliness; these products play a crucial role in preventative health measures, contributing to reduced transmission of pathogens and improved indoor air quality. Moreover, the psychological benefit of living in a clean, sanitized environment significantly contributes to overall well-being, cementing the market’s importance.

Key driving factors propelling the market include rapid urbanization, leading to higher density living and increased need for sanitation; rising health consciousness, particularly post-COVID-19, which institutionalized frequent disinfection; and the steady increase in global disposable incomes, enabling consumers to purchase premium and specialized cleaning solutions. Additionally, stringent regulatory standards in developed markets concerning ingredient safety and environmental impact continually force manufacturers to innovate and introduce safer, more effective, and sustainably packaged products, ensuring dynamic market evolution and sustained demand growth.

Household Cleaning Market Executive Summary

The Household Cleaning Market is characterized by vigorous competition, rapid product innovation focused on sustainability, and significant shifts in distribution strategies. Current business trends indicate a strong prioritization of Environmental, Social, and Governance (ESG) criteria, resulting in the proliferation of ‘green’ product lines that leverage biodegradable packaging and natural ingredients. Major corporations are actively acquiring niche, eco-focused brands to integrate sustainable portfolios and appeal to environmentally conscious millennials and Gen Z consumers. Furthermore, digital transformation is impacting the market through direct-to-consumer (DTC) models and enhanced supply chain transparency, optimizing inventory and responsiveness to volatile consumer demand.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to expanding middle-class populations, increased hygiene awareness campaigns, and undeveloped penetration rates in rural areas compared to North America and Europe. While North America and Europe remain key revenue hubs, marked by maturity and high adoption of specialized products, growth here is driven primarily by product premiumization and the shift towards concentrated formats. The Middle East and Africa (MEA) are also showing promising expansion, fueled by urbanization and infrastructure development, which drives foundational demand for essential cleaning agents.

Segment trends highlight the dominance of surface cleaners and laundry care, although specialized segments like dishwashing detergents (especially automatic dishwashing tabs) are witnessing rapid value growth due to convenience and lifestyle changes. Crucially, the formulation segment is heavily trending towards liquid and pod formats over traditional powders, offering enhanced ease of use and dosage control. Within the end-user segment, the institutional cleaning sector (commercial cleaning services) is influencing retail market trends, as successful professional formulations often trickle down into consumer-grade products, emphasizing concentrated power and efficacy.

AI Impact Analysis on Household Cleaning Market

Common user questions regarding AI's impact on the Household Cleaning Market often revolve around operational efficiency, personalized product recommendations, and the development of 'smart' cleaning devices. Key concerns frequently raised include how AI can optimize complex supply chains involving volatile chemical components, whether generative AI can accelerate the formulation and testing of sustainable chemistries, and the potential displacement of manual cleaning tasks by AI-driven robotic cleaners. Users are highly interested in understanding how data analytics and machine learning are being leveraged to predict regional outbreak patterns that influence demand for disinfectants and sanitizers, and how hyper-personalized subscriptions based on usage data can revolutionize purchasing habits. Essentially, the consensus expectations center on AI driving efficiency, sustainability, and automated end-user experiences.

AI is fundamentally transforming the manufacturing and retail aspects of household cleaning. In production, predictive maintenance and quality control driven by machine learning algorithms minimize downtime and reduce material waste, crucial for maintaining narrow margins in high-volume FMCG production. On the consumer side, AI algorithms analyze vast datasets of purchasing habits, local water quality, dwelling types, and cleaning frequencies to offer highly tailored product bundles and promotional pricing, significantly improving customer retention and increasing the average transaction value. This data-driven personalization moves beyond simple demographic targeting to behavioral pattern recognition, leading to improved marketing effectiveness.

Furthermore, AI is instrumental in accelerating Research and Development (R&D). Machine learning models can simulate molecular interactions, allowing chemists to predict the stability, efficacy, and toxicity of novel cleaning formulations before expensive laboratory synthesis is undertaken. This application is particularly vital for companies seeking to meet aggressive sustainability targets by quickly identifying viable bio-based surfactants and chelating agents. The integration of AI into robotic vacuum cleaners and automated mopping systems also represents a significant end-user impact, defining the future landscape of cleaning automation and influencing demand for specific specialized concentrates compatible with smart devices.

- AI optimizes supply chain logistics, predicting demand fluctuations and reducing stock-outs of seasonal or high-demand products like disinfectants.

- Machine learning accelerates green chemistry R&D by simulating the efficacy and safety profile of sustainable formulations.

- AI-driven robotics (smart vacuums, mops) redefine cleaning habits, increasing demand for compatible, concentrated cleaning solutions.

- Predictive analytics inform personalized marketing, optimizing product bundling and subscription services based on consumer usage data.

- Manufacturing processes utilize AI for predictive maintenance and enhanced quality control, reducing waste and improving operational efficiency.

DRO & Impact Forces Of Household Cleaning Market

The Household Cleaning Market dynamics are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces that dictate strategic direction and market growth trajectory. Key drivers, such as escalating consumer awareness regarding health and hygiene, coupled with rising global population and urbanization, provide a foundational increase in demand. However, this growth is constantly mitigated by significant restraints, primarily revolving around the volatility of raw material prices (e.g., petrochemical derivatives and essential oils) and the intense price sensitivity exhibited by mass-market consumers, which restricts premiumization potential in certain segments. Opportunities abound in the burgeoning demand for sustainable, non-toxic, and refillable products, alongside the untapped potential of emerging digital commerce channels and customized cleaning solutions tailored to specific water hardness or climate conditions.

The primary impact forces include substitution risk, driven by the emergence of highly effective homemade or low-cost natural remedies, and the high bargaining power of large distributors and retailers, who dictate shelf space and pricing terms, particularly in mature markets. Supplier bargaining power is moderate but increases significantly for specialized, high-performance ingredients or proprietary green chemical technologies. Regulatory forces act as a double-edged sword: while they restrain the use of certain chemicals, they simultaneously drive innovation towards safer, patentable alternatives, creating new market spaces for compliant manufacturers.

Furthermore, technological innovation, especially in concentrated formats and smart dispensing systems, acts as a pivotal force, reshaping consumer behavior toward efficiency and reduced environmental footprint. The market's attractiveness is sustained by the high frequency of purchase and non-discretionary nature of these goods, ensuring continuous revenue streams despite economic fluctuations. Strategic focus is therefore heavily placed on mitigating raw material cost exposure through diversified sourcing and leveraging sustainable innovation to justify higher price points, thereby navigating the competitive intensity characteristic of the FMCG landscape.

Segmentation Analysis

The Household Cleaning Market is meticulously segmented across various parameters including product type, formulation, packaging, distribution channel, and application, allowing for precise targeting and strategic market deployment. Product type segmentation is critical, separating primary categories such as fabric care (laundry detergents, softeners), surface care (all-purpose, specialized kitchen/bathroom cleaners), dishwashing products (manual and automatic), and specialty applications (air fresheners, insect repellents). This detailed breakdown enables manufacturers to address specific cleaning needs and allocate R&D investment towards high-growth niches like advanced disinfection or enzymatic stain removal.

Formulation segmentation distinguishes between traditional liquid, powder, and highly concentrated formats such as pods, tablets, and sprays, with the latter gaining significant traction due to portability and measured dosing convenience. The fastest-growing sub-segment is undoubtedly eco-friendly and natural formulations, driven by increased public health awareness and a preference for plant-derived ingredients over synthetic chemicals. Distribution channels, spanning supermarkets/hypermarkets, convenience stores, and the accelerating e-commerce sector, define consumer access points, with online sales proving vital for personalized bundles and niche specialty products that require detailed explanatory content.

Understanding these segments is crucial for strategic differentiation. For instance, while hypermarkets dominate volume sales in laundry care, e-commerce allows smaller brands to build trust and market share in premium, sustainable surface cleaner categories. Market participants are increasingly focusing on customized packaging solutions, such as recyclable pouches and reusable dispensers, to align with regulatory pressures and consumer preference for minimal environmental impact, directly influencing purchasing decisions within specific demographic segments.

- By Product Type:

- Surface Cleaners (Multi-Purpose, Kitchen, Bathroom, Glass)

- Laundry Care (Detergents - Liquid, Powder, Pods; Fabric Softeners)

- Dishwashing Products (Manual, Automatic Dishwasher Detergents)

- Toilet Cleaners

- Specialty Cleaners (Floor Cleaners, Oven Cleaners, Drain Openers)

- By Formulation:

- Chemical/Synthetic

- Natural/Bio-based/Green

- Concentrated

- Ready-to-Use

- By Format:

- Liquids

- Powders/Granules

- Sprays

- Wipes/Pads

- Tablets/Pods

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores/Retail Shops

- E-commerce/Online Retail

- Other Channels (Direct Sales, Institutional Suppliers)

Value Chain Analysis For Household Cleaning Market

The value chain for the Household Cleaning Market is extensive, starting from the sourcing of raw materials and culminating in the final consumer purchase. The upstream analysis focuses on the procurement of essential inputs, primarily surfactants, builders, solvents, enzymes, chelating agents, and fragrances. This stage is characterized by high volatility, as many base chemicals are petrochemical derivatives, linking input costs directly to global oil prices. Manufacturers must maintain robust relationships with specialized chemical suppliers to ensure quality consistency and manage price fluctuations. Furthermore, the rising demand for sustainable products necessitates the sourcing of specialized bio-based ingredients, which often come with unique supply chain complexities and higher costs.

The midstream involves manufacturing, formulation, and packaging. Formulation is a highly proprietary process requiring significant R&D investment to ensure efficacy, stability, and safety compliance. Modern manufacturing emphasizes highly automated blending and filling processes to achieve economies of scale. Packaging, increasingly focused on sustainability, involves material shifts toward post-consumer recycled (PCR) plastics, recyclable polymers, and refillable systems. Efficiency in the midstream is vital for maintaining competitive pricing, as the products are generally low-margin, high-volume consumables.

The downstream analysis addresses distribution channels, which include both direct and indirect routes. Indirect distribution, dominated by large retailers (supermarkets, hypermarkets, mass merchandisers), accounts for the majority of sales volume globally, leveraging their extensive geographic reach and cold chain infrastructure (though less critical for cleaning products). Direct channels are rapidly growing via e-commerce platforms and brand-specific online stores, allowing companies to gather direct consumer data, bypass retail markups, and efficiently distribute specialized or subscription-based products. Effective collaboration with logistics providers is paramount to ensure the timely and cost-effective delivery of bulky, heavy, and sometimes hazardous chemical goods to both retail outlets and end-users, optimizing the final leg of the value chain.

Household Cleaning Market Potential Customers

Potential customers for the Household Cleaning Market are exceptionally broad, categorized primarily into residential (B2C) and commercial/institutional (B2B) segments. The largest segment, residential end-users, includes all households globally, driven by factors such as family size, presence of children or pets, socio-economic status, and regional hygiene standards. Within B2C, distinct customer profiles exist: the value-conscious consumer prioritizing low cost and multi-purpose functionality; the premium consumer seeking specialized, high-performance, or luxury scented products; and the sustainability-focused consumer demanding certified organic, biodegradable, and low-toxicity formulations. Marketing strategies must be finely tuned to address these varied purchasing motivations.

The B2B segment, often referred to as the Institutional, Commercial, and Industrial (ICI) sector, represents critical high-volume buyers. This segment includes hotels, hospitals and healthcare facilities, educational institutions, corporate offices, contract cleaning service providers, and food processing plants. These buyers have stringent requirements, prioritizing efficacy, regulatory compliance (especially for disinfection), high concentration levels for bulk use efficiency, and specialized certifications. For instance, hospitals require EPA-registered disinfectants, while contract cleaners value superior cost-in-use and rapid turnaround performance.

The emerging potential customer profile is the "smart home" integrator or consumer utilizing automated cleaning systems. These customers require compatible, highly concentrated, often cartridge-based cleaning solutions optimized for robotic devices. Manufacturers are increasingly targeting this tech-savvy niche by developing formulations that minimize foaming, prevent residue build-up, and extend the lifespan of automated cleaning equipment, representing a significant future growth vector for specialized product developers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.8 Billion |

| Market Forecast in 2033 | $340.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, Reckitt Benckiser Group PLC, S. C. Johnson & Son Inc., Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Kao Corporation, Colgate-Palmolive Company, The Clorox Company, Godrej Consumer Products Limited, Amway Corporation, Ecover (Method/SC Johnson), SEB Professional, McBride plc, L'Occitane Group (E.O. Products), Better Life, Inc., Bio-D Company, Green Works (Clorox), Seventh Generation (Unilever) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Cleaning Market Key Technology Landscape

The Household Cleaning Market is witnessing a rapid evolution in its technological landscape, focusing predominantly on maximizing efficiency, minimizing environmental impact, and improving user convenience. A major technological shift involves the development of encapsulated cleaning ingredients, such as timed-release fragrance beads or concentrated active agents encased in dissolvable polymers (common in laundry and dish pods). This encapsulation technology ensures ingredient stability, offers precise dosing control, and delivers prolonged efficacy, significantly enhancing the value proposition of premium cleaning products compared to traditional liquids.

Another pivotal technological advancement is the integration of advanced biotechnology, particularly the use of specialized enzymes and probiotic cleaners. Enzyme technology allows for the targeted breakdown of specific organic stains (proteins, fats, starches) at lower temperatures and pH levels, enabling highly effective, yet gentler, cleaning solutions. Probiotic cleaners introduce beneficial microorganisms that continuously consume organic soil, offering long-lasting odor control and residual cleaning effects, an innovation highly sought after in pet care and professional sanitation markets. These bio-based technologies are instrumental in meeting the demand for non-toxic and environmentally safe alternatives.

Furthermore, packaging technology is undergoing a revolution driven by sustainability mandates. Innovations include ultralightweighting of plastic bottles, transitioning to 100% PCR content, and the widespread adoption of dissolvable films and water-soluble packaging for concentrates (e.g., refill tablets). Smart dispensing systems, integrated with IoT technology, also represent a future frontier, providing measured dosing for automated devices and simplifying the refilling process, thereby minimizing product waste and enhancing the consumer experience.

In addition to formulation and packaging, the technology of application is evolving. High-performance microfiber technology, electrostatically charged dust collection materials, and spray mechanisms that atomize liquids for better surface coverage (often utilizing non-aerosol, air-powered systems) are continually being refined. The synergy between these advanced cleaning tools and specialized chemical formulations allows users to achieve professional-grade results with less effort and less chemical usage, reinforcing the overall market trend toward efficiency and environmental responsibility.

The manufacturing process itself is benefiting from advanced automation and sensor technology. Sophisticated mixing and blending equipment ensures precise chemical ratios, critical for maintaining the safety and efficacy of disinfectants and complex multi-component formulations. Robotics in packaging lines increases throughput and reduces labor costs. The adoption of digital twins and simulation software in R&D further streamlines the product development cycle, allowing manufacturers to optimize formulations for various conditions (e.g., hard water compatibility) before initiating costly physical trials.

Finally, blockchain technology is being explored to enhance supply chain transparency, allowing consumers and regulators to verify the origin and sustainability claims of ingredients, a feature particularly valued in the green cleaning segment. This technological push for verifiability builds consumer trust and differentiates authentic sustainable brands from those engaging in "greenwashing." These technologies collectively underscore the market's trajectory towards smarter, safer, and more sustainable cleaning solutions.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, driven by substantial population growth, rapid urbanization, and significant improvements in disposable income across economies like China, India, and Southeast Asian nations. Increased access to modern retail infrastructure and rising awareness of Western-style hygiene practices are fueling demand for branded, packaged cleaning products, replacing traditional, unbranded solutions. The primary growth drivers are surface disinfectants and laundry care, although cultural preferences often dictate specific product formats (e.g., highly concentrated powders remain popular in some rural areas). Manufacturers are strategically investing in localized product variations and extensive distribution networks to capture the diverse consumer base in this highly dynamic region.

- North America: North America represents a highly mature and technologically advanced market characterized by high consumer spending power and a strong focus on specialty products. Growth here is primarily valuation-driven, fueled by premiumization, the transition to concentrated and eco-friendly formulas, and the widespread adoption of smart cleaning devices. Consumers are highly responsive to marketing based on ingredient transparency, ethical sourcing, and environmental certifications (e.g., EPA Safer Choice). The market penetration of specialized products (e.g., hardwood floor cleaners, stainless steel polishes) is highest in this region, necessitating continuous product differentiation and innovation to maintain market share against established competitors.

- Europe: Europe is defined by stringent environmental and chemical regulations (such as REACH), which fundamentally dictate product formulation and market entry. The region is a global leader in the adoption of sustainable cleaning solutions, with high demand for refillable, zero-waste, and vegan-certified products. Growth is steady, driven by regulatory compliance and consumer preference for natural ingredients. Western European countries exhibit high penetration rates, while Eastern Europe offers moderate growth opportunities as consumer spending and product awareness catch up. Key trends include the shift from traditional chlorine-based disinfectants to peroxide and other safer biocides, emphasizing health and safety standards.

- Latin America (LATAM): The LATAM market is marked by moderate to high growth, largely influenced by macroeconomic stability and increasing urbanization. Brazil and Mexico are the dominant markets, showing rising demand for branded and convenient formats, particularly laundry liquids and multi-purpose cleaners. Price sensitivity remains a factor, requiring manufacturers to balance cost-effective production with quality standards. The expansion of modern retail chains is crucial for increasing the penetration of higher-value cleaning products in previously underserved populations.

- Middle East and Africa (MEA): The MEA region is emerging as a significant market, driven by construction booms, high standards in hospitality sectors, and a recent surge in public health campaigns. The GCC countries exhibit high per capita expenditure on premium cleaning products due to expatriate population influences and high sanitation standards in commercial spaces. Africa, while highly fragmented, offers substantial long-term growth potential, particularly in basic hygiene and laundry care, as distribution infrastructure improves and awareness campaigns effectively reach mass consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Cleaning Market.- Procter & Gamble (P&G)

- Unilever

- Reckitt Benckiser Group PLC

- S. C. Johnson & Son Inc.

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Kao Corporation

- Colgate-Palmolive Company

- The Clorox Company

- Godrej Consumer Products Limited

- Amway Corporation

- Ecover (Method/SC Johnson)

- SEB Professional

- McBride plc

- L'Occitane Group (E.O. Products)

- Better Life, Inc.

- Bio-D Company

- Green Works (Clorox)

- Seventh Generation (Unilever)

- Ecolab Inc. (Institutional Focus)

- Lion Corporation

Frequently Asked Questions

Analyze common user questions about the Household Cleaning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward sustainable household cleaning products?

The shift is primarily driven by heightened consumer awareness regarding environmental health and personal safety, coupled with stringent government regulations concerning chemical usage and plastic waste. Consumers are actively seeking biodegradable ingredients, plant-derived formulations, and refillable or zero-waste packaging options, influencing major manufacturers to overhaul their product portfolios to meet these ethical demands.

How is e-commerce impacting the distribution of household cleaning agents?

E-commerce is revolutionizing distribution by providing specialized direct-to-consumer (DTC) access, enabling subscription services for recurring purchases, and facilitating the sale of concentrated or niche products that perform poorly in traditional retail settings. Online platforms reduce reliance on large retailers and offer brands superior consumer data for personalized marketing and demand forecasting.

Which product segment is projected to exhibit the fastest growth rate?

The Surface Cleaners segment, particularly specialized disinfectants and all-purpose cleaners with validated antimicrobial efficacy, is expected to see rapid growth. This acceleration is a direct result of institutionalized post-pandemic hygiene practices globally, maintaining high consumer demand for validated germ-killing capabilities in residential settings.

What are the primary restraints affecting the profitability of the Household Cleaning Market?

Profitability is restrained chiefly by the extreme volatility of raw material costs, especially petrochemical-derived surfactants, and intense price competition among leading global brands. Consumers' high price sensitivity in mass-market categories forces companies to absorb increased input costs or strategically invest in premium sustainable lines to justify higher retail prices.

What role does technology play in modern household cleaning formulations?

Technology plays a crucial role through the development of highly concentrated formats (pods/tablets), advanced enzyme and probiotic biotechnology for stain and odor removal, and smart packaging designed for sustainability and precise dosing. These innovations improve cleaning efficacy while minimizing the user's environmental footprint and enhancing overall convenience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Household Cleaning Tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bottle Orienter Market Statistics 2025 Analysis By Application (Food & Beverages, Household Cleaning Products, Cosmetics, Pharmaceutical, Others), By Type (Inline Bottle Orienter, Rotary Container Orienter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Herbal Oil Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Orange, Citronella, Corn Mint, Eucalyptus, Lemon, Clove Leaf, Others), By Application (Food & Beverages, Pharmaceutical, Cosmetics & Personal Care Products, Spa & Salon Products, Household Cleaning Products, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager